Utilizing such a structure offers several advantages. It simplifies the process of compiling financial data, reduces the likelihood of errors, and promotes comparability across different periods or entities. This readily accessible format allows for efficient identification of areas for improvement and informed decision-making.

This foundational understanding of structured financial reporting serves as a basis for exploring more nuanced aspects of financial analysis, including key performance indicators, budgeting, and forecasting.

1. Revenue

Revenue, the top line of a profit and loss statement, represents the total income generated from a company’s primary business activities. Within a simplified template, revenue serves as the starting point for calculating profitability. Accurate revenue recognition is critical for a reliable financial statement. For example, a software company selling subscriptions recognizes revenue over the subscription period, not as a lump sum at the time of sale. This principle ensures the financial statement reflects performance accurately over time. The relationship between revenue and the rest of the statement is fundamental; all subsequent calculations and analyses depend on this initial figure. Understanding revenue streams and their impact on the overall financial picture is crucial for strategic decision-making.

Different revenue models impact how revenue is reported. A retail business recognizes revenue upon the sale of goods, while a service-based business might recognize revenue as services are rendered. These distinctions influence the timing and nature of revenue entries on the statement. Furthermore, factors such as sales returns, discounts, and allowances can affect the final revenue figure. Analyzing revenue trends, including growth rates and comparisons to previous periods or industry benchmarks, offers valuable insights into business performance and market dynamics.

Effective revenue management directly impacts profitability. Strategies to increase revenue, such as expanding market share or introducing new product lines, must be balanced against cost considerations. Revenue analysis within the context of a profit and loss statement allows for assessment of the effectiveness of these strategies. Accurate revenue reporting within a simplified template provides a clear foundation for evaluating financial health and making informed decisions regarding future operations and growth.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a simplified profit and loss statement template, COGS is a crucial element for determining gross profit and understanding the relationship between production costs and revenue. Accurate COGS calculations are essential for assessing profitability and making informed business decisions.

- Direct MaterialsDirect materials encompass the raw materials used in production. For a furniture manufacturer, this includes wood, fabric, and metal. Accurately tracking direct material costs is essential for calculating COGS and managing inventory efficiently. Within a simplified template, direct materials contribute significantly to the overall COGS figure, impacting gross profit margins directly.

- Direct LaborDirect labor represents the wages and benefits paid to employees directly involved in the production process. Assembly line workers, machine operators, and quality control personnel in a manufacturing plant are examples of direct labor. This cost component is directly tied to production output and impacts the COGS calculation within a simplified statement. Fluctuations in labor costs can significantly affect profitability.

- Manufacturing OverheadManufacturing overhead includes all other costs directly related to the production process but not classified as direct materials or labor. Examples include factory rent, utilities, and depreciation of manufacturing equipment. These indirect costs are allocated to the production process and incorporated into COGS. Accurate allocation of overhead is essential for precise COGS calculations within a simplified profit and loss statement.

- Inventory ValuationInventory valuation methods, such as FIFO (First-In, First-Out) and LIFO (Last-In, First-Out), impact how COGS is calculated. Different valuation methods can lead to different COGS figures and subsequent impacts on reported profitability within a simplified template. Choosing an appropriate valuation method requires careful consideration of industry practices and the specific characteristics of the business. This choice can significantly influence the interpretation of financial performance within the simplified statement.

Understanding these facets of COGS is essential for interpreting a simplified profit and loss statement. Accurate COGS data provides valuable insights into operational efficiency and product pricing strategies. By analyzing COGS in relation to revenue, businesses can make informed decisions regarding production processes, cost control measures, and pricing adjustments to optimize profitability. Effective COGS management is directly linked to a company’s financial health and long-term sustainability.

3. Gross Profit

Gross profit, a key metric within a simplified profit and loss statement, represents the profitability of a company’s core business operations after accounting for the direct costs associated with producing goods or services. Calculated as revenue minus the cost of goods sold (COGS), gross profit provides insights into the efficiency of production and pricing strategies. Analyzing gross profit trends is crucial for assessing financial health and making informed business decisions.

- Relationship to Revenue and COGSGross profit directly reflects the relationship between revenue generated and the cost of goods sold. A higher gross profit indicates efficient production and effective pricing. Conversely, a low gross profit may signal issues with cost control, pricing pressures, or inefficient production processes. Within a simplified profit and loss template, gross profit provides a clear picture of the profitability of core operations.

- Indicator of Pricing Strategy EffectivenessGross profit serves as a key indicator of the effectiveness of pricing strategies. A high gross profit margin suggests successful premium pricing strategies or efficient cost management. Conversely, a low margin might necessitate price adjustments or cost reduction initiatives to improve profitability. Analyzing gross profit within a simplified statement allows businesses to evaluate pricing strategies and make necessary adjustments.

