Having a hard copy facilitates detailed review and analysis without reliance on electronic devices. This accessibility simplifies sharing information with individuals or groups during meetings, presentations, or consultations. Furthermore, a printed format allows for manual annotations, comparisons with previous periods, and integration into physical filing systems, promoting a more comprehensive understanding of financial trends and potential areas for improvement.

The following sections will delve deeper into creating, utilizing, and interpreting these valuable financial documents. Topics covered will include the key components of a profit and loss statement, variations for different business structures, and best practices for generating and maintaining these records.

1. Accessibility

Accessibility, in the context of financial documentation, refers to the ease with which information can be obtained, reviewed, and understood. Printable profit and loss statement templates directly enhance accessibility. A readily available physical copy eliminates the need for specialized software, internet access, or specific devices. This is particularly beneficial for collaborative discussions, presentations, and consultations where participants may not have uniform access to digital resources. For instance, a printed statement allows stakeholders to simultaneously review figures during a board meeting, fostering a more efficient and focused discussion. Furthermore, it enables advisors, consultants, or potential investors who may not have direct access to a company’s digital systems to readily assess financial performance.

The ability to quickly and easily access financial data is crucial for timely decision-making. Imagine a scenario where a business owner needs to secure a short-term loan. Having a readily available printed statement allows them to immediately provide the necessary financial information to the lender, expediting the loan approval process. This immediacy can be critical in situations requiring swift financial action. Moreover, printed statements can be easily incorporated into physical filing systems, providing a readily accessible archive for historical analysis and comparisons, further enhancing accessibility over time.

While digital formats offer advantages in terms of data manipulation and storage, printable templates remain vital for ensuring broad access to critical financial information. This accessibility promotes transparency, facilitates efficient communication, and empowers informed decision-making among all stakeholders, regardless of their technological resources. This is especially relevant for small businesses or those operating in environments with limited digital infrastructure. Maintaining both digital and printable versions ensures comprehensive accessibility and caters to diverse informational needs.

2. Customization

Customization capabilities significantly enhance the utility of printable profit and loss statement templates. Adapting a template to specific business needs ensures the resulting statement accurately reflects the organization’s financial structure and provides relevant insights. This adaptability streamlines analysis and supports more informed decision-making.

- Chart of Accounts IntegrationA business’s chart of accounts provides a structured list of all financial accounts used in its general ledger. A customizable template allows for seamless integration with this chart of accounts, ensuring the profit and loss statement accurately captures all relevant revenue and expense categories. For example, a service-based business might include accounts for consulting fees, whereas a retail business would include accounts for cost of goods sold. This precise categorization provides a granular view of financial performance tailored to the specific industry and business model.

- Time Period SelectionCustomizable templates offer flexibility in selecting reporting periods. Businesses can generate statements for various durations, such as monthly, quarterly, or annually. This allows for tracking performance against short-term goals and long-term strategic objectives. For instance, comparing monthly statements helps identify seasonal trends, while annual statements provide a broader overview of yearly performance. This adaptable reporting timeframe empowers businesses to monitor progress and identify areas needing attention with the appropriate level of granularity.

- Inclusion of Specific MetricsBusinesses often track key performance indicators (KPIs) beyond standard revenue and expense categories. Customizable templates allow for the inclusion of such metrics, providing a more holistic view of financial health. A restaurant, for example, might include metrics like average order value or customer churn rate alongside traditional profit and loss data. Integrating these specialized metrics provides a deeper understanding of the factors driving financial performance.

- Branding and FormattingMaintaining consistent branding across all business documents reinforces professional identity. Customizable templates allow businesses to incorporate their logo, color schemes, and preferred fonts. This reinforces brand recognition when sharing financial statements with external stakeholders like investors or lenders. Moreover, adjusting formatting elements like font sizes and column widths enhances readability and ensures clarity, further increasing the document’s effectiveness as a communication tool.

