Utilizing such a framework offers several advantages. It promotes transparency by providing a complete picture of a company’s financial activities. This comprehensive overview enables stakeholders, including investors and creditors, to make more informed decisions. Moreover, it fosters financial discipline by encouraging a systematic approach to tracking and reporting financial performance. This standardized structure simplifies the auditing process and enhances the reliability of financial information.

This overview lays the foundation for a deeper exploration of specific aspects of comprehensive income reporting. Further discussion will delve into the specific components, practical applications, and regulatory requirements related to this critical financial statement.

1. Standardized Format

A standardized format is crucial for the statement of comprehensive income. Consistency in presentation allows for straightforward comparison of financial performance across different reporting periods within the same entity and across different entities. This comparability is essential for investors, analysts, and other stakeholders who rely on these statements to make informed decisions. A standardized structure ensures that all material information is presented systematically, reducing the risk of misinterpretation or overlooking key data. For example, consistently placing net income at the top, followed by other comprehensive income items, and finally arriving at total comprehensive income, ensures a clear understanding of how these elements contribute to overall financial performance.

Without a standardized format, analyzing trends and identifying potential issues would be significantly more challenging. Imagine trying to compare two statements with different line items, varying terminology, and inconsistent ordering. The lack of uniformity would obscure meaningful insights and hinder effective analysis. Standardization facilitates benchmarking against industry peers, providing valuable context for evaluating a company’s financial health. This consistent structure also simplifies the auditing process, promoting greater transparency and accountability.

In summary, the standardized format of the statement of comprehensive income is integral to its usefulness. This structure facilitates clear communication of financial performance, enables meaningful comparisons, and strengthens the reliability of reported data. Adherence to established reporting standards ensures that stakeholders can confidently rely on this information for decision-making, contributing to a more transparent and efficient capital market.

2. Comprehensive Income

Comprehensive income represents the change in equity of a business entity during a period from transactions and other events and circumstances from non-owner sources. It encompasses all changes in equity other than those resulting from investments by owners and distributions to owners. The statement of comprehensive income template provides the structured framework for reporting this crucial aspect of financial performance. This connection is fundamental, as the template serves as the vehicle for communicating comprehensive income to stakeholders. Without a standardized template, the comprehensive picture of a company’s financial performance would be fragmented and difficult to interpret. The template ensures consistent reporting of all components of comprehensive income, including net income and other comprehensive income (OCI).

Consider a company that holds investments classified as available-for-sale. Changes in the fair value of these securities are recognized as unrealized gains or losses in OCI. While these gains or losses are not yet realized through a sale, they still impact the company’s overall financial position and are therefore included in comprehensive income. The statement of comprehensive income template ensures that these unrealized gains and losses are reported transparently alongside net income. This provides a more complete picture of the companys performance than focusing solely on net income, which excludes these fluctuations. Another example is foreign currency translation adjustments. Changes in exchange rates can affect the value of a company’s foreign subsidiaries. These fluctuations are also captured in OCI and reported within the statement of comprehensive income. This comprehensive view is essential for multinational corporations, as it reflects the true impact of currency movements on their financial position.

A clear understanding of the relationship between comprehensive income and its reporting template is essential for analyzing a company’s financial health. It enables stakeholders to evaluate not only a company’s profitability but also its overall financial performance, encompassing all changes in equity from non-owner sources. This holistic perspective allows for informed decision-making, as it provides a more complete picture of a company’s financial activities and their impact on shareholder value. Challenges may arise in interpreting complex OCI items, requiring careful analysis and understanding of accounting standards. However, the structured nature of the statement, facilitated by the template, aids in navigating this complexity and promotes greater transparency in financial reporting.

3. Period-Specific Data

The statement of comprehensive income template fundamentally relies on period-specific data. This temporal focus provides insights into financial performance over defined periods, such as a quarter or a year. Reporting data within specific timeframes allows for trend analysis, performance evaluation, and informed decision-making. Without this temporal constraint, the information presented would lack the context necessary for meaningful interpretation. The template’s structure facilitates the organization and presentation of this time-sensitive data, ensuring clarity and comparability across different periods. For instance, presenting quarterly data allows stakeholders to track performance trends throughout the year, identify seasonal patterns, and assess the impact of specific events on financial results. Similarly, annual data provides a broader perspective on overall performance and facilitates comparisons with previous years or industry benchmarks.

