Utilizing such a framework allows for better budget management, identification of areas for potential savings, and improved financial planning. By tracking cash flow, individuals can gain insights into their spending habits and adjust accordingly to achieve financial goals. This detailed financial overview is invaluable for setting realistic budgets, reducing debt, and building a stronger financial foundation.

This foundation in understanding monthly finances is crucial for exploring further topics related to budgeting, saving, and investing. It serves as a stepping stone towards achieving long-term financial stability and security. Deeper dives into specific aspects of personal finance will build upon this core understanding of income and expenses.

1. Income

Accurate income documentation is fundamental to a functional personal monthly income statement template. Income represents the inflow of funds, forming the foundation upon which expense management and financial planning are built. Without a precise record of all income sources, the template’s accuracy and usefulness are compromised. This includes not only primary sources like salary but also secondary sources such as investment returns, rental income, or freelance earnings. For example, an individual might have a primary salary and supplemental income from a side business. Accurately recording both on the template provides a complete picture of total income.

Understanding total income allows for realistic budgeting and informed financial decisions. An accurate income figure enables individuals to assess their spending capacity relative to their earnings. This is crucial for setting achievable financial goals, whether it’s saving for a down payment, investing for retirement, or managing debt. Overestimating income can lead to overspending and financial instability, while underestimating it can unnecessarily restrict spending and hinder progress towards financial goals. For instance, accurately recording a bonus or commission payment can provide a clearer picture of available funds for debt reduction or investment.

Precise income tracking within the template facilitates better financial planning and analysis. By diligently recording all income sources, individuals gain valuable insights into their financial health. This allows for more effective budgeting, identification of potential income growth opportunities, and ultimately, a more secure financial future. Challenges may arise from irregular income streams or overlooking less frequent sources. Addressing these challenges through meticulous record-keeping ensures the template remains a reliable tool for achieving financial well-being.

2. Expenses

A comprehensive understanding of expenditures is crucial for effective utilization of a personal monthly income statement template. Detailed expense tracking provides insights into spending patterns, enabling informed financial decisions. Categorizing expenses facilitates analysis, revealing areas of potential overspending and opportunities for savings. For example, tracking grocery expenditures over several months can reveal trends and inform future budgeting decisions. Similarly, monitoring recurring subscriptions can identify unnecessary services that can be eliminated to reduce expenses. The template serves as a tool for organizing these details, contributing to a clearer picture of financial health.

The relationship between expenses and the template is symbiotic; accurate expense recording enhances the template’s value, while the template provides a framework for organized expense management. This interplay allows for the identification of both fixed and variable expenses. Fixed expenses, such as rent or mortgage payments, remain relatively constant, while variable expenses, like groceries or entertainment, fluctuate. Distinguishing between these categories allows for more strategic budget allocation. For instance, understanding the proportion of income allocated to fixed expenses can inform decisions about housing choices or transportation costs. The template facilitates this analysis by providing a structured platform for recording and categorizing all expenses.

Effective expense management, facilitated by the template, forms the cornerstone of sound financial planning. By analyzing spending patterns, individuals can identify areas for improvement and make informed decisions about resource allocation. This understanding allows for more effective budgeting, debt management, and saving strategies. Challenges may arise in consistently and accurately recording every expense. Overcoming these challenges through disciplined tracking and categorization ensures the template remains a powerful tool for achieving long-term financial stability.

3. Categorization

Effective utilization of a personal monthly income statement template hinges on systematic categorization. Categorization provides a structured framework for organizing financial data, enabling meaningful analysis of income and expenses. Without a logical categorization system, the template becomes a mere repository of numbers, lacking the analytical power to inform financial decisions.

- Needs versus WantsDistinguishing between essential expenditures (needs) and discretionary spending (wants) is fundamental. Needs encompass necessities like housing, food, and healthcare, while wants include entertainment, dining out, and non-essential purchases. This categorization illuminates spending patterns, highlighting areas where adjustments can be made to achieve financial goals. For example, allocating a smaller percentage of income to wants can free up resources for savings or debt reduction.

- Fixed versus Variable ExpensesCategorizing expenses as fixed (consistent, predictable amounts) or variable (fluctuating amounts) provides further insights. Rent or mortgage payments exemplify fixed expenses, while groceries and utility bills represent variable expenses. Understanding this distinction allows for better forecasting and budget allocation. For instance, anticipating increases in variable expenses, such as heating costs during winter, allows for proactive adjustments in other spending categories.

