Utilizing such a tool empowers individuals to track progress toward financial goals, identify areas for improvement, and secure loans or other forms of financing. The readily available information facilitates proactive financial management and contributes to a greater sense of control over personal finances.

This overview lays the groundwork for a deeper exploration of key concepts related to personal finance. The following sections will delve into the specific components of a streamlined balance sheet, offer practical guidance on creating one, and discuss strategies for leveraging this information to achieve financial well-being.

1. Assets

Accurate representation of assets is fundamental to a reliable personal financial statement. A comprehensive understanding of asset categories and their valuation contributes to a clear picture of financial standing. This section details key asset types typically included in a streamlined balance sheet.

- Liquid AssetsLiquid assets are readily convertible to cash. Common examples include checking and savings accounts, money market funds, and certificates of deposit. These assets provide immediate financial flexibility and are crucial for covering short-term expenses and emergencies. Accurately listing liquid assets is essential for assessing short-term financial stability.

- InvestmentsInvestments encompass assets held for long-term growth and income generation. Examples include stocks, bonds, mutual funds, and retirement accounts. Their market value fluctuates, impacting overall net worth. Regularly updating investment values provides a realistic assessment of financial progress.

- Real PropertyReal property comprises land and any permanent structures attached to it, including primary residences and rental properties. Current market value is typically used for valuation purposes, reflecting potential equity. This asset class often represents a significant portion of an individual’s net worth.

- Personal PropertyPersonal property includes tangible, movable assets such as vehicles, furniture, jewelry, and electronics. While often less substantial than real property, these items contribute to a complete picture of owned resources. Accurate estimations of their current value are important for a thorough financial assessment.

A comprehensive view of assets, encompassing liquid holdings, investments, and tangible property, provides the foundation for calculating net worth and making informed financial decisions. By meticulously documenting these holdings, individuals gain a clearer understanding of their financial resources and can strategically plan for future goals.

2. Liabilities

Accurate representation of liabilities is crucial for a comprehensive understanding of one’s financial position within a personal financial statement. A clear grasp of outstanding obligations provides valuable context for assessing net worth and making informed financial decisions. This section details key liability types commonly included in a streamlined balance sheet.

- Secured DebtSecured debt represents borrowings backed by collateral, such as mortgages and auto loans. Defaulting on these loans can lead to repossession of the collateral. Understanding the terms and balances of secured debt is essential for assessing long-term financial obligations.

- Unsecured DebtUnsecured debt lacks collateral backing, including credit card balances, personal loans, and medical bills. Interest rates are often higher due to the increased risk for lenders. Managing unsecured debt effectively is crucial for maintaining a healthy credit score and avoiding excessive interest payments.

- Short-Term LiabilitiesShort-term liabilities represent obligations due within one year, encompassing utility bills, rent payments, and credit card balances. Timely management of these obligations is critical for maintaining good financial standing and avoiding late payment penalties.

- Long-Term LiabilitiesLong-term liabilities extend beyond one year, typically including mortgages, student loans, and car loans. Understanding the amortization schedules and long-term implications of these debts is crucial for effective financial planning.

A thorough understanding of liabilities, encompassing secured and unsecured debts, as well as short-term and long-term obligations, provides a complete picture of financial commitments. Accurate accounting for these obligations is essential for calculating net worth and developing a realistic financial plan. By carefully tracking and managing liabilities, individuals can make informed decisions to improve their overall financial health.

3. Net Worth

Net worth represents a fundamental element within a streamlined balance sheet, providing a concise measure of financial health. Calculated as the difference between total assets and total liabilities, this figure offers a snapshot of one’s financial standing at a specific point in time. Understanding the nuances of net worth calculation and interpretation is crucial for effective financial planning and decision-making.

- CalculationNet worth is derived by subtracting total liabilities from total assets. For example, an individual with $250,000 in assets and $100,000 in liabilities possesses a net worth of $150,000. Accurate valuation of both assets and liabilities is essential for a reliable net worth calculation. Consistent tracking allows individuals to monitor progress over time and identify trends.

- InterpretationA positive net worth signifies that assets exceed liabilities, indicating a stronger financial position. Conversely, a negative net worth implies that liabilities outweigh assets. While a positive net worth is generally desirable, the absolute value should be interpreted in context with individual financial goals and circumstances. Analyzing trends in net worth over time provides more insightful information than a single snapshot.

- Influencing FactorsSeveral factors can influence net worth, including income, expenses, investment performance, and debt management. Increasing income, reducing expenses, and making sound investment decisions can contribute to a higher net worth. Effectively managing and reducing debt also plays a significant role in improving overall financial standing.

- Financial PlanningNet worth serves as a valuable metric for financial planning and goal setting. Tracking net worth over time allows individuals to assess the effectiveness of financial strategies and make adjustments as needed. Regularly reviewing net worth in conjunction with other financial indicators provides a comprehensive view of financial health and informs future decisions related to saving, investing, and debt management.

