Utilizing such a structured document offers numerous advantages. It simplifies financial record-keeping, enables automated calculations, and allows for easy generation of reports. This accessibility to organized data empowers informed decision-making, efficient financial management, and better strategic planning for future growth and stability. These tools can be adapted to suit businesses of varying sizes and complexities.

Understanding the components and application of this financial tool is vital for business success. The following sections will delve deeper into specific aspects, including practical examples and best practices for its effective implementation. Further discussion will explore how this tool integrates with other financial documents and contributes to a comprehensive financial overview.

1. Revenue

Accurate revenue reporting is fundamental to a reliable profit and loss statement. Within a structured template, revenue data provides the basis for assessing financial performance and profitability. Understanding its various facets is crucial for accurate reporting and informed decision-making.

- Operating RevenueThis represents income generated from a company’s core business operations. For a retail business, this would be sales of goods; for a service-based company, it would be fees earned from providing services. Accurate recording of operating revenue is essential for determining gross profit and overall profitability. Within a spreadsheet template, this data typically resides in dedicated rows, often categorized by product or service.

- Non-Operating RevenueThis encompasses income derived from sources outside a company’s primary business activities. Examples include interest earned on investments, income from asset sales, or royalties. While not central to core operations, non-operating revenue contributes to overall profitability and should be accurately tracked within the template, typically in separate rows below operating revenue.

- Revenue RecognitionThis principle dictates when revenue is recorded. Generally accepted accounting principles (GAAP) provide guidance on revenue recognition timing, often when a product is delivered or a service is rendered. Proper application of revenue recognition principles ensures financial statement accuracy and compliance. A well-designed template facilitates adherence to these principles through designated fields and formulas.

- Revenue AnalysisBeyond simple recording, analyzing revenue trends is crucial for strategic decision-making. A spreadsheet template allows for calculating key metrics such as revenue growth, average revenue per user, and revenue by product or service. These insights inform pricing strategies, product development, and overall business strategy. Visualizations like charts can be easily generated within the spreadsheet to further aid analysis.

Comprehensive revenue tracking and analysis within a structured template are critical for understanding a company’s financial health. By meticulously documenting and analyzing both operating and non-operating revenue, businesses gain valuable insights into performance drivers and can make informed decisions to enhance profitability and long-term sustainability. This detailed breakdown, facilitated by the template, ultimately feeds into the broader financial narrative presented by the profit and loss statement.

2. Expenses

Accurate expense tracking is crucial for a comprehensive understanding of profitability. A profit and loss statement spreadsheet template provides a structured framework for categorizing and analyzing expenses, enabling businesses to identify cost drivers and optimize financial performance. The relationship between expenses and the template is integral to generating a meaningful profit and loss statement. Accurately categorized and quantified expenses, inputted into the template, directly impact the calculated profit or loss. For example, a manufacturing company using a template can categorize expenses into direct costs, like raw materials, and indirect costs, like rent. This categorization enables calculation of gross profit and operating income, offering insights into cost management effectiveness.

Various expense types require careful consideration within the template. Cost of goods sold (COGS) represents the direct costs associated with producing goods sold by a company. Operating expenses encompass costs incurred through normal business operations, such as salaries, rent, and marketing. Non-operating expenses include costs unrelated to core business activities, such as interest expense or losses from asset sales. Accurately classifying and recording these expenses within the template is critical for calculating net profit or loss and for conducting meaningful financial analysis. For example, a retail business can analyze its operating expenses within the template to identify areas for cost reduction, such as negotiating lower rent or optimizing staffing levels.

Effective expense management, facilitated by a detailed profit and loss statement template, offers significant advantages. By diligently tracking and categorizing expenses, businesses gain valuable insights into cost structures, enabling informed decisions about pricing, resource allocation, and overall financial strategy. Furthermore, accurate expense data is crucial for tax reporting, financial projections, and attracting potential investors. A robust understanding of expense management, within the context of a structured template, empowers businesses to optimize profitability and achieve long-term financial sustainability.

