This streamlined presentation offers several advantages. Its simplicity makes it easily understandable, even for those without a financial background. It also requires less preparation time compared to more complex formats. This ease of use makes it particularly well-suited for smaller businesses or organizations with uncomplicated financial structures.

Understanding this basic structure provides a solid foundation for exploring more nuanced financial reporting methods and analyzing business performance. This discussion will now delve further into the practical applications and specific examples of this reporting method, offering a detailed guide to its creation and interpretation.

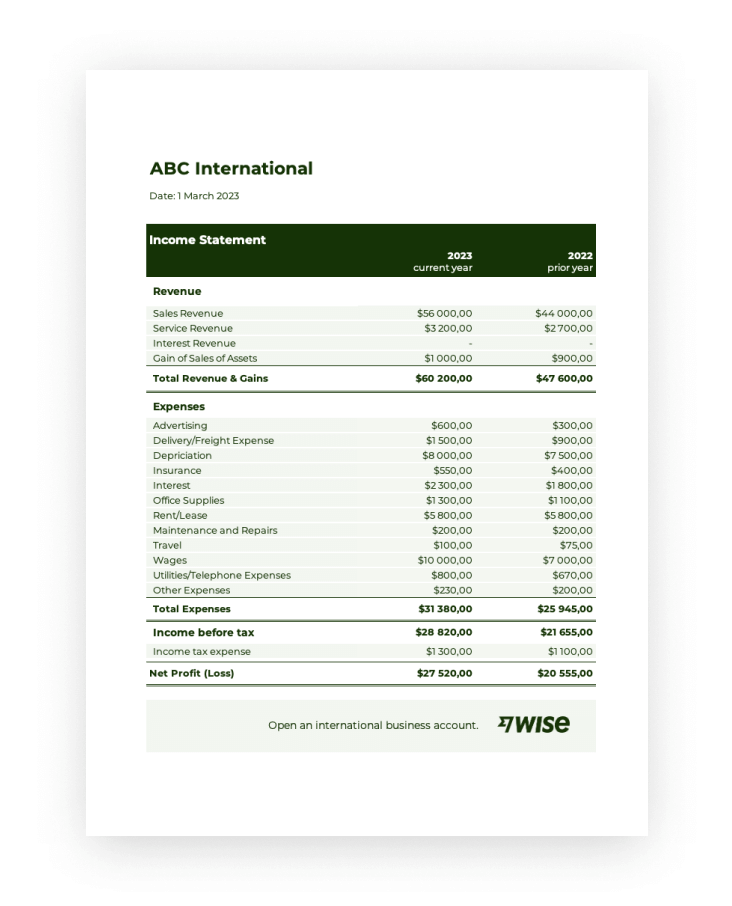

1. Revenues

Revenues represent the lifeblood of any business, forming the cornerstone of the single-step income statement template. Accurately capturing and presenting revenue data is paramount for assessing financial health and making informed decisions. This section explores the key facets of revenue within this simplified reporting framework.

- Sales RevenueThis constitutes the primary revenue stream for most businesses, representing income generated from the sale of goods or services. Examples include retail sales, consulting fees, or subscription payments. In a single-step statement, sales revenue contributes significantly to the total revenue figure, directly impacting the calculated net income. Accurate tracking of sales is essential for a reliable financial overview.

- Interest IncomeEarned from interest-bearing investments or loans, this revenue stream, while potentially smaller than sales revenue, still contributes to the overall financial picture. Examples include interest earned on bank deposits, bonds, or loans provided to other entities. Within the single-step format, it is aggregated with other revenue sources to determine total revenue.

- Dividend IncomeGenerated from investments in other companies’ stocks, dividend income represents a share of the distributing company’s profits. This revenue source reflects the returns gained from holding equity investments. Similar to interest income, dividend income is combined with other revenue streams in the single-step statement.

- Other RevenueThis category encompasses any revenue-generating activities not falling under the previous classifications. Examples include gains from the sale of assets, rental income, or royalties. Including these diverse sources within the total revenue figure ensures a comprehensive view of all income streams impacting profitability within the single-step template.

A thorough understanding of these revenue components is crucial for accurate interpretation of the single-step income statement. By aggregating these diverse sources, the statement provides a concise yet complete overview of a business’s financial inflows, enabling informed decision-making and effective performance evaluation. The interplay between these revenue streams and the total expenses determines the ultimate profitability reflected in the net income.

