Utilizing these predictive financial tools offers several advantages. They enable businesses to anticipate potential financial challenges and opportunities, facilitating proactive adjustments to strategies and operations. These projections also play a critical role in securing funding from investors or lenders, demonstrating the viability and potential return on investment of a business venture. Furthermore, they provide a benchmark against which actual performance can be measured, allowing for ongoing monitoring and adjustments to ensure progress towards financial goals.

This article will further explore the components, creation, and practical applications of these crucial planning instruments. Subsequent sections will delve into specific examples and best practices for developing and utilizing these powerful tools for financial forecasting.

1. Forecasting

Forecasting forms the foundation of pro forma financial statements. These statements are, in essence, projections of future financial performance based on a set of assumptions. Accurate forecasting is crucial for effective business planning, resource allocation, and decision-making.

- Sales Projections:Predicting future sales revenue is a cornerstone of forecasting. This involves analyzing market trends, historical sales data, pricing strategies, and competitive landscapes. For instance, a company launching a new product might project sales based on market research and anticipated customer adoption rates. Accurate sales projections drive the revenue figures within the pro forma income statement.

- Expense Budgeting:Forecasting expenses involves anticipating the costs associated with generating projected revenue. This includes costs of goods sold, operating expenses, marketing and sales expenses, and administrative expenses. A manufacturer, for example, might project raw material costs based on anticipated production volumes and commodity price fluctuations. Expense budgeting directly impacts profitability projections within the pro forma income statement.

- Capital Expenditure Planning:Forecasting capital expenditures involves predicting investments in long-term assets, such as property, plant, and equipment. These projections influence both the pro forma income statement (through depreciation expense) and the pro forma balance sheet (through changes in asset values). For example, a growing company might project investments in new manufacturing facilities to support increased production capacity.

- Funding Requirements:Forecasting funding needs involves projecting the amount of external financing required to support projected growth and operations. This might include debt financing, equity financing, or a combination of both. These projections directly impact the pro forma balance sheet, particularly the debt and equity sections. A startup, for instance, might project funding needs based on anticipated operating losses and planned capital investments.

Through these interconnected forecasts, the pro forma income statement and balance sheet provide a comprehensive view of a company’s projected financial position and performance, enabling informed decision-making and strategic planning.

2. Structure

Structure is essential to the efficacy of pro forma financial statements. A standardized format ensures clarity, consistency, and comparability. The income statement consistently presents revenue, cost of goods sold, operating expenses, and net income. This structured presentation allows for easy identification of key performance indicators and facilitates trend analysis. Similarly, the balance sheet adheres to a structured format, presenting assets, liabilities, and equity in a standardized manner. This structure allows stakeholders to readily assess a company’s financial position and its ability to meet its obligations. For example, a lender reviewing a loan application can quickly assess the applicant’s liquidity and solvency by examining the structure of the pro forma balance sheet.

A well-defined structure also facilitates scenario analysis. By modifying key assumptions within the structured template, businesses can explore the potential impact of different business strategies or economic conditions on their projected financial performance. For instance, a company considering expanding into a new market can use a structured pro forma income statement to model the potential impact of different pricing strategies or market penetration rates on projected revenue and profitability. This structured approach enables systematic evaluation of various scenarios, supporting informed decision-making.

In conclusion, a structured format is fundamental to the utility of these projected financial documents. This structure not only ensures clarity and comparability but also facilitates analysis and informed decision-making. Adhering to a standardized structure enables stakeholders to readily interpret the information presented, facilitating effective communication and informed financial planning. The inability to maintain a consistent structure can lead to misinterpretations and hinder effective financial analysis, underscoring the importance of structure in maximizing the utility of these crucial planning tools.

3. Standardization

Standardization plays a critical role in the efficacy of projected financial statements. A standardized format, typically following Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), ensures consistency and comparability across different businesses and time periods. This consistency allows stakeholders, such as investors, lenders, and management, to readily interpret and analyze the information presented. For example, a standardized income statement consistently presents revenue, cost of goods sold, operating expenses, and net income, facilitating direct comparison of performance across different companies or across different periods for the same company. Without standardization, comparing financial projections would be significantly more challenging, potentially leading to misinterpretations and flawed decision-making.

Furthermore, standardization facilitates the use of pre-built templates and software, streamlining the process of creating these projections. These templates provide a structured framework, ensuring all necessary information is included and presented in a logical order. This reduces the risk of errors and omissions, enhancing the reliability and credibility of the projections. For instance, a financial planning software package might offer standardized templates for various industries, allowing businesses to quickly generate projections based on their specific needs and assumptions. This standardization not only saves time and resources but also improves the accuracy and consistency of the projections.

