Utilizing a standardized structure offers several advantages. It facilitates easy comparison of performance across different periods, enabling trend analysis and informed decision-making. This clarity also simplifies communication with stakeholders, such as investors and lenders, who rely on this information to assess financial health. Furthermore, a readily available framework can save time and resources, allowing for efficient financial reporting and analysis.

Understanding the core components and benefits of this type of financial reporting lays the groundwork for exploring broader topics in financial management, including budgeting, forecasting, and performance analysis. These interconnected concepts contribute to a comprehensive understanding of an organization’s financial landscape.

1. Revenue

Revenue, the top line of a profit and loss statement, represents the total income generated from business activities before any expenses are deducted. Within the context of a streamlined profit and loss statement, revenue serves as the starting point for calculating profitability. Its accurate recording and categorization are crucial for a meaningful financial analysis. For instance, a software company’s revenue might comprise software license sales, subscription fees, and consulting services. Clearly distinguishing these revenue streams provides granular insights into business performance.

The relationship between revenue and profitability is not always straightforward. A high revenue figure does not necessarily translate to a high profit margin. Consider two businesses: one with $1 million in revenue and $900,000 in expenses, and another with $500,000 in revenue and $200,000 in expenses. While the former boasts higher revenue, the latter exhibits greater profitability. Therefore, analyzing revenue in conjunction with expenses is essential for assessing the overall financial health reflected in a profit and loss statement.

Accurate revenue recognition is critical for generating a reliable profit and loss statement. Challenges can arise in determining the timing of revenue recognition, particularly for subscription-based services or long-term contracts. Employing appropriate accounting standards ensures consistency and transparency in financial reporting, allowing stakeholders to draw accurate conclusions about a company’s financial performance based on the provided data.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a company. Within a simplified profit and loss statement, COGS plays a crucial role in determining gross profit, a key indicator of operational efficiency. Accurately calculating COGS requires meticulous tracking of direct material costs, direct labor, and manufacturing overhead. For example, a furniture manufacturer’s COGS includes the cost of wood, upholstery, labor for assembly, and factory utilities. Omitting or misclassifying these costs can lead to an inaccurate gross profit calculation and misrepresent the company’s financial performance.

Understanding the relationship between COGS and revenue is fundamental to interpreting a profit and loss statement. A high COGS relative to revenue indicates a lower gross profit margin, suggesting potential inefficiencies in production or procurement processes. Conversely, a low COGS signifies a higher potential for profitability. Consider two retailers selling identical products; one with a COGS of $60 per unit and the other with a COGS of $40 per unit. Assuming both sell at $100 per unit, the latter retailer enjoys a significantly higher gross profit margin. This comparison underscores the importance of managing COGS effectively to maximize profitability.

Accurate COGS calculation is paramount for sound financial analysis and decision-making. Challenges may arise in allocating indirect costs and handling inventory valuation. Employing consistent accounting methods, such as FIFO (First-In, First-Out) or LIFO (Last-In, First-Out), ensures comparability across reporting periods and strengthens the reliability of the profit and loss statement. A clear understanding of COGS provides valuable insights into a company’s cost structure, enabling informed pricing strategies and operational improvements aimed at enhancing profitability.

3. Gross Profit

Gross profit, a key figure within a simple profit and loss statement template, represents the profitability of a company’s core business operations after accounting for the direct costs associated with producing goods or services. It provides a crucial link between revenue and net profit, offering insights into operational efficiency and pricing strategies. Understanding gross profit is fundamental to analyzing a company’s financial health and making informed business decisions.

- Calculation and InterpretationGross profit is calculated by subtracting the cost of goods sold (COGS) from revenue. A higher gross profit indicates a greater ability to generate profit from core operations. For example, if a company generates $200,000 in revenue and incurs $120,000 in COGS, the gross profit is $80,000. This figure reveals the portion of revenue available to cover operating expenses and contribute to net profit. Analyzing gross profit trends over time can signal changes in production costs, pricing strategies, or sales volume.

- Impact on ProfitabilityGross profit directly influences a company’s overall profitability. A healthy gross profit margin provides a cushion to absorb operating expenses and generate net income. Conversely, a declining gross profit margin can erode profitability and limit a company’s ability to invest in growth initiatives. Comparing gross profit margins across industry competitors provides valuable benchmarks for assessing performance and identifying areas for improvement.

