Utilizing this type of financial projection offers several advantages. It allows businesses to anticipate potential financial challenges and opportunities, enabling proactive adjustments to strategies and operations. Furthermore, it facilitates better resource allocation, informed pricing decisions, and more effective cost management. It also provides a valuable benchmark for measuring actual performance against planned results, enabling data-driven analysis and continuous improvement. Finally, it can be a crucial tool for securing funding from investors or lenders, demonstrating financial viability and growth potential.

This foundational understanding of financial forecasting provides a basis for exploring the key components and practical applications of these crucial planning tools in more detail.

1. Forecasting Revenue

Revenue forecasting forms the cornerstone of a projected profit and loss statement. Accurate revenue projections are essential for determining profitability, planning resource allocation, and making informed business decisions. Without a realistic assessment of future income, the remaining elements of the statement lack a solid foundation.

- Sales Volume ProjectionsPredicting the quantity of products or services sold within the given timeframe is crucial. This involves analyzing market trends, historical sales data, and anticipated market share. For example, a retail business might predict sales volume based on factors like seasonal demand, advertising campaigns, and competitor activity. Inaccurate sales volume projections can significantly impact the accuracy of the entire profit and loss statement.

- Pricing StrategiesThe pricing of products or services directly affects revenue. Factors like competitor pricing, cost of goods sold, and perceived value influence pricing decisions. A software-as-a-service company might analyze competitor pricing models and customer willingness to pay to determine optimal subscription fees. This directly impacts the projected revenue figures.

- Sales Mix ConsiderationsBusinesses selling multiple products or services must consider the projected sales mix. The proportion of each offering sold influences overall revenue, as different products may have different profit margins. For instance, a restaurant needs to estimate the popularity of individual menu items to accurately project overall revenue. This impacts both revenue projections and cost of goods sold estimates.

- Market Analysis and Growth AssumptionsUnderstanding market dynamics and making reasonable assumptions about future growth is essential. Factors like economic conditions, industry trends, and competitive landscape play a significant role. A manufacturer might analyze industry growth projections and market share trends to estimate future sales. These assumptions directly inform the revenue projections within the projected profit and loss statement.

These facets of revenue forecasting directly impact the accuracy and reliability of a projected profit and loss statement. A well-informed revenue projection, based on careful analysis and realistic assumptions, provides a solid foundation for sound financial planning and decision-making.

2. Projecting Expenses

Accurately projecting expenses is crucial for a realistic and useful projected profit and loss statement. A comprehensive understanding of anticipated costs allows businesses to forecast profitability, manage resources effectively, and make informed financial decisions. Underestimating or overlooking expenses can lead to inaccurate projections and potentially jeopardize financial stability.

- Cost of Goods Sold (COGS)For businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, manufacturing labor, and direct overhead. Accurately projecting COGS is essential for determining gross profit margins. For example, a furniture manufacturer must project the cost of lumber, hardware, and labor required to produce its furniture. These projections directly impact the overall profitability estimates on the statement.

- Operating ExpensesOperating expenses encompass the costs incurred in running the business outside of direct production. These include rent, salaries, marketing expenses, and administrative costs. Projecting these recurring costs provides insights into the overall financial efficiency of the business. For instance, a software company must project salaries for its development team, marketing costs for new customer acquisition, and rent for its office space. Accurate projections of these operating expenses are crucial for realistic profitability forecasting.

- Variable vs. Fixed CostsDistinguishing between variable and fixed costs is essential for accurate expense projection. Variable costs fluctuate with sales volume (e.g., commissions, raw materials), while fixed costs remain constant regardless of sales (e.g., rent, salaries). Understanding this distinction allows businesses to adjust projections based on anticipated sales volume. For example, a retail store must project variable costs like sales commissions based on projected sales, while rent remains fixed regardless of sales volume. This analysis informs more accurate and adaptable expense projections.

- Depreciation and AmortizationDepreciation reflects the decrease in value of tangible assets over time, while amortization accounts for the decline in value of intangible assets. Including these non-cash expenses in the projected profit and loss statement provides a more complete picture of the business’s financial position. For example, a manufacturing company needs to account for the depreciation of its machinery, affecting profitability projections over time. This allows for more accurate long-term financial planning.

By carefully considering these expense categories and accurately projecting future costs, businesses create a more reliable and insightful projected profit and loss statement. This comprehensive view of anticipated expenses facilitates more effective financial planning, resource allocation, and informed decision-making.

3. Estimating Profitability

Estimating profitability represents a core objective of a projected profit and loss statement template. This process translates projected revenues and expenses into anticipated profit figures, providing crucial insights into the financial viability and potential success of business ventures. Accurate profitability estimation informs strategic decision-making, resource allocation, and performance evaluation.

- Gross Profit MarginGross profit margin represents the percentage of revenue remaining after deducting the direct costs associated with producing goods or services (COGS). Calculating projected gross profit margin provides insights into the efficiency of production and pricing strategies. For example, a manufacturing company might aim for a specific gross profit margin to ensure sufficient funds for covering operating expenses and generating profit. This metric within the projected statement allows businesses to evaluate the viability of their pricing and production processes.