In conclusion, standardization is essential for maximizing the value and usability of projected financial reports. It ensures consistency, comparability, and facilitates the use of pre-built tools and templates. This standardization ultimately enhances the reliability and credibility of the projections, enabling informed decision-making by stakeholders. Failing to adhere to standardized formats can lead to confusion, misinterpretations, and ultimately, suboptimal financial decisions. Therefore, embracing standardization is crucial for effectively leveraging these powerful tools for financial planning and analysis.

4. Key Assumptions

Projected financial statements are inherently forward-looking, relying on a set of key assumptions about future conditions. These assumptions, forming the foundation of the entire projection, directly influence the projected financial outcomes. Understanding and critically evaluating these assumptions is therefore crucial for interpreting and utilizing these statements effectively.

- Revenue Growth RateA critical assumption is the rate at which revenue is expected to grow. This assumption is typically based on factors such as historical sales data, market trends, competitive landscape, and anticipated pricing strategies. Overly optimistic revenue growth assumptions can lead to inflated projections, while overly conservative assumptions can underestimate potential. For example, a technology startup might assume a high revenue growth rate based on anticipated market disruption, while a mature company in a stable industry might project a more modest growth rate.

- Cost StructureAssumptions about the relationship between costs and revenue are also crucial. These include assumptions about fixed costs (which remain constant regardless of production volume) and variable costs (which fluctuate with production volume). Accurate cost assumptions are essential for projecting profitability. For example, a manufacturing company might assume that raw material costs will rise in the future due to anticipated supply chain disruptions, impacting its projected gross profit margin.

- Capital ExpendituresAssumptions regarding investments in long-term assets, such as property, plant, and equipment, are crucial for both the projected income statement and balance sheet. These assumptions influence depreciation expense on the income statement and asset values on the balance sheet. A company anticipating significant expansion might project substantial capital expenditures for new facilities, while a company focusing on maintaining existing operations might project lower levels of capital investment.

- Financing AssumptionsAssumptions about the cost and availability of financing impact the projected balance sheet and, indirectly, the income statement (through interest expense). These assumptions include the interest rates on debt financing and the terms of any equity financing. A company seeking external funding might assume a specific interest rate based on prevailing market conditions and its creditworthiness, impacting its projected debt levels and interest expense.

The reliability of projected financial statements directly depends on the validity of these underlying assumptions. Sensitivity analysis, exploring the impact of varying these assumptions, is essential for understanding the potential range of outcomes and the inherent uncertainties in financial forecasting. A thorough understanding of these key assumptions enables stakeholders to critically evaluate the projections and make informed decisions based on a realistic assessment of potential future financial performance.

5. Financial Planning

Financial planning provides a roadmap for achieving financial goals, encompassing budgeting, forecasting, and resource allocation. Projected financial reports, such as pro forma income statements and balance sheets, serve as crucial tools in this process, translating strategic objectives into concrete financial projections. These projected statements provide a framework for evaluating the financial viability of different strategies, enabling informed decision-making and resource allocation.

- Setting ObjectivesFinancial planning begins with clearly defined financial objectives. These objectives might include achieving a specific revenue target, improving profitability, or increasing market share. Projected financial statements provide a mechanism for quantifying these objectives, translating them into specific financial targets. For example, a company aiming to double its revenue within five years would use projected income statements to model the required sales growth and associated expenses.

- Developing StrategiesOnce financial objectives are established, financial planning involves developing strategies to achieve them. These strategies might include launching new products, expanding into new markets, or implementing cost-cutting measures. Projected financial statements allow businesses to evaluate the potential financial impact of different strategies. For example, a company considering a new product launch can use pro forma statements to model the projected revenue, costs, and profitability of the new product line, assessing its contribution to overall financial objectives.

- Resource AllocationEffective financial planning requires careful allocation of resources. Projected financial statements inform resource allocation decisions by highlighting areas where investment is needed to achieve projected growth or improve financial performance. For instance, a company projecting rapid sales growth might need to invest in additional production capacity or expand its sales force. The projected statements provide the financial justification for these investments, demonstrating their contribution to achieving overall financial goals.

