Accessibility and adaptability are key advantages of these resources. They eliminate the cost associated with purchasing specialized software or hiring professional services, making financial management more attainable. The ability to tailor these documents to specific needs ensures relevance and practicality for various financial situations. This empowers users to gain control over their finances, identify areas for improvement, and track progress towards financial goals.

This foundational understanding paves the way for a deeper exploration of specific financial statements, their components, and their applications in different contexts. Topics such as balance sheets, income statements, and cash flow statements, along with practical guidance on their utilization, will be examined in detail.

1. Accessibility

Accessibility, in the context of financial management tools, refers to the ease with which individuals can obtain and utilize them. It plays a crucial role in promoting financial literacy and empowering informed decision-making. For printable, no-cost financial statement templates, accessibility translates to widespread availability and usability, regardless of technical expertise or financial resources.

- Ease of AcquisitionFree templates are readily available online, eliminating financial barriers associated with purchasing software or professional services. This ease of acquisition democratizes access to essential financial management resources, enabling a wider range of individuals to benefit from organized record-keeping.

- Device CompatibilityPrintable formats ensure compatibility across various devices. Whether using a desktop computer, laptop, tablet, or even a smartphone, individuals can download, view, and print these templates. This versatility caters to different technological preferences and levels of access.

- User-FriendlinessWell-designed templates employ a clear, straightforward structure, making them easily understandable and usable even for individuals with limited financial expertise. Pre-built sections and labels guide users through the process of inputting their financial information, reducing the likelihood of errors and promoting accurate record-keeping.

- No Technical BarriersUnlike specialized financial software, printable templates require no specific technical skills or software installations. This eliminates a significant barrier to entry, making these tools accessible to a broader audience, including those less comfortable with technology.

The accessibility of these no-cost, printable templates empowers individuals to take control of their finances. By removing cost, technical, and usability barriers, these resources promote financial inclusion and contribute to more effective personal financial management.

2. Cost-effectiveness

Cost-effectiveness represents a critical advantage of printable, free financial statement templates. Eliminating the financial burden associated with proprietary software or professional accounting services makes sound financial management accessible to a wider audience. This affordability allows individuals and small businesses, often operating with limited budgets, to allocate resources more strategically. Consider, for example, a freelancer or entrepreneur starting a new venture. Utilizing free templates allows them to track income and expenses meticulously without incurring additional costs, crucial during the initial stages of business development. This empowers them to reinvest savings into core business operations, contributing to long-term sustainability.

Furthermore, the cost-effectiveness of these templates extends beyond initial adoption. Unlike subscription-based software requiring ongoing payments, free templates represent a one-time resource. This eliminates recurring expenses, providing long-term value. A non-profit organization, for instance, can utilize free templates year after year to manage its finances effectively, allocating more funds towards its mission rather than administrative overhead. This responsible stewardship of resources underscores the practical significance of cost-effective financial management tools.

In conclusion, the cost-effectiveness of printable, free financial statement templates democratizes access to crucial financial management tools. By removing financial barriers, these resources empower individuals and organizations to allocate funds more strategically, fostering financial stability and long-term growth. This affordability translates to tangible benefits, enabling reinvestment into core activities and contributing to overall financial well-being. The ease of access and continued cost-free utilization underscores their value as sustainable tools for effective financial management.

3. Customizability

Customizability is a key feature of printable, free financial statement templates, enabling adaptation to diverse financial contexts. This flexibility allows individuals and organizations to tailor these tools to specific needs, enhancing their relevance and practicality. A generic template might suffice for basic tracking, but the ability to modify categories and sections unlocks significant potential for more nuanced financial management.

- Category ModificationUsers can adapt expense and income categories to reflect their unique financial activities. A household might customize a template to track grocery spending, utilities, and childcare, while a freelance consultant might categorize income by client or project. This targeted approach provides granular insights into financial flows, facilitating more effective budgeting and analysis.

- Section Addition/RemovalTemplates can be modified by adding or removing sections as needed. An individual tracking investments might add a section for capital gains and dividends, while a small business owner could include sections for inventory and cost of goods sold. This modularity ensures the template remains relevant and comprehensive, reflecting specific financial priorities.

- Integration with Existing SystemsCustomizability allows seamless integration with existing financial management practices. Users can adapt templates to complement existing spreadsheets, budgeting software, or accounting systems. This interoperability promotes consistency in financial record-keeping, simplifying data consolidation and analysis across different platforms.

- ScalabilityAs financial situations evolve, customizable templates can adapt accordingly. A growing business, for instance, can expand its template to accommodate increasing complexity in its financial operations. This scalability ensures the template remains a valuable tool throughout different stages of financial development.

