Utilizing such a structured document allows for a clearer understanding of financial health. This organized overview can be instrumental in financial planning, loan applications, and investment decisions. A physical copy provides readily accessible information, useful for consultations and record-keeping.

This understanding of a structured financial overview allows for a deeper exploration of key topics such as asset management, liability reduction strategies, and building a robust financial future.

1. Organization

A well-organized financial statement provides the foundation for effective financial management. A printable template offers a structured approach to organizing financial data, facilitating informed decision-making and a clear understanding of one’s financial position.

- Categorization of AssetsClear categorization of assets (e.g., liquid assets, investments, fixed assets) enables efficient tracking and analysis of ones resources. Distinguishing between a checking account balance and a retirement investment portfolio allows for a more nuanced understanding of available resources and long-term financial health. This structured approach facilitates informed decisions regarding asset allocation and investment strategies.

- Structured Liability ReportingOrganized reporting of liabilities, such as separating mortgage debt from credit card debt, provides a clear picture of financial obligations. Understanding the types and magnitudes of debts allows for prioritized repayment strategies and informed decisions regarding debt management. This structured overview aids in identifying areas for potential cost savings and improved financial stability.

- Net Worth CalculationA template facilitates accurate net worth calculation by clearly separating assets and liabilities. This calculation, representing the difference between what one owns and what one owes, provides a concise snapshot of overall financial health. Regularly tracking net worth using an organized template allows for monitoring financial progress and identifying potential areas for improvement.

- Chronological TrackingWhile not inherent to a single printed statement, using the same template format over time allows for chronological tracking of financial progress. Comparing statements from different periods reveals trends in asset growth, debt reduction, and net worth changes, offering valuable insights into the effectiveness of financial strategies and informing future planning.

These organizational features contribute to a comprehensive and easily understandable overview of one’s financial status, enabling informed financial planning and decision-making. A printable template facilitates these organizational benefits, providing a tangible tool for actively managing and improving financial health.

2. Accessibility

Accessibility, in the context of a printable personal financial statement template, refers to the ease and convenience with which individuals can access, review, and utilize their financial information. This accessibility plays a crucial role in facilitating informed financial decisions and promoting effective financial management.

- Immediate AvailabilityA printed statement provides immediate access to financial data without requiring a computer, internet connection, or specific software. This can be particularly beneficial in situations where digital access is limited or unavailable, such as during travel or in areas with unreliable internet service. Having a physical copy ensures that crucial financial information is always readily at hand.

- Simplified SharingPrinted copies facilitate easy sharing with financial advisors, lenders, or other relevant parties. This tangible format can be particularly useful during consultations, loan applications, or estate planning discussions. Sharing a physical document can enhance communication and collaboration, fostering a more productive exchange of information.

- Enhanced Review and AnalysisReviewing a printed statement can offer a different perspective compared to viewing it on a screen. Some individuals find it easier to identify trends, discrepancies, or areas for improvement when reviewing physical documents. This tactile engagement can enhance comprehension and facilitate a more thorough analysis of financial data.

- Secure Record KeepingMaintaining printed copies provides a secure backup of financial records independent of digital storage solutions. This can be crucial in cases of computer malfunctions, data breaches, or other technological disruptions. Physical records offer a tangible and durable backup, ensuring that critical financial information is preserved even in unforeseen circumstances.

The accessibility offered by a printable personal financial statement template empowers individuals to take control of their finances. The ease of access, simplified sharing, and secure record-keeping contribute to a more proactive and informed approach to financial management. This tangible format enhances the utility of the financial statement, making it a valuable tool for individuals seeking to understand and improve their financial well-being.

3. Comprehensiveness

Comprehensiveness, within the context of a printable personal financial statement template, signifies the inclusion of all relevant financial data necessary for a thorough understanding of one’s financial position. This comprehensive overview is crucial for effective financial planning, analysis, and decision-making. A template lacking crucial information limits its utility for informed financial management.

