Utilizing such a form offers several advantages. It simplifies the process of financial reporting, reducing the likelihood of errors and omissions. It promotes better financial management by providing a clear overview of income and expenditure. The ability to easily print copies facilitates sharing information with stakeholders like investors, lenders, or tax authorities. Furthermore, maintaining physical records can be crucial for auditing purposes and long-term financial analysis.

This article will delve deeper into the specifics of using and understanding these forms, covering topics such as key components, variations for different business structures, and best practices for accurate and efficient completion.

1. Free Download

The availability of free downloads for blank income statement templates represents a significant advantage for businesses, particularly startups and small enterprises with limited resources. Removing the cost barrier associated with proprietary software or professional template design services democratizes access to essential financial tools. This accessibility allows organizations to allocate funds towards other critical operational needs while still maintaining organized and accurate financial records. Free access also fosters financial literacy and encourages best practices in record-keeping, even for those without formal accounting training.

The impact of freely downloadable templates extends beyond mere cost savings. Openly available resources often foster a sense of community and collaboration. Users can share modified templates or best practices, contributing to a collective improvement in financial management for small businesses. This collaborative environment can also lead to the development of more specialized templates tailored to specific industries or organizational structures, further enhancing the value and utility of free resources.

While free downloads offer undeniable benefits, users should exercise caution and ensure the chosen template originates from a reputable source. Verification of accuracy and adherence to generally accepted accounting principles (GAAP) is crucial for reliable financial reporting. Furthermore, users should assess the template’s flexibility and customizability to ensure it aligns with the specific needs and reporting requirements of their organization. A well-chosen free template, coupled with diligent financial practices, can significantly contribute to the long-term success and sustainability of a business.

2. Customizable Format

The adaptability of a printable blank income statement template is essential for its practical application across diverse business structures and reporting requirements. A customizable format allows users to tailor the template to reflect specific revenue streams, expense categories, and industry-specific metrics. This flexibility ensures the template remains relevant and informative regardless of the organization’s size or complexity. The ability to modify a standard template prevents the need to create a new form from scratch, saving valuable time and resources.

- Adapting to Industry SpecificsDifferent industries operate with unique financial considerations. A customizable template allows, for example, a retail business to include line items for cost of goods sold and sales returns, while a service-based business might focus on consulting fees or project-based revenue. This tailored approach ensures the income statement accurately reflects the core financial activities of the specific sector. The ability to adjust line items allows for a granular view of revenue and expenses, enhancing financial analysis.

- Scaling for Business GrowthAs businesses expand, their financial reporting needs evolve. A customizable template accommodates this growth by allowing users to add new revenue streams, expense categories, or departmental breakdowns as required. This scalability ensures the income statement remains a relevant tool for financial management throughout the organization’s lifecycle, from startup to established enterprise. The capacity to adapt the template prevents the need for frequent template replacements as the business scales.

- Integrating with Existing SystemsCustomizable templates can be designed to integrate seamlessly with existing accounting software or financial management systems. This integration streamlines data entry and reduces the risk of errors associated with manual transcription. Compatibility with various software platforms ensures efficient data transfer and reporting, further enhancing the utility of the template. Consistent formatting across different systems improves data integrity and facilitates comparative analysis.

- Meeting Specific Reporting RequirementsDifferent stakeholders may require specific financial information. A customizable template allows users to tailor the level of detail and presentation to meet these diverse needs. For example, a simplified version might suffice for internal management reporting, while a more comprehensive version might be necessary for investors or lenders. This adaptability ensures the provided financial information is relevant and appropriate for the intended audience, enhancing transparency and communication.

In conclusion, the customizable nature of printable blank income statement templates is a critical factor in their widespread applicability and effectiveness. By offering the ability to adapt to specific industry needs, scale with business growth, integrate with existing systems, and meet diverse reporting requirements, these templates become valuable tools for financial management across a wide range of organizations and contexts. The flexibility inherent in customizable templates empowers businesses to maintain accurate, relevant, and informative financial records, contributing to better decision-making and long-term success.

