Utilizing such a structured report allows for informed financial decisions. It facilitates the tracking of key performance indicators, enabling property owners to identify areas for cost optimization and revenue growth. Furthermore, this organized financial record is essential for accurate tax reporting and can be instrumental in securing financing or attracting potential investors. Regularly reviewing this financial summary contributes to improved budgeting, more effective property management, and ultimately, enhanced profitability.

The following sections will delve into the specific components of this financial tool, offering practical guidance on its creation and utilization for maximizing investment returns.

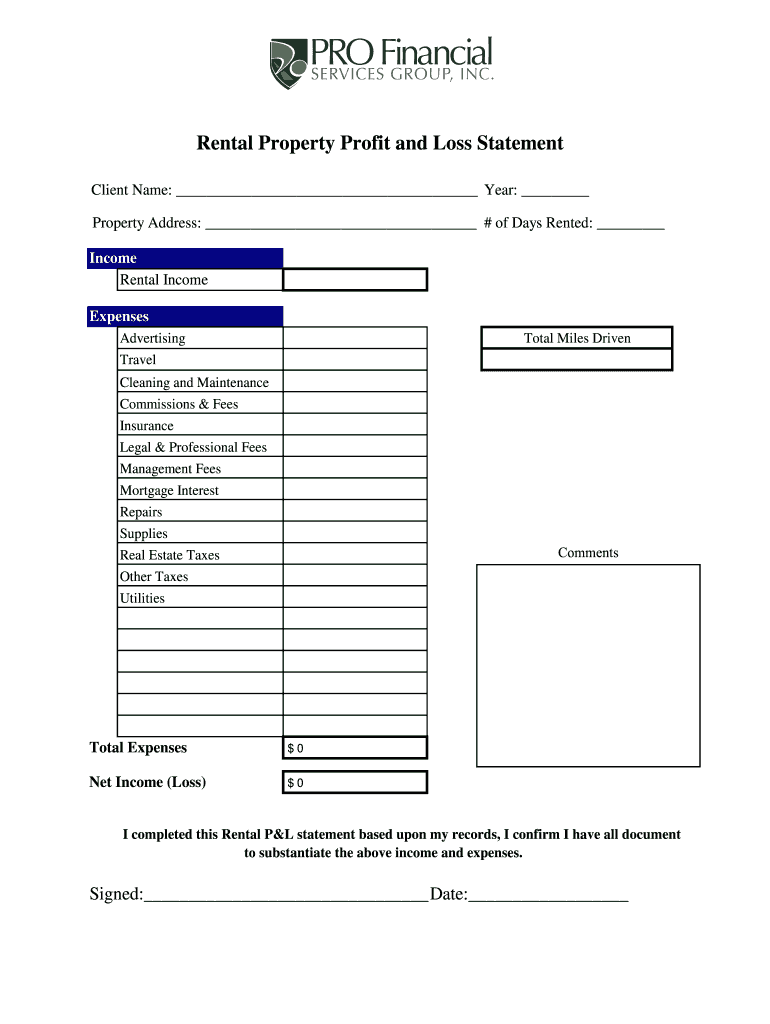

1. Income

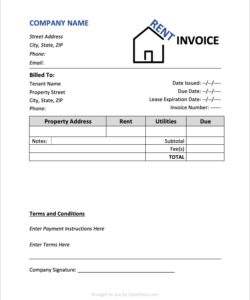

Accurate income reporting forms the foundation of a reliable rental profit and loss statement. This section encompasses all revenue generated by the property, including monthly rent payments, late fees, pet fees, parking fees, and any other ancillary income streams. For example, a property owner might receive $1,500 in monthly rent, $50 in late fees, and $25 in pet fees. Meticulous recording of each income source ensures a comprehensive picture of revenue generation, crucial for calculating accurate profit margins. Understanding the breakdown of income sources also allows for strategic planning; for instance, if pet fees consistently contribute a significant portion of revenue, an owner might consider expanding pet-friendly amenities to attract more tenants.

Misrepresenting or omitting income figures can lead to skewed profitability calculations and inaccurate tax reporting. Consider a scenario where a property owner fails to record consistent late fees. This oversight underestimates total income and potentially misrepresents the financial health of the property. Accurate income reporting is not only essential for understanding profitability but also for making informed decisions regarding future investments and property management strategies. Consistent and detailed income tracking enables data-driven decision-making, contributing to the long-term financial success of the rental property.

In summary, the income section of a rental profit and loss statement provides a critical overview of revenue generation. Detailed tracking of all income sources, including both regular and ancillary income streams, is crucial for accurate profitability assessment and informed financial management. This meticulous approach facilitates data-driven decision-making, contributing to optimized returns and long-term financial stability.

2. Expenses

A comprehensive understanding of expenses is crucial for accurate profitability assessment within a rental profit and loss statement template. This section details all costs associated with property ownership and management, providing insights into areas for potential cost optimization and informed financial planning. Accurately categorized and consistently tracked expenses contribute to a realistic portrayal of financial performance, enabling data-driven decisions for maximizing returns.

