Utilizing such a document offers several advantages. It simplifies a complex tax process, reducing the likelihood of errors and omissions that could lead to audits or penalties. It also saves time and resources by providing a readily available, legally sound framework, eliminating the need to draft a declaration from scratch. This standardized approach promotes consistency and clarity in reporting, facilitating a smoother interaction with tax authorities.

Further exploration of the specific requirements, applicable thresholds, and proper usage of these documents can aid in maximizing the deduction and ensuring accurate compliance.

1. Pre-designed document

A pre-designed document plays a critical role in streamlining compliance with Section 199A. It provides a structured framework for taxpayers to demonstrate adherence to the qualified business income (QBI) deduction requirements, reducing the complexities associated with interpreting and applying tax law.

- Standardized FormatThe standardized format ensures consistency and completeness in reporting. This reduces the risk of errors or omissions that could trigger audits or penalties. A consistent structure allows tax authorities to process information efficiently, facilitating a smoother tax filing process.

- Simplified CompliancePre-designed templates simplify the process of claiming the QBI deduction. Rather than navigating complex regulations and drafting declarations from scratch, taxpayers can utilize a readily available, legally sound document. This reduces the burden on taxpayers and promotes accurate reporting.

- Reduced RiskUsing a template mitigates the risk of errors and omissions that could lead to IRS scrutiny. By adhering to a pre-approved structure, taxpayers can demonstrate a clear intent to comply with Section 199A. This can be particularly valuable during audits, providing evidence of good-faith efforts to comply with tax law.

- Efficiency and Time SavingsTemplates save valuable time and resources. They eliminate the need for extensive research and drafting, allowing taxpayers to focus on other aspects of their business. This efficiency benefits both individual taxpayers and tax professionals, streamlining the tax preparation process.

These facets of a pre-designed document contribute significantly to efficient and accurate compliance with Section 199A. By leveraging these advantages, taxpayers can effectively manage the complexities of the QBI deduction and minimize potential compliance issues. This structured approach fosters a smoother and more confident interaction with tax authorities.

2. Simplified Compliance

Simplified compliance represents a key benefit derived from using a Section 199A safe harbor statement template. Navigating the complexities of Section 199A can be challenging for taxpayers due to intricate rules and regulations surrounding qualified business income (QBI) deductions. Templates offer a structured approach, simplifying the process by providing a pre-determined format that incorporates the necessary elements for compliance. This reduces the burden on taxpayers to interpret complex tax law independently, minimizing the potential for errors and omissions. By adhering to a standardized template, taxpayers can more easily demonstrate adherence to the required criteria, such as meeting trade or business tests and gross receipts thresholds.

For instance, consider a small business owner operating a qualified trade or business. Determining eligibility for the QBI deduction and accurately calculating the deduction can be daunting. A template provides clear guidance on the information required and how to present it, eliminating guesswork and reducing the likelihood of miscalculations. This streamlined process allows the business owner to focus on core business operations rather than navigating complex tax regulations. Similarly, for tax professionals managing multiple clients, templates offer efficiency and consistency, ensuring all necessary information is collected and reported uniformly, reducing the administrative burden and improving accuracy across client portfolios. This standardization promotes a smoother tax filing process, minimizing the risk of audits or inquiries from tax authorities.

In conclusion, simplified compliance achieved through the use of templates significantly contributes to a more efficient and less stressful tax season. By providing a clear framework and reducing the complexities associated with Section 199A, these templates empower taxpayers and tax professionals to navigate the QBI deduction with greater confidence and accuracy. This structured approach not only saves time and resources but also mitigates potential compliance risks, fostering a more positive and productive interaction with tax authorities.

3. Reduced Audit Risk

A primary advantage of utilizing a Section 199A safe harbor statement template lies in mitigating the risk of IRS audits. By adhering to a pre-approved, structured format, taxpayers demonstrate a clear intent to comply with the complex regulations surrounding qualified business income (QBI) deductions. This proactive approach can significantly reduce the likelihood of scrutiny from tax authorities.

- Demonstrated ComplianceTemplates provide a standardized method for reporting QBI deduction details, ensuring all necessary information is presented clearly and consistently. This structured approach signals to the IRS a commitment to accurate reporting and adherence to regulations, reducing the perception of potential discrepancies that might trigger an audit.

- Reduced Errors and OmissionsTemplates minimize the risk of errors and omissions that often attract IRS attention. By providing pre-defined fields and prompts, they guide taxpayers through the reporting process, reducing the likelihood of unintentional mistakes or overlooked details that could raise red flags during an audit. This structured approach promotes accuracy and completeness, minimizing potential audit triggers.

