Utilizing a standardized structure offers several advantages. It ensures consistency in reporting, simplifies financial analysis, facilitates comparisons across different periods, and aids in informed decision-making. These pre-designed formats often incorporate best practices, minimizing errors and promoting clarity. They are particularly beneficial for smaller enterprises that may lack dedicated accounting personnel, providing a readily available framework for accurate financial reporting.

Further exploration of this subject will encompass detailed discussions of key components, practical examples, and available resources for generating these statements effectively. Subsequent sections will delve into the significance of each line item, illustrate interpretation techniques, and guide readers through leveraging these tools for optimal financial management.

1. Revenue

Revenue represents the lifeblood of any business and forms the cornerstone of the profit and loss (P&L) statement. Within the context of a P&L template for small businesses, revenue signifies the total income generated from business activities before any expenses are deducted. Accurately recording and analyzing revenue is paramount for understanding financial performance and making informed decisions. For instance, a retail business’s revenue might primarily stem from product sales, while a consulting firm’s revenue would come from service fees. Understanding the sources and drivers of revenue is crucial for sustainable growth. Inaccuracies in revenue reporting can distort the entire P&L statement and lead to flawed financial assessments.

Revenue directly impacts profitability. A higher revenue figure, assuming expenses remain constant or decrease, contributes to greater profit. Conversely, declining revenue can signify underlying issues within the business model or market conditions. Consider a bakery that experiences a sudden drop in revenue. This decline could be attributed to various factors, such as increased competition, changing consumer preferences, or pricing strategies. Analyzing revenue trends within the P&L statement allows businesses to identify such issues and implement corrective measures. Monitoring revenue streams and comparing them against historical data and industry benchmarks provides valuable insights into business performance.

Effective revenue management is essential for long-term financial health. Accurately capturing all revenue streams within the P&L template provides a clear picture of financial standing. This clarity enables informed decision-making regarding pricing, cost control, and investment strategies. Regularly reviewing revenue figures within the P&L statement allows businesses to track progress toward financial goals, identify potential challenges, and adapt to changing market dynamics. This understanding of revenue within the context of the P&L statement ultimately empowers businesses to achieve sustainable profitability and growth.

2. Expenses

Expenses represent the outflow of money required to operate a business. Within the framework of a profit and loss (P&L) statement template for small businesses, accurately categorizing and tracking expenses is critical for determining profitability and making informed financial decisions. Expenses are broadly classified into operating expenses (e.g., rent, salaries, marketing) and cost of goods sold (COGS) (e.g., raw materials, direct labor). A comprehensive understanding of these expense categories is crucial for effective financial management. For example, a restaurant’s expenses would include ingredients (COGS), staff wages (operating expense), and rent (operating expense). Ignoring or misclassifying expenses can lead to an inaccurate representation of profitability and hinder informed decision-making.

The relationship between expenses and profitability is inversely proportional. Higher expenses, with revenue held constant, result in lower profit margins. Conversely, effectively managing and minimizing expenses can contribute to increased profitability. Consider a manufacturing company facing rising raw material costs. This increase in COGS directly impacts the bottom line, reducing profitability unless mitigating actions, such as price adjustments or sourcing alternative materials, are implemented. Analyzing expenses within the P&L statement enables businesses to identify areas for cost optimization and improve overall financial performance. Examining expense trends over time and comparing them to industry benchmarks provides valuable insights into cost efficiency.

Effective expense management is fundamental to long-term financial sustainability. A well-structured P&L template facilitates accurate expense tracking, categorization, and analysis. This detailed view of expenses empowers businesses to identify cost-saving opportunities, negotiate better deals with suppliers, and make strategic decisions regarding resource allocation. Regularly reviewing expenses within the context of the P&L statement allows businesses to monitor financial health, control costs, and enhance profitability. Understanding and managing expenses is integral to achieving sustainable growth and long-term financial success.

