Utilizing such a structured document facilitates informed financial decision-making. It allows for tracking progress toward financial goals, identifying areas for improvement, and providing a clear picture for securing loans or investments. This organized approach to personal finance empowers individuals to take control of their financial well-being and plan for the future with greater confidence.

This foundation of understanding facilitates exploration of key topics such as asset allocation, debt management, and long-term financial planning strategies, all crucial components of a comprehensive financial plan.

1. Assets

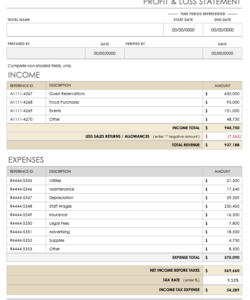

Assets represent the cornerstone of a personal net worth statement template, encompassing all items owned with measurable monetary value. Accurate asset valuation is crucial for a realistic portrayal of financial standing. Categorizing assets facilitates a comprehensive overview and informed financial planning. Common categories include liquid assets (e.g., cash, checking accounts, savings accounts), readily convertible to cash; investment assets (e.g., stocks, bonds, mutual funds), held for potential growth; and fixed assets (e.g., real estate, vehicles), tangible property expected to retain long-term value. For example, an individual might list a primary residence valued at $300,000, a retirement account balance of $150,000, and a vehicle worth $20,000 as assets on the statement. The accurate inclusion of these values provides a foundation for calculating net worth and making informed financial decisions.

The relationship between assets and liabilities within the template provides crucial insights into financial health. A high asset value contributes positively to net worth, offering potential for leveraging financial opportunities. However, asset value alone does not provide a complete picture. Considering asset liquidity, growth potential, and diversification alongside liabilities offers a more robust understanding of one’s overall financial position. For instance, a large asset portfolio concentrated in a single, volatile investment presents a different risk profile compared to a diversified portfolio, even if the total value is similar. Understanding these nuances is essential for informed decision-making and long-term financial stability.

Thorough asset documentation within a personal net worth statement template empowers individuals to monitor financial progress and make informed choices. Regularly updating asset values reflects market fluctuations and life changes, ensuring the statement provides an accurate snapshot of current financial health. This practice enables individuals to identify potential areas for improvement, such as diversifying investments or considering strategies for asset appreciation. The documented asset information serves as a valuable tool for financial planning, facilitating informed decisions related to retirement planning, estate management, and other long-term financial goals. Furthermore, a well-maintained asset record simplifies complex financial processes, such as loan applications or estate settlements, by providing readily accessible and organized financial data.

2. Liabilities

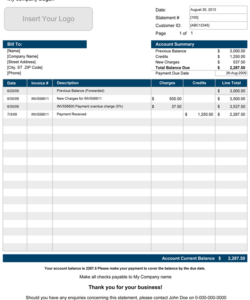

Liabilities represent financial obligations owed to external parties, forming a critical component of a personal net worth statement template. Accurate accounting of liabilities is essential for determining a realistic net worth figure. Common examples include mortgages, student loans, auto loans, credit card debt, and any other outstanding balances. Understanding the nature and extent of liabilities is crucial for assessing overall financial health. For instance, an individual with a $200,000 mortgage, a $30,000 auto loan, and $5,000 in credit card debt carries a total liability of $235,000. This figure, when compared against assets, reveals the individual’s net worth position.

The interplay between liabilities and assets within the template reveals crucial insights into financial stability. High liability levels relative to assets can indicate financial vulnerability and potential challenges in meeting financial obligations. Conversely, a lower liability burden signifies a stronger financial position, offering greater flexibility and opportunity. For example, an individual with significant assets but equally high liabilities might have a lower net worth than someone with fewer assets but minimal debt. This comparison highlights the importance of considering both sides of the financial equation. Managing and reducing liabilities strategically contributes to long-term financial health and enhances net worth over time. Prioritizing high-interest debts or consolidating loans can significantly impact the liability side of the equation and improve overall financial standing.