3. Profit/Loss Calculation

The core purpose of a profit and loss statement spreadsheet template is to facilitate the accurate and efficient calculation of net profit or loss. This calculation, derived from the relationship between revenues and expenses, provides a fundamental measure of a company’s financial performance over a specific period. Understanding the components of this calculation and how they interact within the template is crucial for informed financial decision-making.

- Gross ProfitCalculated as revenue less the cost of goods sold (COGS), gross profit represents the profitability of a company’s core products or services before considering operating expenses. Within the template, this calculation is typically automated using a formula that subtracts the COGS value from the revenue value. Analyzing gross profit margins helps assess pricing strategies and production efficiency. For a manufacturing company, a declining gross profit margin might signal increasing raw material costs or production inefficiencies, prompting investigation and corrective action.

- Operating IncomeDerived by subtracting operating expenses from gross profit, operating income reflects the profitability of a company’s core business operations. The template facilitates this calculation by automatically deducting categorized operating expenses from the calculated gross profit. Monitoring operating income trends helps evaluate the efficiency of core business functions. A retail business, for example, can track operating income to assess the effectiveness of marketing campaigns or store management practices.

- Net IncomeRepresenting the bottom line, net income is calculated by subtracting all expenses, including non-operating expenses and taxes, from total revenue. The template performs this final calculation, providing a comprehensive measure of profitability after all costs are considered. Net income is a key indicator of a company’s overall financial health and its ability to generate profit for investors. A growing net income trend often signals a healthy and sustainable business model.

- Profit MarginsVarious profit margins, such as gross profit margin, operating profit margin, and net profit margin, provide insights into profitability at different levels. These margins, calculated within the template by dividing profit figures by revenue, are expressed as percentages. Analyzing these margins helps understand the relationship between revenue, costs, and profitability. For example, a software company can use net profit margin to evaluate the effectiveness of its pricing model and cost control measures.

By automating these calculations, the profit and loss statement spreadsheet template provides a clear and concise overview of a company’s financial performance. This readily accessible data empowers stakeholders to make informed decisions regarding pricing, cost management, investment strategies, and overall business strategy. Regularly reviewing and analyzing the calculated figures within the template is essential for maintaining financial health and achieving long-term sustainability.

4. Time Period

The time period specified within a profit and loss statement spreadsheet template is crucial for accurate financial reporting and analysis. This defined timeframe, whether a month, quarter, or year, provides the necessary context for interpreting financial performance. Selecting an appropriate time period depends on the specific needs of the business and the nature of its operations. A retail business might analyze monthly statements to track sales trends and seasonality, while a long-term infrastructure project might utilize annual statements to assess overall progress and profitability. Choosing a consistent time period allows for meaningful comparisons and trend analysis over time. For example, comparing quarterly statements year-over-year can reveal growth patterns and identify potential areas for improvement.

The defined time period influences several key aspects of the profit and loss statement. Revenue recognition, expense accrual, and inventory valuation are all tied to the specified timeframe. A shorter time period, such as a month, provides a more granular view of financial performance but may not capture long-term trends. Conversely, a longer time period, such as a year, offers a broader perspective but may obscure short-term fluctuations. The choice of time period also impacts the comparability of financial data with industry benchmarks and competitors. For instance, analyzing quarterly performance against industry averages allows a business to assess its relative market position and identify areas for competitive advantage.

Understanding the relationship between the time period and the information presented within the profit and loss statement template is essential for sound financial management. Selecting an appropriate and consistent time period ensures accurate reporting, facilitates meaningful analysis, and enables informed decision-making. This understanding empowers businesses to track performance, identify trends, and make strategic adjustments to achieve financial objectives. Furthermore, a clearly defined time period enhances transparency and accountability, providing stakeholders with a consistent and reliable view of financial performance.

5. Data Organization

Effective data organization within a profit and loss statement spreadsheet template is paramount for accurate financial reporting, analysis, and informed decision-making. A well-structured template ensures data clarity, accessibility, and consistency, facilitating efficient financial management. Logical data organization enables stakeholders to quickly grasp key financial metrics and trends, supporting timely and effective responses to changing business conditions.

