Utilizing such a structure offers several advantages. It enables informed financial decision-making, facilitates the identification of areas for potential savings and improved cash flow management, and aids in setting realistic financial goals. This organized approach simplifies tax preparation and can be instrumental in securing loans or other forms of credit by demonstrating responsible financial management.

Understanding the components and benefits of this organized approach to personal finances is crucial for achieving financial stability and long-term success. The following sections will explore these aspects in greater detail, providing practical guidance and examples.

1. Income

Income forms the foundation of a personal income statement. Accurate income documentation is crucial for understanding financial inflows and subsequently, for calculating net income. Various income streams, including salaries, wages, investment returns, and rental income, contribute to the overall income figure. For example, an individual might have a primary salary from employment, supplemented by dividend income from investments. Accurately capturing all income sources provides a realistic picture of total financial resources available during a given period.

A comprehensive understanding of income is essential for effective budgeting and financial planning. Analyzing income trends can reveal potential areas for improvement, such as negotiating a salary raise or diversifying investment portfolios. Furthermore, accurate income reporting is critical for tax purposes and loan applications, where lenders often assess income stability and sufficiency. A clear picture of income allows individuals to align their financial goals with their actual resources.

In summary, income serves as a critical component within a personal income statement. Detailed income tracking enables informed financial decision-making, from budgeting and expense management to long-term financial planning. Understanding income sources, trends, and their impact on overall financial health is essential for achieving financial stability and long-term success.

2. Expenses

Accurate expense tracking is crucial for a comprehensive understanding of financial outflows within a personal income statement and balance sheet template. Analyzing expenses provides insights into spending habits and informs budgeting decisions, ultimately contributing to a clearer picture of overall financial health.

- Fixed ExpensesFixed expenses represent consistent, predictable outflows occurring regularly, such as rent or mortgage payments, loan installments, and subscription fees. Understanding these fixed costs is fundamental for budgeting, as they represent a committed portion of one’s income. For example, a significant portion of an individual’s income might be allocated to mortgage payments, influencing the remaining funds available for discretionary spending.

- Variable ExpensesVariable expenses fluctuate in amount and frequency, encompassing groceries, utilities, transportation, and entertainment. These expenses are often influenced by lifestyle choices and external factors. Monitoring variable expenses is key to identifying areas for potential savings and improved budget management. For instance, tracking grocery spending can reveal opportunities to reduce costs by planning meals or choosing more economical options.

- Discretionary ExpensesDiscretionary expenses represent non-essential spending on items or experiences that enhance lifestyle but are not strictly necessary, like dining out, travel, or hobbies. Managing discretionary expenses is crucial for aligning spending with financial goals. Evaluating and adjusting these expenses can free up resources for savings, debt reduction, or investments. For example, reducing the frequency of dining out can contribute to achieving a savings goal.

- Categorizing ExpensesCategorizing expenses provides a structured approach to understanding spending patterns and identifying areas for improvement. Assigning expenses to specific categories, such as housing, transportation, or entertainment, enables a detailed analysis of where funds are allocated. This categorization facilitates informed decision-making regarding budget adjustments and financial goal setting. For instance, a high percentage of spending allocated to transportation might prompt an evaluation of commuting options or vehicle choices.

Careful expense tracking and categorization are integral components of a sound financial management strategy. Analyzing expenses within the framework of a personal income statement and balance sheet template allows for informed decisions regarding budgeting, spending habits, and the pursuit of financial goals. By understanding the nuances of different expense types and their impact on overall financial health, individuals can strive toward greater financial stability and long-term success.

