Utilizing these forward-looking financial reports allows businesses to anticipate potential challenges and opportunities, supporting informed decision-making. They are essential for securing funding, attracting investors, and evaluating the viability of new ventures or strategic initiatives. The clarity and structure provided facilitate communication with lenders and investors, showcasing a company’s potential for growth and profitability. This structured approach enables businesses to explore various scenarios and adjust their strategies accordingly, maximizing the potential for success.

The following sections delve deeper into the specific components, creation process, practical applications, and limitations of these predictive financial tools.

1. Standardized Format

A standardized format is fundamental to the efficacy of projected financial reports. Consistency in structure, terminology, and presentation ensures comparability across periods, facilitates analysis, and enhances communication with stakeholders. A standardized template typically includes a balance sheet, income statement, and statement of cash flows, each adhering to established accounting principles. This structured approach allows for quick identification of key financial metrics and trends, enabling informed decision-making.

For instance, presenting revenue, expenses, and profit consistently across different pro forma statements allows for direct comparison of projected performance under various scenarios. A standardized balance sheet structure, with clearly defined asset, liability, and equity sections, enables stakeholders to readily assess the projected financial health of the company. This consistency is particularly crucial when seeking funding, as investors and lenders rely on standardized information for evaluation and comparison.

Maintaining a standardized format in projected financials promotes transparency, reduces ambiguity, and strengthens the credibility of the projections. While the specific assumptions and data inputs may vary based on the specific circumstances and goals, the underlying structure provides a stable framework for analysis and interpretation. This consistency ultimately contributes to more informed business decisions, improved stakeholder communication, and a more robust planning process.

2. Projected Data Inputs

The accuracy and reliability of a pro forma financial statement depend critically on the quality of the underlying data inputs. These projections, based on informed estimates and assumptions about future performance, form the foundation upon which the entire financial model is built. Understanding the various categories of projected data inputs, their sources, and their impact on the overall pro forma statement is essential for creating a robust and credible financial forecast.

- Sales Projections:Forecasting future sales revenue is often the starting point for creating pro forma financial statements. This involves estimating the quantity of goods or services to be sold and their corresponding prices. Market research, historical sales data, industry trends, and anticipated economic conditions all inform these projections. Accurate sales projections are critical as they directly impact revenue figures, which cascade through the income statement and influence other financial metrics.

- Cost of Goods Sold (COGS) Projections:Projecting the cost of producing goods or delivering services is another key input. COGS includes direct material costs, direct labor costs, and manufacturing overhead. These projections often rely on historical cost data, supplier agreements, and anticipated changes in input prices. Accurate COGS projections are crucial for determining gross profit margins and overall profitability.

- Operating Expense Projections:Operating expenses encompass all the costs associated with running the business, excluding COGS. These include expenses like rent, salaries, marketing, and administrative costs. Projecting operating expenses often involves analyzing historical trends, considering planned changes in business operations, and factoring in anticipated inflationary pressures. Accurate operating expense projections are necessary for determining operating income and assessing the efficiency of business operations.

- Capital Expenditure Projections:Planned investments in fixed assets, such as equipment, property, and software, are reflected as capital expenditures. These projections are based on the companys strategic plans for growth and expansion. Accurately forecasting capital expenditures is important for projecting future depreciation expense, which impacts both the income statement and the balance sheet. These projections also influence the financing needs of the company.

These interconnected projections form the core of the pro forma financial statement. The reliability of the entire pro forma statement hinges on the accuracy and reasonableness of these underlying data inputs. Careful consideration of relevant factors, rigorous analysis, and sensitivity analysis, exploring the impact of varying assumptions, contribute to the development of a credible and informative financial forecast. This comprehensive approach enables businesses to make informed decisions, secure funding, and effectively communicate their financial outlook to stakeholders.

3. Key Assumptions

Pro forma financial statements, by their very nature, are projections of future performance. They rely heavily on key assumptions about various factors that influence a company’s financial outcomes. These assumptions, based on informed estimates and analysis, bridge the gap between historical data and future expectations. The validity and reliability of the entire pro forma exercise depend critically on the reasonableness and transparency of these underlying assumptions. Understanding their nature, their impact, and the process of their development is crucial for interpreting and utilizing pro forma financial statements effectively.

