Utilizing a structured format for organizing personal finances offers several advantages. It allows for a clear and concise overview of one’s financial standing, enabling informed decision-making regarding spending, saving, and investing. This organized approach facilitates tracking progress toward financial goals and identifying areas needing attention. Furthermore, a readily available summary of financial information can be invaluable when applying for loans, mortgages, or other forms of credit.

This understanding of the structure and benefits of a standardized personal financial summary provides a foundation for exploring the specific components in detail. The following sections will delve into the categories of assets and liabilities, offering practical guidance on accurately classifying and valuing various financial holdings. Subsequent discussions will address calculating net worth and interpreting the overall financial picture.

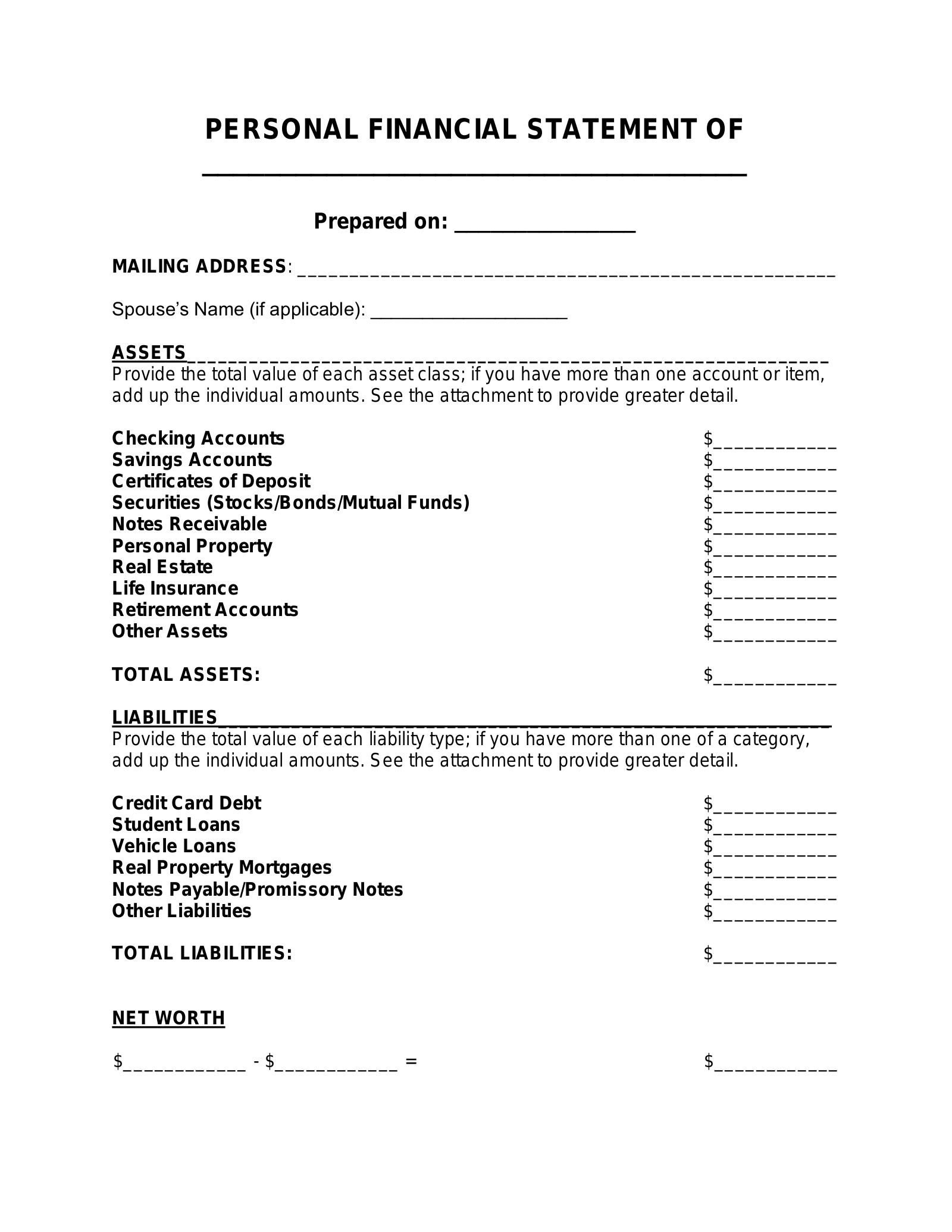

1. Assets

Assets represent items of economic value owned by an individual and constitute a crucial component of a personal statement of financial position. Accurate representation of assets is essential for determining net worth and understanding overall financial health. Categorizing assets appropriately allows for a comprehensive view of one’s financial holdings. Common asset categories include liquid assets (easily converted to cash, such as checking and savings accounts), investments (stocks, bonds, mutual funds), and fixed assets (tangible property like real estate and vehicles). For example, an individual might list $5,000 in a checking account as a liquid asset, $20,000 invested in a mutual fund as an investment, and a home valued at $250,000 as a fixed asset.