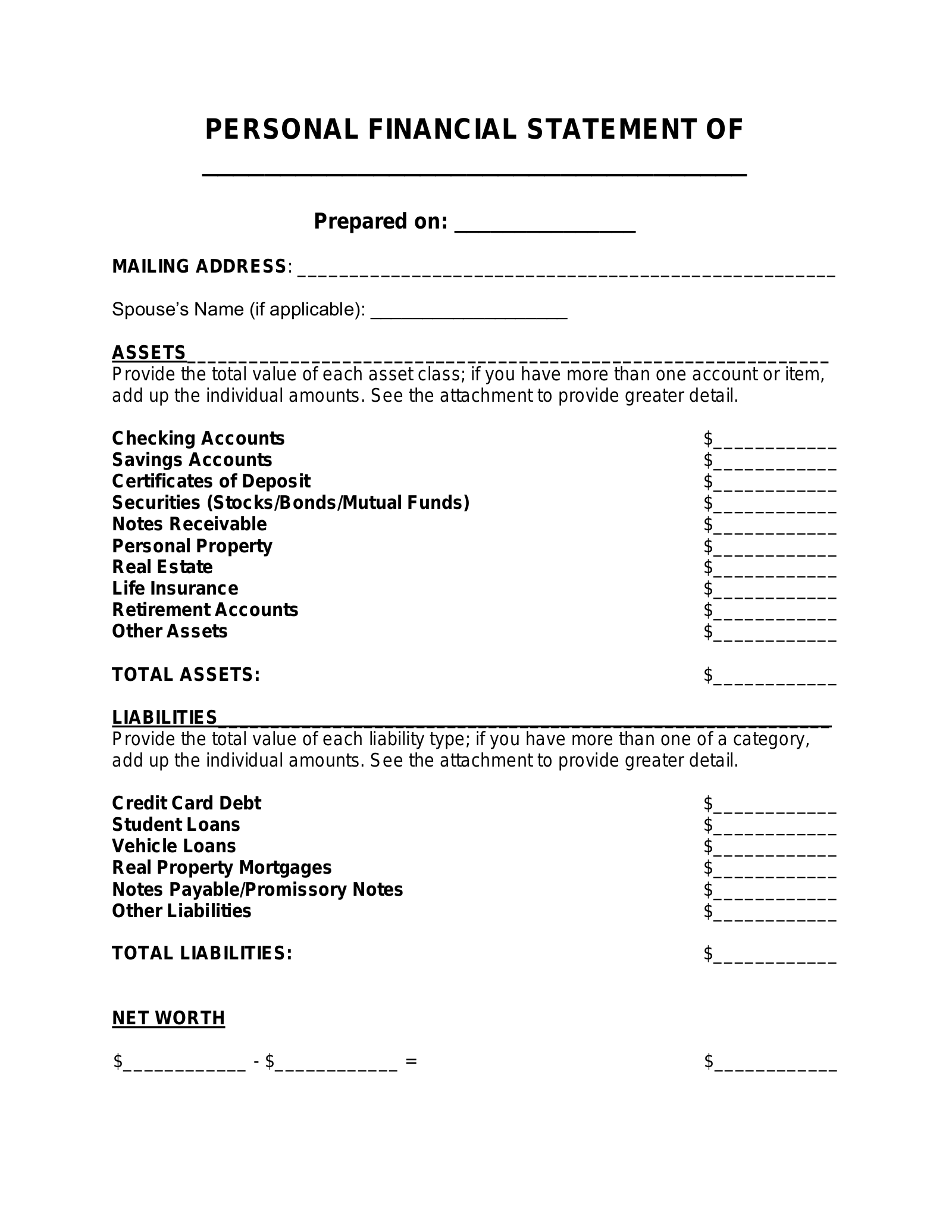

3. Assets

Assets, representing items of economic value owned, play a crucial role within a personal income statement and balance sheet template. They provide a snapshot of an individual’s financial holdings and contribute significantly to calculating net worth. Understanding the various types of assets and their respective characteristics is essential for comprehensive financial planning.

Assets are broadly categorized as current or non-current. Current assets, such as cash, checking and savings accounts, and easily liquidated investments, are readily convertible to cash, typically within one year. Non-current assets, including real estate, retirement accounts, and investment portfolios, represent longer-term holdings and are not intended for immediate liquidation. For example, a primary residence constitutes a non-current asset, while the funds held in a money market account represent a current asset. The balance between current and non-current assets reflects an individual’s liquidity and long-term investment strategy.

Accurately valuing assets is critical for determining net worth and making informed financial decisions. Real estate appraisals, investment portfolio valuations, and assessments of other tangible assets, such as vehicles or collectibles, provide a realistic picture of overall holdings. Understanding asset allocation and diversification strategies can further enhance long-term financial stability. Regularly reviewing and updating asset information within the context of a personal income statement and balance sheet template allows for proactive adjustments to financial plans and investment strategies, contributing to long-term financial well-being.

