Utilizing readily available, no-cost structures for these reports offers several advantages. It saves time and resources by eliminating the need to create a document from scratch. These formats often incorporate best practices in financial reporting, ensuring clarity and accuracy. Furthermore, using a standardized structure facilitates comparison across different periods and simplifies communication with stakeholders like investors and lenders. This accessibility empowers businesses, particularly startups or smaller enterprises, to manage their finances effectively without significant upfront investment.

This article will further explore the key components of these financial reports, different available formats, and how they can be effectively used to gain valuable insights into business performance and inform strategic decision-making.

1. Revenue

Revenue, the lifeblood of any business, forms the cornerstone of a profit and loss statement. Accurately capturing and analyzing revenue streams is essential for understanding financial performance and making informed decisions. Utilizing a free template provides a structured framework for organizing and interpreting this critical data.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail store, this would be the receipts from customer purchases. Within a free template, sales revenue is often the top-line figure, setting the stage for subsequent calculations. Accurate recording of sales is paramount for assessing overall profitability and growth.

- Other RevenueBeyond core sales, businesses may generate income from other sources. These can include interest earned on investments, rental income from property, or licensing fees. A free template accommodates these diverse income streams, providing a comprehensive view of all revenue-generating activities. This detailed breakdown allows for a more nuanced understanding of the business’s financial health.

- Revenue RecognitionThe timing of revenue recognition is crucial for accurate financial reporting. Revenue should be recognized when earned, not necessarily when cash is received. For example, a subscription service might recognize revenue monthly, even if the customer pays annually. Free templates often incorporate best practices for revenue recognition, ensuring compliance with accounting standards and providing a clear picture of performance over time.

- Revenue AnalysisSimply recording revenue is insufficient; analysis is key. Comparing revenue figures across different periods, analyzing trends, and identifying anomalies are vital for strategic decision-making. A free template facilitates this analysis by providing a structured format for data comparison and interpretation. This can reveal seasonal patterns, growth areas, or potential problems requiring attention. For instance, declining revenue in a specific product line might signal a need for adjustments in marketing or pricing strategies.

By systematically capturing and analyzing revenue data within a standardized framework provided by a free profit and loss statement template, businesses gain valuable insights into their financial health. This understanding forms the basis for informed decision-making, driving growth and ensuring long-term sustainability. Further exploration of expenses and their relationship to revenue provides a complete picture of profitability.

2. Expenses

Accurate expense tracking is crucial for understanding profitability and making informed financial decisions. A free profit and loss statement template provides a structured framework for categorizing and analyzing expenses, enabling businesses to identify areas for cost optimization and improve overall financial performance. The relationship between expenses and the profit and loss statement is fundamental, as expenses directly impact net profit or loss. By subtracting total expenses from total revenues, businesses arrive at their net income figure. This figure is a key indicator of financial health and sustainability.

Several expense categories are typically included within a profit and loss statement. Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. This includes raw materials, direct labor, and manufacturing overhead. For a manufacturing company, accurately tracking COGS is crucial for determining product pricing and profitability. Operating expenses encompass the costs of running the day-to-day business operations, including rent, salaries, marketing, and administrative expenses. Monitoring operating expenses is essential for identifying potential cost savings and maintaining efficient operations. For example, a software company might analyze its marketing expenses to determine the effectiveness of different campaigns and optimize its marketing budget. Interest expense reflects the cost of borrowing money. Managing debt levels and associated interest expenses is critical for long-term financial stability.

Effective expense management requires consistent tracking and analysis. Free profit and loss statement templates often provide predefined categories for common expenses, simplifying the process of recording and organizing financial data. This standardized format facilitates comparison across different periods, enabling businesses to identify trends and anomalies in their spending patterns. For instance, a rising trend in administrative expenses might warrant further investigation to identify potential inefficiencies. By leveraging free templates and diligently tracking expenses, businesses gain valuable insights into their cost structure, empowering them to make data-driven decisions to improve profitability and achieve their financial goals. Understanding both revenue and expenses provides a complete view of a company’s financial performance.

