Utilizing such a document offers several advantages. It promotes clarity and reduces the likelihood of disputes arising from misunderstandings regarding payments. The readily available documentation streamlines accounting processes for landlords and provides tenants with a convenient way to track their rental expenses. This organized approach contributes to a more professional and positive landlord-tenant relationship.

The subsequent sections will delve into the specific components typically found within these documents, explore various methods of creating and accessing them, and discuss best practices for their usage to maximize efficiency and transparency in rental management. Further exploration will also cover legal considerations and potential customization options to meet specific needs.

1. Payment Dates

Accurate recording of payment dates is crucial within a structured rent statement. This information provides a chronological record of transactions, enabling both landlords and tenants to reconcile payments against the lease terms. Discrepancies can be readily identified and addressed, minimizing potential disputes. For instance, a tenant might question a late fee if the recorded payment date doesn’t align with their bank statement. Clear documentation of payment dates protects both parties by providing verifiable evidence of financial activity.

Furthermore, precise payment dates are essential for accurate accounting and financial reporting. Landlords can track income flow, identify late payments, and calculate applicable late fees. This detailed record supports efficient property management and facilitates informed financial decisions. Consider a scenario where a landlord needs to demonstrate consistent rental income for a loan application. A rent statement with accurate payment dates provides the necessary documentation.

In summary, accurate payment dates within a rent statement contribute to transparency and accountability. This element not only supports efficient dispute resolution but also provides critical data for financial management and reporting. The meticulous inclusion of payment dates ensures a comprehensive and reliable record of the tenancy’s financial history, fostering a professional and well-documented landlord-tenant relationship. This practice minimizes misunderstandings and promotes trust between both parties.

2. Payment Amounts

Accurate documentation of payment amounts is a fundamental component of a comprehensive rent statement. Clarity regarding the precise amount received for each payment period is essential for both landlords and tenants. This information allows for reconciliation with banking records and ensures that all parties are in agreement regarding the financial status of the tenancy. Discrepancies, such as partial payments or overpayments, can be readily identified and addressed, preventing potential disputes. For example, a tenant may have made a partial payment due to unforeseen circumstances. Clearly documenting the received amount on the rent statement facilitates a transparent discussion and resolution.

Furthermore, the detailed recording of payment amounts enables accurate tracking of rental income and expenses. This data is critical for landlords’ financial management, including budgeting, forecasting, and tax reporting. Consider a scenario where a landlord needs to analyze rental income trends for a specific property. A rent statement with precise payment amounts provides the necessary data for this analysis. Similarly, tenants can utilize this information to manage their own financial records and ensure accurate budgeting for housing expenses. The clear documentation of payment amounts empowers informed financial decision-making for both parties.

In summary, precise documentation of payment amounts within a rent statement is crucial for transparent financial management and dispute resolution. This level of detail supports accurate record-keeping for both landlords and tenants, facilitating effective communication and fostering a professional landlord-tenant relationship. Accurate payment records contribute to a clear understanding of financial obligations and promote a smoother tenancy experience.

3. Outstanding Balance

Within the framework of a rent statement, the outstanding balance represents a critical piece of information, reflecting the total amount of rent and associated fees owed by a tenant to a landlord. This figure provides a clear snapshot of the tenant’s current financial standing with respect to the lease agreement. Accurate calculation and prominent display of the outstanding balance are crucial for transparency and effective financial management for both parties.

- Current Rent DueThis component of the outstanding balance represents the rent owed for the current payment period. For example, if rent is due on the first of the month and a payment has not been received, the full monthly rent amount constitutes the current rent due. This information is vital for tenants to understand their immediate payment obligation.

- Overdue RentOverdue rent reflects any unpaid rent from previous periods. This might include rent from the previous month, or even older outstanding amounts. A rent statement should clearly delineate overdue rent from current rent due, allowing tenants to understand the accumulated debt. This clarity can help prevent misunderstandings and facilitate timely payment.

- Accrued Late FeesLate fees, if applicable, contribute to the outstanding balance. These fees, typically associated with overdue rent, should be clearly itemized on the rent statement. Transparency regarding the calculation and application of late fees is important to avoid disputes. The statement should clearly show the date the late fee was incurred and the amount charged.

- Other ChargesBeyond rent and late fees, other charges may contribute to the outstanding balance. These could include charges for repairs, utilities, or other agreed-upon expenses. Itemizing these charges separately on the rent statement enhances transparency and allows tenants to understand the composition of the total amount owed. For example, a charge for repairing damage caused by the tenant would be listed separately.

A comprehensive rent statement template must incorporate a clear and accurate representation of the outstanding balance, encompassing all its constituent elements. This transparency fosters a clear understanding of the financial obligations within the tenancy and contributes significantly to a professional and well-managed landlord-tenant relationship. Providing this detailed breakdown minimizes the potential for disputes and promotes timely resolution of any financial discrepancies.

