Utilizing a structured format offers several advantages. It promotes transparency and accountability by clearly presenting all equity-related activities. This clarity enables investors and creditors to assess the company’s financial performance and stability more effectively. A standardized structure also facilitates comparison across different periods and against industry benchmarks, providing valuable insights into trends and potential risks. Furthermore, it simplifies the auditing process, ensuring compliance with regulatory requirements.

The following sections delve deeper into the specific components of this crucial financial statement, providing practical guidance on its preparation and interpretation, and exploring its significance in various business contexts.

1. Beginning Balance

The beginning balance of equity forms the foundation of the statement of changes in equity. It represents the cumulative equity position of the entity at the start of the reporting period, carrying forward the net effect of all prior transactions affecting equity. This figure serves as the baseline against which subsequent changes during the period are measured. Without a precise beginning balance, accurately tracking and explaining the changes in equity becomes impossible. For instance, if a company’s beginning retained earnings balance is misstated, the calculated change in retained earnings and the resulting ending balance will also be incorrect, potentially leading to misinterpretations of financial performance.

Consider a scenario where a company begins the year with $50,000 in retained earnings. During the year, it earns $10,000 in net income and distributes $2,000 in dividends. The correct ending retained earnings balance should be $58,000 ($50,000 + $10,000 – $2,000). However, if the beginning balance was erroneously recorded as $40,000, the calculated ending balance would be $48,000, understating retained earnings by $10,000. This inaccuracy could mislead investors and creditors about the company’s financial health. Accurately determining the beginning balance is, therefore, crucial for ensuring the integrity of the entire statement.

Understanding the role and importance of the beginning balance within the broader context of the statement of changes in equity is essential for proper financial reporting. It ensures the accuracy and reliability of the reported equity changes, facilitating informed decision-making by stakeholders. Reconciling the beginning balance with the prior period’s ending balance provides a crucial check on the accuracy of the data and highlights any discrepancies that require investigation. This process contributes significantly to maintaining the overall integrity of financial reporting.

2. Comprehensive Income

Comprehensive income plays a crucial role within the statement of changes in equity. It represents the holistic change in equity during a period, encompassing all gains and losses, regardless of whether they are recognized in the traditional income statement. This includes net income, as well as other comprehensive income (OCI). OCI captures items such as unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and certain pension plan adjustments. These components are not reflected in net income but directly impact equity. Consequently, comprehensive income provides a more complete picture of an entity’s financial performance than net income alone.

The impact of comprehensive income on the statement of changes in equity can be illustrated through a practical example. Suppose a company reports net income of $100,000 and an unrealized gain on available-for-sale securities of $20,000. While the $100,000 net income appears on the income statement, the $20,000 unrealized gain is recorded as OCI. Both amounts, however, flow through to the statement of changes in equity, increasing the retained earnings balance. This demonstrates how comprehensive income provides a more encompassing view of equity changes by capturing both realized and unrealized gains and losses. Ignoring OCI would provide an incomplete understanding of the factors driving changes in equity.

Understanding the relationship between comprehensive income and the statement of changes in equity is essential for stakeholders. It provides a comprehensive perspective on the factors influencing an entity’s financial position and performance. By considering both net income and OCI, investors and analysts can gain a deeper understanding of the true profitability and long-term financial health of an organization. This understanding facilitates more informed investment decisions and enhances the ability to assess an entity’s financial strength and stability. Recognizing the nuances of comprehensive income allows for a more robust evaluation of financial performance beyond traditional income statement figures.

3. Issued Shares

Issued shares represent the portion of a company’s authorized share capital that has been distributed to investors. Within the context of the statement of changes in equity, issued shares reflect transactions that increase or decrease the number of shares outstanding. Issuing new shares increases equity by the amount of capital received, while repurchasing shares (treasury stock) decreases equity. These transactions directly impact the company’s ownership structure and capital base. For example, if a company issues 1,000 shares at a price of $10 per share, the common stock portion of equity increases by $10,000. Conversely, if the company repurchases 500 shares at $12 per share, equity decreases by $6,000.

The impact of issued shares on the statement of changes in equity extends beyond simply increasing or decreasing the number of shares outstanding. It also affects other equity components, such as additional paid-in capital. When shares are issued at a price above par value, the excess amount is recorded as additional paid-in capital. This further increases equity and reflects the premium investors are willing to pay for the company’s shares. Understanding the interplay between issued shares, common stock, and additional paid-in capital is crucial for interpreting the overall impact on equity. Analyzing trends in issued shares can offer valuable insights into a company’s financing strategies and growth prospects.

Accurately reflecting issued share transactions within the statement of changes in equity is critical for financial transparency and regulatory compliance. Misrepresenting these transactions can distort the true picture of a company’s equity position and mislead investors. A clear and detailed presentation of issued shares, including the number of shares issued or repurchased and the related price, enhances the statement’s informativeness. This enables stakeholders to assess the company’s capital structure, dilution effects, and overall financial health. Therefore, maintaining meticulous records of issued share transactions and presenting them accurately in the statement is paramount for maintaining investor confidence and complying with reporting standards.

