Utilizing a pre-designed structure for this crucial financial report offers numerous advantages. It ensures consistency in reporting, simplifies the process of data entry, and reduces the risk of errors. Furthermore, a standardized format facilitates comparisons across different periods, making it easier to track progress and identify trends. Access to such resources empowers small business owners to monitor performance effectively and strategically manage their finances.

This article will further explore the key components of these reports, offer guidance on their creation and interpretation, and discuss how they can be leveraged for business growth and financial success.

1. Revenue Streams

Accurate representation of revenue streams within a profit and loss statement is foundational for understanding a business’s financial performance. A clear breakdown of income sources allows for targeted analysis and informed decision-making. This section explores the various facets of revenue streams and their implications within the context of a profit and loss statement.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, this would be the revenue from selling products. For a consulting firm, it would be the fees earned for providing services. Accurately recording sales revenue is crucial as it forms the basis for calculating gross profit and ultimately, net profit.

- Other RevenueThis category encompasses income derived from sources outside of core business operations. Examples include interest earned on investments, income from rental properties, or royalties from intellectual property. While often smaller than sales revenue, these sources can contribute significantly to overall profitability and should be tracked meticulously.

- Revenue RecognitionThe timing of revenue recognition impacts the accuracy of a profit and loss statement. Revenue should be recognized when it is earned, not necessarily when cash is received. For example, if a company provides a service in December but receives payment in January, the revenue should be recorded in December. Understanding revenue recognition principles ensures accurate financial reporting.

- Revenue SegmentationCategorizing revenue streams by product line, customer segment, or geographic region provides valuable insights into business performance. This allows for analysis of which areas are most profitable and which may require attention. For example, a business might discover that one product line generates a significantly higher profit margin than others, informing future product development and marketing strategies.

By carefully detailing and analyzing each revenue stream, businesses gain a comprehensive understanding of their financial health. This granular approach, reflected in the profit and loss statement, enables informed decisions regarding pricing strategies, cost management, and overall business strategy.

2. Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Accurate calculation of COGS is crucial for determining gross profit and ultimately, net profit on the profit and loss statement. Understanding its various components provides valuable insights into a company’s profitability and operational efficiency.

- Direct MaterialsThis includes the raw materials and components used in the production process. For a furniture maker, this would be the cost of wood, fabric, and hardware. Tracking direct material costs is essential for accurate COGS calculation and pricing decisions.

- Direct LaborThis encompasses the wages and benefits paid to employees directly involved in producing goods. For a manufacturer, this would include the salaries of assembly line workers. Understanding direct labor costs helps businesses assess production efficiency and labor costs.

- Manufacturing OverheadThis category includes all other costs directly associated with the production process, excluding direct materials and labor. Examples include factory rent, utilities, and depreciation of manufacturing equipment. Accurately allocating manufacturing overhead is important for determining the true cost of production.

- Inventory ValuationThe method used to value inventory (e.g., FIFO, LIFO, weighted average) directly impacts COGS. Different valuation methods can result in different COGS values, affecting gross profit and net profit. Consistency in inventory valuation is crucial for comparability across reporting periods.

Accurate COGS calculation within a profit and loss statement is critical for assessing profitability. By understanding the components of COGS and their relationship to revenue, businesses can make informed decisions regarding pricing, production efficiency, and inventory management. This analysis provides crucial insights for long-term financial planning and sustainable growth.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day operations, excluding the direct costs of producing goods or services (COGS). These expenses are critical components of the profit and loss statement, directly impacting a company’s profitability. A detailed understanding of operating expenses is essential for effective financial management and informed decision-making.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a wide range of costs related to sales, marketing, and administration. Examples include salaries of sales and marketing personnel, advertising costs, rent for office space, and office supplies. Managing SG&A expenses effectively is crucial for maintaining profitability without compromising essential business functions.

