Utilizing such a document offers numerous advantages. It simplifies financial tracking, facilitating informed decision-making regarding property investments. Regular access to clear financial data empowers owners to monitor performance, identify potential issues, and optimize their investment strategies. This transparency also strengthens the relationship between owners and management companies, fostering trust and mutual understanding.

This foundational understanding of organized financial reporting is essential for exploring the more nuanced aspects of property management, including best practices, legal considerations, and technological advancements. The following sections will delve into these topics, providing valuable insights for both property owners and managers.

1. Accuracy

Accuracy forms the bedrock of reliable financial reporting in property management. Inaccurate figures within an owner statement can lead to misinformed decisions with potentially significant financial consequences. For example, an understated vacancy rate could lead an owner to overestimate projected income and make unwise investment choices. Similarly, overstated repair expenses might trigger unnecessary investigations and distrust between owner and manager. The ripple effect of inaccurate data can impact everything from budgeting and forecasting to tax liabilities and property valuations.

Maintaining accuracy requires diligent data entry, robust accounting practices, and regular reconciliation of accounts. Property management software plays a crucial role by automating calculations and reducing human error. Regular audits, both internal and external, can further enhance accuracy and identify any systemic issues. Consider a scenario where inconsistent recording of late fees leads to discrepancies between the collected amount and the reported income. This inaccuracy not only misrepresents the property’s financial health but can also erode trust between the owner and management.

Ultimately, accurate financial reporting fosters trust, supports informed decision-making, and contributes to the successful management of the property. Addressing potential challenges related to data entry, system integration, and human error is crucial for maintaining accuracy and ensuring the overall integrity of the financial information provided to property owners. This meticulous approach to accuracy strengthens the foundation upon which successful property management is built.

2. Clarity

Clarity within a property management owner statement is paramount for effective communication and informed decision-making. A clear statement ensures property owners can readily understand the financial performance of their investments. This clarity hinges on several factors, including logical organization, concise language, and visually appealing presentation. Consider a scenario where an owner statement combines multiple property reports into a single, undifferentiated document. The lack of clear separation between properties makes it difficult to assess individual performance, potentially obscuring issues specific to one investment. Similarly, using technical jargon without explanation can create confusion and hinder an owner’s ability to grasp the financial picture.

Well-defined sections, clear headings, and consistent formatting contribute significantly to clarity. Each element of the statement, from income and expenses to net operating income and cash flow, should be presented in a way that is easy to locate and interpret. Visual aids, such as charts and graphs, can further enhance understanding, particularly when presenting trends over time. Imagine a statement that visually represents maintenance expenses over the past year. A clear upward trend would immediately highlight a potential issue requiring further investigation, whereas this trend might be lost within pages of numerical data. The strategic use of visuals transforms complex data into readily digestible insights.

Clarity empowers property owners to actively engage with their investment’s financial performance. It facilitates proactive decision-making, allows for timely identification of potential problems, and strengthens the relationship between owner and property manager. The absence of clarity, however, can breed mistrust and lead to missed opportunities for optimization. Therefore, prioritizing clarity within owner statements is an essential component of effective property management. This emphasis on clear and accessible financial reporting underscores a commitment to transparency and facilitates a collaborative approach to achieving investment goals.

3. Consistency

Consistency in property management owner statements is crucial for accurate financial analysis and trend identification. Standardized reporting allows for seamless comparison across different periods, properties, or portfolios. This facilitates informed decision-making based on reliable and comparable data. Without consistent formatting and content, identifying meaningful trends and potential issues becomes significantly more challenging.

- PeriodicityRegular reporting intervals, whether monthly, quarterly, or annually, establish a consistent timeframe for evaluating performance. Imagine comparing a monthly statement to an annual one; the disparity in timeframe makes it nearly impossible to assess short-term trends or identify emerging issues. Consistent periodicity ensures data is comparable and provides a reliable basis for tracking progress and identifying deviations from expected performance.

- TerminologyUsing the same terminology throughout all statements avoids ambiguity and ensures clear communication. For example, consistently labeling “operating expenses” prevents confusion that might arise if different terms like “overhead” or “running costs” are used interchangeably. Standardized terminology allows property owners to readily understand the information presented and avoids misinterpretations that could lead to incorrect conclusions about financial performance.

