Utilizing such a form offers several advantages. It facilitates a clear understanding of the financial obligations and entitlements of each party, minimizing potential disputes. The structured format aids in accurate record-keeping for tax purposes and future reference. This organized approach simplifies a complex process, reducing stress and contributing to a smoother, more efficient transaction.

The following sections will delve into the specific components of these forms, explain how to interpret them, and discuss their significance within the broader context of real estate transactions. This information will empower both buyers and sellers to navigate the closing process with confidence.

1. Standardized Form

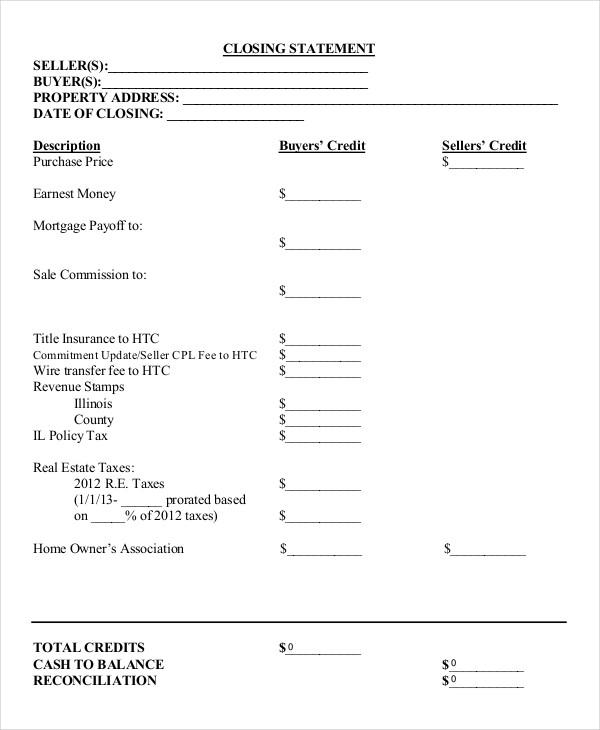

Standardization in closing statement templates plays a vital role in facilitating clarity, efficiency, and legal soundness in real estate transactions. A standardized form ensures consistent presentation of crucial information, enabling all partiesbuyers, sellers, lenders, and legal representativesto readily locate and interpret key figures and clauses. This consistency minimizes the risk of misunderstandings or misinterpretations that could otherwise lead to disputes or delays. Standardized forms often incorporate legally required disclosures and provisions, ensuring compliance with applicable regulations and reducing the potential for legal challenges. For example, a standardized form will typically include sections for recording the earnest money deposit, loan details, title insurance information, and proration of property taxes, all presented in a consistent and predictable manner.

The use of a standardized form also contributes to increased efficiency in processing real estate transactions. The predictable structure allows for streamlined review by all parties, simplifying the closing process and reducing the time required to finalize the transaction. This standardization benefits lenders by simplifying the underwriting process and minimizing the risk of errors in loan documentation. Furthermore, standardized forms facilitate data analysis and reporting, allowing for more efficient tracking of real estate market trends and transactional data. For instance, readily identifiable sections for closing costs allow for easier comparison across different transactions, aiding in market analysis and cost control.

In conclusion, standardized forms in real estate closings are essential for ensuring clear communication, legal compliance, and efficient processing. They contribute significantly to minimizing risks and facilitating smooth transactions for all stakeholders. While variations may exist due to local customs or specific transaction details, the core elements of a standardized closing statement template provide a robust framework for navigating the complexities of property transfer. Adhering to these standards promotes transparency and professionalism within the real estate industry.

2. Itemized Debits and Credits

A comprehensive understanding of itemized debits and credits is fundamental to interpreting a real estate closing statement template. This detailed breakdown of financial obligations and entitlements provides transparency and clarity for all parties involved in the transaction. Each item reflects a specific cost or payment associated with the property transfer, ensuring accurate accounting and facilitating a smooth closing process.

- Purchase PriceThe purchase price represents the agreed-upon amount for the property itself. This figure is a fundamental debit for the buyer and a corresponding credit for the seller. It forms the basis for calculating other related costs, such as transfer taxes and real estate commissions.

- Loan AmountsLoan amounts represent funds disbursed by the lender to the buyer for financing the purchase. This is a credit to the buyer, offsetting the debit of the purchase price. The specific loan terms, including interest rate and repayment schedule, will be detailed elsewhere in the closing documents but impact the overall financial picture presented in the statement.

