Utilizing a formalized structure for forecasting finances facilitates informed decision-making. It enables proactive management of resources, supporting strategic investments, expense control, and securing necessary funding. This foresight allows businesses to navigate economic uncertainties and capitalize on growth opportunities. Furthermore, it enhances stakeholder confidence by demonstrating financial stability and preparedness.

This understanding of financial forecasting provides a foundation for exploring related topics such as budgeting, variance analysis, and financial modeling. It also underscores the importance of accurate data input and regular review for effective financial management.

1. Forecasting Future Inflows

Accurate forecasting of future inflows forms the cornerstone of a reliable projected cash flow statement template. This process involves estimating all potential sources of incoming cash over a specific period. These sources can include sales revenue, investments, loan proceeds, and other forms of income. The accuracy of these projections directly impacts the reliability of the entire cash flow statement and the subsequent financial decisions based upon it. A robust forecasting process considers historical data, market trends, sales pipelines, and external economic factors to arrive at realistic inflow projections.

Consider a manufacturing company launching a new product. Forecasting future inflows requires estimating sales volume based on market research, pre-orders, and competitor analysis. This projected sales revenue, along with other anticipated inflows like existing product sales and interest income, feeds into the projected cash flow statement template. This allows the company to anticipate its financial position and make informed decisions about production capacity, inventory management, and marketing spend. Without accurate inflow projections, the company risks overproduction, stockouts, or insufficient marketing resources, potentially jeopardizing the product launch and overall financial health.

Effective inflow forecasting allows businesses to anticipate periods of strong and weak cash flow. This foresight allows for proactive financial management, including strategic investment decisions, debt management, and operational adjustments. While historical data provides a starting point, incorporating current market dynamics and external factors is essential for achieving realistic projections and ensuring the practical utility of the projected cash flow statement. Understanding the complexities and nuances of inflow forecasting is critical for developing a comprehensive and reliable financial roadmap.

2. Predicting future outflows

Predicting future outflows forms an integral part of a comprehensive projected cash flow statement template. Accurate outflow projections are essential for understanding the overall financial picture and ensuring sustainable business operations. Outflows encompass all anticipated expenses, including operating costs like salaries, rent, and utilities, as well as capital expenditures such as equipment purchases and investments. Accurately forecasting these outflows allows organizations to anticipate potential cash shortfalls and implement proactive measures to mitigate financial risks.

Consider a retail business planning for the holiday season. Predicting future outflows involves estimating increased inventory purchases, additional staffing costs for seasonal workers, and higher marketing expenditures to drive sales. These projected outflows, combined with existing operational expenses like rent and utilities, provide a comprehensive view of anticipated cash needs. This allows the business to secure necessary financing in advance, negotiate favorable terms with suppliers, or adjust pricing strategies to optimize profitability during the peak season. Failure to accurately predict these outflows could lead to cash flow constraints, missed sales opportunities, and ultimately, compromised financial performance.

The practical significance of accurately predicting future outflows extends beyond short-term financial planning. It informs long-term strategic decisions regarding expansion, investment, and resource allocation. By understanding the anticipated outflow patterns, businesses can make data-driven decisions about capital investments, product development, and market entry strategies. While inherent uncertainties exist in any forecasting exercise, utilizing historical data, industry benchmarks, and market analysis enhances the accuracy of outflow projections and improves the overall reliability of the projected cash flow statement as a tool for financial management.

3. Standardized Structure

A standardized structure is fundamental to the efficacy of a projected cash flow statement template. Consistency in format and content allows for clear communication, efficient analysis, and meaningful comparisons across periods and projects. This structure ensures all essential elements are included and presented in a logical order, facilitating informed financial decision-making.

- Categorization of Cash FlowsCash flows are categorized into operating activities, investing activities, and financing activities. This categorization provides a clear picture of cash generation from core business operations, investments in assets, and financing sources. For instance, cash from sales falls under operating activities, while the purchase of equipment belongs to investing activities. This standardized categorization allows stakeholders to analyze the drivers of cash flow and assess financial health.

- Consistent Time IntervalsProjected cash flow statements utilize consistent time intervals, typically monthly or quarterly, for a specified period. This consistent timeframe enables trend analysis and facilitates comparison between actual and projected figures. For example, tracking monthly cash flow projections against actual performance allows businesses to identify variances and implement corrective actions promptly. This regular monitoring enhances financial control and supports proactive management.

- Uniform Reporting FormatA uniform reporting format ensures clarity and comparability. Key metrics like beginning cash balance, net cash flow, and ending cash balance are presented consistently, facilitating understanding and analysis. This standardized format eliminates ambiguity and promotes efficient communication among stakeholders, including investors, lenders, and management.