- Revenue Growth Assumptions:Projecting future revenue often involves assumptions about market growth rates, market share, pricing strategies, and product lifecycle. For instance, a company launching a new product might assume a certain market penetration rate and average selling price. These assumptions significantly influence projected revenue figures, which, in turn, affect profitability and cash flow projections. Overly optimistic revenue growth assumptions can lead to inflated pro forma results, while overly conservative assumptions can understate the company’s potential.

- Cost Assumptions:Pro forma statements incorporate assumptions about future costs, including cost of goods sold, operating expenses, and capital expenditures. These assumptions might be based on historical cost trends, anticipated changes in input prices, or expected efficiency improvements. For example, a manufacturing company might assume a certain percentage increase in raw material costs based on current market trends. Accurate cost assumptions are crucial for determining projected profit margins and assessing the financial viability of future operations.

- Macroeconomic Assumptions:External factors, such as inflation rates, interest rates, and economic growth, can significantly impact a company’s financial performance. Pro forma statements often incorporate assumptions about these macroeconomic variables. For instance, a company might assume a specific inflation rate when projecting future operating expenses. These assumptions reflect the broader economic environment in which the company operates and influence various aspects of the pro forma projections, including sales, costs, and financing needs.

- Financing Assumptions:Pro forma statements often include assumptions about future financing activities, such as debt issuance, equity financing, or dividend payments. These assumptions influence the projected capital structure of the company and its associated financing costs. For example, a company planning to raise capital through debt financing would need to make assumptions about the interest rate on the debt and the repayment schedule. These assumptions directly impact the projected balance sheet and cash flow statement, providing insights into the company’s future financial position and liquidity.

Clearly articulated and justified key assumptions underpin the credibility and usefulness of pro forma financial statements. Sensitivity analysis, which explores the impact of varying these assumptions, further enhances their value by providing a range of potential outcomes and highlighting the key drivers of financial performance. This rigorous and transparent approach to developing and communicating key assumptions ensures that pro forma financial statements serve as effective tools for planning, decision-making, and stakeholder communication.

4. Financial Forecasting

Financial forecasting forms the core of creating a pro forma financial statement template. The template provides the structure, while forecasting populates it with data, transforming it from a static framework into a dynamic tool for financial planning and decision-making. Forecasting utilizes historical data, industry trends, and strategic assumptions to project future financial performance, offering a glimpse into the potential outcomes of various business strategies.

- Historical Data AnalysisPast performance serves as a valuable starting point for predicting future trends. Analyzing historical financial statementsincluding revenue, expenses, and cash flowreveals patterns and provides a baseline for future projections. For example, consistent revenue growth over the past five years, adjusted for market changes, can inform revenue projections for the next fiscal year. This historical context provides a crucial foundation for building realistic and data-driven forecasts within the pro forma template.

- Industry BenchmarkingComparing a company’s performance against industry averages and competitors provides valuable insights into its relative position and potential growth trajectory. Industry benchmarks offer a frame of reference for evaluating the reasonableness of financial projections. For example, if a company’s projected profit margin significantly exceeds the industry average, it warrants further investigation and justification within the pro forma statement. This benchmarking process strengthens the credibility and objectivity of the financial forecast.

- Scenario PlanningExploring different “what-if” scenarios is crucial for understanding the potential impact of various factors on financial outcomes. Creating multiple pro forma statements, each based on a different set of assumptionssuch as optimistic, pessimistic, and most likely scenariosallows businesses to assess their resilience and adaptability to changing market conditions. This process helps identify potential risks and opportunities, enabling proactive planning and informed decision-making. For example, a company might create different pro forma statements to analyze the financial impact of varying sales growth rates or changes in input costs.

- Sensitivity AnalysisTesting the impact of changes in key assumptions on the projected financial results is a vital part of financial forecasting. Sensitivity analysis helps identify the key drivers of financial performance and the degree to which projected outcomes are susceptible to changes in specific variables. For example, analyzing the impact of a change in the assumed interest rate on the projected debt burden can provide valuable insights into the financial risks associated with debt financing. This process enhances the understanding of the uncertainties inherent in financial forecasting and strengthens the robustness of the pro forma financial statement.

Integrating these forecasting techniques into the pro forma financial statement template allows businesses to create a comprehensive and dynamic picture of their future financial position. The insights gained from this analysis inform strategic decision-making, resource allocation, and stakeholder communication, ultimately contributing to a more robust and adaptable business strategy.

5. Scenario Planning

Scenario planning is an integral component of utilizing pro forma financial statement templates effectively. It allows businesses to explore the potential impact of various future uncertainties on their financial performance. By developing multiple pro forma statements, each based on a different set of assumptions, businesses can gain a more comprehensive understanding of potential risks and opportunities, leading to more informed decision-making and resource allocation.