2. Expenses

Expenses represent the outflow of resources incurred to generate revenue and operate a business. Within the single-step income statement template, expenses are aggregated into a single sum, which is then subtracted from the total revenues to determine net income. A clear understanding of expense categorization and its impact on profitability is essential for effective financial analysis.

Several key expense categories contribute to the total expense figure within the single-step format. Cost of Goods Sold (COGS) represents the direct costs associated with producing goods sold by a business. Operating expenses encompass costs incurred through normal business operations, such as rent, salaries, and marketing. Interest expense reflects the cost of borrowing funds, while income tax expense represents the amount owed in taxes based on taxable income. Accurately classifying and recording these expenses is crucial for a reliable representation of financial performance.

For example, a retail business would include the purchase price of inventory in COGS, while rent for the retail space would fall under operating expenses. A company financing its operations through debt would record the associated interest payments as interest expense. Understanding the nature of these expenses and their relationship to revenue generation provides valuable insights into a business’s profitability and operational efficiency. Misclassifying or omitting expenses can lead to an inaccurate portrayal of financial performance and hinder informed decision-making.

The accurate and comprehensive reporting of expenses plays a pivotal role in determining net income within the single-step income statement template. By consolidating all expense categories into a single figure, this streamlined format facilitates a clear comparison between total revenues and total expenses, enabling straightforward calculation of net income. This simplified presentation makes it easier to assess overall profitability and evaluate the financial health of a business. However, the lack of detailed expense categorization in the single-step format may limit deeper analysis into the drivers of profitability. This aspect underscores the importance of considering the specific informational needs when choosing between single-step and multi-step income statement presentations.

3. Net Income

Net income represents the ultimate bottom line in financial performance, calculated as the difference between total revenues and total expenses. Within the single-step income statement template, this calculation is streamlined, providing a clear and concise view of profitability. Understanding the components contributing to net income and its implications is crucial for assessing a business’s financial health.

- Profitability MeasurementNet income serves as the primary indicator of a company’s profitability. A positive net income signifies that revenues exceed expenses, indicating a profitable period. Conversely, a negative net income, or net loss, indicates that expenses have surpassed revenues. In the context of a single-step income statement, net income is readily apparent due to the straightforward calculation. This clear presentation facilitates quick assessment of overall profitability.

- Impact of Revenue and ExpensesNet income is directly influenced by both revenue and expenses. Increases in revenue, assuming expenses remain constant or decrease, will lead to higher net income. Conversely, rising expenses, with stagnant or declining revenue, will negatively impact net income. The single-step format, while simplifying the presentation, still clearly showcases this interplay between revenue and expenses. For example, a business experiencing significant sales growth coupled with effective cost control will likely see a corresponding increase in net income reflected directly on the single-step statement.

- Basis for Financial RatiosNet income serves as a key component in various financial ratios used to analyze business performance. Profitability ratios, such as net profit margin, directly utilize net income in their calculations. These ratios provide insights into a company’s efficiency in generating profit relative to its revenue or assets. The readily available net income figure from the single-step income statement facilitates easy calculation of these crucial performance metrics. This readily available figure streamlines the analytical process.

- Indicator of Financial HealthNet income provides a snapshot of a business’s overall financial health and sustainability. Consistent profitability, as evidenced by positive net income over time, suggests sound financial management and growth potential. Conversely, persistent losses raise concerns about long-term viability and may necessitate strategic adjustments. The single-step income statement, with its clear presentation of net income, facilitates this high-level assessment of financial well-being.

Net income, being the culmination of all revenue and expense activity, holds significant weight in the single-step income statement template. Its straightforward calculation and clear presentation in this format allow for rapid assessment of profitability and overall financial performance. While the single-step statement doesn’t provide the granular detail of a multi-step statement, it effectively highlights the bottom line, making it particularly useful for small businesses or those seeking a concise overview of financial health.

4. Simplicity

Simplicity stands as a defining characteristic of the single-step income statement template. This streamlined format directly calculates net income by subtracting total expenses from total revenues. This straightforward approach eliminates the need for categorizing revenues and expenses into operational and non-operational activities, as seen in multi-step statements. This inherent simplicity offers significant advantages, particularly for small businesses or those with less complex financial structures. Consider a freelance consultant; their income statement might simply list all client payments as revenue and all business-related expenses, like software subscriptions and travel costs, as expenses. The difference reveals their net income directly, without needing complex classifications.

