Utilizing a pre-designed structure for this financial report offers several advantages. It ensures consistency in reporting, simplifies the process of organizing financial data, and reduces the likelihood of errors. This standardized approach allows for easy comparison across different periods and facilitates benchmarking against industry averages. Moreover, it provides a professional presentation of financial information, enhancing credibility with stakeholders.

Understanding the structure and components of this type of financial report is essential for effective financial management. The following sections will delve into the key elements, explain how to interpret them, and discuss best practices for generating and using this invaluable tool.

1. Revenue

Revenue, the lifeblood of any business, forms the cornerstone of the income statement. It represents the total income generated from sales of goods or services during a specific accounting period. Accurately recording and analyzing revenue is crucial for understanding a company’s financial health and performance. Within the structured format of an income statement, revenue typically appears at the top, providing the basis for calculating subsequent figures like gross profit and net income. For example, a bakery’s revenue would comprise all sales of bread, pastries, and cakes over a given period, regardless of whether payment is received immediately or invoiced. This top-line figure demonstrates market demand for the bakery’s offerings and its capacity to generate sales.

The relationship between revenue and the income statement extends beyond mere reporting. Changes in revenue directly impact profitability. An increase in revenue, assuming expenses remain constant or grow at a slower rate, leads to higher profits. Conversely, declining revenue can signal market challenges or internal operational issues, potentially resulting in losses. For instance, if the bakery experiences a sudden drop in revenue, it might indicate changing consumer preferences, increased competition, or issues with product quality. Analyzing revenue trends within the income statement provides valuable insights for strategic decision-making, such as pricing adjustments, marketing campaigns, or product development initiatives.

Understanding the importance of revenue within the context of an income statement is fundamental for effective financial management. It enables business owners to track performance, identify potential problems, and make informed decisions to drive profitability and growth. While factors like cost management are important, revenue generation remains the primary driver of a healthy bottom line and long-term sustainability. Monitoring revenue trends, understanding their underlying causes, and strategically responding to changes are essential for achieving financial success.

2. Expenses

Expenses, the outflow of money required to operate a business, constitute a critical component of the income statement. They represent the costs incurred in generating revenue and maintaining operations. A comprehensive understanding of expenses is essential for accurate profitability assessment and informed financial decision-making. Within the structured format of an income statement template, expenses are categorized and meticulously documented, providing a clear picture of where financial resources are allocated. This detailed breakdown enables business owners to identify areas of potential cost savings and optimize resource allocation for maximum efficiency.

The relationship between expenses and the income statement extends beyond mere recording. Expenses directly impact profitability. Higher expenses, with revenue held constant, result in lower profit margins. Conversely, effectively managing and reducing expenses can significantly improve profitability. For instance, a retail store’s expenses might include rent, utilities, inventory costs, salaries, and marketing. If the store experiences a sudden increase in utility expenses, it could impact profitability. Analyzing expense trends within the income statement provides insights into operational efficiency and cost control measures. This analysis facilitates strategic decisions such as negotiating better lease terms, implementing energy-saving measures, or optimizing inventory management.

Categorizing expenses within an income statement template facilitates a deeper understanding of cost structures. Common categories include cost of goods sold (COGS), operating expenses (e.g., rent, salaries, marketing), and non-operating expenses (e.g., interest expense, taxes). This structured approach enables comparisons across different periods and against industry benchmarks, revealing potential inefficiencies and areas for improvement. Furthermore, accurately recording and classifying expenses is crucial for compliance with accounting standards and tax regulations. A well-maintained income statement, reflecting a clear and comprehensive picture of expenses, is vital for securing financing, attracting investors, and making informed decisions for long-term financial health and sustainable growth.

3. Profitability

Profitability, the ultimate measure of a business’s financial success, is inextricably linked to the income statement. This financial report provides the foundational data for calculating and analyzing various profitability metrics, offering crucial insights into a company’s ability to generate earnings relative to its revenue and expenses. Understanding profitability is essential for evaluating financial performance, making informed business decisions, and attracting investors.

- Gross ProfitGross profit represents the revenue remaining after deducting the direct costs associated with producing goods or services (Cost of Goods Sold). For a manufacturing company, this includes raw materials and direct labor. A high gross profit margin indicates efficient production processes and effective pricing strategies. This metric, readily derived from the income statement, provides a fundamental assessment of a company’s core business operations.