- Research and Development (R&D)R&D expenses represent investments in developing new products, services, or processes. These costs can be significant for companies in innovative industries. While R&D contributes to future growth potential, careful management of these expenses is necessary to balance investment with profitability.

- Depreciation and AmortizationDepreciation reflects the allocation of the cost of tangible assets (e.g., buildings, equipment) over their useful life. Amortization represents the allocation of the cost of intangible assets (e.g., patents, copyrights) over their useful life. These non-cash expenses are important considerations in assessing a company’s true profitability.

- Other Operating ExpensesThis category includes various other expenses not directly related to sales, marketing, administration, R&D, or depreciation/amortization. Examples include legal fees, insurance premiums, and repairs and maintenance. Careful tracking of these miscellaneous expenses is essential for accurate financial reporting.

Accurate representation of operating expenses within a profit and loss statement provides a clear picture of a company’s cost structure and its impact on profitability. Analyzing trends in operating expenses allows businesses to identify areas for potential cost reduction, improve operational efficiency, and ultimately enhance profitability. This detailed understanding is fundamental for sound financial planning and sustainable business growth. Furthermore, comparing operating expenses to revenue can reveal key performance indicators, allowing for data-driven adjustments to business strategy.

4. Gross Profit Margin

Gross profit margin represents the profitability of a business after deducting the direct costs associated with producing goods or services (COGS) from revenue. It is a key metric within a profit and loss statement, providing insights into a company’s pricing strategies, production efficiency, and overall financial health. Calculated as (Revenue – COGS) / Revenue, this percentage reveals the proportion of revenue remaining after covering direct production costs. A higher gross profit margin indicates greater efficiency in managing production costs relative to revenue generation.

Within the context of a profit and loss statement template for a small business, gross profit margin plays a crucial role in assessing financial performance. For example, a bakery selling cakes for $30 each with a COGS of $10 per cake has a gross profit margin of 66.7% (($30 – $10) / $30). This indicates that for every dollar of revenue generated, 66.7 cents remain after covering the direct costs of baking the cakes. This remaining amount contributes to covering operating expenses and ultimately, generating net profit. Analyzing gross profit margin trends over time allows businesses to identify potential issues with rising production costs, declining sales prices, or inefficiencies in the production process. A declining gross profit margin can signal the need for adjustments in pricing strategies, cost control measures, or operational improvements.

Understanding gross profit margin is fundamental for informed decision-making within a small business. Consistently monitoring and analyzing this metric within the profit and loss statement enables businesses to optimize pricing strategies, manage production costs effectively, and improve overall profitability. It serves as a crucial indicator of financial health and provides valuable insights for sustainable growth and long-term financial planning. Furthermore, comparing a company’s gross profit margin to industry benchmarks can offer insights into competitive positioning and areas for potential improvement.

5. Net Profit/Loss

Net profit/loss, often referred to as the “bottom line,” represents the ultimate measure of a business’s profitability over a specific period. Within the context of a profit and loss statement template for a small business, net profit/loss is the final calculation, reflecting the financial outcome after all revenues and expenses have been accounted for. It is derived by subtracting total expenses (including COGS and operating expenses) from total revenues. A positive net profit indicates that the business generated more revenue than it incurred in expenses, while a negative net profit (a net loss) signifies that expenses exceeded revenue.

This figure is a crucial component of the profit and loss statement as it provides a concise summary of a company’s financial performance. For instance, a small retail business generating $100,000 in revenue with total expenses of $80,000 will report a net profit of $20,000. Conversely, if expenses increase to $110,000 while revenue remains constant, the business will report a net loss of $10,000. Understanding the factors contributing to net profit/loss, such as sales volume, pricing strategies, and cost management, is essential for making informed business decisions. Analyzing trends in net profit/loss over multiple reporting periods allows businesses to assess growth trajectory, identify potential financial challenges, and make proactive adjustments to strategy.