4. Late Fees (if applicable)

Within the structure of a rent statement, the inclusion and detailed explanation of late fees, when applicable, is a critical component of transparent financial communication between landlords and tenants. This section clarifies the implications of late rent payments and ensures that tenants are fully informed of the financial consequences. A well-defined late fee policy, clearly articulated within the rent statement, fosters accountability and encourages timely rent payments.

- Legal Framework and ComplianceLate fees must adhere to local and state regulations. Rent statements should reflect legally permissible late fee amounts and calculation methods. For example, some jurisdictions limit late fees to a percentage of the monthly rent, while others impose fixed maximum charges. Compliance with these regulations is essential to avoid legal challenges and maintain a professional landlord-tenant relationship. The rent statement serves as documentation of the agreed-upon and legally compliant late fee policy.

- Clarity and TransparencyThe rent statement must clearly outline the conditions under which late fees are applied. This includes specifying the grace period, if any, and the date on which a payment is considered late. For instance, a rent statement might stipulate that rent is due on the first of the month and a grace period of five days is provided before a late fee is assessed. This clarity prevents disputes arising from misunderstandings regarding the application of late fees.

- Calculation MethodologyThe method used to calculate late fees should be transparently presented within the rent statement. This might involve a fixed fee, a percentage of the overdue rent, or a combination of both. The statement should clearly illustrate how the late fee is determined, providing an example calculation if necessary. This transparency allows tenants to understand how the late fee is derived and promotes financial accountability.

- Impact on Outstanding BalanceLate fees, when applied, contribute to the outstanding balance owed by the tenant. The rent statement should clearly reflect the impact of late fees on the total amount due. This reinforces the financial consequences of late payments and encourages tenants to prioritize timely rent payments to avoid accumulating additional charges. A well-structured rent statement clearly separates late fees from the base rent amount, providing a comprehensive overview of all charges.

By incorporating a detailed explanation of late fees within the rent statement template, landlords establish a transparent and legally sound framework for handling late rent payments. This practice not only protects the landlord’s financial interests but also provides tenants with a clear understanding of their responsibilities, fostering a professional and mutually respectful landlord-tenant relationship. This clarity minimizes the potential for disputes arising from late payments and contributes to a smoother tenancy experience for both parties.

5. Property Address

Accurate identification of the property subject to the rental agreement is a fundamental requirement of any rent statement. Inclusion of the complete and correct property address ensures clarity and prevents potential disputes arising from misidentification. The property address serves as a key identifier, linking the financial transactions documented within the rent statement to the specific premises being rented.

- Legal Description and IdentificationThe property address serves as a legally recognized identifier of the premises. This information is crucial for legal documentation, tax purposes, and official correspondence. For example, in the event of a legal dispute, the precise property address is essential for accurate identification of the property in question. Including this information on the rent statement reinforces its legal validity and provides a clear reference point for all parties involved.

- Distinguishing Multiple PropertiesFor landlords managing multiple properties, accurate inclusion of the property address on each rent statement is essential for differentiating between tenancies. This prevents confusion and ensures that payments are correctly allocated to the corresponding property. Consider a landlord who owns several apartment buildings. The distinct property address on each rent statement allows for accurate tracking of rental income and expenses for each individual building.

- Verification and Confirmation for TenantsInclusion of the property address on the rent statement allows tenants to verify that the document pertains to their specific tenancy. This prevents misunderstandings and ensures that tenants are paying rent for the correct premises. This is particularly important for tenants renting multiple properties or those who have recently moved. The clearly stated property address confirms the financial transaction’s relevance to the specific property they occupy.

- Official Correspondence and Record-KeepingThe property address on the rent statement serves as a crucial reference point for official correspondence and record-keeping. This information facilitates accurate filing and retrieval of documents related to the tenancy. For instance, when filing tax returns, the property address is essential for accurately reporting rental income and expenses. Similarly, the property address is vital for insurance purposes and other official documentation related to the property.

In conclusion, the accurate inclusion of the property address on a rent statement is a fundamental aspect of effective property management. This information ensures clarity, prevents disputes, and facilitates accurate financial record-keeping. The property address serves as a crucial link between the financial transactions documented on the statement and the physical property itself, contributing to a transparent and well-documented landlord-tenant relationship.

6. Contact Information

Inclusion of accurate and accessible contact information within a rent statement template is crucial for facilitating effective communication between landlords and tenants. This information empowers tenants to readily address inquiries, report maintenance issues, or seek clarification regarding their accounts. Conversely, it allows landlords to efficiently communicate important updates, notices, or reminders to tenants. This bidirectional communication channel strengthens the landlord-tenant relationship and contributes to a smoother tenancy experience. For instance, a tenant experiencing a plumbing issue can quickly contact the landlord using the information provided on the rent statement, facilitating prompt resolution. Similarly, a landlord can efficiently notify tenants of upcoming property inspections or maintenance work.