- Expense TypesCategorizing expenses by type, such as housing, transportation, food, healthcare, and entertainment, provides a granular view of spending habits. This detailed breakdown facilitates targeted analysis, revealing specific areas for potential savings or adjustments. For example, tracking transportation expenses can highlight the cost-effectiveness of different commuting options or the potential benefits of reducing vehicle usage.

- Income SourcesCategorizing income sources, such as salary, investments, rental income, or side hustles, allows for a comprehensive understanding of total earnings. This categorization can inform decisions related to career advancement, investment strategies, or diversification of income streams. For example, tracking income from various sources can reveal the relative contribution of each stream and inform decisions about resource allocation for maximizing overall income.

These categorization strategies empower individuals to leverage the full potential of a personal monthly income statement template. By organizing financial data into meaningful categories, the template becomes a powerful tool for analyzing spending patterns, identifying areas for improvement, and ultimately, achieving financial well-being. This structured approach facilitates informed decision-making, enabling individuals to take control of their finances and work towards their financial goals.

4. Regular Tracking

Regular tracking forms the cornerstone of effective personal monthly income statement template utilization. The template’s value lies not in its static structure, but in the dynamic insights derived from consistently recorded data. Sporadic or inconsistent data entry renders the template ineffective, obscuring meaningful trends and hindering accurate financial assessment. Consistent engagement with the template transforms it from a mere form into a powerful financial management tool. For example, tracking daily coffee purchases might reveal a surprising cumulative expense, prompting a reevaluation of spending habits. Similarly, consistently logging fuel costs can illuminate the financial impact of commuting choices. This regular interaction with the template fosters financial awareness and promotes informed decision-making.

The cause-and-effect relationship between regular tracking and financial clarity is undeniable. Diligent recording of income and expenses illuminates spending patterns, identifies areas for potential savings, and facilitates proactive budget adjustments. Without consistent tracking, financial blind spots emerge, hindering effective planning and potentially leading to overspending or accumulating unnecessary debt. Consider the example of recurring subscription services. Regular tracking can reveal forgotten or underutilized subscriptions, offering opportunities for cost reduction. Conversely, neglecting to track these expenses can lead to ongoing, unnoticed drains on financial resources. The practical significance of this understanding lies in the empowerment it provides the ability to make informed decisions based on concrete data rather than assumptions.

Regular engagement with the template cultivates financial discipline and provides a foundation for long-term financial well-being. Challenges may arise in maintaining consistency, particularly amidst busy schedules. However, overcoming these challenges through establishing routines and utilizing technological aids, such as budgeting apps or automated transaction tracking, ensures the template remains a valuable tool. The insights gained from regular tracking empower individuals to take control of their finances, make informed decisions, and achieve their financial goals.

5. Analysis

Analysis of data within a personal monthly income statement template is essential for extracting actionable insights. The template itself serves as a structured repository of financial information, but without thorough analysis, its value remains untapped. This analysis involves examining income and expense trends over time, identifying patterns, and drawing conclusions that inform financial decisions. Cause and effect relationships become clearer through analysis. For instance, a consistent increase in dining out expenses might correlate with a decrease in grocery spending, suggesting a shift in lifestyle choices. Identifying such trends allows for informed adjustments to spending habits and budget allocation.

As a crucial component of a comprehensive personal finance strategy, analysis elevates the template from a record-keeping tool to a driver of financial improvement. Examining the proportion of income allocated to various expense categories provides a clear picture of financial priorities. This understanding can reveal areas of overspending or highlight opportunities for increased savings or investment. For example, analysis might reveal that a significant portion of income is allocated to transportation costs, prompting consideration of alternative commuting options or vehicle downsizing. The practical application of this understanding lies in its ability to empower informed decisions that align with financial goals.

Analysis provides the crucial link between data and informed financial action. It empowers individuals to move beyond simply tracking income and expenses to actively shaping their financial future. Challenges may arise in interpreting data or identifying relevant trends. Overcoming these challenges through utilizing analytical tools, seeking financial guidance, or continuously refining analytical skills ensures the template becomes a catalyst for achieving financial well-being. This analytical approach is not merely about understanding past spending; it’s about leveraging that understanding to make informed decisions and build a more secure financial future.