- FormattingConsistent formatting, including the placement of key data points and the use of consistent visual elements, enhances readability and facilitates quick comparisons. If income is presented at the top of one statement and at the bottom of another, it creates unnecessary work for the owner to locate essential information. Consistent formatting streamlines the review process, allowing owners to quickly access and compare key financial metrics.

- MetricsTracking the same key performance indicators (KPIs) across all statements provides a consistent framework for evaluating property performance. Inconsistency in reported metrics, such as fluctuating inclusion or exclusion of vacancy rates, makes it challenging to assess performance trends accurately. Consistent use of KPIs ensures a standardized approach to performance measurement, facilitating reliable analysis and comparison across properties and periods.

These facets of consistency contribute to a more effective and transparent reporting process. This allows property owners to gain clear, reliable insights into their investments, fostering trust and enabling data-driven decisions. Consistent reporting empowers both property managers and owners to work collaboratively toward shared financial goals, optimizing investment strategies and ensuring long-term success.

4. Comprehensiveness

Comprehensiveness in a property management owner statement is essential for providing a holistic view of an investment’s financial performance. A comprehensive statement encompasses all relevant income and expense categories, offering a complete and accurate picture of profitability. This detailed overview empowers owners to make well-informed decisions based on a thorough understanding of their investment’s financial health. For instance, a statement omitting details about specific operating expenses, such as landscaping or pest control, could mislead an owner about the true cost of property ownership. This lack of comprehensiveness might lead to inaccurate profit projections and hinder effective budgeting.

Furthermore, a comprehensive statement should include not only current financial data but also historical information and future projections. This allows for trend analysis, performance benchmarking, and proactive planning. Consider a scenario where an owner statement only includes current month data. Without historical context, it becomes difficult to assess whether current performance is improving or declining. The inclusion of historical data and projections provides valuable context for interpreting current performance and anticipating future challenges or opportunities. Moreover, detailed breakdowns within each income and expense category, such as specifying the types of maintenance performed or the sources of rental income, further enhance the statement’s analytical value. This granular level of detail allows owners to pinpoint areas for potential cost savings or revenue growth.

In conclusion, comprehensiveness is a critical attribute of effective property management owner statements. It ensures transparency, facilitates informed decision-making, and fosters a stronger understanding of investment performance. The absence of key data points can lead to misinterpretations, hindering effective management and potentially impacting the overall success of the investment. A comprehensive approach to financial reporting provides the necessary insights to navigate the complexities of property ownership and optimize investment strategies.

5. Timeliness

Timely delivery of property management owner statements is crucial for effective oversight and informed decision-making. Statements provide a snapshot of an investment’s financial health, enabling owners to monitor performance, identify potential issues, and make strategic adjustments. Delayed information renders these functions less effective, hindering the ability to respond proactively to changing market conditions or property-specific challenges. A delayed statement might obscure a developing problem, such as a rising vacancy rate or increasing maintenance costs, preventing timely intervention and potentially exacerbating the issue.

- Prompt Issue IdentificationTimely statements facilitate prompt identification of emerging issues, such as late rent payments, escalating repair costs, or increasing vacancy rates. Early awareness allows for swift corrective action, mitigating potential financial losses. For example, a promptly delivered statement revealing a sudden increase in maintenance expenses might trigger an investigation into the underlying cause, potentially uncovering a major repair need that, if left unaddressed, could lead to significantly higher costs down the line.

- Informed Decision-MakingTimely access to financial data empowers owners to make informed decisions regarding their investments. Whether considering rent adjustments, property improvements, or refinancing options, up-to-date information is essential. Consider a scenario where an owner is contemplating property upgrades. A timely statement providing current income and expense data allows for accurate assessment of the potential return on investment and informs a more strategic decision-making process.

- Accurate Budgeting and ForecastingTimely statements provide the necessary data for accurate budgeting and forecasting. Predicting future performance relies on understanding current trends and financial standing. A delayed statement can skew projections, potentially leading to inaccurate budget allocations and hindering effective financial planning. For instance, relying on outdated income figures can lead to overly optimistic budget projections, potentially creating financial shortfalls later on.

