Clear, concise payroll documentation offers several advantages. It empowers employees to verify the accuracy of their pay, aids in financial planning and budgeting, and serves as crucial documentation for tax purposes. For employers, such records are essential for compliance with legal and regulatory requirements. Well-maintained records also streamline payroll processes and minimize potential disputes.

This foundational understanding of structured payroll documentation paves the way for a deeper exploration of related topics, such as payroll legislation, tax withholding calculations, and best practices for record-keeping. A thorough grasp of these concepts is invaluable for both employers and employees seeking to navigate the complexities of compensation and ensure accurate, transparent financial records.

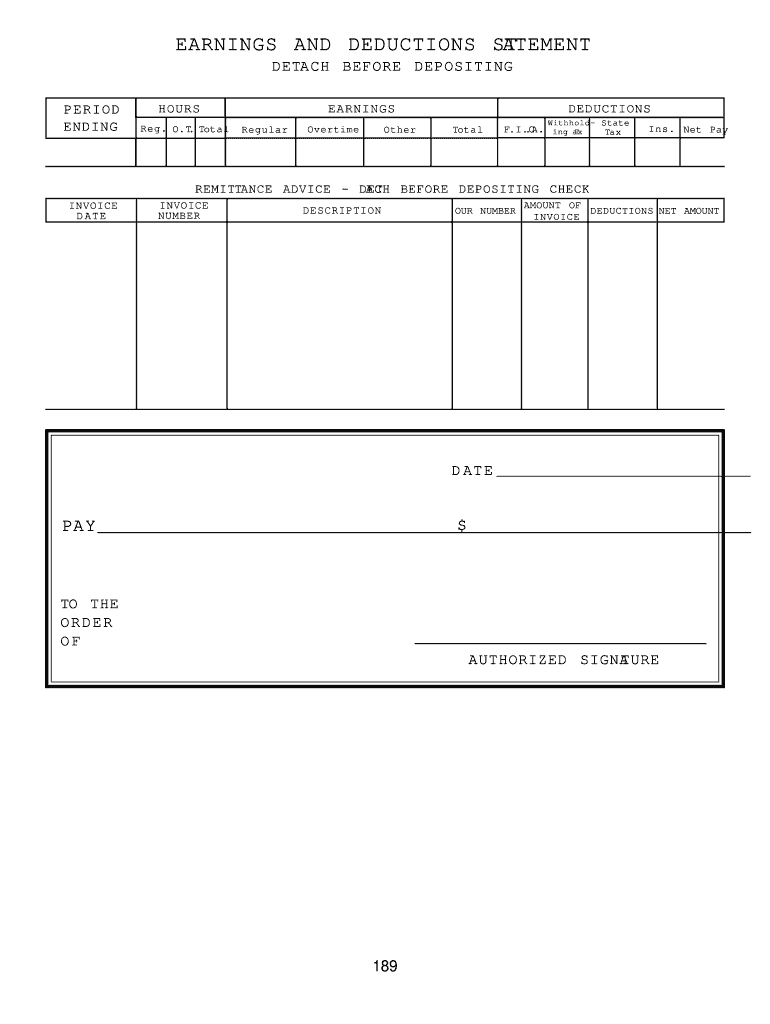

1. Standardized Format

Standardized formats are crucial for earnings and deductions documentation. Consistency ensures clarity, simplifies interpretation, and facilitates comparisons across pay periods. A standardized template provides a structured framework for presenting information, ensuring all essential components, such as gross pay, deductions, and net pay, are consistently located and easily identifiable. This consistency reduces the likelihood of errors and misunderstandings. For instance, a standardized format might consistently display gross earnings at the top, followed by federal tax withholdings, then state tax, and so on, ensuring predictable placement of information.

