Utilizing a standardized structure offers several advantages. It promotes transparency and consistency in reporting, simplifying comparisons across different properties or time periods. This clarity enables informed decision-making by investors, lenders, and property managers. Furthermore, a well-organized presentation of financial data can streamline audits and regulatory compliance processes. These organized frameworks can also identify areas for potential cost savings and revenue growth.

This foundation in financial reporting principles will allow for a deeper exploration of specific statement components, analysis techniques, and their practical applications in real estate investment and management.

1. Standardized Structure

Standardized structure forms the bedrock of effective financial reporting in real estate. A consistent format ensures all essential data points are captured and presented uniformly, regardless of the specific property or portfolio being analyzed. This uniformity facilitates clear comparisons across different investments, time periods, or market conditions. Without a standardized template, comparing performance metrics becomes challenging, potentially obscuring critical trends or insights. For instance, evaluating the profitability of two apartment buildings becomes significantly easier when both properties’ income and expenses are categorized identically within their respective financial statements.

Consistent categorization within a standardized structure allows for streamlined analysis and benchmarking. Consider the calculation of net operating income (NOI). If one statement includes property taxes under operating expenses while another classifies them as administrative costs, direct comparison of NOI becomes misleading. A standardized structure eliminates such discrepancies, ensuring consistent calculation methodologies and enabling meaningful performance comparisons. This consistency also simplifies the aggregation of financial data from multiple properties within a portfolio, providing a consolidated overview of financial health.

Standardized structures are essential for efficient communication and informed decision-making in real estate finance. They facilitate clear communication between property managers, investors, and lenders. This clarity reduces the risk of misinterpretations and promotes trust among stakeholders. Furthermore, a structured approach to financial reporting simplifies audits and ensures regulatory compliance. The ability to readily access and interpret key financial metrics supports data-driven decisions regarding acquisitions, dispositions, and property management strategies.

2. Key Performance Indicators (KPIs)

Key performance indicators (KPIs) represent crucial metrics derived from financial statement data, providing quantifiable insights into a property’s financial health and operational efficiency. A well-designed real estate financial statement template facilitates the calculation and analysis of these KPIs, enabling stakeholders to assess investment performance and make informed decisions. The template serves as a structured repository of the raw data required for KPI calculation, ensuring consistency and accuracy in reporting. Without a standardized template, extracting and analyzing data for KPI calculation becomes cumbersome and prone to errors, potentially leading to misinformed decisions.

Examples of critical KPIs in real estate include net operating income (NOI), capitalization rate (cap rate), cash-on-cash return, and debt service coverage ratio (DSCR). A financial statement template provides the necessary data points for calculating these metrics. For instance, NOI is derived from income and expense data within the template, while the cap rate requires the NOI and property value. Calculating the cash-on-cash return necessitates data on cash flow and initial investment, both typically found within or derived from the financial statement. Similarly, the DSCR utilizes NOI and debt service figures from the template. Analyzing these KPIs allows investors to evaluate property profitability, assess risk, and compare investment opportunities objectively. For example, a low cap rate compared to similar properties might suggest an overvalued asset, while a high DSCR indicates a strong ability to meet debt obligations.

Understanding the relationship between KPIs and the financial statement template is essential for effective real estate investment management. The template acts as the foundation for accurate KPI calculation, enabling meaningful performance analysis and benchmarking. This understanding empowers investors to identify areas for improvement, optimize operational efficiency, and make data-driven decisions that enhance investment returns. Challenges can arise from inconsistencies in data entry or incomplete templates, highlighting the importance of maintaining accurate and comprehensive records within a standardized framework. By leveraging a robust financial statement template and understanding the significance of KPIs, investors can navigate the complexities of the real estate market and maximize the potential of their investments.

3. Income & Expenses

A comprehensive understanding of income and expenses is fundamental to sound real estate financial management. Within a real estate financial statement template, these two components provide the basis for assessing profitability and operational efficiency. The template offers a structured framework for capturing all relevant income streams, including rental income, parking fees, laundry services, and other ancillary revenue sources. Similarly, it systematically categorizes operating expenses, such as property taxes, insurance, maintenance, utilities, and management fees. This detailed categorization allows for precise calculation of net operating income (NOI), a critical metric for evaluating property performance. For example, a multi-family property’s income section might detail monthly rents collected from each unit, while the expense section would itemize costs associated with property upkeep and management. Analyzing the relationship between income and expenses within the template reveals crucial insights into a property’s financial health. For instance, a rising trend in maintenance expenses against stagnant rental income could signal the need for capital improvements or adjustments to rental pricing strategies.