Regularly calculating and analyzing net worth within the context of a streamlined balance sheet provides valuable insights into financial progress. By understanding the factors influencing this key metric, individuals can make informed choices to improve their overall financial well-being and work toward achieving long-term financial goals.

4. Snapshot in Time

A key characteristic of a streamlined balance sheet is its representation of financial standing at a specific moment. This “snapshot in time” perspective offers valuable insights into financial health but requires careful interpretation. Unlike a continuously updating measure, a balance sheet captures assets, liabilities, and net worth at a fixed point. Consider an individual assessing finances before a major purchase like a home. The balance sheet used for loan pre-approval reflects their financial state at that application date. Subsequent changes in income, expenses, or investments are not reflected in that document. This principle also applies to tracking progress toward financial goals. A balance sheet created today may differ significantly from one generated six months later due to market fluctuations, debt repayment, or changes in asset values.

The “snapshot in time” nature underscores the importance of regular updates. Frequent assessments, such as quarterly or annually, provide a dynamic view of financial progress and enable more informed decision-making. For instance, consistent debt reduction efforts might not be immediately apparent in day-to-day finances but become clear when comparing balance sheets from different periods. Similarly, tracking investment growth over time offers a tangible measure of progress toward long-term financial goals. Understanding this temporal aspect allows for more effective use of the information presented within a streamlined balance sheet.

Recognizing that a balance sheet offers a static view of a dynamic financial landscape is crucial for its effective utilization. Regular updates and comparative analysis between different periods provide the necessary context for interpreting financial health and making informed adjustments to financial strategies. This dynamic approach, coupled with an understanding of the “snapshot in time” concept, empowers individuals to leverage a streamlined balance sheet as a powerful tool for achieving long-term financial well-being.

5. Financial Health

Financial health represents an individual’s overall financial well-being. A streamlined balance sheet serves as a crucial diagnostic tool for assessing this health, providing a clear picture of assets, liabilities, and net worth. This interrelationship allows for informed decision-making regarding spending, saving, and investing. Cause and effect relationships between financial behaviors and resulting financial health become evident through regular balance sheet review. For instance, consistently saving a portion of income is likely to reflect positively on net worth growth over time. Conversely, accumulating high-interest debt may lead to a decline in net worth, signaling potential financial distress. Consider a recent graduate diligently paying down student loans while simultaneously building an emergency fund. Tracking progress through regular balance sheet updates provides tangible evidence of improving financial health, fostering motivation and reinforcing positive financial behaviors.

Understanding financial health as a dynamic component within a streamlined balance sheet offers practical significance. It empowers individuals to identify areas for improvement, set realistic financial goals, and measure progress toward achieving them. A consistently growing net worth, coupled with decreasing debt, indicates strengthening financial health. This knowledge facilitates proactive management of finances and allows for timely adjustments to spending habits, saving strategies, or investment portfolios. Furthermore, a clear understanding of one’s financial health, as presented in a balance sheet, is often required when seeking financial products such as mortgages or loans. Lenders utilize this information to assess creditworthiness and determine loan eligibility.

Regularly utilizing a streamlined balance sheet offers a tangible means of assessing and improving financial health. By understanding the cause-and-effect relationship between financial behaviors and outcomes, individuals can make informed decisions that contribute to long-term financial well-being. The practical application of this understanding empowers individuals to take control of their finances, build a strong financial foundation, and achieve their financial aspirations. Challenges may include maintaining accurate records and consistently updating the balance sheet. However, the long-term benefits of proactive financial management far outweigh the effort required. This practice contributes significantly to overall financial stability and resilience, crucial for navigating unexpected financial challenges and achieving long-term prosperity.

Key Components of a Streamlined Personal Financial Statement

A concise personal financial statement provides a clear overview of one’s financial position. Understanding its core components is essential for accurate assessment and effective financial planning.

1. Assets: Assets represent items of economic value owned by an individual. These include liquid assets (cash, checking and savings accounts), investments (stocks, bonds, retirement accounts), real property (land, buildings), and personal property (vehicles, furniture).

2. Liabilities: Liabilities represent outstanding financial obligations or debts. These encompass secured debt (mortgages, auto loans), unsecured debt (credit card balances, personal loans), and both short-term (due within one year) and long-term (due beyond one year) debts.

3. Net Worth: Net worth is the difference between total assets and total liabilities. A positive net worth indicates assets exceed liabilities, while a negative net worth signifies the opposite. This key metric provides a snapshot of overall financial standing.

4. Income: While not directly part of the balance sheet itself, income streams are essential context. Including income sources, such as salaries, wages, investments, and rental income, provides a more complete picture of financial resources available.

