Utilizing a standardized structure offers several advantages for real estate professionals. It enables informed decision-making based on concrete financial data, facilitating effective cost management and optimized revenue generation strategies. This structured approach also simplifies tracking performance trends, identifying areas for improvement, and securing financing by demonstrating financial health to potential lenders or investors. Regular reporting contributes to greater transparency and accountability in financial operations.

The following sections will delve into the key components of this vital financial tool, explore practical applications for various real estate ventures, and offer guidance on creating and interpreting the information it presents. Understanding these facets is essential for achieving and maintaining financial success in the real estate sector.

1. Revenue Streams

Accurately representing revenue streams is fundamental to a comprehensive real estate profit and loss statement. A clear understanding of income sources allows for effective financial planning, performance evaluation, and informed decision-making. This section explores the core components of revenue generation within real estate.

- Rental IncomeThis constitutes the primary revenue source for most income-generating properties. It includes monthly rent payments from tenants, late fees, and potentially pet fees or parking charges. Accurate recording of rental income is crucial for assessing property performance and forecasting future cash flow.

- Property SalesFor investors focused on property flipping or development, revenue from property sales represents a significant income stream. This includes the final sale price less selling expenses like commissions and closing costs. Proper accounting for these costs is essential for determining actual profit margins.

- Other IncomeThis category encompasses ancillary revenue sources, including laundry facilities, vending machines, or advertising space within the property. While often smaller than primary income sources, these contributions can enhance overall profitability and should be meticulously tracked.

- Deferred RevenueThis represents payments received for services or goods not yet delivered. In real estate, this could include security deposits or prepaid rent. While not immediately recognized as income, understanding deferred revenue is essential for accurate financial reporting and liability management.

A thorough understanding of these revenue streams and their accurate representation within a profit and loss statement provides valuable insights into financial performance. This information is crucial for making strategic decisions regarding property management, investment strategies, and overall financial planning within the real estate sector.

2. Operating Expenses

Operating expenses represent a critical component of a real estate profit and loss statement. Accurate tracking and analysis of these costs are essential for determining true profitability and making informed financial decisions. Operating expenses directly impact net income, influencing investment returns and overall financial health.

Common operating expenses include property taxes, insurance premiums, maintenance and repairs, property management fees, utilities, and marketing costs. For example, neglecting routine maintenance can lead to larger, unexpected repair costs later, impacting profitability. Similarly, escalating property taxes can significantly reduce net income. Understanding these costs and their potential fluctuations allows for proactive budget adjustments and informed investment strategies. Effective cost management strategies, such as negotiating favorable insurance premiums or implementing energy-efficient upgrades, can positively impact the bottom line.

A comprehensive understanding of operating expenses is crucial for successful real estate ventures. Accurately categorizing and recording these costs within a profit and loss statement provides valuable insights into financial performance, facilitating informed decision-making regarding property management, investment strategies, and overall financial planning. Regularly reviewing and analyzing operating expenses empowers stakeholders to identify areas for cost optimization, ultimately enhancing profitability and long-term financial sustainability.

3. Debt Service

Debt service represents a significant financial obligation for many real estate investments and plays a crucial role within a profit and loss statement. Accurately accounting for debt service is essential for determining true profitability and assessing the financial health of an investment. This section explores key facets of debt service within the context of real estate finance.

- Mortgage Principal and Interest PaymentsThis constitutes the largest portion of debt service for most real estate investors. Principal represents the repayment of the original loan amount, while interest represents the cost of borrowing. Accurately tracking these payments is fundamental to understanding the true cost of financing and its impact on profitability.

- Loan Amortization ScheduleAn amortization schedule details the breakdown of each payment over the loan term, showing the allocation between principal and interest. Understanding the amortization schedule helps investors project future debt service obligations and analyze the long-term financial implications of the loan.

- Impact on Cash FlowDebt service directly impacts cash flow, reducing the amount of available funds for other expenses or reinvestment. Accurately projecting debt service obligations is essential for maintaining positive cash flow and avoiding financial distress.

- Debt Service Coverage Ratio (DSCR)The DSCR is a key metric used by lenders to assess an investment’s ability to generate sufficient cash flow to cover debt obligations. It is calculated by dividing net operating income by total debt service. A higher DSCR indicates a lower risk of default and a stronger financial position.

Accurately reflecting debt service within a real estate profit and loss statement provides critical insights into financial performance. By understanding the components of debt service and its impact on profitability, investors can make informed decisions regarding financing options, investment strategies, and overall financial planning. This information is crucial for navigating the complexities of real estate finance and achieving long-term financial success.

