Utilizing a pre-designed structure for this type of report offers several advantages. It ensures consistency in reporting, simplifies the process of data entry and analysis, and reduces the likelihood of errors. A standardized format also facilitates comparison with previous periods and industry benchmarks, enabling a deeper understanding of performance trends and areas for improvement. This readily available, structured approach saves valuable time and resources, allowing organizations to focus on interpreting the data and implementing strategic actions.

The following sections will delve deeper into the key components of such a report, explore best practices for its creation and utilization, and highlight the significance of regular financial analysis for sustained growth and profitability.

1. Standardized Structure

A standardized structure is fundamental to the efficacy of a year-to-date profit and loss statement template. Consistency in formatting, account categorization, and calculation methods ensures comparability across reporting periods, facilitating trend analysis and performance evaluation. Without a standardized framework, comparing financial data from different points within the same fiscal year, or across different years, becomes significantly more complex and prone to error. A standardized template predefines these elements, eliminating ambiguity and promoting accuracy in financial reporting. For example, consistently categorizing operating expenses allows for accurate tracking and analysis of these costs over time, enabling informed decisions regarding cost control and efficiency improvements.

Consider a business that experiences seasonal fluctuations in sales. A standardized year-to-date profit and loss template allows for direct comparison of performance across these periods, revealing the true impact of seasonality. Without this standardized approach, isolating the effects of seasonality from other factors influencing revenue and expenses becomes challenging. Further, standardized reporting simplifies audits and facilitates communication with stakeholders, providing a clear and consistent view of financial performance. This clarity fosters trust and enhances the understanding of the organization’s financial health.

In conclusion, a standardized structure forms the backbone of a reliable and informative year-to-date profit and loss statement template. This structure is not merely a matter of formatting preference but a crucial element that enables accurate performance analysis, informed decision-making, and effective communication with stakeholders. Challenges related to data inconsistency and reporting complexity are mitigated through the adoption of a standardized approach, leading to a more robust and insightful understanding of financial performance over time.

2. Current Performance Snapshot

A year-to-date profit and loss statement template provides a crucial snapshot of current performance, offering a concise overview of financial results from the beginning of the fiscal year to a specific date. This real-time insight contrasts with the traditional annual statement, delivering more frequent and relevant data for timely decision-making. Understanding current performance is paramount for effective financial management, enabling proactive adjustments and strategic planning.

- Revenue Trends:Tracking revenue on a year-to-date basis reveals emerging trends, allowing businesses to identify growth opportunities or address declining sales promptly. For instance, a retailer might observe a consistent increase in online sales compared to the previous year’s data, informing decisions regarding inventory management and marketing strategies. This up-to-the-minute view of revenue streams enables proactive adjustments to maximize profitability.

- Expense Management:Monitoring expenses year-to-date allows for ongoing cost control and identification of areas for potential savings. A manufacturing company, for example, might analyze year-to-date material costs and identify inefficiencies in the production process. This granular view of expenses facilitates informed decisions regarding resource allocation and cost optimization strategies.

- Profitability Analysis:Calculating profitability year-to-date offers a continuous assessment of financial health. A service-based business can track profit margins over time, identifying periods of peak performance and periods requiring adjustments to pricing or service delivery models. This continuous evaluation of profitability is critical for maintaining sustainable growth.

- Comparative Analysis:Comparing year-to-date performance with previous periods or industry benchmarks provides valuable context for evaluating success and identifying areas for improvement. A software company, for instance, might compare its year-to-date customer acquisition cost with the previous year’s figures to assess the effectiveness of its marketing campaigns. This comparative analysis allows for data-driven decision-making and continuous improvement.

These facets of a current performance snapshot, facilitated by a year-to-date profit and loss statement template, empower businesses to move beyond historical analysis and engage in proactive financial management. By providing a real-time understanding of revenue, expenses, and profitability, this approach enables timely interventions, informed strategic planning, and ultimately, enhanced financial performance. The ability to compare current performance with past data and industry trends further strengthens this approach, fostering a culture of continuous improvement and data-driven decision-making.

3. Year-to-Date Analysis

Year-to-date (YTD) analysis is intrinsically linked to the utility of a profit and loss statement year-to-date template. This analytical approach provides a dynamic view of financial performance, covering the period from the beginning of the fiscal year up to a specified date. Instead of waiting for a full fiscal year to conclude, YTD analysis offers ongoing insights into trends, allowing for timely interventions and strategic adjustments. This approach is crucial for proactive financial management and informed decision-making.