3. Accurate Calculations

Accuracy in calculations forms the bedrock of a reliable income statement. A printable blank income statement template, while providing a structured framework, relies entirely on the user’s ability to input correct figures. Errors in calculating revenue, cost of goods sold, operating expenses, or other line items can lead to a misrepresentation of the company’s financial performance. This can have significant consequences, ranging from misinformed internal decision-making to inaccurate reporting to external stakeholders like investors and tax authorities. Consider a scenario where a business understates its expenses due to a calculation error. This could lead to an artificially inflated net income figure, potentially resulting in overestimated profitability and flawed strategic planning.

Several factors contribute to ensuring accurate calculations within an income statement template. Meticulous data entry is paramount, requiring careful attention to detail and verification of figures from source documents like invoices and receipts. Understanding the formulas and relationships between different line items is crucial. For instance, gross profit is derived by subtracting the cost of goods sold from revenue. An incorrect calculation of either component will inevitably lead to an inaccurate gross profit figure. Employing tools like spreadsheet software with built-in formulas can help mitigate the risk of manual calculation errors. However, these tools are only as effective as the data entered into them. Regular review and reconciliation of figures against supporting documentation are essential for maintaining accuracy and identifying discrepancies.

The importance of accurate calculations extends beyond simply generating correct numbers. A precisely calculated income statement provides a clear and trustworthy picture of a company’s financial health. This, in turn, enables informed decision-making regarding pricing strategies, cost control measures, and investment opportunities. Furthermore, accurate reporting fosters transparency and builds trust with stakeholders. Inaccurate financial statements, on the other hand, can damage credibility, erode investor confidence, and lead to potential legal or regulatory issues. Therefore, emphasizing accurate calculations within the context of printable blank income statement templates is crucial for sound financial management and responsible business practices.

4. Financial Analysis

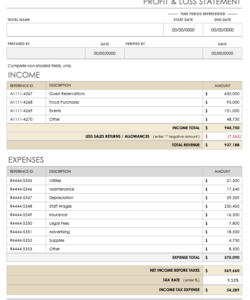

Financial analysis relies heavily on the data presented within an income statement. A printable blank income statement template, once populated with accurate figures, becomes a foundational document for conducting various analytical procedures. Analyzing trends in revenue and expenses over time provides insights into a company’s performance and growth trajectory. Calculating key financial ratios, such as gross profit margin, operating profit margin, and net profit margin, offers a deeper understanding of profitability and operational efficiency. These analyses can reveal areas of strength and weakness, informing strategic decisions related to pricing, cost control, and resource allocation. For example, a declining gross profit margin over several quarters might signal increasing production costs or competitive pressures on pricing, prompting management to investigate and implement corrective actions. Furthermore, comparing a company’s financial ratios to industry benchmarks provides context and allows for an assessment of competitive positioning.

The practical significance of using a printable blank income statement template for financial analysis is multifaceted. It facilitates a structured and standardized approach to examining financial data, ensuring consistency and comparability across different periods. This structured approach simplifies the identification of trends and anomalies, enabling timely interventions and strategic adjustments. Moreover, the ability to readily print and share these templates promotes collaborative analysis and informed decision-making among stakeholders. For instance, a printed income statement, accompanied by relevant financial ratios, can serve as a valuable tool during investor presentations or loan applications, demonstrating financial transparency and sound management practices. Furthermore, readily accessible historical data, as organized within printed income statements, supports forecasting and budgeting processes, enabling more accurate financial projections and resource allocation.