- Clear Terminology and DefinitionsUtilizing clear terminology and definitions ensures all stakeholders interpret the data consistently. This clarity minimizes misunderstandings and promotes accurate analysis. For instance, clearly defining “free cash flow” eliminates potential confusion and ensures all parties understand its specific meaning within the context of the statement. This precise language enhances the reliability and usefulness of the projected cash flow statement.

The standardized structure of a projected cash flow statement template is crucial for effective financial planning and analysis. By adhering to a consistent format, organizations can generate reliable projections, track performance, and make informed decisions that support financial stability and growth. This structure transforms the template from a simple data collection tool into a powerful instrument for strategic financial management.

4. Financial Planning Tool

A projected cash flow statement template serves as a crucial financial planning tool, enabling organizations to anticipate future financial positions and make informed decisions. It provides a structured framework for projecting future cash inflows and outflows, facilitating proactive management of financial resources.

- Strategic Decision-MakingThe template supports strategic decision-making by providing insights into future cash availability. For example, a business considering expansion can use the projected cash flow statement to assess the financial feasibility of the project, considering the impact on cash flow from increased operating expenses and capital expenditures. This informed approach minimizes financial risks associated with expansion and allows for proactive resource allocation.

- Early Warning SystemThe template acts as an early warning system for potential cash flow shortfalls. By projecting future inflows and outflows, businesses can identify periods where cash flow might be tight. This foresight allows for proactive measures like securing short-term financing, adjusting expenditure plans, or negotiating extended payment terms with suppliers, mitigating the impact of potential financial challenges.

- Performance MonitoringComparing projected cash flow against actual results provides a valuable mechanism for performance monitoring. Variances between projected and actual figures highlight areas requiring attention, enabling timely corrective action. For example, if actual sales consistently fall short of projections, it signals a need to review sales strategies, marketing efforts, or pricing models. This continuous monitoring and adjustment process enhances financial control and improves overall performance.

- Stakeholder CommunicationA well-structured projected cash flow statement enhances communication with stakeholders. It provides investors, lenders, and other stakeholders with a clear picture of the organization’s anticipated financial performance, fostering transparency and building confidence. This clear communication strengthens relationships with stakeholders and facilitates access to capital when needed.

By utilizing a projected cash flow statement template as a financial planning tool, organizations gain valuable insights into their future financial health. This proactive approach to financial management supports informed decision-making, mitigates risks, and fosters sustainable growth. The template’s value lies in its ability to transform financial data into actionable insights, empowering organizations to navigate the complexities of the financial landscape and achieve their strategic objectives.

5. Liquidity Management

Maintaining sufficient liquid assets to meet immediate obligations is crucial for financial stability. A projected cash flow statement template plays a vital role in effective liquidity management by providing a forward-looking view of cash inflows and outflows. This predictive capacity allows organizations to anticipate potential liquidity shortfalls or surpluses and take proactive measures to optimize cash resources.

- Forecasting Short-Term Cash NeedsProjecting cash flows facilitates accurate forecasting of short-term cash needs. By anticipating upcoming expenses and comparing them to projected inflows, organizations can identify potential shortfalls. For example, a seasonal business can anticipate higher inventory needs and increased labor costs during peak seasons, allowing for proactive arrangement of short-term financing or adjustments to operational plans. This foresight minimizes the risk of liquidity crises and ensures smooth business operations.

- Optimizing Cash ResourcesProjected cash flow statements enable organizations to optimize their cash resources. Anticipating periods of surplus liquidity allows for strategic decisions regarding short-term investments, debt reduction, or capital expenditures. Conversely, forecasting potential shortfalls allows for timely cost-cutting measures, renegotiation of payment terms, or securing lines of credit. This proactive approach maximizes the efficient use of cash and minimizes the cost of borrowing.

- Stress Testing Financial PlansProjected cash flow statements enable stress testing of financial plans under various scenarios. By adjusting key assumptions, such as sales growth or economic downturns, organizations can assess their resilience to unexpected events. For instance, a company can model the impact of a sudden drop in sales on its liquidity position, allowing it to develop contingency plans to mitigate potential negative consequences. This scenario planning enhances preparedness and strengthens financial stability.

- Enhancing Stakeholder ConfidenceDemonstrating effective liquidity management through robust cash flow projections enhances stakeholder confidence. Investors and lenders gain assurance in the organization’s ability to meet its financial obligations, fostering trust and improving access to capital. This enhanced credibility supports long-term financial stability and growth.

