Utilizing a standardized structure offers several advantages. It streamlines the billing process, reducing the time and effort required to generate individual statements. The consistent presentation of information minimizes the risk of errors and misunderstandings, fostering trust and positive client relationships. Furthermore, a professional-looking document enhances the business’s image and reinforces its commitment to accurate and efficient financial management.

This foundation of understanding facilitates exploration of specific elements within the account statement, best practices for customization and implementation, and its broader role in maintaining healthy financial relationships. The following sections will delve into these topics, providing a comprehensive overview of effective account statement management.

1. Clarity

Clarity serves as a cornerstone of effective financial communication. Within the context of a statement of account template, clarity ensures that the recipient can readily understand the information presented. This encompasses clear labeling of all figures, a logical flow of data, and consistent formatting. A lack of clarity can lead to confusion, disputes, and delayed payments. For example, ambiguous descriptions of individual transactions or a poorly organized layout can make it difficult for clients to reconcile the statement with their own records. Conversely, a clear and concise statement fosters transparency and strengthens the client-business relationship.

Several factors contribute to clarity within a statement of account template. Using descriptive but concise language for transaction details avoids ambiguity. Consistent date formats and currency notations prevent misinterpretations. A logical grouping of related transactions, such as invoices and payments, facilitates reconciliation. Furthermore, clear visual cues, such as distinct sections for contact information, billing summaries, and transaction details, improve readability and navigation. Employing a well-designed template ensures consistent clarity across all statements, reinforcing professionalism and reliability.

Achieving clarity in a statement of account template ultimately reduces administrative overhead and strengthens financial relationships. By minimizing the potential for misunderstandings, clear communication reduces the need for follow-up inquiries and corrections. This streamlined process benefits both the business and its clients, contributing to efficient financial management and fostering trust. Addressing potential ambiguity proactively through a well-structured template demonstrates a commitment to transparency and professionalism, ultimately benefiting all stakeholders.

2. Accuracy

Accuracy in financial reporting is paramount, serving as the foundation of trust between businesses and their clients. A sample statement of account template plays a crucial role in ensuring this accuracy by providing a structured framework for recording and presenting financial data. Inaccurate statements can lead to disputes, damaged reputations, and potential legal ramifications. Therefore, meticulous attention to detail and adherence to established accounting principles are essential when utilizing a template.

- Data Entry ValidationMinimizing errors during data entry is the first line of defense against inaccuracies. Templates can incorporate features such as dropdown menus for predefined categories and automatic calculations to reduce manual input and the associated risks. For example, selecting “Invoice” or “Payment” from a dropdown ensures consistent categorization, while automated calculations prevent mathematical errors. This validation process significantly improves the reliability of the information presented.

- Reconciliation ProcessesRegular reconciliation of the statement of account with internal records is crucial for identifying and rectifying discrepancies. Templates can facilitate this process by providing clear summaries of transactions and balances, enabling efficient comparisons with other financial documents. Reconciling bank statements with recorded transactions, for example, ensures that all payments and receipts are accurately reflected. This ongoing monitoring maintains the integrity of the financial data.

- Audit TrailsMaintaining a clear audit trail is essential for accountability and transparency. Templates can incorporate features that track modifications, timestamps, and user information for each transaction. This detailed record provides a verifiable history of all changes, facilitating investigations into discrepancies and ensuring compliance with regulatory requirements. A comprehensive audit trail builds confidence in the accuracy and reliability of the financial information.

- Regular Review and UpdatesPeriodic review and updates of the template itself are crucial for maintaining accuracy. This includes verifying the accuracy of formulas, ensuring compliance with evolving accounting standards, and incorporating feedback from users. Regularly reviewing tax calculations within the template, for example, ensures compliance with current regulations. This proactive approach maintains the template’s relevance and effectiveness in ensuring accurate financial reporting.

These facets of accuracy, when integrated into a statement of account template, contribute significantly to the reliability and trustworthiness of financial reporting. By minimizing errors, facilitating reconciliation, providing audit trails, and maintaining up-to-date templates, businesses can ensure the integrity of their financial communications and foster stronger client relationships built on transparency and trust.

3. Conciseness

Conciseness in a statement of account template contributes directly to its clarity and effectiveness. Presenting information succinctly, without sacrificing essential details, respects the recipient’s time and improves comprehension. Overly detailed or verbose statements can obscure critical information and lead to confusion. A concise template ensures that the recipient can quickly grasp the key financial data, facilitating timely payments and reducing the need for clarification.