- Performance Tracking:YTD analysis allows businesses to monitor key performance indicators (KPIs) like revenue, expenses, and profitability throughout the year. A restaurant, for example, can track its YTD revenue growth to assess the effectiveness of new menu items or promotional campaigns. This ongoing performance tracking facilitates proactive adjustments to maximize profitability and minimize potential losses. Without YTD analysis, identifying and addressing negative trends might be delayed until the end of the fiscal year, potentially exacerbating negative outcomes.

- Trend Identification:Analyzing financial data on a YTD basis reveals evolving trends, providing insights into factors influencing performance. A retail store can analyze YTD sales data to identify seasonal buying patterns or the impact of marketing initiatives on customer behavior. Recognizing these trends allows businesses to adapt their strategies and optimize resource allocation for maximum impact. Historical annual data alone would not reveal these nuanced trends with the same level of granularity and timeliness.

- Benchmarking and Comparisons:YTD figures can be compared against previous periods or industry averages to gauge performance and identify areas for improvement. A manufacturing company, for instance, can compare its YTD production costs against previous years to assess the effectiveness of cost-saving measures. This comparative analysis provides valuable context for evaluating success and identifying areas requiring attention. Furthermore, comparing YTD performance against industry benchmarks reveals competitive positioning and highlights areas where the business excels or lags.

- Forecasting and Budgeting:YTD data plays a vital role in forecasting future performance and developing accurate budgets. A construction company can utilize YTD project completion rates and expenses to forecast project timelines and budget requirements for upcoming projects. This forward-looking approach to financial planning, grounded in real-time data, enhances accuracy and allows for proactive adjustments to resource allocation and project management. Relying solely on historical annual data would limit the accuracy and relevance of these forecasts.

In conclusion, YTD analysis is an essential component of utilizing a profit and loss statement year-to-date template effectively. By offering a dynamic view of financial performance, it empowers businesses to make informed decisions, identify and capitalize on emerging trends, benchmark against competitors, and develop more accurate forecasts. This analytical approach shifts financial management from reactive to proactive, fostering a data-driven environment that promotes sustainable growth and profitability.

4. Simplified Reporting

Simplified reporting is a key benefit derived from utilizing a profit and loss statement year-to-date template. These templates often incorporate pre-built formulas, automated calculations, and standardized categories, significantly streamlining the process of data entry and report generation. This streamlined approach reduces manual effort, minimizing the risk of errors and freeing up valuable time for analysis and interpretation of the financial data. Consider a small business owner who previously spent hours manually compiling financial data. A template automates calculations of gross profit, operating income, and net income, allowing the owner to focus on understanding these figures rather than on their derivation.

The impact of simplified reporting extends beyond mere time savings. Standardized templates ensure consistency in reporting, facilitating comparisons across different periods and against industry benchmarks. This consistency is crucial for identifying trends, evaluating performance, and making informed business decisions. For example, a standardized template might categorize marketing expenses consistently across all YTD reports. This allows for accurate tracking of marketing ROI and facilitates data-driven decisions regarding budget allocation and campaign effectiveness. Without a standardized approach, comparing marketing spend and its impact on revenue across different periods would be significantly more challenging.

Furthermore, simplified reporting enhances accessibility to financial data. User-friendly templates often integrate with existing accounting software, allowing for seamless data import and report generation. This integration minimizes the technical expertise required to generate and interpret financial reports, empowering individuals across the organization to make data-driven decisions. For example, a sales manager can readily access YTD sales data by region, enabling targeted interventions to address underperforming areas. This accessibility to real-time data fosters a culture of data-driven decision-making throughout the organization, contributing to enhanced agility and responsiveness.

In summary, simplified reporting, facilitated by a profit and loss statement year-to-date template, is integral to effective financial management. By streamlining data entry, ensuring consistency, and enhancing accessibility to key financial metrics, these templates empower organizations to move beyond manual data crunching and focus on strategic analysis and informed decision-making. This shift towards data-driven insights allows businesses to identify trends, optimize resource allocation, and ultimately enhance financial performance.

5. Informed Decisions

A profit and loss statement year-to-date template provides the foundation for informed decision-making, offering a clear and current view of financial performance. Access to accurate, up-to-the-minute data empowers stakeholders to move beyond reactive management and engage in proactive strategies that drive profitability and sustainable growth. Utilizing this type of template facilitates data-driven insights, enabling organizations to identify trends, assess risks, and capitalize on opportunities.

- Strategic Planning:A clear understanding of year-to-date performance is crucial for effective strategic planning. For example, a company experiencing consistent revenue growth in a particular product line can use this data to justify further investment in that area. Conversely, identifying declining sales in another segment enables timely interventions, such as adjusting marketing strategies or streamlining operations. This data-driven approach to strategic planning ensures resources are allocated effectively, maximizing return on investment and supporting long-term growth.