- Operating Profit MarginOperating profit margin reflects the percentage of revenue remaining after deducting both COGS and operating expenses. This metric indicates the profitability of core business operations, excluding interest and taxes. A software company, for instance, uses projected operating profit margin to assess the efficiency of its operations and resource allocation. Within the projected statement, this figure helps evaluate the long-term sustainability and financial health of the business.

- Net Profit MarginNet profit margin represents the final profitability measure after all expenses, including interest and taxes, have been deducted from revenue. This metric reflects the overall profitability of the business. A retail business, for example, utilizes projected net profit margin to evaluate its overall financial performance and potential return on investment. Within the projected statement, this bottom-line figure serves as a key indicator of financial success and informs investor decisions.

- Sensitivity Analysis and Scenario PlanningProfitability estimates benefit from sensitivity analysis and scenario planning. This involves adjusting key assumptions, such as sales volume or pricing, to understand the impact on profitability under different scenarios. For instance, a construction company might model different material cost scenarios to understand their potential impact on project profitability. This practice, reflected within the projected statement through various scenarios, enhances the understanding of potential risks and opportunities, leading to more informed decision-making.

These elements of profitability estimation, integrated within a projected profit and loss statement template, provide a comprehensive view of a business’s financial outlook. This forward-looking perspective facilitates proactive adjustments to strategies, informed resource allocation, and ultimately, contributes to achieving financial objectives. By analyzing projected profit margins and conducting sensitivity analyses, businesses gain valuable insights into their potential financial performance and make more informed decisions to maximize profitability.

4. Time Horizon

The time horizon chosen for a projected profit and loss statement significantly influences its structure, level of detail, and overall purpose. Selecting an appropriate timeframe is crucial for aligning the projection with specific business objectives and ensuring its practical utility. The time horizon dictates the granularity of data required and the types of analyses performed. A short-term horizon, such as a month or quarter, requires detailed projections of revenue and expenses, focusing on operational efficiency and short-term performance. Conversely, a long-term horizon, spanning multiple years, emphasizes broader trends, strategic investments, and long-term growth projections. For example, a startup seeking seed funding might project its financials for three to five years, focusing on demonstrating growth potential, while an established retail business might project its next quarter’s performance to manage inventory and optimize staffing levels.

The interplay between time horizon and projected profit and loss statements manifests in several practical applications. Short-term projections inform operational decisions like pricing adjustments, inventory management, and marketing campaigns. Long-term projections, on the other hand, support strategic planning, capital investment decisions, and long-term growth initiatives. For instance, a manufacturer using a one-year time horizon might focus on optimizing production schedules and managing raw material costs. In contrast, a technology company using a five-year horizon might prioritize research and development investments and market expansion strategies. The chosen timeframe directly impacts the allocation of resources and the prioritization of business activities.

Understanding the crucial role of the time horizon in a projected profit and loss statement is essential for effective financial planning and decision-making. Selecting the appropriate timeframe ensures that the projection aligns with business objectives, provides relevant insights, and supports informed decisions across different operational and strategic contexts. Failing to carefully consider the time horizon can lead to inaccurate projections, misallocation of resources, and ultimately, hinder the achievement of financial goals. Therefore, aligning the time horizon with the specific purpose of the projected statement is paramount for its practical value and contribution to business success.

5. Key Assumptions

Key assumptions underpin the entire structure of a projected profit and loss statement template. These assumptions represent educated guesses about future conditions, both internal and external to the organization, that influence projected financial outcomes. They bridge the gap between historical data and future expectations, providing a basis for financial projections. Without clearly defined and justifiable assumptions, the projected statement loses its credibility and predictive power. For instance, a retail business projecting holiday season sales might assume a certain percentage increase based on prior years’ trends and planned marketing campaigns. This assumption, along with others related to staffing costs and inventory levels, directly impacts projected revenue, expenses, and ultimately, profitability. The validity of these assumptions directly influences the reliability of the entire projection.

The cause-and-effect relationship between key assumptions and projected financial figures is crucial. Changes in assumptions, even seemingly minor ones, can ripple through the entire projected profit and loss statement, leading to significant variations in projected outcomes. Consider a manufacturing company projecting raw material costs. An assumption of stable prices might lead to one projected profit margin, while an assumption of rising prices, due to supply chain disruptions for example, would lead to a different, likely lower, projected margin. Understanding this dynamic underscores the importance of carefully considering and documenting all key assumptions. Sensitivity analysis, wherein key assumptions are systematically varied, provides insights into the potential range of financial outcomes and the inherent risks associated with each assumption. This practice enhances the understanding of the potential impact of unforeseen circumstances and allows for more informed contingency planning.

Transparency and justification are paramount when outlining key assumptions. Clearly stating the rationale behind each assumption strengthens the credibility of the projected profit and loss statement and facilitates informed decision-making. This transparency is particularly critical when presenting the projected statement to external stakeholders, such as investors or lenders. They need to understand the underlying assumptions to assess the reliability and potential risks associated with the projected financials. For example, a technology startup projecting rapid user growth must articulate the assumptions underlying this projection, including market penetration rates, customer acquisition costs, and competitive landscape analysis. Robust justification strengthens the credibility of the projection and enhances its value as a decision-making tool.