Consider a scenario where a statement includes lengthy descriptions for each transaction, repeating information readily available elsewhere. This redundancy not only clutters the document but also makes it challenging to locate crucial details like the total amount due or the payment deadline. In contrast, a concise statement utilizes clear, abbreviated descriptions and focuses on presenting the essential financial data in a readily digestible format. This approach improves the recipient’s understanding and streamlines the payment process.

Achieving conciseness requires careful consideration of the information presented. Utilizing standardized abbreviations and codes for common transactions can significantly reduce clutter. Grouping related transactions, such as multiple invoices within a single billing period, can provide a more consolidated view. Furthermore, leveraging visual elements, such as tables and charts, can present complex data in a concise and easily understandable manner. The balance between detail and brevity ensures the statement remains informative yet manageable, ultimately promoting efficient financial communication.

4. Professionalism

A professional appearance reflects positively on a business, fostering trust and enhancing its credibility. Within the context of financial documentation, a sample statement of account template contributes significantly to this image. A professionally designed template conveys competence, attention to detail, and a commitment to clear communication. This, in turn, strengthens client relationships and reinforces the perception of a well-managed organization.

- Branding ConsistencyIncorporating consistent branding elements, such as logos, color schemes, and fonts, reinforces brand identity and creates a cohesive visual experience. A statement of account that aligns visually with other business communications strengthens brand recognition and reinforces professionalism. Conversely, inconsistent branding can create a disjointed impression, potentially undermining the perceived credibility of the document.

- Clear and Concise LanguageUsing clear, concise, and professional language throughout the statement avoids ambiguity and ensures effective communication. Avoiding jargon or overly technical terms makes the document accessible to a wider audience. For example, using “outstanding balance” instead of “amount receivable” improves clarity for clients unfamiliar with accounting terminology. This attention to language contributes to a professional and respectful tone.

- High-Quality PresentationThe overall presentation of the statement, including layout, formatting, and visual elements, contributes significantly to its perceived professionalism. A well-organized document with a clean layout is easier to read and understand. Using appropriate fonts, spacing, and visual hierarchy enhances readability and reinforces a professional image. Conversely, a cluttered or poorly formatted statement can create a negative impression, suggesting a lack of attention to detail.

- Error-Free DocumentationAccuracy and attention to detail are essential for maintaining a professional image. A statement free of errors, whether typographical, computational, or factual, reflects positively on the business’s competence and attention to quality. Thorough proofreading and verification processes are crucial for ensuring error-free documentation. Even minor errors can undermine the credibility of the statement and create a negative impression.

These elements of professionalism, when integrated into a sample statement of account template, contribute significantly to the overall impression a business makes on its clients. A professional presentation not only enhances the clarity and effectiveness of the statement but also reinforces the business’s commitment to quality and professionalism in all its interactions. This, in turn, fosters trust, strengthens client relationships, and contributes to a positive brand image.

5. Customization

Customization allows a sample statement of account template to evolve beyond a generic form into a tailored communication tool. This adaptability is crucial for addressing the specific needs of diverse businesses and client relationships. While a standard template provides a foundational structure, customization empowers businesses to incorporate unique branding elements, specific payment terms, or detailed transaction descriptions relevant to their industry. This tailored approach enhances clarity, reinforces professionalism, and improves the overall client experience.

Consider a business operating within a subscription-based model. A standard template might not adequately reflect the recurring nature of transactions or the specific subscription tiers offered. Customization enables the inclusion of fields for subscription start and end dates, renewal terms, and specific service details. Similarly, a business operating internationally might need to adapt the template to accommodate different currencies, languages, or tax regulations. These tailored modifications ensure the statement of account remains relevant and informative for each specific client interaction. Furthermore, customization extends to the integration of specific payment methods, such as online payment portals or QR codes, streamlining the payment process and enhancing convenience for clients.

Effectively leveraging customization requires a balance between flexibility and consistency. While adapting the template to specific needs is essential, maintaining a core structure ensures clarity and professionalism. Over-customization can lead to inconsistencies and undermine the template’s benefits. A well-defined customization strategy ensures that modifications enhance rather than detract from the template’s functionality. This strategic approach to customization transforms the statement of account from a generic document into a powerful tool for communication, reinforcing client relationships and enhancing financial transparency.

