Regularly using such a structured document allows businesses to monitor performance, identify trends, and make informed decisions. This practice facilitates proactive financial management, enabling adjustments to strategies and operations based on real-time data. It also assists in forecasting future performance and securing financing by demonstrating financial stability and predictability to lenders and investors.

The following sections delve deeper into the specific components, practical applications, and best practices associated with effectively managing short-term financial performance through this structured approach.

1. Standardized Format

A standardized format is essential for ensuring consistency and comparability in financial reporting, particularly within the context of a document used to track short-term cash flow. This consistency allows for accurate trend analysis, performance evaluation, and informed decision-making over time. Adhering to a standardized structure facilitates internal review and external audits, promoting transparency and enhancing stakeholder confidence.

- Consistent StructureA consistent structure ensures all essential elements are included and presented uniformly. This typically involves sections for operating activities, investing activities, and financing activities. Each section adheres to a predefined format, allowing for easy comparison across different reporting periods. This consistent presentation facilitates the identification of significant changes and trends within each activity category.

- Comparable PeriodsStandardization enables direct comparison between quarters, facilitating the identification of seasonal trends and performance fluctuations. Comparing current performance to the same quarter of the previous year reveals growth patterns and potential areas for improvement. This comparative analysis provides valuable insights for strategic planning and resource allocation.

- Clear TerminologyUsing standard financial terminology ensures clarity and avoids ambiguity in reporting. Consistent definitions for terms like “net cash flow,” “operating income,” and “capital expenditures” prevent misinterpretations and ensure all stakeholders understand the data presented. This clarity is crucial for both internal analysis and external communication.

- Auditing and ComplianceA standardized format simplifies the auditing process and ensures compliance with accounting principles and regulations. This structured approach allows auditors to efficiently review financial records, enhancing transparency and accountability. Adherence to standardized practices strengthens credibility and fosters trust with investors and lenders.

By adhering to a standardized format, businesses ensure that their financial data is presented accurately, consistently, and transparently. This structured approach facilitates effective analysis, informed decision-making, and streamlined reporting processes, contributing to overall financial stability and growth.

2. Three-month Intervals

The three-month interval inherent in a quarterly cash flow statement provides a critical balance between detailed insight and manageable reporting frequency. Annual statements offer a high-level overview, but lack the granularity to capture short-term fluctuations. Monthly statements, while detailed, can be overly frequent for strategic decision-making and may obscure larger trends. Quarterly reporting strikes a balance, offering sufficient detail to identify emerging trends and potential issues while allowing time for considered responses. This timeframe aligns with typical business cycles, enabling effective performance evaluation and strategic adjustments within a reasonable timeframe.

Consider a seasonal retail business. A quarterly statement captures the full impact of peak seasons, revealing the cash flow dynamics specific to those periods. This allows for informed inventory management, staffing decisions, and marketing strategies for subsequent cycles. Alternatively, a manufacturing company might use quarterly data to assess the impact of changes in raw material prices or production efficiency on cash flow. This information facilitates timely adjustments to pricing strategies or operational processes, mitigating potential negative impacts. These examples illustrate the practical value of three-month intervals in providing actionable financial insights.

Understanding the significance of the three-month interval is crucial for effectively leveraging the insights provided by a quarterly cash flow statement. This frequency facilitates proactive financial management, enabling timely interventions based on observable trends and contributing to enhanced financial stability and growth. Analyzing data within these defined periods provides a framework for identifying potential challenges, optimizing resource allocation, and making informed decisions that align with short-term and long-term financial goals. The balance between detail and reporting frequency makes this timeframe a valuable tool for businesses seeking to maintain financial health and achieve sustainable growth.

3. Cash Inflow/Outflow Tracking

Comprehensive cash flow management hinges on meticulous tracking of inflows and outflows. Within the framework of a quarterly cash flow statement, this tracking provides a granular view of financial activity, enabling informed decision-making and effective resource allocation. Understanding the dynamics of cash movement is fundamental to assessing financial health and ensuring sustainable growth. This detailed record serves as a cornerstone for financial planning, performance analysis, and strategic adjustments.

- Operating ActivitiesTracking cash flows from operating activities provides insights into the core business functions. This encompasses revenue generated from sales, payments to suppliers, salaries, and other operating expenses. Analyzing these flows helps assess the profitability and efficiency of core operations. For example, consistently increasing cash inflows from sales suggest strong demand, while rising outflow for raw materials might indicate supply chain issues or price increases.