4. Net Income/Loss

The net income/loss calculation represents the culmination of the real estate profit and loss statement. This bottom-line figure provides a concise overview of financial performance, indicating the overall profitability or loss incurred during the reporting period. Understanding the components contributing to net income/loss is crucial for assessing investment success and making informed decisions.

- Total RevenueThis encompasses all income generated from the property, including rental income, property sales, and other ancillary revenue streams. Accurate revenue reporting provides the foundation for determining overall profitability.

- Total ExpensesThis includes all operating expenses, such as property taxes, insurance, maintenance, and utilities, as well as debt service payments. Comprehensive expense tracking is essential for understanding the cost of operations and its impact on net income.

- Calculating Net Income/LossNet income is calculated by subtracting total expenses from total revenue. A positive result indicates profitability, while a negative result signifies a loss. This calculation provides a clear measure of financial performance and serves as a key indicator of investment success.

- Interpreting the ResultsAnalyzing net income/loss trends over time offers valuable insights into property performance and the effectiveness of management strategies. Consistent profitability demonstrates financial health, while sustained losses may indicate the need for operational adjustments or strategic reevaluation.

Net income/loss provides a crucial benchmark for evaluating investment performance within the real estate sector. By analyzing this key figure within the context of the entire profit and loss statement, stakeholders gain a comprehensive understanding of financial health, enabling data-driven decisions regarding property management, investment strategies, and overall financial planning.

5. Performance Analysis

Performance analysis relies heavily on data derived from a real estate profit and loss statement. The statement provides the raw financial data revenues, expenses, and resulting net income/loss which forms the basis for evaluating investment performance. This analysis goes beyond simply calculating profit or loss; it involves examining trends, identifying contributing factors, and ultimately informing future decision-making. For example, declining rental income might trigger an investigation into market conditions, property management practices, or necessary property improvements. Conversely, increasing operating expenses might prompt a review of vendor contracts or energy efficiency measures. Without the structured data provided by the statement, performance analysis would lack the necessary foundation for objective assessment.

Analyzing key performance indicators (KPIs) derived from the statement offers valuable insights. Metrics such as net operating income (NOI), capitalization rate, and cash flow provide a comprehensive picture of financial health and operational efficiency. Consider a scenario where NOI is consistently below market benchmarks. This could indicate issues with rent collection, inflated operating costs, or a combination of factors. Performance analysis utilizing the profit and loss statement helps pinpoint these areas for improvement, enabling proactive measures to enhance profitability. Furthermore, comparing performance across different properties within a portfolio allows for identifying top performers and underperforming assets, facilitating strategic resource allocation.

Effective performance analysis, grounded in data from the profit and loss statement, is essential for long-term success in real estate. It provides the framework for data-driven decision-making, enabling investors and property managers to identify opportunities for growth, mitigate risks, and optimize returns. By understanding the cause-and-effect relationships revealed through this analysis, stakeholders can proactively address challenges, adapt to changing market conditions, and ultimately achieve their financial objectives within the dynamic real estate landscape.

Key Components of a Real Estate Profit and Loss Statement

A well-structured profit and loss statement provides a comprehensive overview of financial performance. Understanding its key components is crucial for informed decision-making and effective financial management within the real estate sector.

1. Reporting Period: Clearly defines the timeframe covered by the statement, whether it’s a month, quarter, or year. This ensures accurate tracking of financial performance within specific periods and facilitates comparisons over time.

2. Revenue: Encompasses all income generated from real estate activities. This includes rental income, property sales proceeds, and any other ancillary income streams. Accurate revenue reporting is fundamental to assessing overall profitability.

3. Operating Expenses: Details all costs associated with operating and maintaining properties. These include property taxes, insurance premiums, maintenance and repair costs, property management fees, and utilities. Comprehensive expense tracking is essential for understanding profitability and identifying areas for cost optimization.

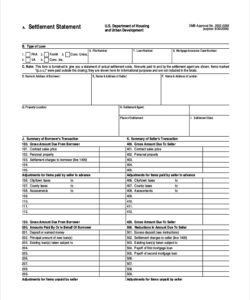

4. Debt Service: Accounts for all payments related to financing, including mortgage principal and interest. Accurately reflecting debt service obligations is crucial for determining true profitability and assessing the impact of financing on cash flow.

5. Net Operating Income (NOI): Represents the difference between total revenue and operating expenses, excluding debt service. NOI provides a clear picture of a property’s profitability before considering financing costs.