The customizability of these templates empowers users to create a truly personalized financial management tool. This adaptability ensures relevance across diverse financial contexts, from personal budgeting to small business accounting. By tailoring these templates to specific needs, individuals and organizations gain a clearer understanding of their financial position, facilitating more informed decision-making and contributing to greater financial success. This ability to adapt underscores the enduring value of printable, free financial statement templates as versatile tools for effective financial management.

4. Printable Format

The printable format of free financial statement templates offers distinct advantages in managing finances. Tangible records facilitate manual review, analysis, and archival, supplementing digital record-keeping. This accessibility supports diverse user preferences and needs across various financial contexts.

- Tangible Record KeepingPrinted copies provide a physical backup, safeguarding against data loss due to technical malfunctions or digital security breaches. This tangible format also allows for annotations, highlighting key figures or insights directly on the document. For example, marking trends in monthly expenses on a printed income statement provides a readily accessible visual representation of spending patterns.

- Offline AccessibilityPrintable formats offer access to financial information regardless of internet connectivity. This proves invaluable in areas with limited internet access or during travel. A business owner attending an off-site meeting, for instance, can readily review printed financial statements without requiring internet access.

- Simplified Sharing and CollaborationPrinted copies facilitate easy sharing and collaboration during meetings or consultations. Distributing printed statements allows all participants to simultaneously review the same information, fostering more focused discussions. A financial advisor, for example, can review a client’s printed statements during a consultation, facilitating a collaborative discussion on financial planning.

- Archival and AuditingPrinted records offer a reliable method for long-term archival and auditing purposes. Physical copies provide a readily accessible audit trail, simplifying the process of verifying financial information. This is crucial for tax preparation, loan applications, or internal audits, where verifiable records are essential. Maintaining printed copies alongside digital records ensures comprehensive documentation for future reference.

The printable format enhances the utility of free financial statement templates. Offering accessibility, facilitating collaboration, and providing a reliable archival method, printable formats complement digital record-keeping, contributing to a more comprehensive and robust approach to financial management. This tangible aspect strengthens financial record-keeping practices, ensuring accessibility and security while supporting diverse individual and organizational needs.

5. Financial Clarity

Financial clarity, the ability to comprehensively understand one’s financial position, is intrinsically linked to effective financial management. Printable, free financial statement templates play a crucial role in achieving this clarity by providing a structured framework for organizing and analyzing financial data. This structured approach empowers individuals and organizations to gain actionable insights into their financial health, facilitating informed decision-making.

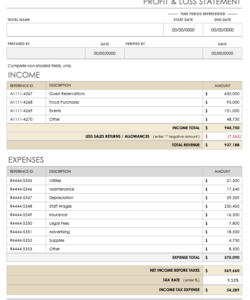

- Income and Expense TrackingTemplates provide dedicated sections for recording income and expenses, categorized for detailed analysis. Tracking income sources, whether from salary, investments, or sales, allows for accurate revenue monitoring. Categorizing expenses, such as housing, transportation, or operational costs, provides insights into spending patterns. This granular view facilitates budgeting, identifies areas for potential savings, and promotes responsible financial management.

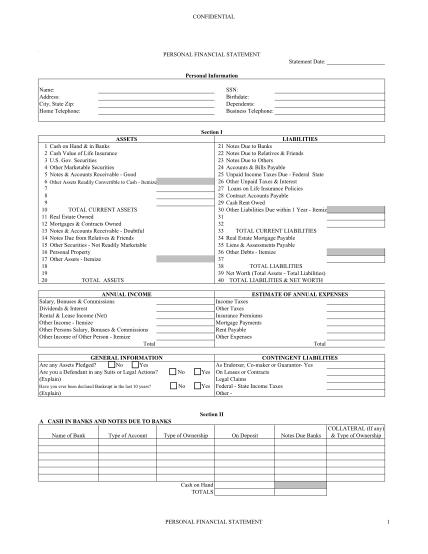

- Asset and Liability ManagementTemplates incorporate sections for listing assets (e.g., property, investments, savings) and liabilities (e.g., loans, debts, mortgages). Understanding the balance between assets and liabilities offers a clear picture of net worth and overall financial stability. This information is crucial for loan applications, investment decisions, and long-term financial planning.

- Cash Flow MonitoringTracking cash inflows and outflows helps assess financial health and liquidity. Templates designed for cash flow analysis provide a structured format for recording all cash transactions. This aids in forecasting future cash needs, managing working capital effectively, and ensuring sufficient funds for operational expenses and debt servicing. For businesses, this is particularly crucial for maintaining solvency and navigating periods of fluctuating revenue.

- Performance EvaluationRegularly updating and reviewing completed templates provides a historical record of financial activity. This allows for performance evaluation over time, identifying trends in income, expenses, and overall financial health. Analyzing past performance informs future financial strategies, enabling proactive adjustments to achieve financial goals. This ongoing monitoring contributes to continuous improvement in financial management practices.