Consider a company experiencing rapid growth. Analyzing period-specific data reveals the trajectory of revenue growth, expense management, and overall profitability over time. This information is crucial for investors assessing the company’s financial health and future prospects. Conversely, a company facing financial challenges can use period-specific data to pinpoint the timing and nature of the downturn, enabling targeted interventions and corrective actions. Furthermore, period-specific data allows for the calculation of key performance indicators (KPIs) such as earnings per share or return on equity, which are essential for evaluating a company’s financial strength and profitability. These KPIs are typically calculated and compared across different periods to assess trends and identify areas for improvement. This analysis would be impossible without the organization of data within specific timeframes.

In conclusion, the connection between period-specific data and the statement of comprehensive income template is integral to the statement’s purpose and utility. The template provides the structure for organizing and presenting this time-sensitive information, enabling meaningful analysis, performance evaluation, and informed decision-making. Challenges may arise in ensuring data accuracy and consistency across reporting periods. However, the structured approach enforced by the template mitigates these risks and promotes greater transparency in financial reporting. This clear, temporally-focused presentation of financial information is essential for stakeholders seeking to understand a company’s performance and make sound investment or lending decisions.

4. Equity Changes

The statement of comprehensive income template serves as a crucial tool for understanding changes in equity. By providing a structured framework, the template captures all equity changes excluding owner investments and distributions, offering a comprehensive view of how a company’s financial position evolves over time. This detailed perspective is essential for stakeholders seeking to assess a company’s financial health and long-term sustainability.

- Comprehensive Income ComponentsThe template meticulously separates and presents the components of comprehensive income, including net income and other comprehensive income (OCI). This breakdown allows analysts to discern the impact of both traditional operating activities and other less frequent but potentially significant events on equity. For instance, unrealized gains or losses from available-for-sale securities, which are part of OCI, are clearly distinguished from operating income, providing a more nuanced understanding of equity changes. This segregation allows stakeholders to assess the relative contributions of different sources to overall equity growth or decline.

- Accumulated OCIThe template tracks the accumulated balance of OCI over time. This accumulation provides a historical record of unrealized gains and losses, allowing analysts to understand how these items have impacted equity over the long term. For example, the cumulative effect of foreign currency translation adjustments can reveal the long-term impact of exchange rate fluctuations on a company’s equity. This historical perspective is essential for assessing the potential volatility and long-term stability of a company’s equity.

- Impact on Retained EarningsThe template illustrates the relationship between net income and retained earnings. Net income, a key component of comprehensive income, directly impacts retained earnings, which represent the accumulated profits reinvested in the business. This connection is crucial for understanding how profitable operations contribute to the growth of equity. By clearly presenting net income and its effect on retained earnings, the template facilitates analysis of a company’s ability to generate and retain profits.

- Total Equity ReconciliationThe statement of comprehensive income template, often linked with the statement of changes in equity, provides a complete reconciliation of beginning and ending equity balances. This reconciliation details all changes in equity during a period, offering a comprehensive summary of the factors contributing to equity growth or decline. This comprehensive view allows stakeholders to assess the combined impact of all equity-related activities, including comprehensive income, owner investments, and distributions.

By systematically presenting these facets of equity changes, the statement of comprehensive income template provides a powerful tool for financial analysis. It allows stakeholders to dissect the various factors influencing equity, understand their individual and cumulative impacts, and gain a comprehensive understanding of a company’s financial performance and position. This detailed perspective is crucial for informed decision-making regarding investment, lending, and other financial interactions.

5. Comparative Analysis

Comparative analysis is integral to extracting meaningful insights from a statement of comprehensive income template. The template’s standardized structure facilitates comparisons across different reporting periods and against industry benchmarks. This comparative approach enables stakeholders to identify trends, assess performance, and make informed decisions. Examining trends in revenue, expenses, and profitability over multiple periods provides a dynamic view of a company’s financial trajectory. Comparing a company’s performance metrics to industry averages offers valuable context for evaluating its relative strengths and weaknesses. For example, consistently increasing revenue over several quarters suggests positive growth, while declining profit margins might warrant further investigation. Benchmarking against competitors reveals if a company’s performance is in line with industry norms or if it deviates significantly, signaling potential opportunities or risks.

Consider a company whose net income has steadily increased over the past three years. While this positive trend appears promising, comparative analysis reveals that the company’s revenue growth has significantly outpaced its net income growth. Further investigation might uncover increasing operating expenses as the primary driver of this discrepancy, signaling potential inefficiencies. Conversely, a company experiencing declining revenue might appear to be struggling. However, comparative analysis against industry data could reveal that the entire industry is facing similar headwinds, suggesting external factors rather than internal issues as the primary cause. Moreover, examining the components of other comprehensive income, such as unrealized gains and losses, over multiple periods provides insights into the volatility and long-term impact of these items on equity.