3. Profit/Loss

The core purpose of a profit and loss statement is to determine the net profit or loss incurred by a business over a specific period. This bottom-line figure, derived from the interplay of revenues and expenses, provides critical insights into financial performance and sustainability. Access to free templates simplifies this process, enabling businesses to easily generate these statements and track their financial health. Understanding the components contributing to profit or loss is essential for informed decision-making and strategic planning.

- Gross ProfitThis represents the difference between revenue and the cost of goods sold (COGS). It reflects the profitability of core business operations before considering other operating expenses. For example, a furniture manufacturer selling a chair for $200 with COGS of $100 has a gross profit of $100. Tracking gross profit within a free template helps businesses assess the efficiency of production and pricing strategies. Analyzing trends in gross profit can reveal potential issues with production costs or pricing pressures.

- Operating ProfitCalculated by subtracting operating expenses from gross profit, this figure reflects the profitability of the business after accounting for the costs of running daily operations. Continuing the furniture manufacturer example, if operating expenses (rent, salaries, etc.) total $60, the operating profit would be $40. Free templates facilitate this calculation, providing a clear picture of operational efficiency. Consistent monitoring of operating profit helps businesses identify areas for cost optimization.

- Net Profit/LossThis is the final bottom-line figure, representing the overall profit or loss after all expenses, including interest and taxes, have been deducted. Suppose the furniture manufacturer has an interest expense of $10 and taxes of $5. The net profit would then be $25. Using a free template ensures all expenses are accounted for, resulting in an accurate net profit or loss calculation. This final figure is a key indicator of a business’s financial health and its ability to generate sustainable profits.

- Profit MarginsThese ratios, calculated by dividing profit figures (gross, operating, or net) by revenue, express profitability as a percentage. They provide valuable insights into a company’s pricing strategy and cost control. For example, the furniture manufacturers net profit margin is 12.5% ($25/$200). Free templates can include formulas to automatically calculate these margins, facilitating analysis and benchmarking against industry averages. Consistent tracking of profit margins helps businesses identify areas for improvement and assess the impact of strategic decisions on profitability.

By leveraging the structured format of a free profit and loss statement template, businesses can effectively track these key profit and loss metrics. This enables a comprehensive understanding of financial performance, informing strategic decision-making to drive profitability and achieve long-term financial goals. Analyzing these metrics over time provides valuable insights into trends and potential areas for improvement, empowering businesses to proactively manage their financial health.

4. Time Period

The “Time Period” component is fundamental to the utility of a profit and loss statement, defining the specific timeframe covered by the financial data. Free templates accommodate various reporting periods, typically monthly, quarterly, or annually. The choice of time period influences the insights derived from the statement. A shorter time frame, such as a month, offers a granular view of performance, enabling prompt identification of emerging trends or issues. Conversely, a longer duration, like a year, provides a broader perspective on overall financial health and stability. Analyzing data across multiple periods allows for trend analysis and performance comparisons.

Consider a seasonal business, like a holiday decoration retailer. A monthly profit and loss statement using a free template would reveal peak sales and profitability during the holiday season, while other months might show lower figures. This information is crucial for inventory management and resource allocation. Comparing monthly statements year over year can identify growth or decline patterns, informing strategic planning for subsequent seasons. An annual statement for the same business would provide an overview of the entire year’s performance, incorporating both peak and off-season results. This allows for assessment of overall profitability and financial health.

The selection of an appropriate time period depends on the specific informational needs of the business. Short-term analysis facilitates immediate tactical adjustments, while long-term perspectives inform broader strategic decisions. Free templates offer the flexibility to generate statements for different durations, empowering businesses to tailor their analysis to specific requirements and gain valuable insights into their financial performance over time. Understanding the impact of time period selection on financial analysis ensures accurate interpretation of results and facilitates effective decision-making.

5. Free Access

Accessibility is a crucial factor for businesses seeking efficient financial management tools. The availability of profit and loss statement templates at no cost significantly reduces the barrier to entry for effective financial tracking and analysis. This free access democratizes the use of these essential tools, empowering businesses of all sizes, particularly startups and smaller enterprises, to manage their finances strategically.

- Reduced Financial BarriersEliminating cost as a factor allows businesses to allocate resources to other critical areas, such as operations, marketing, or product development. A startup with limited capital can leverage free templates to establish sound financial practices from the outset, fostering responsible growth without incurring unnecessary expenses. This free access contributes to a more level playing field for businesses of varying sizes and financial capacities.

