Utilizing such a framework offers several advantages. It simplifies the process of compiling financial data, reduces the likelihood of errors, and promotes a comprehensive understanding of personal finances. This understanding can be leveraged for improved financial planning, securing loans, attracting investors, or simply gaining a better grasp of one’s financial health. The readily available structure removes the guesswork from organizing complex financial details, allowing users to focus on accurate data entry and analysis.

The following sections will delve deeper into specific components, offering practical guidance on effective utilization and highlighting key considerations for maximizing the benefits of structured financial documentation.

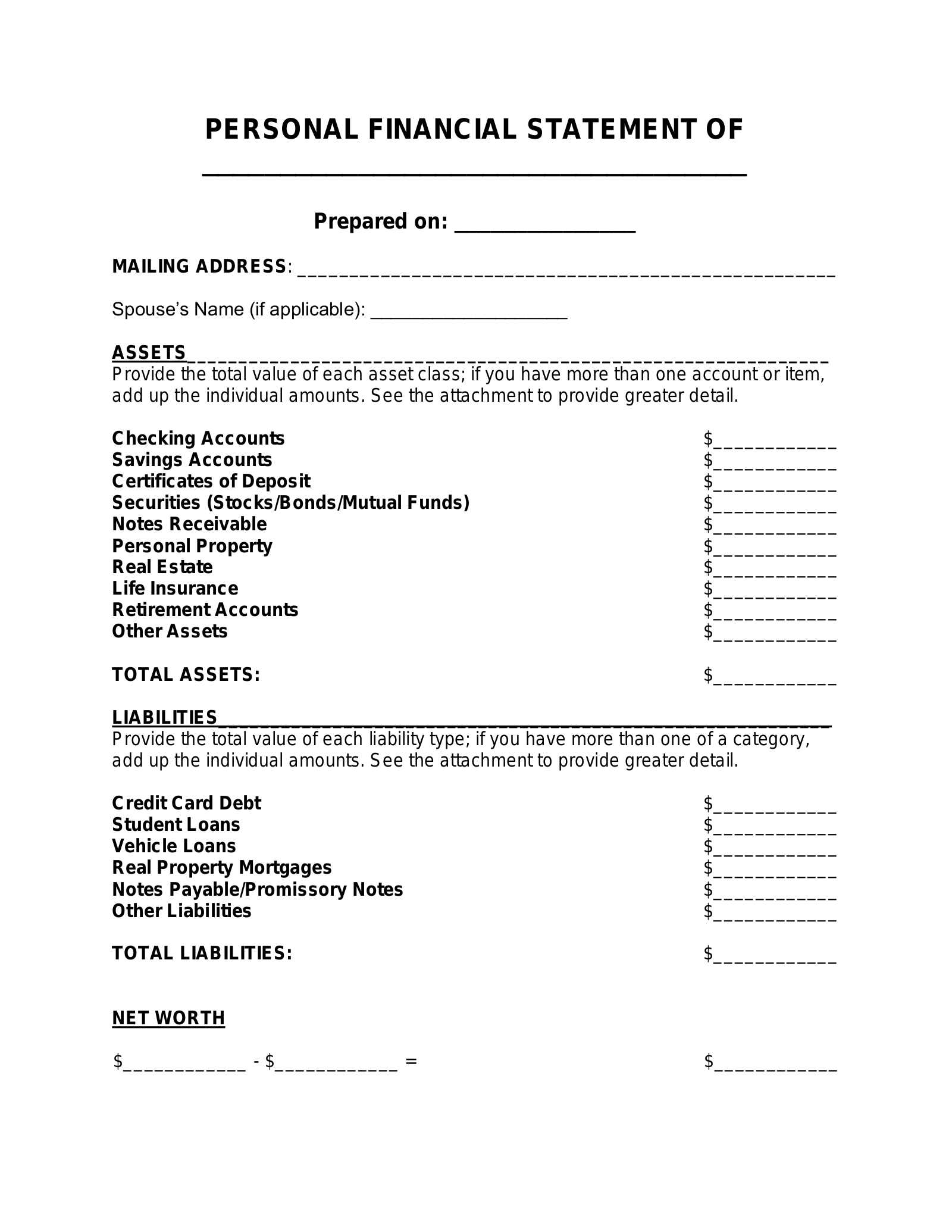

1. Assets

Accurate asset documentation is crucial for a comprehensive personal financial statement. Assets, representing items of ownership with inherent monetary value, contribute significantly to an individual’s net worth calculation. Proper categorization and valuation within the template provide a clear picture of financial strength and stability. Categorization typically includes liquid assets (easily converted to cash, such as checking accounts and money market funds), investment assets (stocks, bonds, and retirement accounts), and fixed assets (real estate and vehicles). Accurate valuation, often based on fair market value, ensures a realistic representation of one’s financial position. For example, a recently purchased vehicle might be listed as an asset, but its value should reflect current market depreciation.