Effectively leveraging a printable blank income statement template for financial analysis requires more than just accurate data entry. Understanding the underlying accounting principles and the interrelationships between different line items is crucial for drawing meaningful conclusions. Furthermore, proficiency in interpreting financial ratios and utilizing analytical tools enhances the value derived from the template. While the template provides the framework, the analytical skills of the user ultimately determine the depth and quality of the insights gained. Challenges may arise in interpreting complex financial data or in adapting analytical techniques to specific industry contexts. However, mastering these skills empowers organizations to utilize printable blank income statement templates as powerful instruments for driving financial performance and achieving strategic objectives.

5. Record Keeping

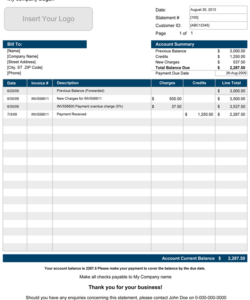

Meticulous record keeping is inextricably linked to the effective utilization of printable blank income statement templates. These templates, while providing a structured framework for financial reporting, are only as valuable as the data they contain. Comprehensive and accurate records of revenue and expenses form the basis for populating the template and generating a reliable income statement. Without proper record keeping, the resulting financial statement may be incomplete, inaccurate, or even misleading, potentially hindering informed decision-making and undermining the credibility of the reported financial performance. Consider a scenario where a business fails to maintain detailed records of its operating expenses. This could lead to an incomplete income statement, understating actual expenses and overstating profitability. Such inaccuracies could have serious repercussions, from flawed budgeting and forecasting to misinformed investment decisions.

Printable income statement templates serve as a valuable tool for organizing and preserving financial records. The printed format provides a tangible and readily accessible record of financial performance over specific periods. This physical documentation complements digital record-keeping systems and offers a crucial backup in case of data loss or system failures. Furthermore, printed copies facilitate sharing information with stakeholders who may not have access to digital systems, such as external auditors or potential investors. Organized financial records, as facilitated by printed income statements, are also essential for demonstrating compliance with tax regulations and other legal requirements. For example, a business undergoing a tax audit can readily provide printed income statements along with supporting documentation, demonstrating transparency and facilitating the audit process.

Maintaining robust financial records, coupled with the use of printable blank income statement templates, contributes significantly to the long-term financial health and stability of an organization. Accurate and accessible records enable effective financial analysis, support informed strategic planning, and foster trust with stakeholders. Challenges in maintaining consistent and accurate record-keeping practices can arise, particularly in rapidly growing businesses or those with limited resources. However, prioritizing record keeping, along with the structured approach offered by printable templates, establishes a strong foundation for financial management and positions the organization for sustained success. This diligent approach to record keeping not only fulfills legal and regulatory obligations but also empowers businesses to make informed decisions, optimize resource allocation, and navigate the complexities of the financial landscape with confidence.

6. Informed Decisions

Sound financial decisions rely heavily on accurate and accessible financial data. A printable blank income statement template, when properly utilized, provides a crucial framework for organizing and interpreting this data, enabling informed decision-making across various aspects of business operations. The template facilitates analysis of revenue streams, expense categories, and profitability, empowering stakeholders to make strategic choices based on concrete financial insights rather than speculation or guesswork. This connection between the template and informed decision-making is fundamental to the financial health and long-term success of any organization.

- Strategic PlanningUnderstanding historical financial performance, as captured within a printable income statement template, is essential for effective strategic planning. Analyzing trends in revenue, expenses, and profitability informs decisions related to growth strategies, market expansion, product development, and resource allocation. For instance, identifying consistently growing revenue streams might encourage investment in expanding those areas, while consistently high expenses in a particular category might prompt cost-cutting measures or process optimization initiatives. The template provides the historical data necessary for developing realistic and achievable strategic goals.

- Pricing StrategiesInformed pricing decisions require a clear understanding of costs and profitability. Printable income statement templates provide the necessary data to calculate cost of goods sold, gross profit margins, and operating expenses, enabling businesses to set prices that cover costs, generate profit, and remain competitive within the market. Analyzing the impact of price changes on profitability, as reflected in the income statement, allows for data-driven pricing adjustments and optimization strategies. For example, if increasing prices leads to a significant drop in sales volume and lower overall profit, the income statement data provides clear evidence for revisiting the pricing strategy.

