Organized financial records offer numerous advantages. They enable owners to monitor profitability, track cash flow, and identify potential financial challenges early on. This information is crucial for informed decision-making, securing funding from lenders, and attracting potential investors. Furthermore, well-maintained records simplify tax preparation and ensure compliance with regulatory requirements.

This foundation of organized financial information is essential for understanding several key aspects of business health, such as generating accurate projections, managing budgets effectively, and achieving sustainable growth. The following sections will explore these topics in greater detail.

1. Standardized Format

Standardized formatting is a cornerstone of effective financial statement templates. Consistency in structure, labeling, and data presentation ensures comparability across reporting periods, facilitating trend analysis and performance evaluation. A standardized balance sheet, for instance, consistently presents assets, liabilities, and equity in the same order, allowing for straightforward comparison of figures from one quarter to the next. This allows business owners to readily identify changes in asset valuation, debt levels, or owner’s equity, providing insights into financial health and stability.

Without a standardized format, analyzing financial data becomes significantly more complex and time-consuming. Imagine comparing balance sheets where asset categories are listed differently each month. Extracting meaningful insights would require significant manual restructuring of the data. A standardized template eliminates this inefficiency, providing a clear and consistent view of financial performance. This allows for more efficient identification of areas needing attention, such as rising operating expenses or declining sales revenue. For example, a consistent format for the income statement makes it easy to track gross profit margins over time, enabling prompt investigation and corrective action if margins begin to shrink.

Standardized formats promote accuracy and reduce the risk of errors in data entry and interpretation. Clear, predefined fields within a template guide users to input data correctly, minimizing the chance of misplaced figures. This is particularly valuable for small businesses that may not have dedicated accounting personnel. A structured template provides a framework for accurate record-keeping, even for those without extensive financial expertise. Ultimately, a standardized format empowers informed decision-making by providing reliable, readily accessible, and comparable financial information. This, in turn, contributes to better financial management and sustainable business growth.

2. Key Financial Data

Financial statement templates provide a framework for organizing key financial data, enabling a comprehensive understanding of a business’s financial health. These templates typically encompass core financial statements: the balance sheet, income statement, and cash flow statement. Each statement captures specific data points crucial for assessing different aspects of financial performance. The balance sheet provides a snapshot of assets, liabilities, and equity at a specific point in time, revealing the company’s financial position. The income statement details revenues and expenses over a period, illustrating profitability. The cash flow statement tracks the movement of cash both into and out of the business, highlighting liquidity and solvency.

The effectiveness of these templates relies heavily on the accurate capture and presentation of key financial data. For example, within the income statement, accurate recording of sales revenue, cost of goods sold, and operating expenses is essential for calculating gross profit and net income. Misrepresenting or omitting data within any of these categories can lead to inaccurate profitability assessments, potentially misguiding business decisions. Similarly, on the balance sheet, the correct valuation of assets and liabilities is crucial. Overstating asset values or understating liabilities can create a misleading picture of financial stability. A robust financial statement template facilitates the systematic collection and organization of this crucial data, reducing the risk of errors and promoting informed decision-making. Consider a scenario where a business consistently underreports its bad debt expense. This practice might temporarily inflate reported profits, but it ultimately masks the true financial health of the business, potentially leading to inadequate reserves for uncollectible accounts.

Understanding the relationship between key financial data and the structure of financial statement templates is fundamental for sound financial management. Accurate data capture within a standardized framework allows for meaningful analysis, trend identification, and informed strategic planning. This understanding enables businesses to not only assess their current financial standing but also to project future performance and make proactive adjustments to ensure long-term viability. Furthermore, accurately presented financial data enhances credibility with lenders, investors, and other stakeholders. The ability to demonstrate a clear and accurate understanding of financial performance builds trust and strengthens the business’s overall financial reputation.