Standardization also plays a vital role in data analysis and reporting. Uniform data structure allows for easy aggregation and analysis of payroll information, enabling businesses to track labor costs, identify trends, and make informed decisions. Furthermore, a standardized format simplifies integration with accounting and payroll software systems, improving efficiency and reducing administrative burdens. Imagine a large company with thousands of employees. A standardized format allows them to quickly analyze payroll data across departments, identify discrepancies, and generate reports for regulatory compliance. This level of data management would be significantly more challenging without a standardized approach.

In conclusion, a standardized format is essential for effective management of earnings and deductions documentation. It promotes clarity, simplifies analysis, and enhances compliance. While specific formats may vary based on legal requirements and organizational needs, the underlying principle of consistency remains paramount. This foundation of standardization enables efficient payroll processing, accurate record-keeping, and informed decision-making within organizations of all sizes. Failure to maintain standardized formats can lead to confusion, errors, and difficulties in complying with regulatory requirements, highlighting the practical significance of this seemingly simple, yet critically important aspect of payroll management.

2. Comprehensive Income Details

Accurate and detailed income reporting forms the cornerstone of a robust payroll system. Within a statement of earnings and deductions template, comprehensive income details provide transparency and ensure clarity for both employers and employees. This detailed breakdown fosters trust, facilitates financial planning, and supports accurate tax reporting.

- Gross PayGross pay represents the total earnings before any deductions. This typically includes regular wages, overtime pay, bonuses, and commissions. For example, an employee’s gross pay might include 40 hours of regular work at $15 per hour plus 5 hours of overtime at $22.50 per hour, totaling $712.50. Accurate calculation and clear presentation of gross pay are fundamental for subsequent deduction calculations and net pay determination.

- Overtime PayOvertime pay, often calculated at a premium rate, compensates employees for work beyond standard hours. Clear documentation of overtime hours and the applied rate ensures compliance with labor regulations. For instance, a template might detail 10 overtime hours at 1.5 times the regular hourly rate, demonstrating adherence to legal requirements and providing transparency to the employee regarding their earnings. This detailed breakdown avoids potential disputes and clarifies the compensation for extra work.

- Bonuses and CommissionsBonuses and commissions, often performance-based, represent additional income beyond regular wages. Precise documentation of these variable components is crucial for accurate record-keeping. A template may specify a $500 bonus for exceeding sales targets or a 5% commission on sales totaling $10,000, resulting in a $500 commission. This clear presentation allows employees to understand the basis of their additional compensation and verify its accuracy.

- Other EarningsAdditional earnings might include reimbursements, allowances, or non-salary benefits. Clear categorization and documentation of these components ensure comprehensive income reporting. For example, a template might include a $100 reimbursement for business expenses or a $50 transportation allowance. Including these details ensures a complete picture of the employee’s compensation and avoids omissions that could affect tax calculations or financial planning.

The detailed reporting of these income components within a statement of earnings and deductions template provides a comprehensive overview of an employee’s compensation. This transparency is essential for maintaining accurate records, building trust between employers and employees, and facilitating informed financial decisions. Furthermore, this detailed breakdown simplifies tax reporting and ensures compliance with regulatory requirements, reinforcing the importance of comprehensive income details within a well-structured payroll system.

3. Accurate Deduction Calculations

Precise deduction calculations are essential for compliant and transparent payroll processing. Within a statement of earnings and deductions template, accurate deductions ensure employees receive the correct net pay while meeting legal obligations for tax withholding and other mandatory contributions. Methodical calculation and clear documentation of deductions build trust and minimize potential disputes.

- Tax WithholdingAccurate tax withholding, based on employee declarations and current tax regulations, ensures compliance and avoids penalties. Calculations consider federal income tax, state income tax (where applicable), Social Security tax, and Medicare tax. For example, an individual’s federal income tax withholding is determined by their W-4 form and relevant tax tables, ensuring appropriate amounts are deducted from each paycheck. Precise tax withholding avoids underpayment, which could lead to penalties, and overpayment, which ties up employee funds unnecessarily.