- Impact on Overall ProfitabilityGross profit directly impacts a company’s overall profitability. A healthy gross profit provides a strong foundation for covering operating expenses and generating net income. Monitoring gross profit trends within a simplified profit and loss statement allows businesses to assess their ability to manage costs and generate profits from core operations. This understanding is critical for long-term financial sustainability.

- Benchmarking and Industry ComparisonsComparing gross profit margins to industry benchmarks provides valuable insights into a company’s competitive position. A higher gross profit margin compared to competitors suggests a stronger cost structure or more effective pricing strategies. Conversely, a lower margin may indicate areas for improvement. Analyzing gross profit within a simplified template facilitates industry comparisons and informs strategic decision-making.

Understanding gross profit within the context of a simplified profit and loss statement provides crucial insights into a company’s financial performance. By analyzing gross profit trends, businesses can identify areas for improvement in production efficiency, pricing strategies, and cost management. This analysis is essential for optimizing profitability and achieving sustainable growth. The gross profit figure provides a crucial link between revenue generation and the eventual net income reported on the simplified statement, offering a valuable perspective on the overall financial health of the organization.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services. Within a simplified profit and loss statement template, operating expenses are crucial for determining operating income and assessing overall profitability. Careful management and analysis of operating expenses are essential for long-term financial sustainability.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a wide range of costs related to sales, marketing, administrative functions, and general overhead. Examples include salaries of sales and marketing personnel, advertising costs, rent for office space, and utilities. These expenses are essential for running the business but do not directly contribute to the production of goods or services. Within a simplified profit and loss statement, SG&A expenses significantly impact operating income. Analyzing SG&A trends helps businesses identify areas for cost optimization and efficiency improvements.

- Research and Development (R&D) ExpensesR&D expenses represent investments in developing new products, services, or processes. These costs can include salaries of research personnel, laboratory equipment, and testing materials. While R&D is crucial for innovation and long-term growth, it can represent a significant operating expense. Within a simplified profit and loss statement, R&D expenses are carefully considered, balancing investment in future growth with current profitability. Analyzing R&D spending trends allows businesses to evaluate the effectiveness of innovation efforts.

- Depreciation and AmortizationDepreciation represents the allocation of the cost of tangible assets, such as buildings and equipment, over their useful lives. Amortization represents the allocation of the cost of intangible assets, such as patents and trademarks. These non-cash expenses reflect the gradual decline in value of these assets over time. Within a simplified profit and loss statement, depreciation and amortization are factored into operating expenses, impacting overall profitability calculations. Understanding these expenses is crucial for accurate financial reporting.

- Other Operating ExpensesThis category encompasses various other expenses incurred in running the business that do not fit into the other categories. Examples include insurance premiums, legal fees, and repairs and maintenance. While often smaller than other operating expense categories, these costs can still impact overall profitability. Within a simplified profit and loss statement, these expenses are tracked and analyzed to identify areas for potential cost savings. Careful monitoring of these expenses contributes to effective cost management.

Understanding operating expenses is crucial for interpreting a simplified profit and loss statement. Analyzing operating expenses in relation to revenue reveals critical insights into cost structure and operational efficiency. By carefully managing and analyzing operating expenses, businesses can optimize profitability and ensure long-term financial health. The breakdown of operating expenses within a simplified template provides valuable context for assessing the overall financial performance of the organization and identifying areas for potential improvement and cost control.

5. Operating Income

Operating income, a key performance indicator within a simplified profit and loss statement, reveals the profitability of a company’s core business operations after deducting both the direct costs of goods sold (COGS) and operating expenses. This metric provides a clear picture of a company’s earning power from its primary business activities, excluding ancillary income or expenses such as investments or interest payments. Understanding operating income is essential for evaluating operational efficiency and assessing the overall financial health of an organization.

- Relationship to Gross Profit and Operating ExpensesOperating income represents the residual profit after subtracting operating expenses from gross profit. This relationship highlights the impact of operating costs on overall profitability. High operating expenses can significantly reduce operating income even if gross profit is strong, underscoring the importance of cost control measures. For example, a retail company with a high gross profit margin may still report low operating income due to substantial marketing and administrative expenses.

- Indicator of Core Business PerformanceOperating income isolates the profitability of a company’s core operations, excluding extraneous factors such as interest income or one-time gains. This focus allows for a more accurate assessment of the ongoing health and sustainability of the business. For example, a manufacturing company can assess the effectiveness of its production and sales strategies by analyzing trends in operating income over time, independent of fluctuations in investment income.