- Investing ActivitiesMonitoring cash flows related to investing activities offers a perspective on long-term investments. This includes purchases and sales of property, plant, and equipment (PP&E), acquisitions of other businesses, and investments in securities. These flows reflect strategic decisions regarding capital allocation and future growth. For instance, significant cash outflows for new equipment could indicate expansion plans, while inflows from the sale of assets might suggest a divestiture strategy.

- Financing ActivitiesTracking cash flows from financing activities illuminates how the business is funded. This includes proceeds from debt or equity financing, loan repayments, and dividend payments. Analyzing these flows provides insights into the company’s capital structure and its ability to meet financial obligations. For example, an increase in debt financing might signal expansion plans or financial challenges, while consistent dividend payments demonstrate financial stability and shareholder returns.

- Net Cash FlowThe net cash flow, derived from the combined inflows and outflows across all activities, provides a crucial overview of financial performance during the quarter. This figure represents the net increase or decrease in cash and cash equivalents. A positive net cash flow indicates the company generated more cash than it spent, while a negative net cash flow suggests the opposite. This key metric serves as a critical indicator of financial health and sustainability.

By meticulously tracking cash inflows and outflows within each of these categories, businesses gain a comprehensive understanding of their financial performance within a given quarter. This granular detail informs strategic decision-making, enhances resource allocation, and facilitates proactive adjustments to ensure financial stability and sustainable growth. The insights derived from cash flow tracking empower organizations to navigate financial complexities and achieve their strategic objectives.

4. Operational Activities

Operational activities form the core of a quarterly cash flow statement, reflecting the cash generated or used in the daily functions of a business. This section provides crucial insights into the financial sustainability and efficiency of core operations, distinguishing profitable sales from actual cash flow generated. Accurately representing operational activities is crucial for understanding short-term financial health and making informed decisions about resource allocation, pricing strategies, and operational efficiency. This section bridges the gap between profit and cash, revealing the timing of inflows and outflows related to core business functions.

A key aspect of analyzing operational activities involves understanding the cause-and-effect relationships between business operations and resulting cash flows. For instance, increased sales typically lead to higher cash inflows, but this relationship can be complex due to factors like credit sales, which delay the receipt of cash. Similarly, efficient inventory management can reduce cash outflows by minimizing storage costs and obsolescence. Analyzing the timing differences between revenue recognition and cash collection reveals the efficiency of working capital management. For example, a company with a short cash conversion cycle efficiently converts sales into cash, indicating strong operational performance. Conversely, a long cash conversion cycle may suggest challenges in collecting receivables or managing inventory. Real-world examples further illustrate this connection. A retail business might experience increased cash inflows during peak seasons due to higher sales volumes. However, if this is accompanied by a significant increase in inventory purchases financed by short-term debt, the net impact on cash flow might be less significant than the sales figures alone suggest. Understanding these dynamics is essential for making informed decisions about inventory levels, pricing, and financing strategies. In the manufacturing sector, operational activities might reflect cash outflows for raw materials, labor, and overhead costs, alongside inflows from product sales. Analyzing these flows reveals the efficiency of production processes and the profitability of individual product lines. Identifying bottlenecks or inefficiencies in operations can lead to targeted improvements that enhance cash flow generation.

In summary, the operational activities section of a quarterly cash flow statement provides crucial insights into the financial health and sustainability of a business. Accurately recording and analyzing these activities, including the timing of inflows and outflows related to sales, expenses, and working capital management, is essential for making informed business decisions. Understanding the cause-and-effect relationship between business operations and cash flows empowers organizations to optimize processes, enhance profitability, and achieve sustainable growth. By analyzing the timing differences between revenue recognition and cash collection, businesses can pinpoint potential inefficiencies and identify areas for improvement. This detailed understanding of operational cash flow is critical for effective short-term financial management and long-term strategic planning. The information presented within this section allows stakeholders to assess the efficiency of core business functions, identify potential financial challenges, and make informed decisions that contribute to overall financial stability and success.

5. Investing Activities

Investing activities within a quarterly cash flow statement template provide crucial insights into a company’s long-term strategic decisions regarding capital allocation and asset management. This section details cash flows related to the acquisition and disposal of long-term assets, offering a perspective on how the company invests in its future growth and operational capacity. Analyzing these activities helps stakeholders understand the company’s investment strategy, assess its potential for future earnings, and evaluate its overall financial health.