- Risk Management:Year-to-date financial data allows organizations to identify and mitigate potential risks. For instance, a consistent increase in operating expenses, coupled with stagnant revenue, signals a potential profitability challenge. Recognizing this trend early allows management to implement cost-control measures or explore alternative revenue streams, mitigating the risk of financial distress. Without access to current financial data, these risks might go unnoticed until they significantly impact the organization’s financial health.

- Performance Evaluation:Evaluating performance against pre-defined targets is essential for organizational success. A year-to-date profit and loss statement provides the necessary data to assess progress toward financial goals. For example, a company aiming for a specific profit margin can track its year-to-date performance and identify any deviations from the target. This ongoing monitoring allows for timely corrective actions, increasing the likelihood of achieving desired outcomes. Annual performance reviews alone would not provide the timely feedback necessary for effective course correction.

- Investment Decisions:Sound investment decisions require a thorough understanding of financial performance. A company considering expanding its operations can utilize year-to-date data to assess its financial capacity and project the potential return on investment. This data-driven approach reduces the risk associated with investment decisions and increases the likelihood of successful outcomes. Relying solely on historical annual data would not reflect the current financial state of the organization, potentially leading to misinformed investment choices.

In conclusion, the ability to make informed decisions is inextricably linked to the utilization of a profit and loss statement year-to-date template. By providing a clear, concise, and current view of financial performance, these templates empower stakeholders to engage in proactive strategic planning, effectively manage risks, accurately evaluate performance, and make sound investment decisions. This data-driven approach is essential for achieving sustainable growth, maximizing profitability, and ensuring long-term financial health. The shift from reactive to proactive management, facilitated by access to timely and accurate financial data, is a key driver of organizational success in today’s dynamic business environment.

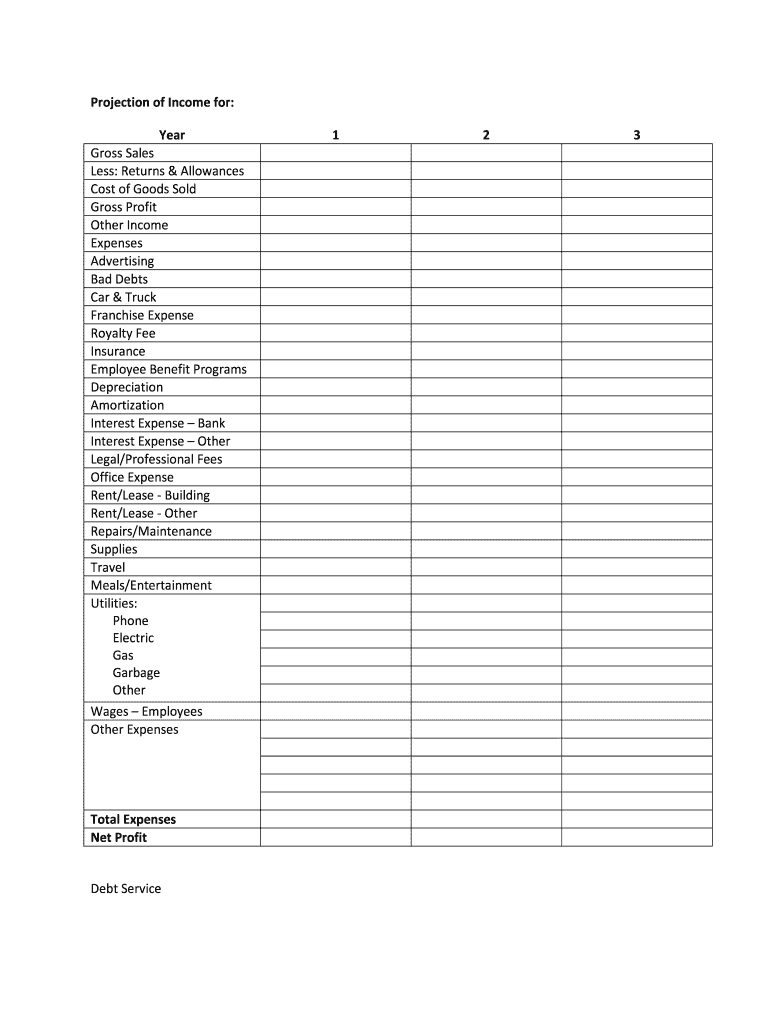

Key Components of a Year-to-Date Profit and Loss Statement

A comprehensive year-to-date profit and loss statement requires several key components to provide a thorough understanding of financial performance. These components work together to paint a clear picture of an organization’s financial health from the start of the fiscal year to a specific date.