5. Expenses: Similar to income, regular expenses offer valuable context for interpreting the balance sheet. Tracking spending patterns across categories like housing, transportation, and food provides insights into financial behavior and potential areas for improvement.

6. Date: A balance sheet represents financial standing at a specific point in time. Clearly stating the date of creation is crucial for accurate interpretation and comparison with future statements, allowing for analysis of progress over time.

Accurate representation of these elements within a streamlined personal financial statement provides a foundation for informed financial decisions. Regularly reviewing and updating this information allows for proactive financial management and contributes to long-term financial well-being.

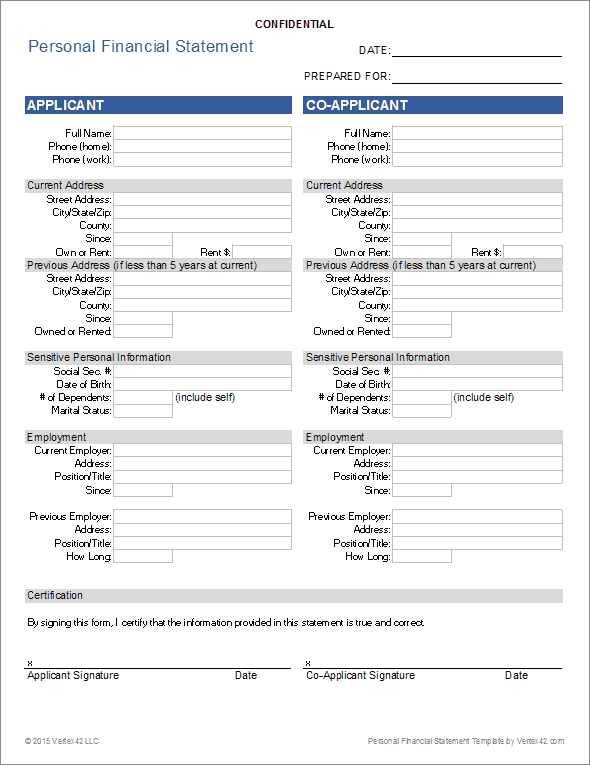

How to Create a Simple Personal Financial Statement

Creating a concise personal financial statement involves a straightforward process of organizing financial information into key categories. This document provides a clear snapshot of one’s financial health at a specific point in time.

1. Choose a Date: Specify the date for which the financial statement is being prepared. This ensures accuracy and allows for comparison with future statements.

2. List Assets: Categorize and list all owned assets, including liquid assets (cash, bank accounts), investments (stocks, bonds), real property (homes, land), and personal property (vehicles, valuables). Determine the current market value for each asset.

3. List Liabilities: Document all outstanding debts, including secured debts (mortgages, auto loans) and unsecured debts (credit card balances, personal loans). Record the current outstanding balance for each liability.

4. Calculate Net Worth: Subtract the total liabilities from the total assets. This resulting figure represents net worth, a key indicator of financial health.

5. Document Income and Expenses (Optional): While not strictly part of the balance sheet, including income sources and regular expenses provides valuable context for interpreting the financial statement and identifying areas for improvement. This information can be presented in a separate supporting document or section.

6. Review and Update Regularly: Financial situations change over time. Regularly reviewing and updating the personal financial statement, such as quarterly or annually, ensures accuracy and facilitates ongoing financial monitoring and planning.

7. Seek Professional Advice (Optional): Financial advisors can provide personalized guidance based on individual financial situations. Consulting with a professional can offer valuable insights and support for achieving financial goals.

A well-organized personal financial statement facilitates informed financial decision-making. Maintaining accurate records and regular updates contribute to a clear understanding of financial health and support effective long-term financial planning. This simple yet powerful tool empowers informed decision-making and contributes to overall financial well-being.

A streamlined personal financial statement template provides a crucial framework for understanding and managing individual finances. Through organized categorization of assets, liabilities, and the resulting calculation of net worth, this tool offers a clear snapshot of financial health at a specific point in time. Regular updates and thoughtful analysis of this document empower informed decision-making regarding spending, saving, and investing, ultimately contributing to long-term financial well-being. Understanding the components within this templateliquid assets, investments, real and personal property, secured and unsecured debts, short-term and long-term obligationsallows for a comprehensive assessment of one’s financial position. This detailed perspective facilitates identification of areas for improvement and supports the development of sound financial strategies.

Leveraging a streamlined personal financial statement template contributes significantly to financial literacy and empowers proactive financial management. Consistent utilization of this tool fosters greater awareness of financial standing, enabling individuals to make informed choices aligned with their financial goals. This practice fosters financial stability, resilience, and the ability to navigate economic fluctuations effectively, supporting individuals in achieving long-term financial security and prosperity. The insights gained through regular review and analysis of this statement provide a solid foundation for making informed financial decisions and building a secure financial future.