- Evidence of Good FaithUsing a template serves as evidence of a taxpayer’s good-faith effort to comply with Section 199A. In the event of an audit, the use of a recognized template can demonstrate a proactive approach to compliance, potentially mitigating penalties or further scrutiny. This documented adherence to established guidelines strengthens the taxpayer’s position during an audit.

- Efficient Record-KeepingTemplates facilitate organized record-keeping by providing a structured framework for documenting QBI deduction details. This organized approach simplifies the process of responding to IRS inquiries and substantiating claimed deductions during an audit. Well-maintained records, facilitated by template usage, contribute to a smoother audit experience.

In summary, utilizing a Section 199A safe harbor statement template significantly reduces audit risk by promoting accurate reporting, demonstrating a commitment to compliance, and facilitating organized record-keeping. This proactive approach not only minimizes the likelihood of an audit but also strengthens the taxpayer’s position in the event of an IRS inquiry, contributing to a more confident and efficient tax management process.

4. Standardized Format

Standardized format is a critical element of a Section 199A safe harbor statement template. The structured nature of these templates ensures consistent reporting of information required for compliance with qualified business income (QBI) deduction regulations. This consistency facilitates efficient processing by tax authorities and reduces the likelihood of errors or omissions that could trigger audits or penalties. A standardized format provides a clear framework for presenting information, ensuring all necessary elements are included and presented uniformly, regardless of the specific business or individual circumstances.

Consider, for example, a scenario where multiple businesses, each with varying structures and revenue streams, utilize a standardized template. Despite their differences, the consistent format ensures each business reports the necessary information in a uniform manner. This allows the IRS to process and analyze the information efficiently, reducing the potential for misunderstandings or discrepancies. Furthermore, a standardized format simplifies the process for tax professionals, allowing for streamlined data entry and analysis across multiple clients, regardless of the complexity of their individual situations. This consistency promotes accuracy and reduces the administrative burden associated with managing multiple tax filings.

Standardization promotes transparency and clarity in reporting. By adhering to a prescribed format, taxpayers provide a clear and concise representation of their QBI deduction claims. This transparency not only facilitates IRS review but also allows taxpayers to maintain organized records and easily track their compliance with relevant regulations. Understanding the importance of standardized format within the context of Section 199A safe harbor statement templates is crucial for accurate and efficient tax compliance. This structured approach benefits both taxpayers and tax authorities by streamlining the reporting process, reducing errors, and promoting a more transparent and efficient interaction with the tax system. Ultimately, a standardized format contributes to a more robust and reliable system for administering QBI deductions.

5. Specific Requirements Declaration

A crucial component of a Section 199A safe harbor statement template is the specific requirements declaration. This section serves as an explicit affirmation that a taxpayer meets the necessary criteria for claiming the qualified business income (QBI) deduction. It provides a structured framework for attesting compliance with various aspects of Section 199A, such as the trade or business test, gross receipts limitations, and specified service trade or business (SSTB) classifications. Without a clear and accurate declaration, the template loses its efficacy in demonstrating compliance and mitigating audit risk.

The specific requirements declaration establishes a direct link between the taxpayer’s activities and the eligibility criteria outlined in Section 199A. For example, a taxpayer engaged in a rental real estate enterprise must declare that the activity constitutes a trade or business under the relevant regulations. Further, the declaration might include specific details regarding the level of taxpayer participation, demonstrating compliance with the real estate safe harbor. Similarly, taxpayers operating SSTBs must declare compliance with applicable income limitations and demonstrate that their business falls within the defined SSTB categories. These declarations provide verifiable assertions that underpin the QBI deduction claim, offering a layer of transparency and accountability. A failure to accurately declare specific requirements can invalidate the entire safe harbor statement, potentially leading to disallowance of the deduction and increased scrutiny from tax authorities.

In conclusion, the specific requirements declaration within a Section 199A safe harbor statement template serves as a cornerstone of compliance. It ensures taxpayers explicitly address critical eligibility criteria, reinforcing the validity of their QBI deduction claims. Accurate and comprehensive declarations are essential for mitigating audit risk and demonstrating good-faith efforts to adhere to complex tax regulations. This component underscores the importance of a thorough understanding of Section 199A and the specific requirements relevant to each taxpayer’s unique circumstances.

Key Components of a Section 199A Safe Harbor Statement Template

Understanding the core components of a Section 199A safe harbor statement template is essential for accurate compliance with qualified business income (QBI) deduction regulations. These components work together to provide a structured framework for demonstrating eligibility and mitigating audit risk.