This simplicity translates into several practical benefits. Preparation time is significantly reduced, freeing up resources for other essential tasks. The ease of interpretation makes it accessible to a wider audience, even those without a deep understanding of accounting principles. Furthermore, this straightforward presentation can facilitate quicker decision-making based on a readily apparent overview of profitability. For instance, a small bakery can quickly assess its weekly profitability using a single-step statement, allowing prompt adjustments to pricing or ingredient sourcing if necessary. This rapid analysis, enabled by the template’s simplicity, provides agility in responding to market dynamics.

While simplicity offers numerous advantages, it also presents limitations. The lack of detailed expense categorization hinders in-depth analysis of cost structures and profitability drivers. This aggregated approach might obscure crucial insights into operational efficiency, potentially limiting strategic decision-making. Therefore, while the single-step income statement’s simplicity proves invaluable for certain contexts, understanding its limitations is essential for selecting the most appropriate financial reporting method based on specific informational needs. Choosing between single-step and multi-step formats depends on the balance between simplicity and the need for detailed analysis.

5. Ease of Use

Ease of use represents a significant advantage of the single-step income statement template. Its straightforward structure, calculating net income by simply subtracting total expenses from total revenues, minimizes complexity. This characteristic makes it particularly beneficial for small businesses, startups, or individuals with limited accounting expertise. Consider a small bookstore owner; they can readily compile a single-step statement by summing up all sales receipts and subtracting the total of all expense invoices, quickly arriving at net income without needing complex accounting software or specialized knowledge. This ease of use frees up time and resources, allowing focus on core business operations.

The reduced complexity contributes to faster preparation and interpretation of financial statements. Unlike multi-step statements requiring categorization of revenues and expenses into operational and non-operational activities, the single-step format streamlines the process. This allows for quicker identification of profitability trends and facilitates timely decision-making. For example, a freelancer can quickly generate a single-step statement to assess monthly profitability, allowing for immediate adjustments to pricing strategies or expense management if necessary. This rapid analysis enables agile responses to changing market conditions.

While ease of use makes the single-step format attractive, its crucial to acknowledge its limitations. The aggregated nature of revenue and expense data restricts in-depth analysis of profitability drivers and cost structures. This lack of granular detail can hinder strategic planning and performance optimization. Therefore, while ease of use is a significant benefit, businesses requiring more detailed financial insights should consider the trade-offs before opting for this simplified approach. The choice between single-step and multi-step formats hinges on balancing the need for simplicity with the demand for comprehensive financial analysis.

6. Single Calculation

The “single calculation” aspect lies at the heart of the single-step income statement template. This defining feature streamlines the process of determining net income, differentiating it from more complex formats. Understanding this core principle is fundamental to grasping the template’s utility and limitations.

- Direct Net Income DeterminationThe single calculation directly determines net income by subtracting the sum of all expenses from the sum of all revenues. This contrasts with multi-step statements, which involve intermediate calculations like gross profit and operating income. A small online retailer, for example, would simply total all sales revenue and subtract the total of all expenses, including website hosting, marketing, and cost of goods sold, arriving directly at net income. This directness simplifies the process considerably.

- Simplified Profitability AssessmentThis single calculation provides a straightforward assessment of profitability. The direct arrival at net income allows for immediate understanding of whether a business has generated a profit or a loss during the reporting period. A freelance writer, for instance, can quickly assess their monthly profitability by subtracting their total expenses from their total invoiced amounts. This immediate insight facilitates prompt financial decision-making.

- Reduced Complexity in PreparationThe single calculation approach significantly reduces the complexity of income statement preparation. It eliminates the need for classifying revenues and expenses into various categories, streamlining the process and reducing the potential for errors. A food truck owner, for example, wouldn’t need to categorize sales by item; total sales revenue would suffice for the calculation, simplifying record-keeping and reporting.

- Focus on the Bottom LineThe single calculation emphasizes the bottom line net income. This focus provides a clear and concise overview of financial performance without delving into the nuances of different revenue and expense categories. A consultant, for instance, can quickly gauge their overall financial success by focusing solely on the difference between total billings and total expenses. This direct focus facilitates high-level financial overview and decision-making.