- Cost ManagementControlling expenses is crucial for maintaining profitability and financial stability. Printable income statement templates enable detailed analysis of expense categories, identifying areas where costs are excessive or inefficient. This granular view of expenses facilitates targeted cost-cutting measures, process improvements, and resource optimization initiatives. Tracking the impact of these cost-saving measures on the income statement over time demonstrates their effectiveness and informs further refinements to cost management strategies. For example, if implementing energy-efficient practices leads to a demonstrable reduction in utility expenses on the income statement, it reinforces the value of such initiatives.

- Investment DecisionsWhether considering investments in new equipment, expansion projects, or research and development, informed decisions require a clear understanding of the potential return on investment. Printable income statement templates provide the historical financial data needed to project future cash flows, assess profitability, and evaluate the financial viability of investment opportunities. Analyzing the potential impact of these investments on future income statements enables data-driven investment decisions and risk assessment. For example, projecting the increased revenue generated by a new product line, as reflected on a pro forma income statement, supports informed investment decisions related to product development and launch.

In conclusion, printable blank income statement templates are not merely tools for recording financial figures; they are integral to the process of informed decision-making. By providing a structured framework for analyzing revenue, expenses, and profitability, these templates empower businesses to make strategic choices based on concrete financial insights. This data-driven approach to decision-making, facilitated by the readily accessible and organized information within the template, strengthens financial management, optimizes resource allocation, and enhances the long-term prospects of success.

Key Components of an Income Statement Template

Understanding the core components of an income statement template is crucial for accurate financial reporting and analysis. These components provide a structured framework for organizing financial data and deriving meaningful insights into an organization’s performance.

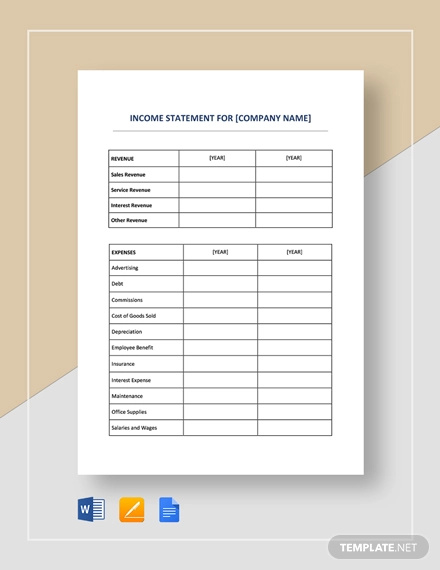

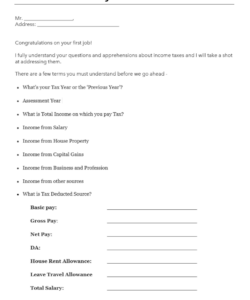

1. Revenue: This section represents the total income generated from the sale of goods or services. It typically includes sales revenue, interest income, and any other income earned during the reporting period. Accuracy in reporting revenue is paramount, as it forms the basis for calculating subsequent figures like gross profit and net income.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate calculation of COGS is crucial for determining gross profit and understanding the profitability of core business operations. Service-based businesses generally do not have COGS.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit earned from core business operations before accounting for operating expenses. This figure is a key indicator of a company’s production efficiency and pricing strategies.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. These include salaries, rent, utilities, marketing expenses, and administrative costs. Accurate categorization and reporting of operating expenses are crucial for understanding the cost structure of the business.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the core business operations after accounting for all operating costs. This figure is a key performance indicator for evaluating management efficiency and overall operational effectiveness.

6. Other Income/Expenses: This section includes any income or expenses not directly related to core business operations, such as interest income, gains or losses from investments, or one-time extraordinary items. Including these items provides a comprehensive view of the organization’s overall financial performance.