1. Identification of the Trade or Business: Clear identification of the specific trade or business activity for which the QBI deduction is being claimed is fundamental. This includes providing details such as the nature of the business, its organizational structure, and relevant identifying information.

2. Gross Receipts Test Declaration: A declaration stating whether the trade or business meets the gross receipts test is essential. This involves reporting total gross receipts and affirming they fall within the applicable thresholds established by Section 199A. Accuracy in this declaration is critical for determining eligibility.

3. Specified Service Trade or Business (SSTB) Determination: Explicitly addressing whether the trade or business qualifies as an SSTB is crucial. This requires a detailed analysis of the business activities and a clear declaration stating whether it falls within the defined SSTB categories. Accurate SSTB determination is vital for proper application of income limitations.

4. Real Estate Enterprise Designation (if applicable): For taxpayers involved in rental real estate activities, a clear designation of the enterprise as a qualified real estate enterprise, if applicable, is necessary. This includes providing details about the level of taxpayer participation and compliance with the real estate safe harbor requirements.

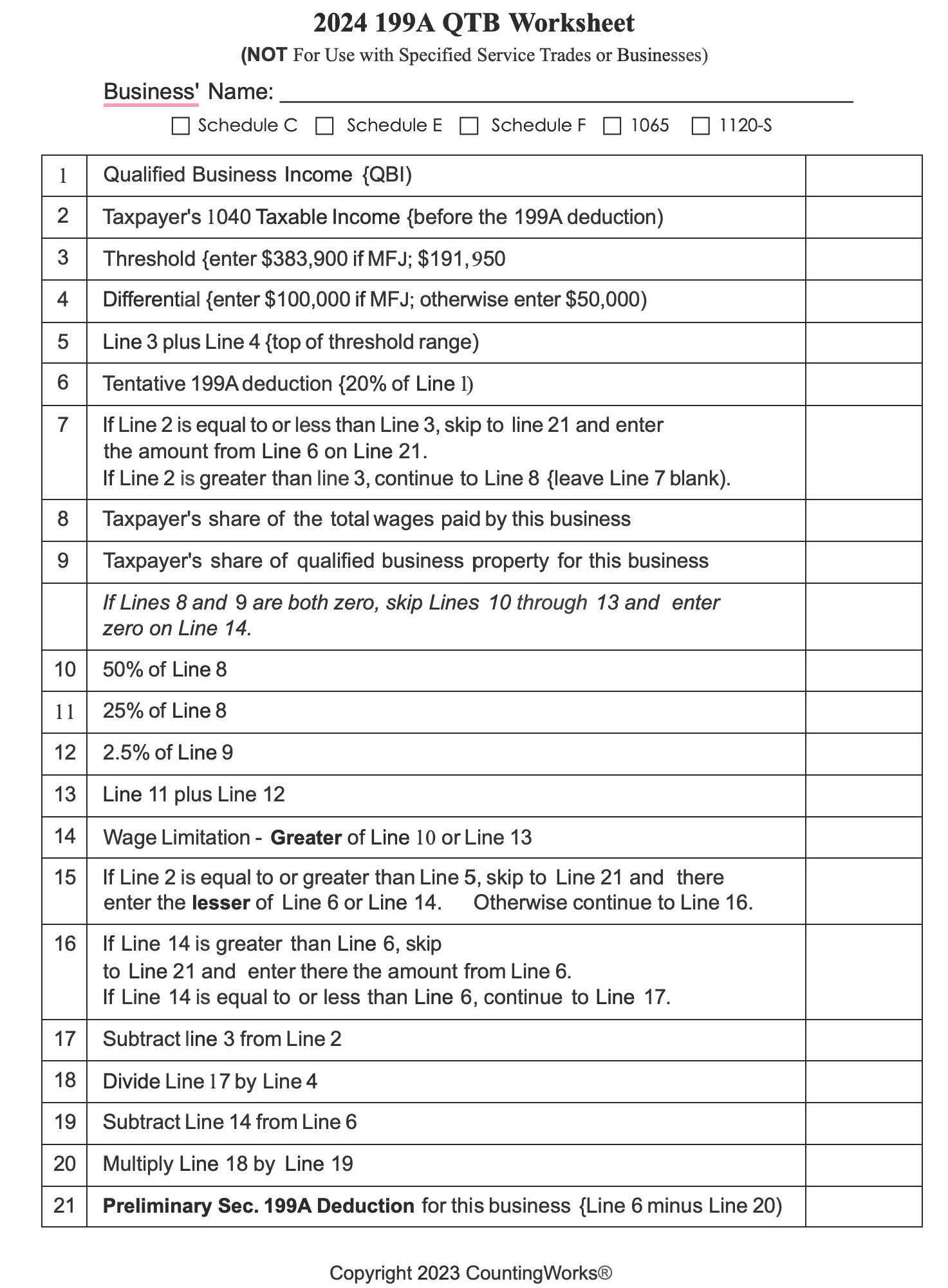

5. Wage and Capital Limitations Declaration: Addressing wage and capital limitations is crucial for accurately calculating the QBI deduction. This involves reporting W-2 wages paid by the business and the unadjusted basis immediately after acquisition (UBIA) of qualified property. Accurate reporting of these figures ensures proper application of the limitations.

6. Aggregation Rules Application (if applicable): If applicable, a statement explaining the application of aggregation rules to combine multiple trades or businesses for QBI deduction purposes is required. This section outlines the rationale and methodology used for aggregation, ensuring compliance with relevant regulations.

These elements form the foundation of a compliant and effective Section 199A safe harbor statement. Proper completion of each component ensures accurate representation of the taxpayer’s situation, facilitates efficient processing by tax authorities, and ultimately reduces the risk of audits and penalties.

How to Create a Section 199A Safe Harbor Statement Template

Creating a robust Section 199A safe harbor statement template requires careful consideration of key components and adherence to specific regulatory requirements. A well-crafted template facilitates accurate reporting, streamlines compliance, and mitigates potential audit risks. The following steps outline the process for developing an effective template.

1. Define Template Scope and Purpose: Clearly define the intended scope and purpose of the template. Specify the types of businesses or activities it will cover and the specific safe harbor provisions it addresses. A focused approach ensures clarity and relevance.

2. Incorporate Identification Information: Include fields for essential identifying information, such as taxpayer name, taxpayer identification number (TIN), business legal name, and business activity code. Accurate identification is fundamental for proper processing.