The ability to customize a printable profit and loss statement template ensures relevance and clarity, whether used for internal review, presentations to stakeholders, or record-keeping purposes. This adaptable nature makes these templates a valuable tool for businesses of all sizes and across various industries, providing a tailored view of financial performance to support informed decision-making and strategic planning.

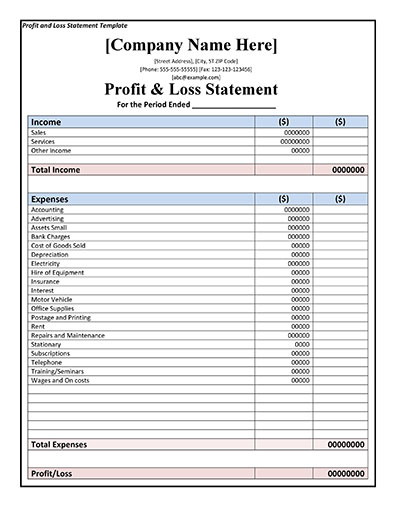

3. Standardized Format

Standardized formatting is a cornerstone of effective financial reporting. A printable profit and loss statement template enforces this standardization, ensuring consistency and comparability across reporting periods. This consistency simplifies analysis, facilitates trend identification, and enhances communication with stakeholders. A standardized format typically includes clearly labeled sections for revenue, cost of goods sold (if applicable), operating expenses, and net income. This structured presentation allows users to quickly locate and interpret key financial figures. For instance, comparing the operating expenses across multiple printed statements readily reveals any significant fluctuations or areas of concern.

Consider a scenario where a business submits financial statements to a bank for loan consideration. A standardized format immediately communicates professionalism and facilitates the bank’s review process. The loan officer can readily locate and analyze key figures like net income and operating expenses, expediting the evaluation process. Conversely, a non-standardized statement can create confusion and potentially delay loan approval. Internally, standardized statements enable consistent performance tracking and trend analysis, supporting data-driven decision-making. A consistent format simplifies the comparison of year-over-year performance, allowing management to quickly identify areas of improvement or concern. This consistency fosters a more efficient and effective approach to financial management.

Adhering to a standardized format, whether dictated by industry regulations or internal best practices, enhances the clarity and credibility of financial reporting. Printable templates facilitate this adherence, reducing the risk of errors and inconsistencies. This structured presentation promotes transparency, simplifies communication, and supports sound financial decision-making, both internally and externally. The ease of generating consistent, standardized statements through printable templates empowers businesses to present their financial performance effectively and professionally.

4. Offline Analysis

Offline analysis, facilitated by printable profit and loss statement templates, offers distinct advantages in financial review. Disconnecting from digital distractions allows for focused examination of financial data, fostering deeper understanding and more insightful interpretation. Printed copies enable annotation, highlighting key figures, and jotting down observations directly on the document. This tactile interaction promotes a more engaged and thorough analysis, often uncovering nuances missed in a purely digital review. For example, reviewing a printed statement during a strategy session enables team members to collectively annotate and discuss observations, fostering a shared understanding of financial performance.

Consider a scenario where a business owner is evaluating cost-cutting strategies. Reviewing a printed profit and loss statement offline allows for uninterrupted focus on expense trends. The owner can manually calculate expense ratios, compare figures across different periods, and circle areas requiring further investigation, all without the distractions of email notifications or software updates. This focused approach can lead to the identification of non-essential expenses or inefficiencies, supporting more effective cost management strategies. Furthermore, offline analysis provides accessibility in situations where internet connectivity is limited or unavailable, such as during travel or in remote locations. This ensures business continuity and allows for timely financial reviews regardless of technological constraints.

While digital tools offer powerful analytical capabilities, offline analysis remains a valuable component of financial review, particularly when utilizing printable profit and loss statement templates. This approach encourages focused examination, promotes deeper understanding, and offers accessibility advantages. Balancing digital analysis with offline review provides a comprehensive approach to financial management, empowering informed decision-making and strategic planning. Maintaining both digital and physical records ensures data integrity and accessibility across diverse operational scenarios. This integrated approach maximizes the value of financial data and supports informed decision-making.