4. Liabilities

Liabilities, representing financial obligations or debts owed to others, form a critical component of a personal income statement and balance sheet template. A clear understanding of liabilities is essential for assessing overall financial health and making informed financial decisions. Liabilities are categorized based on their repayment terms, with short-term liabilities due within one year and long-term liabilities extending beyond that timeframe. Credit card balances, short-term loans, and outstanding utility bills exemplify short-term liabilities, while mortgages, student loans, and auto loans represent long-term obligations. Accurately documenting and categorizing liabilities provides a comprehensive overview of outstanding debts and their impact on net worth.

The relationship between liabilities and net worth is inversely proportional. As liabilities increase, net worth decreases, and vice-versa. For instance, accumulating high-interest credit card debt can significantly impact net worth negatively. Conversely, diligently paying down a mortgage increases equity in the property and positively influences net worth. Therefore, effectively managing liabilities is crucial for maintaining a healthy financial standing. Strategies for managing liabilities include prioritizing high-interest debt repayment, consolidating loans, and negotiating lower interest rates. Understanding the impact of liabilities on net worth empowers individuals to make strategic decisions regarding debt management and long-term financial planning.

Integrating liabilities into a personal income statement and balance sheet template provides a holistic view of financial obligations within the broader context of income, expenses, and assets. This integrated perspective allows for a comprehensive assessment of financial health and facilitates informed decision-making regarding debt management, budgeting, and financial goal setting. By understanding the nature and impact of liabilities, individuals can develop strategies to minimize debt, maximize net worth, and achieve long-term financial stability.

5. Net Worth

Net worth, a key indicator of financial health, represents the difference between total assets and total liabilities. Within a personal income statement and balance sheet template, net worth provides a snapshot of an individual’s financial position at a specific point in time. It reflects the cumulative result of financial decisions and provides a benchmark for measuring progress toward financial goals. A positive net worth indicates that assets exceed liabilities, while a negative net worth signifies that liabilities outweigh assets. Changes in net worth over time reflect the impact of income, expenses, asset appreciation or depreciation, and debt management. For instance, consistently saving a portion of income and strategically investing can lead to a steady increase in net worth over time, even without significant changes in income.

Calculating net worth involves a comprehensive assessment of all assets and liabilities. Assets encompass tangible items like real estate and vehicles, as well as financial holdings such as investment accounts and retirement savings. Liabilities include outstanding debts like mortgages, student loans, and credit card balances. Regularly calculating and analyzing net worth within the context of a personal income statement and balance sheet template allows individuals to track financial progress, identify areas for improvement, and adjust financial strategies as needed. For example, a stagnant or declining net worth might prompt a review of spending habits, debt management strategies, or investment choices. Understanding the factors influencing net worth empowers individuals to make informed decisions that contribute to long-term financial well-being.

Net worth serves as a powerful tool for assessing financial health and progress toward long-term financial goals. By regularly calculating and analyzing net worth within the framework of a personal income statement and balance sheet template, individuals can gain valuable insights into their financial standing. This understanding facilitates informed decision-making regarding spending, saving, investing, and debt management, ultimately contributing to greater financial stability and long-term success. While net worth is a crucial metric, it should be considered in conjunction with other factors, such as income stability and long-term financial goals, for a comprehensive assessment of overall financial health.

6. Financial Health

Financial health represents the overall state of one’s personal finances. A structured approach, facilitated by a personal income statement and balance sheet template, provides the framework for assessing and improving this vital aspect of well-being. Understanding the key components of financial health and their interplay within this framework is crucial for informed financial decision-making.

- Spending HabitsAnalyzing spending patterns within a personal income statement illuminates areas of overspending and potential savings. Regularly tracking expenses against income reveals opportunities to optimize spending and align it with financial goals. For example, identifying a high proportion of discretionary spending on entertainment might prompt adjustments to allocate more resources toward debt reduction or investment. Understanding spending habits is foundational for achieving and maintaining financial health.

- Debt ManagementEffective debt management, a cornerstone of financial health, involves strategically addressing liabilities documented within a balance sheet. Prioritizing high-interest debt repayment and exploring options like debt consolidation contribute to reducing overall debt burden. Monitoring debt levels and repayment progress within the framework of a balance sheet provides a clear picture of financial obligations and their impact on net worth. Minimizing debt contributes significantly to long-term financial stability and improved financial health.

- Emergency PreparednessBuilding an emergency fund, typically consisting of readily available liquid assets, is crucial for mitigating unforeseen financial challenges. A personal balance sheet aids in assessing the adequacy of liquid assets relative to potential emergencies. Maintaining an emergency fund provides a financial safety net and reduces reliance on high-interest debt in times of crisis, contributing to greater financial resilience and overall financial health.