By facilitating organized record-keeping and analysis across these key areas, printable, free financial statement templates contribute significantly to financial clarity. This enhanced understanding empowers informed decision-making, promoting financial stability and facilitating progress toward financial objectives. The accessibility and adaptability of these templates make them invaluable tools for individuals and organizations seeking to gain greater control over their financial well-being.

Key Components of Financial Statement Templates

Effective financial management relies on accurate and organized data. Understanding the key components within a financial statement template is crucial for maximizing its utility. The following components provide the fundamental structure for comprehensive financial record-keeping.

1. Income Statement: This component summarizes revenues and expenses over a specific period, providing a clear picture of profitability. Key elements include revenue streams, cost of goods sold (if applicable), operating expenses, and net income.

2. Balance Sheet: This statement provides a snapshot of assets, liabilities, and equity at a specific point in time. It offers insights into an entity’s financial position by illustrating what is owned (assets), what is owed (liabilities), and the residual value (equity).

3. Cash Flow Statement: This component tracks the movement of cash both into and out of an entity. It categorizes cash flow into operating, investing, and financing activities, providing a comprehensive overview of cash management practices and liquidity.

4. Supporting Schedules: These supplementary documents provide detailed breakdowns of specific line items within the primary financial statements. Examples include schedules for accounts receivable, accounts payable, or inventory, offering greater granularity for analysis.

5. Statement of Changes in Equity (for businesses): This statement details changes in equity over a specific period, including retained earnings, capital contributions, and distributions. It provides insights into how equity has changed due to both operational performance and financial activities.

Utilizing these core components allows for a comprehensive and structured approach to financial record-keeping. This detailed view facilitates informed decision-making, enabling proactive financial management and contributing to greater financial stability and success. Regularly updating and analyzing these components offers valuable insights into financial performance and overall financial health.

How to Create a Printable Free Financial Statement Template

Creating a financial statement template requires careful consideration of key components and their organization. A well-structured template facilitates accurate record-keeping and informed financial analysis. The following steps outline the process of creating a functional and effective template.

1: Determine the Purpose: Define the specific purpose of the template. A template for personal budgeting will differ significantly from one designed for small business accounting. Clearly outlining the intended use will guide the selection of relevant components and their structure.

2: Select Key Components: Choose the necessary financial statement components. Common components include an income statement, balance sheet, and cash flow statement. Consider adding supporting schedules for more detailed tracking of specific accounts, like accounts receivable or inventory.

3: Design the Layout: Organize the chosen components in a clear, logical manner. Use tables or spreadsheets to structure data entry fields. Label rows and columns clearly to ensure accurate data input. Consider grouping related items together for easier analysis and interpretation.

4: Choose a Software Tool: Utilize spreadsheet software (e.g., Microsoft Excel, Google Sheets, LibreOffice Calc) or word processing software with table functionality to create the template. Spreadsheet software offers built-in formulas and functions for automated calculations, enhancing efficiency.

5: Incorporate Formulas (if using spreadsheet software): Integrate formulas for automatic calculations of key metrics, such as net income, total assets, or net cash flow. Automated calculations improve accuracy and reduce manual effort, minimizing the risk of errors.

6: Test and Refine: Populate the template with sample data to test its functionality and identify any potential issues. Ensure formulas calculate correctly and that the layout facilitates easy data entry and analysis. Refine the template based on testing results to maximize usability.

7: Ensure Printability: Verify that the template prints correctly. Adjust formatting as needed to ensure all content fits within the printable area and maintains its intended structure. Consider using a print preview function to check the layout before printing.

8: Save and Distribute: Save the completed template in a commonly accessible format (e.g., .xlsx, .ods, .pdf). Distribute the template electronically or as printed copies, depending on user needs and preferences. Clearly communicate instructions for using the template effectively.

By following these steps, a functional and effective financial statement template can be created. This structured approach to financial record-keeping provides the foundation for informed decision-making, promoting financial stability and success. Regular review and analysis of financial data within the template provide insights into performance, enabling proactive adjustments to financial strategies.

Accessible, no-cost, and adaptable financial statement templates offer invaluable tools for effective financial management. Their adaptability supports diverse financial contexts, from personal budgeting to small business accounting. Key features, including customizability, printability, and support for clear financial tracking, contribute significantly to informed decision-making. Understanding core components, such as income statements, balance sheets, and cash flow statements, empowers users to gain a comprehensive view of their financial standing.

Leveraging these resources fosters financial literacy and promotes responsible financial practices. Accurate record-keeping, facilitated by well-designed templates, provides the foundation for sound financial decisions, contributing to long-term financial stability and success. Regularly reviewing and analyzing financial data within these templates unlocks potential for continuous improvement in financial management practices, ultimately empowering informed decision-making and fostering financial well-being.