3. Simplified Analysis

Financial statement templates significantly simplify the analysis of a small business’s financial performance. Standardized formatting ensures consistent data presentation across reporting periods, facilitating direct comparisons and trend identification. Calculating key performance indicators (KPIs) like gross profit margin, net profit margin, and current ratio becomes straightforward when data is consistently organized. Without a template, extracting these KPIs would require manual calculations and data manipulation, increasing the risk of errors and consuming valuable time. For example, comparing year-over-year revenue growth is significantly easier when income statement data adheres to a consistent format, allowing quick identification of growth trends or revenue declines.

This simplified analysis empowers data-driven decision-making. readily accessible KPIs offer insights into areas requiring attention, such as rising operating expenses or declining sales. A template-driven analysis can reveal, for instance, a steadily decreasing current ratio, signaling potential liquidity issues. This insight allows for proactive interventions, like negotiating extended payment terms with suppliers or securing a line of credit. Conversely, consistently strong profit margins, readily apparent from a standardized income statement, can support decisions to reinvest profits in expansion or research and development. Without simplified analysis, identifying these critical trends and making informed decisions becomes significantly more challenging.

Simplified analysis, facilitated by financial statement templates, is crucial for effective financial management. It allows business owners to quickly grasp their financial position, identify potential problems, and capitalize on opportunities. This efficiency is particularly valuable for small businesses, which often lack dedicated financial analysts. Templates empower owners to monitor their financial health proactively, even without extensive accounting expertise, contributing to better financial outcomes and long-term sustainability. Moreover, readily available and understandable financial data strengthens communication with stakeholders, including lenders and investors, bolstering credibility and fostering trust.

4. Informed Decisions

Sound financial decisions are the bedrock of any successful business. A well-structured financial statement template provides the necessary foundation for informed decision-making by offering a clear and organized view of financial performance. This organized data empowers business owners to move beyond guesswork and make strategic choices based on concrete financial insights.

- Strategic PricingUnderstanding cost structures and profit margins is essential for setting optimal prices. A financial statement template enables businesses to accurately track cost of goods sold, operating expenses, and revenue, facilitating informed pricing decisions that balance profitability with market competitiveness. For instance, a detailed income statement can reveal the impact of price adjustments on profit margins, allowing businesses to fine-tune pricing strategies for maximum profitability.

- Resource AllocationFinancial statements illuminate areas of strength and weakness within a business. This insight is crucial for effective resource allocation. A business might, for example, identify a consistently high-performing product line through profit analysis within an income statement. This information could then justify allocating more resources towards expanding that product line, while potentially diverting resources from underperforming areas.

- Investment EvaluationWhether considering equipment purchases, expansion projects, or new hires, investment decisions require careful evaluation of potential returns. Financial statement templates provide the historical data needed to project future performance and assess the financial viability of investments. For example, historical cash flow data, readily available within a standardized cash flow statement, is essential for accurately forecasting the payback period of a new capital investment.

- Risk ManagementIdentifying and mitigating financial risks is crucial for long-term sustainability. Analyzing financial statements can reveal potential risks, such as declining sales, increasing debt levels, or shrinking profit margins. This early identification allows for proactive risk management strategies. For instance, consistently low liquidity ratios, easily calculated from balance sheet and cash flow data within a template, could signal a need to secure additional financing or adjust operational expenses to improve cash flow.

By providing a structured framework for analyzing financial data, templates empower businesses to make informed decisions across all areas of operation, from pricing and resource allocation to investment evaluation and risk management. This data-driven approach strengthens financial health, enhances competitiveness, and promotes long-term sustainability.

5. Investor Confidence

Investor confidence is crucial for securing funding and achieving sustainable growth. Organized financial records, often facilitated by templates, play a vital role in building this confidence. A clear and accurate presentation of financial performance demonstrates professionalism, transparency, and sound financial management, all of which are essential for attracting and retaining investors.

- Transparency and CredibilityStandardized financial statements enhance transparency by providing a consistent and easily understandable view of financial performance. This transparency builds credibility with potential investors, assuring them that the business is managing its finances responsibly and ethically. A disorganized or incomplete financial record, conversely, can raise red flags and deter investment. For example, a consistently applied revenue recognition policy, evident within a standardized income statement, demonstrates financial integrity and builds trust with investors.