The relationship between assets and the template extends beyond simple listing. Accurate asset documentation facilitates informed financial decisions, from investment strategies to loan applications. Understanding the composition and value of one’s assets enables strategic allocation and risk management. For instance, a diversified portfolio of assets across different classes (e.g., stocks, bonds, real estate) can mitigate potential losses and enhance long-term growth. Furthermore, lenders often rely on asset information within the statement to assess creditworthiness and determine loan eligibility. A well-documented asset portfolio can strengthen loan applications and potentially secure more favorable terms.

In summary, meticulous asset documentation within a financial statement template offers more than just a snapshot of current holdings. It provides a foundation for strategic financial planning, informed decision-making, and improved access to financial opportunities. Challenges can arise in accurately valuing certain assets, such as real estate or collectibles. Consulting with appraisal professionals can mitigate these challenges and ensure a realistic and comprehensive financial overview.

2. Liabilities

A comprehensive understanding of liabilities is essential for accurate financial representation within a structured template. Liabilities, representing outstanding obligations or debts, play a crucial role in determining net worth and overall financial health. Accurate documentation of liabilities within the template provides a clear picture of financial obligations and their potential impact on long-term financial goals. Common examples include mortgages, student loans, credit card balances, and auto loans. Each liability entry typically includes the creditor’s name, outstanding balance, interest rate, and minimum payment amount. For instance, a mortgage would be listed with the lender’s name, the remaining principal balance, the agreed-upon interest rate, and the required monthly payment. This detailed information enables a precise calculation of total liabilities and facilitates informed financial planning. Understanding the structure and implications of liabilities is critical for accurate self-assessment and effective financial management.

The interplay between liabilities and the template extends beyond simple record-keeping. Accurate liability documentation facilitates informed borrowing decisions, debt management strategies, and overall financial planning. By understanding the total amount owed and the associated interest rates, individuals can make informed decisions about debt consolidation, refinancing options, and prioritizing repayment strategies. For example, consolidating high-interest credit card debt into a lower-interest personal loan can significantly reduce the overall cost of borrowing and accelerate debt repayment. Furthermore, accurate liability documentation allows for realistic budgeting and financial forecasting. Understanding the impact of recurring debt payments on monthly cash flow enables effective budgeting and informed allocation of resources. It allows individuals to anticipate potential financial challenges and proactively adjust spending habits or explore alternative income streams.

In summary, meticulous documentation of liabilities within a financial statement template offers a critical foundation for sound financial management. It empowers individuals to understand their financial obligations, make informed borrowing decisions, and develop effective debt management strategies. Challenges can arise when dealing with complex liabilities, such as variable-rate loans or shared debt obligations. Consulting with financial advisors can help navigate these complexities and ensure a thorough and accurate representation of liabilities within the template. This detailed understanding of liabilities is essential for navigating financial decisions and achieving long-term financial stability.

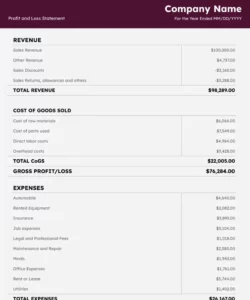

3. Income

Accurate income reporting is fundamental to a comprehensive personal financial statement. Income, representing the inflow of funds from various sources, provides a critical foundation for budgeting, financial planning, and assessing overall financial health. Within a structured template, income documentation allows for a clear understanding of financial resources available for expenses, debt repayment, and investments. Common income sources include salaries, wages, investment returns, rental income, and business profits. Each income source should be clearly identified and quantified within the template, often on a monthly or annual basis. For example, an individual might list their monthly salary, quarterly dividend income from investments, and annual rental income from a property. This detailed breakdown enables a precise calculation of total income and facilitates informed financial decision-making.