5. Easy Sharing

Facilitating clear communication of financial performance is crucial for any business. Printable profit and loss statement templates directly support this objective through enhanced sharing capabilities. Distributing physical copies simplifies communication, especially in situations where digital access is limited or impractical. For example, providing printed statements during a board meeting ensures all members have immediate access to the same information, fostering a more focused and efficient discussion. This ease of sharing extends beyond internal communication, enabling straightforward distribution to external stakeholders such as potential investors, lenders, or regulatory bodies. This direct and accessible format fosters transparency and strengthens credibility.

Consider a scenario where a small business owner seeks funding from a local bank. Presenting a printed profit and loss statement allows the loan officer to immediately review the business’s financial health, expediting the loan application process. This tangible format also allows for annotation and discussion during the meeting, promoting a clearer understanding of the business’s financial position. In contrast, relying solely on digital files might require the loan officer to access external systems, potentially delaying the review process. Furthermore, distributing printed statements at investor presentations strengthens communication and fosters a sense of transparency, increasing investor confidence. This ease of sharing, particularly in formal settings, enhances the professional presentation of financial data.

Effective communication of financial information is essential for building trust and making informed decisions. Printable profit and loss statement templates enhance sharing capabilities, facilitating efficient and transparent communication with both internal and external stakeholders. This direct and accessible format supports collaborative discussions, expedites decision-making processes, and reinforces professional credibility. While digital sharing methods offer convenience, printed copies remain a valuable tool for ensuring clear, accessible communication in diverse situations. Maintaining both digital and printed versions ensures information can be readily shared regardless of technological constraints or audience preferences. This adaptable approach supports comprehensive communication strategies and fosters stronger stakeholder relationships.

6. Record Keeping

Meticulous record keeping forms the bedrock of sound financial management. Printable profit and loss statement templates play a vital role in this process, providing a tangible, organized format for documenting financial performance. Generating and retaining these printed statements creates a readily accessible historical record, crucial for tracking progress, identifying trends, and supporting informed decision-making. This physical archive complements digital records, offering a secure backup and facilitating offline analysis. For instance, maintaining printed statements for each fiscal year allows for easy year-over-year performance comparisons, revealing long-term trends and supporting strategic planning. This organized archive also simplifies tax preparation, providing readily available documentation of income and expenses. Furthermore, in the event of data loss or system failures, printed records ensure business continuity by providing access to critical financial information.

Consider a scenario where a business faces an audit. Having a comprehensive archive of printed profit and loss statements simplifies the audit process, providing readily available documentation to support financial claims. This organized record-keeping system instills confidence and demonstrates financial transparency. Similarly, when seeking investment, a well-maintained archive of financial statements enhances credibility and provides potential investors with a clear picture of the business’s financial trajectory. This readily available historical data fosters trust and supports informed investment decisions. Moreover, consistent record keeping, facilitated by printable templates, aids in identifying and rectifying discrepancies or errors, contributing to the overall accuracy and integrity of financial reporting.

Effective record keeping, supported by printable profit and loss statement templates, is essential for financial transparency, regulatory compliance, and informed decision-making. These physical records provide a readily accessible archive, safeguarding against data loss and facilitating efficient analysis. Maintaining a comprehensive and organized financial history empowers businesses to demonstrate financial stability, track progress towards goals, and adapt strategies based on historical performance. This proactive approach to record keeping contributes significantly to long-term financial health and sustainability.

Key Components of a Profit and Loss Statement

A comprehensive profit and loss statement provides a detailed overview of a business’s financial performance. Understanding the key components is essential for accurate interpretation and effective utilization of this crucial financial document.

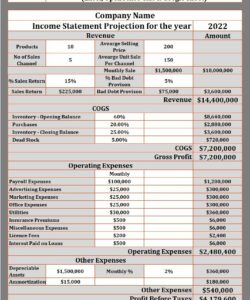

1. Revenue: This section represents the total income generated from a business’s primary operations. It includes sales of goods or services, and depending on the nature of the business, might also include other income streams like interest earned or royalties.

