Utilizing a pre-designed structure offers several advantages. It ensures consistency in reporting, simplifying comparisons across different periods. It facilitates informed decision-making by highlighting key performance indicators. A standardized format also streamlines the process of preparing financial reports, saving time and reducing the risk of errors. Furthermore, it promotes transparency and accountability by presenting financial information in a clear and organized manner.

This foundational understanding of the structure and benefits of such a financial report paves the way for a deeper exploration of its individual components, analytical techniques, and practical applications in various business contexts.

1. Standardized Structure

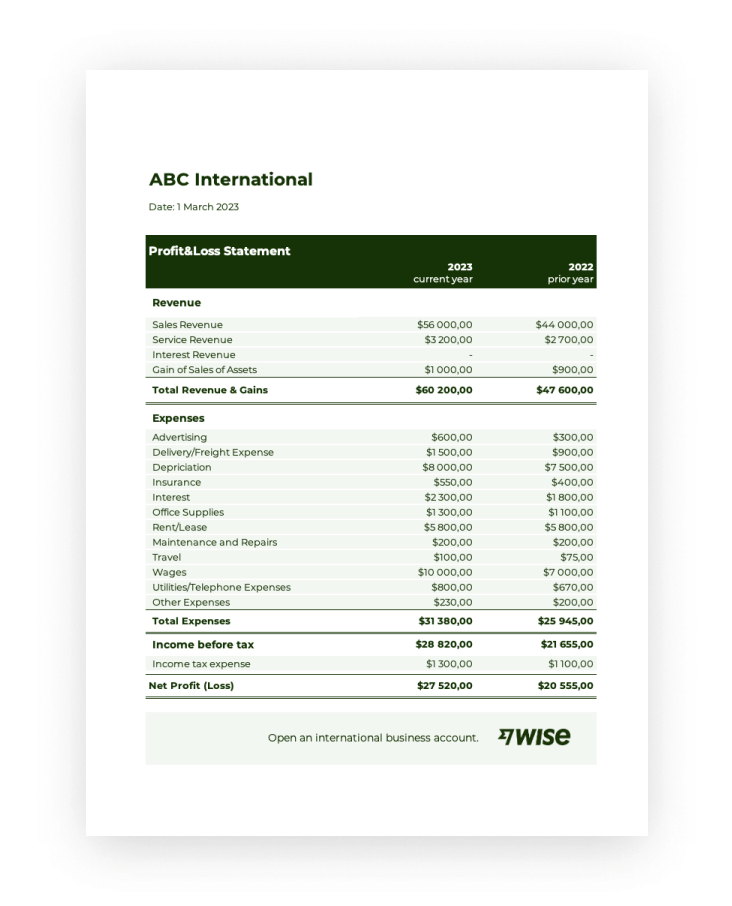

Standardized structure is a cornerstone of effective financial reporting, particularly within the context of profit and loss statements. A consistent format ensures comparability across different reporting periods, allowing for trend analysis and performance evaluation. This structure typically segregates information into key categories such as revenue, cost of goods sold, operating expenses, and other income and expenses. Such categorization facilitates a clear understanding of the factors contributing to an organization’s profitability or loss. Without a standardized structure, analyzing financial performance and identifying areas for improvement becomes significantly more challenging. For instance, comparing revenue growth year-over-year becomes straightforward when the revenue figures are consistently presented in the same section of the statement across different periods.

The benefits of a standardized structure extend beyond internal analysis. External stakeholders, such as investors and creditors, rely on these standardized reports to assess financial health and make informed decisions. Consistent reporting builds trust and transparency, enabling stakeholders to compare performance across different companies within the same industry. Imagine a scenario where each company reported financial data in a unique format. Comparing performance would be a complex and time-consuming endeavor, hindering effective investment decisions and market analysis.

In conclusion, the standardized structure of a profit and loss statement is essential for both internal management and external stakeholders. It provides a clear, consistent, and comparable view of financial performance, facilitating informed decision-making and promoting transparency within the financial ecosystem. While specific line items might vary based on industry or business model, adherence to a standardized framework remains crucial for effective financial communication and analysis.

2. Financial Performance Overview

A profit and loss statement template provides the framework for a comprehensive financial performance overview. This overview offers insights into an organization’s profitability and operational efficiency over a specific period. Understanding the components within this framework allows stakeholders to assess financial health and make informed decisions.