The value assigned to each asset should reflect its current market worth. Liquid assets are typically recorded at their face value, while investments are valued based on their current market price. Fixed assets, such as real estate, are often assessed based on recent comparable sales or professional appraisals. Accurately valuing assets ensures the personal statement of financial position provides a realistic representation of one’s financial standing. For instance, if the real estate market experiences a downturn, the value of a property on the statement should be adjusted accordingly to maintain accuracy.

A comprehensive understanding of asset classification and valuation is crucial for constructing a meaningful personal statement of financial position. Challenges can arise in valuing certain assets, particularly illiquid assets like privately held businesses or collectibles. Seeking professional advice can be beneficial in these situations. Accurate asset reporting provides a solid foundation for financial planning, enabling informed decisions regarding debt management, investment strategies, and retirement planning.

2. Liabilities

Liabilities represent financial obligations or debts owed to external parties. Accurate accounting for liabilities is critical for a comprehensive understanding of one’s financial position within a personal statement of financial position template. A clear representation of liabilities provides insights into the extent of financial commitments and their potential impact on long-term financial health.

- Short-Term LiabilitiesThese obligations are typically due within one year. Common examples include credit card balances, utility bills, and short-term loans. Accurately tracking these liabilities is essential for managing cash flow and ensuring timely payments. Within the context of a personal financial statement, short-term liabilities provide a snapshot of immediate financial demands.

- Long-Term LiabilitiesThese debts extend beyond one year. Examples include mortgages, student loans, and auto loans. Understanding the total amount and repayment terms of long-term liabilities is crucial for long-term financial planning. Their presence significantly impacts net worth calculations and influences decisions regarding major purchases or investments.

- Secured vs. Unsecured DebtSecured debt is backed by collateral, such as a house in a mortgage or a car in an auto loan. Unsecured debt lacks such collateral, including credit card debt and personal loans. This distinction is relevant in assessing risk and understanding the potential consequences of default. A personal financial statement should clearly differentiate between these debt types to provide a more nuanced view of financial obligations.

- Contingent LiabilitiesThese represent potential future obligations that depend on the outcome of a specific event. Examples include co-signing a loan or being named in a lawsuit. While not always quantifiable, disclosing contingent liabilities is important for transparency and a complete understanding of potential future financial burdens. These items, though uncertain, can significantly impact one’s financial position if they become actual liabilities.

Accurate and comprehensive reporting of liabilities is essential for a meaningful personal statement of financial position. Understanding the different categories of liabilities, their terms, and their potential impact provides valuable insights for effective debt management and overall financial planning. A thorough accounting of liabilities allows individuals to assess their debt burden, prioritize repayment strategies, and make informed decisions about future borrowing. This understanding, combined with a clear picture of assets, enables individuals to gain a holistic view of their financial health and work towards their financial goals.

3. Net Worth Calculation

Net worth calculation forms the core of a personal statement of financial position template. It provides a concise summary of an individual’s financial health by quantifying the difference between total assets and total liabilities. A positive net worth signifies assets exceeding liabilities, indicating a degree of financial security. Conversely, a negative net worth indicates liabilities outweigh assets, suggesting potential financial vulnerability. Understanding this relationship is crucial for assessing financial progress and making informed financial decisions.

Consider an individual with $300,000 in assets, including a home, investments, and savings, and $150,000 in liabilities, primarily a mortgage and student loans. Their net worth would be $150,000, representing the residual value after all debts are settled. Alternatively, if liabilities totaled $350,000, the net worth would be -$50,000, indicating a greater degree of financial strain. Tracking net worth over time, as reflected in regularly updated personal financial statements, reveals the impact of financial decisions and changing economic circumstances.

Calculating net worth is not merely a mathematical exercise; it offers valuable insights into one’s financial trajectory. A rising net worth often indicates effective financial management, while a declining net worth may signal the need for adjustments in spending or saving habits. Monitoring net worth empowers individuals to identify financial strengths and weaknesses, facilitating proactive financial planning and informed decision-making regarding investments, debt management, and retirement planning. The net worth figure within the personal financial statement acts as a key performance indicator of overall financial health and provides a benchmark for evaluating progress toward financial goals.

