Utilizing a standardized structure offers several advantages. It facilitates easy comparison of performance across different periods, simplifies financial analysis for informed decision-making, and streamlines the process of communicating financial results to investors, lenders, and other interested parties. This clarity and accessibility promote better financial management and transparency.

Understanding the core components and practical application of this reporting tool is essential for effective financial management. The following sections delve into the specific elements, offer practical examples, and provide guidance on how to interpret the data for actionable insights.

1. Revenues

Accurate revenue reporting forms the foundation of a reliable profit and loss statement. A clear understanding of revenue sources and their proper categorization is essential for assessing financial performance and making informed business decisions. This section explores key facets of revenue within the context of a streamlined profit and loss structure.

- Sales RevenueThis represents income generated from the core business operations, typically the sale of goods or services. For a retail business, sales revenue would reflect the total value of goods sold. Accurate tracking of sales revenue is paramount as it directly impacts profitability calculations and provides insights into market demand and pricing strategies.

- Other RevenueThis category encompasses income derived from sources other than primary business operations. Examples include interest income, rental income, or royalties. While often secondary to sales revenue, these sources contribute to the overall financial picture and should be accurately recorded and categorized.

- Revenue RecognitionThis principle dictates when revenue is recorded. Generally, revenue is recognized when earned, meaning when goods are delivered or services are rendered, regardless of when payment is received. Proper revenue recognition ensures accurate financial reporting and prevents misrepresentation of financial performance.

- Revenue BreakdownPresenting revenue in a detailed breakdown, segmented by product line, customer segment, or geographic region, provides valuable insights into business performance drivers. This granular view enables targeted analysis and informed decision-making regarding resource allocation and growth strategies.

A thorough understanding of these revenue facets ensures accurate and meaningful profit and loss reporting. This clarity facilitates informed decision-making, effective financial management, and transparent communication with stakeholders. Accurate revenue reporting provides the basis for evaluating profitability, identifying trends, and developing sound business strategies.

2. Expenses

Accurate and comprehensive expense tracking is crucial for a meaningful profit and loss statement. Understanding the various expense categories and their impact on profitability provides essential insights for effective financial management. This section explores key expense facets within the context of streamlined profit and loss reporting.

- Cost of Goods Sold (COGS)For businesses selling goods, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit and understanding the profitability of core business operations. For example, a furniture manufacturer would include the cost of wood, upholstery, and labor directly involved in production within COGS.

- Operating ExpensesThese expenses are incurred in running the business and are not directly tied to production. Examples include rent, salaries for administrative staff, marketing, and utilities. Managing operating expenses effectively is crucial for maintaining profitability and ensuring long-term sustainability. Analyzing trends in operating expenses can reveal areas for potential cost optimization.

- Interest ExpenseThis represents the cost of borrowing money. It is calculated based on outstanding debt and interest rates. Understanding interest expense is crucial for managing debt levels and evaluating the overall cost of capital. Higher interest expenses can significantly impact profitability and should be carefully monitored.

- Depreciation and AmortizationThese are non-cash expenses that reflect the decrease in value of assets over time. Depreciation applies to tangible assets (e.g., equipment), while amortization applies to intangible assets (e.g., patents). Including these expenses provides a more accurate representation of the true cost of using these assets in business operations.

Effective expense management is directly linked to profitability. A detailed understanding of these expense categories within the framework of a profit and loss statement enables informed decision-making, cost control measures, and ultimately, improved financial performance. By analyzing expense trends and comparing them to revenue, businesses can gain valuable insights into operational efficiency and identify opportunities for improvement.

3. Profit/Loss Calculation

The core purpose of a streamlined profit and loss statement is to determine the net financial outcome of business operations over a specific period. Profit/loss calculation, derived from the interplay of revenues and expenses, provides a crucial indicator of financial health and sustainability. This section explores the key facets of this calculation within the context of a simplified reporting template.

- Gross ProfitCalculated as revenue less the cost of goods sold (COGS), gross profit represents the profitability of core business operations before accounting for other operating expenses. For a retailer, gross profit reflects the markup on goods sold. Monitoring gross profit margins provides insights into pricing strategies and production efficiency.

- Operating ProfitDerived by subtracting operating expenses from gross profit, operating profit reflects the profitability of the business after accounting for the costs of running day-to-day operations. This metric provides a clearer picture of the efficiency and sustainability of the business model. A positive operating profit indicates the business is generating sufficient revenue to cover its operating costs.

- Net ProfitThis represents the final profit or loss after all expenses, including interest and taxes, are deducted from revenues. Net profit is the bottom line and represents the overall profitability of the business. This figure is crucial for assessing the financial health and long-term viability of the organization. Investors and lenders often focus on net profit as a key indicator of financial performance.