- Closing CostsClosing costs encompass various expenses associated with finalizing the transaction. These can include appraisal fees, title insurance premiums, lender fees, and escrow charges. These costs are typically itemized separately as debits to either the buyer or seller, as stipulated in the purchase agreement.

- Prepaid ItemsPrepaid items, such as property taxes and homeowner’s insurance, are often prorated at closing. The portion covering the period after the closing date is typically a debit to the buyer and a credit to the seller, ensuring each party pays only for the time they own the property.

Careful review of these itemized debits and credits is essential for both buyers and sellers to ensure accuracy and a full understanding of their financial obligations. Discrepancies should be addressed before closing to avoid potential disputes and ensure a legally sound transaction. The itemized format within the real estate closing statement template provides a clear and concise record of all financial aspects of the property transfer, promoting transparency and facilitating a smooth closing process.

3. Buyer/Seller Information

Accurate and complete buyer/seller information is paramount to the legal validity and successful execution of a real estate closing. Within the closing statement template, this information serves not only as identification but also plays a crucial role in establishing the legal transfer of ownership and financial responsibility.

- Full Legal NamesFull legal names, as they appear on official identification documents, are crucial for accurate record-keeping and legal documentation. These names must match precisely with those appearing on the deed and other legal instruments. Using nicknames or abbreviated names can create discrepancies and potential legal challenges in the future.

- Current Mailing AddressesCurrent mailing addresses are essential for all official correspondence related to the transaction and future property-related communications. Providing accurate addresses ensures that all parties receive critical documents and notifications promptly. This includes legal notices, tax documents, and other important information pertaining to the property.

- Contact InformationValid phone numbers and email addresses facilitate timely communication between all parties involved in the closing process. This enables quick resolution of any unforeseen issues or questions that may arise, streamlining the transaction and minimizing delays. Efficient communication channels are crucial for addressing time-sensitive matters and ensuring a smooth closing.

- Social Security Numbers/Tax Identification NumbersSocial security numbers (for individuals) or tax identification numbers (for entities) are required for IRS reporting purposes related to the real estate transaction. These numbers ensure compliance with tax regulations and accurate reporting of capital gains or losses associated with the sale. Accurate reporting is crucial for both buyers and sellers to fulfill their tax obligations.

The accurate recording of buyer/seller information within the closing statement template is not merely a formality; it forms the foundation of a legally sound and transparent transaction. Inaccurate or incomplete information can lead to delays, disputes, and potential legal complications, highlighting the importance of meticulous attention to detail in this crucial aspect of the closing process. This information, combined with other elements of the closing statement, provides a comprehensive record of the transaction, protecting the interests of all parties involved.

4. Property Details

Accurate and comprehensive property details are essential components of a real estate closing statement template. These details establish the specific property being transferred, ensuring legal clarity and preventing future disputes. The connection between property details and the closing statement is integral to the validity and enforceability of the transaction. Property details serve as the unambiguous identifier of the subject property, linking the financial aspects of the closing statement to the physical asset being conveyed. This linkage is critical for title transfer, tax assessments, and legal record-keeping.

Several key property details are typically included within the closing statement template. The legal description, derived from official surveys and records, provides a precise and legally binding definition of the property boundaries. This description avoids ambiguity and potential conflicts regarding the extent of the property being conveyed. The street address, while more commonly used for everyday identification, serves as a supplementary identifier and aids in locating the property. Inclusion of the property’s parcel or tax identification number further strengthens the identification, linking it to public records and tax assessments. For example, a closing statement might include the legal description, “Lot 15, Block 3, Subdivision of Green Meadows, as recorded in Book 2, Page 50, of the County Recorder’s Office,” alongside the street address and parcel number. This multifaceted identification ensures clarity and prevents misunderstandings.

Accurate property details within the closing statement are crucial for several reasons. They facilitate a clean title transfer, ensuring that ownership is properly and legally assigned to the buyer. These details are also essential for property tax assessments and calculations, ensuring that taxes are levied correctly on the new owner. Moreover, accurate property details provide a clear record of the transaction for future reference, protecting the interests of both buyer and seller. Challenges can arise if property details are incomplete or inaccurate. Disputes over property boundaries, incorrect tax assessments, and difficulties in obtaining title insurance are potential consequences of inaccurate property information. Therefore, meticulous attention to detail in recording these details within the closing statement template is essential for a smooth and legally sound transaction.