- Strengthened Owner-Manager RelationshipConsistent and timely delivery of statements fosters trust and transparency between property owners and managers. This open communication strengthens the professional relationship and contributes to a more collaborative approach to property management. Conversely, consistently late statements can erode trust and create tension, hindering effective communication and potentially impacting the overall success of the management relationship.

In the dynamic landscape of property management, timely access to financial information is paramount. Delays can have cascading effects, impacting everything from issue identification and decision-making to budgeting and forecasting. The consistent and timely delivery of comprehensive owner statements is a cornerstone of effective property management, fostering transparency, enabling proactive responses, and contributing to the long-term success of the investment. By prioritizing timeliness, property managers demonstrate a commitment to accountability and empower owners with the knowledge necessary to navigate the complexities of property ownership effectively.

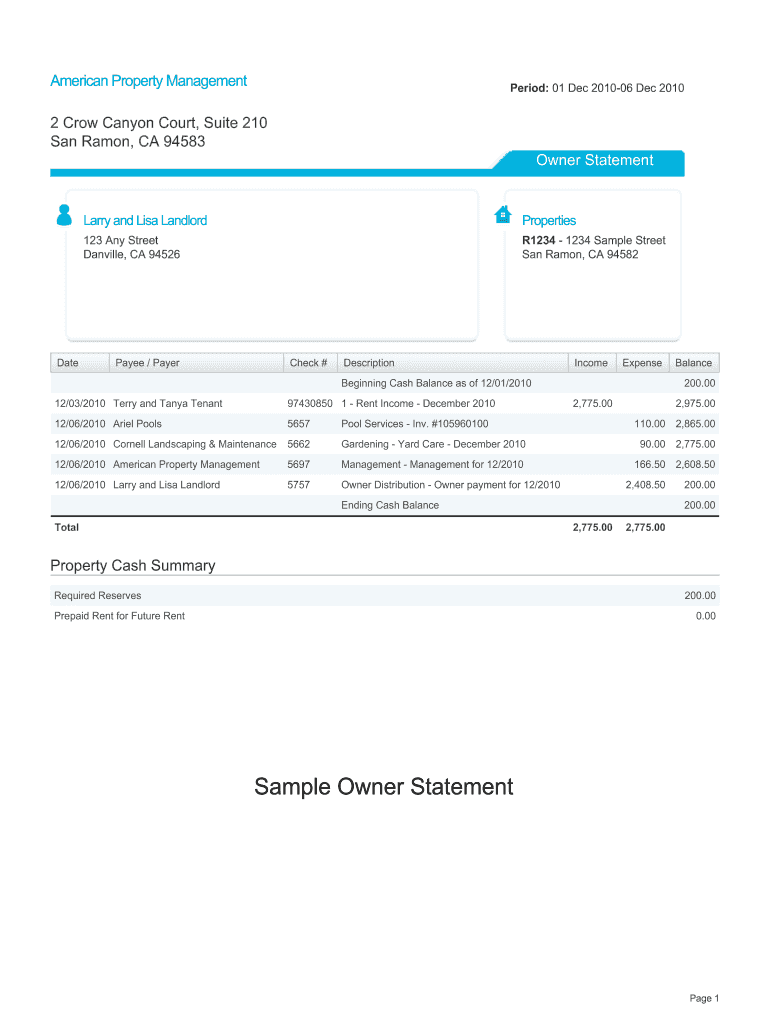

Key Components of a Property Management Owner Statement

A well-structured owner statement provides a clear and comprehensive overview of a property’s financial performance. Several key components contribute to this clarity and comprehensiveness, enabling effective monitoring and informed decision-making.

1. Property Identification: Clear identification of the property, including address and unit number (if applicable), is essential for accurate record-keeping and avoids confusion when managing multiple properties.

2. Reporting Period: The statement must clearly specify the reporting period, whether it’s a month, quarter, or year. This allows for accurate tracking of performance over time and facilitates comparisons across different periods.