- Operating ExpensesThese recurring costs are essential for the day-to-day operation and maintenance of the property. Examples include property taxes, insurance premiums, routine maintenance and repairs, landscaping, pest control, and property management fees. Accurately tracking these expenses reveals trends and potential areas for cost reduction. For instance, consistently high repair costs might necessitate preventative maintenance to mitigate future expenses. Ignoring or underestimating operating expenses can lead to an inflated profit perception, hindering effective financial planning.

- Capital ExpendituresThese investments in property improvements or upgrades contribute to long-term value appreciation. Examples include roof replacements, HVAC system upgrades, major renovations, and appliance replacements. While not recurring expenses like operating costs, capital expenditures represent significant investments that impact overall profitability. Properly accounting for these expenses provides a more accurate depiction of long-term investment performance and allows for strategic planning of future capital allocation.

- Financing CostsIf the property is financed through a mortgage, financing costs represent the expenses associated with the loan. These include mortgage interest payments, loan origination fees, and other related expenses. Accurately tracking financing costs allows for precise profit calculation after debt servicing. Understanding the impact of financing on overall profitability is crucial for evaluating investment performance and making informed decisions about refinancing or other financial strategies.

- Vacancy CostsPeriods of vacancy represent lost income and potential expenses related to marketing and preparing the unit for new tenants. Factoring potential vacancy periods into the expense analysis allows for a more realistic profitability projection. For instance, if a property experiences a 10% vacancy rate annually, incorporating this lost income into the expense calculation provides a more accurate understanding of net operating income and aids in informed rental pricing decisions.

By meticulously tracking and categorizing these various expense types within the rental profit and loss statement template, property owners gain a comprehensive understanding of their investment’s financial performance. This detailed analysis informs strategic decision-making related to cost management, rent adjustments, and future investments, ultimately contributing to optimized profitability and long-term financial success.

3. Net profit/loss

The net profit/loss calculation represents the culmination of the rental profit and loss statement, providing a clear indication of an investment’s financial performance. Derived by subtracting total expenses from total income, this figure represents the bottom line the actual profit or loss generated by the rental property over a specific period. A positive net profit signifies profitability, while a negative net profit indicates a loss. Understanding this fundamental calculation is crucial for assessing investment performance and making informed financial decisions.

Consider a scenario where a rental property generates $2,000 in monthly income and incurs $1,500 in total expenses. The net profit, in this case, would be $500. Conversely, if expenses increase to $2,200 while income remains constant, the result is a net loss of $200. This demonstrates the direct relationship between income, expenses, and net profit/loss. Analyzing these figures reveals the financial health of the investment and highlights areas for potential improvement. For instance, a consistent net loss might necessitate rent adjustments, cost-cutting measures, or a reassessment of the investment strategy.

Accurate and consistent tracking of income and expenses is paramount for a reliable net profit/loss calculation. Inaccuracies in either category can lead to a distorted view of financial performance, potentially hindering effective decision-making. Regularly reviewing the net profit/loss figure within the context of the rental profit and loss statement empowers property owners to make informed decisions about rent adjustments, cost optimization strategies, and future investments. Understanding this crucial metric is fundamental for maximizing returns and ensuring the long-term financial success of rental properties.

4. Regular Reporting

Regular reporting, utilizing a rental profit and loss statement template, provides crucial insights into the financial health of rental properties. Consistent reporting, whether monthly, quarterly, or annually, enables property owners to identify trends, potential issues, and opportunities for optimization. This consistent analysis fosters proactive management, facilitating informed decision-making and contributing to long-term financial success. For example, consistently increasing vacancy rates, revealed through regular reporting, might indicate the need for adjustments in marketing strategies or rental pricing.

The benefits of regular reporting extend beyond simply tracking income and expenses. It allows for performance benchmarking against previous periods, identifying deviations and prompting investigation into underlying causes. For instance, a sudden spike in maintenance costs might reveal the need for preventative repairs or upgrades to avoid larger expenses in the future. Furthermore, regular reporting facilitates proactive financial planning, allowing property owners to anticipate potential challenges, such as seasonal fluctuations in income or upcoming large expenditures like roof replacements. This forward-looking approach enables more effective budgeting and resource allocation.

Consistent utilization of a rental profit and loss statement template through regular reporting provides a comprehensive understanding of investment performance. It empowers property owners to move beyond reactive management, fostering proactive strategies for cost optimization, revenue enhancement, and informed decision-making. This structured approach to financial analysis contributes significantly to maximizing returns and achieving long-term financial stability in the dynamic landscape of rental property management. Failing to implement regular reporting can lead to missed opportunities for optimization and increased risk of financial setbacks. Consistent monitoring is therefore essential for sustained success.

5. Informed Decisions

A rental profit and loss statement template provides the foundation for informed decision-making in property management. By offering a clear and comprehensive overview of income and expenses, this financial tool empowers property owners to make data-driven decisions that optimize profitability and mitigate risks. Without a structured understanding of financial performance, decisions become reactive rather than proactive, potentially leading to missed opportunities and financial instability.