- Retirement ContributionsRetirement contributions, both mandatory and voluntary, require precise calculations based on chosen plans and contribution rates. Accurate record-keeping within the template facilitates retirement planning and ensures proper fund allocation. An employee contributing 5% of their gross pay to a 401(k) plan would have this deduction clearly documented, allowing them to track their savings and plan for their future. Accurate tracking within the template also ensures proper transfer of funds to the retirement account.

- Insurance PremiumsHealth, life, and disability insurance premiums, often deducted pre-tax, require accurate calculation and documentation. Clear presentation of these deductions within the template allows employees to understand their coverage costs and verify accuracy. For example, a monthly health insurance premium of $200 would be clearly itemized, allowing the employee to reconcile this with their benefits plan and understand the impact on their net pay. This transparency promotes understanding and avoids confusion regarding benefit costs.

- Other DeductionsWage garnishments, union dues, or other deductions mandated by law or agreement necessitate accurate calculation and transparent documentation. Including these within the template provides a complete picture of the employee’s deductions and ensures compliance. For instance, a $50 monthly union due would be clearly documented, providing transparency and facilitating reconciliation with union records. This meticulous approach ensures accurate reflection of all deductions and promotes financial clarity.

Accurate deduction calculations are inextricably linked to the efficacy of a statement of earnings and deductions template. Precise calculations, coupled with transparent documentation within the template, ensure compliance, build trust, and facilitate informed financial decisions for both employers and employees. This meticulous approach to deductions forms a critical component of responsible payroll management and promotes a clear understanding of compensation and its various components.

4. Transparent Record-Keeping

Transparent record-keeping, facilitated by a well-structured statement of earnings and deductions template, forms the bedrock of trust and accountability in payroll management. Clear, accessible records empower employees to understand their compensation and verify its accuracy, fostering a positive employer-employee relationship. This transparency also aids in financial planning and ensures compliance with regulatory requirements.

- Accessibility of Informationreadily available payroll information empowers employees to review their earnings and deductions, promoting financial awareness. Access to historical records through a centralized system, for instance, allows employees to track income trends and verify past payments. This accessibility reduces inquiries to payroll departments and empowers employees to manage their finances effectively.

- Clarity of DocumentationClear, concise documentation within the template avoids ambiguity and ensures all parties understand the components of compensation. Consistent terminology and standardized formatting within the template facilitate easy interpretation. For example, clearly labeling deductions as “Federal Income Tax” rather than using abbreviations or codes promotes understanding and avoids confusion. This clarity minimizes potential misunderstandings and promotes trust.

- Data Integrity and SecurityMaintaining accurate and secure payroll records is paramount. Templates stored within secure systems, protected by access controls and encryption, ensure data integrity and prevent unauthorized access. Regular audits and backups further safeguard data and maintain its reliability for reporting and compliance purposes. This level of security protects sensitive employee information and maintains the trustworthiness of the payroll system.

- Auditability and ComplianceTransparent records simplify audits, both internal and external. Clear documentation within the template supports compliance with tax regulations and labor laws. readily accessible data, organized within a standardized format, streamlines audits and reduces the likelihood of compliance issues. This preparedness minimizes potential penalties and reinforces the organization’s commitment to legal compliance.

Transparent record-keeping, enabled by a comprehensive statement of earnings and deductions template, is not merely a best practiceit is a cornerstone of ethical and efficient payroll management. By promoting accessibility, clarity, data integrity, and auditability, such records strengthen trust, ensure compliance, and empower both employers and employees to manage compensation effectively. This transparency fosters a positive work environment and contributes to a more robust and accountable financial ecosystem within the organization.

5. Legal Compliance

Adherence to legal requirements is paramount in payroll management. A well-designed statement of earnings and deductions template serves as a crucial tool for ensuring compliance with various regulations governing payroll practices. This structured approach facilitates accurate record-keeping, proper tax withholding, and adherence to labor laws, minimizing potential legal risks and fostering a transparent and compliant payroll system.