Detailed liability documentation within a personal net worth statement template fosters financial awareness and informed decision-making. Regularly updating liabilities, including outstanding balances and interest rates, ensures the statement reflects current financial obligations. This practice empowers individuals to track progress toward debt reduction goals and identify potential areas for improvement, such as refinancing high-interest loans or developing a budget to manage spending. Understanding the composition and impact of liabilities facilitates more effective financial planning, enabling informed decisions regarding debt management, investment strategies, and future financial goals. A clear grasp of liabilities empowers individuals to navigate financial challenges proactively and build a more secure financial future.

3. Calculation

Calculation forms the core of a personal net worth statement template, providing the crucial link between assets and liabilities. Net worth, representing overall financial standing, is derived by subtracting total liabilities from total assets. This straightforward calculation provides a concise snapshot of financial health at a specific point in time. For example, an individual with $350,000 in assets and $235,000 in liabilities possesses a net worth of $115,000. Understanding this fundamental calculation is essential for interpreting the information presented within the template and making informed financial decisions.

The calculated net worth figure serves as a key indicator of financial progress and stability. A positive net worth suggests assets outweigh liabilities, indicating a healthy financial position. Conversely, a negative net worth indicates liabilities exceed assets, signaling potential financial vulnerability. Tracking net worth over time provides valuable insights into the effectiveness of financial strategies. For instance, consistent increases in net worth might reflect successful investing and debt management, while a declining net worth could prompt a review of spending habits and financial goals. Regularly calculating and analyzing net worth empowers individuals to identify areas for improvement and adjust financial strategies as needed.

The accuracy of the calculation hinges on meticulous record-keeping and honest assessment of both assets and liabilities. Overestimating asset values or underestimating liabilities can lead to a misleading net worth figure and hinder effective financial planning. Employing realistic valuations and maintaining updated records ensures the calculated net worth provides a reliable foundation for financial decision-making. Understanding the limitations of the calculation is also crucial. Net worth represents a snapshot in time and does not predict future financial performance. Market fluctuations, unexpected expenses, and life changes can impact net worth, highlighting the importance of regular updates and ongoing financial planning.

4. Regular Updates

Maintaining an up-to-date personal net worth statement template is crucial for accurate financial assessment and effective long-term planning. Regular updates ensure the statement reflects current financial realities, enabling informed decision-making and proactive adjustments to financial strategies.

- FrequencyThe recommended frequency for updating a personal net worth statement is typically quarterly or annually, though more frequent updates may be beneficial during periods of significant financial change. Quarterly updates allow for timely adjustments to financial strategies based on recent market fluctuations or life events. Annual updates provide a comprehensive yearly overview of financial progress.

- Impact of Market FluctuationsRegular updates capture the impact of market volatility on investment assets. For example, a decline in stock market values will be reflected in the updated statement, providing a realistic assessment of current net worth. This awareness allows for informed decisions regarding investment strategies, such as rebalancing portfolios or adjusting risk tolerance.

- Debt ManagementTracking liabilities through regular updates facilitates effective debt management. Monitoring outstanding balances and interest rates allows for identifying opportunities to reduce debt burdens and improve overall financial health. For instance, observing a consistent decrease in loan balances reinforces the effectiveness of debt reduction strategies.

- Life EventsSignificant life events, such as purchasing a home, changing employment, or receiving an inheritance, impact financial standing. Regular updates ensure these changes are reflected in the net worth statement, providing a clear picture of their financial implications. This updated information facilitates informed decisions regarding financial planning and future goals.

Consistent updates transform the personal net worth statement template from a static document into a dynamic tool for financial management. This practice fosters financial awareness, enabling individuals to adapt to changing circumstances, pursue financial goals effectively, and build a more secure financial future.

5. Financial Planning

Financial planning relies heavily on a clear understanding of one’s current financial position. A personal net worth statement template provides this crucial foundation, enabling informed decisions and strategic goal setting. It serves as a roadmap for navigating financial complexities and achieving long-term financial security. The template facilitates a structured approach to financial planning, enabling individuals to align their resources with their objectives effectively.

- Goal SettingA comprehensive financial plan begins with defining clear, measurable, achievable, relevant, and time-bound (SMART) goals. Whether it’s retirement planning, purchasing a home, or funding education, the net worth statement provides a baseline for setting realistic goals. For example, an individual aiming to retire with $1 million can use the statement to assess current progress and adjust savings strategies accordingly. The template clarifies the gap between current net worth and desired future financial status, informing goal-setting and resource allocation.