6. Accessibility

Accessibility, within the context of a sample statement of account template, refers to the ease with which clients can receive, understand, and interact with the provided financial information. It encompasses various facets, from the delivery method and format to the clarity of the presented data. Ensuring accessibility is crucial for promoting transparency, facilitating timely payments, and fostering positive client relationships. A readily accessible statement of account empowers clients to manage their financial obligations effectively and contributes to a smoother business operation.

- Delivery MethodsMultiple delivery methods cater to diverse client preferences and technological capabilities. Offering options such as postal mail, email, and secure online portals ensures clients can access their statements conveniently. For example, providing downloadable PDF statements through a secure client portal allows for convenient archiving and retrieval. Choosing appropriate delivery methods based on client demographics and technological infrastructure enhances accessibility and promotes efficient communication.

- Format CompatibilityProviding statements in commonly used and easily accessible formats is crucial for ensuring compatibility across different devices and software. Utilizing formats such as PDF or CSV ensures clients can open and view their statements regardless of their operating system or software preferences. Offering accessible HTML versions benefits users who rely on assistive technologies. Compatibility considerations minimize technical barriers and promote inclusivity, ensuring all clients can access and review their financial information without difficulty.

- Data Clarity and OrganizationThe clarity and organization of the data within the statement significantly impact its accessibility. Clear labeling, logical grouping of transactions, and consistent formatting enhance readability and comprehension. For example, using clear headings for different sections, such as “Account Summary,” “Transaction Details,” and “Payment Information,” improves navigation and understanding. A well-structured statement enables clients to quickly locate and interpret the information they need, regardless of their financial literacy.

- Accessibility Features for Users with DisabilitiesConsideration for users with disabilities is essential for ensuring inclusivity. Templates should adhere to accessibility guidelines, such as providing alternative text for images, ensuring sufficient color contrast, and using appropriate font sizes. Offering braille or large-print versions caters to specific needs. These accommodations ensure that all clients, regardless of their abilities, can access and understand their financial information. Addressing accessibility needs demonstrates a commitment to inclusivity and fosters positive client relationships.

These facets of accessibility, when integrated into a sample statement of account template, contribute significantly to a positive client experience. By offering diverse delivery methods, ensuring format compatibility, prioritizing data clarity, and incorporating accessibility features, businesses can empower clients to manage their financial obligations effectively. This proactive approach to accessibility fosters transparency, strengthens client relationships, and contributes to a more efficient and inclusive business operation. Ultimately, accessible statements of account benefit both the client and the business, facilitating clear communication and promoting financial well-being.

Key Components of a Statement of Account Template

Essential elements comprise a comprehensive and effective statement of account template. These components ensure clarity, accuracy, and professionalism in financial communication, fostering transparency and positive client relationships.

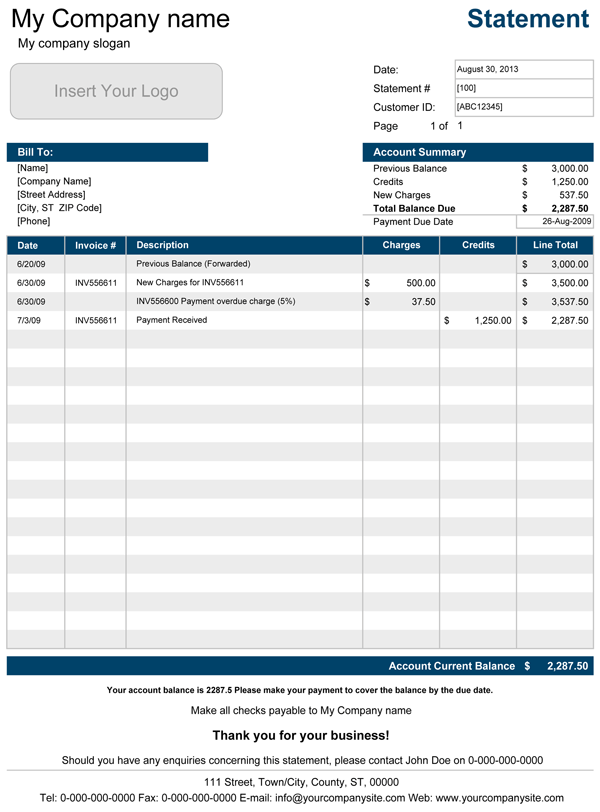

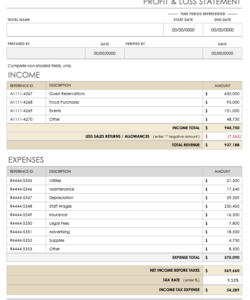

1. Account Information: This section clearly identifies both the business issuing the statement and the client receiving it. Accurate and up-to-date contact details for both parties facilitate communication and ensure efficient delivery. This typically includes business names, addresses, phone numbers, and account numbers.

