Utilizing such a structured financial document allows real estate professionals to track profitability, identify areas for cost optimization, and project future earnings. This granular insight empowers better budgeting, more strategic investment decisions, and ultimately contributes to sustained business growth and financial stability. It also provides essential information for tax preparation and can be invaluable when seeking financing.

The following sections will delve into the specific components of a well-structured statement for realtors, exploring best practices for its creation and utilization, and highlighting key performance indicators to monitor for optimal financial health.

1. Revenue Tracking

Revenue tracking forms the cornerstone of an accurate and informative profit and loss statement for realtors. Meticulous recording of all income sources is essential for understanding profitability and making informed business decisions. This encompasses not only commissions from sales and rentals but also other potential income streams such as referral fees or property management services. Without comprehensive revenue tracking, the resulting financial picture is incomplete, hindering effective analysis and planning. For instance, a realtor might underestimate their total income if referral bonuses are inconsistently recorded, leading to inaccurate profit calculations and potentially flawed business strategies.

The connection between revenue tracking and a realtor’s profit and loss statement is a direct and crucial one. Accurate revenue data feeds directly into the statement, impacting the calculated profit or loss. This data allows realtors to identify their most profitable service areas, understand seasonal trends in their income, and assess the effectiveness of different marketing strategies. For example, by tracking revenue generated from online property listings versus traditional advertising, a realtor can allocate marketing resources more effectively. Furthermore, precise revenue data is essential for tax reporting and compliance, minimizing the risk of penalties and ensuring legal soundness.

In summary, meticulous revenue tracking is not merely a bookkeeping task; it is the foundation upon which sound financial decisions are built. It provides the essential data for a realtor’s profit and loss statement to reflect the true financial performance of the business. Challenges in consistent and accurate revenue recording can be mitigated through utilizing dedicated real estate accounting software or engaging professional bookkeeping services. The insights derived from properly tracked revenue are invaluable for strategic planning, business growth, and long-term financial stability within the dynamic real estate market.

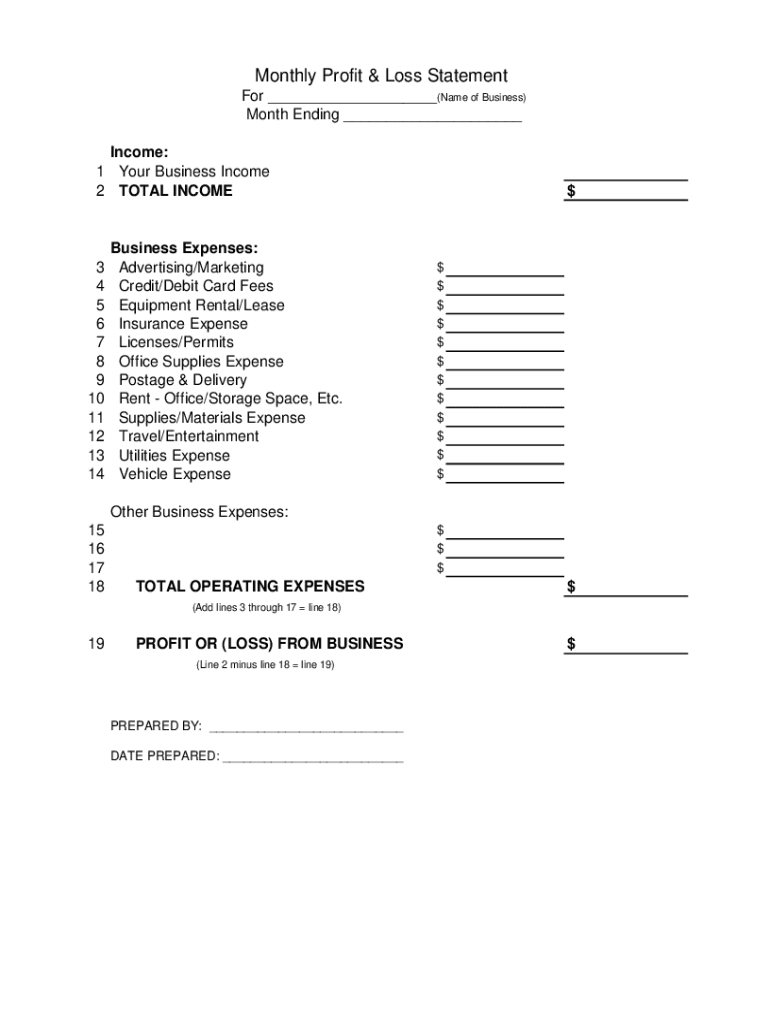

2. Expense Categorization

Expense categorization is integral to a comprehensive realtor profit and loss statement template. Categorizing expenses provides a granular view of where funds are allocated, enabling informed financial decisions. Without a structured approach, costs become obfuscated, hindering effective analysis. Clear categories, such as marketing, office supplies, professional fees, and travel, allow for precise tracking and identification of areas for potential cost optimization. For example, separating marketing expenses into online advertising, print materials, and open house events reveals which channels yield the highest return on investment.