- Operating ProfitOperating profit, calculated by subtracting operating expenses (such as rent, salaries, and marketing costs) from gross profit, reflects the profitability of a company’s core business operations before considering interest and taxes. This metric, presented on the income statement, helps evaluate the efficiency of management in controlling operating costs and generating profits from day-to-day activities. A higher operating profit margin often signifies effective cost management and operational efficiency.

- Net ProfitNet profit, often referred to as the “bottom line,” represents the final profit after all expenses, including interest and taxes, have been deducted from revenue. This figure, clearly displayed on the income statement, provides the most comprehensive measure of a company’s overall profitability. A positive net profit indicates that the business is generating more income than it is spending, while a negative net profit (a net loss) signals financial challenges.

- Profit MarginsProfit margins, expressed as percentages, provide a standardized way to analyze profitability and compare performance across different periods or against industry benchmarks. Gross profit margin, operating profit margin, and net profit margin, all derived from the income statement, offer insights into different aspects of profitability. Analyzing trends in these margins can reveal areas for improvement in pricing strategies, cost control, and overall financial management.

These interconnected profitability metrics, derived from the income statement, provide a comprehensive view of a business’s financial health. Analyzing these metrics helps identify strengths and weaknesses, inform strategic decision-making, and drive sustainable growth. The income statement serves as an essential tool for understanding and managing profitability, ultimately contributing to long-term financial success.

4. Time Period

The time period covered by an income statement is fundamental to its interpretation and usefulness. A defined timeframe provides a snapshot of financial performance, enabling analysis of revenue, expenses, and profitability within specific boundaries. Common reporting periods include monthly, quarterly, and annually. Each timeframe serves different analytical purposes. Monthly statements facilitate close monitoring of short-term trends, while annual statements offer a broader overview of yearly performance. The selected period directly impacts the data presented and the insights derived. For example, a seasonal business might experience significant revenue fluctuations throughout the year. An annual income statement would smooth out these fluctuations, while monthly statements would reveal the peaks and troughs, offering more granular insights into seasonal trends. The choice of time period depends on the specific analytical needs and the nature of the business.

Comparing income statements across consistent time periods is crucial for identifying trends and evaluating performance. Analyzing quarterly statements over multiple years, for example, reveals patterns of growth or decline. This comparison allows for informed decision-making based on historical data and projected future performance. Furthermore, understanding the impact of time period selection on key financial metrics is essential. For example, a short-term increase in expenses, such as a one-time marketing campaign, might appear significant on a monthly income statement but less impactful on an annual statement. This contextual understanding prevents misinterpretations of financial data and allows for more accurate performance evaluation.

Accurately defining the reporting period and consistently applying it across financial statements are crucial for reliable financial analysis. This consistency ensures comparability, facilitating accurate trend analysis and informed decision-making. Moreover, the chosen time period should align with the business’s operational cycle and reporting requirements. Using a consistent and appropriate timeframe ensures the income statement remains a relevant and valuable tool for managing financial performance and achieving strategic goals.

5. Standardized Format

A standardized format is essential for small business income statement templates. Consistency ensures clarity, comparability, and ease of interpretation for both internal stakeholders and external parties such as lenders and investors. A structured presentation of financial data allows for efficient analysis, trend identification, and informed decision-making. A standardized template minimizes the risk of errors and omissions, promoting accuracy and reliability in financial reporting.