- Capital ExpendituresCapital expenditures represent investments in fixed assets, such as property, plant, and equipment (PP&E). These investments are crucial for maintaining or expanding operational capacity and driving future growth. Significant cash outflows for capital expenditures may indicate a company is investing in new facilities, upgrading existing equipment, or expanding into new markets. For example, a manufacturing company investing in automated machinery might expect increased production efficiency and lower labor costs in future periods. Analyzing capital expenditures helps assess the company’s commitment to long-term growth and its ability to generate future revenue.

- Acquisitions and DivestituresAcquisitions and divestitures involve the purchase or sale of other businesses or significant assets. Acquisitions represent investments in expanding market share, acquiring new technologies, or diversifying operations. Divestitures, conversely, may reflect a strategic shift in focus, the sale of underperforming assets, or a need to raise capital. Analyzing these activities provides insights into the company’s strategic direction and its ability to manage its portfolio of assets effectively. For instance, a technology company acquiring a smaller competitor might aim to expand its market reach and acquire valuable intellectual property.

- Investments in SecuritiesInvestments in securities, such as stocks and bonds, can represent both short-term and long-term strategic decisions. Short-term investments may be aimed at generating returns on excess cash, while long-term investments might be part of a broader diversification strategy. Analyzing these activities helps understand the company’s approach to managing liquidity and its risk tolerance. For example, a company investing in government bonds might prioritize capital preservation, while investments in high-growth stocks indicate a higher risk appetite.

- Loaning and Borrowing related to investmentsCompanies may engage in lending or borrowing activities related to investments. Providing loans to other entities can generate interest income, while borrowing funds can finance large acquisitions or capital projects. Analyzing these cash flows provides insight into the company’s financial leverage and its ability to manage debt obligations. For instance, a real estate company might borrow funds to finance the development of a new property, expecting future rental income to cover the loan repayments.

Understanding the investing activities section of a quarterly cash flow statement is crucial for evaluating a company’s long-term growth potential and financial stability. By analyzing the cash flows related to capital expenditures, acquisitions, divestitures, and investments, stakeholders gain valuable insights into the company’s strategic direction, its ability to generate future earnings, and its overall financial health. This information complements the operational activities section, providing a comprehensive view of the company’s financial performance and its prospects for future growth. These investment decisions, reflected in the cash flows, offer a critical lens through which to assess the long-term viability and strategic direction of an organization.

6. Financing Activities

Financing activities within a quarterly cash flow statement offer critical insights into how a company secures and manages funding. This section details cash flows related to debt, equity, and other financing sources, illuminating the company’s capital structure and its ability to meet financial obligations. Analyzing financing activities provides stakeholders with a deeper understanding of the company’s financial stability, its long-term financial strategy, and its capacity for future investment and growth. Understanding these activities is crucial for assessing financial risk and evaluating the long-term sustainability of the business.

Several key components comprise the financing activities section. Debt financing involves borrowing money through loans or issuing bonds. Cash inflows from debt increase available capital, while outflows represent principal and interest repayments. Equity financing involves raising capital by issuing shares. Inflows represent proceeds from stock sales, while outflows may include share repurchases or dividend payments. Other financing activities can include transactions with preferred stock, convertible debt, and other complex financial instruments. Each of these activities impacts the company’s capital structure and influences its financial risk profile. For example, a company relying heavily on debt financing might be more vulnerable to interest rate fluctuations and economic downturns. Conversely, a company primarily financed through equity might have greater flexibility but could dilute existing shareholders’ ownership. Analyzing the balance between debt and equity financing provides valuable insights into the company’s financial strategy and risk tolerance.

Practical applications of this analysis are numerous. Consider a rapidly growing technology company that raises capital through an initial public offering (IPO). The cash inflow from the IPO, recorded under financing activities, provides funds for research and development, expansion into new markets, or acquisitions. Alternatively, a mature company might choose to repurchase its own shares, reducing the number of outstanding shares and potentially increasing earnings per share. This outflow would be reflected in the financing activities section. Another example might involve a company refinancing existing debt at a lower interest rate. While this doesn’t directly change the principal amount owed, it reduces future interest payments, impacting cash outflows within financing activities. Analyzing these activities over multiple quarters reveals trends in the company’s financing strategy and provides insights into its long-term financial planning. This analysis informs stakeholders about the company’s financial stability, its capacity for future investment, and its ability to generate sustainable returns. Understanding these dynamics is essential for assessing financial risk, evaluating investment opportunities, and making informed decisions about the long-term prospects of the business.

