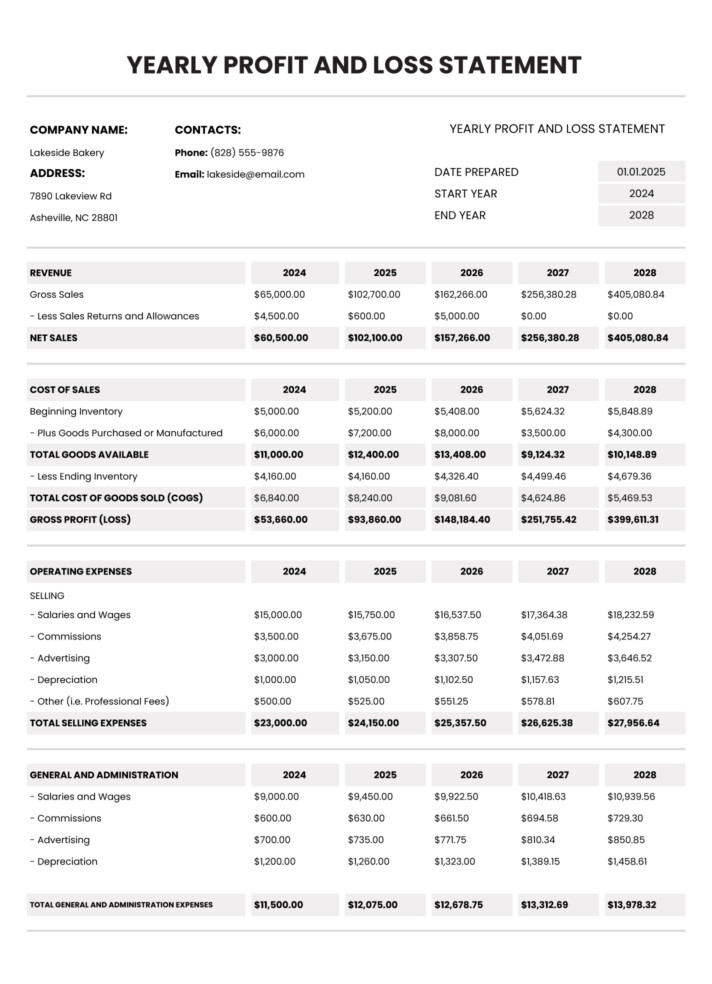

Leveraging such pre-designed structures provides several advantages, including time savings, improved accuracy, and consistent reporting formats. This facilitates better comprehension of financial performance across different periods and departments, empowering stakeholders to make informed strategic choices. Visualizations can be customized to suit specific business needs, highlighting key performance indicators (KPIs) and providing interactive drill-down capabilities for in-depth analysis.

This foundation enables exploration of related topics such as data integration, report customization, key performance indicators, and best practices for generating insightful financial reports. These elements contribute to a robust and effective financial analysis workflow within the business intelligence environment.

1. Data Integration

Accurate and insightful financial reporting within a Power BI income statement template relies heavily on seamless data integration. Connecting various data sources allows for a comprehensive view of financial performance, enabling informed decision-making. Without proper integration, the template remains a static shell, lacking the dynamic data that brings it to life.

- Data Source ConnectivityEstablishing connections to disparate systems, such as accounting software, ERP systems, and CRM platforms, is fundamental. These connections can be direct or through intermediary data warehouses. For example, integrating data from a company’s sales database with its expense tracking system provides a holistic view of revenue and costs, essential for an accurate income statement. Secure and reliable data pipelines ensure data integrity and consistency within the report.

- Data Transformation and CleaningRaw data often requires transformation before use in a Power BI template. This may involve cleaning, formatting, and aggregating data from various sources to ensure consistency and compatibility. For instance, standardizing date formats or converting currencies ensures data accuracy within the income statement. This process also contributes to a cleaner and more efficient reporting structure.