- Impact on Investment DecisionsOperating income is a key metric used by investors to assess the profitability and growth potential of a company. Consistent and growing operating income indicates a strong and sustainable business model, making the company more attractive to potential investors. Conversely, declining operating income may signal operational challenges and deter investment.

- Use in Financial Ratio AnalysisOperating income plays a crucial role in various financial ratios, such as operating margin and return on assets, which provide deeper insights into profitability and efficiency. These ratios enable comparisons across different periods and against industry benchmarks, offering a more comprehensive understanding of financial performance. A high operating margin, calculated by dividing operating income by revenue, indicates strong operational efficiency and profitability.

Within a simplified profit and loss statement template, operating income serves as a central performance metric, reflecting the effectiveness of core business operations. Analyzing operating income trends, in conjunction with other key figures within the statement, allows for informed decision-making regarding pricing strategies, cost management, and investment allocation. This analysis offers a clear understanding of the factors driving profitability and informs strategies for sustainable growth and financial success.

6. Net Income/Loss

Net income/loss, the bottom line of a profit and loss statement, represents the ultimate measure of a company’s profitability after all revenues and expenses have been accounted for. Within a simplified profit and loss statement template, this figure encapsulates the overall financial outcome of a given period. Understanding net income/loss is crucial for assessing financial performance and making informed business decisions.

- Relationship to All Revenue and Expense CategoriesNet income/loss is derived by subtracting all expenses, including cost of goods sold, operating expenses, interest expense, and taxes, from total revenues. This comprehensive calculation reflects the cumulative impact of all financial activities during the reporting period. For instance, a company with high revenue may still report a net loss if expenses exceed revenue. This interconnectedness underscores the importance of managing both revenue generation and cost control.

- Indicator of Overall Financial PerformanceNet income/loss serves as the definitive indicator of a company’s overall financial performance. A positive net income signifies profitability, while a net loss indicates that expenses exceeded revenues. This bottom-line figure provides a concise summary of financial outcomes, allowing stakeholders to quickly assess the company’s financial health. Consistent profitability, reflected in positive net income figures, is essential for long-term sustainability and growth.

- Impact on Stakeholder DecisionsNet income/loss significantly influences decisions made by various stakeholders. Investors use net income figures to evaluate investment potential, lenders consider profitability when assessing creditworthiness, and management relies on this metric to make strategic decisions regarding future operations and resource allocation. For example, consistent net losses may lead to difficulty securing financing or attracting investors.

- Use in Financial Ratio AnalysisNet income/loss is a key component in several crucial financial ratios, including profit margin, return on equity, and earnings per share. These ratios provide deeper insights into profitability, efficiency, and investor returns. Analyzing these ratios, using net income/loss as a foundational element, allows for comparisons across different periods, against competitors, and against industry benchmarks, providing a more comprehensive understanding of financial performance.

Within a simplified profit and loss statement template, net income/loss serves as the culminating figure, summarizing the overall financial outcome of a period. Understanding the components contributing to this final result, and its implications for various stakeholders, is essential for effective financial analysis and informed decision-making. Analyzing net income/loss trends over time provides crucial insights into a company’s financial health, sustainability, and potential for future growth.