In conclusion, comparative analysis enhances the value of the statement of comprehensive income template by providing a dynamic and contextualized understanding of financial performance. This approach empowers stakeholders to move beyond static figures and uncover meaningful trends, assess relative performance, and identify potential opportunities or risks. While data availability and consistency can present challenges, the standardized structure of the template promotes comparability and facilitates informed decision-making based on a thorough understanding of financial trends and industry context.

Key Components of a Statement of Comprehensive Income Template

A robust template ensures consistent and transparent reporting of comprehensive income. Understanding its core components is crucial for accurate interpretation and analysis.

1. Heading: The heading clearly identifies the entity, the statement type (Statement of Comprehensive Income), and the reporting period. This information provides essential context for the data presented.

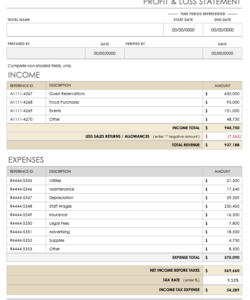

2. Net Income: This section presents the bottom line of the traditional income statement, reflecting the company’s profit or loss from operations after all revenues and expenses are considered.

3. Other Comprehensive Income (OCI): This section reports items that affect equity but are excluded from net income. Common examples include unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and certain pension plan adjustments.

4. Total Comprehensive Income: This figure represents the sum of net income and other comprehensive income, providing a holistic view of the overall change in equity during the period.

5. Period-Specific Data: Data is presented for a defined period, such as a quarter or a year. This temporal focus enables trend analysis and performance evaluation.

6. Comparative Information: Often, prior-period figures are presented alongside current-period data, facilitating comparisons and trend identification.

These interconnected components provide a comprehensive view of a company’s financial performance beyond traditional profitability measures. The standardized structure ensures consistent reporting and facilitates informed decision-making by stakeholders.

How to Create a Statement of Comprehensive Income Template

Creating a statement of comprehensive income template involves structuring key elements for clear and consistent reporting. This process ensures comprehensive representation of financial performance beyond traditional income statements.

1. Define the Reporting Entity and Period: Clearly identify the company or organization for which the statement is prepared. Specify the reporting period, whether it’s a quarter, a year, or another designated timeframe. This contextual information is crucial for accurate interpretation.

2. Structure the Net Income Section: Begin with revenue and deduct the cost of goods sold to arrive at gross profit. Subtract operating expenses, such as selling, general, and administrative expenses, to determine operating income. Incorporate non-operating income and expenses, including interest income and expense, gains or losses from asset sales, and other non-recurring items, to arrive at income before taxes. Deduct income tax expense to determine net income.

3. Incorporate Other Comprehensive Income (OCI): Create a separate section for OCI items. Common examples include unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and certain pension adjustments. Clearly label each OCI component for transparency.

4. Calculate Total Comprehensive Income: Sum the net income and the total of other comprehensive income items to arrive at total comprehensive income. This figure represents the overall change in equity during the reporting period, excluding owner investments and distributions.

5. Include Comparative Figures: Present prior-period data alongside current-period figures for each line item. This comparative format allows for trend analysis and performance evaluation over time.

6. Ensure Template Flexibility: Design the template to accommodate potential future changes in accounting standards or company-specific reporting requirements. This adaptability ensures long-term utility and avoids the need for frequent template revisions.

7. Review and Refine: Thoroughly review the template for accuracy, completeness, and clarity. Ensure that all necessary components are included and that the presentation facilitates easy interpretation. Refine the template as needed based on feedback or evolving reporting needs.

A well-designed template facilitates consistent reporting, enabling stakeholders to analyze performance trends, evaluate financial health, and make informed decisions based on a comprehensive understanding of a company’s financial activities.

The statement of comprehensive income template provides a structured approach to presenting a holistic view of an entity’s financial performance. By encompassing both net income and other comprehensive income, it offers a more complete and nuanced understanding of changes in equity over a specific period, excluding owner investments and distributions. Standardization facilitates comparability across reporting periods and against industry benchmarks, enabling stakeholders to identify trends, evaluate performance, and make informed decisions based on comprehensive data. Key components, including net income, other comprehensive income items, and total comprehensive income, contribute to a clear and consistent representation of financial activities.

Thorough understanding and proper utilization of the statement of comprehensive income template are essential for transparent financial reporting and sound financial analysis. As accounting standards and business practices evolve, ongoing review and adaptation of the template are crucial to maintaining its relevance and effectiveness in providing a comprehensive and accurate portrayal of an entity’s financial position. This ensures continued access to reliable information, fostering informed decision-making and promoting financial stability within the broader economic landscape.