3. Profitability

Profitability, a core measure of a business’s financial success, represents the ability to generate earnings after accounting for all expenses. Within the context of a profit and loss (P&L) statement template for small businesses, profitability is not merely a final figure; it provides a crucial lens through which to assess overall financial health and sustainability. The P&L statement systematically deducts expenses from revenue to arrive at net income, the quintessential indicator of profitability. This process illuminates the relationship between revenue generation, cost control, and the resulting profit or loss. For instance, a small e-commerce business might generate substantial revenue, but high marketing and shipping costs could erode profitability unless effectively managed. Understanding the factors influencing profitability is essential for informed decision-making.

Analyzing profitability within the P&L statement goes beyond simply calculating net income. Examining gross profit, operating profit, and net profit margins provides a nuanced understanding of performance across different operational levels. Gross profit reveals the efficiency of production or service delivery, while operating profit assesses the effectiveness of overall business operations. Net profit margin, the ultimate measure of profitability, reflects the percentage of revenue retained as profit after all expenses are covered. Consider a software company with a high gross profit margin but a low net profit margin. This scenario might indicate excessive administrative or marketing expenses, highlighting areas for potential cost optimization. Tracking profitability trends within the P&L statement over time allows businesses to identify areas for improvement, assess the impact of strategic decisions, and make data-driven adjustments.

Sustained profitability is the cornerstone of long-term business viability. The P&L statement, through its detailed representation of revenues, expenses, and resulting profits, provides an indispensable tool for monitoring and managing profitability. Regularly reviewing the P&L statement empowers businesses to identify potential threats to profitability, implement corrective measures, and make strategic investments that drive sustainable growth. Understanding profitability within the context of the P&L statement is not merely an accounting exercise; it is a critical management function that informs strategic planning and ensures long-term financial success. Failing to prioritize profitability analysis within the P&L statement can lead to unsustainable business practices and ultimately jeopardize long-term survival.

4. Time Period

The time period covered by a profit and loss (P&L) statement is a crucial element for understanding financial performance. A P&L statement provides a snapshot of a business’s financial activities over a defined period, enabling analysis of trends and comparisons across different time frames. Selecting the appropriate time period is essential for extracting meaningful insights and making informed decisions. Whether it’s a month, a quarter, a year, or a custom period, the chosen timeframe significantly impacts the interpretation of the financial data presented.

- Fiscal YearA fiscal year represents a company’s financial year, which may or may not align with the calendar year. For example, a company’s fiscal year could run from July 1st to June 30th. Analyzing the P&L statement for the entire fiscal year provides a comprehensive overview of annual performance and facilitates year-over-year comparisons. This longer timeframe allows for the identification of broader trends and the assessment of long-term financial health.

- Quarterly ReportingQuarterly P&L statements offer a more granular view of performance, enabling businesses to track progress toward annual goals and identify potential issues more frequently. Analyzing quarterly data allows for quicker identification of emerging trends and facilitates more timely adjustments to business strategies. For instance, a seasonal business might experience significant fluctuations in revenue and expenses across different quarters, making quarterly P&L analysis essential for effective management.

- Monthly TrackingMonthly P&L statements provide the most frequent performance updates, offering a close-up view of financial activities. This level of detail is particularly beneficial for businesses requiring tight financial control or those experiencing rapid growth or change. For example, a startup might closely monitor monthly P&L statements to track burn rate, manage cash flow, and ensure sufficient runway. Monthly tracking allows for proactive adjustments to operations and rapid responses to changing market conditions.

- Year-to-Date AnalysisYear-to-date (YTD) analysis within a P&L statement provides a cumulative overview of performance from the beginning of the fiscal year to a specific date. This allows businesses to track progress towards annual targets and compare performance against previous years’ YTD figures. Understanding YTD performance is essential for evaluating the effectiveness of current strategies and making necessary adjustments to achieve desired outcomes.

Selecting the appropriate time period for a P&L statement depends on the specific needs of the business. While annual reports provide a broad overview of financial health, more frequent reporting, such as quarterly or monthly, allows for timely identification of trends and adjustments to strategies. Understanding the nuances of each timeframe and utilizing a consistent reporting period within the P&L template is crucial for accurate financial analysis and informed decision-making. A well-defined time period provides the context necessary to interpret financial data, track progress, and ensure sustainable growth.