- Performance MonitoringFinancial planning is an ongoing process, requiring continuous monitoring and adjustments. Projected financial statements serve as benchmarks against which actual performance can be measured. Regularly comparing actual results to projected results allows businesses to identify deviations from the plan, analyze the causes of these deviations, and make necessary adjustments to strategies or operations. This ongoing monitoring and adjustment process ensures that the company stays on track to achieve its financial objectives.

In conclusion, projected financial statements are integral to effective financial planning. They provide a framework for setting objectives, developing strategies, allocating resources, and monitoring performance. By translating strategic goals into concrete financial projections, these statements enable informed decision-making, driving businesses towards sustainable growth and financial success. The ability to create and interpret these statements is therefore a crucial skill for anyone involved in financial planning and analysis.

Key Components of Pro Forma Financial Statements

Understanding the underlying structure of projected financial statements is crucial for effective financial planning and analysis. These key components work together to provide a comprehensive view of a company’s projected financial position and performance.

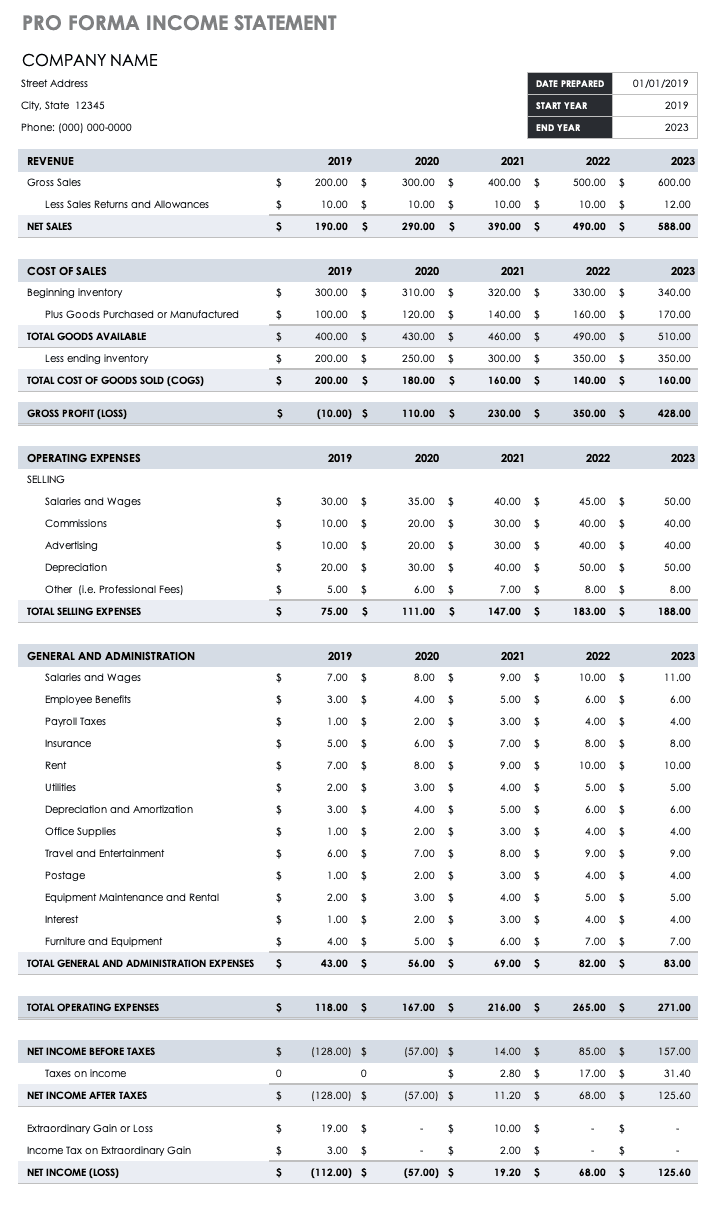

1. Revenue Projections: The foundation of a pro forma income statement, revenue projections estimate future sales based on market analysis, historical data, pricing strategies, and anticipated growth rates. Accuracy in these projections is paramount as they drive subsequent profitability calculations.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with producing those goods. Accurate COGS projections are essential for calculating gross profit margins and assessing the overall profitability of sales.

3. Operating Expenses: These encompass the costs of running the business, including selling, general, and administrative expenses (SG&A). Projecting operating expenses requires careful consideration of factors such as staffing levels, marketing budgets, and rent.

4. Depreciation and Amortization: These non-cash expenses reflect the decline in value of long-term assets over time. Accurate projections are necessary for reflecting the true cost of using these assets and accurately projecting net income.