- Data Modeling and RelationshipsDefining relationships between different datasets is crucial for accurate calculations and insightful analysis within the template. For example, linking sales data with product information allows for profit analysis by product line. Establishing these connections empowers users to explore the interdependencies within their financial data, revealing deeper insights into performance drivers.

- Data Refresh SchedulingRegular data refreshes are essential to maintain report accuracy and relevance. Automated refresh schedules ensure the income statement reflects the latest financial information. This allows stakeholders to monitor performance trends and react to changes promptly, making timely and informed decisions based on current data. The frequency of refreshes should align with the business’s reporting needs.

Effective data integration empowers the Power BI income statement template to become a dynamic tool, offering real-time insights into financial performance. By connecting, transforming, and modeling data from diverse sources, organizations gain a comprehensive and accurate view of their financial health, enabling data-driven decision-making and strategic planning.

2. Visualizations

Effective data visualization is crucial for conveying the financial narrative within a Power BI income statement template. Transforming raw data into insightful visuals allows stakeholders to quickly grasp key performance indicators, trends, and potential areas of concern. Well-chosen visualizations enhance comprehension and facilitate data-driven decision-making.

- Chart SelectionChoosing appropriate chart types is paramount. Line charts effectively display trends over time, while bar charts compare performance across different categories (e.g., product lines or departments). Pie charts can illustrate the proportion of revenue generated by each business segment. Selecting the right visualization ensures clear communication of financial data and avoids misinterpretations.

- Data RepresentationData should be presented clearly and concisely. Axes should be labeled accurately, and scales chosen to avoid distortions. Color coding can highlight specific data points or categories, drawing attention to key performance indicators. For example, using contrasting colors for revenue and expenses enhances visual clarity and facilitates comparison.

- Interactive ElementsIncorporating interactive elements, such as drill-down capabilities, allows users to explore data in greater detail. Clicking on a data point in a chart could reveal the underlying transactions contributing to that value. Such interactivity empowers users to conduct ad-hoc analysis and gain deeper insights into financial performance.

- Report Layout and DesignA well-designed report layout enhances readability and comprehension. Visualizations should be arranged logically, with clear headings and annotations. Maintaining a consistent visual style throughout the report ensures a professional and cohesive presentation. A cluttered or poorly organized report can obscure insights and hinder effective communication.

Visualizations within a Power BI income statement template transform data into actionable insights. Thoughtful chart selection, clear data representation, interactive elements, and a well-designed layout contribute to a compelling financial narrative, empowering stakeholders to understand performance, identify trends, and make informed decisions.

3. Customization

Tailoring pre-built income statement templates within Power BI is essential for aligning with specific organizational needs and reporting requirements. Customization options directly impact the template’s effectiveness as an analytical tool. Modifying elements like key performance indicators (KPIs), data sources, and visual representations transforms a generic template into a bespoke solution that accurately reflects a company’s financial structure and analytical objectives. For example, a manufacturing company might customize its income statement to track cost of goods sold (COGS) by specific raw materials, providing granular insight into production expenses. Similarly, a service-based business might prioritize revenue by client segment, facilitating targeted analysis of customer profitability. Without customization, the template may lack relevance and fail to provide the specific insights needed for strategic decision-making.

Customization extends beyond simply adding or removing data fields. It encompasses the flexibility to adjust calculations, incorporate specific industry metrics, and tailor visualizations to highlight key performance drivers. A company operating on a subscription model, for instance, might customize the template to calculate monthly recurring revenue (MRR) and churn rate. Furthermore, visual customizations can be applied to emphasize these metrics through distinct chart formatting or interactive dashboards. This level of adaptability enables businesses to track performance based on the metrics most relevant to their operational model and strategic goals. The ability to incorporate calculated fields and measures allows for complex analyses, such as variance analysis against budget or prior periods, enriching the analytical capabilities of the income statement.