1. Revenue: This section details all income generated from primary business activities. It typically includes sales revenue, service fees, and other income streams relevant to core operations. Accurate revenue reporting is fundamental to assessing overall financial performance and growth.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead. Understanding COGS is essential for calculating gross profit and assessing production efficiency.

3. Gross Profit: Calculated as revenue minus COGS, gross profit represents the profit generated from core business operations before accounting for operating expenses. This metric provides insight into the profitability of products or services offered.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. Examples include salaries, rent, marketing expenses, and administrative costs. Careful tracking of operating expenses is crucial for cost management and profitability analysis.

5. Operating Income: Calculated as gross profit minus operating expenses, operating income reflects the profit generated from core business operations after accounting for all operating costs. This key metric provides a clear view of operational efficiency.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations. Examples include interest income, investment gains or losses, and one-time expenses. These items provide a comprehensive view of all financial activity.

7. Income Before Taxes: This represents the net income generated before accounting for income tax expenses. It provides a clear picture of profitability before the impact of tax obligations.

8. Net Income: This is the final profit or loss figure after all revenues and expenses, including taxes, have been accounted for. Net income represents the bottom line and is a crucial indicator of overall financial performance.

Accurate and comprehensive reporting of these components provides essential insights into financial performance, enabling data-driven decisions and strategic planning. Regular review of these figures allows stakeholders to understand trends, identify areas for improvement, and make informed choices that contribute to long-term financial health and sustainable growth.

How to Create a Profit and Loss Statement Year to Date Template

Creating a robust template ensures consistent and accurate reporting of year-to-date financial performance. The following steps outline a structured approach to developing a template suitable for various organizational needs.

1. Define Reporting Period: Specify the start and end dates for the year-to-date period. Clarity regarding the reporting timeframe is crucial for accurate analysis and comparisons.

2. Establish Key Metrics: Determine the essential financial metrics to include. These typically encompass revenue, cost of goods sold (COGS), gross profit, operating expenses, operating income, other income/expenses, income before taxes, and net income. Selection should align with specific informational needs.

3. Structure the Template: Organize the template logically, grouping related metrics. A common structure follows a hierarchical format, starting with revenue and progressing through calculations to arrive at net income. A clear structure enhances readability and comprehension.

4. Incorporate Formulas and Calculations: Embed formulas to automate calculations. For instance, gross profit is calculated as revenue minus COGS. Automating these calculations reduces manual effort and minimizes the risk of errors.

5. Categorize Expenses: Establish clear categories for operating expenses. Examples include salaries, rent, marketing, and utilities. Categorization facilitates detailed analysis of spending patterns and identification of areas for potential cost optimization.

6. Choose a Software Tool: Select an appropriate software tool for creating the template. Spreadsheet software offers flexibility and customization options, while accounting software often includes built-in reporting features. Selection depends on the complexity of reporting requirements and integration with existing systems.

7. Test and Refine: Thoroughly test the template with sample data to ensure accuracy and functionality. Refine formulas, formatting, and categories as needed. Rigorous testing ensures the template produces reliable and meaningful results.

8. Implement and Maintain: Implement the template within the organization and establish procedures for regular updates and maintenance. Regular review and updates ensure the template remains relevant and accurate, providing ongoing support for informed decision-making.

A well-designed template, incorporating these elements, provides a robust framework for tracking year-to-date financial performance, enabling organizations to monitor progress, identify trends, and make data-driven decisions that contribute to sustainable growth and profitability. Consistent application and regular review of the template ensure its ongoing effectiveness as a valuable tool for financial management.

Effective financial management hinges on timely and accurate insights. A profit and loss statement year-to-date template provides a crucial tool for organizations seeking to understand their financial performance throughout the fiscal year. Standardized reporting, facilitated by such a template, allows for consistent tracking of key metrics, including revenue, expenses, and profitability. This structured approach enables meaningful comparisons across reporting periods, identification of emerging trends, and informed decision-making. Simplified reporting processes, often incorporating automated calculations, reduce the risk of errors and free up valuable time for analysis and strategic planning.

The insights derived from a well-structured year-to-date profit and loss statement empower organizations to move beyond reactive management and engage in proactive strategies that drive growth and profitability. Regular review of these statements fosters a data-driven culture, enabling timely interventions, informed resource allocation, and a deeper understanding of the factors influencing financial performance. Ultimately, consistent utilization of this financial management tool provides a critical foundation for achieving long-term financial health and sustained success in a competitive business environment.