The significance of income within the template extends beyond simple record-keeping. Accurate income reporting provides a basis for realistic budgeting, effective debt management, and informed investment strategies. Understanding the regularity and consistency of income streams enables individuals to create realistic budgets that align with their financial goals. For instance, a consistent monthly salary allows for predictable budgeting and facilitates planning for large expenses or investments. Furthermore, accurate income reporting is essential for securing loans or lines of credit. Lenders rely on income verification to assess an applicant’s ability to repay borrowed funds. A well-documented income history strengthens loan applications and can lead to more favorable lending terms. Additionally, understanding income patterns allows for strategic investment decisions. Knowing the amount of disposable income available after covering essential expenses enables informed allocation of funds towards various investment vehicles, aligning with individual risk tolerance and financial objectives.

In summary, meticulous income documentation within a financial statement template provides more than just a snapshot of current earnings. It empowers individuals to create realistic budgets, manage debt effectively, and make informed investment decisions. Challenges can arise when dealing with variable income sources, such as freelance work or commission-based earnings. Utilizing historical data and conservative projections can help mitigate these challenges and ensure a realistic and comprehensive representation of income within the template. This accurate income representation is crucial for sound financial planning and achieving long-term financial stability.

4. Expenses

Thorough expense tracking is crucial for a comprehensive personal financial statement. Expenses, representing the outflow of funds for goods and services, provide essential insights into spending patterns and contribute significantly to accurate financial planning. Within a structured template, expense documentation allows for a clear understanding of where financial resources are allocated and how spending aligns with overall financial goals. Common expense categories include housing, transportation, food, healthcare, utilities, and debt repayment. Each expense should be categorized and quantified within the template, often on a monthly or annual basis. For example, an individual might track monthly rent or mortgage payments, weekly grocery expenses, annual insurance premiums, and recurring loan payments. This detailed breakdown facilitates a precise calculation of total expenses and enables informed financial decision-making. Understanding spending habits is essential for effective budgeting and long-term financial stability.

The relationship between expenses and the template extends beyond simple record-keeping. Accurate expense documentation provides a basis for realistic budgeting, informed spending choices, and effective debt management. By understanding spending patterns, individuals can identify areas for potential cost savings, adjust spending habits to align with financial goals, and make informed decisions about future purchases or investments. For example, tracking monthly grocery expenses can reveal opportunities to reduce spending by planning meals more effectively or utilizing coupons and discounts. Furthermore, accurate expense documentation enables realistic budgeting and financial forecasting. Understanding recurring expenses and anticipating future financial needs facilitates effective budgeting and informed allocation of resources. It allows individuals to anticipate potential financial challenges and proactively adjust spending or explore alternative income streams. Moreover, lenders and creditors often utilize expense information from financial statements to assess an applicant’s debt-to-income ratio, a critical factor in determining creditworthiness and loan eligibility. A well-documented expense history can strengthen loan applications and potentially secure more favorable lending terms.

In summary, meticulous expense documentation within a financial statement template offers a critical foundation for sound financial management. It empowers individuals to understand their spending habits, create realistic budgets, and make informed financial decisions. Challenges can arise in consistently tracking all expenses, especially smaller, recurring transactions. Utilizing budgeting apps or personal finance software can help automate this process and ensure comprehensive expense documentation. This detailed understanding of expenses is essential for navigating financial decisions and achieving long-term financial well-being. A well-maintained expense record within the framework of a financial template provides a powerful tool for financial control and long-term prosperity.

5. Net Worth Calculation

Net worth calculation forms the cornerstone of a sample personal financial statement template. It provides a concise snapshot of an individual’s financial health by quantifying the difference between total assets and total liabilities. This calculation serves as a key indicator of financial progress and stability. A positive net worth, where assets exceed liabilities, generally indicates a healthy financial position, while a negative net worth suggests outstanding obligations outweigh owned resources. The template facilitates this calculation by providing a structured framework for organizing and summarizing asset and liability information. For instance, if an individual’s assets total $300,000 (including home equity, investments, and savings) and liabilities total $100,000 (including mortgage, student loans, and credit card debt), the net worth is calculated as $300,000 – $100,000 = $200,000. This positive net worth indicates a healthy financial standing.

Understanding net worth and its calculation within the template allows for informed financial decision-making. Tracking net worth over time provides insights into the effectiveness of financial strategies and highlights areas for improvement. An increasing net worth typically indicates positive financial progress, while a declining net worth may signal the need to reassess financial goals and strategies. For example, an individual actively paying down debt while simultaneously increasing investment contributions will likely observe a positive trend in their net worth over time. This information can be leveraged to refine financial goals, adjust investment strategies, and make informed decisions regarding major purchases, retirement planning, or estate management. Furthermore, financial institutions utilize net worth as a key factor in assessing creditworthiness and determining loan eligibility.