- Wage and Hour LawsCompliance with wage and hour laws, such as minimum wage requirements and overtime regulations, is essential. Templates facilitate accurate calculation and documentation of hours worked and corresponding wages, ensuring adherence to these legal stipulations. For instance, a template automatically calculates overtime pay based on recorded hours, ensuring compliance with federal and state overtime provisions. Accurate records support compliance and provide evidence of fair labor practices in case of audits or disputes.

- Tax Withholding and ReportingAccurate tax withholding and timely reporting are critical legal obligations. Templates enable precise calculation of federal, state, and local taxes based on employee W-4 forms and current tax regulations. They also facilitate the generation of required tax forms, such as W-2s and 1099s, ensuring accurate and timely reporting to relevant tax authorities. This meticulous approach minimizes the risk of penalties and ensures compliance with complex tax regulations.

- Data Retention and PrivacyData retention and privacy regulations mandate secure storage and handling of sensitive employee information. Templates, especially those integrated with secure payroll systems, play a vital role in ensuring compliance with these regulations. Data encryption, access controls, and regular backups protect employee data and maintain confidentiality, minimizing the risk of data breaches and associated legal repercussions. This safeguards employee privacy and reinforces the organization’s commitment to data security.

- Record-Keeping RequirementsMaintaining accurate and accessible payroll records is essential for demonstrating compliance. Templates provide a structured framework for documenting earnings, deductions, and other payroll-related information. This organized approach simplifies audits, facilitates reporting, and provides readily available documentation to support legal compliance. Well-maintained records demonstrate adherence to regulations and provide a clear audit trail for regulatory scrutiny.

A comprehensive statement of earnings and deductions template serves as more than just a record-keeping tool; it functions as a cornerstone of legal compliance in payroll management. By facilitating adherence to wage and hour laws, tax regulations, data privacy mandates, and record-keeping requirements, these templates mitigate legal risks, promote transparency, and foster a culture of compliance within the organization. This structured approach protects both employers and employees and contributes to a more robust and legally sound payroll system. Failure to maintain accurate and compliant records can result in substantial penalties, legal challenges, and reputational damage, underscoring the critical importance of a robust and legally compliant payroll process.

Key Components of a Statement of Earnings and Deductions Template

A comprehensive statement of earnings and deductions template requires several key components to ensure clarity, accuracy, and legal compliance. These components provide a detailed breakdown of an employee’s compensation, facilitating informed financial decisions and transparent record-keeping.

1. Employee Information: This section identifies the employee and employer. Essential information includes the employee’s full name, address, social security number, and employee identification number. The employer’s name, address, and tax identification number are also typically included. This information ensures accurate record association and facilitates tax reporting.

2. Pay Period: The pay period, clearly defined within the template, specifies the timeframe covered by the statement. This typically includes the start and end dates of the pay period. Clear delineation of the pay period ensures accurate calculation of earnings and deductions and facilitates reconciliation with timesheets or other time-tracking records.

3. Gross Earnings: Gross earnings represent the total compensation earned before any deductions. This section details the various components of gross pay, including regular wages, overtime pay, bonuses, commissions, and any other earnings. Itemizing each component provides transparency and allows employees to verify the accuracy of their earnings.

4. Deductions: Deductions encompass all amounts withheld from gross earnings. This section itemizes each deduction, including federal, state, and local taxes, retirement contributions, insurance premiums, wage garnishments, and other deductions. Clearly presenting each deduction promotes transparency and facilitates reconciliation with benefit plans and other agreements.

5. Net Pay: Net pay, calculated by subtracting total deductions from gross earnings, represents the employee’s take-home pay. Clear presentation of net pay within the template provides the employee with a readily understandable figure representing their compensation after all deductions.