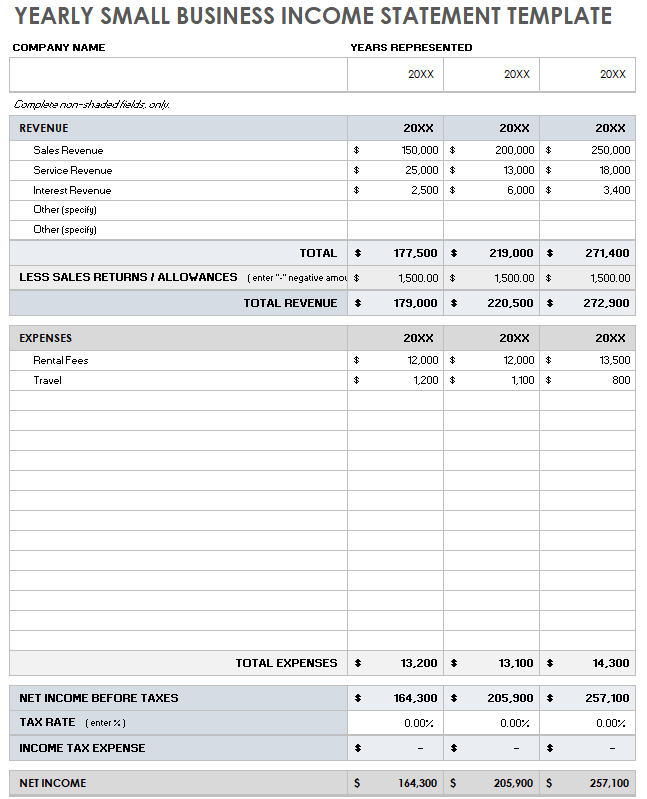

- Consistent StructureA standardized template provides a predefined structure for organizing financial data. This structure typically includes sections for revenue, cost of goods sold, gross profit, operating expenses, operating profit, other income and expenses, and net profit. This consistent organization facilitates quick access to specific information and simplifies comparisons across different periods or against industry benchmarks. For example, a consistent placement of operating expenses allows for efficient tracking of trends in administrative costs, marketing expenditures, and research and development investments.

- Clear TerminologyUsing standardized terminology ensures that all stakeholders understand the information presented. Consistent use of terms like “revenue,” “gross profit,” and “net income” avoids ambiguity and facilitates clear communication. For instance, consistently using “Cost of Goods Sold” instead of varying terms like “cost of sales” or “direct costs” ensures clarity and avoids potential misinterpretations. This clarity is particularly crucial when sharing financial statements with external parties.

- ComparabilityA standardized format enables comparison across different accounting periods. This comparability is crucial for identifying trends in revenue growth, expense management, and profitability. For example, comparing operating profit margins over consecutive quarters reveals whether operational efficiency is improving or declining. This analysis supports data-driven decisions regarding pricing strategies, cost control measures, and investment allocation.

- Compliance and ReportingA standardized income statement format often aligns with generally accepted accounting principles (GAAP) and regulatory requirements. This alignment simplifies financial reporting, tax preparation, and audits. Consistent adherence to established accounting standards ensures compliance and enhances credibility with external stakeholders such as investors, lenders, and regulatory bodies. A standardized format streamlines the process of preparing financial reports for various purposes, saving time and resources.

Utilizing a standardized format for small business income statements enhances the value and usability of this crucial financial document. Consistency, clarity, and comparability promote accurate analysis, informed decision-making, and effective communication with stakeholders, contributing to better financial management and overall business success.

6. Financial Analysis

Financial analysis relies heavily on the data presented within a small business income statement template. This structured financial report provides the foundational information necessary for conducting various analytical techniques, enabling stakeholders to assess a company’s financial health, performance, and prospects. The standardized format of the template facilitates consistent data organization, making it easier to perform calculations, identify trends, and draw meaningful conclusions. Cause and effect relationships between different financial elements, such as the impact of rising costs on profitability, become clearer through analysis of the income statement data. For instance, if a company’s cost of goods sold increases significantly while revenue remains stagnant, analyzing the income statement can reveal the cause, such as rising raw material prices or increased production inefficiencies. This analysis can then inform strategic decisions to mitigate the negative impact on profitability, such as exploring alternative suppliers or optimizing production processes.

As a critical component of financial analysis, the income statement template supports various analytical approaches. Ratio analysis, for example, uses data from the income statement to calculate key profitability metrics like gross profit margin, operating profit margin, and net profit margin. These metrics provide insights into a company’s efficiency in generating profits from its operations. Trend analysis, another important technique, examines changes in key figures over time, such as revenue growth, expense fluctuations, and profit trends. This analysis reveals patterns that can inform future projections and strategic planning. For example, consistent growth in operating expenses might signal a need for cost control measures, while a steady increase in revenue could justify expansion plans. Furthermore, comparing a company’s income statement data to industry benchmarks provides valuable context, revealing areas of strength and weakness relative to competitors. This comparative analysis can inform strategic adjustments to improve competitiveness and market positioning.

A thorough understanding of the income statement template is essential for effective financial analysis. This understanding enables stakeholders to extract meaningful insights from the data, identify potential risks and opportunities, and make informed decisions to drive sustainable growth and profitability. The ability to interpret and analyze the information within the income statement empowers businesses to proactively manage their finances, optimize performance, and achieve long-term financial success. Regular review and analysis of the income statement, combined with other financial reports, provide a comprehensive view of a company’s financial position and inform strategic planning for future growth and stability.