Furthermore, the presence of contact information on the rent statement strengthens accountability and transparency. It provides a clear point of contact for both parties, fostering a sense of responsibility and professionalism. Consider a scenario where a tenant identifies a discrepancy in their rent statement. readily available contact information enables them to quickly address the issue with the landlord, preventing potential escalation of the matter. Similarly, landlords can utilize the contact information to address tenant inquiries regarding late fees or other charges, promoting transparency and mutual understanding. This open communication channel minimizes potential misunderstandings and contributes to a more positive and productive landlord-tenant relationship.

In summary, incorporating accurate contact information within a rent statement template is a fundamental aspect of effective property management. It facilitates proactive communication, fosters accountability, and contributes to a more positive landlord-tenant relationship. This readily accessible information empowers both parties to address inquiries and resolve issues efficiently, promoting a smoother and more transparent tenancy experience. The absence of clear contact information can lead to frustration, delays in addressing critical issues, and potentially strained relationships. Therefore, prioritizing the inclusion of contact information within a rent statement demonstrates professionalism and a commitment to effective communication.

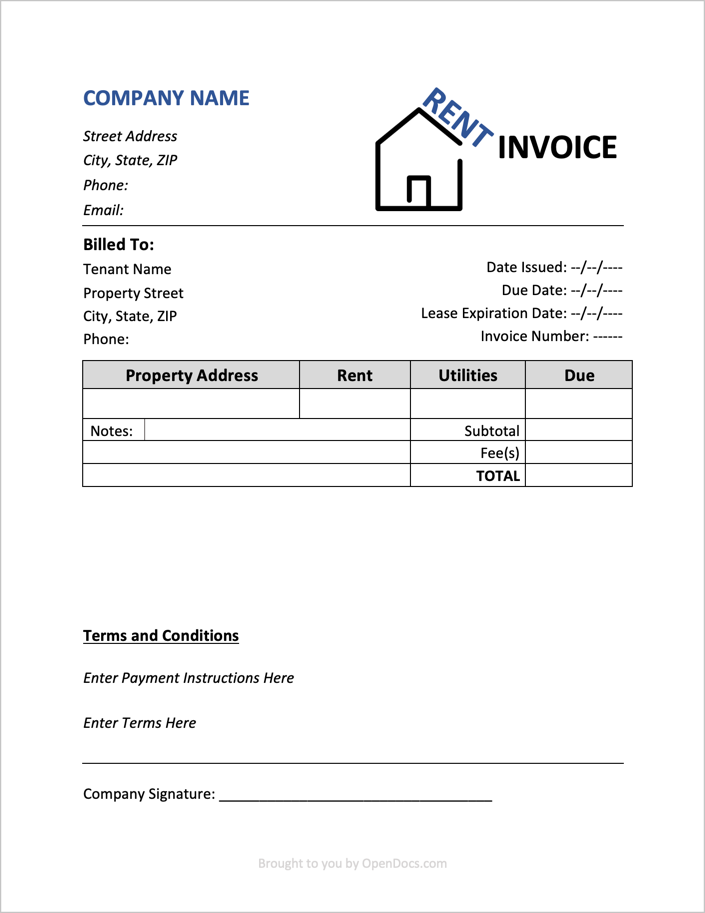

Key Components of a Rent Statement

A comprehensive rent statement provides a transparent record of financial transactions between landlord and tenant. Clarity and accuracy are paramount to ensure both parties understand the financial status of the tenancy. Several key components contribute to a well-structured and informative rent statement.

1. Property Address: Precise identification of the rental property is essential. The full address, including unit number if applicable, ensures clarity and prevents confusion, particularly for landlords managing multiple properties. This allows for accurate record-keeping and facilitates clear communication regarding the specific premises.

2. Tenant Name(s): Clear identification of the tenant(s) responsible for the rental payments is crucial. Listing all tenants named on the lease ensures accountability and facilitates direct communication. This clarity prevents misunderstandings and ensures all parties responsible are aware of the financial obligations.

3. Payment Period: The specific timeframe covered by the rent statement must be clearly defined. This might be a monthly, quarterly, or other agreed-upon period. Specifying the payment period allows for accurate tracking of payments and facilitates reconciliation with tenant records.

4. Payment Due Date: The date rent is due according to the lease agreement should be prominently displayed. This information serves as a reminder for tenants and enables timely payment processing. A clear due date minimizes late payments and contributes to a smoother financial relationship.

5. Payment Amount Due: The total amount of rent due for the specified payment period must be clearly stated. This includes the base rent and any other agreed-upon charges, such as pet fees or parking fees. Clarity regarding the total amount due prevents misunderstandings and ensures accurate payment processing.