2. Cost of Goods Sold (COGS): Applicable to businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, manufacturing labor, and direct overhead expenses.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit reflects the profitability of core business operations before accounting for other expenses.

4. Operating Expenses: This category encompasses expenses incurred in running the business, excluding COGS. Examples include salaries, rent, marketing costs, administrative expenses, and depreciation.

5. Operating Income: Derived by subtracting Operating Expenses from Gross Profit, this figure reflects the profitability of the business’s core operations after accounting for all operating expenses.

6. Other Income/Expenses: This section captures income or expenses not directly related to core operations, such as interest income, investment gains or losses, or one-time expenses.

7. Income Before Taxes: This represents the total income earned by the business before accounting for income tax obligations.

8. Net Income: This crucial bottom-line figure represents the final profit or loss after all revenues and expenses, including taxes, have been accounted for. It provides a clear picture of the business’s overall profitability.

Careful analysis of these components allows stakeholders to assess financial health, identify trends, and make informed decisions regarding resource allocation, pricing strategies, and future investments.

How to Create a Printable Profit and Loss Statement Template

Creating a printable profit and loss statement template requires careful planning to ensure accuracy, clarity, and relevance to specific business needs. A well-structured template streamlines the process of generating consistent, professional financial statements. The following steps outline the process:

1. Define Reporting Period: Specify the timeframe the statement will cover (e.g., monthly, quarterly, annually). This ensures consistency and allows for meaningful comparisons across periods. Clearly indicating the reporting period on the template itself prevents ambiguity.

2. Establish Key Components: Include essential sections such as revenue, cost of goods sold (if applicable), gross profit, operating expenses, operating income, other income/expenses, income before taxes, and net income. This comprehensive structure ensures all relevant financial data is captured.

3. Integrate Chart of Accounts: Align the template with the business’s chart of accounts. This ensures accurate categorization of revenues and expenses, providing a granular view of financial performance. Accurate account mapping is crucial for precise financial reporting.

4. Incorporate Relevant Metrics: Include key performance indicators (KPIs) specific to the business or industry. This provides a more holistic view of performance beyond standard financial metrics. Tailoring the template to specific business needs enhances its analytical value.

5. Design for Clarity: Utilize clear labels, consistent formatting, and appropriate spacing. This enhances readability and ensures easy interpretation of financial data. A well-designed template facilitates efficient review and analysis.

6. Ensure Printability: Optimize the template for printing, considering factors such as page size, margins, and font selection. This guarantees a professional and legible printed output. Testing the template with different printers and paper sizes ensures consistent results.

7. Incorporate Branding (Optional): Consider adding company logos, color schemes, and other branding elements for a professional and consistent look. This reinforces brand identity when sharing statements externally. Consistent branding enhances professional presentation.

8. Review and Refine: Thoroughly review the template for accuracy and completeness before widespread use. Regularly review and update the template to adapt to changing business needs. Ongoing refinement ensures the template remains relevant and effective.

Developing a robust and adaptable template streamlines the process of generating clear, consistent, and informative profit and loss statements, supporting informed financial management and effective communication with stakeholders. Regular review and refinement ensure the template’s continued relevance and accuracy.

Printable profit and loss statement templates provide a crucial tool for effective financial management. Their accessibility, customizability, and standardized format support efficient analysis, informed decision-making, and transparent communication with stakeholders. Offline review capabilities encourage focused analysis, while easy sharing facilitates collaborative discussions and strengthens relationships with investors and lenders. Furthermore, maintaining printed records contributes to robust record-keeping practices, essential for regulatory compliance and historical analysis.

Leveraging the benefits of printable profit and loss statement templates contributes significantly to a comprehensive understanding of financial performance. This understanding empowers organizations to make data-driven decisions, optimize resource allocation, and navigate the complexities of the financial landscape. Consistent utilization of these templates promotes financial transparency, strengthens accountability, and contributes to long-term stability and growth.