Utilizing such a structured format offers significant advantages. It facilitates consistent tracking of financial health, enables informed decision-making based on clear performance indicators, and simplifies the process of identifying areas for improvement or potential cost reductions. This structured approach also streamlines tax preparation and can be instrumental in securing funding from investors or lenders.

The following sections will delve deeper into the key components of this essential financial tool, exploring best practices for its creation and utilization, and highlighting how it can contribute to enhanced financial management within the retail sector.

1. Revenue Streams

A retail profit and loss statement meticulously details all sources of income. Accurately categorizing these revenue streams provides crucial insights into business performance. For instance, a clothing retailer might categorize revenue by clothing type (men’s, women’s, children’s), specific product lines (formal wear, casual wear), or sales channels (online, in-store). This granular approach allows for the identification of high-performing areas and potential weaknesses. Understanding which products or channels contribute most significantly to overall revenue informs strategic decisions regarding inventory management, marketing, and sales strategies. For example, if online sales of men’s casual wear significantly outperform other categories, resources might be allocated to enhance the online shopping experience for that specific demographic.

Furthermore, analyzing trends in revenue streams over time provides a dynamic view of business growth and market responsiveness. Declining revenue from a specific product line could signal shifting consumer preferences or increased competition. Conversely, a surge in online sales might indicate the effectiveness of a recent marketing campaign or a growing preference for online shopping. This data-driven analysis allows for proactive adjustments to business strategies, ensuring alignment with market demands and maximizing profitability. Effective revenue stream analysis can also pinpoint seasonal sales patterns, enabling optimized inventory control and targeted promotional activities.

In conclusion, precise categorization and analysis of revenue streams within a profit and loss statement are indispensable for sound financial management. This detailed breakdown allows for a nuanced understanding of business performance, enabling data-driven decision-making and enhancing the ability to adapt to market dynamics. The identification of key revenue drivers empowers businesses to capitalize on strengths, address weaknesses, and ultimately, drive sustainable growth and profitability.

2. Cost of Goods Sold (COGS)

A critical component of any retail profit and loss statement is the accurate calculation and analysis of Cost of Goods Sold (COGS). COGS represents the direct costs associated with producing or acquiring the goods sold by a retailer. Understanding and managing COGS is essential for determining profitability and making informed business decisions.

- Direct CostsCOGS encompasses only direct costs tied to product acquisition or production. This includes the purchase price of inventory from manufacturers or wholesalers, raw materials, direct labor involved in production (if applicable), and freight-in costs. It excludes indirect costs like marketing, administrative overhead, and salaries of non-production staff. For a clothing retailer, the cost of the clothing items purchased from a supplier constitutes a direct cost, while the rent paid for the retail store does not.

- Inventory Valuation MethodsSeveral accepted accounting methods exist for valuing inventory and calculating COGS, including First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted-Average Cost. The chosen method impacts the reported COGS and subsequent profit figures. FIFO assumes the oldest inventory is sold first, LIFO assumes the newest inventory is sold first, while the weighted-average method calculates an average cost for all units. Selecting an appropriate method requires careful consideration of its impact on financial reporting and tax liabilities.

- Gross Profit CalculationCOGS plays a direct role in determining gross profit, a key indicator of a retailer’s profitability. Gross profit is calculated by subtracting COGS from revenue. A higher COGS directly reduces gross profit, highlighting the importance of managing these costs effectively. Analyzing gross profit margin (gross profit divided by revenue) helps assess pricing strategies and overall operational efficiency.

- Impact on Pricing and ProfitabilityAccurately tracking and analyzing COGS is crucial for strategic pricing decisions. Understanding the direct costs associated with each product allows retailers to set prices that ensure adequate profit margins. Regularly reviewing COGS can reveal opportunities for cost optimization, such as negotiating better prices with suppliers or improving production efficiency. These adjustments can significantly impact overall profitability without requiring adjustments to retail pricing strategies.

Effective COGS management is fundamental to sound financial analysis within the retail context. By accurately tracking and analyzing these costs, retailers gain valuable insights into profitability, pricing strategies, and overall operational efficiency. This information is essential for making informed decisions that contribute to long-term financial health and sustainable business growth. Understanding the relationship between COGS and other key metrics within the profit and loss statement provides a comprehensive overview of the financial health of the business.