- Budgeting and SpendingEffective budgeting and spending habits are integral to achieving financial goals. A personal net worth statement template informs budgeting decisions by highlighting areas of potential overspending and opportunities for increased savings. For instance, a high debt-to-asset ratio might indicate the need for stricter budgeting and spending adjustments. The template facilitates informed decisions regarding resource allocation, ensuring spending aligns with financial objectives.

- Investment StrategiesInvestment decisions are guided by the information presented within the net worth statement. An individual with a substantial net worth and low debt might consider higher-risk investments with greater potential returns. Conversely, someone with a lower net worth and higher debt might prioritize lower-risk investments focused on preserving capital. The template provides context for assessing risk tolerance and selecting appropriate investment strategies aligned with individual financial circumstances.

- Debt ManagementDeveloping a debt management plan is a critical aspect of financial planning. The net worth statement clarifies the extent of current debt obligations and their impact on overall financial health. This understanding enables informed decisions regarding debt reduction strategies, such as prioritizing high-interest debts or consolidating loans. The template facilitates proactive debt management, promoting financial stability and contributing to long-term net worth growth.

By providing a clear snapshot of financial health, the personal net worth statement template becomes an indispensable tool for effective financial planning. It empowers individuals to make informed decisions regarding goal setting, budgeting, investing, and debt management, ultimately paving the way for long-term financial security and success.

6. Snapshot in Time

A personal net worth statement template functions as a financial photograph, capturing one’s precise financial standing at a specific moment. This “snapshot in time” characteristic is crucial for understanding the document’s purpose and limitations. It represents a static view of assets, liabilities, and net worth on a particular date, not a prediction of future performance. For example, a statement generated today reflects current market values and outstanding debts. Tomorrow, market fluctuations or new debt could alter the financial picture significantly. Recognizing this temporal aspect is fundamental to utilizing the template effectively.

The “snapshot in time” nature allows for tracking progress and identifying trends by comparing statements generated at different intervals. Regular updates, ideally quarterly or annually, provide a series of snapshots, revealing how financial health evolves over time. Analyzing these snapshots can highlight the impact of financial decisions, market changes, and life events. For instance, consistent increases in net worth over several snapshots might indicate successful long-term investment strategies. Conversely, a sudden drop in net worth could signal the need to reassess financial priorities and adapt accordingly. This comparative analysis provides actionable insights for informed financial management.

While the static nature of a single statement limits its predictive capacity, it offers a crucial foundation for future planning. By understanding current financial standing, individuals can set realistic financial goals, develop appropriate budgeting strategies, and make informed investment decisions. The “snapshot in time” serves as a benchmark for measuring progress and evaluating the effectiveness of financial strategies. Recognizing its limitations encourages proactive financial management, emphasizing the importance of regular updates and ongoing adaptation to dynamic financial circumstances. This approach fosters financial awareness and empowers individuals to navigate the complexities of personal finance effectively.

Key Components of a Personal Net Worth Statement Template

Understanding the core components of a personal net worth statement template is crucial for effective financial management. The following elements provide a framework for utilizing this valuable tool.

1. Assets: All items of monetary value owned, including cash, investments, real estate, and personal property. Accurate valuation is essential. Categorization (e.g., liquid, investment, fixed) provides a clearer overview.

2. Liabilities: All outstanding debts and financial obligations, such as mortgages, loans, and credit card balances. Accurate accounting is vital for determining a realistic net worth figure.

3. Calculation: Net worth is calculated by subtracting total liabilities from total assets. This simple calculation provides a concise overview of financial health at a specific point in time.

4. Regular Updates: Consistent updates, typically quarterly or annually, ensure the statement reflects current financial realities. This practice allows for timely adjustments to financial strategies.

5. Financial Planning: The template serves as a foundation for informed financial planning, enabling realistic goal setting, effective budgeting, and strategic investment decisions.

6. Snapshot in Time: The statement represents one’s financial position at a specific moment. Regular updates provide a series of snapshots, revealing trends and the impact of financial decisions over time.

Accurate and consistent use of these components transforms a personal net worth statement template into a powerful tool for managing and improving financial well-being. This organized approach empowers informed decision-making and facilitates progress toward long-term financial security.