Accurate calculation and interpretation of net profit/loss within the profit and loss statement template are fundamental for small business success. This figure provides a critical benchmark for evaluating financial health, informing investment decisions, and securing financing. Consistent monitoring of net profit/loss allows businesses to track progress towards financial goals, identify areas for improvement, and make data-driven decisions to ensure long-term sustainability and growth. Furthermore, understanding the relationship between net profit/loss and other key metrics within the statement, such as gross profit margin and operating expenses, provides a comprehensive view of financial performance and facilitates strategic planning.

6. Financial Period

The financial period defines the timeframe covered by a profit and loss statement. This specified period, whether a month, quarter, or year, provides the boundaries for reporting financial performance. Accuracy and consistency in defining the financial period are crucial for meaningful analysis and comparison. A profit and loss statement for a specific quarter, for example, should only include revenues and expenses incurred during that three-month period. Attempting to compare statements with inconsistent or overlapping financial periods renders the analysis meaningless. Understanding the financial period is fundamental for interpreting the data presented within the statement accurately.

Selecting an appropriate financial period depends on the specific needs of the business. A shorter financial period, such as a month, provides more frequent insights into performance, allowing for quicker identification of trends and potential issues. This can be particularly beneficial for businesses in rapidly changing markets or those experiencing periods of rapid growth or decline. Conversely, longer financial periods, such as a year, offer a broader overview of performance and can be more useful for long-term strategic planning. Publicly traded companies, for example, are typically required to report annual financial statements. The choice of financial period influences the scope of the data and the insights derived from the profit and loss statement, directly impacting decision-making processes.

Consistent application of the chosen financial period is critical for tracking performance trends and making meaningful comparisons. Analyzing profit and loss statements over multiple, consistent financial periods enables businesses to identify patterns, assess growth trajectory, and make informed projections. This consistency is crucial for both internal management and external reporting. For example, comparing quarterly profit and loss statements over several years allows for the identification of seasonal trends in revenue or expenses. This understanding can inform budgeting, staffing decisions, and other operational strategies. In conclusion, the financial period provides the essential context for interpreting the data within a profit and loss statement. Accurate definition and consistent application of the financial period are foundational for sound financial analysis and effective business management.

Key Components of a Profit and Loss Statement for Small Businesses

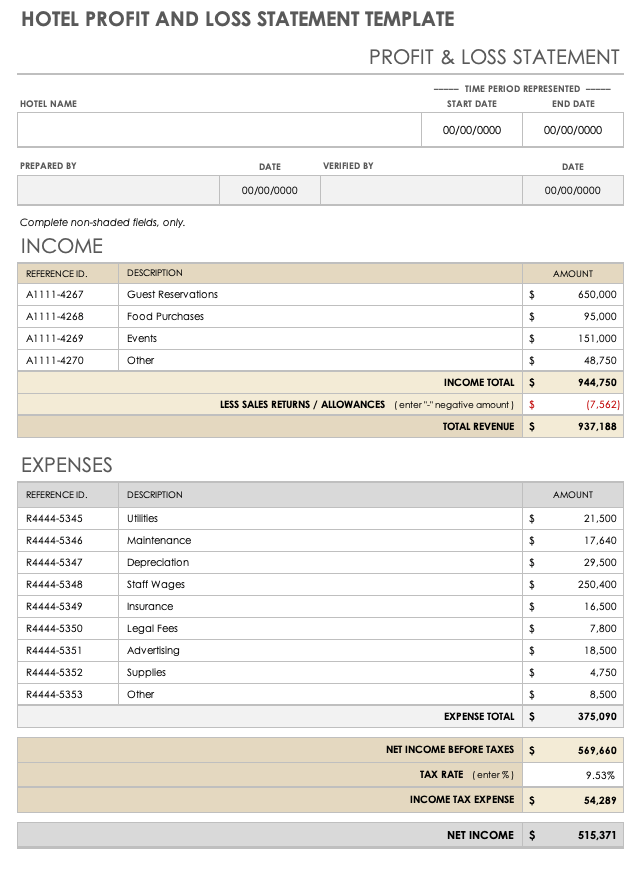

A profit and loss statement, also known as an income statement, provides a snapshot of a company’s financial performance over a specific period. Understanding its key components is crucial for effective financial management and informed decision-making.