- Ease of ImplementationFree templates are readily available online, often requiring minimal effort to download and implement. This eliminates the need for costly custom software solutions or manual creation of spreadsheets, saving valuable time and resources. A small restaurant owner, for example, can quickly download a template and begin tracking revenue and expenses without needing specialized accounting software or expertise. This ease of use fosters wider adoption of sound financial practices.

- Standardized FormattingFree templates often adhere to standard accounting principles and best practices, ensuring consistency and accuracy in financial reporting. This standardization simplifies communication with stakeholders, such as investors or lenders, who are accustomed to reviewing information presented in familiar formats. A consistent format also facilitates comparison of performance across different periods, enabling businesses to identify trends and make informed decisions based on reliable data.

- Facilitated Learning and AdoptionThe widespread availability of free templates contributes to greater understanding and adoption of sound financial management practices. Entrepreneurs and small business owners can easily access and utilize these resources to learn about key financial metrics and develop essential financial management skills. This accessibility fosters a more financially literate business environment, contributing to improved outcomes and overall economic stability.

Free access to profit and loss statement templates empowers businesses to manage their finances effectively, regardless of size or financial resources. By removing cost barriers, simplifying implementation, and promoting standardized reporting, these freely available tools contribute to a more financially sound and sustainable business ecosystem. The ability to track and analyze financial performance empowers businesses to make informed decisions, fostering growth and stability.

6. Standardized Format

Standardized formatting is a key advantage of utilizing free profit and loss statement templates. These templates adhere to established accounting conventions, presenting financial data in a consistent and recognizable structure. This consistency facilitates several critical functions, including streamlined analysis, improved communication with stakeholders, and enhanced comparability across different periods or businesses. A standardized format ensures that key financial metrics, such as revenue, cost of goods sold, operating expenses, and net profit, are presented in a predictable order and manner. This allows users to quickly locate and interpret critical information without needing to decipher a unique or unfamiliar structure. For example, a lender reviewing a loan application can easily assess the applicant’s financial health when the information is presented in a standard profit and loss format.

Furthermore, standardized formatting simplifies the process of comparing financial performance across different reporting periods. Using a consistent template ensures that data from one month or quarter can be directly compared to previous periods, enabling trend analysis and identification of potential issues or opportunities. A retailer using a standardized profit and loss template can easily track sales growth or decline over several quarters, identifying seasonal patterns or the impact of marketing campaigns. This comparability empowers businesses to make data-driven decisions regarding inventory management, pricing strategies, and resource allocation. Standardization also facilitates benchmarking against industry averages or competitors, providing valuable context for evaluating performance and identifying areas for improvement.

In conclusion, the standardized format offered by free profit and loss statement templates provides significant benefits for businesses. Consistency streamlines analysis, enhances communication with stakeholders, and enables meaningful comparisons across different periods and against industry benchmarks. This structure promotes clarity, accuracy, and efficiency in financial reporting, empowering businesses to make informed decisions and achieve sustainable growth. While some businesses with complex financial structures may require customized reporting, the standardized format offered by free templates is highly beneficial for the vast majority of businesses seeking to manage their finances effectively.

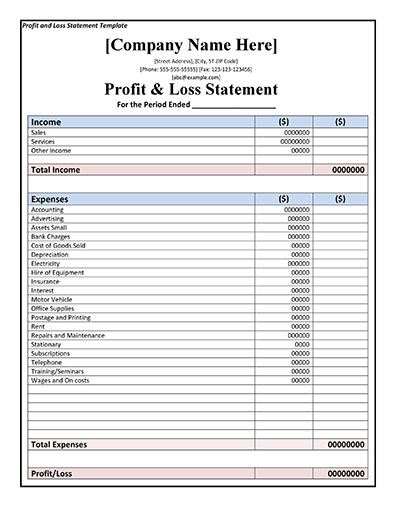

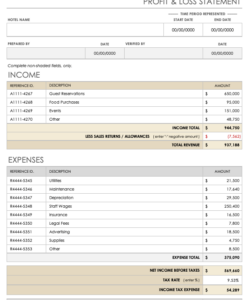

Key Components of a Profit and Loss Statement

A profit and loss statement, accessible through readily available free templates, provides crucial insights into a business’s financial performance. Understanding its key components is essential for effective financial management and informed decision-making.