3. Income Summary: This section details all income generated during the reporting period, including rental income, late fees, and any other miscellaneous income sources. Detailed breakdowns within this section, such as specifying income from individual units, further enhance transparency.

4. Expense Summary: A comprehensive breakdown of all expenses incurred during the reporting period is crucial. This includes operating expenses (e.g., maintenance, repairs, utilities, property taxes, insurance) and any capital expenditures. Itemized lists within each expense category provide granular detail and facilitate analysis of spending patterns.

5. Net Operating Income (NOI): Calculated by subtracting total operating expenses from total income, NOI represents the property’s profitability before accounting for debt service or other financial obligations. This key metric provides a clear picture of the property’s operating efficiency.

6. Beginning and Ending Balance: Including the beginning and ending cash balances for the reporting period provides context for understanding cash flow dynamics and allows for tracking of available funds.

7. Management Fees: Transparent reporting of management fees, including the fee structure and amount charged during the reporting period, ensures clarity and accountability.

8. Additional Notes or Comments: This section allows for inclusion of any relevant contextual information, such as explanations for unusual expenses or updates on ongoing projects. This narrative element complements the numerical data and provides valuable insights.

These components work together to create a robust and informative document that empowers property owners with the knowledge necessary for effective financial management and strategic decision-making.

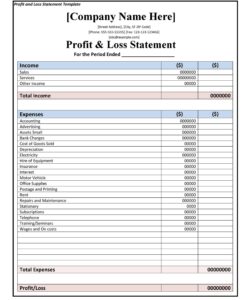

How to Create a Property Management Owner Statement Template

Creating a standardized template ensures consistent and comprehensive reporting of property financials. This structured approach facilitates clarity, simplifies analysis, and promotes informed decision-making.

1. Define the Reporting Period: Establish a consistent reporting timeframe (monthly, quarterly, or annually). This ensures comparability across periods and facilitates trend analysis. Clearly indicate the specific dates covered by the statement.

2. Property Identification: Include fields for essential property details, such as the full address and unit number (if applicable). This ensures accurate record-keeping and avoids confusion when managing multiple properties.

3. Income Section: Structure this section to capture all income sources. Include line items for rental income, late fees, application fees, and other miscellaneous income. Provide space for detailed breakdowns, such as rent collected from individual units within a multi-unit property.

4. Expense Section: Create a comprehensive expense section encompassing all potential operating costs. Categorize expenses logically (e.g., maintenance, repairs, utilities, taxes, insurance, management fees). Allow for itemized entries within each category to provide granular detail and facilitate analysis.

5. Calculations: Incorporate formulas to automatically calculate key metrics like Net Operating Income (NOI), which is derived by subtracting total operating expenses from total income. This automation minimizes manual calculations and reduces the risk of errors.

6. Balance Summary: Include fields for the beginning and ending balance for the reporting period. This provides context for understanding cash flow dynamics and allows for tracking of available funds.

7. Management Fees: Clearly outline the management fee structure and include a dedicated line item for the fees charged during the reporting period. This promotes transparency and accountability.

8. Notes and Comments: Incorporate a section for additional notes or comments. This space allows for explanations of unusual fluctuations, updates on ongoing projects, or other pertinent information that adds context to the numerical data.

A well-designed template incorporating these elements provides a clear, consistent, and comprehensive overview of property financials, empowering owners with the information necessary for effective oversight and informed decision-making. Regular review and refinement of the template, based on evolving needs and best practices, further enhances its value and ensures its continued effectiveness as a management tool.

Accurate, clear, consistent, comprehensive, and timely financial reporting, as facilitated by a well-designed template, forms the cornerstone of effective property management. Such reporting empowers owners with the insights necessary for informed decision-making, fostering transparency and accountability within the owner-manager relationship. Understanding the key components of these statements, from income and expense summaries to net operating income calculations, allows for a more thorough analysis of property performance and facilitates proactive management strategies.

Effective utilization of these tools contributes significantly to optimized financial outcomes and the long-term success of property investments. Continual refinement of reporting processes, incorporating best practices and technological advancements, remains crucial for navigating the evolving complexities of the property management landscape. This commitment to robust financial reporting underscores a dedication to maximizing investment potential and achieving sustained growth.