Utilizing a pre-built structure offers several advantages. It ensures consistency in reporting, simplifies the process of creating financial statements, and reduces the risk of errors. This standardized approach allows for easy comparison across different periods or against industry benchmarks, facilitating informed decision-making and strategic planning. It can also be a valuable tool for securing funding, as it presents a clear picture of financial health to potential investors or lenders.

The following sections will delve deeper into specific aspects of creating and interpreting these essential financial documents, exploring best practices and common variations to suit different business needs.

1. Structure

A standardized structure is fundamental to the effectiveness of a profit and loss statement template. This structure ensures consistency, comparability, and clarity in presenting financial performance. A well-defined framework allows stakeholders to readily understand the information presented and draw meaningful conclusions about a company’s financial health.

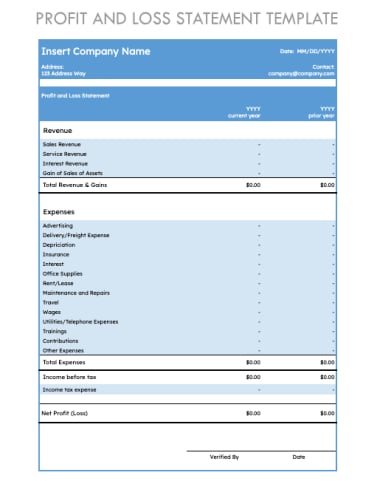

- HeaderThe header typically includes the company name, the statement title (“Profit and Loss Statement”), and the reporting period (e.g., “For the Year Ended December 31, 2024”). This information clearly identifies the subject and timeframe of the financial report.

- Revenue SectionThis section details all sources of income generated during the reporting period. It may include subcategories like sales revenue, service revenue, and other income. This section establishes the “top line” figure from which expenses are deducted.

- Expense SectionExpenses are categorized and listed in this section. Common categories include cost of goods sold (COGS), operating expenses (e.g., rent, salaries, marketing), and non-operating expenses (e.g., interest expense). Clear categorization allows for analysis of spending patterns and cost control.

- Profit CalculationThis section presents the calculated profit figures, starting with gross profit (revenue minus COGS), then operating profit (gross profit minus operating expenses), and finally, net profit (operating profit minus non-operating expenses and taxes). These figures provide key indicators of profitability at different levels of the business.

Adhering to a consistent structure within the profit and loss statement template ensures that financial information is presented logically and systematically. This structured approach facilitates accurate analysis, comparison across periods, and informed decision-making by management, investors, and other stakeholders.

2. Revenue

Revenue represents the lifeblood of any business and holds a pivotal position within a profit and loss statement template. It forms the foundation upon which profitability is assessed. Accurately recording and analyzing revenue is essential for understanding a company’s financial performance and making informed business decisions. Revenue figures within the template reflect the total income generated from a company’s primary business activities, typically sales of goods or services, before any expenses are deducted. This “top-line” figure serves as the starting point for calculating profitability metrics. For example, a retail business selling clothing would record its total sales from clothing as revenue within the specified period. This revenue figure is then used to calculate gross profit by deducting the cost of goods sold.

The relationship between revenue and the profit and loss statement extends beyond mere recording. Changes in revenue directly impact profitability. An increase in revenue, assuming expenses remain constant or increase at a slower rate, will lead to higher profits. Conversely, a decline in revenue can significantly reduce profitability or even result in a net loss. Analyzing revenue trends over time allows businesses to identify growth patterns, seasonality, and potential issues impacting sales performance. This analysis can inform strategic decisions related to pricing, marketing, and product development. For instance, if a software company observes a consistent decline in revenue from a particular product line, it can investigate the underlying causes and take corrective action, such as updating the product or adjusting marketing strategies.

A thorough understanding of revenue within the context of a profit and loss statement is crucial for assessing financial health and making informed strategic decisions. By analyzing revenue trends, businesses can identify areas of strength and weakness, enabling proactive adjustments to maximize profitability and ensure long-term sustainability. The proper recording and interpretation of revenue data within the template allows for accurate calculation of key profitability metrics, enabling informed resource allocation, investment decisions, and overall business strategy development.

3. Expenses

Expenses represent the costs incurred in generating revenue and operating a business. Within a sample profit and loss statement template, expenses are meticulously categorized and subtracted from revenue to determine profitability. A comprehensive understanding of expenses is crucial for effective financial management and analysis. The relationship between expenses and the profit and loss statement is one of direct impact. Higher expenses reduce profitability, while lower expenses contribute to increased profit margins. This cause-and-effect relationship underscores the importance of expense management in achieving financial goals.

Expenses within the template are typically categorized into several key areas. Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. For a manufacturer, COGS includes raw materials, direct labor, and manufacturing overhead. Operating expenses encompass the costs of running the business, including rent, salaries, marketing, and administrative expenses. Non-operating expenses are those not directly related to core business operations, such as interest expense or losses from the sale of assets. Categorizing expenses provides valuable insights into cost structures and allows for targeted cost control measures. For example, a restaurant can analyze its food costs (COGS) and labor costs (operating expenses) to identify potential areas for improvement, such as reducing food waste or optimizing staffing levels.