4. Dividends

Dividends represent distributions of a company’s earnings to its shareholders. Within the statement of changes in equity, dividends signify a reduction in retained earnings and, consequently, total equity. They represent a return of capital to investors and reflect a company’s profitability and dividend policy. The type of dividend (cash or stock) determines the specific impact on the statement. Cash dividends directly reduce retained earnings, while stock dividends impact the number of shares outstanding and potentially other equity components like additional paid-in capital. For instance, a cash dividend of $0.50 per share on 10,000 outstanding shares would decrease retained earnings by $5,000. A stock dividend, on the other hand, increases the number of shares outstanding while potentially transferring amounts from retained earnings to common stock and additional paid-in capital, depending on the specific terms of the stock dividend.

The relationship between dividends and the statement of changes in equity is crucial for understanding a company’s financial management practices. Consistent and increasing dividends can signal financial health and stability, attracting investors seeking income. However, large dividend payouts can also limit a company’s ability to reinvest earnings for future growth. Analyzing dividend trends within the statement of changes in equity helps stakeholders gauge a company’s financial performance and evaluate its dividend policy’s sustainability. Consider a company consistently paying high dividends despite declining profits. This could indicate potential financial strain and an unsustainable dividend policy, potentially leading to future dividend cuts. Conversely, a company steadily increasing its dividends alongside earnings growth suggests a healthy financial position and a commitment to rewarding shareholders.

Accurate reporting of dividends within the statement of changes in equity is essential for regulatory compliance and investor confidence. Misstated or omitted dividend information can distort the true financial picture and mislead stakeholders. Transparency in dividend reporting, including the type, amount, and timing of distributions, enhances the statement’s informativeness. This allows for a comprehensive assessment of a company’s financial performance, its ability to generate returns for investors, and the long-term sustainability of its dividend policy. Therefore, ensuring accurate and detailed dividend reporting within the statement of changes in equity is fundamental for maintaining financial transparency and supporting informed investment decisions.

5. Ending Balance

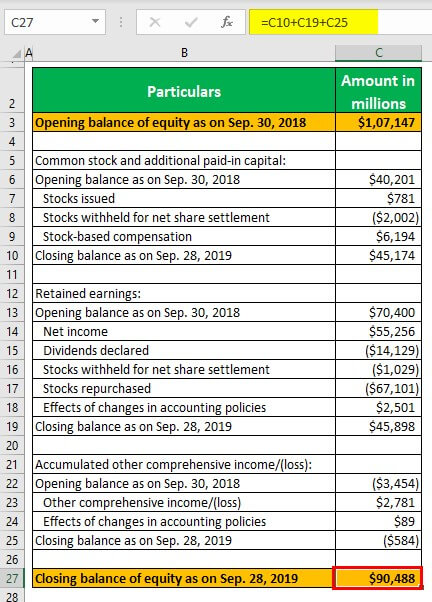

The ending balance in a statement of changes in equity represents the cumulative result of all equity-related transactions during a given period. It signifies the net equity position at the end of the reporting period, reflecting the combined effects of beginning balance, net income, other comprehensive income, issued shares, dividends, and other equity-related adjustments. This figure serves as a crucial link between the current period’s statement and the subsequent period’s beginning balance, ensuring continuity in financial reporting. Understanding the ending balance is essential for evaluating a company’s financial position and tracking changes in its ownership structure over time. For instance, an increase in the ending equity balance compared to the beginning balance, after accounting for dividends, suggests an improvement in the company’s financial health, potentially driven by profitability and capital appreciation. Conversely, a decline may signal financial challenges or significant dividend distributions.

The ending balance provides valuable insights into several aspects of a company’s financial health. It offers a snapshot of the company’s net worth at a specific point in time, reflecting its accumulated earnings, capital contributions, and the impact of other equity-related activities. Comparing ending balances across multiple periods allows stakeholders to analyze trends in equity growth and assess the long-term sustainability of a company’s financial performance. Furthermore, the ending balance serves as a key input for various financial ratios and metrics used in investment analysis and creditworthiness assessments. For example, the debt-to-equity ratio, a crucial indicator of financial leverage, utilizes the ending equity balance as a denominator, highlighting the relative proportions of debt and equity financing. A high debt-to-equity ratio may indicate increased financial risk, while a low ratio suggests a more conservative capital structure.