- Best-Case ScenarioThis scenario models optimal conditions, such as higher-than-expected sales growth, lower input costs, and favorable macroeconomic factors. It provides a benchmark for potential upside and informs strategic decisions aimed at maximizing favorable outcomes. For example, a best-case scenario might project the financial impact of successfully penetrating a new market segment or launching a highly successful product. Analyzing this scenario within the pro forma template helps identify key drivers of success and informs resource allocation decisions aimed at achieving these ambitious targets.

- Base-Case ScenarioThis scenario represents the most likely outcome based on current market conditions and reasonable assumptions about future performance. It serves as a primary reference point for evaluating the feasibility and potential return of various business strategies. For example, a base-case scenario might project the financial impact of maintaining current market share and achieving steady sales growth. This scenario, modeled within the pro forma template, provides a realistic assessment of the company’s likely financial performance under normal operating conditions.

- Worst-Case ScenarioThis scenario models adverse conditions, such as lower sales growth, increased competition, unfavorable economic downturns, or supply chain disruptions. It helps assess the company’s vulnerability to potential risks and informs mitigation strategies. For example, a worst-case scenario might project the financial impact of a significant economic recession or a major disruption in the supply chain. Analyzing this scenario within the pro forma template helps identify potential vulnerabilities and informs contingency planning efforts aimed at mitigating the impact of adverse events.

- Sensitivity Analysis within ScenariosWithin each scenario, sensitivity analysis further refines the understanding of the potential impact of changes in key assumptions. By systematically varying specific variables, such as sales growth rates or input costs, while holding other factors constant, businesses can assess the sensitivity of projected financial outcomes to changes in these key drivers. For example, a company might analyze the impact of a 10% increase or decrease in sales volume on profitability and cash flow within each scenario. This granular analysis provides valuable insights into the key factors that influence financial performance and strengthens the robustness of the scenario planning process.

By integrating these scenarios into the pro forma financial statement template, businesses gain a deeper understanding of the potential range of financial outcomes, enabling more informed and strategic decision-making. This comprehensive approach facilitates proactive risk management, identifies opportunities for growth, and enhances communication with stakeholders about the company’s financial outlook under various potential future conditions.

6. Stakeholder Communication

Effective communication with stakeholders is crucial for securing investment, building trust, and ensuring alignment on strategic goals. A well-structured pro forma financial statement template serves as a powerful communication tool, providing a clear and concise representation of a company’s projected financial performance. This transparency fosters informed decision-making among stakeholders and strengthens their confidence in the company’s management and future prospects.

- Investor RelationsPro forma statements provide potential investors with critical insights into the anticipated financial returns of an investment. Metrics such as projected revenue growth, profit margins, and return on investment (ROI) offer a tangible basis for evaluating investment opportunities. A clear and comprehensive pro forma statement, backed by reasonable assumptions, can significantly enhance investor confidence and attract necessary capital. For example, a startup seeking venture capital funding can utilize a pro forma statement to demonstrate its growth potential and attract investors.

- Lender InteractionsWhen seeking financing from banks or other lending institutions, pro forma statements play a vital role in demonstrating creditworthiness. Lenders carefully scrutinize projected cash flow statements to assess a company’s ability to repay debt obligations. A robust pro forma statement, supported by realistic assumptions and sensitivity analysis, increases the likelihood of securing favorable loan terms and strengthens the company’s credibility with lenders. For established businesses seeking to expand operations, a detailed pro forma can be crucial in securing the necessary financing.

- Internal Planning and Performance ManagementWithin an organization, pro forma statements serve as valuable tools for budgeting, resource allocation, and performance evaluation. They provide a roadmap for achieving financial targets and facilitate ongoing monitoring of progress. Comparing actual results against projected figures allows management to identify deviations, analyze their causes, and make necessary adjustments to strategies and operations. This internal use of pro forma statements strengthens financial discipline and promotes accountability.

- Strategic PartnershipsWhen forming strategic partnerships or joint ventures, pro forma statements provide a common financial framework for evaluating the potential benefits and risks of the collaboration. They enable partners to assess the financial viability of the venture and align their expectations regarding future performance. A clear and transparent pro forma statement facilitates informed negotiations and strengthens the foundation for a successful partnership. For example, two companies considering a merger can use pro forma statements to assess the combined financial impact and potential synergies.

