Utilizing such a structured report offers numerous advantages. Accurate profit and loss tracking allows for optimized financial management and informed investment decisions. This documentation is also essential for tax reporting and can be instrumental in securing financing. Furthermore, a well-maintained record of income and expenses provides valuable insights into property performance trends, enabling proactive adjustments and improved long-term profitability.

The following sections will delve deeper into the key components of this type of financial document, providing practical guidance on its creation and utilization. Topics will include detailed explanations of income and expense categories, best practices for accurate record-keeping, and strategies for leveraging the insights gained to enhance property investment returns.

1. Income

Accurate income reporting forms the foundation of a reliable rental property income statement. This section captures all revenue generated by the property, providing crucial data for assessing profitability and making informed financial decisions. Accurately categorized income streams enable clear tracking of performance against projections and market trends.

Several income categories typically appear within a rental property income statement template. The most common is monthly rent collected from tenants. Additional income sources might include late fees, pet fees, parking fees, laundry facility income, or revenue from other amenities. Clearly distinguishing between these categories provides a granular view of income generation and highlights areas for potential revenue growth. For example, if parking fees consistently contribute a significant portion of income, an owner might consider expanding parking availability. Conversely, consistently low laundry income might prompt an evaluation of equipment or pricing.

A comprehensive understanding of income sources and their respective contributions is essential for sound financial management. Meticulous income tracking, categorized within a structured template, allows for accurate profit calculation, effective expense management, and data-driven investment strategies. Furthermore, accurate income reporting ensures compliance with tax regulations and strengthens the credibility of financial records when seeking financing or engaging in property valuations. Neglecting to accurately capture all income streams can lead to an incomplete financial picture, hindering informed decision-making and potentially impacting long-term investment success.

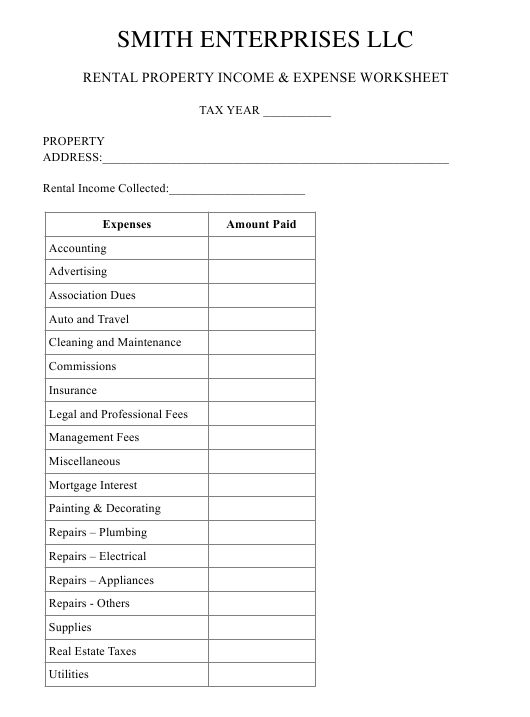

2. Expenses

A comprehensive understanding of expenses is crucial for accurate profitability assessment within a rental property income statement template. Accurately categorized and documented expenses provide insights into operational efficiency and inform strategic financial decisions. Ignoring or underestimating expenses can lead to an inaccurate profit calculation, potentially jeopardizing long-term financial stability.

Several key expense categories typically appear within a rental property income statement template. These include operating expenses such as property taxes, insurance, repairs and maintenance, property management fees, utilities (if paid by the owner), and advertising costs. Mortgage payments, while not strictly operating expenses, are another significant outflow. Further categorization within these broad areas offers a more granular view. For instance, repairs and maintenance can be further divided into plumbing, electrical, HVAC, and landscaping. This detailed breakdown allows for targeted cost analysis. For example, if landscaping costs consistently exceed projections, it might prompt a review of current landscaping contracts or exploration of alternative solutions. Similarly, recurring plumbing issues might indicate the need for preventative maintenance to avoid larger expenses in the future.

Accurate and detailed expense tracking offers numerous benefits. It allows for precise profit calculation, identification of areas for cost optimization, and informed budget forecasting. This data is also crucial for tax reporting and can be leveraged when negotiating financing or insurance premiums. Furthermore, a well-maintained record of expenses facilitates informed decision-making regarding rent adjustments and capital improvements. Ultimately, meticulous expense management, facilitated by a structured template, contributes to maximized profitability and sustainable investment growth.

3. Profit/Loss

The “Profit/Loss” section, a core component of a rental property income statement template, represents the financial outcome of the property’s operation over a specific period. Calculated as the difference between total income and total expenses, this figure provides a critical measure of investment performance. A positive result signifies profitability, while a negative result indicates a loss. Understanding this fundamental relationship is essential for informed decision-making regarding property management and investment strategies.