Key Components of a Projected Profit and Loss Statement

A well-structured projected profit and loss statement requires careful consideration of several key components. These components work together to provide a comprehensive view of a company’s anticipated financial performance.

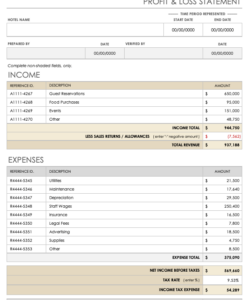

1. Revenue Projections: Forecasted revenue forms the foundation of the statement. This component details anticipated sales, incorporating factors such as sales volume, pricing strategies, sales mix, and market growth assumptions. Accurate revenue projections are crucial for determining overall profitability.

2. Cost of Goods Sold (COGS): For businesses dealing with physical products, COGS represents the direct costs associated with production. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS projections are essential for determining gross profit margins.

3. Operating Expenses: These expenses encompass the costs of running the business beyond direct production costs. Examples include rent, salaries, marketing and advertising expenses, and administrative costs. Projecting operating expenses provides insight into the overall efficiency of the business operations.

4. Other Expenses: This category captures expenses not directly tied to core operations, such as interest expense, depreciation, and amortization. Incorporating these expenses provides a more complete picture of the company’s financial obligations.

5. Profitability Metrics: Several key profitability metrics are derived from the projected revenue and expenses. These include gross profit margin, operating profit margin, and net profit margin. These metrics provide crucial insights into the financial health and potential success of the business.

6. Time Horizon: The chosen time horizon (monthly, quarterly, annual, or multi-year) dictates the level of detail and the overall purpose of the projection. Short-term projections focus on operational efficiency, while long-term projections emphasize strategic planning and growth trajectories.

7. Key Assumptions: Underlying the entire projected statement are key assumptions about future conditions, both internal and external. These assumptions, based on market research, historical data, and industry trends, influence all projected figures. Clearly stated and justified assumptions are crucial for the credibility and reliability of the statement.

These components work interdependently to create a robust financial projection. Careful consideration of each element ensures the accuracy and reliability of the projected profit and loss statement, enabling informed decision-making and effective financial planning.

How to Create a Projected Profit and Loss Statement

Creating a projected profit and loss statement involves a systematic process of estimating future financial performance. This process requires careful consideration of various factors, including historical data, market trends, and internal business strategies.

1. Define the Time Horizon: Establish the period the projection will cover (e.g., monthly, quarterly, annually, or multi-year). The time horizon influences the level of detail and the overall focus of the projection.

2. Project Revenue: Forecast sales revenue based on market analysis, historical data, anticipated sales volume, pricing strategies, and sales mix. This forms the basis for subsequent calculations.

3. Estimate Cost of Goods Sold (COGS): For businesses selling physical products, determine the direct costs associated with production, including raw materials, direct labor, and manufacturing overhead.

4. Project Operating Expenses: Estimate recurring costs associated with running the business, such as rent, salaries, marketing and advertising expenses, and administrative overhead.

5. Include Other Expenses: Account for expenses not directly tied to core operations, such as interest expense, depreciation, and amortization. These provide a more complete financial picture.

6. Calculate Profitability Metrics: Determine key profitability metrics like gross profit margin, operating profit margin, and net profit margin based on the projected revenue and expense figures.

7. Document Key Assumptions: Clearly articulate all underlying assumptions about future conditions, both internal and external, that influence the projected figures. This enhances transparency and allows for sensitivity analysis.

8. Review and Refine: Regularly review and refine the projected statement as new information becomes available or business conditions change. This ensures the projection remains relevant and useful for decision-making.

A robust projected profit and loss statement provides a crucial tool for financial planning, resource allocation, and performance evaluation. By systematically following these steps and maintaining a rigorous approach to data analysis and assumption justification, organizations can develop a reliable and insightful projection that supports informed decision-making and contributes to achieving financial objectives.

Financial projections, utilizing structured templates, offer a crucial tool for businesses seeking to navigate the complexities of the financial landscape. Through meticulous forecasting of revenue and expenses, these templates provide a framework for estimating profitability and understanding the potential financial implications of various business strategies. A detailed examination of key components, including cost of goods sold, operating expenses, and key assumptions, allows for a comprehensive understanding of the factors influencing financial outcomes. The importance of selecting an appropriate time horizon and conducting sensitivity analysis further enhances the value of these projections as decision-making tools.

Effective utilization of these financial tools empowers organizations to make informed decisions regarding resource allocation, pricing strategies, and operational efficiency. By embracing a proactive approach to financial planning and leveraging the insights derived from projected financial statements, businesses can position themselves for sustainable growth and long-term success in a dynamic and ever-evolving market. A well-constructed projection serves not only as a roadmap for future performance but also as a testament to a commitment to sound financial management and strategic foresight.