3. Designate Gross Receipts Reporting: Incorporate sections for reporting gross receipts for the relevant tax year. Provide clear instructions for calculating and reporting gross receipts accurately, ensuring compliance with the applicable thresholds.

4. Integrate SSTB Determination Section: Include a dedicated section for determining SSTB status. Provide clear guidance and criteria for classifying the business activity and determining whether it falls within the defined SSTB categories. Accurate SSTB determination is essential for proper application of income limitations.

5. Address Real Estate Enterprise Designations: If applicable, incorporate a section for designating qualified real estate enterprises. Include fields for reporting relevant details, such as property ownership percentage and the level of taxpayer participation in rental real estate activities.

6. Incorporate Wage and Capital Limitation Reporting: Include sections for reporting W-2 wages and UBIA of qualified property. Provide clear instructions for accurately calculating and reporting these figures, ensuring proper application of limitations.

7. Address Aggregation Rules (if applicable): If the template allows for aggregation of multiple trades or businesses, include a section addressing aggregation rules. Provide clear instructions and criteria for applying aggregation principles, ensuring compliance with relevant regulations.

8. Review and Update Regularly: Regularly review and update the template to reflect changes in tax law and regulations. Maintaining an up-to-date template ensures continued accuracy and compliance.

A well-designed Section 199A safe harbor statement template provides a structured approach to claiming the QBI deduction. By incorporating these key components and adhering to regulatory guidelines, taxpayers can streamline compliance, minimize errors, and reduce the risk of IRS scrutiny. Regular review and updates ensure the template remains a valuable tool for navigating the complexities of Section 199A.

Careful consideration of available resources, including pre-designed templates and professional guidance, offers a pathway to navigate these complexities effectively. Understanding the nuances of Section 199A and its associated safe harbor provisions is crucial for taxpayers seeking to maximize the QBI deduction while maintaining compliance with tax law. Accurate reporting, supported by a structured approach, minimizes the risk of errors, audits, and potential penalties. Leveraging available tools and resources empowers taxpayers to approach this aspect of tax planning with confidence and accuracy.

Staying informed about regulatory updates and seeking expert advice when needed allows taxpayers to adapt to evolving tax landscapes and optimize their approach to the QBI deduction. Proactive engagement with these provisions contributes to a more efficient and compliant tax strategy, ultimately benefiting both individual taxpayers and the overall integrity of the tax system. Diligent attention to detail and a commitment to accurate reporting remain essential for navigating the complexities of Section 199A and maximizing its benefits within the bounds of tax law. A well-informed approach to these provisions ensures taxpayers can confidently claim the QBI deduction while upholding the principles of accurate and compliant tax reporting.