Accurate recording and categorization of income and expenses within the template are paramount for informed decision-making. Misclassifying expenses or omitting income streams can lead to inaccurate NOI calculations, potentially distorting investment analysis. For example, incorrectly categorizing a capital expenditure as an operating expense can artificially inflate operating costs and underestimate the property’s true profitability. The template serves as a control mechanism, ensuring consistent data entry and classification. This consistency allows for reliable comparisons across different properties or time periods, facilitating benchmarking and performance evaluation. Furthermore, a well-maintained income and expense record within the template streamlines tax reporting and simplifies audits. This structured data also allows for scenario analysis, enabling investors to model the financial impact of potential rent increases, expense reductions, or capital investments. Such analyses support data-driven decisions regarding property management, financing, and investment strategies.

Effective management of income and expenses, facilitated by a well-structured real estate financial statement template, forms the cornerstone of successful real estate investment. The template provides the necessary framework for accurate data capture, analysis, and reporting, enabling informed decision-making and ultimately contributing to enhanced profitability and long-term investment success. Challenges can arise from inconsistent data entry practices or the use of overly simplistic templates that lack the necessary detail for comprehensive analysis. Overcoming these challenges requires adopting standardized procedures, utilizing comprehensive templates, and emphasizing the importance of accurate and consistent financial record-keeping.

4. Assets & Liabilities

A clear representation of assets and liabilities is crucial within a real estate financial statement template. This section provides a snapshot of a property’s financial position at a specific point in time. Assets, representing what a property owns, typically include the property itself, any associated land, and equipment. Liabilities, representing what a property owes, encompass mortgages, loans, and other outstanding debts. Accurately capturing these elements within the template is essential for determining net worth and understanding the overall financial health of the investment. For example, a property valued at $1 million with a mortgage of $700,000 would have a net equity of $300,000, reflecting the owner’s stake in the asset. This information is crucial for loan applications, property valuations, and investment decisions.

The relationship between assets and liabilities within the template provides key insights into financial leverage and risk. High leverage, characterized by a significant proportion of debt relative to assets, can amplify potential returns but also increases the risk of financial distress if property values decline or income streams falter. Analyzing this relationship allows investors to assess the financial stability of a property and make informed decisions regarding financing and investment strategies. For instance, a property with a high loan-to-value ratio (LTV) might be considered riskier than a comparable property with a lower LTV. The template facilitates this analysis by providing a structured presentation of asset and liability data. Further, understanding the specific types of liabilities, such as short-term versus long-term debt, provides a more nuanced perspective on financial obligations and their potential impact on cash flow.

Maintaining accurate and up-to-date records of assets and liabilities within the real estate financial statement template is essential for effective financial management. This information is crucial for obtaining financing, making informed investment decisions, and complying with regulatory requirements. Challenges can arise from inconsistent valuation practices or incomplete records of outstanding debts. Overcoming these challenges requires adhering to standardized accounting principles, regularly updating asset valuations, and maintaining comprehensive records of all financial obligations. This diligent approach to asset and liability management provides a solid foundation for sound financial decision-making in real estate investment.

5. Comparability

Comparability, facilitated by consistent data structure and presentation, forms a cornerstone of effective financial analysis in real estate. Standardized templates ensure consistent categorization and reporting of financial data across different properties, time periods, or investment portfolios. This uniformity allows for meaningful comparisons, revealing trends, identifying outliers, and supporting data-driven decision-making. Without consistent presentation, comparing performance metrics becomes challenging, potentially obscuring valuable insights.

- Performance BenchmarkingStandardized templates enable direct comparison of key performance indicators (KPIs) like net operating income (NOI), cap rate, and cash-on-cash return across multiple properties or over time. For example, comparing the NOI of two similar properties managed under different strategies can reveal the effectiveness of each approach. Tracking a single property’s NOI year-over-year highlights trends in profitability and operational efficiency.

- Investment AnalysisComparability aids in evaluating potential investment opportunities. Consistent financial reporting allows for objective comparisons of different properties, facilitating informed decisions regarding acquisitions or dispositions. For instance, comparing the cap rates of several potential investment properties helps investors identify those offering the most attractive risk-adjusted returns.