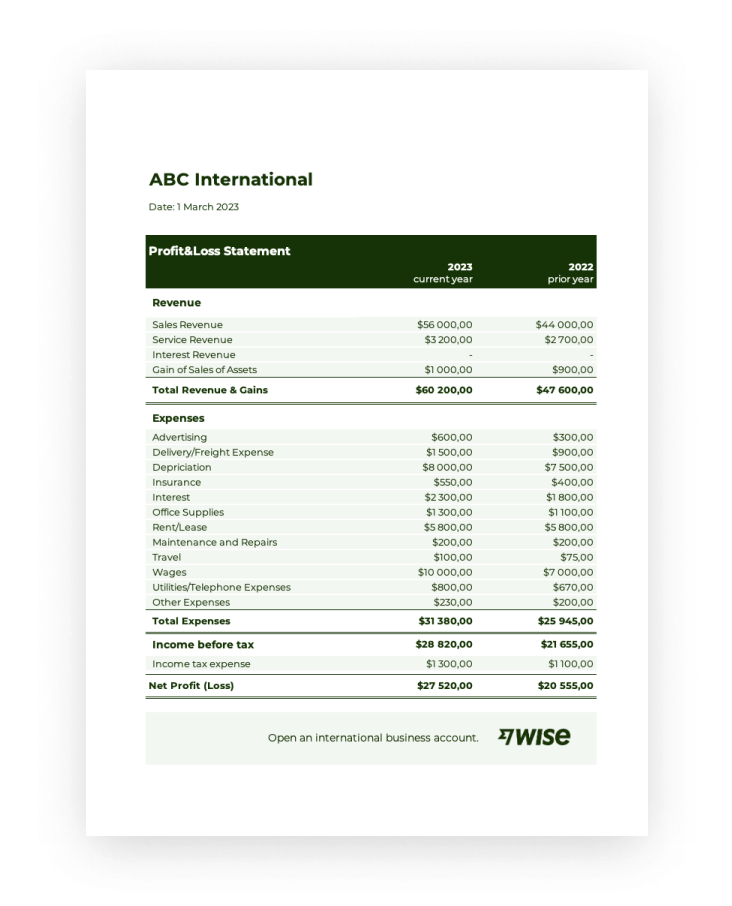

Key Components of a Simplified Profit and Loss Statement

A simplified profit and loss statement provides a concise overview of financial performance. Understanding its key components is fundamental for assessing profitability and making informed business decisions.

1. Revenue: This represents income generated from primary business activities, forming the foundation for profitability calculations. Accurate revenue recognition is critical for a reliable financial statement. For subscription-based services, revenue is recognized over the subscription period, reflecting performance accurately across time.

2. Cost of Goods Sold (COGS): COGS encompasses direct costs tied to production, including raw materials, direct labor, and manufacturing overhead. These costs are subtracted from revenue to determine gross profit. Accurate COGS calculations are essential for understanding profit margins.

3. Gross Profit: Calculated as revenue minus COGS, gross profit indicates profitability after accounting for direct production costs. This metric reveals the efficiency of production and pricing strategies.

4. Operating Expenses: These costs pertain to running the business and include selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, and amortization. Operating expenses are subtracted from gross profit to determine operating income.

5. Operating Income: This figure reflects profitability from core business operations after deducting both COGS and operating expenses. Operating income isolates the earning power of the primary business activities.

6. Interest Expense: This represents the cost of borrowing money. It’s deducted from operating income to arrive at pre-tax income.

7. Income Tax Expense: This accounts for taxes owed on earnings. It’s subtracted from pre-tax income to determine net income.

8. Net Income/Loss: This bottom-line figure represents the ultimate measure of profitability after accounting for all revenues and expenses. Net income signifies profit, while a net loss indicates expenses exceeded revenues. This crucial metric informs stakeholder decisions and facilitates financial ratio analysis, offering insights into a company’s overall financial health and sustainability.

These interconnected components provide a structured view of financial performance, enabling informed assessments of profitability, operational efficiency, and financial health. Analyzing trends within these components offers valuable insights for strategic decision-making and long-term growth.

How to Create a Simplified Profit and Loss Statement

Creating a simplified profit and loss statement involves organizing key financial data to present a clear picture of profitability. The following steps outline the process:

1. Choose a Reporting Period: Specify the timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods allow for accurate trend analysis.

2. Calculate Revenue: Determine total revenue generated from sales of goods or services during the chosen period. Ensure accurate revenue recognition based on established accounting principles.

3. Determine Cost of Goods Sold (COGS): Calculate direct costs associated with production or service delivery, including raw materials, direct labor, and manufacturing overhead. This figure is crucial for calculating gross profit.

4. Calculate Gross Profit: Subtract COGS from revenue to arrive at gross profit. This metric reflects profitability after accounting for direct costs.

5. Itemize Operating Expenses: List all operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), depreciation, and amortization. Categorizing expenses allows for detailed analysis and cost control.

6. Calculate Operating Income: Subtract total operating expenses from gross profit to determine operating income. This metric reveals profitability from core business operations.

7. Account for Interest and Taxes: Subtract interest expense and income tax expense from operating income to arrive at pre-tax income and ultimately, net income.

8. Determine Net Income/Loss: This final figure represents the overall profit or loss for the reporting period after all revenues and expenses have been considered.

Organizing financial data in this structured format provides a clear and concise overview of profitability, enabling informed assessments of financial performance and strategic decision-making.

A concise, readily accessible format for organizing financial data, like a profit and loss statement simple template, provides crucial insights into an organization’s financial performance. Understanding the core components revenue, cost of goods sold, gross profit, operating expenses, and net income/loss allows stakeholders to assess profitability, efficiency, and overall financial health. The structured nature of such a template facilitates consistent reporting, trend analysis, and informed decision-making regarding pricing strategies, cost management, and resource allocation.

Leveraging a clear and simplified approach to financial reporting empowers organizations to identify areas for improvement, optimize operations, and achieve sustainable growth. Regular review and analysis of these statements, coupled with comparisons to industry benchmarks and past performance, provides a critical foundation for navigating the financial landscape and achieving long-term success. This proactive approach to financial management is essential for informed strategic planning and ensuring the ongoing financial health of any organization.