Accurate determination and presentation of the ending balance are critical for ensuring the integrity of financial reporting and facilitating informed decision-making. Errors in calculating the ending balance can have cascading effects, impacting future financial statements and potentially leading to misinterpretations of a company’s financial position. Furthermore, a clear and transparent presentation of the ending balance, accompanied by detailed explanations of the changes in equity components, enhances the understandability and usefulness of the statement of changes in equity. This allows stakeholders to gain a comprehensive understanding of the factors driving changes in equity and make informed judgments about a company’s financial performance and prospects. Therefore, meticulous attention to detail and adherence to accounting standards are essential for ensuring the accuracy and reliability of the ending balance and, consequently, the entire statement of changes in equity. This contributes to maintaining trust in financial reporting and promoting sound financial analysis.

Key Components of a Statement of Changes in Equity

A comprehensive understanding of a statement of changes in equity requires a detailed examination of its core components. These components provide a structured overview of the factors influencing equity fluctuations during a specific reporting period.

1. Beginning Balance: The opening equity balance at the start of the reporting period. This figure represents the cumulative effect of all prior transactions affecting equity and serves as the baseline for measuring subsequent changes.

2. Comprehensive Income: Encompasses all changes in equity during the period, including both net income (from the income statement) and other comprehensive income (OCI), which includes items like unrealized gains and losses not recognized in net income.

3. Issued Shares: Reflects changes in the number of shares outstanding. Issuing new shares increases equity, while share repurchases decrease it. This component also captures the impact of additional paid-in capital from issuing shares above par value.

4. Dividends: Distributions of earnings to shareholders, reducing retained earnings and total equity. This component details both cash and stock dividends and their respective impacts on different equity elements.

5. Other Equity Adjustments: Encompasses unusual or infrequent transactions that affect equity but do not fall under the other categories. These might include items like changes in accounting principles impacting retained earnings or adjustments related to stock-based compensation plans.

6. Ending Balance: The final equity balance at the end of the reporting period. This figure represents the cumulative effect of the beginning balance and all changes during the period, providing a snapshot of the entity’s net worth attributable to shareholders.

Careful analysis of these interconnected elements offers valuable insights into an entity’s financial performance, capital structure, and overall financial health. Understanding how each component contributes to changes in equity is crucial for informed financial analysis and decision-making.

How to Create a Statement of Changes in Equity

Creating a statement of changes in equity involves a systematic process of organizing and presenting key financial information. This process ensures transparency and facilitates understanding of the factors influencing changes in an entity’s equity over a specific period.

1. Determine the Reporting Period: Clearly define the start and end dates for the statement, ensuring consistency with other financial reports.

2. Gather Necessary Information: Collect relevant financial data, including the prior period’s ending equity balance (which becomes the current period’s beginning balance), net income, other comprehensive income, details of issued and repurchased shares, dividend distributions, and any other equity-related transactions.

3. Structure the Statement: Organize the statement with clear column headings representing each equity component (e.g., common stock, additional paid-in capital, retained earnings, accumulated other comprehensive income). Include rows for the beginning balance, changes during the period, and the ending balance for each component.

4. Calculate Beginning Balances: Input the ending balances of each equity component from the prior period as the beginning balances for the current period.

5. Record Changes in Equity: Input the changes in each equity component during the reporting period. This includes adding net income and other comprehensive income to retained earnings, recording the impact of issued and repurchased shares, subtracting dividends, and reflecting any other adjustments.

6. Calculate Ending Balances: Sum the beginning balance and the changes for each equity component to arrive at the ending balances.

7. Disclose Additional Information: Include any necessary disclosures or notes explaining significant transactions or accounting policies that impact equity, ensuring compliance with relevant accounting standards.

8. Review and Verify: Thoroughly review the completed statement for accuracy and completeness, ensuring consistency with other financial statements and adherence to reporting requirements. Verify the mathematical accuracy of all calculations and ensure proper classification of equity transactions. This final review helps maintain the integrity and reliability of the financial information presented.

A well-structured statement provides a clear and concise overview of changes in equity, facilitating informed analysis and decision-making by stakeholders. Accurate data, clear labeling, and comprehensive disclosures ensure transparency and enhance the statement’s usefulness in evaluating an entity’s financial performance and stability.

This exploration has highlighted the crucial role of a structured approach to presenting equity changes. From the beginning balance, representing the foundation upon which changes are built, to the ending balance, reflecting the culmination of all transactions, each component offers valuable insights into an entity’s financial activities and overall health. Comprehensive income, issued shares, dividends, and other adjustments each contribute to the dynamic nature of equity, providing a comprehensive narrative of financial performance and ownership structure. A meticulous approach to preparing this statement, with accurate data and clear presentation, ensures transparency and facilitates informed decision-making.

Accurate and transparent reporting of equity changes is paramount for maintaining stakeholder trust and fostering a stable financial environment. By understanding the intricacies of this statement, investors, creditors, and other stakeholders can gain a deeper understanding of an entity’s financial performance and long-term sustainability. This understanding empowers informed decisions and contributes to the efficient allocation of capital in the market. Further exploration of industry-specific nuances and evolving reporting standards will enhance the analytical value and ensure the continued relevance of this essential financial statement in an increasingly complex financial landscape.