4. Snapshot in Time

A personal statement of financial position template provides a snapshot of an individual’s financial standing at a specific point in time. This characteristic is crucial for understanding its function and utility in financial planning. Unlike a continuously updating system, the statement captures a precise moment, offering a static view of assets, liabilities, and net worth. This time-bound perspective provides a benchmark for assessing progress, making informed decisions, and adapting to changing financial circumstances.

- Current Financial StatusThe statement reflects the current value of assets and liabilities. For example, a property purchased years ago is listed at its current market value, not its original purchase price. Similarly, outstanding loan balances are recorded as of the statement date. This real-time assessment is crucial for accurate net worth calculation and informed decision-making regarding debt management, investment strategies, and retirement planning. Changes in market conditions or personal circumstances between statement updates are not reflected until the next snapshot is taken.

- Basis for ComparisonRegularly generated statements provide a basis for comparing financial progress over time. By analyzing changes in net worth, asset allocation, and debt levels between snapshots, individuals can track the impact of financial decisions and identify areas for improvement. For example, a consistent increase in net worth over several statements might indicate effective saving and investment strategies. Conversely, a stagnant or declining net worth could suggest the need to re-evaluate spending habits or explore alternative investment options.

- Dynamic Nature of FinancesThe “snapshot” nature underscores the dynamic nature of personal finances. Financial situations are constantly evolving due to various factors, including market fluctuations, career changes, and unexpected expenses. Regularly updating the personal financial statement allows individuals to capture these changes and adapt their financial strategies accordingly. The frequency of updates depends on individual circumstances and financial goals; however, periodic reviews, at least annually, are generally recommended to maintain an accurate and relevant overview of one’s financial health.

- Planning and Decision-MakingThe clear and concise information presented in a snapshot facilitates informed financial planning and decision-making. By understanding their current financial position, individuals can set realistic financial goals, develop effective strategies for debt reduction, and make informed choices regarding investments and major purchases. For example, a clear picture of asset allocation can inform decisions about diversifying investments, while an understanding of debt levels can influence decisions about taking on additional financial obligations.

The “snapshot in time” aspect of a personal statement of financial position template is essential for its effectiveness as a financial planning tool. It allows individuals to gain a clear understanding of their financial health at a specific moment, track progress over time, and make informed decisions based on accurate and up-to-date information. The dynamic nature of personal finances necessitates regular updates to ensure the statement remains a relevant and reliable reflection of one’s financial situation.

5. Regular Updates

Maintaining an accurate and relevant personal statement of financial position requires regular updates. Financial situations are dynamic; asset values fluctuate, liabilities change, and income and expenses vary over time. Regular updates ensure the statement reflects current reality, enabling informed financial decisions.

- Frequency of UpdatesThe ideal update frequency depends on individual circumstances and financial activity. For relatively stable financial situations, annual updates might suffice. However, significant life events, such as purchasing a home or receiving a large inheritance, warrant immediate updates to reflect the altered financial landscape. More frequent updates, perhaps quarterly or semi-annually, are beneficial for those actively managing investments or navigating complex financial situations.

- Tracking ChangesRegular updates enable tracking changes in net worth, providing valuable insights into the effectiveness of financial strategies. Observing a consistent upward trend in net worth suggests sound financial management, while a decline might indicate the need for adjustments in spending, saving, or investment strategies. Monitoring these changes allows for timely intervention and course correction.

- Data AccuracyRegular updates enhance the accuracy of the financial statement. Asset valuations, particularly for investments and real estate, can shift considerably. Similarly, outstanding debt balances change with each payment. Updating these figures periodically ensures the statement reflects current market conditions and the actual status of liabilities, leading to more accurate net worth calculations and informed financial decisions.

- Financial Planning and Goal SettingUp-to-date financial statements are essential for effective financial planning and goal setting. Setting realistic financial goals, such as retirement savings or debt reduction, requires a clear understanding of one’s current financial position. Regularly updated statements provide this foundation, allowing individuals to monitor progress toward goals, adjust strategies as needed, and make informed decisions about resource allocation.

Regular updates are integral to the value and utility of a personal statement of financial position template. They ensure the statement remains a relevant and reliable tool for assessing financial health, tracking progress, and making informed decisions to achieve financial goals. Failing to update the statement regularly diminishes its accuracy and effectiveness in supporting sound financial management.