- Clear Chart of AccountsA well-defined chart of accounts provides a systematic framework for categorizing financial data. Each account represents a specific type of revenue, expense, asset, liability, or equity. A consistent and logical chart of accounts within the template ensures data uniformity and facilitates accurate reporting. For example, a retail business might categorize revenue by product line and expenses by department, enabling detailed analysis of profitability by segment. This structured approach allows for easy aggregation and analysis of financial data.

- Consistent FormattingConsistent formatting, including date formats, number formats, and cell formatting, enhances data readability and reduces errors. Standardized formatting within the template ensures data integrity and facilitates seamless data import and export. Using consistent date formats prevents chronological inconsistencies, while uniform number formats ensure accurate calculations and comparisons. For instance, consistently formatting currency values prevents misinterpretations and errors in financial calculations. Consistent cell formatting, such as using bold text for headers, improves readability and visual clarity.

- Logical Data FlowA logical flow of data within the template, from revenue entries to expense categorization and culminating in profit/loss calculation, ensures a clear and understandable presentation of financial information. A well-designed template guides users through the data entry process, minimizing errors and promoting efficient data analysis. Organizing data chronologically within the template, for example, facilitates trend analysis and performance comparisons over time. Clearly separating revenue and expense sections within the template enhances clarity and understanding of financial performance.

- Data ValidationImplementing data validation rules within the template helps prevent data entry errors and ensures data integrity. Validation rules can restrict data entry to specific formats or ranges, preventing inconsistencies and improving data quality. For example, setting a validation rule to accept only positive values for revenue entries prevents accidental input of negative numbers. Restricting data entry to specific date ranges ensures chronological consistency within the template. Data validation safeguards data accuracy and enhances the reliability of financial reports.

By adhering to these data organization principles within a profit and loss statement spreadsheet template, businesses can ensure data accuracy, facilitate insightful analysis, and enhance decision-making. A well-organized template provides a solid foundation for financial management, contributing to improved operational efficiency and long-term sustainability. This structured approach ultimately supports better financial planning, reporting, and control, benefiting all stakeholders.

Key Components of a Profit and Loss Statement Spreadsheet Template

A comprehensive profit and loss statement spreadsheet template facilitates effective financial analysis. Several key components contribute to its efficacy.

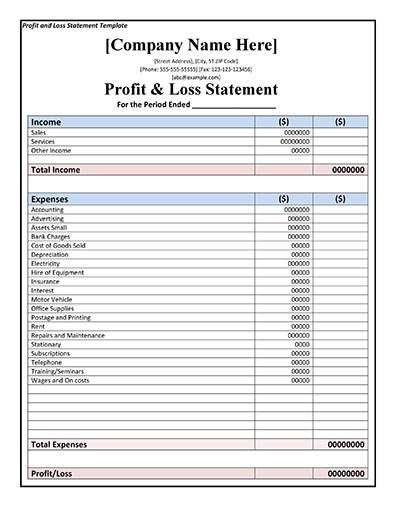

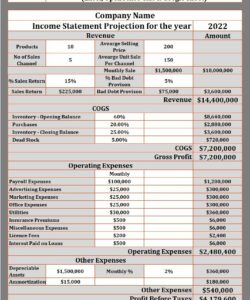

1. Revenue: Accurate revenue reporting is foundational. This section encompasses all income generated from sales, services, and other sources. Clear delineation of operating and non-operating revenue streams provides crucial insights into a company’s core business activities and additional income sources.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with production. Accurate COGS calculation is essential for determining gross profit and assessing pricing strategies.

3. Gross Profit: Calculated as revenue less COGS, gross profit reflects the profitability of a company’s core offerings before accounting for operating expenses. Analyzing gross profit margins helps evaluate pricing effectiveness and production efficiency.

4. Operating Expenses: This section encompasses all costs incurred through normal business operations, including salaries, rent, marketing, and administrative expenses. Detailed categorization of operating expenses provides insights into cost drivers and areas for potential optimization.