In essence, the pro forma financial statement template acts as a central communication hub, providing a consistent and transparent platform for conveying critical financial information to various stakeholders. This clear and structured communication fosters trust, facilitates informed decision-making, and strengthens the overall financial health and stability of the organization. The insights gained from the pro forma analysis and its effective communication can significantly impact the success of fundraising efforts, strategic partnerships, and internal planning initiatives.

Key Components of Pro Forma Financial Statements

Constructing robust pro forma financial statements requires careful consideration of key components, each contributing to a comprehensive and credible financial projection. These interconnected elements provide a structured framework for forecasting future performance and communicating financial expectations to stakeholders.

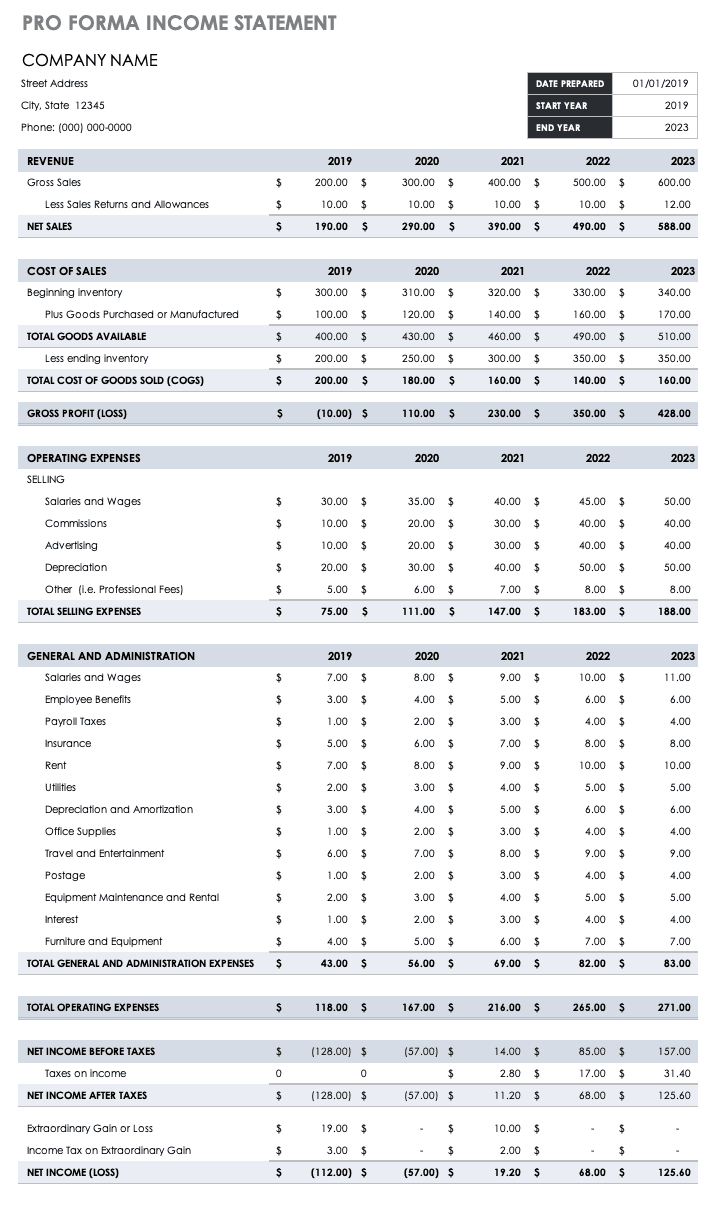

1. Income Statement: The pro forma income statement projects future revenue, expenses, and resulting profit or loss. Key elements include revenue projections based on anticipated sales volume and pricing, cost of goods sold (COGS) forecasts, operating expense projections, and calculations of gross profit, operating income, and net income. Accuracy in these projections is crucial for assessing profitability and informing pricing and cost management strategies.

2. Balance Sheet: The pro forma balance sheet projects the company’s future assets, liabilities, and equity. Key elements include projected cash balances, accounts receivable, inventory levels, fixed assets, accounts payable, debt obligations, and equity contributions. This forward-looking view of the company’s financial position provides insights into its anticipated liquidity, solvency, and capital structure.

3. Statement of Cash Flows: The pro forma statement of cash flows projects future cash inflows and outflows from operating, investing, and financing activities. This statement provides a crucial view of the company’s anticipated cash position and its ability to generate cash from operations. Accurately forecasting cash flows is essential for managing liquidity, making informed investment decisions, and securing financing.