How to Create a Personal Net Worth Statement

Creating a personal net worth statement involves compiling a comprehensive inventory of assets and liabilities. This organized approach provides a clear snapshot of one’s current financial standing and serves as a valuable tool for financial planning.

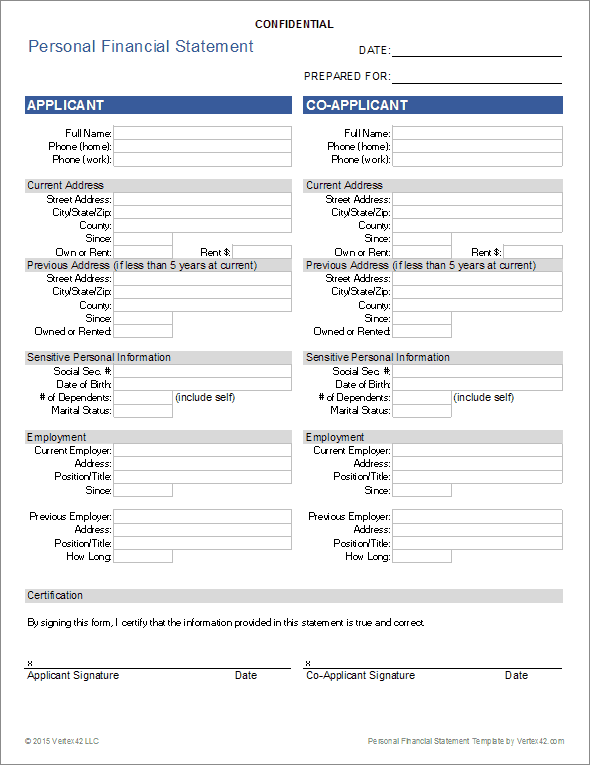

1. Gather Financial Documents: Collect all relevant financial documents, including bank statements, investment account summaries, loan documents, and credit card statements. This comprehensive collection ensures accurate data entry and a reliable net worth calculation.

2. List Assets: Create a detailed list of all owned assets, categorized for clarity. Common categories include liquid assets (cash, checking accounts), investment assets (stocks, bonds), and fixed assets (real estate, vehicles). Accurate valuation is crucial; use current market values for readily marketable assets and appraised values for less liquid assets like real estate.

3. List Liabilities: Compile a comprehensive list of all outstanding debts and financial obligations. Include mortgages, student loans, auto loans, credit card balances, and any other outstanding loans. Accuracy is paramount; ensure all listed debts reflect current outstanding balances.

4. Calculate Net Worth: Subtract the total sum of liabilities from the total sum of assets. The resulting figure represents net worth, a key indicator of overall financial health.

5. Choose a Template or Software: While a simple spreadsheet can suffice, numerous templates and software applications offer pre-built formats for organizing and calculating net worth. These resources often include additional features for tracking progress over time and generating visual representations of financial data.

6. Update Regularly: Regular updates, ideally quarterly or annually, ensure the statement accurately reflects evolving financial circumstances. This practice facilitates informed financial decision-making and allows for adjustments to financial strategies as needed.

7. Analyze and Interpret: Review the completed statement to understand current financial standing. Analyze the relationship between assets and liabilities, and identify areas for potential improvement, such as reducing debt or diversifying investments.

A meticulously compiled and regularly updated personal net worth statement provides a clear and accurate representation of financial health. This organized approach empowers informed financial planning, enabling effective management of assets, liabilities, and the pursuit of long-term financial goals.

A structured approach to personal finance, utilizing a dedicated document, provides individuals with a clear and concise snapshot of their financial health. By meticulously documenting assets, liabilities, and calculating the difference, a comprehensive understanding of one’s financial position emerges. This organized approach facilitates informed decision-making regarding budgeting, investing, and debt management. Regularly updating this document ensures it remains a relevant and reliable tool for monitoring progress toward financial goals and adapting to changing financial circumstances.

This proactive engagement with personal finances empowers individuals to navigate financial complexities with greater confidence and control. The insights gained through this structured approach contribute to long-term financial stability and facilitate the achievement of financial aspirations. It provides a foundation for building a more secure financial future, one informed by accurate data and strategic planning.