- Portfolio ManagementConsistent data structure within a template streamlines portfolio-level analysis. Aggregating financial data from multiple properties within a portfolio becomes straightforward, allowing for a consolidated view of overall performance and risk. This aggregated view enables portfolio managers to identify top-performing assets, allocate resources effectively, and optimize investment strategies across the entire portfolio.

- Market AnalysisComparability facilitates benchmarking against market trends. By comparing a property’s performance metrics to industry averages or competitors’ data, investors can assess its relative performance and identify areas for improvement. For instance, comparing a property’s vacancy rate to the market average can reveal opportunities to enhance marketing or leasing strategies.

These facets of comparability, facilitated by the use of real estate financial statement templates, underscore the importance of consistent data structure and presentation in real estate investment management. This consistency empowers stakeholders to make data-driven decisions, optimize investment strategies, and enhance overall financial performance. Without this comparability, informed decision-making becomes significantly more challenging, increasing the risk of missed opportunities or suboptimal resource allocation.

6. Data-Driven Decisions

Data-driven decision-making, a cornerstone of modern real estate investment, relies heavily on the accurate and consistent information provided by financial statement templates. These templates serve as structured repositories of financial data, enabling stakeholders to extract meaningful insights and make informed choices regarding acquisitions, dispositions, financing, and property management. Without a standardized framework for data collection and presentation, the ability to make objective, data-backed decisions becomes significantly compromised. A well-designed template facilitates the calculation of key performance indicators (KPIs), such as net operating income (NOI), capitalization rate, and cash-on-cash return, providing quantifiable metrics for evaluating investment performance and comparing potential opportunities. For example, an investor considering two properties can use data from their respective financial statements to compare NOI, operating expenses, and potential rental income, enabling a data-driven assessment of each investment’s potential profitability and risk.

The practical significance of data-driven decisions in real estate manifests in several ways. Informed pricing strategies, derived from market analysis and property performance data captured within the template, maximize rental income and occupancy rates. Strategic renovations, justified by expense analysis and projected return on investment calculations derived from the template, enhance property value and attract tenants. Efficient property management, guided by data on operating costs and tenant demographics extracted from the template, minimizes expenses and maximizes operational efficiency. For instance, data on maintenance expenses within the template might reveal recurring issues with a particular building system, prompting proactive repairs or replacements that prevent larger, more costly problems in the future. Similarly, analyzing tenant demographics can inform targeted marketing campaigns and amenity upgrades that cater to specific tenant needs and preferences, ultimately enhancing tenant satisfaction and retention.

The reliance on real estate financial statement templates for data-driven decisions underscores the importance of accurate data entry, consistent reporting practices, and a comprehensive understanding of the metrics derived from the template. Challenges arise when data is incomplete, inconsistent, or misinterpreted. Overcoming these challenges requires a commitment to data integrity, standardized procedures for data collection and entry, and ongoing training for individuals responsible for managing and interpreting financial data. The ability to leverage the power of data-driven decision-making, facilitated by robust financial statement templates, represents a critical advantage in the competitive real estate market, enabling investors and property managers to optimize returns, mitigate risks, and achieve long-term financial success.

Key Components of Real Estate Financial Statements

Effective financial management in real estate necessitates a structured approach to organizing and interpreting financial data. The following components are essential for a comprehensive understanding of a property’s financial performance and position.

1. Income Statement: This component details all revenue generated by a property, including rental income, parking fees, and other ancillary income sources. It also outlines all operating expenses, such as property taxes, insurance, maintenance, and management fees. The income statement provides a clear picture of a property’s profitability over a specific period.

2. Balance Sheet: This statement presents a snapshot of a property’s financial position at a specific point in time. It lists all assets, including the property itself and any associated equipment, as well as all liabilities, such as mortgages and outstanding loans. The balance sheet provides insights into a property’s net worth and overall financial health.

3. Cash Flow Statement: This component tracks the movement of cash both into and out of a property. It details cash inflows from operations, investments, and financing activities, as well as cash outflows for expenses, debt service, and capital expenditures. The cash flow statement provides a dynamic view of a property’s liquidity and its ability to generate cash.

4. Statement of Changes in Equity: For properties held by entities with ownership structures involving equity, this statement details the changes in equity over a specific period. It accounts for factors such as contributions from owners, net income, and distributions to owners, providing a clear picture of how equity is impacted by financial performance and ownership decisions.

5. Supporting Schedules: These schedules provide detailed breakdowns of specific line items within the core financial statements. Examples include schedules for operating expenses, rent rolls, and debt amortization. Supporting schedules enhance transparency and provide granular insights into the financial data.