Effective expense categorization directly impacts the accuracy and utility of the profit and loss statement. By meticulously classifying each expense, realtors gain a clear understanding of their cost structure. This clarity facilitates benchmarking against industry averages, identifying potential overspending, and informing budgetary adjustments. Furthermore, detailed expense records simplify tax preparation and provide supporting documentation for audits. For instance, accurately categorizing vehicle expenses, including mileage and maintenance, ensures proper deductions and minimizes tax liabilities. Conversely, poorly categorized expenses can lead to missed deductions and potential compliance issues.

In conclusion, systematic expense categorization is essential for maximizing the value of a realtor profit and loss statement template. It empowers realtors to understand their spending patterns, optimize resource allocation, and enhance profitability. Challenges in maintaining consistent categorization can be addressed through utilizing accounting software or establishing standardized expense tracking procedures. The insights derived from well-categorized expenses contribute significantly to informed financial management, ultimately supporting business growth and long-term success.

3. Profit Calculation

Profit calculation is the core function of a realtor profit and loss statement template. It provides the essential metric for evaluating financial performance and making informed business decisions. Understanding the components of profit calculation and its implications is crucial for effective financial management in the real estate industry. A clear profit calculation reveals the financial health of the business, highlighting areas of strength and weakness. Without this precise figure, strategic planning and informed decision-making become significantly more challenging.

- Gross ProfitGross profit represents the revenue remaining after deducting the direct costs associated with providing services, primarily the cost of sales. For realtors, this might include transaction fees, marketing costs directly tied to a specific sale, or staging expenses. Calculating gross profit provides insight into the profitability of core business operations before accounting for overhead. A healthy gross profit margin indicates efficient operations and effective pricing strategies.

- Operating ProfitOperating profit is derived by subtracting operating expenses, such as office rent, salaries, and marketing expenses, from the gross profit. This metric reveals the profitability of the business after accounting for the costs of running daily operations. Analyzing operating profit helps assess the efficiency of resource management and identify potential areas for cost reduction. For instance, a declining operating profit might signal the need to review staffing levels or marketing expenditures.

- Net ProfitNet profit represents the final profit after all expenses, including taxes and interest, have been deducted from revenue. This is the bottom-line measure of profitability and reflects the overall financial success of the business. Monitoring net profit trends over time is essential for assessing long-term financial health and making informed decisions about investments and growth strategies. Consistent net profit growth indicates a healthy and sustainable business model.

- Profit MarginsProfit margins, expressed as percentages, provide a standardized way to analyze profitability. Gross profit margin, operating profit margin, and net profit margin reveal the proportion of revenue that translates into profit at each stage. These metrics facilitate comparison against industry benchmarks and aid in identifying areas for improvement. For example, a low net profit margin might indicate the need to review pricing strategies or reduce overhead costs.

Accurate profit calculation, encompassing these facets, is paramount for utilizing a realtor profit and loss statement template effectively. By understanding these metrics, realtors gain actionable insights into their financial performance, enabling data-driven decisions regarding pricing, cost management, and long-term business strategy. This data-driven approach strengthens financial stability and fosters sustainable growth within the competitive real estate landscape.

4. Performance Analysis

Performance analysis relies heavily on data derived from the realtor profit and loss statement template. The statement serves as a foundational document, providing key metrics for evaluating business health and identifying areas for improvement. This analysis extends beyond simply calculating profit; it involves examining trends, comparing performance against benchmarks, and understanding the underlying factors driving financial outcomes. For example, a consistent decline in gross profit margin might indicate a need to reassess pricing strategies or explore more cost-effective marketing channels. Conversely, a steady increase in operating profit could suggest effective cost management and efficient resource allocation.

The statement facilitates several crucial performance analyses. Analyzing revenue streams reveals which service areas contribute most significantly to profitability. Examining expense trends helps identify areas of potential overspending or inefficiency. Calculating key performance indicators, such as return on investment (ROI) for marketing campaigns, provides data-driven insights for optimizing resource allocation. For instance, by tracking the cost of online advertising against the leads generated, a realtor can determine the effectiveness of their digital marketing strategy and make necessary adjustments. Furthermore, comparing current performance against historical data or industry benchmarks provides context and identifies areas where the business excels or requires attention.