3. Operating Expenses

Operating expenses represent the costs incurred in running a retail business, excluding the direct costs of goods sold. A detailed breakdown of these expenses within a profit and loss statement is crucial for understanding profitability and making informed decisions regarding resource allocation and cost control. Careful monitoring of operating expenses is essential for maintaining healthy profit margins and ensuring long-term financial stability.

- Selling, General, and Administrative Expenses (SG&A)SG&A expenses encompass a wide range of costs necessary for daily operations and supporting sales activities. These include salaries and wages for non-production staff (sales associates, administrative personnel, management), rent, utilities, marketing and advertising expenditures, depreciation of assets, and office supplies. Tracking SG&A provides insights into the efficiency of overhead operations. For example, high marketing costs coupled with stagnant sales growth might indicate the need to re-evaluate marketing strategies.

- Rent and Occupancy CostsFor brick-and-mortar retailers, rent and associated occupancy costs (property taxes, maintenance, utilities) represent a significant operating expense. Analyzing these costs in relation to sales revenue helps assess the efficiency of store locations and overall profitability. A retailer with multiple locations can compare the rent-to-sales ratio across different stores to identify underperforming locations or optimize resource allocation.

- Marketing and AdvertisingMarketing and advertising expenses are crucial for driving sales and brand awareness. Tracking these costs alongside sales data allows retailers to assess the effectiveness of their marketing campaigns. A profit and loss statement facilitates comparisons between different marketing channels (online advertising, print media, social media) to determine the most effective strategies and optimize resource allocation.

- Depreciation and AmortizationDepreciation reflects the gradual reduction in value of tangible assets (equipment, fixtures, vehicles) over time, while amortization represents the same for intangible assets (software, patents). These non-cash expenses are essential for accurately reflecting the true cost of doing business and understanding the long-term value of investments.

By carefully analyzing operating expenses within the framework of a retail profit and loss statement, businesses can identify areas for cost optimization, improve operational efficiency, and enhance profitability. Understanding the relationship between operating expenses, COGS, and revenue is essential for comprehensive financial management and making informed decisions that contribute to long-term success. Regularly reviewing these figures and comparing them to industry benchmarks enables proactive adjustments to operational strategies and maximizes the potential for sustainable growth.

4. Gross Profit

Gross profit represents the profitability of a retail business after accounting for the direct costs associated with producing or acquiring the goods sold. Within a retail profit and loss statement template, gross profit serves as a key performance indicator, providing insights into the effectiveness of pricing strategies, cost management, and overall operational efficiency. A healthy gross profit margin is essential for covering operating expenses and generating net income.

- Calculation and InterpretationGross profit is calculated by subtracting the cost of goods sold (COGS) from revenue. This figure reflects the revenue remaining after covering the direct costs associated with the products sold. A higher gross profit indicates greater efficiency in managing product costs and pricing strategies. Analyzing trends in gross profit over time provides valuable insights into the overall health and direction of the business. Declining gross profit, even with increasing sales, could signal rising production costs or ineffective pricing strategies.

- Relationship with COGSThe direct relationship between gross profit and COGS highlights the importance of accurate cost accounting. Effective inventory management and efficient procurement processes directly impact COGS and, consequently, gross profit. Negotiating favorable terms with suppliers, optimizing inventory levels to minimize storage costs, and streamlining production processes contribute to a lower COGS and a higher gross profit margin.

- Impact on Operating Expenses and Net IncomeGross profit serves as the foundation for covering operating expenses and generating net income. A sufficient gross profit margin is essential for absorbing selling, general, and administrative expenses (SG&A), such as rent, salaries, and marketing costs. After deducting operating expenses from gross profit, the remaining amount represents the net income or loss. Therefore, a healthy gross profit is a prerequisite for achieving profitability and long-term financial sustainability.

- Gross Profit Margin AnalysisExpressing gross profit as a percentage of revenue (gross profit margin) provides a standardized metric for comparing performance across different periods or against industry benchmarks. Analyzing trends in gross profit margin helps identify potential issues or opportunities related to pricing strategies, cost control, and product mix. A declining gross profit margin might indicate the need to adjust pricing strategies, negotiate better supplier contracts, or re-evaluate product offerings.