6. Template Usage

Effective template usage is essential for maximizing the benefits of a personal monthly income statement template. Consistent and accurate data entry transforms the template from a static document into a dynamic tool for financial management. This consistent usage fosters a deeper understanding of personal finances, revealing trends and patterns that might otherwise remain obscured. Cause and effect relationships become clearer through consistent data entry. For example, tracking entertainment expenses alongside income fluctuations can reveal the impact of financial pressures on discretionary spending. This understanding enables informed adjustments to spending habits and budget allocation.

As a core component of sound financial practice, consistent template usage facilitates proactive financial management. Regularly updating the template allows individuals to monitor progress toward financial goals, identify potential financial challenges, and make timely adjustments. For instance, tracking savings contributions alongside investment returns provides a clear picture of progress toward a down payment or retirement fund. This real-time feedback enables proactive course correction, ensuring financial goals remain attainable. The practical significance of this understanding lies in its ability to empower informed decisions and facilitate proactive financial management. Regular engagement transforms the template into a control panel for personal finances, providing the insights needed to navigate financial complexities effectively.

Consistent template usage cultivates financial discipline and provides a foundation for long-term financial well-being. Challenges may arise in maintaining consistency amidst the demands of daily life. However, overcoming these challenges through integrating template usage into routines, leveraging technological aids like budgeting apps, or seeking professional guidance ensures that the template remains a valuable asset. This consistent engagement is not merely about recording numbers; it’s about cultivating a proactive approach to financial management, empowering individuals to take control of their financial destinies and achieve long-term financial security.

Key Components of a Personal Monthly Income Statement Template

A well-structured template provides a comprehensive overview of an individual’s financial status. Key components work together to capture essential data, facilitating informed financial decisions.

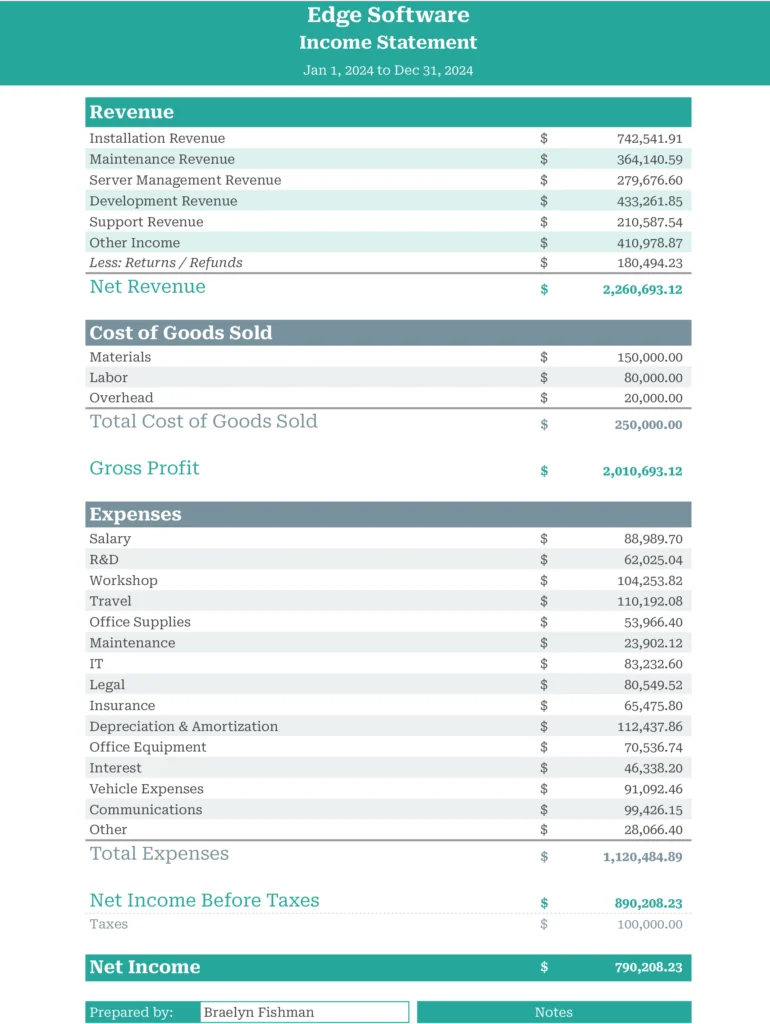

1. Income: Accurate recording of all income sources, including salaries, wages, investments, and other earnings, is fundamental. This data establishes the foundation for budgeting and expense management.