In summary, net worth calculation provides a critical metric for evaluating overall financial health. Within a sample personal financial statement template, it serves as a focal point for assessing financial progress, informing decision-making, and gaining a clear understanding of one’s financial standing. While the calculation itself is straightforward, accurately valuing assets and liabilities is crucial for a reliable net worth figure. Professional appraisals and consistent record-keeping contribute to the accuracy and utility of this essential financial indicator within the template. Regularly reviewing and analyzing net worth calculations within the template fosters financial awareness and contributes to long-term financial well-being.

Key Components of a Personal Financial Statement Template

A well-structured personal financial statement template provides a comprehensive overview of an individual’s financial position. Several key components contribute to this overview, enabling informed financial decision-making and effective planning.

1. Assets: A detailed account of all owned items with monetary value. This includes liquid assets (easily convertible to cash), investment assets (stocks, bonds, retirement accounts), and fixed assets (real estate, vehicles). Accurate valuation is crucial, often reflecting current market value rather than original purchase price.

2. Liabilities: A comprehensive list of outstanding debts and financial obligations. This encompasses mortgages, student loans, credit card balances, auto loans, and other forms of debt. Details typically include creditor, outstanding balance, interest rate, and payment terms.

3. Income: Documentation of all income streams, including salaries, wages, investment returns, rental income, and business profits. Frequency (monthly, annual, etc.) and source should be clearly specified for each income entry.

4. Expenses: A categorized breakdown of all expenditures, including essential living expenses (housing, food, transportation, utilities) and discretionary spending. Regular tracking and categorization are essential for identifying potential cost savings and budgeting effectively.

5. Net Worth Calculation: The core calculation derived by subtracting total liabilities from total assets. This single figure provides a concise snapshot of overall financial health and serves as a key metric for tracking financial progress over time.

Accurate and comprehensive documentation across these components provides a powerful tool for managing personal finances, setting realistic financial goals, and making informed decisions regarding investments, debt management, and long-term financial planning.

How to Create a Personal Financial Statement

Creating a personal financial statement involves organizing key financial data into a structured format. This process facilitates a clear overview of one’s financial standing and provides a valuable tool for planning and decision-making.

1. Gather Necessary Documents: Collect all relevant financial documents, including bank statements, investment account summaries, loan documents, and recent pay stubs. This comprehensive collection ensures accurate data entry and a complete financial picture.

2. List Assets: Categorize and list all owned assets, including liquid assets (cash, checking accounts), investment assets (stocks, bonds, retirement accounts), and fixed assets (real estate, vehicles). Determine the current market value for each asset. Accuracy in valuation is critical for a realistic net worth calculation.

3. Document Liabilities: Itemize all outstanding debts and financial obligations, including mortgages, student loans, credit card balances, and auto loans. Record the creditor, outstanding balance, interest rate, and minimum payment for each liability.

4. Calculate Income: List all sources of income, including salaries, wages, investment returns, rental income, and business profits. Specify the frequency (monthly, annual, etc.) and provide accurate figures for each income source.

5. Track Expenses: Categorize and record all expenses, including housing costs, transportation, food, utilities, debt payments, and discretionary spending. Detailed expense tracking provides insights into spending patterns and informs budgeting decisions.

6. Calculate Net Worth: Subtract total liabilities from total assets to determine net worth. This key figure provides a snapshot of overall financial health and serves as a benchmark for tracking financial progress. Regularly updating and reviewing this calculation is essential for effective financial management.

7. Review and Update Regularly: A personal financial statement is not a static document. Regular review and updates, ideally at least annually or whenever significant financial changes occur, ensure its ongoing accuracy and relevance for informed financial decision-making.

8. Utilize a Template or Software: Consider using a pre-designed template or personal finance software to streamline the process. These tools provide structured formats and automated calculations, reducing the risk of errors and simplifying data entry.

A well-maintained personal financial statement provides a powerful tool for understanding one’s financial position, setting realistic goals, and making informed decisions that contribute to long-term financial well-being.

A structured framework for organizing financial information offers a crucial tool for gaining a comprehensive understanding of one’s financial position. By systematically documenting assets, liabilities, income, and expenses, individuals gain valuable insights into their financial health and create a foundation for informed decision-making. This structured approach facilitates accurate net worth calculation, enables effective budgeting, and empowers individuals to take control of their financial future.

Regular utilization of such a framework promotes financial awareness and enables proactive financial management. This empowers informed choices regarding investments, debt management, and long-term financial planning. Ultimately, consistent engagement with organized financial documentation contributes significantly to achieving financial stability and long-term financial well-being.