- Due Diligence SupportInvestors conduct due diligence before committing funds. Well-organized financial records, often produced using templates, significantly streamline this process. readily accessible and verifiable financial data allows investors to efficiently assess the business’s financial health, profitability, and growth potential. This efficiency can expedite investment decisions and reduce the perceived risk associated with the investment. Imagine an investor trying to analyze financial data scattered across various spreadsheets with inconsistent formatting. This scenario complicates due diligence and increases the likelihood of the investor pursuing other opportunities.

- Performance EvaluationInvestors rely on financial statements to evaluate a business’s past performance and project future potential. Standardized templates facilitate this evaluation by enabling clear comparisons across reporting periods and simplifying the calculation of key performance indicators. Consistent tracking of metrics like return on investment (ROI) and profit margins, easily calculated from template-based statements, provides investors with quantifiable data to assess investment viability. For instance, a consistently growing ROI, readily apparent from standardized financial statements, can significantly bolster investor confidence.

- Risk AssessmentFinancial statement templates contribute to a more comprehensive risk assessment by providing investors with a structured view of financial data. This structured data allows for easier identification of potential financial risks, such as high debt levels, declining sales, or inconsistent profitability. A clear understanding of these risks allows investors to make more informed decisions about the level of risk they are willing to assume. For example, a consistently high debt-to-equity ratio, easily calculated from balance sheet data within a template, might signal a higher level of financial risk, potentially influencing an investor’s decision.

By providing a framework for organized and transparent financial reporting, templates play a pivotal role in building investor confidence. This increased confidence can unlock access to capital, facilitate growth, and contribute to long-term business success. The ability to present clear, consistent, and readily analyzable financial data is a powerful tool for attracting and retaining investors, ultimately driving sustainable growth and value creation.

6. Regulatory Compliance

Regulatory compliance represents a critical aspect of small business operations. Financial statement templates play a vital role in meeting these obligations. Accurate and organized financial records, often facilitated by templates, are essential for fulfilling tax requirements, meeting industry-specific regulations, and securing necessary licenses and permits. These templates ensure consistent data capture and reporting, simplifying the process of demonstrating compliance. For instance, a properly formatted income statement, generated from a template, simplifies the calculation of taxable income, ensuring accurate tax filings and minimizing the risk of penalties. Similarly, consistent balance sheet reporting facilitates compliance with debt covenants, demonstrating financial stability to lenders and maintaining access to credit.

Failure to maintain compliant financial records can lead to significant consequences. Penalties for inaccurate or late tax filings can strain a small business’s limited resources. Non-compliance with industry regulations can result in fines, legal action, or even the revocation of operating licenses. Consider a restaurant failing to maintain accurate records of food costs and sales revenue, making it difficult to demonstrate compliance with health and safety regulations regarding food spoilage and waste. This oversight could lead to fines and reputational damage. Conversely, meticulously maintained financial records, facilitated by a template, can expedite audits and regulatory reviews, demonstrating a commitment to compliance and building trust with regulatory bodies. A construction company, for example, utilizing a template to track project expenses and revenue can easily demonstrate compliance with building codes and safety regulations, facilitating project approvals and minimizing delays.

Understanding the link between regulatory compliance and financial statement templates is essential for long-term business viability. Templates provide a framework for consistent, accurate, and readily accessible financial data, simplifying the compliance process and minimizing the risk of penalties. This proactive approach to compliance strengthens a business’s financial foundation, builds credibility with stakeholders, and fosters a culture of responsible financial management. Ultimately, embracing structured financial record-keeping through the use of templates contributes significantly to a business’s ability to navigate the regulatory landscape successfully and achieve sustainable growth.