5. Financial Transparency

Financial transparency forms the cornerstone of a trustworthy and legally sound real estate closing process. The closing statement template serves as the primary vehicle for achieving this transparency, providing a comprehensive and detailed account of all financial aspects of the transaction. This detailed disclosure empowers both buyers and sellers to fully understand their respective financial obligations and entitlements, minimizing the potential for disputes and fostering a sense of fairness and trust.

The closing statement’s itemized structure contributes significantly to financial transparency. Clearly delineated debits and credits, along with explanations for each entry, allow both parties to trace the flow of funds throughout the transaction. For example, a closing statement will typically itemize lender fees, appraisal costs, title insurance premiums, and prepaid property taxes, providing a clear picture of where each dollar is allocated. This level of detail enables informed decision-making and allows for verification of charges against agreed-upon terms. Without such transparency, opportunities for hidden fees or misrepresented costs could arise, potentially jeopardizing the integrity of the transaction. Consider a scenario where a seller attempts to pass on undisclosed repair costs to the buyer. A transparent closing statement would expose such an attempt, protecting the buyer’s financial interests and maintaining the integrity of the transaction.

Transparency within the closing statement also extends to the proration of ongoing expenses, such as property taxes and homeowner’s association dues. The statement clearly outlines how these costs are divided between buyer and seller based on the closing date, ensuring each party pays only their fair share. This clarity prevents disputes and ensures equitable distribution of financial responsibility. Furthermore, the closing statement serves as a crucial document for tax reporting purposes. Accurate and transparent reporting of transaction details simplifies tax filing for both buyers and sellers, ensuring compliance with tax regulations and minimizing the risk of audits or penalties. In conclusion, financial transparency, facilitated by a comprehensive closing statement template, is indispensable for a successful and legally sound real estate transaction. It protects the interests of all parties involved, promotes trust, and contributes to the overall integrity of the real estate market. This transparency empowers informed decision-making, minimizes the potential for disputes, and provides a clear record of the transaction for future reference and compliance purposes.

6. Transaction Record

A real estate closing statement template serves as a comprehensive transaction record, meticulously documenting all financial aspects of a property transfer. This documentation provides a permanent and legally sound record of the agreement between buyer and seller, outlining the details of the transaction and serving as a crucial reference point for future inquiries or disputes. The closing statement’s function as a transaction record is essential for several reasons. It provides evidence of the financial agreement, protecting both parties in case of discrepancies or disagreements that may arise after closing. For instance, if a question arises regarding the amount paid for property taxes or the allocation of closing costs, the closing statement serves as the definitive source of information.

The detailed breakdown of costs and payments within the closing statement allows for accurate financial reconciliation and ensures that all funds are accounted for. This detailed record simplifies tax reporting for both buyer and seller, providing the necessary documentation for claiming deductions or reporting capital gains. Consider a scenario where a tax audit requires verification of the purchase price or closing costs associated with a property sale. The closing statement provides the necessary documentation to support the reported figures, potentially avoiding penalties or legal complications. Moreover, the closing statement functions as a historical record of the transaction, valuable for future reference. It can be used to track property values, verify ownership history, and support loan applications or refinancing efforts. For example, when applying for a home equity loan, the closing statement from the original purchase can provide crucial information about the property’s value and outstanding mortgage balance.

In summary, the real estate closing statement template’s role as a transaction record is paramount to the integrity and legal soundness of a property transfer. It protects the interests of both buyer and seller, provides a clear and comprehensive record of financial details, and serves as a valuable reference document for future needs. This comprehensive documentation contributes significantly to the transparency and accountability of real estate transactions, fostering trust and minimizing the potential for disputes. The careful preservation of this document is essential for all parties involved, as its value extends far beyond the immediate closing process.

Key Components of a Real Estate Closing Statement Template

Understanding the core components of a closing statement template is crucial for a smooth and legally sound transaction. The following elements provide a framework for comprehending this essential document.

1. Buyer and Seller Information: Full legal names, current mailing addresses, contact information, and social security or tax identification numbers are essential for accurate record-keeping, legal validity, and compliance with tax regulations. This information unequivocally identifies the parties involved in the transaction.

2. Property Details: A precise legal description, street address, and parcel or tax identification number are crucial for clearly identifying the property being conveyed. This information links the financial aspects of the closing to the specific physical asset, preventing ambiguities and future disputes regarding property boundaries.