A comprehensive template typically includes detailed sections for assets, encompassing various categories such as liquid assets (cash, checking accounts), investments (stocks, bonds, retirement accounts), and fixed assets (real estate, vehicles). Liabilities are equally detailed, encompassing short-term debts (credit card balances) and long-term obligations (mortgages, student loans). Accurate representation of both assets and liabilities is fundamental for a realistic net worth calculation. Omitting categories, such as outstanding loan balances or investment properties, can lead to a skewed perception of financial health and hinder effective planning. For instance, neglecting to include a significant investment property in the asset section would underestimate one’s net worth, potentially leading to uninformed financial decisions.

Furthermore, a comprehensive template may also include sections for income and expenses, providing a holistic view of financial flows. This allows for analysis of spending patterns, identification of potential savings opportunities, and informed budgeting. Without a comprehensive overview of income and expenses, developing a realistic budget or identifying areas for financial improvement becomes challenging. For example, excluding regular contributions to a retirement account from the expense section might lead to an overestimation of disposable income, hindering accurate budget planning. Therefore, the comprehensiveness of a printable personal financial statement template directly impacts its effectiveness as a tool for financial management, enabling informed decision-making and facilitating a clear understanding of one’s overall financial well-being.

4. Clarity

Clarity in a printable personal financial statement template refers to the ease with which the information presented can be understood and interpreted. A clear and concise template facilitates accurate assessment of one’s financial situation, enabling informed decision-making and effective financial planning. Lack of clarity can lead to misinterpretations, hindering sound financial management.

- Standardized FormatA standardized format, with clear headings and consistent labeling, ensures that information is presented in a logical and easily navigable manner. Using distinct sections for assets, liabilities, and net worth calculation, for example, allows for quick identification of key financial data. A disorganized or inconsistently formatted template can lead to confusion and hinder effective analysis. Imagine a statement where assets and liabilities are intermingled without clear demarcation; extracting meaningful insights becomes significantly more challenging.

- Precise TerminologyEmploying precise financial terminology avoids ambiguity and ensures accurate understanding. Using terms like “liquid assets” instead of a more generic term like “cash” clarifies the specific types of assets included. Imprecise language can lead to misinterpretations of financial data. For instance, using the term “debt” without specifying whether it refers to short-term or long-term obligations can obscure the true nature of one’s liabilities.

- Visual PresentationEffective use of visual elements, such as tables, charts, and clear font choices, enhances readability and comprehension. Presenting data in a tabular format, for instance, allows for easy comparison of different asset or liability categories. A cluttered or visually confusing template can make it difficult to extract meaningful information. Consider a statement with excessive use of different fonts, sizes, and colors; it can overwhelm the reader and obscure the underlying financial data.

- Concise LanguageUsing concise and straightforward language avoids unnecessary jargon and ensures that the information is accessible to a wide audience. Explaining complex financial terms in plain language enhances understanding and avoids potential confusion. Overly technical or verbose language can create a barrier to comprehension, especially for individuals without a strong financial background. For example, using the term “amortization schedule” without further explanation might not be readily understood by everyone.

Clarity in a printable personal financial statement template is essential for effective financial management. A well-designed template prioritizes clear and concise communication, enabling individuals to readily understand their financial situation and make informed decisions based on accurate data. This clarity empowers informed financial planning, contributing to greater financial well-being.

5. Tangibility

Tangibility, a defining characteristic of a printable personal financial statement template, offers distinct advantages in financial management. Unlike digital counterparts, a printed statement provides a physical document, fostering a different kind of engagement with financial data. This tangible format offers practical benefits that contribute to a more grounded and proactive approach to financial organization.

The physical presence of a printed statement allows for a tactile interaction often absent in digital formats. This can enhance comprehension and retention of information. Underlining key figures, making handwritten notes, or physically organizing multiple statements for comparison facilitates a deeper engagement with the data. For example, reviewing a printed statement during a financial planning session allows for immediate annotations and revisions, fostering a more interactive and productive discussion. Furthermore, a printed statement serves as a readily accessible reference without reliance on technology. In situations where digital access is limited or impractical, such as during travel or power outages, a printed copy ensures critical financial information remains available. Consider a scenario where an individual needs to provide financial documentation urgently while in a location with limited internet connectivity; a printed statement becomes invaluable.