5. Template Structure

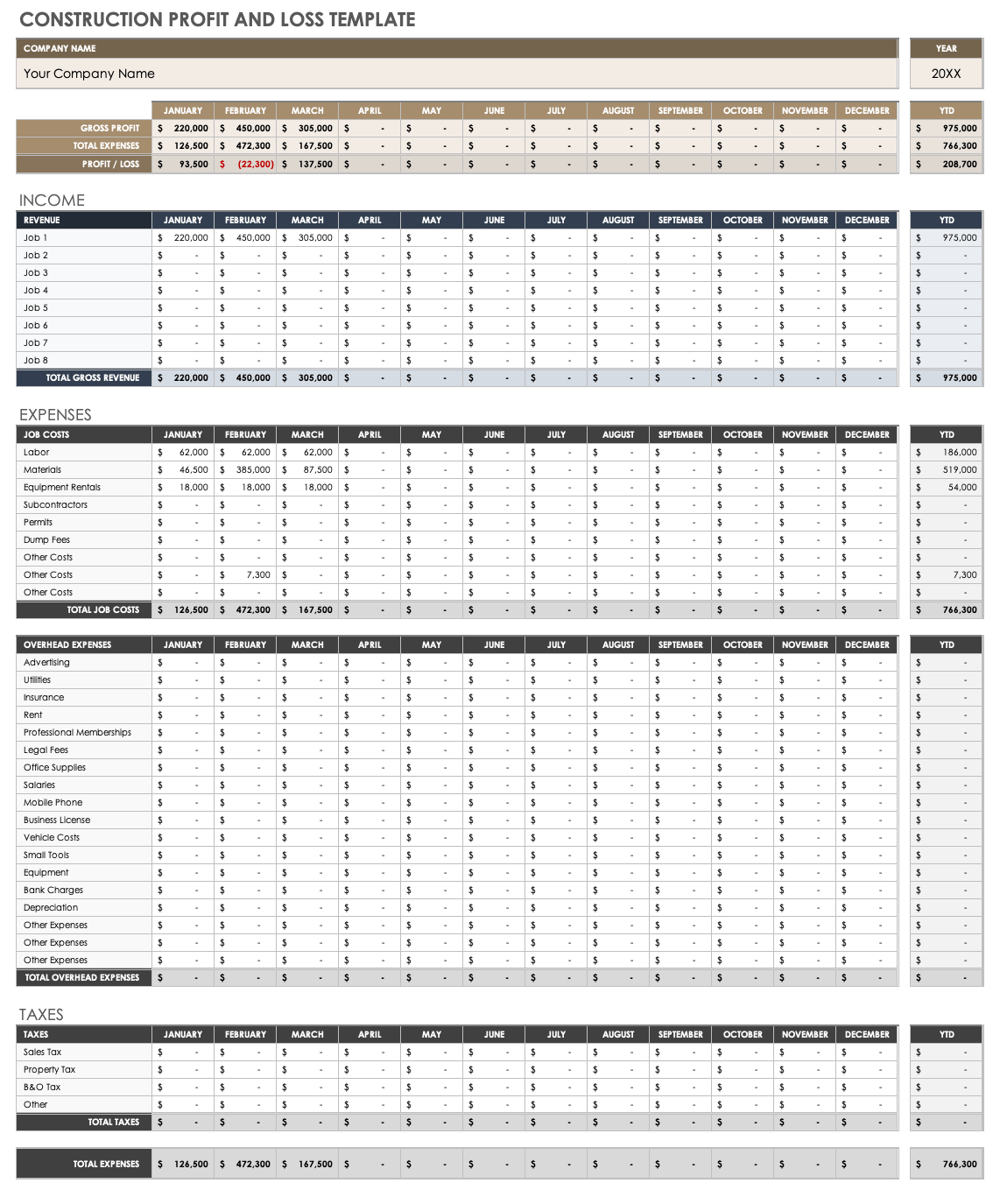

A well-defined template structure is essential for creating clear, consistent, and easily interpretable profit and loss (P&L) statements. A standardized format ensures that financial information is presented logically and systematically, facilitating analysis and comparison across different periods. A structured template also simplifies the process of generating P&L statements, reducing the risk of errors and omissions. Consistency in structure allows stakeholders to quickly locate and interpret key financial data, supporting informed decision-making and strategic planning.