6. Year-to-Date Totals: Year-to-date totals provide a cumulative record of earnings and deductions for the calendar year. This information is essential for tax reporting and financial planning, allowing employees to track their income and deductions throughout the year. These totals facilitate accurate tax filing and informed financial decisions.

7. Employer Contact Information: Contact information for the payroll department or relevant personnel facilitates communication regarding payroll inquiries. This typically includes a phone number, email address, and mailing address. Providing contact information promotes transparency and enables employees to address any questions or concerns promptly.

Accurate and comprehensive documentation within a standardized framework ensures transparent communication, supports informed financial decisions, and promotes compliance with legal requirements. This structured approach reinforces accountability and fosters trust between employers and employees, contributing to a more robust and effective payroll system.

How to Create a Statement of Earnings and Deductions Template

Creating a robust template requires careful consideration of essential components and legal requirements. A well-structured template ensures accurate record-keeping, facilitates compliance, and promotes transparency in payroll processes.

1. Define the Scope: Determine the specific needs and legal requirements. Consider jurisdictional regulations regarding payroll and data privacy. Research industry best practices and evaluate existing template options. This initial assessment informs template design and ensures compliance with relevant legal frameworks.

2. Essential Information Fields: Include fields for employee and employer information, pay period dates, and payment date. Employee information comprises full name, address, social security number, and employee identification number. Employer details include company name, address, and tax identification number. Accurate and complete information ensures proper record-keeping and facilitates tax reporting.

3. Gross Earnings Breakdown: Provide separate fields for each component of gross earnings. Include regular wages, overtime pay, bonuses, commissions, and other earnings. This detailed breakdown ensures transparency and allows for verification of earnings calculations.

4. Itemized Deductions: Include fields for each deduction type. Common deductions include federal, state, and local taxes, retirement contributions, insurance premiums, and wage garnishments. Itemizing deductions promotes transparency and allows employees to understand the breakdown of their net pay.

5. Net Pay Calculation: Clearly display the calculated net pay, derived by subtracting total deductions from gross earnings. This provides a readily understandable figure representing take-home pay. Ensure accurate calculation and clear presentation of this crucial figure.

6. Year-to-Date Summaries: Include year-to-date totals for gross earnings and each deduction type. This cumulative information is essential for tax reporting and financial planning. Accurate year-to-date tracking facilitates accurate tax filing and informed financial decisions.

7. Contact Information: Provide contact information for payroll inquiries. This typically includes a phone number, email address, and mailing address for the payroll department or relevant personnel. Accessible contact information promotes transparency and facilitates prompt resolution of inquiries.

8. Choose a Format: Select an appropriate format, considering accessibility and integration with existing payroll systems. Options include spreadsheet software, dedicated payroll software, or printable PDF forms. The chosen format should support accurate calculations, secure data storage, and efficient record-keeping. Consider long-term storage and retrieval needs when selecting a format.

A meticulously crafted template, encompassing these key components, establishes a robust foundation for accurate payroll processing, transparent record-keeping, and legal compliance. Regular review and updates ensure ongoing adherence to evolving regulations and best practices.

Accurate and comprehensive payroll documentation is paramount for both employers and employees. Standardized templates provide a structured framework for recording earnings, deductions, and net pay, ensuring transparency and facilitating compliance with legal and regulatory requirements. Key components, such as detailed earnings breakdowns, itemized deductions, and year-to-date summaries, empower informed financial decisions and promote accountability. Meticulous record-keeping, supported by a well-designed template, minimizes disputes, simplifies audits, and fosters trust between employers and employees.

Effective management of compensation requires a commitment to accuracy, transparency, and ongoing adherence to evolving legal and industry best practices. Leveraging structured documentation, organizations can streamline payroll processes, promote financial well-being, and cultivate a positive and compliant work environment. A thorough understanding of these principles empowers stakeholders to navigate the complexities of compensation and contribute to a more robust and equitable financial ecosystem.