Effective customization transforms a standardized Power BI income statement template into a dynamic analytical tool specifically tailored to an organization’s unique context. It empowers businesses to move beyond generic reporting and gain granular insights into their financial performance. However, achieving optimal customization requires careful planning and execution. Challenges can arise from data compatibility issues, complex calculation requirements, and the need for ongoing maintenance as business needs evolve. Successfully addressing these challenges necessitates a clear understanding of reporting objectives, meticulous data preparation, and ongoing collaboration between business users and developers to ensure the customized template remains a relevant and reliable source of financial intelligence.

4. Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) are integral to a Power BI income statement template, providing quantifiable metrics for evaluating financial performance against strategic objectives. KPIs transform raw financial data into actionable insights, enabling informed decision-making. The selection and visualization of KPIs within the template directly influence the narrative conveyed about financial health and operational efficiency. Cause-and-effect relationships between business activities and financial outcomes can be explored by analyzing KPIs over time and across different business segments. For example, tracking the KPI “gross profit margin” can reveal the impact of changes in raw material costs or pricing strategies on profitability. Similarly, monitoring “operating expense ratio” can illuminate the effectiveness of cost-control measures. Analyzing the interplay of these KPIs provides a comprehensive understanding of the factors driving financial performance.

As essential components of a Power BI income statement template, KPIs offer several practical applications. Real-world examples illustrate their significance: a retail business might track “sales per square foot” to optimize store layouts and inventory management. An e-commerce company might focus on “customer acquisition cost” to evaluate marketing campaign effectiveness. A manufacturing firm might monitor “inventory turnover rate” to identify potential supply chain bottlenecks. These examples demonstrate how KPIs provide focused insights relevant to specific industry contexts. Visualizing these KPIs within the Power BI template allows for clear communication of performance trends and identification of areas requiring attention. Interactive dashboards enable users to drill down into the underlying data for deeper analysis, fostering data-driven decision-making and operational improvements.

Effective utilization of KPIs within a Power BI income statement template requires careful consideration of business objectives and strategic goals. KPIs should be relevant, measurable, achievable, relevant, and time-bound (SMART). Challenges can arise from selecting inappropriate KPIs or misinterpreting their implications. Furthermore, data quality issues and inconsistencies can undermine the reliability of KPI-based analysis. Successfully leveraging KPIs requires establishing robust data governance processes, ensuring data accuracy, and fostering a culture of data-driven decision-making throughout the organization. Ultimately, the strategic selection and insightful visualization of KPIs within the Power BI income statement template empower businesses to gain a deeper understanding of financial performance, drive operational efficiency, and achieve strategic objectives.

5. Interactive Analysis

Interactive analysis significantly enhances the utility of a Power BI income statement template. The ability to explore data dynamically transforms static financial reporting into an exploratory process. Users can manipulate data, filter results, and drill down into specific details, fostering a deeper understanding of underlying trends and drivers of financial performance. This interactivity allows for identification of cause-and-effect relationships, such as the impact of marketing campaigns on revenue generation or the correlation between production volume and cost of goods sold. Without interactive analysis, insights remain limited to the surface level presented in a static report. For example, identifying an unexpected drop in revenue in a specific quarter can trigger an interactive exploration of sales data by product line, region, or sales representative, pinpointing the root cause of the decline.

Several interactive features are essential components of effective income statement analysis within Power BI. Filtering enables users to focus on specific data subsets, such as a particular product category or time period. Drill-down functionality allows users to move from summarized figures to granular transactional details, providing context and revealing underlying patterns. Cross-filtering connects related visualizations, allowing changes in one visual to dynamically filter others, facilitating exploration of relationships between different financial metrics. For instance, selecting a specific product category in a sales chart could automatically filter the income statement to display the corresponding revenue and costs associated with that category. Slicers provide intuitive filtering controls, allowing users to easily select data subsets based on various criteria. Tooltips offer contextual information when hovering over data points, further enhancing understanding and interpretation of the visualizations.