Key Components of a Small Business Income Statement Template

A well-structured income statement template provides a clear and organized overview of a company’s financial performance. Understanding the key components is crucial for accurate interpretation and effective financial management.

1. Revenue: This section represents the total income generated from sales of goods or services during a specific accounting period. It’s the starting point for calculating profitability and typically appears at the top of the statement.

2. Cost of Goods Sold (COGS): COGS includes all direct costs associated with producing the goods sold by a company. For a manufacturer, this includes raw materials and direct labor. For a retailer, it represents the cost of purchasing inventory.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profit earned before deducting operating expenses. This metric provides insight into the profitability of a company’s core business operations.

4. Operating Expenses: This section encompasses all costs incurred in running the business, excluding COGS. Examples include rent, salaries, marketing, and administrative expenses. These costs are categorized to provide a detailed view of operational expenditures.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income represents the profit generated from core business operations before considering interest and taxes. This metric reflects the efficiency of management in controlling operating costs.

6. Other Income and Expenses: This section includes income and expenses not directly related to core business operations, such as interest income, interest expense, and gains or losses from the sale of assets. These items are often presented separately to provide a clearer picture of core profitability.

7. Net Income: Often referred to as the “bottom line,” net income represents the final profit after all expenses, including interest and taxes, have been deducted from revenue. This is the ultimate measure of a company’s profitability during a specific period.

These components work together to provide a comprehensive picture of a company’s financial performance during a given period. Analyzing these elements allows stakeholders to understand profitability, identify trends, and make informed decisions for future growth and stability.

How to Create a Small Business Income Statement Template

Creating a standardized income statement template ensures consistent financial reporting, facilitates analysis, and supports informed decision-making. The following steps outline the process of developing a practical and effective template.

1. Define the Reporting Period: Establish the specific time frame covered by the income statement (e.g., monthly, quarterly, annually). Consistent reporting periods allow for accurate trend analysis and comparisons.

2. Structure the Template: Organize the template with clear sections for each key component: Revenue, Cost of Goods Sold (COGS), Gross Profit, Operating Expenses, Operating Income, Other Income and Expenses, and Net Income. This structured approach ensures consistency and clarity.

3. Categorize Revenue Streams: If a business has multiple revenue streams, categorize them within the Revenue section. This detailed breakdown provides insights into the performance of different product lines or services.

4. Itemize Expenses: Within the Operating Expenses section, itemize specific expense categories such as rent, salaries, utilities, marketing, and administrative costs. This detailed breakdown facilitates cost control and analysis.

5. Include Formulas for Calculations: Incorporate formulas within the template to automatically calculate key metrics such as Gross Profit (Revenue – COGS), Operating Income (Gross Profit – Operating Expenses), and Net Income (Operating Income + Other Income – Other Expenses). Automated calculations minimize errors and save time.

6. Use Clear and Consistent Terminology: Employ standardized accounting terms throughout the template. This consistency ensures clarity and facilitates understanding for all stakeholders.

7. Choose a Format: Select a format that is easy to read and understand, whether it’s a spreadsheet, accounting software, or a dedicated template within a financial management system. Consider incorporating visual elements like charts and graphs to enhance data visualization.

8. Regularly Review and Update: As a business evolves, its financial reporting needs may change. Regularly review and update the income statement template to ensure it remains relevant and effectively captures the company’s financial activities.

A well-designed template provides a framework for consistent financial reporting, enabling business owners to track performance, analyze trends, and make data-driven decisions for growth and profitability. This structured approach strengthens financial management, enhances transparency, and supports long-term sustainability.

Accurate financial reporting is the cornerstone of informed decision-making for any enterprise. A properly structured income statement template provides a crucial framework for capturing, organizing, and analyzing financial data. From revenue generation and expense management to profitability assessment and trend analysis, the income statement offers invaluable insights into a company’s financial health and performance. Understanding the key components, utilizing a standardized format, and applying appropriate analytical techniques empower businesses to effectively monitor progress, identify areas for improvement, and navigate the complexities of the financial landscape.

Effective utilization of an income statement template contributes significantly to long-term financial stability and sustainable growth. Regular review and analysis of this vital financial report, coupled with strategic planning and proactive management, pave the way for informed decision-making and continued success. The income statement serves as an essential tool for understanding the financial narrative of a business, enabling informed choices that shape its future trajectory.