- Relationship with Pricing StrategiesGross profit is intrinsically linked to pricing strategies. Setting prices too low can result in a thin gross profit margin, leaving little room for error or unexpected expenses. Conversely, excessively high prices can deter customers and negatively impact sales volume. Finding the optimal price point requires careful consideration of COGS, market competition, and customer demand. Analyzing gross profit data informs pricing decisions and helps optimize revenue generation while maintaining healthy profit margins.

- Role in Financial PlanningGross profit projections play a vital role in financial planning and forecasting. Accurate gross profit estimates are essential for developing realistic budgets, setting achievable sales targets, and making informed investment decisions. By understanding the factors that influence gross profit, businesses can develop strategies to improve operational efficiency, control costs, and maximize profitability. This forward-looking perspective enhances financial stability and supports sustainable growth.

By analyzing gross profit within the context of a simple profit and loss statement template, stakeholders gain a clearer understanding of a company’s core business performance. This understanding informs strategic decision-making, from pricing and cost management to long-term financial planning. Gross profit serves as a crucial indicator of financial health and provides valuable insights for achieving sustainable profitability.

4. Operating Expenses

Operating expenses represent the costs incurred in running a business’s day-to-day activities, excluding the direct costs of producing goods or services (COGS). Within a simple profit and loss statement template, these expenses are crucial for determining net profit, providing insights into a company’s cost structure and efficiency. Understanding the composition and management of operating expenses is essential for informed financial analysis and decision-making.

Several categories comprise operating expenses, each offering insights into different aspects of a business’s cost structure. These include selling, general, and administrative expenses (SG&A), research and development (R&D), and marketing and advertising expenses. SG&A encompasses salaries, rent, utilities, and office supplies; R&D covers expenses related to innovation and product development; and marketing and advertising expenses include promotional campaigns and brand-building activities. For instance, a technology company might allocate a significant portion of its operating expenses to R&D, while a retail business might focus on SG&A and marketing. Analyzing the proportion of each expense category reveals a company’s operational priorities and cost management strategies.

The relationship between operating expenses and net profit is direct and significant. Higher operating expenses reduce net profit, while lower operating expenses contribute to a higher bottom line. Consider two companies with identical revenue and gross profit: one with operating expenses of $50,000 and the other with $30,000. The latter will report a higher net profit due to its lower operating costs. This highlights the importance of carefully managing operating expenses without compromising essential business functions. Effective cost control, efficient resource allocation, and strategic investment in key areas are essential for maximizing profitability. Furthermore, comparing operating expense ratios against industry benchmarks provides valuable insights into a company’s performance relative to its competitors and identifies potential areas for improvement. Successfully managing operating expenses within the context of a simple profit and loss statement offers a clear path to improved financial performance and sustainable growth.

5. Net Profit/Loss

Net profit/loss, often referred to as the “bottom line,” represents the ultimate measure of a company’s profitability after all revenues and expenses are accounted for within a given period. Within the framework of a simple profit and loss statement template, net profit/loss serves as the culminating figure, summarizing the overall financial performance of the business. Understanding its calculation, interpretation, and implications is critical for assessing financial health and making informed strategic decisions.

- Calculation and InterpretationNet profit/loss is derived by subtracting total expenses, including cost of goods sold (COGS) and operating expenses, from total revenues. A positive net profit indicates profitability, while a negative net profit signifies a loss. For instance, a company with $500,000 in revenue, $200,000 COGS, and $150,000 in operating expenses reports a net profit of $150,000. This figure represents the residual earnings available to reinvest in the business, distribute to shareholders, or retain as reserves. Analyzing net profit trends over time provides insights into a company’s financial trajectory and sustainability.

- Impact of Revenue and ExpensesNet profit/loss is directly influenced by both revenue generation and cost management. Increases in revenue, assuming expenses remain constant or decrease, contribute to higher net profit. Conversely, rising expenses, without a corresponding increase in revenue, can lead to lower net profit or even a net loss. Effectively managing both revenue streams and expense levels is crucial for achieving and maintaining profitability. For example, implementing cost-cutting measures, optimizing pricing strategies, or expanding into new markets can positively impact the bottom line.

- Importance for StakeholdersNet profit/loss holds significant importance for various stakeholders, including investors, lenders, and management. Investors rely on net profit figures to assess the financial viability and potential returns of their investments. Lenders use net profit as an indicator of a company’s ability to repay loans. Management utilizes net profit data to evaluate performance, make strategic decisions regarding resource allocation, and set future financial goals. A consistent track record of profitability strengthens a company’s financial standing and enhances its credibility with stakeholders.