Key Components of a Quarterly Cash Flow Statement

A structured quarterly cash flow statement comprises several essential components, each providing unique insights into an organization’s financial performance. These components, when analyzed collectively, offer a comprehensive understanding of short-term financial health and sustainability.

1. Operating Activities: This section details cash flows generated from the core business operations. It includes cash received from customers, payments to suppliers, salaries, and other operating expenses. Analyzing operational cash flows reveals the profitability and efficiency of the core business functions.

2. Investing Activities: This component focuses on cash flows related to long-term investments. It includes purchases and sales of property, plant, and equipment (PP&E), acquisitions and divestitures of businesses, and investments in securities. Analyzing investing activities provides insights into a company’s growth strategy and its allocation of capital for future returns.

3. Financing Activities: This section details cash flows related to how the company is funded. It includes proceeds from debt or equity financing, loan repayments, and dividend payments. Analyzing financing activities illuminates the company’s capital structure and its ability to meet financial obligations.

4. Beginning Cash Balance: The starting cash balance for the quarter provides context for understanding the net change in cash position. It represents the cash and cash equivalents available at the beginning of the reporting period.

5. Ending Cash Balance: This crucial figure represents the cash and cash equivalents available at the end of the reporting period. It is the result of the combined inflows and outflows from operating, investing, and financing activities, added to the beginning cash balance.

6. Net Increase/Decrease in Cash: This figure represents the overall change in cash position during the quarter. A positive value indicates a net increase in cash, while a negative value signifies a net decrease. This key metric provides a concise summary of the company’s cash flow performance.

Careful analysis of these components, individually and in aggregate, provides a robust understanding of an organization’s financial performance within a given quarter. This information is essential for making informed business decisions, evaluating financial health, and planning for future growth and sustainability.