Tangibility also enhances the security and longevity of financial records. While digital files are susceptible to corruption, accidental deletion, or hacking, a printed statement offers a durable and independent backup. This physical record provides a safeguard against data loss and ensures that critical financial information remains accessible regardless of technological disruptions. Maintaining organized physical files of printed statements creates a robust archive for future reference. This can be particularly important for tax purposes, estate planning, or tracking long-term financial progress. In conclusion, the tangibility of a printed personal financial statement template contributes significantly to its practical value. The ability to physically interact with the data, the inherent portability and accessibility, and the enhanced security of physical records make printed statements a valuable tool for effective financial management.

Key Components of a Personal Financial Statement Template

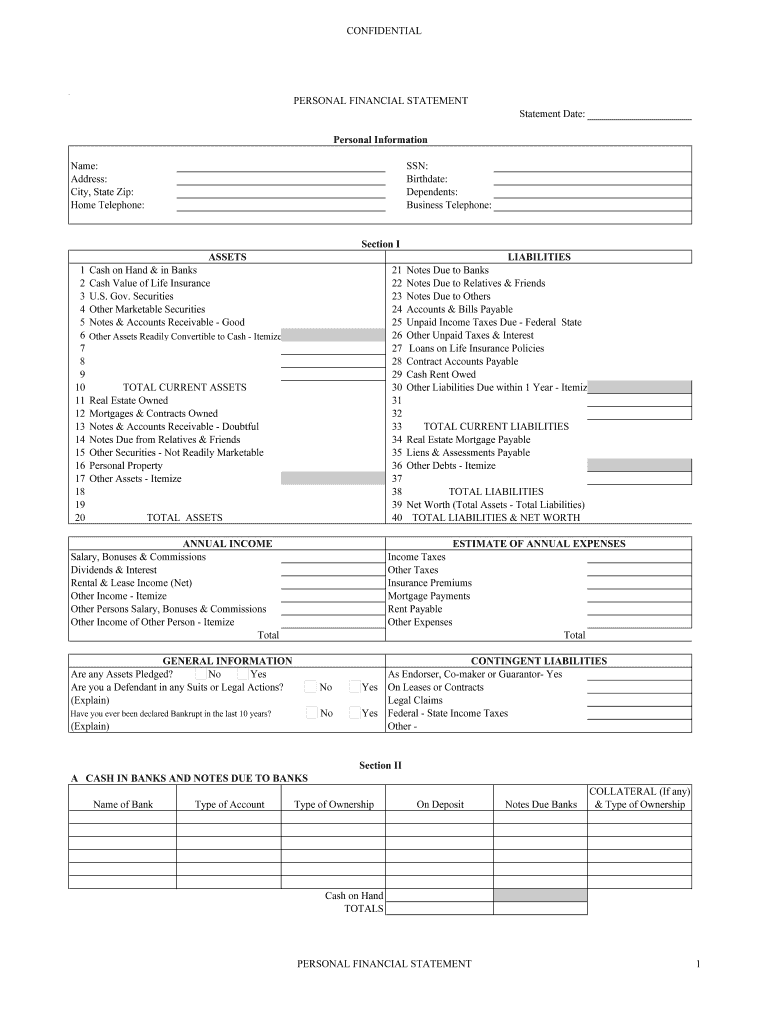

A comprehensive personal financial statement template provides a structured framework for organizing key financial data. This structure facilitates a clear understanding of one’s financial position, enabling informed decision-making and effective financial planning. The following components are essential for a robust and useful template.

1. Assets: This section details everything owned of monetary value. Categorization is crucial, typically dividing assets into liquid assets (easily convertible to cash, such as checking and savings accounts), investments (stocks, bonds, retirement funds), and fixed assets (real estate, vehicles). Accurate valuation is essential for a realistic representation of financial standing. For example, real estate should be listed at its current market value, not the original purchase price.

2. Liabilities: This section outlines all outstanding debts and financial obligations. Similar to assets, categorization provides clarity, separating short-term liabilities (credit card balances, short-term loans) from long-term liabilities (mortgages, student loans). Accurate reporting of outstanding balances is critical for a realistic assessment of financial obligations. Failing to include a recent loan, for example, would misrepresent the overall debt burden.