- Relationship with Financial RatiosNet profit/loss figures are integral to calculating key financial ratios, such as profit margin and return on investment (ROI). These ratios provide deeper insights into a company’s profitability and efficiency relative to its resources. Analyzing these ratios in conjunction with net profit/loss allows for a more comprehensive understanding of financial performance and facilitates informed comparisons against industry benchmarks and competitors. Monitoring these metrics enables proactive adjustments to business strategies and enhances long-term financial sustainability.

By understanding the calculation, influencing factors, and implications of net profit/loss within the context of a simple profit and loss statement template, stakeholders gain valuable insights into a company’s overall financial health. This understanding informs investment decisions, lending practices, and internal management strategies, contributing to more effective financial planning and sustainable growth. Net profit/loss serves as the ultimate measure of a company’s financial success and provides a crucial benchmark for evaluating performance and making informed decisions for future growth and stability.

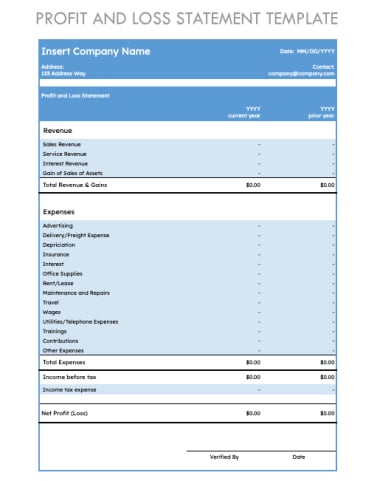

Key Components of a Streamlined Profit and Loss Statement

A concise profit and loss statement provides a clear overview of financial performance. Understanding its key components is crucial for interpreting the data and extracting meaningful insights.

1. Revenue: This represents the total income generated from sales of goods or services during a specific period. Accurate revenue recognition is essential for a reliable statement.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing the goods sold. This includes raw materials, direct labor, and manufacturing overhead.

3. Gross Profit: Calculated as Revenue – COGS, gross profit indicates the profitability of core business operations before accounting for other expenses.

4. Operating Expenses: These expenses encompass the costs of running the business, including salaries, rent, marketing, and administrative expenses.

5. Operating Income: Derived by subtracting operating expenses from gross profit, this figure reflects the profitability of the business’s core operations.

6. Other Income/Expenses: This category includes income or expenses not directly related to core operations, such as interest income or expense, gains or losses from investments, and other non-operating items.

7. Net Profit/Loss: This bottom-line figure represents the overall profitability of the business after accounting for all revenues and expenses. Its calculated as Operating Income + Other Income – Other Expenses.

Analyzing these interconnected components provides a comprehensive understanding of a company’s financial performance and its ability to generate profit.

How to Create a Simple Profit and Loss Statement

Creating a straightforward profit and loss statement involves organizing key financial data into a structured format. This process facilitates clear insight into an organization’s financial performance over a specific period.

1: Define the Reporting Period: Specify the timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods allow for accurate comparison and trend analysis.

2: Record Revenue: Document all income generated from sales of goods or services during the defined period. Ensure accurate categorization of revenue streams for detailed analysis.

3: Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

4: Determine Gross Profit: Calculate gross profit by subtracting COGS from revenue. This figure represents the profit generated from core business operations before accounting for other expenses.

5: Itemize Operating Expenses: List all expenses incurred in running the business, including salaries, rent, utilities, marketing, and administrative costs. Categorizing expenses provides insights into cost structure.

6: Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income. This figure reflects the profitability of core business operations after accounting for operating expenses.

7: Account for Other Income/Expenses: Include any non-operating income or expenses, such as interest income, investment gains or losses, and one-time charges. This provides a comprehensive view of all financial activity.

8: Calculate Net Profit/Loss: Determine the final net profit or loss by adding other income and subtracting other expenses from operating income. This bottom-line figure represents the overall profitability of the business during the reporting period.

A well-structured statement offers valuable insights into financial performance, facilitating informed decision-making, resource allocation, and strategic planning. Regularly generating these statements allows for performance monitoring, trend analysis, and proactive adjustments to business strategies.

A streamlined profit and loss statement template provides a crucial framework for understanding financial performance. From revenue generation and cost of goods sold to operating expenses and net profit/loss, each element offers valuable insights into an organization’s financial health. Utilizing such a template allows for efficient tracking, analysis, and communication of financial data, enabling informed decision-making and strategic planning.

Effective financial management hinges on the ability to interpret and utilize the information presented within a profit and loss statement. Regularly generating and analyzing these statements empowers organizations to identify trends, assess profitability, and adapt strategies to achieve financial objectives. This proactive approach to financial management is essential for long-term sustainability and success.