Consider a scenario where a property consistently generates a low net profit margin. Analysis of the statement might reveal that maintenance costs are disproportionately high. Armed with this data, the owner can investigate the root causes, potentially identifying the need for preventative maintenance or energy-efficient upgrades. This informed decision, driven by data from the statement, leads to long-term cost savings and improved profitability. Alternatively, consistently high vacancy rates, highlighted by the statement, might prompt a review of rental pricing strategies or marketing efforts, leading to improved occupancy and increased revenue.

The practical significance of informed decision-making, facilitated by the use of a rental profit and loss statement template, extends beyond individual property management. Accurate financial data informs investment strategies, allowing property owners to assess the viability of expanding their portfolio or divesting underperforming assets. Furthermore, these statements provide essential documentation for securing financing or attracting potential investors, demonstrating financial stability and responsible management. In essence, the informed decisions stemming from the utilization of this financial tool contribute significantly to long-term financial success in the competitive landscape of rental property investment.

Key Components of a Rental Profit and Loss Statement

A well-structured rental profit and loss statement provides a comprehensive overview of a property’s financial performance. Understanding the key components is crucial for accurate analysis and informed decision-making.

1. Reporting Period: Clearly defines the timeframe covered by the statement, whether it’s a month, quarter, or year. This provides context for the financial data presented.

2. Property Identification: Specifies the property or properties included in the statement, ensuring clarity when managing multiple investments.

3. Income: Details all revenue generated by the property, including rents, late fees, and other ancillary income sources. Accuracy in this section is crucial for determining overall profitability.

4. Operating Expenses: Covers recurring costs associated with property operation and maintenance, such as property taxes, insurance, repairs, and management fees. Analyzing trends in operating expenses helps identify areas for potential cost savings.

5. Capital Expenditures: Accounts for investments in property improvements or upgrades that contribute to long-term value appreciation. These expenditures, while not recurring, impact overall investment performance.

6. Financing Costs: Details expenses related to any loans secured against the property, including mortgage interest payments and associated fees. Understanding financing costs is essential for accurate profit calculation after debt servicing.

7. Net Operating Income (NOI): Calculated by subtracting operating expenses from total income. NOI represents the property’s profitability before considering financing costs.

8. Net Profit/Loss: The bottom line, calculated by subtracting all expenses, including financing costs, from total income. This key figure indicates the actual profit or loss generated by the property during the reporting period.

Accurate and consistent tracking of these components provides a robust foundation for financial analysis. This data-driven approach empowers informed decisions related to property management, investment strategies, and long-term financial planning.

How to Create a Rental Profit and Loss Statement

Creating a rental profit and loss statement involves organizing income and expense data to provide a clear picture of financial performance. A structured approach ensures accuracy and facilitates informed decision-making.

1. Define the Reporting Period: Specify the timeframe covered by the statement (e.g., month, quarter, or year). A consistent reporting period allows for effective trend analysis.

2. Identify the Property: Clearly identify the specific property or properties included in the statement, especially important for managing multiple investments.

3. Itemize Income Sources: List all sources of income, including rental payments, late fees, pet fees, parking fees, and any other ancillary revenue. Accurate income reporting is fundamental for determining profitability.

4. Categorize Operating Expenses: Detail all operating expenses, such as property taxes, insurance, maintenance and repairs, utilities, landscaping, property management fees, and advertising costs. Categorization allows for targeted cost analysis and optimization.

5. Account for Capital Expenditures: Include any capital expenditures, such as property improvements, renovations, or major repairs, that contribute to long-term value appreciation. Distinguishing these from operating expenses provides a clearer picture of investment performance.

6. Include Financing Costs: If applicable, itemize financing costs, including mortgage interest payments, loan origination fees, and other related expenses. This ensures accurate profit calculation after debt servicing.

7. Calculate Net Operating Income (NOI): Subtract total operating expenses from total income to arrive at the NOI. This metric represents the property’s profitability before considering financing costs.

8. Determine Net Profit/Loss: Subtract total expenses, including financing costs and capital expenditures, from total income to calculate the net profit or loss. This bottom-line figure provides a comprehensive view of the property’s financial performance during the reporting period.

By following these steps, a comprehensive and accurate rental profit and loss statement can be generated, providing valuable insights for effective property management and informed financial decision-making. Regularly generating and reviewing these statements allows for proactive management, optimized profitability, and long-term financial success.

Effective property management hinges on a clear understanding of financial performance. A rental profit and loss statement template provides the necessary structure for achieving this clarity, enabling property owners to track income and expenses, calculate net profit/loss, and make informed decisions. From understanding the nuances of income categorization and expense tracking to analyzing net operating income and factoring in capital expenditures and financing costs, each component contributes to a comprehensive view of financial health. Regular reporting, utilizing this structured approach, fosters proactive management, allowing for timely identification of potential issues, optimization opportunities, and data-driven decision-making.

In the dynamic landscape of rental property investment, financial clarity is paramount for sustained success. Utilizing a rental profit and loss statement template is not merely a bookkeeping exercise; it is a strategic tool that empowers informed decisions, mitigates risks, and ultimately, contributes to long-term financial stability and growth. Consistent application of these principles positions property owners to navigate market fluctuations, optimize returns, and achieve their investment objectives.