5. Operating Income: Calculated as gross profit less operating expenses, operating income reveals the profitability of a company’s core business operations. Monitoring operating income trends helps assess operational efficiency and overall business performance.

6. Other Income/Expenses: This section captures income and expenses not directly related to core business operations, such as interest income, investment gains/losses, and one-time expenses. Accurate reporting of these items provides a comprehensive view of a company’s financial performance beyond its core activities.

7. Net Income: Often referred to as the “bottom line,” net income represents the final profit or loss after all revenues and expenses are considered. This key metric reflects a company’s overall financial health and its ability to generate profit for stakeholders.

8. Time Period: The specified reporting period (e.g., monthly, quarterly, annually) provides essential context for the data presented. Consistent timeframes facilitate meaningful comparisons and trend analysis over time, allowing for informed decision-making.

A well-structured template, encompassing these components, allows for detailed analysis of financial performance, informing strategic decision-making and contributing to long-term sustainability.

How to Create a Profit and Loss Statement Spreadsheet Template

Creating a profit and loss statement spreadsheet template requires a structured approach to ensure accuracy and usability. The following steps outline the process:

1. Define the Reporting Period: Specify the timeframe for the statement (e.g., monthly, quarterly, annually). Consistent reporting periods facilitate comparison and trend analysis.

2. Establish a Chart of Accounts: Create a structured list of accounts to categorize revenues and expenses systematically. This ensures consistency and facilitates detailed analysis.

3. Design the Spreadsheet Layout: Organize the spreadsheet into clear sections for revenue, cost of goods sold (if applicable), gross profit, operating expenses, operating income, other income/expenses, and net income. Clear visual separation enhances readability.

4. Input Revenue Categories: List all revenue streams, differentiating between operating and non-operating revenue. Include separate rows for each revenue category to facilitate detailed tracking.

5. Input Cost of Goods Sold (COGS): If applicable, detail all direct costs associated with producing goods sold. Accurate COGS calculation is crucial for determining gross profit.

6. Input Operating Expense Categories: Categorize and list all operating expenses, such as salaries, rent, marketing, and administrative costs. Detailed categorization allows for insightful analysis of cost drivers.

7. Input Other Income/Expenses: Include any income or expenses not directly related to core business operations. This ensures a comprehensive view of financial performance.

8. Implement Formulas for Calculations: Automate calculations for gross profit, operating income, and net income using spreadsheet formulas. This minimizes errors and ensures accuracy.

9. Implement Data Validation: Use data validation features to restrict data entry to specific formats or ranges, reducing errors and ensuring data integrity.

10. Test and Refine: Thoroughly test the template with sample data to ensure accurate calculations and identify any necessary adjustments. Ongoing review and refinement enhance the template’s effectiveness over time.

A well-designed template provides a robust framework for tracking financial performance, facilitating informed decision-making, and contributing to long-term business success. Regular review and adaptation to evolving business needs ensure continued effectiveness.

Effective financial management hinges on accurate, accessible data. A profit and loss statement spreadsheet template provides a structured framework for organizing revenue and expenses, calculating key profitability metrics, and facilitating informed decision-making. Understanding its components, from revenue streams and cost of goods sold to operating expenses and net income, is crucial for interpreting financial performance. Furthermore, meticulous data organization, incorporating a clear chart of accounts, consistent formatting, and data validation, ensures data integrity and enhances the template’s usability. Through accurate data capture and automated calculations, the template empowers businesses to analyze trends, identify areas for improvement, and make strategic adjustments to optimize financial outcomes.

Leveraging a robust profit and loss statement spreadsheet template contributes significantly to financial transparency and control. Regular review and analysis of the data within the template enable proactive financial management and informed strategic planning. This structured approach empowers organizations to monitor performance against targets, adapt to changing market conditions, and pursue sustainable growth. Ultimately, a well-designed and consistently utilized template serves as an invaluable tool for achieving financial stability and long-term success.