In conclusion, the realtor profit and loss statement template is not merely a record of financial transactions; it is a critical tool for performance analysis. By leveraging the data within the statement, realtors can gain a comprehensive understanding of their business performance, identify areas for improvement, and make informed decisions to drive growth and profitability. Challenges in conducting effective performance analysis often stem from inconsistent data tracking or a lack of clear benchmarks. Addressing these challenges requires implementing robust accounting practices and utilizing industry-specific metrics to gain a clear and actionable understanding of financial performance within the dynamic real estate market.

5. Financial Planning

Financial planning for real estate professionals relies significantly on the data provided by a profit and loss statement template. The statement serves as a crucial tool, offering historical performance insights that inform future financial decisions. This data-driven approach empowers realtors to develop realistic budgets, set achievable financial goals, and make strategic investments to drive business growth and ensure long-term stability.

- BudgetingBudgeting utilizes historical expense and revenue data from the profit and loss statement to create a realistic financial roadmap for the future. By understanding past spending patterns and income trends, realtors can develop budgets that align with their business objectives. For instance, if the statement reveals consistently high marketing expenses relative to revenue generated, the budget might prioritize more cost-effective marketing strategies or allocate a larger portion of resources to lead generation activities with a proven higher return on investment.

- Goal SettingFinancial goal setting, grounded in the data from the profit and loss statement, allows for the establishment of achievable targets. Analyzing past performance provides a realistic baseline for setting future revenue goals, profit margins, and expense reduction targets. For example, if the statement shows a consistent year-over-year increase in net profit, a realtor might set a goal to further increase that profit by a specific percentage in the coming year. This data-driven approach ensures that goals are ambitious yet attainable, motivating performance and driving business growth.

- Investment DecisionsInvestment decisions benefit significantly from the insights provided by the profit and loss statement. Analyzing profitability trends and expense patterns informs decisions regarding investments in marketing, technology, or expansion. For example, if the statement reveals strong profitability in a specific market segment, a realtor might consider investing in targeted marketing campaigns to further penetrate that market. Conversely, if the statement indicates declining profitability due to high operational costs, investments in technology to streamline processes and reduce expenses might be prioritized.

- Risk ManagementRisk management utilizes the profit and loss statement to identify potential financial vulnerabilities. Analyzing expense trends and revenue fluctuations can reveal areas of financial risk, enabling proactive mitigation strategies. For example, if the statement shows a heavy reliance on a single revenue stream, a realtor might diversify their services or expand into new markets to reduce dependence and mitigate the risk of revenue decline. This proactive approach, informed by historical data, strengthens financial resilience and safeguards against unforeseen market fluctuations.

In conclusion, the realtor profit and loss statement template is not merely a historical record; it is a critical tool for forward-looking financial planning. By leveraging the data and insights derived from the statement, realtors can develop realistic budgets, set achievable goals, make informed investment decisions, and proactively manage financial risks. This data-driven approach empowers realtors to navigate the dynamic real estate market with greater confidence and achieve long-term financial success.

Key Components of a Realtor Profit and Loss Statement Template

A well-structured profit and loss statement template for realtors provides a comprehensive overview of financial performance. Understanding its key components is essential for informed decision-making and business growth. These components offer a detailed breakdown of revenue, expenses, and resulting profitability, enabling realtors to assess their financial health and identify areas for improvement.

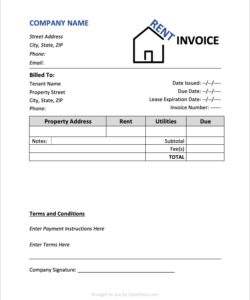

1. Revenue: This section details all income generated from real estate activities. Crucially, it should differentiate between various revenue streams, such as sales commissions, rental commissions, property management fees, and referral bonuses. This breakdown allows for analysis of each revenue stream’s performance and contribution to overall profitability.

2. Cost of Sales: These are expenses directly related to generating revenue. For realtors, this might include transaction fees, marketing costs tied to specific sales (e.g., photography, staging), and commissions paid to cooperating brokers. Accurate tracking of these costs is essential for calculating gross profit.

3. Gross Profit: Calculated by subtracting the cost of sales from total revenue, gross profit represents the profitability of core business operations before accounting for overhead expenses. This metric is a key indicator of pricing effectiveness and operational efficiency.