1. Revenue: This represents income generated from a company’s primary business activities. It typically includes sales of goods or services. Accurate revenue reporting is fundamental for assessing overall financial performance.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Gross profit is calculated by subtracting COGS from revenue. This metric represents the profit generated after accounting for the direct costs of production. Analyzing gross profit helps assess pricing strategies and production efficiency.

4. Operating Expenses: These expenses represent the costs incurred in running a business’s day-to-day operations, excluding COGS. Examples include salaries, rent, marketing expenses, and administrative costs. Managing operating expenses is crucial for profitability.

5. Operating Income: Operating income is calculated by subtracting operating expenses from gross profit. This metric reflects the profit generated from core business operations before considering interest and taxes. It provides insights into operational efficiency.

6. Other Income/Expenses: This category includes income or expenses not directly related to core business operations, such as interest income, investment gains or losses, and one-time expenses. These items provide a more comprehensive picture of a company’s financial activities.

7. Net Profit/Loss: Often referred to as the “bottom line,” net profit/loss represents the final calculation after all revenues and expenses have been considered, including taxes and interest. It reflects the overall profitability or loss for the given period.

Accurate reporting and analysis of these components provide valuable insights into a business’s financial health, supporting informed decision-making, strategic planning, and sustainable growth. Regular review allows for proactive adjustments to operational strategies, pricing models, and cost management, contributing to long-term financial success.

How to Create a Profit and Loss Statement

Creating a profit and loss statement involves systematically organizing financial data to present a clear picture of a company’s performance over a defined period. This structured approach ensures accuracy and facilitates informed financial analysis.

1. Define the Reporting Period: Specify the precise timeframe for the statement, whether a month, quarter, or year. Consistency in reporting periods is crucial for accurate comparison and trend analysis.

2. Calculate Revenue: Accurately record all income generated from sales of goods or services during the reporting period. Ensure consistent revenue recognition principles are applied.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from revenue to determine the gross profit. This metric reflects the profitability of sales before operating expenses are considered.

5. Itemize Operating Expenses: Categorize and record all operating expenses, including salaries, rent, marketing, and administrative costs. Detailed tracking allows for better cost management and analysis.

6. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. This represents profitability from core business operations.

7. Account for Other Income/Expenses: Include any non-operational income or expenses, such as interest income or investment gains/losses, to arrive at a more comprehensive picture of financial performance.

8. Calculate Net Profit/Loss: Subtract all expenses, including taxes and interest, from total revenue to determine the net profit or loss. This “bottom line” figure provides a concise summary of overall profitability for the reporting period.

Following these steps provides a structured approach to creating a profit and loss statement, allowing for accurate assessment of financial performance and informed business decisions.

Effective financial management is crucial for the success of any small business. Profit and loss statement templates provide a structured framework for understanding financial performance by systematically tracking revenue, costs, and expenses. Utilizing these templates allows business owners to monitor profitability, identify areas for improvement, and make informed decisions about pricing, cost control, and resource allocation. Accurate and consistent reporting through these statements provides critical insights into a company’s financial health, supporting strategic planning and long-term growth.

Regularly generating and analyzing these statements empowers small businesses to navigate the complexities of the financial landscape. This practice fosters financial awareness, enabling proactive adjustments to business strategies and ensuring long-term sustainability. The insights derived from these reports contribute to a deeper understanding of the financial drivers of success, ultimately leading to informed decisions that promote growth and resilience in the face of economic challenges. Mastering the use of these templates is not merely a bookkeeping exercise but a strategic imperative for achieving financial stability and long-term prosperity.