3. Net Worth Calculation: This component calculates the difference between total assets and total liabilities, providing a concise snapshot of overall financial health. This figure represents the residual value after all debts are settled. Accurate calculations, based on the comprehensive listing of assets and liabilities, are fundamental to a realistic understanding of one’s financial position. A miscalculation, whether due to inaccurate data entry or omissions, can significantly distort the perceived net worth.

4. Income Statement (Optional): While not always included in a basic template, an income statement provides valuable insights into income and expenses. This section details all sources of income and categorizes expenses, allowing for analysis of spending patterns and identification of potential savings opportunities. This information, while not directly contributing to the net worth calculation, offers a dynamic view of financial flows and informs budgeting decisions.

5. Date and Personal Information: Clearly stating the date of the statement is crucial for tracking financial progress over time. Including personal information, such as name and contact details, ensures proper identification and facilitates record-keeping. This seemingly minor detail ensures that the statement remains relevant and accurately reflects the individual’s financial situation at a specific point in time.

A well-designed template facilitates accurate data entry, clear categorization, and precise calculations, resulting in a comprehensive and reliable overview of one’s financial standing. This organized information is essential for effective financial planning, analysis, and decision-making.

How to Create a Printable Personal Financial Statement Template

Creating a printable personal financial statement template involves structuring a document to effectively organize and present key financial data. This structured approach facilitates a clear understanding of one’s financial position and supports informed decision-making.

1. Software Selection: Choose appropriate software. Spreadsheet applications offer robust calculation and formatting capabilities well-suited for financial documents. Word processing software can also be utilized, though manual calculations may be required. Selecting the right tool ensures efficiency and accuracy.

2. Asset Section Creation: Establish a dedicated section for assets. Categorize assets into logical groupings: liquid assets (cash, checking accounts), investments (stocks, bonds), and fixed assets (real estate, vehicles). Include fields for item descriptions, current market values, and relevant details (account numbers, property addresses). Accurate and detailed asset listing is crucial.

3. Liability Section Development: Develop a separate section for liabilities. Categorize liabilities similarly: short-term (credit card balances) and long-term (mortgages). Include fields for creditor names, outstanding balances, and payment terms. Thorough liability documentation provides a complete picture of financial obligations.

4. Net Worth Calculation Integration: Integrate a formula to automatically calculate net worth (total assets minus total liabilities). This real-time calculation provides an immediate snapshot of financial health, reflecting changes as data is updated. Accurate automated calculation is essential for reliable net worth tracking.

5. Income and Expense Section (Optional): Consider including an optional section for income and expenses. Provide fields for income sources (salary, investments) and expense categories (housing, transportation). While not directly impacting net worth, this section offers insights into financial flows and informs budgeting decisions.

6. Date and Personal Information Inclusion: Incorporate fields for the statement date and personal information (name, address). This ensures accurate record-keeping and allows for tracking financial progress over time. Proper identification and date stamping maintain the relevance and integrity of the document.

7. Formatting for Clarity: Format the template for clarity and readability. Use clear headings, consistent fonts, and a logical layout. Consider incorporating visual aids such as tables or borders to enhance organization. A well-formatted template facilitates efficient data entry and analysis.

8. Print Functionality Verification: Verify proper print functionality. Ensure all sections fit within the printable area and that formatting is preserved during printing. Test printing on different printers or paper sizes, if necessary, to confirm compatibility. A printable template requires seamless transition from digital to physical format.

A well-structured template, incorporating these components, provides a clear and organized overview of one’s financial position. This facilitates informed financial management, supporting effective planning and decision-making.

A printable personal financial statement template provides a structured framework for organizing and understanding financial data. Its key benefits include clear organization of assets and liabilities, facilitating accurate net worth calculation. Accessibility, through a physical document, allows for immediate review, simplified sharing, and secure record-keeping. Comprehensiveness ensures all relevant financial information is captured, while clarity promotes easy interpretation. Tangibility offers a tactile engagement, enhancing comprehension and providing a durable record. The template’s essential componentsassets, liabilities, net worth calculation, optional income statement, date, and personal informationwork together to offer a holistic financial overview.

Effective financial management requires a clear understanding of one’s financial position. Utilizing a printable personal financial statement template empowers individuals to take control of their finances, enabling informed decision-making for a more secure financial future. Regularly updating and reviewing this document fosters proactive financial management and contributes to long-term financial well-being.