4. Operating Expenses: This category encompasses all costs associated with running the business, excluding the cost of sales. Examples include office rent, salaries, marketing and advertising expenses, insurance, professional fees, and utilities. Detailed categorization of operating expenses allows for identification of areas for potential cost optimization.

5. Operating Profit: Derived by subtracting operating expenses from gross profit, operating profit indicates the profitability of the business after accounting for the costs of daily operations. This metric provides insight into the efficiency of resource management and overall business performance.

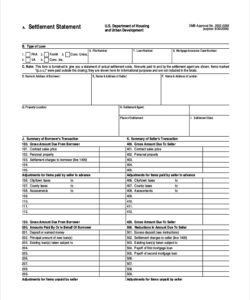

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations. Examples include interest income, investment gains or losses, and one-time expenses. Including these items provides a more complete picture of overall financial performance.

7. Net Profit: Representing the bottom line, net profit is calculated by subtracting all expenses, including taxes and interest, from total revenue and other income. This metric reflects the overall financial success of the business and is a key indicator of long-term sustainability.

Accurate and detailed reporting within each of these components provides realtors with a comprehensive understanding of their financial position, enabling data-driven decisions for sustained growth and profitability. This granular view allows for informed adjustments to pricing strategies, expense management, and business development initiatives, ultimately contributing to long-term success in the competitive real estate market.

How to Create a Realtor Profit and Loss Statement Template

Creating a profit and loss statement provides real estate professionals with a clear picture of their financial performance. A well-structured template ensures consistency and accuracy, facilitating informed decision-making. The following steps outline the process of creating a comprehensive and effective template.

1. Choose a Time Period: Specify a clear reporting period, such as a month, quarter, or year. Consistent reporting periods allow for accurate tracking of performance trends over time.

2. Define Revenue Categories: Establish distinct categories for all revenue streams, including sales commissions, rental commissions, property management fees, and referral bonuses. This categorization allows for analysis of each revenue source’s contribution to overall profitability.

3. Categorize Expenses: Create detailed expense categories, such as marketing and advertising, office supplies, salaries, rent, utilities, professional fees, and insurance. Granular categorization facilitates cost analysis and identification of areas for potential savings.

4. Calculate Cost of Sales: Determine all expenses directly related to revenue generation. For realtors, this typically includes transaction fees, marketing costs tied to specific sales (like photography or staging), and commissions paid to cooperating brokers. This calculation is essential for determining gross profit.

5. Calculate Gross Profit: Subtract the cost of sales from total revenue to arrive at gross profit. This figure represents the profitability of core business operations before accounting for overhead expenses.

6. Calculate Operating Profit: Subtract operating expenses from gross profit to determine operating profit. This metric reveals the profitability of the business after accounting for all operating costs.

7. Account for Other Income/Expenses: Include any income or expenses not directly related to core business operations, such as interest income, investment gains/losses, and one-time expenses. This provides a more complete financial picture.

8. Calculate Net Profit: Subtract all remaining expenses, including taxes and interest, from operating profit (plus other income) to arrive at net profit. This is the bottom-line measure of profitability.

9. Calculate Profit Margins: Divide each profit level (gross, operating, net) by total revenue to express profitability as a percentage. This allows for benchmarking against industry standards and tracking performance over time.

A well-defined template, encompassing these elements, provides a structured approach to analyzing financial performance. Consistent use of this template allows for accurate tracking of progress, identification of areas for improvement, and informed decision-making to drive business growth and ensure long-term financial stability.

Effective financial management is paramount for success in the competitive real estate industry. A realtor profit and loss statement template provides an indispensable tool for achieving this objective. By offering a structured framework for tracking revenue, categorizing expenses, and calculating profit, the template empowers real estate professionals to gain a comprehensive understanding of their financial performance. Analyzing these figures allows for informed decision-making regarding pricing strategies, cost optimization, and investment opportunities. Furthermore, the template facilitates accurate financial planning, enabling realtors to set realistic budgets, achieve financial goals, and mitigate potential risks. Ultimately, consistent and insightful utilization of a well-structured profit and loss statement template contributes significantly to long-term financial stability and sustainable growth within the dynamic real estate market.

In the evolving landscape of real estate, informed financial decisions are not merely advantageous; they are essential for sustained success. Leveraging the insights provided by a profit and loss statement template positions real estate professionals to navigate market fluctuations, capitalize on emerging opportunities, and achieve lasting financial prosperity. The disciplined application of financial analysis, facilitated by a comprehensive template, empowers realtors to not only understand their current financial standing but also to proactively shape their future financial trajectory.