- Revenue StreamsRevenue streams represent the inflow of cash from primary business operations. For a retail business, this could include sales of goods. For a service-based company, this would encompass fees earned from providing services. Within a profit and loss statement, revenue streams are typically presented at the top, providing a starting point for calculating profitability. Analyzing revenue trends can reveal growth patterns, market demand fluctuations, and the effectiveness of sales strategies.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods sold by a business. This includes raw materials, manufacturing labor, and factory overhead. For service companies, this might be the direct cost of delivering the service. Understanding COGS is crucial for calculating gross profit and assessing pricing strategies. Analyzing COGS helps identify potential cost efficiencies within the production process.

- Operating ExpensesOperating expenses represent the costs incurred in running a business’s day-to-day operations, excluding COGS. These include rent, salaries, marketing expenses, and administrative costs. Analyzing operating expenses provides insights into operational efficiency and resource allocation. Monitoring these expenses can reveal areas for potential cost reduction and improved resource management.

- Net Income/LossNet income or loss is the bottom line of the profit and loss statement. It represents the overall profitability of the business after all revenues and expenses have been accounted for. A positive net income indicates profit, while a negative net income signifies a loss. This figure is a key indicator of financial health and is often used by investors and creditors to assess financial performance and make investment decisions.

By presenting these facets within a structured format, a profit and loss statement template enables a comprehensive analysis of financial performance. Comparing figures across different reporting periods allows for the identification of trends, the evaluation of strategic initiatives, and the implementation of informed business decisions. This detailed overview becomes a crucial tool for both internal management and external stakeholders in understanding an organizations financial health and trajectory.

3. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) derived from the profit and loss statement provide crucial insights into an organization’s financial health and operational efficiency. These metrics offer quantifiable measures of performance across various aspects of the business, enabling data-driven decision-making and strategic planning. Analyzing KPIs within the context of a standardized profit and loss statement template allows for consistent tracking, trend analysis, and performance benchmarking.

- Gross Profit MarginGross profit margin represents the percentage of revenue remaining after deducting the cost of goods sold (COGS). Calculated as (Revenue – COGS) / Revenue, this KPI reflects the efficiency of production and pricing strategies. A higher gross profit margin indicates greater profitability on each unit sold. For example, a company with a gross profit margin of 60% retains $0.60 for every dollar of revenue generated after covering production costs. Tracking this KPI over time reveals trends in production costs, pricing effectiveness, and overall product profitability.

- Operating Profit MarginOperating profit margin measures the profitability of core business operations, excluding interest and taxes. Calculated as Operating Income / Revenue, this KPI reflects the efficiency of managing operating expenses. A higher operating profit margin suggests effective cost control and operational efficiency. For instance, a company with a 20% operating profit margin retains $0.20 for every dollar of revenue after covering operating expenses. Monitoring this KPI allows for the identification of areas for potential cost optimization and improved operational efficiency.

- Net Profit MarginNet profit margin represents the overall profitability of the business after accounting for all revenues and expenses, including interest and taxes. Calculated as Net Income / Revenue, this KPI reflects the effectiveness of overall financial management. A higher net profit margin indicates greater overall profitability. A company with a 10% net profit margin earns $0.10 in profit for every dollar of revenue generated after covering all expenses. Tracking this KPI over time allows for the assessment of overall financial health and the effectiveness of strategic initiatives.

- Return on Sales (ROS)Return on sales (ROS), similar to net profit margin, measures a company’s ability to generate profit from its revenue. It demonstrates how efficiently management uses revenue to generate profit after paying all expenses. A higher ROS typically signifies stronger financial performance and efficient operations. For example, an ROS of 15% suggests that the company generates $0.15 in profit for every dollar of sales. Analyzing ROS helps understand profitability trends and assess the impact of business strategies.

By analyzing these KPIs within the framework of a profit and loss statement, stakeholders gain a comprehensive understanding of financial performance, operational efficiency, and profitability trends. These insights are crucial for informed decision-making, strategic planning, and performance benchmarking against competitors or industry averages. Regular monitoring and analysis of these metrics enable proactive identification of potential issues and opportunities for improvement, contributing to sustainable growth and financial success.