- Profit MarginsExpressing profit as a percentage of revenue (e.g., gross profit margin, net profit margin) provides valuable insights into profitability relative to sales. Comparing margins across different periods or against industry benchmarks allows for a deeper understanding of performance trends and competitive positioning. Consistent monitoring of profit margins can help identify areas for improvement and optimize pricing strategies.

Accurate profit/loss calculation is the cornerstone of a meaningful profit and loss statement. Understanding these key facets provides essential information for evaluating financial performance, making informed decisions, and communicating effectively with stakeholders. By analyzing profit/loss data within the context of a simplified reporting template, businesses can gain a clear understanding of their financial health and develop strategies for sustainable growth.

4. Reporting Period

The reporting period defines the timeframe covered by a simple profit and loss statement template. Selecting an appropriate reporting period is crucial for generating meaningful insights into financial performance. A well-defined timeframe provides a consistent basis for analysis, allowing for accurate tracking of trends and informed decision-making.

- Fiscal YearA fiscal year represents a 12-month period used for accounting purposes. It may align with the calendar year or follow a different schedule based on the organization’s operational cycle. Analyzing financial performance over a full fiscal year provides a comprehensive overview of annual profitability and allows for year-over-year comparisons. For example, a retail business might choose a fiscal year that ends after the holiday shopping season.

- Quarterly ReportingBreaking down the fiscal year into quarterly periods (typically three-month intervals) allows for more frequent monitoring of financial performance. Quarterly reports offer insights into shorter-term trends and enable more timely adjustments to business strategies. This frequency is particularly valuable for businesses operating in dynamic markets or experiencing rapid growth. Comparing quarterly performance against previous quarters or the same quarter of the prior year provides valuable insights.

- Monthly ReportingMonthly reporting provides the most granular view of financial performance. Tracking revenue and expenses on a monthly basis allows for close monitoring of cash flow and quick identification of potential issues. This frequency is particularly beneficial for businesses with tight margins or those requiring close management of working capital. Monthly reports can also be aggregated for quarterly and annual analysis.

- Year-to-Date ReportingYear-to-date reporting aggregates financial data from the beginning of the fiscal year to the current date. This cumulative perspective allows for tracking progress towards annual goals and provides a comprehensive view of performance over a specific timeframe. Year-to-date figures can be compared against the same period in the prior year to assess growth and identify potential challenges.

The choice of reporting period directly impacts the insights derived from a simple profit and loss statement template. Selecting a timeframe aligned with business objectives and operational cycles is crucial for generating meaningful analyses and supporting informed decision-making. Consistent reporting periods facilitate trend analysis, performance evaluation, and effective communication with stakeholders.

5. Concise Presentation

Clarity and accessibility are paramount in financial reporting. A simple profit loss statement template prioritizes concise presentation to ensure stakeholders can quickly grasp key financial insights. Effective communication of financial data relies on a structured format that eliminates unnecessary complexity and highlights essential information.

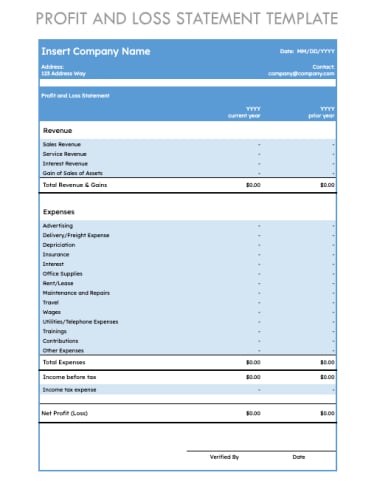

- Clear LayoutA well-organized layout, typically using a tabular format with clearly labeled rows and columns, enhances readability and comprehension. Information should flow logically, presenting revenue, expenses, and calculated profit/loss in a structured manner. For example, grouping similar expense categories together (e.g., all marketing expenses under a single heading) improves clarity. Visual consistency in font, spacing, and formatting further enhances readability.

- Key Figures EmphasisHighlighting key figures, such as gross profit, operating profit, and net profit, draws attention to critical performance indicators. Using bold font, visual cues, or separate summary sections ensures these metrics stand out. This allows stakeholders to quickly assess overall profitability without navigating through excessive detail. Focusing on key performance indicators (KPIs) streamlines the interpretation of the data.

- Elimination of ClutterAvoiding excessive detail or extraneous information prevents visual overload and maintains focus on essential data. A simple template omits unnecessary jargon or technical terms, presenting financial information in a straightforward manner accessible to a broad audience. For example, instead of detailed breakdowns of every minor expense, a consolidated presentation of expense categories suffices for a simplified overview.

- Consistent FormattingConsistent use of formatting conventions, such as currency symbols, decimal places, and date formats, ensures uniformity and prevents misinterpretations. Adhering to established accounting principles and reporting standards further enhances credibility and allows for meaningful comparisons across different periods or entities. Consistent formatting promotes professionalism and reinforces the reliability of the data presented.