Within the context of a retail profit and loss statement, gross profit provides a critical link between revenue generation and overall profitability. Understanding its calculation, relationship to other key metrics, and its implications for business performance allows for informed decision-making regarding pricing strategies, cost management, and operational efficiency. Regularly monitoring gross profit and gross profit margin empowers retailers to proactively address challenges and capitalize on opportunities for sustained growth and financial success.

5. Net Profit/Loss

Net profit/loss, often referred to as the “bottom line,” represents the ultimate measure of a retail business’s financial performance over a specific period. Within the structure of a retail profit and loss statement template, net profit/loss is the final calculation, reflecting the residual earnings after all revenues and expenses have been accounted for. This figure indicates the financial outcome of all operational activities, encompassing sales, cost of goods sold (COGS), and operating expenses. A positive net profit signifies profitability, while a negative net profit, or net loss, indicates that expenses exceeded revenues during the given period. Understanding net profit/loss is crucial for assessing the overall financial health of a retail business and informing strategic decision-making.

The calculation of net profit/loss within a retail profit and loss statement template follows a hierarchical structure. Starting with revenue, COGS is subtracted to arrive at gross profit. Operating expenses, including selling, general, and administrative expenses (SG&A), are then deducted from gross profit to determine operating income. Finally, after accounting for any non-operating income or expenses, such as interest income or expense, and income taxes, the resulting figure represents the net profit or loss. For example, a retailer with $500,000 in revenue, $300,000 in COGS, and $150,000 in operating expenses would report a net profit of $50,000 before taxes. This figure provides a clear and concise measure of the overall profitability of the business operations.

Analysis of net profit/loss trends over time offers valuable insights into the long-term financial trajectory of a retail business. Consistent profitability indicates sustainable business practices and effective management, while persistent losses signal the need for operational adjustments or strategic changes. Factors influencing net profit/loss can include fluctuations in sales volume, changes in COGS due to supplier price increases or inventory management issues, and variations in operating expenses related to marketing campaigns or staffing levels. Monitoring net profit/loss and identifying the underlying drivers of change allows for proactive interventions to improve financial performance and ensure long-term sustainability. Furthermore, comparing net profit/loss figures to industry benchmarks provides a valuable context for assessing the relative financial health and competitiveness of a retail business within its specific market segment. Understanding and interpreting net profit/loss within the framework of a retail profit and loss statement template is essential for effective financial management and informed strategic planning.

6. Time Period Analysis

Analyzing financial performance over specific time periods is crucial for understanding trends, seasonality, and the overall financial health of a retail business. A retail profit and loss statement template facilitates this analysis by providing a structured framework for comparing financial data across different periods. This temporal perspective allows businesses to identify patterns, evaluate the effectiveness of strategies, and make informed decisions for future growth and profitability.

- Comparative AnalysisComparing profit and loss statements across different accounting periods (e.g., month-over-month, year-over-year) reveals significant trends in revenue, expenses, and profitability. For example, a year-over-year comparison can highlight the impact of a new marketing campaign or a change in product pricing. Analyzing these changes over time helps businesses understand the long-term effects of strategic decisions and adapt accordingly.

- Trend IdentificationTime period analysis allows for the identification of underlying trends in key performance indicators. Consistent growth in revenue over several quarters might indicate a successful business strategy, while declining profitability despite increasing sales could signal underlying cost management issues. Recognizing these trends enables proactive adjustments to operations and strategies to address potential challenges or capitalize on opportunities.

- Seasonality and Cyclical PatternsMany retail businesses experience seasonal fluctuations in sales and demand. Analyzing profit and loss statements over multiple years reveals these cyclical patterns, enabling businesses to anticipate changes in demand and optimize inventory management, staffing levels, and marketing efforts. For example, a clothing retailer can anticipate increased sales during holiday seasons and adjust inventory levels accordingly to maximize revenue and minimize storage costs.

- Performance Evaluation and Goal SettingTime period analysis provides a framework for evaluating the effectiveness of business strategies and setting realistic financial goals. By tracking performance against historical data and industry benchmarks, businesses can assess the success of past initiatives and establish achievable targets for future growth and profitability. This data-driven approach to performance management ensures continuous improvement and informed decision-making.