4. Simplified Reporting

Simplified reporting emerges as a direct consequence of employing a well-structured profit and loss statement template. The template’s standardized format streamlines the process of data entry and organization, reducing manual effort and minimizing the risk of errors. This inherent structure eliminates ambiguity and ensures consistency in presenting financial information, making the report easier to interpret and analyze. Consider a scenario where financial data is scattered across multiple spreadsheets without a standardized format. Consolidating and interpreting this information would be a time-consuming and error-prone process. A template predefines the necessary categories and calculations, enabling efficient data entry and automated report generation. This simplification frees up valuable time for analysis and strategic decision-making rather than manual data manipulation.

The simplified reporting facilitated by a template extends beyond internal use. External stakeholders, such as investors and creditors, benefit from the clear and concise presentation of financial information. A standardized format enhances transparency and comparability, allowing stakeholders to quickly assess financial performance and make informed decisions. For instance, comparing key performance indicators across different companies within the same industry becomes significantly easier when those companies utilize similar reporting structures. This standardization promotes informed investment decisions and market analysis. Furthermore, simplified reporting reduces the burden of compliance with regulatory reporting requirements. Pre-built templates often incorporate necessary fields and calculations, ensuring adherence to reporting standards and minimizing the risk of penalties.

In conclusion, simplified reporting, a direct outcome of utilizing a profit and loss statement template, offers substantial benefits. It streamlines internal processes, enhances transparency for external stakeholders, and facilitates compliance with regulatory requirements. This efficiency allows businesses to focus on what truly matters: analyzing financial performance, identifying opportunities for improvement, and making strategic decisions that drive sustainable growth and success. The transition from manual, disparate reporting to a template-driven approach represents a significant step towards efficient financial management and informed decision-making.

5. Informed Decision-Making

Strategic business decisions require a solid foundation of accurate and accessible financial data. A profit and loss statement template provides this foundation, offering a structured view of financial performance that empowers informed decision-making. Understanding the connection between this structured financial data and the resulting decisions is crucial for effective financial management and sustainable growth. This structured data empowers stakeholders to move beyond reactive responses and engage in proactive planning and strategic foresight.

- Performance EvaluationA profit and loss statement offers a clear picture of past financial performance. By analyzing revenue trends, cost structures, and profitability metrics, businesses can identify areas of strength and weakness. For example, declining sales in a specific product line, revealed through the statement, might prompt an investigation into market trends or competitor activities. This data-driven analysis enables informed decisions regarding product development, marketing strategies, and resource allocation. Without this structured data, such evaluations would be based on conjecture rather than concrete evidence.

- Strategic PlanningHistorical financial data, presented through the profit and loss statement, forms the basis for future strategic planning. By understanding past performance trends, organizations can project future outcomes, set realistic goals, and develop strategies to achieve those goals. For instance, consistent growth in revenue, coupled with effective cost management, might justify an expansion strategy. The statement’s data provides the justification for securing funding or allocating resources to support the expansion. This structured approach to planning replaces guesswork with data-backed projections.

- Risk ManagementIdentifying potential risks is crucial for long-term stability. A profit and loss statement helps uncover vulnerabilities within the business model. For example, rising operating expenses, coupled with stagnant revenue, might indicate an impending financial challenge. This early identification allows businesses to implement corrective measures, such as cost reduction initiatives or revenue diversification strategies, to mitigate the risk. This proactive approach, driven by financial data, minimizes potential negative impacts and strengthens resilience.

- Investment DecisionsInvestors and creditors rely heavily on financial statements when making investment decisions. A clear and comprehensive profit and loss statement instills confidence and transparency, increasing the likelihood of securing funding or favorable loan terms. Consistent profitability, demonstrated through the statement, strengthens a company’s credibility and attractiveness to investors. This data-driven transparency becomes a powerful tool in attracting capital and fostering trust with financial stakeholders. Without this structured financial representation, securing investment becomes significantly more challenging.

The structured insights derived from a profit and loss statement template form the backbone of informed decision-making across all levels of an organization. From evaluating past performance to projecting future outcomes and mitigating risks, these data-driven insights empower stakeholders to make strategic choices that drive sustainable growth, enhance profitability, and ensure long-term financial health. The transition from intuition-based decisions to data-driven strategies, facilitated by the template, represents a significant advancement in financial management and strategic leadership.

Key Components of a Profit and Loss Statement Template

A well-structured template ensures consistent presentation of financial performance data. Understanding these key components is fundamental for accurate interpretation and analysis.