These interconnected components offer a comprehensive view of a property’s financial performance, position, and cash flow dynamics. Analyzing these statements in conjunction with market data and investment objectives provides a robust foundation for strategic decision-making in real estate.

How to Create a Real Estate Financial Statement Template

Developing a robust template requires careful consideration of key financial elements and consistent formatting. The following steps outline the process of creating a template suitable for analyzing real estate investments.

1. Define the Scope: Determine the specific purpose of the template. Will it be used for a single property, a portfolio of properties, or for comparative market analysis? The scope will influence the level of detail and the specific metrics included.

2. Choose a Software or Format: Select a suitable software application or format for creating the template. Spreadsheet software offers flexibility and formula automation, while dedicated real estate financial software provides specialized features. Consistency in format is essential for comparability.

3. Structure the Income Statement: Create a section for recording all income streams, including rental income, parking fees, and other ancillary revenue sources. Categorize income clearly and consistently. Include a section for calculating gross operating income (GOI).

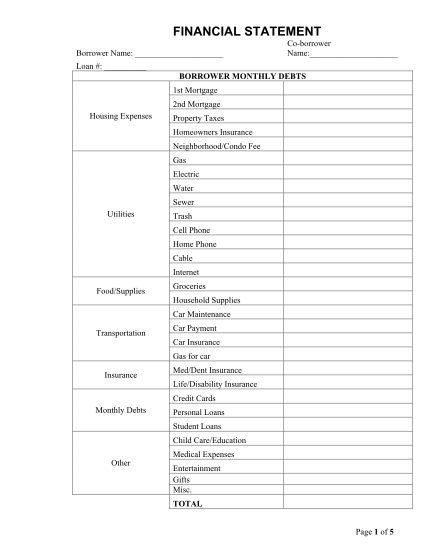

4. Detail Operating Expenses: Develop a comprehensive list of operating expenses, including property taxes, insurance, maintenance, utilities, and management fees. Categorize expenses systematically to facilitate analysis and comparison.

5. Calculate Net Operating Income (NOI): Deduct total operating expenses from gross operating income to arrive at NOI, a crucial metric for evaluating property profitability.

6. Structure the Balance Sheet: Create sections for assets and liabilities. List all assets, including the property itself, land, and equipment. List all liabilities, including mortgages, loans, and other outstanding debts. Calculate net worth by subtracting total liabilities from total assets.

7. Develop a Cash Flow Statement: Outline cash inflows and outflows from operating activities, investing activities, and financing activities. This statement provides insights into a property’s liquidity and ability to generate cash.

8. Incorporate Key Performance Indicators (KPIs): Include sections for calculating key metrics such as capitalization rate, cash-on-cash return, debt service coverage ratio (DSCR), and internal rate of return (IRR). These KPIs provide valuable insights into investment performance.

9. Add Supporting Schedules (Optional): Consider including supporting schedules for detailed breakdowns of specific line items within the core financial statements, such as rent rolls, operating expense breakdowns, and debt amortization schedules.

10. Test and Refine: Populate the template with actual data from a property or portfolio to test its functionality and identify any necessary adjustments. Refine the template over time to ensure it remains relevant and meets evolving analytical needs.

A well-structured template, incorporating these elements, provides a robust framework for analyzing real estate investments, enabling informed decision-making and contributing to long-term financial success. Regular review and refinement ensure the template remains aligned with evolving investment strategies and market conditions.

Structured frameworks for organizing financial data are essential tools for effective real estate investment management. They provide a standardized approach to capturing, analyzing, and interpreting key financial metrics, enabling stakeholders to assess property performance, make informed decisions, and optimize investment strategies. From calculating key performance indicators to understanding the nuances of income and expense analysis, a well-designed template offers valuable insights into a property’s financial health, profitability, and potential for growth. The ability to compare performance across different properties, time periods, and market conditions empowers investors and property managers to make data-driven decisions, mitigate risks, and enhance overall financial outcomes.

As the real estate landscape continues to evolve, the importance of accurate, accessible, and actionable financial data remains paramount. Leveraging robust financial statement templates, coupled with a deep understanding of financial principles, equips stakeholders with the necessary tools to navigate market complexities, identify opportunities, and achieve long-term success in the dynamic world of real estate investment. The ongoing refinement and adaptation of these templates, in response to changing market dynamics and technological advancements, will further enhance their utility as indispensable tools for informed decision-making and financial success in real estate.