By leveraging the time period analysis capabilities of a retail profit and loss statement template, businesses gain valuable insights into their financial performance and overall operational efficiency. This temporal perspective is crucial for identifying trends, understanding seasonality, evaluating the effectiveness of strategies, and setting realistic financial goals. Time period analysis empowers retail businesses to make data-driven decisions, optimize resource allocation, and enhance long-term sustainability and profitability.

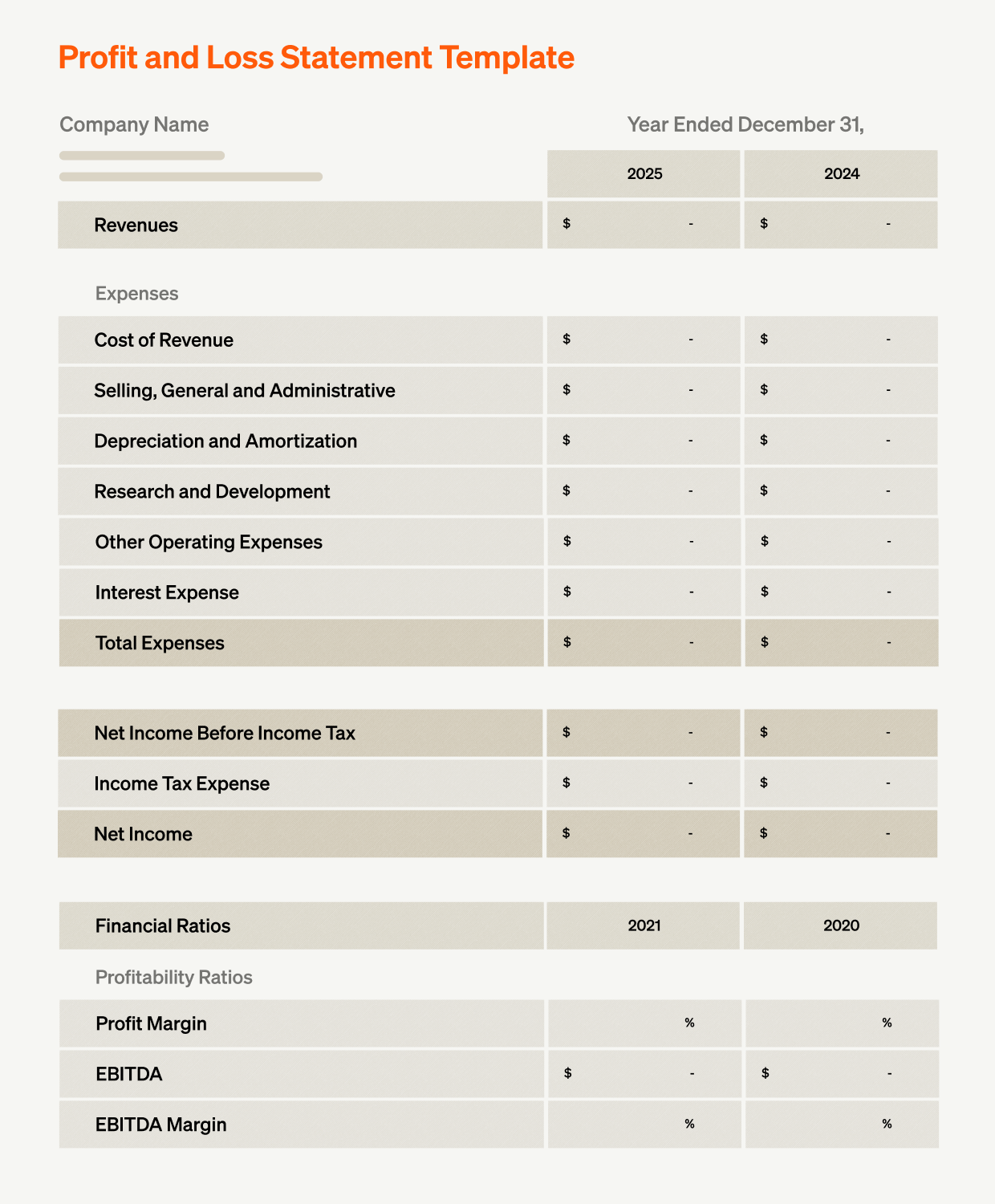

Key Components of a Retail Profit and Loss Statement

A retail profit and loss statement provides a comprehensive overview of a business’s financial performance. Understanding the key components is essential for interpreting this statement and making informed business decisions. Each component offers valuable insights into different aspects of financial health.