3. Purchase Price: The agreed-upon price for the property forms the basis for many other calculations within the closing statement. This figure represents a fundamental debit for the buyer and a corresponding credit for the seller.

4. Loan Details: If financing is involved, details of the loan, including the loan amount, interest rate, and loan terms, are essential components. This information impacts the buyer’s debits and credits and is crucial for understanding the overall financial structure of the transaction.

5. Itemized Costs: A detailed breakdown of all closing costs, including appraisal fees, title insurance premiums, lender fees, recording fees, and transfer taxes, is essential for transparency. Each cost should be clearly identified and allocated to the appropriate party, buyer or seller, as stipulated in the purchase agreement.

6. Prorated Items: Ongoing expenses such as property taxes, homeowner’s insurance, and HOA dues are often prorated at closing based on the date of transfer. The closing statement details how these costs are divided between buyer and seller, ensuring an equitable distribution of financial responsibility.

7. Adjustments and Credits: Any agreed-upon adjustments or credits, such as seller concessions or credits for repairs, are documented in the closing statement. These adjustments impact the final amounts due from each party.

8. Net Due to/from Buyer and Seller: The closing statement culminates in the calculation of the final amounts owed by the buyer and due to the seller. These figures represent the net result of all debits and credits itemized throughout the statement.

Accurate and comprehensive information within each of these components ensures a clear, legally sound, and transparent record of the real estate transaction, protecting the interests of all parties involved.

How to Create a Real Estate Closing Statement Template

Creating a robust closing statement template requires careful attention to detail and adherence to standard real estate practices. While specific requirements may vary depending on local regulations and the nature of the transaction, the following steps outline the essential elements and considerations involved.

1. Define Parties and Property: Begin by clearly identifying the buyer(s) and seller(s) with their full legal names, addresses, and contact information. Accurate property details, including the legal description, address, and parcel identification number, are crucial for unambiguous identification.

2. Establish Purchase Price and Financing: State the agreed-upon purchase price and, if applicable, details of the financing arrangement, including loan amount, interest rate, and loan terms. This information forms the foundation for subsequent financial calculations.

3. Itemize Closing Costs: Create separate sections for itemized closing costs payable by the buyer and seller. Common costs include appraisal fees, loan origination fees, title insurance premiums, recording fees, and transfer taxes. Ensure clear descriptions for each cost.

4. Calculate Prorations: Determine the proration of ongoing expenses, such as property taxes, homeowner’s insurance, and HOA dues. Calculate the amounts owed by each party based on the closing date and clearly document the proration method.

5. Include Adjustments and Credits: Incorporate any agreed-upon adjustments or credits, such as seller concessions for repairs or buyer credits for prepaid expenses. Clearly label each adjustment and its impact on the final amounts due.

6. Calculate Net Due to/from Buyer and Seller: Summarize all debits and credits for both buyer and seller to arrive at the net amount due from the buyer and the net amount due to the seller. This final calculation represents the culmination of all preceding financial details.

7. Review and Verification: Thorough review by all parties, including legal representatives, is crucial to ensure accuracy and agreement on all figures. Verification of all calculations and supporting documentation minimizes the risk of errors and disputes.

8. Format for Clarity and Accessibility: Organize the template in a clear, logical format with distinct sections and labeled entries. Ensure readability through consistent formatting, clear fonts, and ample spacing. Accessibility features can be incorporated to accommodate diverse needs.

A well-constructed closing statement template provides a transparent and legally sound record of the financial aspects of a real estate transaction. Accuracy, clarity, and comprehensive detail are essential for protecting the interests of all parties and ensuring a smooth closing process. Adherence to established real estate conventions and legal requirements further enhances the template’s validity and utility.

Careful consideration of a standardized form for documenting financial transactions in property transfer is crucial for all stakeholders. Accurate completion of this form, encompassing precise property details, transparent itemization of costs, and clear delineation of buyer and seller responsibilities, ensures a legally sound and equitable transfer of ownership. Understanding the components and significance of this documentation empowers both buyers and sellers to navigate the complexities of real estate closings with confidence and clarity.

The documented financial record provided by this form serves not only as a record of the immediate transaction but also as a critical reference point for future financial planning, tax reporting, and potential legal matters. Diligent attention to the accuracy and completeness of this documentation contributes significantly to the stability and integrity of real estate transactions, fostering trust and transparency within the industry. Its utilization represents a commitment to best practices and underscores the importance of informed financial decision-making in real estate transfers.