Effective use of interactive analysis requires thoughtful design and execution. Overly complex dashboards can overwhelm users, while poorly designed visuals can obscure insights. Performance considerations are also crucial; large datasets and complex calculations can impact responsiveness and hinder interactivity. Successfully leveraging interactive analysis within a Power BI income statement template requires a balance between functionality and usability. The template should empower users to explore data intuitively and efficiently, fostering data-driven decision-making and a deeper understanding of financial performance.

6. Report Automation

Report automation significantly enhances the value of a Power BI income statement template by streamlining report generation and distribution. Automating recurring reporting tasks eliminates manual effort, reducing the risk of errors and freeing up valuable time for analysis and interpretation. Scheduled refreshes ensure that reports always reflect the latest data, enabling timely insights and informed decision-making. This automated workflow fosters consistency in reporting formats and reduces the likelihood of discrepancies that can arise from manual data manipulation. For example, a finance department can schedule automated generation and distribution of monthly income statements to key stakeholders, ensuring everyone has access to the most current financial information without manual intervention. This automation also supports compliance requirements by providing auditable records of report generation and distribution processes.

Practical applications of report automation within a Power BI income statement template context are numerous. Automated report generation facilitates performance monitoring against budgets and forecasts, enabling proactive identification of variances and timely corrective action. Automated distribution of customized reports to different departments empowers managers with relevant financial information for operational decision-making. Automated alerts based on predefined thresholds, such as significant changes in key performance indicators, enable timely responses to critical financial events. For instance, an automated alert triggered by a substantial drop in gross profit margin could prompt immediate investigation and corrective measures. This proactive approach enhances financial control and supports agile decision-making.

Effective implementation of report automation requires careful planning and consideration of data security and access control. Automated processes should adhere to organizational data governance policies, ensuring data integrity and confidentiality. Managing access to automated reports is crucial to prevent unauthorized access to sensitive financial information. Scalability is another key consideration, as automation solutions should accommodate increasing data volumes and evolving reporting requirements. Despite these challenges, the benefits of report automation within a Power BI income statement template are substantial. Streamlined workflows, enhanced accuracy, and timely insights contribute significantly to improved financial management and informed decision-making. Integrating report automation strengthens the analytical power of the template, transforming it from a static reporting tool into a dynamic source of financial intelligence.

Key Components of a Power BI Income Statement Template

Effective financial reporting requires a structured approach. A well-designed Power BI income statement template incorporates several crucial components, each contributing to a comprehensive and insightful understanding of financial performance. These components work together to transform raw data into actionable intelligence, enabling data-driven decision-making.

1. Data Integration: Seamless integration of data from various sources, including accounting systems, ERP platforms, and CRM databases, forms the foundation of an effective income statement template. Accurate and reliable data pipelines ensure data integrity and consistency, enabling accurate calculations and insightful analysis. This integration should accommodate data transformation and cleaning processes to standardize formats and ensure data compatibility.

2. Visualizations: Data visualization transforms numerical figures into easily digestible graphical representations, enhancing understanding and facilitating communication of financial performance. Appropriate chart selection, clear labeling, and interactive elements, such as drill-down capabilities, enable stakeholders to quickly grasp key trends, identify potential issues, and explore data in greater detail.

3. Customization: Adaptability is essential. A robust template allows customization of key performance indicators (KPIs), data fields, and visual elements to align with specific organizational requirements and reporting objectives. This flexibility ensures the template remains relevant and provides the specific insights needed for strategic decision-making.

4. Key Performance Indicators (KPIs): KPIs provide quantifiable metrics for evaluating financial performance against strategic goals. Selecting and visualizing relevant KPIs within the template allows for focused performance monitoring and identification of areas requiring attention. Examples include gross profit margin, net income, operating expense ratio, and other industry-specific metrics.

5. Interactive Analysis: Dynamic exploration of data through filtering, drill-down functionality, and cross-filtering empowers users to uncover deeper insights and understand the factors driving financial performance. Interactive elements transform a static report into an exploratory tool, facilitating data discovery and informed decision-making.