1. Revenue: This section details all income generated from sales of goods or services. Subcategories may include operating revenue, non-operating revenue, and gains from other sources. Accurate revenue recognition is crucial for a reliable financial overview.

2. Cost of Goods Sold (COGS): COGS represents direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Understanding COGS is essential for calculating gross profit and assessing pricing strategies.

3. Gross Profit: Calculated as Revenue – COGS, gross profit represents the profit generated after deducting direct production costs. This metric provides insights into production efficiency and pricing effectiveness.

4. Operating Expenses: This section encompasses all expenses incurred in running daily business operations, excluding COGS. Examples include rent, salaries, marketing, and administrative costs. Analyzing operating expenses reveals insights into operational efficiency and resource allocation.

5. Operating Income: Calculated as Gross Profit – Operating Expenses, operating income reflects profitability from core business operations before considering interest and taxes. This metric assesses the efficiency of managing operating expenses and core business functions.

6. Other Income/Expenses: This section includes income or expenses not directly related to core business operations, such as interest income, investment gains, or losses. Inclusion provides a comprehensive financial picture beyond core activities.

7. Income Before Taxes: This represents the income generated before accounting for income tax expenses. It serves as a basis for calculating net income and assessing pre-tax profitability.

8. Income Tax Expense: This section details the expense incurred due to income taxes. Accurate calculation is crucial for compliance and determining net income.

9. Net Income: This bottom-line figure represents the overall profit or loss after accounting for all revenues and expenses, including taxes. Net income is a key indicator of financial performance and overall profitability.

Accurate and consistent presentation of these components provides stakeholders with a comprehensive understanding of financial performance, enabling informed decision-making and strategic planning.

How to Create a Profit and Loss Statement Template

Creating a profit and loss (P&L) statement template provides a standardized framework for analyzing financial performance. A well-designed template ensures consistency, accuracy, and efficient reporting. The following steps outline the process of creating a comprehensive P&L template.

1. Define Reporting Period: Specify the timeframe covered by the statement, whether it’s a month, quarter, or year. A clear reporting period ensures accurate performance analysis within a defined timeframe.

2. Structure Revenue Categories: Establish clear categories for different revenue streams. This might include sales of goods, service fees, or other income sources. Categorization enables detailed revenue analysis.

3. Outline Cost of Goods Sold (COGS): Detail the direct costs associated with producing goods sold. Include line items for raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for gross profit determination.

4. Categorize Operating Expenses: Create categories for operating expenses such as rent, salaries, marketing, and administrative costs. Detailed categorization facilitates expense analysis and cost management.

5. Incorporate Other Income and Expenses: Include sections for non-operating income and expenses like interest income or investment gains/losses. This provides a comprehensive financial overview.

6. Calculate Key Metrics: Include formulas for calculating key performance indicators (KPIs) such as gross profit margin, operating profit margin, and net profit margin. Automated calculations ensure accuracy and efficiency.

7. Design Format and Layout: Choose a clear and easy-to-understand format. Use consistent formatting for headings, subheadings, and data fields. A well-designed layout enhances readability and interpretation.

8. Choose a Platform: Select an appropriate platform for creating the template, such as spreadsheet software or dedicated accounting software. Consider factors like accessibility, collaboration features, and integration with other systems.

A well-structured P&L template, encompassing these components, provides a robust tool for analyzing financial performance, enabling stakeholders to identify trends, make informed decisions, and drive strategic growth. Regular review and refinement of the template ensure its ongoing relevance and effectiveness in reflecting evolving business needs.

Careful analysis reveals the significance of a standardized profit and loss statement template as a cornerstone of sound financial management. From providing a structured overview of financial performance to facilitating informed decision-making, the template’s benefits extend to both internal stakeholders and external parties. Understanding key components, such as revenue streams, cost of goods sold, operating expenses, and key performance indicators, empowers stakeholders to assess operational efficiency, identify trends, and implement data-driven strategies. Simplified reporting, enabled by the template, streamlines internal processes, enhances transparency, and promotes compliance.

Effective utilization of a profit and loss statement template offers organizations a crucial tool for navigating the complexities of the financial landscape. Regular review and analysis of this statement, combined with an understanding of its components and derived metrics, are essential for sustainable growth, informed decision-making, and long-term financial health. This structured approach to financial analysis positions organizations for proactive planning, risk mitigation, and the pursuit of strategic objectives within a dynamic business environment.