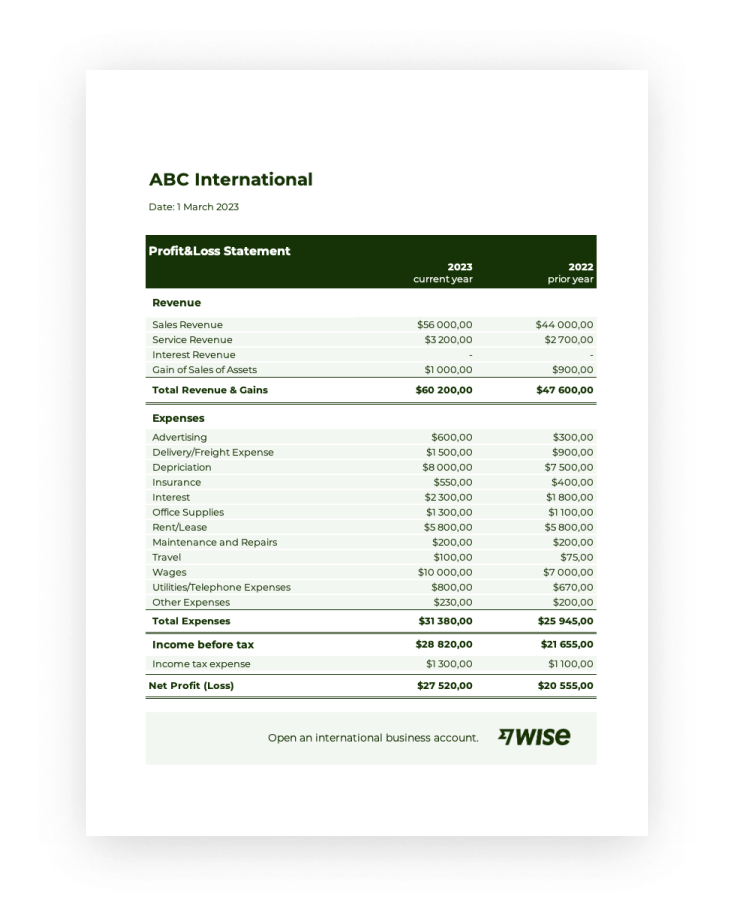

Utilizing a consistent structure offers several advantages. It streamlines the process of preparing financial reports, reducing the likelihood of errors and omissions. Furthermore, the standardized presentation allows for easy comparison across different accounting periods within the same company or against competitors in the same industry. This comparability facilitates benchmarking and performance analysis, enabling businesses to identify areas for improvement and strategic growth. The clarity provided by such a report strengthens transparency and builds trust with stakeholders.

This structured approach to financial reporting lays a solid foundation for exploring more in-depth topics such as revenue recognition, cost accounting, and expense management. A clear understanding of this foundational document provides context for analyzing key performance indicators, assessing profitability, and evaluating long-term financial sustainability.

1. Revenues

Revenue recognition within a standardized profit and loss statement is crucial for accurately reflecting a company’s financial performance. Revenue represents the income generated from the sale of goods or services. A standard template ensures consistent reporting of this income, enabling accurate tracking of performance over time and comparison with industry benchmarks. The timing of revenue recognition, governed by accounting principles, significantly impacts the reported financial position. For example, a subscription-based software company recognizes revenue over the subscription period, not as a lump sum at the time of sale. This methodical approach ensures a more accurate representation of earnings relative to the delivery of services. Incorrect revenue recognition can distort financial reporting, misleading stakeholders and potentially leading to regulatory issues.

Accurate revenue reporting is essential for financial analysis and decision-making. Investors and creditors rely on this information to assess a company’s financial health and growth potential. Internally, management utilizes revenue data to monitor sales performance, set targets, and allocate resources effectively. Understanding the relationship between sales volume, pricing, and overall revenue contributes to strategic planning and informed pricing strategies. For instance, a company experiencing declining revenues despite increased sales volume might need to re-evaluate its pricing model. This analysis is facilitated by the standardized structure of the profit and loss statement, enabling clear visibility of key revenue metrics.