- Standard SectionsA typical P&L template includes standard sections for revenue, cost of goods sold (COGS), gross profit, operating expenses, operating income, other income/expenses, and net income. This standardized organization ensures that all essential financial data is captured and presented in a logical order. For example, a retail business’s P&L statement would clearly delineate sales revenue, the cost of the goods sold, and resulting gross profit, followed by operating expenses such as rent and salaries, ultimately leading to the calculation of net income. This structured approach allows for a comprehensive understanding of the business’s financial performance.

- Clear Labels and DescriptionsClear and concise labels for each line item within the P&L template are crucial for accurate interpretation. Detailed descriptions accompanying each label further enhance clarity and ensure that all stakeholders understand the information presented. For instance, instead of simply listing “Marketing,” a well-structured template might use “Marketing & Advertising Expenses,” providing a more specific understanding of the costs included. This level of detail reduces ambiguity and promotes transparency in financial reporting.

- Formula IntegrationIntegrated formulas within the template automate calculations, minimizing the risk of manual errors and saving time. For example, gross profit is automatically calculated by subtracting COGS from revenue. Similarly, net income is derived by subtracting total expenses from total income. Automated calculations ensure accuracy and consistency in the reported figures, enhancing the reliability of the P&L statement. This feature is particularly beneficial for small businesses that may not have dedicated accounting personnel.

- Formatting and PresentationConsistent formatting and a clear presentation style enhance readability and facilitate understanding. The use of appropriate fonts, spacing, and headings improves the visual appeal and accessibility of the P&L statement. A well-formatted template ensures that information is presented in a clear, concise, and professional manner, enhancing communication with stakeholders and promoting informed financial decision-making.

A well-structured P&L template provides a framework for accurate, consistent, and easily interpretable financial reporting. The standardized sections, clear labeling, formula integration, and professional formatting contribute to a more efficient and reliable process for generating and analyzing P&L statements. Utilizing a structured template empowers small businesses to effectively monitor financial performance, make informed decisions, and achieve sustainable growth. The consistent framework facilitates comparison across different periods, enabling trend analysis and proactive adjustments to business strategies. Ultimately, a well-structured template promotes financial transparency and supports informed financial management.

Key Components of a Profit and Loss Statement Template

Understanding the core components of a profit and loss (P&L) statement template is crucial for sound financial management. The following elements provide a foundational understanding of these statements.

1. Revenue: This section details all income generated from business operations, including sales, services rendered, and any other income streams. Accurate revenue reporting is fundamental to a reliable P&L statement. Different business models will have distinct revenue streams; for example, a subscription-based service will focus on recurring subscription fees, while a retailer emphasizes sales revenue.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead. For service-based businesses, this section may be replaced by “Cost of Services” and include direct labor and other costs directly related to service delivery. Accurate COGS calculation is crucial for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. Analyzing gross profit helps assess the efficiency of production or service delivery processes. Changes in gross profit can indicate shifts in production costs or pricing strategies.

4. Operating Expenses: These expenses are incurred in running the business and are not directly tied to production or service delivery. They include rent, salaries, marketing, administrative costs, and depreciation. Careful management of operating expenses is critical for maintaining healthy profit margins.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the core business operations after accounting for all operating costs. This figure provides insights into the efficiency and effectiveness of the business’s overall operations.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. Including these items provides a comprehensive view of all financial activity affecting the business.

7. Net Income: This is the bottom line the final profit or loss after all revenues and expenses have been accounted for. Net income represents the overall profitability of the business for the given period. It is a key indicator of financial health and sustainability.