2. Expenses: Detailed tracking of all expenditures, categorized for analysis, provides insights into spending patterns. This includes fixed expenses like rent or mortgage payments, as well as variable expenses such as groceries or entertainment.

3. Categorization: Organizing income and expenses into meaningful categories (e.g., housing, transportation, food) allows for targeted analysis and identification of areas for potential savings or adjustments. Distinguishing between needs and wants provides further clarity.

4. Time Period: Specifying the covered period, typically a month, ensures accurate tracking and analysis of financial activity within that timeframe. This allows for comparison across different periods and identification of trends.

5. Net Income: Calculating the difference between total income and total expenses reveals the net income, indicating the surplus or deficit for the given period. This key metric informs financial decision-making and progress towards financial goals.

6. Analysis & Insights: Reviewing the compiled data allows for the identification of trends, potential areas for improvement, and informed adjustments to spending habits. This analysis provides a basis for future financial planning and goal setting.

These components work synergistically to provide a clear and actionable snapshot of financial health, empowering informed financial decisions and progress toward financial objectives. Regular use and analysis of these components contribute to effective budgeting, debt management, and long-term financial stability.

How to Create a Personal Monthly Income Statement Template

Creating a personalized template provides a structured framework for understanding monthly finances. The following steps outline the process of building a template tailored to individual needs.

1: Choose a Format: Select a format spreadsheet software, budgeting apps, or even a simple notebook that suits individual preferences and technological proficiency. Spreadsheet software offers flexibility and formula integration, while budgeting apps provide automated tracking features. A notebook offers a low-tech, readily accessible option.

2: List Income Sources: Document all sources of income, including salary, wages, investment returns, rental income, and any other recurring inflows. Accuracy in this step is crucial for an accurate overall financial picture.

3: Categorize Expenses: Establish expense categories relevant to individual spending habits. Common categories include housing, transportation, food, utilities, healthcare, entertainment, and debt payments. Detailed categorization facilitates analysis and identification of potential savings areas. Consider subcategories within broader categories for a more granular view, such as “groceries” and “dining out” within the “food” category.

4: Track Expenses Diligently: Record all expenses meticulously, assigning each expense to the appropriate category. Leverage available tools, such as bank transaction downloads or budgeting apps, to streamline data entry and ensure accuracy.

5: Calculate Net Income: Subtract total expenses from total income to determine net income. This key figure provides a clear picture of monthly financial performance and informs future budgeting decisions.

6: Analyze and Refine: Regularly review the compiled data, analyzing spending patterns and identifying trends. This analysis provides insights into areas for potential improvement, such as reducing discretionary spending or exploring cost-saving measures. Refine the template over time, adjusting categories or tracking methods to optimize its effectiveness and relevance to evolving financial circumstances.

7: Establish a Regular Review Schedule: Set a consistent schedule for reviewing and updating the template, ideally monthly. Regular engagement fosters financial awareness and promotes proactive financial management.

A well-maintained template provides a powerful tool for managing personal finances, enabling informed decisions, proactive budgeting, and effective progress toward financial goals. Consistent tracking, analysis, and refinement are essential for maximizing its value and achieving financial well-being.

A structured framework for organizing monthly income and expenses provides a crucial foundation for financial well-being. Diligent tracking, categorization, and analysis of financial data within this framework empower informed decision-making, enabling effective budgeting, debt management, and progress toward financial goals. Regular engagement with such a structure fosters financial awareness and promotes proactive financial management. From identifying areas for potential savings to making informed investment choices, the insights derived from a consistently maintained record of income and expenses are invaluable for achieving financial stability and security.

Financial well-being is an ongoing journey, not a destination. A detailed understanding of monthly finances serves as a compass, guiding informed choices and facilitating navigation toward long-term financial security. Leveraging the insights provided by a regularly updated and analyzed income and expense framework empowers individuals to take control of their financial destinies and build a more secure future.