In summary, accurate and consistent revenue reporting within a standard profit and loss statement template is fundamental for sound financial management. It provides a clear picture of a companys top-line performance, supports informed decision-making by both internal and external stakeholders, and facilitates effective resource allocation. Challenges in revenue recognition, such as those presented by complex sales agreements or evolving accounting standards, underscore the importance of adhering to established principles and maintaining a rigorous approach to financial reporting. This diligence contributes to transparency, strengthens credibility with stakeholders, and provides a solid foundation for long-term financial stability.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) is a critical component of a standard profit and loss statement template. It represents the direct costs associated with producing the goods a company sells. Accurate COGS calculation is essential for determining gross profit and understanding the profitability of a company’s core business operations. A clear understanding of COGS provides valuable insights into pricing strategies, production efficiency, and inventory management.

- Direct MaterialsDirect materials comprise the raw materials used in production. This includes the cost of any materials directly incorporated into the finished product. For a furniture manufacturer, this could include wood, fabric, and hardware. Accurate tracking of direct material costs, often through inventory management systems, is crucial for calculating COGS and managing profitability. Increases in raw material prices can significantly impact COGS and, subsequently, net income.

- Direct LaborDirect labor represents the wages and benefits paid to employees directly involved in producing goods. This includes factory workers, assembly line personnel, and quality control inspectors involved in the manufacturing process. Efficient labor management and productivity improvements can reduce direct labor costs and positively influence COGS. Conversely, rising labor costs can negatively impact profitability, emphasizing the importance of monitoring this element closely.

- Manufacturing OverheadManufacturing overhead encompasses all other costs directly associated with the production process but not classified as direct materials or labor. This includes factory rent, utilities, depreciation of manufacturing equipment, and supervisory salaries. Allocating overhead costs accurately is essential for a comprehensive understanding of COGS. Inefficient overhead cost management can inflate COGS and reduce profitability. Analyzing overhead costs can reveal opportunities for cost optimization and process improvement.

- Inventory ValuationInventory valuation methods (e.g., FIFO, LIFO, weighted average) directly impact the reported COGS. The chosen method affects the cost assigned to goods sold during a specific period. Consistent application of a chosen method is vital for accurate COGS calculation and comparability across financial periods. Changes in inventory valuation methods require careful consideration and disclosure as they can significantly influence reported profitability.

The accurate and consistent reporting of COGS within a standard profit and loss statement template is essential for assessing a company’s operational efficiency and profitability. Understanding the components of COGS, including direct materials, direct labor, manufacturing overhead, and inventory valuation methods, allows for a more informed analysis of financial performance. This analysis provides insights into pricing strategies, cost control measures, and overall business health, ultimately contributing to more effective decision-making and long-term financial sustainability.

3. Operating Expenses

Operating expenses represent the costs incurred in running a business’s core operations, excluding the direct costs of producing goods or services (COGS). Within a standard profit and loss statement template, operating expenses are categorized and presented systematically to provide a clear picture of a company’s cost structure. This standardized presentation facilitates analysis of spending trends, cost control effectiveness, and overall operational efficiency. A well-structured presentation of operating expenses enables stakeholders to understand how resources are utilized and assess the company’s ability to manage costs relative to revenue generation.

Several key categories typically comprise operating expenses:

- Selling, General, and Administrative Expenses (SG&A): These include salaries for administrative staff, marketing and advertising costs, rent, utilities, and office supplies. For example, a retail company’s SG&A might include storefront rent, advertising campaigns, and salaries for sales personnel. Analyzing SG&A trends helps assess the effectiveness of marketing strategies and the efficiency of administrative functions.

- Research and Development (R&D): For companies engaged in innovation, R&D expenses are crucial. These costs include salaries for researchers, laboratory equipment, and testing materials. Pharmaceutical companies, for instance, invest heavily in R&D. Understanding the level and trend of R&D spending provides insight into a company’s commitment to innovation and its potential for future growth.

- Depreciation and Amortization: These represent the allocation of the cost of tangible and intangible assets over their useful lives. Depreciation applies to physical assets like machinery, while amortization applies to intangible assets like patents. Including these expenses reflects the ongoing cost of using these assets in operations.

Effective management of operating expenses directly impacts profitability. By carefully monitoring and controlling these costs, businesses can improve their bottom line. For example, a company implementing energy-efficient practices can reduce utility expenses, directly impacting operating income.