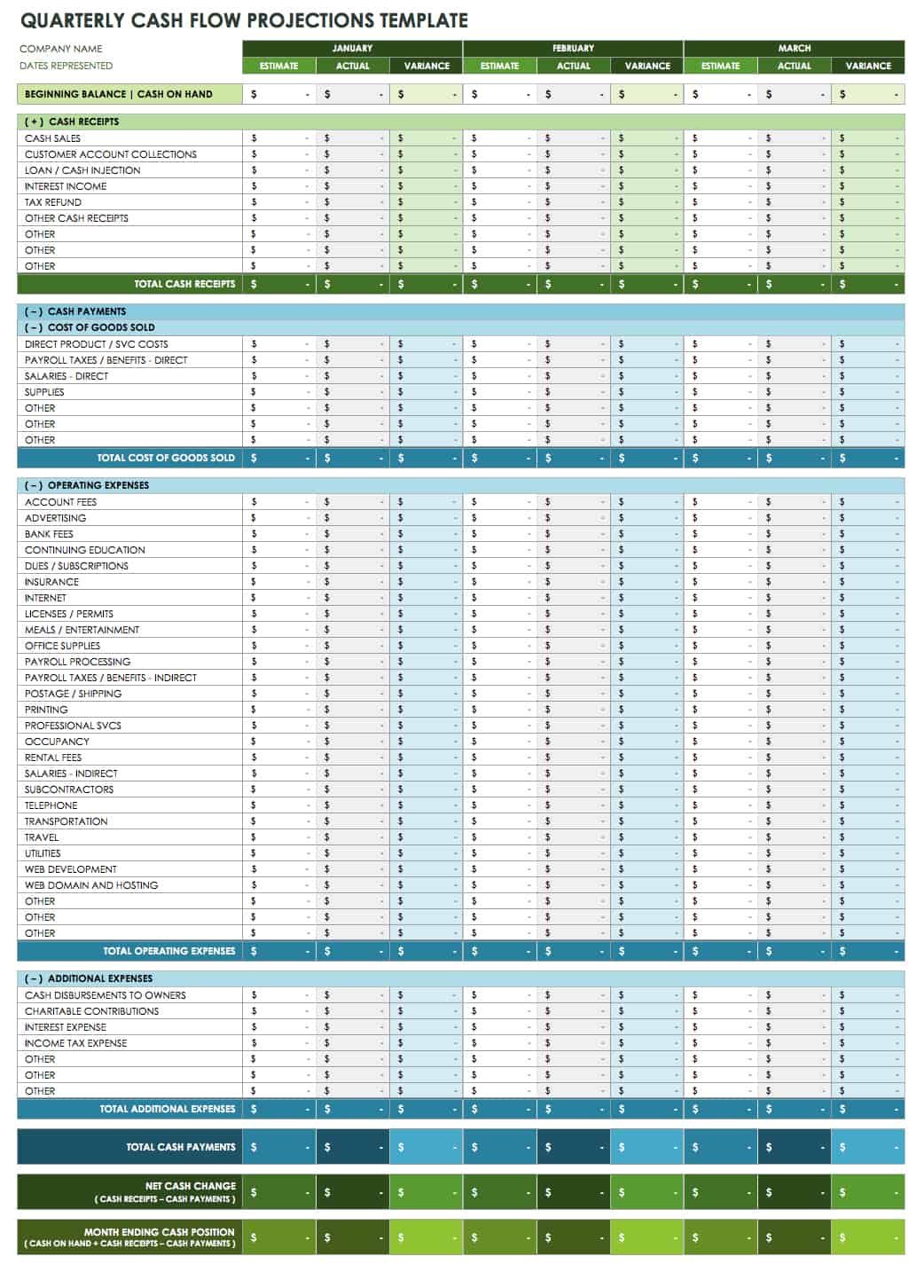

How to Create a Quarterly Cash Flow Statement Template

Creating a robust template facilitates consistent and accurate tracking of cash flow over time. A well-structured template ensures all essential information is captured, allowing for thorough analysis and informed decision-making.

1. Define Reporting Period: Clearly establish the start and end dates for the quarter. This ensures consistency and allows for accurate comparison across periods. A consistent reporting period is fundamental for identifying trends and making informed financial decisions.

2. Structure the Template: Organize the template into three core sections: Operating Activities, Investing Activities, and Financing Activities. This structure aligns with standard accounting practices and facilitates clear categorization of cash flows.

3. Operating Activities Detail: Within this section, include line items for cash inflows from customers, cash outflows for suppliers, salaries, rent, and other operating expenses. This detailed breakdown provides insight into the core business functions.

4. Investing Activities Detail: Include line items for capital expenditures (purchases of fixed assets), proceeds from the sale of assets, investments in securities, and acquisitions or divestitures. These details illuminate long-term investment strategies.

5. Financing Activities Detail: Include line items for proceeds from debt or equity financing, loan repayments, dividend payments, and stock repurchases. This clarifies how the business is funded and its capital structure.

6. Include Beginning and Ending Cash Balances: Record the cash balance at the start of the quarter and calculate the ending balance based on the net cash flow during the period. These figures provide context for understanding the overall change in cash position.

7. Calculate Net Cash Flow: Sum the net cash flows from operating, investing, and financing activities to determine the overall net increase or decrease in cash during the quarter. This crucial metric summarizes the company’s cash flow performance.

8. Review and Refine: Regularly review the template and refine as needed to ensure it accurately captures all relevant cash flows and aligns with evolving business needs. Maintaining an up-to-date template promotes accurate reporting and facilitates effective financial management.

A well-designed template, consistently applied, provides a clear and accurate picture of a company’s financial health. This facilitates informed decision-making, proactive financial management, and sustainable growth. Regular review and refinement ensure the template remains aligned with evolving business needs and provides the most relevant insights.

Effective financial management hinges on a clear understanding of cash flow dynamics. A structured quarterly cash flow statement template provides the framework for capturing, categorizing, and analyzing cash inflows and outflows across core business operations, investments, and financing activities. This structured approach enables organizations to monitor performance, identify trends, and make informed decisions based on real-time data. Consistent use of such a template facilitates proactive financial management, enabling timely adjustments to strategies and operations to ensure financial stability and growth.

Accurate and consistent tracking of cash flow is not merely a reporting requirement; it is a strategic imperative. The insights derived from a well-maintained quarterly cash flow statement empower organizations to navigate financial complexities, optimize resource allocation, and make informed decisions that contribute to long-term sustainability and success. Regularly reviewing and analyzing these statements provides a crucial lens through which to assess financial health, identify potential challenges, and adapt to evolving market conditions, ultimately contributing to enhanced financial performance and long-term viability.