This crucial metric serves several vital functions. It allows investors to assess the financial viability of their rental property, compare performance against projected returns, and identify potential areas for improvement. For example, a consistently negative profit/loss might prompt an investigation into high operating costs, underperforming rent levels, or excessive vacancies. Conversely, a positive profit/loss validates investment decisions and can inform strategies for reinvestment or expansion. Consider a scenario where a property consistently generates a substantial profit. This positive outcome might encourage the investor to consider acquiring additional properties, increasing rent based on market analysis, or investing in property upgrades to further enhance value and attract higher-paying tenants.

Accurate calculation and interpretation of the profit/loss figure are paramount for long-term financial success in rental property investment. This metric serves as a key indicator of financial health, informs strategic adjustments, and guides investment decisions. Understanding the relationship between income, expenses, and the resulting profit/loss empowers property owners to optimize their investments and achieve their financial goals. Failure to adequately monitor and analyze this crucial aspect can lead to missed opportunities for improvement and potentially hinder the overall success of the investment.

4. Reporting Period

The reporting period defines the timeframe covered by a rental property income statement template. This specified duration, whether monthly, quarterly, or annually, provides the boundaries for financial data inclusion. Selecting an appropriate reporting period is crucial for accurate performance analysis and trend identification. A consistent reporting period allows for meaningful comparisons across different periods and facilitates informed decision-making. For example, comparing year-over-year performance using annual statements reveals long-term trends, while monthly statements provide a more granular view of short-term fluctuations.

The choice of reporting period influences the insights derived from the income statement. Short reporting periods, such as monthly, offer a detailed view of current financial activity, enabling rapid responses to changing market conditions or operational issues. Longer periods, like annually, provide a broader perspective on overall performance and facilitate long-term strategic planning. For instance, a property owner analyzing monthly statements might detect a sudden increase in repair costs, prompting immediate investigation. Conversely, reviewing annual statements might reveal a gradual decline in rental income, suggesting the need for adjustments in rental rates or property upgrades.

Accurate and consistent reporting periods are essential for meaningful financial analysis. A clearly defined timeframe ensures data integrity and allows for reliable performance comparisons. This structured approach facilitates informed decision-making, enabling property owners to optimize their investments and achieve their financial objectives. Choosing the appropriate reporting period depends on the specific needs of the property owner or investor, balancing the need for detailed short-term monitoring with the broader perspective offered by longer-term analysis. Ignoring or inconsistently applying reporting periods undermines the value of the income statement and hinders effective financial management.

5. Property Identification

Clear property identification is a fundamental component of a rental property income statement template. Accurate and consistent identification ensures that financial data is correctly attributed to the specific property it represents. This is crucial for managing multiple properties or portfolios, preventing data confusion, and ensuring accurate financial analysis. Without clear identification, consolidated financial reporting becomes unreliable, hindering informed decision-making. For example, imagine an investor owns multiple properties. Misattributing income or expenses between properties due to inadequate identification would lead to skewed profitability assessments for each property, potentially leading to misinformed investment decisions. Accurate property identification facilitates precise tracking of individual property performance, allowing for targeted strategies and optimized resource allocation.

Several methods facilitate effective property identification within a template. These include using a unique property address, a designated property code, or a parcel identification number. The chosen method should be consistently applied across all financial records and reports. This consistency simplifies data management, improves reporting accuracy, and facilitates comparisons across properties. Consider a portfolio containing properties with similar addresses. Relying solely on addresses for identification could lead to confusion. Assigning unique property codes offers a more robust and less error-prone solution, ensuring clear differentiation and accurate financial tracking. This is particularly important for property management software and accounting systems.

Accurate property identification within a rental property income statement template is not merely a matter of organization; it is a foundational element of sound financial management. It ensures data integrity, facilitates accurate performance analysis, and supports informed decision-making for individual properties and overall portfolio management. Failure to prioritize clear and consistent property identification can lead to data errors, misinformed investment strategies, and ultimately, compromised financial outcomes.

6. Template Structure

Template structure refers to the organization and arrangement of information within a rental property income statement template. A well-defined structure ensures consistency, clarity, and comparability of financial data. This structure typically includes distinct sections for income, expenses, and calculations of profit/loss. A logical flow, from revenue sources to operating costs and ultimately to net income, facilitates understanding and analysis. Consistent formatting, clear labeling of categories, and standardized calculations contribute to data integrity and efficient reporting. For example, a template might consistently place gross rental income at the top, followed by specific operating expenses like property taxes and insurance, ultimately leading to the net operating income calculation. This consistent presentation allows for easy comparison across different reporting periods and properties.

The chosen template structure significantly impacts the usability and effectiveness of the income statement. A poorly structured template can lead to data entry errors, difficulty in interpreting results, and inconsistencies in reporting. Conversely, a well-structured template streamlines data entry, facilitates accurate calculations, and enhances the clarity of financial reporting. Consider a scenario where a template lacks clear delineation between different expense categories. This could lead to misclassification of expenses, affecting the accuracy of the profit/loss calculation and hindering effective cost management. A structured template with clearly defined categories mitigates such risks, promoting accurate and reliable financial analysis. Furthermore, standardized templates allow for seamless integration with accounting software and other financial management tools, further enhancing efficiency and data integrity.