Careful analysis of operating expenses within a standard profit and loss statement offers valuable insights for internal management and external stakeholders. Identifying areas of high spending or unfavorable trends allows for proactive cost management strategies. Furthermore, comparing operating expenses across different periods or against industry benchmarks enables companies to assess their operational efficiency and identify areas for potential improvement. Effective cost control, informed by detailed analysis of operating expenses, strengthens financial performance and contributes to long-term sustainability. Challenges in managing operating expenses, such as rising input costs or unexpected economic downturns, necessitate flexible budgeting and robust cost control mechanisms. Successfully navigating these challenges requires accurate, consistent, and transparent reporting within the framework of a standard profit and loss statement template.

4. Non-Operating Income/Expenses

Non-operating income and expenses represent transactions outside a company’s core business activities. Within a standard profit and loss statement template, these items are presented separately from operating income and expenses to provide a clearer picture of profitability derived from core operations versus peripheral activities. This segregation allows for a more accurate assessment of a company’s operational efficiency and its ability to generate sustainable earnings. Understanding the nature and impact of non-operating items is crucial for comprehensive financial analysis.

Non-operating income can include interest income from investments, gains from the sale of assets, or one-time extraordinary gains. For example, a manufacturing company earning interest on its cash reserves would classify this as non-operating income. Conversely, non-operating expenses can include interest expense on debt, losses from asset disposals, or lawsuit settlements. A retail company incurring interest expense on its outstanding loans would categorize this as a non-operating expense. Accurately classifying these items within the standardized template ensures transparency and facilitates meaningful comparisons across different periods and against industry peers.

While non-operating income and expenses are not indicative of a company’s core business performance, they can significantly impact the bottom line. Large non-operating gains or losses can distort the overall picture of profitability, making it essential to analyze both operating and non-operating results when assessing a company’s financial health. For example, a company reporting a significant net profit driven primarily by a one-time asset sale may not be as financially sound as a company with a smaller net profit derived consistently from its core operations. Understanding the distinction between operating and non-operating items allows for a more nuanced interpretation of financial performance and facilitates informed decision-making.

5. Net Income/Loss

Net income/loss, often referred to as the “bottom line,” represents the ultimate outcome of a company’s financial performance over a specific period. Within a standard profit and loss statement template, net income/loss is calculated by subtracting total expenses (including cost of goods sold, operating expenses, and non-operating expenses) from total revenues. This figure provides a concise measure of a company’s profitability, reflecting the residual earnings after all costs have been accounted for. The placement of net income/loss at the bottom of the statement underscores its significance as the culmination of all financial activities detailed within the template.

The relationship between net income/loss and the standard profit and loss statement template is one of inherent interconnectedness. The standardized structure of the template facilitates the systematic aggregation of revenues and expenses, culminating in the calculation of net income/loss. This structured approach ensures consistency and comparability, enabling stakeholders to track profitability trends over time and benchmark performance against industry peers. For example, two companies in the same industry utilizing the same standard template can be directly compared based on their respective net income figures, even if their specific revenue streams or expense structures differ. This comparability is crucial for investors, creditors, and analysts evaluating investment opportunities or assessing creditworthiness. Furthermore, internal management relies on net income/loss figures to evaluate the effectiveness of business strategies and make informed decisions regarding resource allocation and future growth.

Understanding net income/loss within the context of a standard profit and loss statement is fundamental for assessing a company’s overall financial health and sustainability. While a positive net income indicates profitability, it is essential to analyze the components contributing to that figure. A company with consistently growing revenues and well-managed expenses demonstrates greater long-term sustainability than a company with volatile earnings driven primarily by non-operating gains. Furthermore, analyzing net income trends over multiple periods provides a more comprehensive understanding of a company’s financial trajectory and its ability to generate sustainable earnings. Challenges such as economic downturns or industry-specific disruptions can significantly impact net income/loss, highlighting the importance of robust financial planning and adaptive management strategies. Effectively navigating these challenges requires a thorough understanding of the standard profit and loss statement template and the interconnectedness of its various components, culminating in the critical “bottom line” figure of net income/loss.