Effective expense management involves not only tracking and categorizing expenses but also analyzing trends and identifying opportunities for cost reduction. Comparing expense ratios across different periods or against industry benchmarks provides valuable context for evaluating performance. A rising cost of goods sold percentage, for instance, could indicate inefficiencies in the supply chain or increasing raw material prices, prompting management to explore alternative suppliers or negotiate better pricing. Furthermore, understanding the relationship between fixed costs (those that remain constant regardless of production volume) and variable costs (those that fluctuate with production volume) is crucial for making informed decisions about pricing, production levels, and overall business strategy. By leveraging the insights provided by a detailed analysis of expenses within a profit and loss statement, businesses can optimize resource allocation, improve operational efficiency, and enhance profitability.

4. Profitability

Profitability, the ultimate measure of a business’s financial success, is inextricably linked to the profit and loss statement. A sample profit and loss statement template provides the structured framework for calculating and analyzing profitability metrics, offering crucial insights into a company’s financial health and sustainability. Understanding the various facets of profitability within this framework is essential for informed decision-making and strategic planning.

- Gross ProfitGross profit represents the revenue remaining after deducting the direct costs associated with producing goods or services (Cost of Goods Sold). This metric reflects the efficiency of production and pricing strategies. A higher gross profit margin indicates greater profitability at the core operational level. For example, a furniture manufacturer with a higher gross profit margin than its competitors suggests greater efficiency in materials sourcing and production processes. Within the profit and loss statement, gross profit is a key stepping stone towards calculating net profit.

- Operating ProfitOperating profit measures profitability after accounting for both direct costs (COGS) and indirect costs (operating expenses) associated with running the business. This metric provides insight into the efficiency of day-to-day operations. Analyzing operating profit helps assess management’s effectiveness in controlling costs and generating profits from core business activities. A software company with rising operating profit demonstrates efficient management of development, marketing, and administrative expenses. In the context of the profit and loss statement, operating profit signifies the profit generated before considering non-operating income and expenses.

- Net ProfitNet profit represents the bottom line the ultimate measure of profitability after all expenses, including taxes and interest, have been deducted from revenue. This figure indicates the overall financial performance of the company. A positive net profit signifies profitability, while a negative net profit (net loss) indicates financial distress. A consistently growing net profit for a retail chain demonstrates healthy financial performance and sustainable growth. Net profit within the profit and loss statement serves as the definitive indicator of a company’s financial success or challenges.

- Profit MarginsProfit margins, expressed as percentages, provide a standardized way to compare profitability across different periods or against industry benchmarks. Gross profit margin, operating profit margin, and net profit margin offer insights into profitability at different levels of the business. Analyzing trends in these margins provides valuable insights into the company’s cost structure, pricing strategy, and overall financial health. A declining net profit margin for a manufacturing company might signal increased competition or rising input costs. Within the profit and loss statement, profit margins provide context for interpreting the absolute profit figures, facilitating more nuanced analysis and comparisons.

Analyzing these interconnected aspects of profitability within a sample profit and loss statement template provides a comprehensive understanding of a company’s financial performance. These metrics, viewed collectively, enable informed decisions regarding pricing strategies, cost management initiatives, investment opportunities, and overall business strategy. By understanding how these elements contribute to overall profitability, businesses can make data-driven decisions to optimize performance and achieve sustainable financial success.

5. Time Period

The time period covered by a profit and loss statement is a critical component, providing context and comparability for the financial data presented. A sample profit and loss statement template facilitates consistent reporting across specific periods, enabling meaningful analysis of financial performance trends. Selecting the appropriate reporting period allows stakeholders to gain relevant insights into a company’s financial health and make informed decisions.

- Fiscal YearA fiscal year represents a company’s chosen 12-month accounting period, which may or may not align with the calendar year. Many businesses choose a fiscal year that aligns with their natural business cycle. A retailer, for example, might choose a fiscal year ending in January to capture the holiday sales season. Using a consistent fiscal year in the profit and loss statement template allows for year-over-year comparisons and trend analysis of financial performance.

- Quarterly ReportingQuarterly reporting breaks down the fiscal year into four three-month periods. This shorter timeframe provides more frequent snapshots of financial performance, allowing for quicker identification of emerging trends and potential issues. A technology company releasing new products quarterly might use quarterly profit and loss statements to assess the financial impact of each product launch. This frequency within the template enables more responsive management and strategic adjustments.

- Monthly ReportingMonthly reporting provides the most granular view of financial performance, offering a detailed tracking of revenue and expenses on a monthly basis. This level of detail can be particularly useful for businesses with significant monthly fluctuations in sales or expenses. A seasonal business like a landscaping company might benefit from monthly reporting to monitor revenue and expenses closely throughout the year. While not always included in formal financial statements, monthly data within a template can support internal management and decision-making.