6. Net Income/Loss: Calculated by subtracting total expenses, including debt service, from total revenue. This bottom-line figure indicates the overall profitability or loss incurred during the reporting period and serves as a key performance indicator.

Accurate and detailed reporting across these components provides a robust foundation for evaluating financial performance, making strategic decisions, and achieving financial goals within the real estate sector. A comprehensive understanding of these elements is paramount for effective financial management and long-term success.

How to Create a Real Estate Profit and Loss Statement

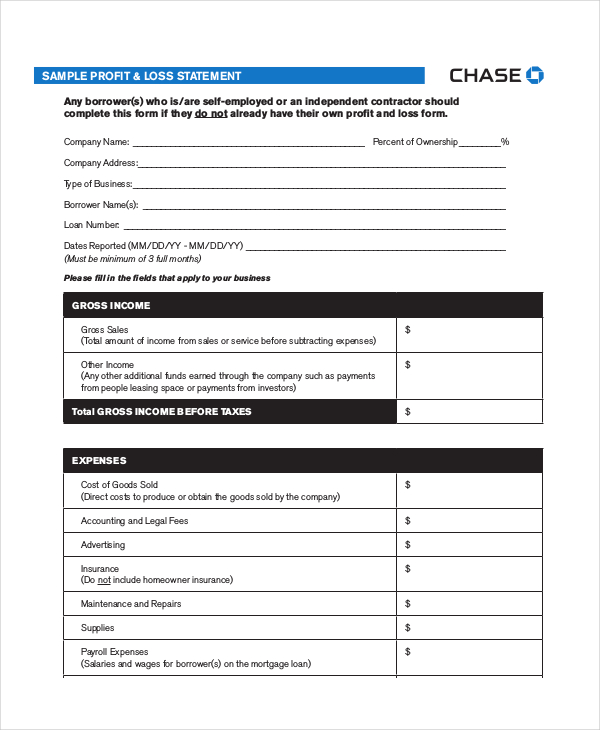

Creating a comprehensive profit and loss statement requires a systematic approach to accurately capture all revenue and expense data. A well-structured statement provides valuable insights into financial performance and informs strategic decision-making.

1. Define the Reporting Period: Specify the precise timeframe covered by the statement (e.g., month, quarter, or year). Consistent reporting periods facilitate trend analysis and performance comparisons.

2. Itemize Revenue Sources: Meticulously list all income generated from real estate activities. This includes rental income, property sales proceeds, late fees, parking fees, and any other ancillary revenue streams.

3. Categorize Operating Expenses: Thoroughly document all costs associated with property operations and maintenance. Common categories include property taxes, insurance premiums, maintenance and repairs, property management fees, utilities, and marketing expenses.

4. Calculate Debt Service: Accurately record all mortgage principal and interest payments. Refer to the loan amortization schedule for detailed payment breakdowns and future projections.

5. Determine Net Operating Income (NOI): Calculate NOI by subtracting total operating expenses from total revenue. This metric reflects the property’s profitability before considering financing costs.

6. Compute Net Income/Loss: Subtract total expenses, including debt service, from total revenue to arrive at the net income or loss. This bottom-line figure represents the overall profitability of the real estate venture during the reporting period.

7. Review and Analyze: Scrutinize the completed statement for accuracy and completeness. Analyze trends, identify outliers, and compare performance against prior periods and industry benchmarks. This analysis provides crucial insights for strategic decision-making and performance optimization.

8. Utilize a Template or Software Consider using a pre-designed template or specialized accounting software to streamline the process and ensure consistency. These tools often offer built-in formulas and reporting functionalities that simplify data entry and analysis.

A meticulously prepared profit and loss statement provides a clear and accurate picture of financial performance. Regularly generating and analyzing this statement enables informed decision-making, facilitates proactive financial management, and contributes to long-term success in the real estate sector.

Effective financial management in real estate hinges on a clear understanding of profitability. A real estate profit and loss statement template provides the framework for organizing revenue and expenses, offering a comprehensive view of financial performance. From tracking rental income and operating costs to calculating debt service and net income, the statement facilitates informed decision-making. By analyzing trends and key performance indicators derived from this data, stakeholders can identify areas for improvement, optimize resource allocation, and adapt to market dynamics.

Leveraging a structured approach to financial reporting empowers real estate professionals to make data-driven decisions, mitigate risks, and achieve long-term financial success. Regularly generating and analyzing profit and loss statements fosters financial transparency, promotes accountability, and contributes to sustainable growth within the real estate sector. This meticulous approach to financial management is not merely a best practice; it is a cornerstone of sustained success in the dynamic world of real estate investment and operations.