5. Interest Expense: This represents the cost of borrowing money and is calculated based on projected debt levels and interest rates. Accurately projecting interest expense is crucial for assessing the impact of financing decisions on profitability.

6. Income Tax Expense: Projected income tax expense is based on projected pre-tax income and applicable tax rates. Accurate projections are essential for determining projected net income and assessing the overall tax burden.

7. Assets: On the pro forma balance sheet, assets represent the resources owned or controlled by the company. These projections reflect anticipated investments in current assets (such as cash and inventory) and long-term assets (such as property, plant, and equipment).

8. Liabilities: Liabilities represent the company’s obligations to others. Projected liabilities reflect anticipated borrowing, accounts payable, and other outstanding obligations. Accurate projections are essential for assessing the company’s financial health and solvency.

9. Equity: Equity represents the owners’ stake in the company. Projections of equity reflect anticipated changes in retained earnings (accumulated profits) and any new equity investments. Understanding projected equity levels is essential for assessing ownership structure and the company’s overall financial strength.

These interconnected components, when combined within the structured format of projected income statements and balance sheets, offer a powerful tool for financial planning and decision-making. They provide a roadmap for anticipating future financial performance, assessing the viability of different strategies, and guiding resource allocation decisions.

How to Create Pro Forma Financial Statements

Creating projected financial statements involves a systematic process of gathering data, making assumptions, and projecting future performance. The following steps outline a structured approach to this process.

1: Establish a Time Horizon: Define the period the projections will cover. This could range from a few months for short-term planning to several years for long-term forecasting. A clearly defined time horizon ensures all projections align with the relevant planning cycle.

2: Gather Historical Data: Collect past financial statements (income statements, balance sheets, cash flow statements) for at least the past three years. This historical data provides a baseline for projecting future performance and identifying trends.

3: Develop Key Assumptions: Formulate assumptions about future economic conditions, industry trends, and internal business operations. These assumptions will drive the projections and should be based on careful research and analysis. Documenting these assumptions is crucial for transparency and later review.

4: Project Revenue: Forecast future sales based on the established assumptions. Consider factors such as market growth, pricing strategies, and competitive dynamics. Different methodologies, such as bottom-up (building up from individual product sales) or top-down (starting with total market size) can be employed.

5: Project Expenses: Forecast costs associated with generating projected revenue. This includes cost of goods sold, operating expenses, and other expenses. Consider both fixed and variable costs, and how they might change with revenue fluctuations.

6: Project Balance Sheet Items: Forecast assets, liabilities, and equity based on projected operating results and financing assumptions. This includes projecting changes in working capital (current assets and liabilities) and long-term assets and liabilities.

7: Review and Refine: Carefully review the completed projections for consistency and reasonableness. Ensure that assumptions align with overall business strategy and that the projected financial position and performance are plausible. Sensitivity analysis, testing the impact of changes in key assumptions, can be valuable.

8: Document and Communicate: Clearly document the assumptions underlying the projections and communicate the projected financial results to stakeholders. Transparency in assumptions allows stakeholders to understand the basis for the projections and assess their potential risks and opportunities.

Creating robust projections requires a rigorous approach, combining historical data, well-reasoned assumptions, and a clear understanding of business drivers. This iterative process provides valuable insights into potential future financial performance, supporting informed decision-making and strategic planning. Regularly updating and refining these projections, as new information becomes available, ensures their continued relevance and value.

Templates for projected income statements and balance sheets provide a structured framework for financial forecasting, enabling businesses to anticipate future performance based on specific assumptions. Understanding the key components, including revenue projections, expense budgeting, and balance sheet items, is crucial for constructing accurate and meaningful projections. The process involves establishing a clear time horizon, gathering historical data, formulating realistic assumptions, and meticulously projecting financial outcomes. Standardization and a structured approach ensure consistency and comparability, facilitating informed decision-making. Regular review and refinement of these projected reports, coupled with sensitivity analysis, are crucial for maintaining their relevance and mitigating potential risks associated with relying on forward-looking information.

Mastering the development and interpretation of these crucial financial tools empowers organizations to navigate the complexities of financial planning, secure funding, and make strategic decisions aligned with long-term objectives. The ability to translate strategic vision into quantifiable financial projections is essential for achieving sustainable growth and navigating an uncertain economic landscape. Continuous refinement of forecasting techniques, coupled with a deep understanding of business drivers and market dynamics, remains paramount for maximizing the value and accuracy of these powerful instruments of financial foresight.