- Year-to-Date ReportingYear-to-date reporting aggregates financial data from the beginning of the fiscal year up to a specific point in time. This cumulative view provides insight into performance trends throughout the year. A construction company using a year-to-date profit and loss statement can track progress on long-term projects and monitor overall financial performance against annual projections. Within the template, year-to-date figures enable effective monitoring of progress towards annual financial goals.

The selected time period within a sample profit and loss statement template directly influences the interpretation of financial data. Choosing the appropriate time frame, whether a fiscal year, quarter, month, or year-to-date, is crucial for gaining relevant insights into business performance and making informed decisions. Consistency in reporting periods facilitates trend analysis and comparisons, enabling stakeholders to accurately assess financial health and make strategic adjustments to optimize profitability and achieve long-term financial goals.

Key Components of a Profit and Loss Statement Template

A profit and loss statement template provides a structured framework for analyzing financial performance. Understanding its key components is crucial for accurate interpretation and informed decision-making.

1. Revenue: Revenue represents the total income generated from a company’s primary business activities, typically from sales of goods or services. It forms the top line of the statement and serves as the basis for calculating profitability.

2. Cost of Goods Sold (COGS): COGS includes the direct costs associated with producing the goods sold by a business. For manufacturers, this includes raw materials, direct labor, and manufacturing overhead. For retailers, it represents the purchase cost of merchandise sold.

3. Gross Profit: Gross profit is calculated by subtracting COGS from revenue. This metric reflects the profitability of a company’s core business operations before considering operating expenses.

4. Operating Expenses: Operating expenses encompass the costs incurred in running the business, including salaries, rent, marketing, and administrative expenses. These expenses are subtracted from gross profit to arrive at operating income.

5. Operating Income: Operating income, also known as Earnings Before Interest and Taxes (EBIT), represents the profit generated from core business operations after accounting for both direct and indirect costs.

6. Other Income/Expenses: This category includes income or expenses not directly related to core business operations, such as interest income, interest expense, gains or losses from investments, and other non-operating items.

7. Income Before Taxes: This figure represents the company’s profit after considering all operating and non-operating income and expenses, but before accounting for income taxes.

8. Income Tax Expense: This represents the expense incurred for corporate income taxes.

9. Net Income: Net income, often referred to as the “bottom line,” represents the final profit after all expenses and taxes have been deducted from revenue. This is the ultimate measure of a company’s profitability.

These components, presented within a structured format, provide a comprehensive overview of a company’s financial performance over a specific period. Analyzing these elements individually and collectively offers valuable insights into profitability, cost structure, and overall financial health, enabling data-driven decisions for improved financial outcomes.

How to Create a Profit and Loss Statement Template

Creating a profit and loss statement template involves structuring key financial data elements to provide a clear and consistent overview of a company’s performance over a specific period. This structured approach facilitates analysis, comparison, and informed decision-making.

1. Define the Reporting Period: Establish the specific timeframe for the statement, whether it’s a fiscal year, quarter, or month. This ensures consistency and allows for accurate comparisons across periods. A clear reporting period is essential for meaningful analysis.

2. Establish Revenue Categories: Determine the relevant revenue streams for the business and categorize them accordingly. This might include sales revenue, service revenue, or other income streams. Clear categorization allows for detailed analysis of revenue sources.

3. Categorize Expenses: Organize expenses into relevant categories such as cost of goods sold (COGS), operating expenses (e.g., rent, salaries, marketing), and non-operating expenses (e.g., interest expense). Accurate categorization facilitates cost control and analysis.

4. Calculate Gross Profit: Subtract COGS from total revenue to determine gross profit. This metric reflects the profitability of core business operations before operating expenses are considered.

5. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. This metric reflects profitability after accounting for both direct and indirect costs of running the business.

6. Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income or expense, gains or losses from investments, and one-time events.

7. Calculate Net Income: Subtract income tax expense from income before taxes to determine net income, the ultimate measure of profitability after all expenses and taxes have been deducted.

8. Format for Clarity: Present the data in a clear and organized format, using consistent headings and subheadings. A well-formatted template enhances readability and understanding. This facilitates informed decision-making based on accurate financial data.

A well-structured template ensures consistency in reporting, simplifies analysis, and promotes informed financial management. By following these steps, one can create a robust profit and loss statement template that serves as a valuable tool for assessing financial performance and making strategic decisions.

A profit and loss statement template provides a crucial framework for understanding financial performance. From revenue generation and expense management to the calculation of gross profit, operating income, and net income, each component contributes to a comprehensive view of a company’s financial health. Utilizing a standardized template ensures consistency, facilitates analysis, and allows for informed decision-making based on accurate and readily interpretable data. Understanding the structure, components, and creation process empowers businesses to leverage this essential tool for financial assessment, strategic planning, and ultimately, achieving sustainable profitability.

Effective financial management hinges on the ability to accurately assess performance and make data-driven decisions. A profit and loss statement template serves as a cornerstone of this process, providing a structured approach to financial analysis and reporting. Leveraging the insights provided by this essential tool empowers organizations to navigate the complexities of the financial landscape, optimize resource allocation, and drive sustainable growth. Regular review and analysis of the profit and loss statement are vital for informed financial management and long-term success.