6. Payment Received Date: Recording the date each payment is received provides a verifiable transaction history. This information helps reconcile payments and identify any discrepancies. Accurate documentation of payment dates protects both landlords and tenants in case of disputes.

7. Payment Amount Received: Documenting the precise amount received for each payment is crucial for accurate record-keeping. This allows for tracking partial payments and facilitates identification of any outstanding balances. Clear documentation of payment amounts contributes to transparent financial management.

8. Outstanding Balance: This figure reflects the total amount owed by the tenant, including any unpaid rent, late fees, or other charges. A clear and accurate outstanding balance provides a snapshot of the tenant’s current financial standing with respect to the lease agreement. This information is vital for both landlords and tenants to understand the financial status of the tenancy.

These components contribute to a transparent and comprehensive overview of the tenancy’s financial status, facilitating effective communication and minimizing potential disputes. Accuracy and clarity in these elements are essential for maintaining a professional and well-documented landlord-tenant relationship.

How to Create a Rent Statement Template

Creating a standardized rent statement template ensures consistency, clarity, and professionalism in managing financial transactions within a tenancy. A well-structured template benefits both landlords and tenants by providing a clear and accurate record of payment history. The following steps outline the process of creating a comprehensive rent statement template.

1. Choose a Format: Select a format suitable for record-keeping, whether a spreadsheet, word processing document, or dedicated property management software. Consider factors such as ease of use, customization options, and integration with existing accounting systems. A spreadsheet offers flexibility for calculations, while dedicated software may provide automated features.

2. Landlord Information: Include clear landlord identification information, including name or business entity name, address, phone number, and email address. This allows tenants to easily contact the landlord with any inquiries or concerns. Clear contact information promotes efficient communication and facilitates prompt resolution of any issues.

3. Tenant Information: Designate spaces for tenant name(s) and the rental property address. Accurate tenant and property identification is crucial for linking financial transactions to the correct tenancy. This information ensures clarity and prevents potential disputes related to misidentification.

4. Payment Details: Create clearly labeled sections for payment details, including the payment period, due date, amount due, received date, and amount received. This structured approach allows for accurate tracking of payments and facilitates reconciliation with tenant records. A well-defined payment section promotes transparency and accountability.

5. Outstanding Balance: Incorporate a section to calculate and display the outstanding balance. This figure should clearly represent the total amount owed by the tenant, including any unpaid rent, late fees, or other applicable charges. Accurate calculation of the outstanding balance is essential for both landlords and tenants to understand the financial status of the tenancy.

6. Late Fee Policy (if applicable): If a late fee policy exists, clearly outline the terms within the template. Specify the grace period, calculation method, and any applicable limits. Transparency regarding late fees helps prevent misunderstandings and ensures compliance with legal regulations. A well-defined late fee policy fosters accountability and encourages timely rent payments.

7. Additional Charges: Include a section for any additional charges beyond rent and late fees, such as utilities, repairs, or other agreed-upon expenses. Itemizing these charges separately provides transparency and allows tenants to understand the composition of the total amount due. Clear documentation of additional charges prevents disputes and fosters a clear understanding of financial obligations.

8. Payment Methods: Specify accepted payment methods within the template, including online payments, checks, or money orders. Providing clear instructions on payment procedures streamlines the payment process and ensures timely receipt of rent. This clarity reduces confusion and minimizes potential delays in payment processing.

A well-designed template incorporating these elements provides a clear, concise, and professional record of rental transactions, promoting transparency and facilitating effective communication between landlords and tenants. Regular use of a standardized template contributes to efficient property management and fosters a positive landlord-tenant relationship.

Accurate and comprehensive documentation of rental transactions is paramount for effective property management. Standardized templates for rent statements provide a structured approach to recording payment history, outstanding balances, and other relevant financial information. This structured approach fosters transparency, reduces disputes, and contributes to a professional landlord-tenant relationship. Key components such as precise payment dates and amounts, clear identification of the property and tenants involved, and transparently presented outstanding balances contribute to a comprehensive financial record. Furthermore, the inclusion of contact information and clear articulation of late fee policies, if applicable, facilitate communication and promote accountability. Utilizing a well-designed template ensures consistency in record-keeping and fosters a clear understanding of financial obligations for both landlords and tenants.

Effective utilization of rent statement templates contributes significantly to efficient property management and positive tenant relations. This practice not only streamlines accounting processes but also empowers informed financial decision-making for all parties involved. Adoption of standardized documentation practices reflects a commitment to professionalism and transparency, fostering trust and minimizing potential conflicts within the landlord-tenant relationship. As the rental landscape continues to evolve, prioritizing clear and accurate financial documentation remains crucial for successful property management.