Key Components of Financial Statement Templates

Effective financial management relies on comprehensive data organization. Templates provide a structured approach to capturing key financial information, ensuring consistency and facilitating informed decision-making. The following components are fundamental to a robust financial statement template:

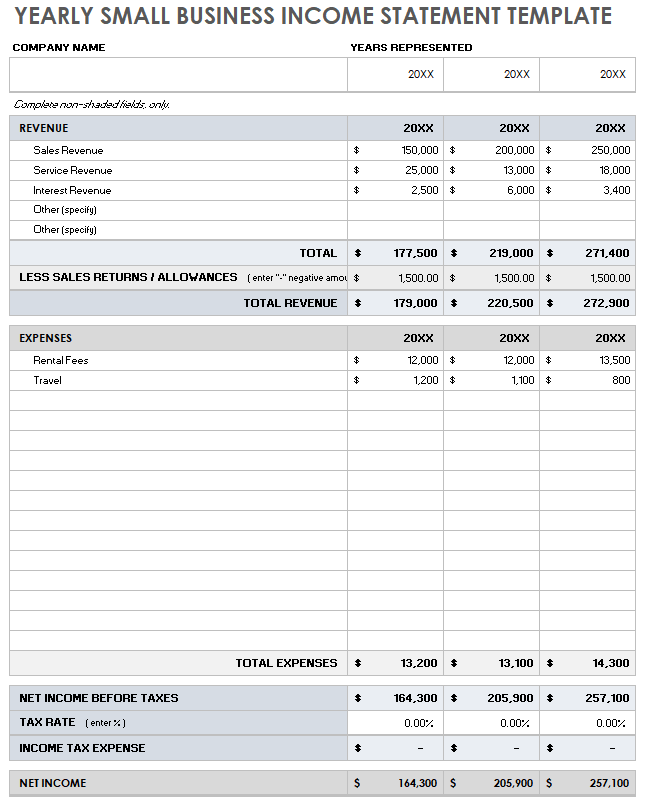

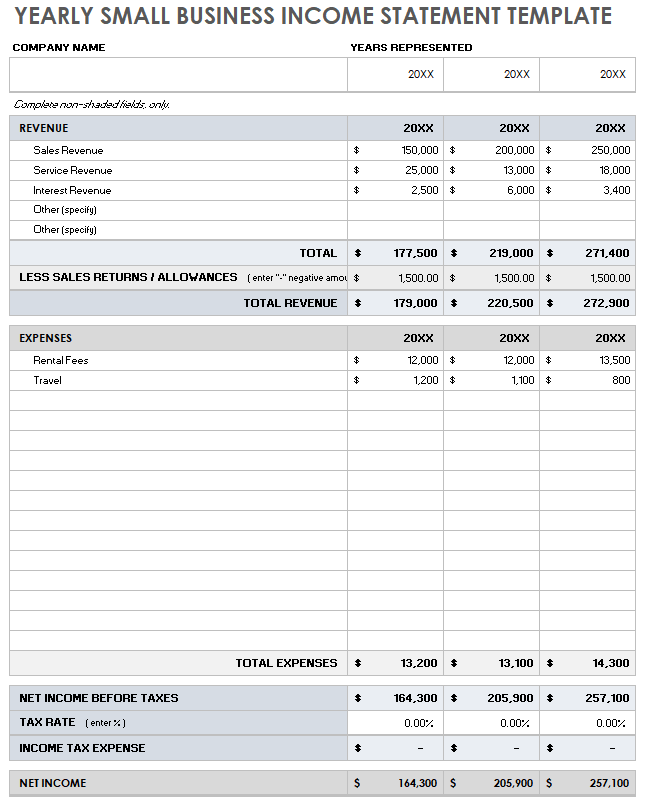

1. Income Statement: This component details revenue generation and expenses incurred over a specific period. Key elements include revenue streams, cost of goods sold (COGS), operating expenses, and net income. Accurate income statement data is crucial for assessing profitability and tracking financial performance over time.

2. Balance Sheet: This statement provides a snapshot of a company’s financial position at a specific point in time. It outlines assets (what the company owns), liabilities (what the company owes), and equity (the owner’s stake). The balance sheet reveals the company’s financial health and stability.

3. Cash Flow Statement: This component tracks the movement of cash into and out of the business. It categorizes cash flow into operating activities (day-to-day operations), investing activities (purchase and sale of assets), and financing activities (debt, equity, and dividends). The cash flow statement is essential for understanding liquidity and solvency.