1. Revenue: This represents the total income generated from sales of goods and services. It’s the starting point of the profit and loss statement and provides a baseline for measuring profitability.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with acquiring or producing the goods sold. This includes the purchase price of inventory, raw materials, direct labor, and freight-in costs.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit represents the profitability of sales before considering operating expenses. It provides a measure of the efficiency of production and pricing.

4. Operating Expenses: These are the costs incurred in running the business, excluding COGS. They include selling, general, and administrative expenses (SG&A) such as rent, salaries, marketing, and utilities.

5. Operating Income: This figure represents the profit generated from core business operations. It is calculated by subtracting operating expenses from gross profit.

6. Other Income/Expenses: This category encompasses any income or expenses not directly related to core operations, such as interest income, interest expense, or gains/losses from asset sales.

7. Net Income/Loss: This is the final calculation on the profit and loss statement, representing the overall profit or loss after considering all revenues and expenses, including taxes. It’s the “bottom line” assessment of financial performance.

Careful analysis of these components allows for a thorough understanding of a retail business’s financial health and its ability to generate profit. These figures inform strategic decisions related to pricing, cost management, and resource allocation, contributing to long-term sustainability and growth.

How to Create a Retail Profit and Loss Statement

Creating a retail profit and loss statement requires a systematic approach to accurately capture and organize financial data. The following steps outline the process of developing a comprehensive and informative statement.

1. Choose a Reporting Period: Specify the timeframe for the statement, whether it’s a month, quarter, or year. This ensures consistency and allows for meaningful comparisons over time.

2. Calculate Revenue: Determine the total revenue generated from sales during the chosen period. Include all sales channels and product categories for a complete picture of income generation.

3. Determine Cost of Goods Sold (COGS): Calculate the direct costs associated with acquiring or producing the goods sold. This includes the purchase price of inventory, raw materials, direct labor, and freight costs. Accurate COGS calculation is crucial for determining gross profit.

4. Calculate Gross Profit: Subtract COGS from revenue to arrive at gross profit. This figure represents the profit generated from sales before considering operating expenses.

5. Itemize Operating Expenses: Detail all operating expenses, including selling, general, and administrative expenses (SG&A). Categorize expenses into specific areas like rent, salaries, marketing, and utilities for a clearer understanding of cost drivers.

6. Calculate Operating Income: Subtract operating expenses from gross profit to determine operating income. This figure reflects the profitability of core business operations.

7. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income or expense, and gains or losses from asset sales. These items are not directly related to core operations but affect overall profitability.

8. Calculate Net Income/Loss: Subtract other expenses and income tax from operating income to arrive at net income or loss. This “bottom line” figure represents the overall profitability of the business after considering all revenues and expenses.

A well-structured retail profit and loss statement provides a clear and comprehensive overview of financial performance. By following these steps, businesses can generate accurate and informative statements that support informed decision-making, effective cost management, and strategic planning for future growth.

Standardized financial documentation provides an essential framework for understanding the financial health of any retail operation. Analysis of revenue streams, cost of goods sold, operating expenses, and resulting profit margins allows for informed decision-making regarding pricing strategies, inventory management, and resource allocation. Accurate and consistent utilization of these structured templates enables businesses to identify trends, evaluate performance against benchmarks, and proactively address potential challenges. Furthermore, these statements serve as crucial tools for communicating financial performance to stakeholders, securing financing, and attracting potential investors.

Effective financial management hinges on the ability to extract actionable insights from financial data. Regularly generating and meticulously analyzing these standardized reports empowers retail businesses to optimize operations, enhance profitability, and navigate the complexities of the modern marketplace. A deep understanding of financial performance, facilitated by consistent reporting, is not merely a best practice but a critical requirement for long-term success and sustainable growth within the competitive retail landscape.