The “single calculation” principle underscores the single-step income statement’s core value proposition: simplicity. While this streamlined approach sacrifices detailed analysis of profitability drivers, it offers an accessible and efficient method for determining net income. This makes it a valuable tool for specific contexts, particularly for smaller entities or those prioritizing a quick, high-level overview of financial performance. However, the limitations imposed by this simplified approach should be carefully considered when choosing between single-step and multi-step formats based on the specific informational needs of the user.

Key Components of a Single-Step Income Statement Template

A single-step income statement template relies on a few core components to present a concise view of financial performance. Understanding these elements is crucial for accurate interpretation and utilization.

1. Heading: The heading clearly identifies the entity, the statement type (Single-Step Income Statement), and the reporting period. This ensures clarity and context for the presented financial information. Accurate identification prevents misinterpretation and provides crucial context for analysis.

2. Revenue Section: This section aggregates all revenue streams into a single total revenue figure. It encompasses various income sources, including sales revenue, interest income, and any other revenue-generating activities. This aggregated presentation simplifies the revenue picture.

3. Expense Section: All expenses incurred during the reporting period are consolidated into a single total expense figure within this section. This includes costs like cost of goods sold, operating expenses, interest expense, and taxes. This consolidated view simplifies expense representation.

4. Net Income Calculation: This represents the core of the single-step format. Net income is calculated by directly subtracting the total expenses from the total revenues. This single calculation provides a straightforward bottom-line figure. This direct calculation clearly presents the overall profitability picture.

These components work together to provide a concise overview of financial performance. While the simplified presentation sacrifices detailed analysis of individual revenue and expense categories, it offers a readily understandable snapshot of profitability. The clear presentation of total revenues, total expenses, and the resulting net income facilitates a quick assessment of financial health.

How to Create a Single-Step Income Statement

Creating a single-step income statement involves a straightforward process, consolidating all revenues and expenses into respective totals to arrive at net income. The following steps outline this process:

1. Define the Reporting Period: Specify the timeframe covered by the income statement, such as a month, quarter, or year. A clearly defined period ensures accurate representation of financial performance within that timeframe.

2. Gather Revenue Data: Collect information on all revenue streams generated during the reporting period. This includes sales revenue, interest income, dividend income, and any other sources of revenue. Accurate revenue data is fundamental to a reliable income statement.

3. Calculate Total Revenues: Sum all collected revenue figures to arrive at a single total revenue amount. This represents the total income generated during the specified period.

4. Gather Expense Data: Compile information on all expenses incurred during the reporting period. This encompasses cost of goods sold (COGS), operating expenses (rent, salaries, marketing), interest expense, and tax expenses. Comprehensive expense data is crucial for accurate profit calculation.

5. Calculate Total Expenses: Sum all collected expense figures to determine the total expenses incurred during the reporting period. This represents the total cost of operations and other expenditures.

6. Calculate Net Income: Subtract the calculated total expenses from the total revenues. The resulting figure represents the net income or net loss for the reporting period. This single calculation provides the bottom line of financial performance.

7. Prepare the Income Statement: Organize the information into a clear and structured format. The statement should include a heading with the company name, statement title, and reporting period. The revenue and expense sections present the respective totals, followed by the calculated net income figure. A well-formatted statement ensures clarity and ease of interpretation.

This structured process simplifies the creation of a single-step income statement, providing a concise overview of financial performance by directly calculating net income from total revenues and total expenses. This simplified format facilitates a quick assessment of profitability without delving into detailed categorization of revenue and expense items.

This exploration of the single-step income statement template has highlighted its core components, benefits, and limitations. Its streamlined structure, focusing on a single calculation to determine net income, offers simplicity and ease of use, particularly advantageous for smaller entities or those seeking a quick overview of financial performance. The aggregation of all revenues and expenses into respective totals, while simplifying reporting, sacrifices the detailed analysis afforded by more complex formats. Understanding this trade-off between simplicity and analytical depth is crucial for informed selection of the most appropriate financial reporting method.

Effective financial reporting serves as a cornerstone of informed decision-making. Selecting the appropriate income statement format, whether single-step or multi-step, depends on the specific informational needs of the user and the complexity of the entity’s financial structure. Careful consideration of these factors ensures that the chosen format provides the necessary insights for sound financial management and strategic planning. Further exploration of different financial reporting methods and their respective applications can enhance understanding of financial analysis and contribute to more informed financial decisions.