4. Statement of Owner’s Equity: This statement, particularly relevant for sole proprietorships and partnerships, details changes in the owner’s equity over a period. It tracks contributions, withdrawals, and net income, providing a clear picture of the owner’s investment in the business.

5. Supporting Schedules: These schedules provide detailed breakdowns of specific line items within the core financial statements. Examples include schedules for accounts receivable, accounts payable, inventory, and fixed assets. Supporting schedules enhance transparency and provide a more granular view of financial data.

6. Charts and Graphs: Visual representations of financial data can enhance understanding and facilitate communication with stakeholders. Graphs depicting trends in revenue, expenses, and profitability can provide valuable insights at a glance. These visual aids complement the numerical data presented in the financial statements.

A comprehensive understanding of these components provides a solid foundation for analyzing financial performance, making informed decisions, and ensuring long-term financial stability. These interconnected elements offer a holistic view of financial health, empowering effective planning and strategic growth.

How to Create a Small Business Financial Statement Template

Creating a robust financial statement template requires careful planning and organization. A well-structured template ensures consistency in data capture, facilitates accurate analysis, and supports informed decision-making. The following steps outline the process:

1. Determine Essential Components: Consider the specific needs of the business. Standard components include an income statement, balance sheet, cash flow statement, and statement of owner’s equity. Depending on the nature of the business, additional schedules for accounts receivable, accounts payable, or inventory might be necessary.

2. Choose a Format: Select a format that aligns with industry best practices and regulatory requirements. Spreadsheets offer flexibility and ease of use for creating customized templates. Consider incorporating formulas for automated calculations, such as calculating gross profit or net income.

3. Establish Consistent Chart of Accounts: A standardized chart of accounts ensures consistent categorization of financial transactions. This consistency is essential for accurate reporting and analysis. Each account should have a clear description and a unique identifier.

4. Design the Template Layout: Structure each statement with clear headings and labels. Ensure sufficient space for data entry and incorporate formulas for automated calculations where appropriate. Consider using visual elements like bold text or borders to enhance readability.

5. Implement Data Validation: Incorporate data validation rules to minimize errors in data entry. Restricting cell inputs to specific data types (e.g., numbers, dates) helps maintain data integrity and ensures accuracy in calculations.

6. Test and Refine: Before full implementation, thoroughly test the template with sample data. Verify the accuracy of formulas and ensure the template functions as intended. Solicit feedback from users and make adjustments as needed.

7. Document the Template: Provide clear instructions on how to use the template, including data entry procedures and definitions of key terms. This documentation ensures consistent application and facilitates training for new users.

8. Regularly Review and Update: Business needs evolve over time. Periodically review and update the template to ensure it remains relevant and aligned with changing regulatory requirements or reporting needs. This ongoing maintenance preserves the template’s effectiveness and ensures accurate financial reporting.

A well-designed template provides a framework for accurate financial reporting, enabling informed decision-making and contributing to long-term financial stability. Regular review and refinement ensure its continued effectiveness in meeting evolving business needs.

Structured financial record-keeping, often facilitated by pre-designed formats, provides a crucial foundation for small business success. Standardized templates offer a systematic approach to organizing essential financial data, encompassing key aspects such as income, expenses, assets, and liabilities. This organized data empowers informed decision-making, enabling effective resource allocation, strategic pricing adjustments, and proactive risk management. Furthermore, readily accessible and verifiable financial information enhances transparency and builds trust with investors and lenders, facilitating access to capital and supporting sustainable growth. Compliance with regulatory requirements is also simplified through consistent and accurate record-keeping.

Effective financial management is not merely a record-keeping exercise; it is a strategic imperative. Accurate and accessible financial data provides the insights needed to navigate the complexities of the business landscape, capitalize on opportunities, and mitigate potential challenges. Investing time and resources in establishing robust financial record-keeping practices, including the utilization of well-designed templates, represents a crucial investment in long-term viability and sustainable growth.