8. Time Period: The P&L statement covers a specific period, such as a month, quarter, or year. This allows for tracking performance trends over time and comparing results across different periods. A consistent time period is essential for meaningful analysis.

Accurate reporting and analysis of these components are essential for understanding financial performance, making informed decisions, and driving sustainable growth. Regular review of these elements within a structured template allows businesses to monitor progress, identify areas for improvement, and adapt to changing market dynamics.

How to Create a Profit and Loss Statement for a Small Business

Creating a profit and loss (P&L) statement involves systematically organizing financial data to present a clear picture of a business’s performance over a specific period. The following steps outline the process of creating a P&L statement using a template, ensuring accuracy and consistency in financial reporting.

1. Choose a Template: Select a P&L template appropriate for the business type and reporting period. Numerous free templates are available online or within spreadsheet software. Ensure the chosen template includes all necessary sections for comprehensive reporting. Consider factors such as industry-specific requirements and the level of detail needed for analysis.

2. Determine the Reporting Period: Specify the time frame covered by the P&L statement, whether it’s a month, quarter, or year. Consistent reporting periods allow for accurate trend analysis and comparisons over time. Align the reporting period with business objectives and reporting requirements.

3. Gather Financial Data: Collect all relevant financial records, including sales invoices, expense receipts, bank statements, and payroll records. Accurate data collection is fundamental to a reliable P&L statement. Utilize accounting software to streamline data collection and ensure accuracy.

4. Input Revenue Data: Enter all revenue generated during the reporting period into the designated section of the template. Categorize revenue streams appropriately, separating sales, services, and other income sources. Ensure accuracy and completeness in revenue reporting.

5. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods or services sold. Include raw materials, direct labor, and manufacturing overhead. For service-based businesses, calculate the cost of services provided. Accurate COGS calculation is essential for determining gross profit.

6. Input Operating Expenses: Enter all operating expenses incurred during the reporting period, including rent, salaries, marketing, and administrative costs. Categorize expenses appropriately for detailed analysis and cost management. Ensure all operating expenses are accurately recorded.

7. Calculate Key Metrics: Utilize the template’s formulas or manually calculate key metrics like gross profit (Revenue – COGS), operating income (Gross Profit – Operating Expenses), and net income (Total Revenue – Total Expenses). These metrics provide crucial insights into profitability and financial performance.

8. Review and Analyze: Carefully review the completed P&L statement for accuracy and completeness. Analyze key metrics and trends to identify areas for improvement, cost optimization, and revenue growth. Compare current performance against previous periods and industry benchmarks. Regular review and analysis of P&L statements are essential for informed financial management.

By following these steps and utilizing a structured template, businesses can create accurate and insightful P&L statements. Regularly generating and analyzing P&L statements provides valuable data for informed decision-making, strategic planning, and sustainable growth. Accurate financial reporting enables businesses to effectively monitor performance, manage costs, and optimize profitability.

Effective financial management hinges on accurate and insightful reporting. Standardized profit and loss statement templates provide a crucial framework for small businesses to organize financial data, calculate key performance indicators, and gain a clear understanding of profitability. From revenue streams and cost of goods sold to operating expenses and net income, these templates offer a structured approach to tracking financial activity over specific periods. Leveraging these tools allows businesses to identify trends, pinpoint areas for improvement, and make informed decisions that drive sustainable growth. Consistent use of these templates promotes financial transparency and facilitates informed financial management.

Regularly generating and analyzing profit and loss statements, utilizing a consistent template, empowers small businesses to navigate the complexities of financial management. This practice fosters financial awareness, enabling proactive adjustments to strategies, optimized resource allocation, and ultimately, long-term financial health. The insights gleaned from these statements provide a foundation for sound decision-making, contributing to a business’s sustained success and resilience in the face of evolving market dynamics. Embracing these tools is not merely a bookkeeping exercise; it’s a strategic imperative for any small business committed to long-term viability and growth.