7. Income Before Taxes: This represents the total income earned before accounting for income tax expenses. It provides a clear picture of the organization’s pre-tax profitability.

8. Income Tax Expense: This represents the expense associated with income taxes. Accurate calculation of this figure is essential for legal compliance and accurate financial reporting.

9. Net Income: This is the final figure on the income statement, representing the organization’s profit after all expenses, including taxes, have been deducted. Net income is a key indicator of overall financial performance and profitability.

These components, when accurately recorded and analyzed, provide a comprehensive picture of an organization’s financial health and performance. Understanding the interrelationships between these components allows for insightful analysis, informed decision-making, and effective financial management.

How to Create a Printable Blank Income Statement Template

Creating a printable blank income statement template involves structuring key financial components within a clear and organized format. This ensures accurate data entry and facilitates subsequent financial analysis. The following steps outline the process of creating a functional and effective template.

1. Software Selection: Choose appropriate software. Spreadsheet software offers flexibility and built-in calculation functions. Word processing software allows for basic template creation but may require manual calculations.

2. Header Information: Clearly label the document as an “Income Statement Template.” Include fields for company name, reporting period, and date prepared. This ensures clarity and proper identification of the financial data.

3. Revenue Section: Create a section for revenue. Include lines for various revenue streams, such as sales revenue, interest income, and other income. Label each line clearly and include a subtotal for total revenue.

4. Cost of Goods Sold (COGS) Section: If applicable, create a section for COGS. Include lines for direct materials, direct labor, and manufacturing overhead. Calculate the total COGS and clearly label the result.

5. Gross Profit Calculation: Insert a formula to calculate gross profit (Revenue – COGS). Clearly label this section and ensure the formula automatically updates based on entered revenue and COGS figures.

6. Operating Expenses Section: Create a detailed section for operating expenses. Include lines for common expenses like salaries, rent, utilities, marketing, and administrative costs. Sub-categorize expenses as needed for more granular analysis. Calculate a subtotal for total operating expenses.

7. Operating Income Calculation: Insert a formula to calculate operating income (Gross Profit – Operating Expenses). Clearly label this section and ensure the formula automatically updates based on entered figures.

8. Other Income/Expenses Section: Include a section for other income and expenses not directly related to core operations, such as interest income or investment gains/losses. Calculate a subtotal for net other income/expenses.

9. Income Before Taxes Calculation: Calculate income before taxes (Operating Income + Net Other Income/Expenses).

10. Income Tax Expense: Include a line for income tax expense.

11. Net Income Calculation: Calculate net income (Income Before Taxes – Income Tax Expense). Clearly label this as the final profit figure.

12. Formatting and Presentation: Use clear and consistent formatting. Ensure proper alignment of figures and labels. Use bold text for section headings and key figures like net income. Consider adding borders or shading to enhance readability.

13. Printing Functionality: Verify the template prints correctly. Adjust margins and page orientation as needed. Ensure all sections and calculations fit within the printable area.

A well-structured template provides a clear and organized format for recording financial data, facilitating accurate reporting, and enabling insightful analysis for informed decision-making.

Printable blank income statement templates provide a crucial framework for organizing and understanding financial performance. Their accessibility, customizability, and role in facilitating accurate calculations are essential for effective financial management. From supporting detailed record-keeping to enabling insightful financial analysis, these templates empower organizations to make informed decisions based on concrete data. Understanding key components, such as revenue, expenses, and profitability metrics, and mastering the creation of a functional template are fundamental to leveraging the full potential of this valuable tool.

Accurate and accessible financial information is the cornerstone of sound business practices. Leveraging printable blank income statement templates effectively contributes significantly to financial transparency, informed decision-making, and long-term organizational success. These tools empower stakeholders at all levels to understand, interpret, and act upon financial data, driving operational efficiency, strategic growth, and sustainable financial health. Embracing a structured approach to financial reporting, as facilitated by these templates, positions organizations for greater financial clarity and control in an increasingly complex economic landscape.