- Investing and Long-Term PlanningStrategic investing and long-term financial planning are essential for building wealth and securing future financial stability. A personal income statement and balance sheet template provides the foundation for informed investment decisions. Understanding income, expenses, assets, and liabilities allows for a realistic assessment of investment capacity and risk tolerance. Regularly reviewing and adjusting long-term financial plans within the context of this framework contributes to achieving financial goals and enhancing overall financial health.

These facets of financial health are interconnected and mutually reinforcing within the structure of a personal income statement and balance sheet template. By consistently tracking and analyzing these elements, individuals gain valuable insights into their financial standing, enabling informed decision-making and promoting long-term financial well-being. A proactive approach to managing these components contributes significantly to achieving and maintaining robust financial health.

Key Components of a Framework for Personal Financial Statements

A structured approach to personal finances necessitates a clear understanding of key components within a standardized framework. These components provide the foundation for organizing financial information and gaining valuable insights into one’s overall financial health.

1. Income: All sources of income, including salaries, wages, investment returns, and other inflows, must be accurately documented. This provides a comprehensive view of available financial resources.

2. Expenses: Detailed tracking of all expenses, categorized as fixed, variable, or discretionary, is crucial for understanding spending patterns and identifying areas for potential savings.

3. Assets: A comprehensive inventory of assets, categorized as current or non-current, reflects an individual’s financial holdings and contributes to calculating net worth. Accurate valuation of assets is essential.

4. Liabilities: All outstanding debts and financial obligations, categorized as short-term or long-term, must be accurately documented to understand the impact of debt on overall financial health.

5. Net Worth: Calculated as the difference between total assets and total liabilities, net worth provides a snapshot of financial standing at a specific point in time and serves as a key indicator of financial progress.

These interconnected elements provide a comprehensive view of an individual’s financial position. Regularly reviewing and analyzing these components within a structured framework facilitates informed financial decision-making and contributes to long-term financial well-being.

How to Create a Personal Financial Statement Template

Creating a template for personal financial statements provides a structured approach to managing finances. The following steps outline the process of developing such a template, enabling organized tracking of income, expenses, assets, and liabilities.

1. Choose a Time Period: Select a specific time frame for the income statement, typically a month or a year. The balance sheet reflects a snapshot in time.

2. Create the Income Section: List all sources of income, including salaries, wages, investment returns, and any other inflows. Provide clear labels for each income source.

3. Create the Expense Section: Categorize expenses as fixed, variable, or discretionary. Itemize each expense within its respective category to facilitate detailed tracking and analysis.

4. Create the Asset Section: List all assets, categorizing them as current (easily convertible to cash) or non-current (long-term holdings). Assign a realistic value to each asset.

5. Create the Liabilities Section: Document all outstanding debts and financial obligations, categorized as short-term (due within one year) or long-term. Record the current balance for each liability.

6. Calculate Net Worth: Subtract total liabilities from total assets to determine net worth. This key figure provides a snapshot of overall financial health.

7. Regularly Update: Consistently update the income statement and balance sheet to reflect changes in income, expenses, assets, and liabilities. Regular updates ensure the accuracy and relevance of the information for informed financial decision-making.

8. Utilize Spreadsheet Software: Leverage spreadsheet software or dedicated financial management tools to create and maintain the template. These tools offer features for automated calculations, charts, and graphs, facilitating analysis and interpretation of financial data.

A well-structured template facilitates ongoing monitoring of financial status and provides valuable insights for informed financial decisions. This organized approach empowers individuals to track progress toward financial goals and maintain a clear understanding of their overall financial health.

A structured approach to personal finance, facilitated by a framework for organizing financial data, provides a comprehensive view of income, expenses, assets, and liabilities. Understanding these key elements and their interrelationships is crucial for informed financial decision-making. Tracking income and expenses allows for a clear understanding of spending habits and net income. Documenting assets and liabilities facilitates accurate net worth calculation, a key indicator of financial health. Regularly reviewing and updating this organized financial information enables proactive adjustments to financial strategies and contributes to long-term financial stability.

Achieving and maintaining financial well-being requires diligent monitoring and analysis of financial data. A well-structured template provides the tools for informed decision-making, empowering individuals to pursue financial goals with clarity and control. The insights gained from this structured approach contribute significantly to long-term financial security and a stronger foundation for future financial success.