Concise presentation within a simple profit loss statement template facilitates efficient communication of financial performance. A clear, structured format, emphasizing key figures while eliminating unnecessary complexity, promotes understanding and supports informed decision-making by stakeholders. This clarity ultimately contributes to better financial management and transparency.

Key Components of a Simple Profit and Loss Statement Template

A concise profit and loss statement relies on a structured format to present key financial data effectively. Understanding these core components is crucial for accurate reporting and informed financial analysis.

1. Revenue: This section details all income generated from business operations, including sales of goods or services, and other revenue streams. Accurate revenue recognition is essential for a reliable financial overview.

2. Cost of Goods Sold (COGS): For businesses selling physical products, COGS represents the direct costs associated with producing those goods. This includes raw materials, direct labor, and manufacturing overhead.

3. Gross Profit: Calculated by subtracting COGS from revenue, gross profit represents the profitability of core business operations before accounting for operating expenses. This metric provides insight into pricing strategies and production efficiency.

4. Operating Expenses: This category encompasses all costs incurred in running the business, excluding COGS. Examples include rent, salaries, marketing, and administrative expenses. Effective management of operating expenses is crucial for profitability.

5. Operating Profit: Derived by subtracting operating expenses from gross profit, operating profit reflects the profitability of the business after accounting for day-to-day operational costs. This metric offers a clearer picture of the efficiency and sustainability of the business model.

6. Other Income/Expenses: This section accounts for income or expenses not directly related to core business operations, such as interest income, interest expense, or gains/losses from asset sales. These items provide a more comprehensive view of the overall financial performance.

7. Net Profit: Representing the final profit or loss after all expenses, including taxes, are deducted from revenues, net profit is the bottom line and a crucial indicator of overall financial health. This figure is essential for assessing the long-term viability of the organization.

8. Reporting Period: The profit and loss statement covers a specific timeframe, such as a fiscal year, quarter, or month. A clearly defined reporting period ensures consistency in financial analysis and allows for meaningful comparisons across different periods.

Effective financial analysis requires a clear understanding of these interconnected components. Accurate data within a structured format facilitates informed decision-making and contributes to a comprehensive assessment of financial performance.

How to Create a Simple Profit and Loss Statement

Creating a clear and concise profit and loss statement involves a structured approach. The following steps outline the process of developing a simple yet effective template for tracking financial performance.

1. Define the Reporting Period: Establish the specific timeframe for the statement, whether it’s a fiscal year, a quarter, or a month. A consistent reporting period is essential for accurate tracking and comparison.

2. Record Revenue: Systematically document all income generated during the reporting period. Categorize revenue streams for a more detailed analysis. Ensure consistent revenue recognition principles are applied.

3. Calculate Cost of Goods Sold (COGS): If applicable, determine the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is crucial for determining gross profit.

4. Itemize Operating Expenses: List all expenses incurred in running the business, excluding COGS. Categorize expenses (e.g., rent, salaries, marketing) for better cost management analysis. Ensure accuracy and completeness in expense recording.

5. Calculate Gross Profit: Subtract COGS from total revenue to determine gross profit. This figure represents the profitability of core business operations before accounting for operating expenses.

6. Calculate Operating Profit: Subtract total operating expenses from gross profit to arrive at operating profit. This metric reflects the profitability of the business after covering day-to-day operational costs.

7. Account for Other Income/Expenses: Include any non-operational income or expenses, such as interest income or expense. This provides a comprehensive picture of the overall financial performance.

8. Calculate Net Profit: Subtract all remaining expenses, including taxes and interest expense, from operating profit to determine net profit. This bottom-line figure reflects the overall profitability after all costs are considered.

9. Present the Data Clearly: Organize the information in a tabular format with clearly labeled rows and columns. Highlight key figures, such as gross profit, operating profit, and net profit. Maintain consistent formatting for currency, decimals, and dates.

A structured approach, encompassing accurate data entry and clear presentation, yields a valuable tool for monitoring financial performance and making informed business decisions. Regular review and analysis of this statement provide crucial insights into profitability, cost management, and overall financial health.

Streamlined reporting of financial performance, through a standardized structure, provides essential insights into revenue streams, cost structures, and resulting profitability. Understanding the core componentsrevenue, cost of goods sold, operating expenses, and the resulting profit calculationsis fundamental to sound financial management. Concise presentation, emphasizing clarity and accessibility, ensures effective communication of financial data to stakeholders.

Effective utilization of this reporting tool empowers informed decision-making, supports proactive cost management strategies, and fosters financial transparency. Regular review and analysis of this statement are crucial for assessing operational efficiency, identifying growth opportunities, and ultimately, ensuring long-term financial sustainability. This structured approach to financial reporting provides a critical foundation for navigating the complexities of the business landscape and achieving sustained success.