Key Components of a Standard Profit and Loss Statement

A standard profit and loss statement template provides a structured framework for presenting a company’s financial performance. Understanding its key components is crucial for interpreting the information contained within the statement and drawing meaningful conclusions about a company’s financial health.

1. Revenue: Revenue represents income generated from a company’s primary business activities, typically from the sale of goods or services. It is the starting point for calculating profitability and provides a crucial indicator of a company’s top-line performance.

2. Cost of Goods Sold (COGS): COGS encompasses the direct costs associated with producing the goods sold by a company. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Gross profit represents the difference between revenue and COGS. It provides a measure of profitability before considering operating expenses, revealing the efficiency of production and pricing strategies.

4. Operating Expenses: Operating expenses encompass the costs incurred in running a business’s core operations, excluding COGS. These include selling, general, and administrative expenses, research and development, and depreciation and amortization.

5. Operating Income: Operating income, also known as Earnings Before Interest and Taxes (EBIT), is calculated by subtracting operating expenses from gross profit. It reflects the profitability of a company’s core business operations.

6. Non-Operating Income/Expenses: These items represent income and expenses unrelated to a company’s core operations, such as interest income, investment gains, or interest expenses. They are presented separately to provide a clear picture of profitability from core activities.

7. Income Before Taxes: This figure represents a company’s earnings after considering both operating and non-operating income and expenses but before accounting for income tax obligations.

8. Net Income/Loss: Net income/loss, the “bottom line,” represents the final result of a company’s financial performance after all revenues and expenses, including taxes, have been accounted for. It provides the most comprehensive measure of profitability.

Analysis of these interconnected components provides a comprehensive understanding of a company’s financial performance, enabling informed decision-making by management, investors, and other stakeholders. Accurate and consistent reporting within this structured framework is essential for transparency and effective financial analysis.

How to Create a Standard Profit and Loss Statement

Creating a standard profit and loss statement involves organizing financial data into a structured format. This process facilitates clear analysis of a company’s financial performance over a specific period.

1. Choose a Reporting Period: Specify the timeframe for the statement, such as a month, quarter, or year. Consistent reporting periods allow for accurate trend analysis.

2. Record Revenue: Document all income generated from sales of goods or services. Ensure accurate revenue recognition principles are followed.

3. Calculate Cost of Goods Sold (COGS): Determine the direct costs associated with producing goods sold, including raw materials, direct labor, and manufacturing overhead.

4. Calculate Gross Profit: Subtract COGS from revenue to determine gross profit, representing profitability before operating expenses.

5. Itemize Operating Expenses: List all operating expenses, including selling, general, and administrative expenses (SG&A), research and development (R&D), and depreciation/amortization.

6. Calculate Operating Income: Subtract operating expenses from gross profit to arrive at operating income, also known as Earnings Before Interest and Taxes (EBIT).

7. Include Non-Operating Income/Expenses: Incorporate any income or expenses unrelated to core operations, such as interest income or expense, gains or losses from investments, and one-time events.

8. Calculate Income Before Taxes: Determine earnings before taxes by summing operating income and non-operating income/expenses.

9. Deduct Income Taxes: Subtract income tax expense to arrive at net income.

10. Present Net Income/Loss: Clearly present the final net income or loss figure, which represents the overall profitability for the reporting period.

A well-structured profit and loss statement provides a clear and concise overview of a company’s financial performance. Consistent application of these steps ensures accurate reporting and facilitates informed financial analysis.

Standardized profit and loss statement templates provide a crucial framework for understanding financial performance. Consistent structure facilitates clear and comparable analysis of revenues, costs, and expenses, leading to accurate calculation of net income or loss. This structured approach allows stakeholders to identify trends, assess profitability, and make informed decisions based on a transparent and reliable representation of financial health. From revenue recognition to cost of goods sold, operating expenses, and non-operating items, each component contributes to a comprehensive understanding of a company’s financial activities.

Effective utilization of these templates is essential for sound financial management and strategic decision-making. The insights derived from a well-structured profit and loss statement contribute to long-term sustainability and informed financial planning. Regular review and analysis of this key financial document are crucial for navigating the complexities of the business environment and ensuring continued financial success. Ultimately, adherence to standardized reporting principles fosters transparency, strengthens credibility, and provides a solid foundation for achieving financial objectives.