2. Statement Period: The statement period defines the timeframe covered by the included transactions. A clearly defined start and end date ensure accurate reconciliation and prevent confusion regarding the applicable timeframe for the reported activity.

3. Opening Balance: The opening balance represents the outstanding amount at the beginning of the statement period. This figure provides context for the subsequent transactions and allows for accurate tracking of account activity over time.

4. Transaction Details: This section forms the core of the statement, providing a detailed record of all transactions within the specified period. Each transaction should include the date, a clear description, and the corresponding debit or credit amount. Precise and unambiguous descriptions facilitate understanding and reconciliation.

5. Payments and Credits: This section details all payments received and credits applied to the account during the statement period. Clear identification of payment methods and dates ensures accurate tracking and proper allocation of funds.

6. Closing Balance: The closing balance represents the outstanding amount at the end of the statement period. This crucial figure provides a clear overview of the current account status and informs future financial decisions.

7. Payment Instructions and Terms: This section outlines accepted payment methods, due dates, and any applicable late payment fees or penalties. Clear payment instructions simplify the process for clients and encourage timely payment.

8. Contact Information for Inquiries: Providing clear contact information for inquiries enables clients to easily resolve any questions or discrepancies. This accessible point of contact fosters open communication and strengthens client relationships.

These components work in concert to provide a comprehensive overview of account activity, facilitating clear communication and efficient financial management. A well-designed template incorporating these elements promotes transparency, reduces misunderstandings, and strengthens the business-client relationship.

How to Create a Sample Statement of Account Template

Creating a professional and effective statement of account template requires careful consideration of key components and best practices. A well-structured template ensures clarity, accuracy, and facilitates efficient financial communication.

1. Define the Purpose and Scope: Clarify the specific needs and objectives of the template. Consider the type of business, industry-specific requirements, and the target audience. A template for a subscription-based service will differ from one for a retail business.

2. Choose a Format: Select an appropriate format, such as a spreadsheet, word processing document, or specialized accounting software. Consider accessibility and compatibility across different platforms and devices. Spreadsheet software offers robust calculation capabilities, while word processing documents allow for greater formatting flexibility.

3. Incorporate Essential Components: Include all necessary elements, such as clear headers for business and client information, statement period, opening balance, transaction details, payments and credits, closing balance, payment instructions, and contact information. Each component contributes to a comprehensive and informative statement.

4. Design for Clarity and Readability: Utilize clear fonts, logical layout, and visual cues, such as headings, subheadings, and tables, to enhance readability and comprehension. A well-organized template minimizes confusion and facilitates efficient review.

5. Ensure Accuracy and Validation: Implement features to minimize data entry errors and ensure accuracy, such as dropdown menus for predefined categories, automatic calculations, and data validation rules. Accuracy builds trust and prevents disputes.

6. Customize for Specific Needs: Tailor the template to reflect specific business requirements, such as branding elements, payment terms, or industry-specific transaction descriptions. Customization enhances relevance and professionalism.

7. Test and Refine: Thoroughly test the template with sample data to identify and correct any errors or inconsistencies. Gather feedback from users to further refine the design and functionality. Testing ensures the template meets practical needs and functions as intended.

8. Maintain and Update: Regularly review and update the template to reflect changes in business processes, accounting standards, or regulatory requirements. Maintaining an up-to-date template ensures ongoing accuracy and compliance.

A well-designed template streamlines the billing process, minimizes errors, and promotes transparency in financial communication. Regular review and refinement ensure the template remains a valuable tool for managing client accounts effectively.

Effective financial communication underpins healthy business-client relationships. Standardized frameworks for presenting account activity offer a crucial tool for achieving this clarity. Discussed aspects include the core components of such frameworks, emphasizing clarity, accuracy, conciseness, and professionalism. Customization options enable tailoring to specific business needs while accessibility considerations ensure broad usability. From initial design to ongoing maintenance and updates, a strategic approach maximizes effectiveness and contributes to efficient financial management.

Precise and transparent financial reporting fosters trust and strengthens professional relationships. Leveraging structured templates promotes efficiency and clarity, contributing to a more robust and sustainable business environment. Continuous refinement of these tools, informed by best practices and evolving needs, remains essential for maintaining effective financial communication in the dynamic landscape of modern commerce.