Effective template structure is essential for accurate, consistent, and easily interpretable financial reporting. It facilitates data management, enhances comparability across periods and properties, and supports informed decision-making. Choosing a template structure that aligns with industry best practices and specific reporting needs is crucial for maximizing the value and utility of the rental property income statement. This structured approach not only improves financial management but also strengthens communication with stakeholders, including investors, lenders, and tax authorities.

Key Components of a Rental Property Income Statement Template

A well-structured template ensures comprehensive financial oversight. Key components provide a standardized framework for capturing and analyzing performance data, enabling informed decision-making and optimized returns.

1. Property Identification: Clear identification, using address, property code, or parcel ID, ensures accurate data attribution, especially crucial for managing multiple properties. This prevents data confusion and supports precise performance tracking for individual assets.

2. Reporting Period: Defining a consistent timeframe (monthly, quarterly, annually) for data inclusion allows for meaningful comparisons and trend analysis. This facilitates informed decision-making based on short-term fluctuations and long-term performance.

3. Income: This section captures all revenue streams. Detailed categorization, including rents, late fees, and other income sources, provides a granular view of revenue generation, highlighting areas for potential growth and informed rent adjustments.

4. Expenses: Accurate expense tracking is crucial. Categorized operating expenses (taxes, insurance, repairs, management fees) and mortgage payments provide insights into operational efficiency and inform cost optimization strategies.

5. Profit/Loss Calculation: The difference between total income and total expenses reveals the financial outcome. This crucial metric informs investment decisions, identifies areas for improvement, and guides rent adjustments or property upgrades.

6. Template Structure: A well-defined structure ensures consistency and clarity. Organized sections for income, expenses, and profit/loss calculation, with clear labels and standardized formulas, facilitate data entry, interpretation, and integration with financial software.

These components work together to provide a comprehensive financial overview, enabling informed decision-making, optimized resource allocation, and ultimately, successful property investment management. Accurate data capture and analysis within a structured template are crucial for maximizing returns and achieving financial goals.

How to Create a Rental Property Income Statement Template

Creating a rental property income statement template involves structuring a document to consistently track income and expenses, calculate profit/loss, and inform financial decisions. A well-designed template facilitates accurate reporting, simplifies analysis, and supports informed property management.

1. Define the Reporting Period: Establish a consistent timeframe (monthly, quarterly, or annually) for the income statement. This ensures comparability and allows for trend analysis over time. The chosen period should align with specific reporting needs and management goals.

2. Establish Property Identification: Implement a clear method for identifying each property within the template. This might involve using the full address, a unique property code, or a parcel identification number. Consistent identification is crucial, especially when managing multiple properties.

3. Structure the Income Section: Create a section to record all income generated by the property. Categorize income sources, such as monthly rent, late fees, pet fees, parking fees, and other miscellaneous income. This detailed breakdown facilitates granular analysis of revenue streams.

4. Structure the Expense Section: Establish a section to record all property-related expenses. Categorize expenses, such as property taxes, insurance, repairs and maintenance, property management fees, utilities, mortgage payments, advertising, and other operating costs. Detailed categorization enables precise expense tracking and analysis.

5. Implement Profit/Loss Calculation: Include a section to calculate the difference between total income and total expenses. This crucial calculation provides a clear picture of property profitability and informs strategic financial decisions. Ensure the formula is accurate and clearly displayed.

6. Design the Template Layout: Organize the template with clear headings and subheadings. Use a consistent format for dates, currency, and numerical values. A well-designed layout enhances readability, simplifies data entry, and minimizes errors. Consider using a spreadsheet program for easy calculations and formatting.

7. Test and Refine: Before implementing the template, test it with sample data to ensure accuracy and functionality. Review the results and refine the template as needed to address any inconsistencies or improve clarity. Regularly review and update the template to reflect changes in regulations, expenses, or income streams.

8. Maintain Consistency: Once finalized, adhere to the template structure for all future income statements. Consistent application ensures data integrity, facilitates meaningful comparisons across periods, and supports accurate financial analysis for informed decision-making.

A structured template with clear income and expense categories, accurate profit/loss calculations, and consistent reporting periods allows for effective performance monitoring, informed decision-making, and optimized property management strategies. Regular review and refinement ensure the template remains a valuable tool for achieving financial objectives.

Effective management of rental properties necessitates a clear understanding of financial performance. A rental property income statement template provides the framework for achieving this clarity through structured data organization, accurate income and expense tracking, and precise profit/loss calculation. Standardized reporting periods, clear property identification, and a well-defined template structure ensure data integrity, facilitate meaningful comparisons, and support informed decision-making. From individual property assessments to portfolio-wide analysis, leveraging such a template enables data-driven insights for optimized financial strategies.

Accurate financial reporting is not merely a record-keeping exercise; it is a cornerstone of successful property investment. A rental property income statement template empowers owners and investors to make informed decisions based on concrete data, leading to enhanced profitability, optimized resource allocation, and sustainable long-term growth. Consistent application and regular review of this essential tool are crucial for navigating the complexities of the rental market and achieving financial objectives.