Effective liquidity management, facilitated by a projected cash flow statement template, is essential for sustained financial health. By providing a clear view of future cash flows, the template empowers organizations to anticipate and manage liquidity challenges, optimize cash resources, and build stakeholder confidence. This proactive approach to liquidity management is crucial for navigating economic uncertainties and achieving long-term financial success.

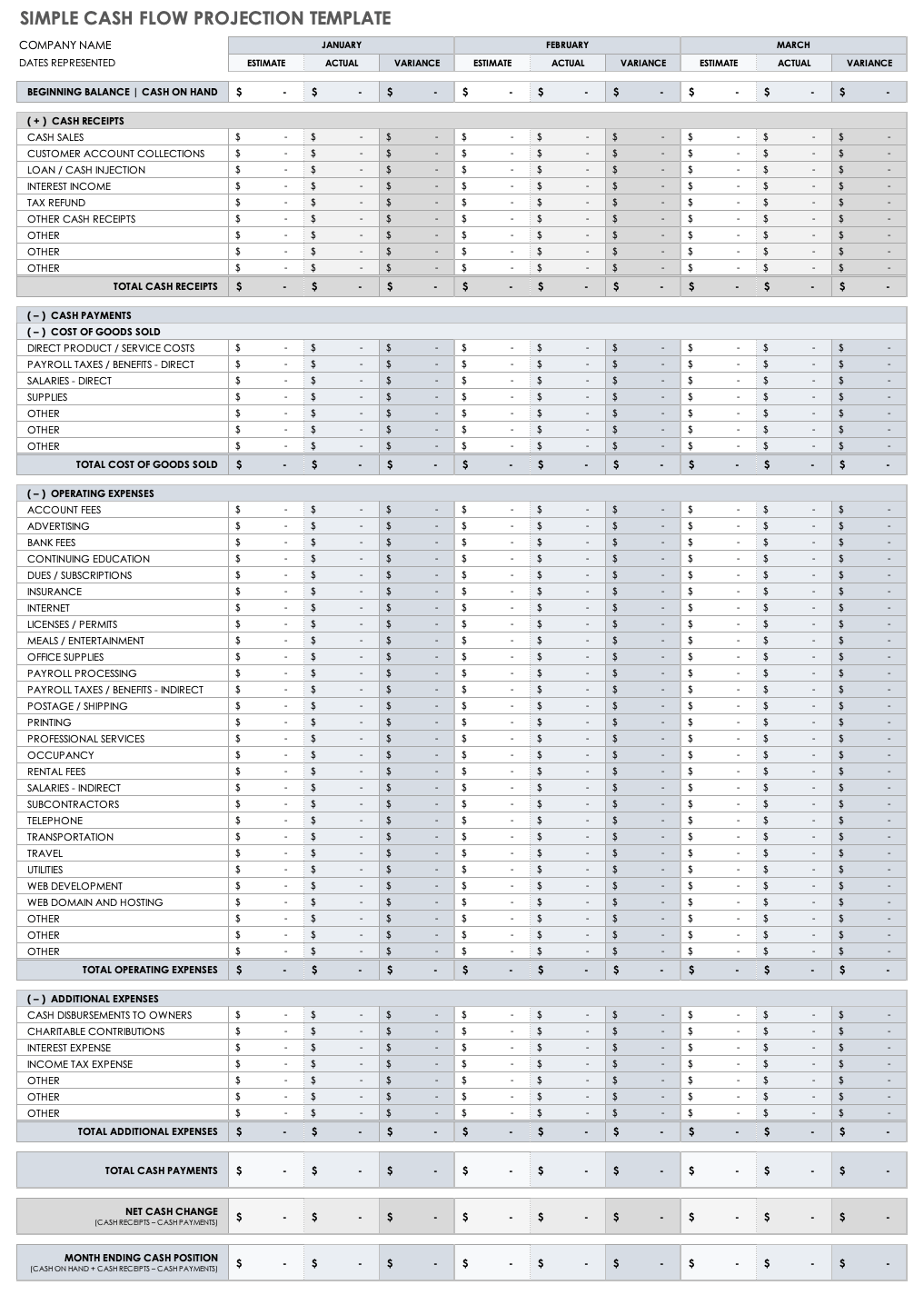

Key Components of a Projected Cash Flow Statement Template

A robust projected cash flow statement template comprises several key components, each contributing to a comprehensive understanding of future liquidity. These components provide a structured framework for anticipating and managing financial resources.

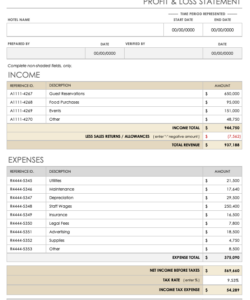

1. Operating Activities: This section details cash flows generated from core business operations. Key elements include cash receipts from customers, payments to suppliers, salary disbursements, and other operating expenses. Accurate projections of these elements are crucial for assessing the profitability and sustainability of core business activities.