1. Revenue: This encompasses all income generated from business activities during the given period. It typically includes sales revenue from core operations and other income streams such as interest or royalties. Accurate revenue recording is fundamental for assessing overall financial health.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. This component is crucial for manufacturers and retailers in determining gross profit and pricing strategies.

3. Gross Profit: Calculated as Revenue – COGS, gross profit reflects the profitability of core business operations before accounting for other operating expenses. Analyzing gross profit trends can reveal insights into production efficiency and pricing effectiveness.

4. Operating Expenses: These expenses encompass the costs of running daily business operations, including rent, salaries, marketing, and administrative costs. Monitoring operating expenses is vital for identifying areas for cost optimization and maintaining operational efficiency.

5. Operating Profit: Derived by subtracting operating expenses from gross profit, this metric indicates profitability after accounting for daily operational costs. Tracking operating profit helps assess the efficiency and sustainability of core business operations.

6. Other Expenses: This category includes expenses not directly tied to core operations, such as interest expense on loans or losses from asset sales. Accurate tracking of these expenses is crucial for a comprehensive understanding of overall financial performance.

7. Net Profit/Loss: This bottom-line figure represents the overall profit or loss after all revenues and expenses have been accounted for. It provides a definitive measure of a company’s financial performance during the specified period.

8. Time Period: The profit and loss statement covers a defined period, such as a month, quarter, or year. The chosen time frame influences the granularity of insights and the types of analysis performed. Different time periods offer different perspectives on financial trends and stability.

Careful analysis of these components within a standardized format, readily available through free templates, provides a comprehensive understanding of a business’s financial performance and informs strategic decision-making for future growth and sustainability.

How to Create a Profit and Loss Statement

Creating a profit and loss statement involves organizing financial data into a structured format. While readily available free templates simplify this process, understanding the underlying principles ensures accurate and effective reporting. The following steps outline the process of creating a statement, even without a pre-designed template.

1. Define the Reporting Period: Specify the timeframe covered by the statement, such as a month, quarter, or year. This defines the scope of the financial data included in the report.

2. Record Revenue: Document all income generated during the reporting period. This includes sales revenue from primary business operations and any other income streams like interest or royalties.

3. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods sold. This applies primarily to businesses involved in manufacturing or retail and includes raw materials, direct labor, and manufacturing overhead.

4. Determine Gross Profit: Calculate gross profit by subtracting COGS from Revenue. This represents the profit from core operations before accounting for other expenses.

5. Itemize Operating Expenses: List all expenses associated with running the business, including rent, salaries, marketing, utilities, and administrative costs. Categorizing expenses systematically enhances analysis and cost management.

6. Calculate Operating Profit: Subtract operating expenses from gross profit to arrive at operating profit. This metric reflects profitability after accounting for the costs of daily operations.

7. Include Other Expenses: Account for expenses not directly related to core operations, such as interest expense or losses from asset sales. This provides a more complete picture of overall financial performance.

8. Calculate Net Profit/Loss: Subtract all expenses (including other expenses) from the operating profit. This bottom-line figure represents the overall profit or loss for the defined reporting period.

Organizing financial data in this structured manner provides a clear and comprehensive overview of financial performance during the specified period. Consistent application of these steps, whether using a free template or building a statement manually, facilitates accurate financial reporting and informed decision-making.

Access to profit loss statement free templates empowers businesses to gain crucial insights into their financial performance. Understanding the key components of these statements, including revenue, expenses, and profit metrics, allows for informed decision-making and strategic planning. Leveraging free templates simplifies the process of creating these reports, enabling businesses of all sizes to track their financial health effectively. The standardized format promotes consistency and facilitates comparison across different periods, fostering data-driven insights and informed financial management.

Effective financial management is essential for long-term business sustainability. Utilizing readily available resources, such as profit loss statement free templates, provides a practical and efficient approach to monitoring financial health and making informed decisions that drive growth and stability. Regular review and analysis of these statements, coupled with strategic adjustments based on identified trends, are crucial for achieving financial objectives and ensuring long-term success.