Key Components of a Personal Financial Statement

A comprehensive personal financial statement requires careful consideration of key components to provide an accurate representation of one’s financial health. Each component plays a crucial role in understanding the overall financial picture.

1. Assets: A detailed account of all items owned with monetary value. This includes liquid assets (cash, checking accounts, savings accounts), investments (stocks, bonds, mutual funds), and fixed assets (real estate, vehicles, personal property). Accurate valuation is essential, often requiring appraisals for fixed assets and referencing current market prices for investments.

2. Liabilities: A complete record of all outstanding debts and financial obligations. This encompasses short-term liabilities (credit card balances, utility bills) and long-term liabilities (mortgages, student loans, auto loans). Accurate reporting of liabilities is crucial for determining net worth and assessing debt burden.

3. Net Worth Calculation: Derived by subtracting total liabilities from total assets. This figure represents the residual value after settling all debts. A positive net worth indicates financial stability, while a negative net worth suggests potential financial challenges.

4. Date: Specifies the precise moment in time the financial statement represents. This “snapshot” characteristic underscores that financial positions are dynamic and subject to change. The date provides context for the reported figures and allows for tracking changes over time.

5. Supporting Documentation: While not directly included within the statement itself, supporting documentation plays a crucial role in verifying the accuracy of reported information. This may include bank statements, investment account summaries, loan documents, and property appraisals. Maintaining organized records facilitates accurate reporting and provides evidence to support the figures presented.

Accurate and comprehensive reporting of these elements provides a robust foundation for financial planning and decision-making. Regularly updated statements, reflecting changes in asset values, liabilities, and net worth, offer valuable insights into financial progress and enable informed choices regarding spending, saving, and investing.

How to Create a Personal Statement of Financial Position

Creating a personal statement of financial position provides a clear overview of one’s financial health. The following steps outline the process of developing this essential financial tool.

1. Choose a Date: Specify the date for which the statement applies. This creates a snapshot of financial standing at a specific point in time.

2. List Assets: Categorize and list all assets, including liquid assets (cash, checking accounts, savings accounts), investments (stocks, bonds, mutual funds, retirement accounts), and fixed assets (real estate, vehicles, personal property). Determine the current market value for each asset. Supporting documentation, such as bank statements and investment account summaries, can aid in accurate valuation.

3. List Liabilities: Categorize and list all outstanding debts and financial obligations. Include short-term liabilities (credit card balances, utility bills) and long-term liabilities (mortgages, student loans, auto loans). Note the current outstanding balance for each liability.

4. Calculate Net Worth: Subtract total liabilities from total assets. This figure represents net worth, a key indicator of overall financial health. A positive net worth indicates assets exceed liabilities, while a negative net worth suggests liabilities outweigh assets.

5. Format the Statement: Organize the information clearly in a table or spreadsheet format. Clearly label asset categories, liability categories, and the net worth calculation. Include the date prominently on the statement.

6. Review and Update: Review the statement for accuracy and completeness. Update the statement regularly, ideally at least annually or after significant financial events. Regular updates ensure the statement remains a relevant and reliable reflection of one’s evolving financial position.

7. Seek Professional Advice (Optional): Consider consulting with a financial advisor for personalized guidance on interpreting the statement, developing financial goals, and creating strategies to improve financial health.

A well-constructed statement facilitates informed financial decisions. Regularly reviewing and updating the statement provides valuable insights into financial progress and empowers individuals to manage their finances effectively.

A structured approach to personal finance, facilitated by a personal statement of financial position template, provides individuals with a powerful tool for understanding and managing their financial health. By meticulously documenting assets, liabilities, and calculating net worth, individuals gain a clear perspective on their current financial standing. Regular updates to this document, reflecting changes in financial circumstances and market conditions, ensure its ongoing relevance and utility. This structured approach empowers informed decision-making regarding spending, saving, investments, and debt management. A well-maintained personal statement of financial position serves as a cornerstone of effective financial planning, enabling informed choices and fostering financial well-being.

Financial well-being is an ongoing journey, not a destination. A personal statement of financial position template provides the compass and roadmap for navigating this journey. Regularly reviewing and updating this document enables informed course corrections and adjustments to financial strategies as life unfolds. This proactive engagement with personal finances empowers individuals to take control of their financial future, fostering long-term financial security and stability. The consistent application of these principles can significantly enhance the prospects of achieving financial goals and securing a sound financial future.