2. Investing Activities: This section captures cash flows related to investments in long-term assets. Key elements include capital expenditures on property, plant, and equipment, as well as investments in other businesses or securities. Projecting these cash flows is essential for evaluating investment strategies and their impact on overall liquidity.

3. Financing Activities: This section details cash flows related to financing the business. Key elements include proceeds from debt or equity financing, loan repayments, and dividend payments. Accurate projections in this section are vital for understanding the organization’s capital structure and its impact on future cash flows.

4. Beginning Cash Balance: This represents the cash available at the start of the projected period. It serves as the foundation upon which projected inflows and outflows are built, providing context for the ending cash balance.

5. Net Cash Flow: This represents the difference between total cash inflows and total cash outflows during the projected period. A positive net cash flow indicates a surplus, while a negative net cash flow signifies a deficit. This key metric provides a concise overview of the organization’s projected cash position.

6. Ending Cash Balance: This signifies the projected cash on hand at the end of the period. It is calculated by adding the net cash flow to the beginning cash balance. This figure is crucial for assessing liquidity and ensuring the organization’s ability to meet its financial obligations.

7. Assumptions and Supporting Schedules: This component provides details about the underlying assumptions used in the projections, adding transparency and context to the statement. Supporting schedules offer detailed breakdowns of specific line items, enhancing the overall understanding of the projected cash flows. These details are vital for validating the projections and assessing their reliability.

These interconnected components provide a holistic view of projected liquidity, enabling informed decision-making and effective financial management. The template facilitates proactive planning, risk mitigation, and ultimately, sustainable financial performance by accurately capturing anticipated cash flows and providing a structured framework for analysis.

How to Create a Projected Cash Flow Statement Template

Creating a projected cash flow statement template requires a structured approach and careful consideration of key financial elements. The following steps outline the process of developing a robust and informative template.

1. Define the Reporting Period: Specify the timeframe for the projected cash flow statement, whether monthly, quarterly, or annually. This timeframe should align with the organization’s financial planning cycle and provide sufficient granularity for analysis.

2. Establish a Baseline: Utilize historical financial data, if available, to establish a baseline for projections. Prior period performance provides valuable insights into cash flow patterns and trends, informing more accurate future projections.

3. Project Operating Activities: Estimate cash inflows from sales and other revenue streams. Project cash outflows for operating expenses, including salaries, rent, utilities, and raw materials. Consider factors influencing these flows, such as sales growth projections and anticipated cost increases.

4. Project Investing Activities: Estimate cash outflows for capital expenditures, such as purchasing equipment or property. Include cash inflows from the sale of existing assets or investments. Consider planned investments and their timing within the reporting period.

5. Project Financing Activities: Estimate cash inflows from debt or equity financing. Project cash outflows for loan repayments, lease payments, and dividend distributions. Incorporate planned financing activities and their impact on cash flows.

6. Calculate Net Cash Flow: Determine the net cash flow for each period by subtracting total cash outflows from total cash inflows. This metric provides a concise overview of the projected cash position.

7. Determine Ending Cash Balance: Calculate the ending cash balance for each period by adding the net cash flow to the beginning cash balance. This figure is crucial for assessing liquidity and ensuring the ability to meet financial obligations.

8. Document Assumptions: Clearly document the key assumptions underlying the projections. These assumptions should include factors such as sales growth rates, cost inflation, and financing terms. This transparency enhances the credibility and understandability of the projected cash flow statement.

Developing a robust projected cash flow statement template provides a crucial tool for financial planning and analysis. The outlined process ensures a structured and comprehensive approach, enhancing the reliability and usefulness of the projections for informed decision-making.

Accurate financial forecasting is essential for sound financial management. A structured approach, utilizing a projected cash flow statement template, provides a framework for anticipating future liquidity, enabling informed decision-making regarding resource allocation, investment strategies, and debt management. Understanding the key components, including operating activities, investing activities, and financing activities, allows for a comprehensive view of projected cash inflows and outflows. The process involves defining the reporting period, establishing a baseline, projecting cash flows for each activity, calculating net cash flow and ending cash balance, and documenting key assumptions. A robust template incorporates historical data, market trends, and external economic factors to enhance projection accuracy.

Effective utilization of a projected cash flow statement template empowers organizations to navigate financial uncertainties, optimize cash resources, and achieve strategic objectives. Regular review and refinement of projections, incorporating actual performance data and adjusting for changing market conditions, further enhance the template’s value as a dynamic financial management tool. This proactive approach to financial planning is crucial for long-term stability and sustainable growth.