4. Key Assumptions: Underlying the pro forma financial statements are key assumptions about future market conditions, economic trends, and internal performance drivers. These assumptions, explicitly stated and justified, provide the basis for the financial projections. Transparency regarding these assumptions is crucial for ensuring the credibility and interpretability of the pro forma statements.

5. Supporting Schedules: Detailed supporting schedules provide the granular data and calculations that underpin the main pro forma statements. These schedules might include sales forecasts by product line, detailed cost breakdowns, capital expenditure plans, and debt amortization schedules. These supporting details enhance the transparency and credibility of the overall pro forma projections.

The interconnectedness of these components allows for a dynamic and comprehensive view of future financial performance. The income statement, balance sheet, and statement of cash flows, informed by key assumptions and supported by detailed schedules, collectively offer a robust framework for planning, decision-making, and stakeholder communication. Careful consideration and rigorous analysis of each component contribute to the development of credible and informative pro forma financial statements.

How to Create Pro Forma Financial Statements

Developing pro forma financial statements requires a structured approach, combining historical data, future assumptions, and financial forecasting techniques. The following steps outline the process:

1. Historical Data Gathering and Analysis: Begin by collecting historical financial data, including income statements, balance sheets, and statements of cash flows. Analyze past performance, identifying trends in revenue, expenses, and cash flow. This historical context provides a foundation for future projections.

2. Define Key Assumptions: Articulate specific assumptions about future market conditions, sales growth, cost trends, and other relevant factors. These assumptions should be based on market research, industry analysis, and internal strategic plans. Documenting these assumptions is crucial for transparency and allows for sensitivity analysis.

3. Project Revenue: Forecast future revenue based on anticipated sales volume, pricing strategies, and market growth rates. Consider various factors that might influence sales, such as new product launches, marketing campaigns, and competitive pressures. Develop multiple revenue projections under different scenarios (e.g., best-case, base-case, worst-case).

4. Project Expenses: Forecast future expenses, including cost of goods sold (COGS), operating expenses, and capital expenditures. Consider historical cost trends, anticipated changes in input prices, and planned investments in fixed assets. Align expense projections with revenue projections and strategic initiatives.

5. Project Cash Flow: Project future cash inflows and outflows from operating, investing, and financing activities. Consider factors such as projected sales, collections, payments to suppliers, capital expenditures, debt repayments, and equity contributions. Accurate cash flow projections are crucial for assessing liquidity and financial stability.

6. Develop Pro Forma Statements: Using the projected data and assumptions, create the pro forma income statement, balance sheet, and statement of cash flows. Ensure consistency and accuracy in calculations and adhere to established accounting principles. Include supporting schedules with detailed calculations and justifications.

7. Conduct Sensitivity Analysis: Test the impact of changes in key assumptions on the projected financial results. This analysis helps identify the key drivers of financial performance and assesses the sensitivity of projections to variations in underlying assumptions. This process strengthens the robustness and reliability of the pro forma statements.

8. Review and Refine: Regularly review and refine the pro forma statements as new information becomes available or market conditions change. This iterative process ensures that the projections remain relevant and reflect the evolving business environment. Regular updates enhance the value of the pro forma statements as tools for ongoing planning and decision-making.

By following these steps and maintaining a rigorous and transparent approach, businesses can develop credible and informative pro forma financial statements that serve as valuable tools for planning, decision-making, and stakeholder communication. This structured approach allows for a dynamic understanding of potential future financial performance and enhances the ability to navigate the complexities of the business environment.

Templates for projected financial reports provide a structured framework for forecasting future performance, enabling businesses to anticipate potential challenges and capitalize on opportunities. Understanding the key components, underlying assumptions, and development process is essential for constructing robust and credible projections. Utilizing these tools effectively involves scenario planning, sensitivity analysis, and clear communication with stakeholders. From securing funding and attracting investors to informing internal decision-making and evaluating strategic initiatives, these projected reports serve as critical tools for navigating the complexities of the business environment and driving sustainable growth.

The ability to accurately forecast financial performance is paramount in today’s dynamic business landscape. Leveraging these structured templates empowers organizations to make informed decisions, mitigate risks, and effectively communicate their vision for the future. As businesses continue to navigate an increasingly complex and uncertain world, the strategic use of these forward-looking financial tools will remain essential for achieving long-term success and sustainable growth.