6. Report Automation: Automating report generation and distribution streamlines workflows, reduces manual effort, and ensures timely access to the latest financial information. Scheduled refreshes and automated distribution enhance efficiency and support compliance requirements.

These interconnected components form a cohesive framework for effective financial reporting within Power BI. By combining robust data integration, insightful visualizations, customization options, relevant KPIs, interactive analysis capabilities, and automated reporting processes, organizations gain a powerful tool for monitoring financial performance, identifying trends, and making informed decisions.

How to Create a Power BI Income Statement Template

Creating a robust income statement template within Power BI involves several key steps. A structured approach ensures a template that effectively integrates data, provides insightful visualizations, and supports informed financial decision-making.

1: Data Source Identification and Connection: Identify and connect relevant data sources. This may include accounting software, ERP systems, or other databases containing financial data. Establish secure and reliable data connections to ensure data integrity and consistency. Consider using Power BI’s built-in connectors or creating custom connectors for specific data sources.

2: Data Model Design: Develop a robust data model within Power BI Desktop. This involves defining relationships between tables, creating calculated columns and measures for key financial metrics (e.g., gross profit, net income), and ensuring data integrity. A well-structured data model is crucial for accurate calculations and efficient report generation.

3: Report Layout Design: Design the report layout using Power BI’s report view. Add visuals such as tables, charts, and matrices to display financial data effectively. Organize visuals logically to create a clear and cohesive narrative. Incorporate interactive elements like slicers and filters for dynamic data exploration.

4: Key Performance Indicator (KPI) Selection: Choose relevant KPIs that align with business objectives and provide insights into financial performance. Visualize KPIs using appropriate charts and gauges to highlight trends and performance against targets. Examples include gross profit margin, net income, operating expense ratio, and return on investment.

5: Visual Enhancements and Formatting: Enhance visual appeal and clarity through formatting options. Use consistent color schemes, appropriate font sizes, and clear labels. Apply conditional formatting to highlight specific data points or trends. Ensure visualizations are accessible and easy to interpret.

6: Interactive Features Implementation: Implement interactive features such as drill-down capabilities, cross-filtering, and tooltips. These features enable users to explore data dynamically, gain deeper insights, and understand the factors driving financial performance. Interactive dashboards empower users to conduct ad-hoc analysis and make data-driven decisions.

7: Report Publishing and Sharing: Publish the completed report to the Power BI service. Configure data refresh schedules to ensure the report reflects the latest information. Share the report with relevant stakeholders, managing access permissions appropriately. Consider embedding the report in other applications or platforms for broader accessibility.

A well-constructed Power BI income statement template provides a robust framework for financial reporting and analysis. Integrating these elements transforms raw data into actionable insights, empowering stakeholders to understand performance, identify trends, and make informed decisions.

Effective financial analysis requires robust tools and insightful reporting. Leveraging a pre-built structure within a business intelligence platform offers a standardized, efficient approach to generating these crucial documents, enabling organizations to visualize revenue, costs, and profitability clearly and concisely. Data integration from various sources, coupled with customizable visualizations and key performance indicators (KPIs), empowers stakeholders to understand performance drivers and make data-driven decisions. Interactive analysis capabilities further enhance exploration, enabling detailed examination of trends and underlying patterns. Automating report generation and distribution streamlines workflows, ensuring timely access to critical financial information. Building a well-structured template involves careful consideration of data sources, report design, KPIs, and interactive features to create a dynamic and insightful tool.

The ability to transform raw financial data into actionable insights represents a significant advantage in today’s dynamic business environment. Organizations that effectively leverage business intelligence tools and pre-designed templates gain a competitive edge through enhanced financial understanding, improved decision-making, and increased operational efficiency. As business needs evolve and data volumes grow, the strategic importance of robust financial reporting and analysis will only continue to increase, driving further innovation and development in business intelligence tools and methodologies.