This structured approach to financial reporting forms a cornerstone for informed decision-making. The following sections delve into the specific components, best practices for utilization, and practical applications of this essential tool for financial management.

1. Standardized Format

A standardized format is fundamental to the efficacy of a statement of financial performance template. Consistency in structure and presentation ensures comparability, simplifies analysis, and promotes transparency. This standardization allows stakeholders to readily interpret financial data and draw meaningful conclusions.

- Uniformity of Line ItemsConsistent use of predefined line items, such as revenue, cost of goods sold, and operating expenses, ensures that financial information is presented in a predictable and easily understood manner. This uniformity facilitates comparisons across different reporting periods and against industry benchmarks. For example, consistently categorizing marketing expenses allows for accurate tracking and analysis of marketing ROI over time.

- Consistent Calculation MethodsStandardized calculation methods for key metrics, such as gross profit and net income, eliminate ambiguity and ensure accuracy. This consistency is crucial for reliable trend analysis and performance evaluation. Using a consistent formula for calculating depreciation expense, for instance, ensures comparability across reporting periods and avoids misleading fluctuations in profitability.

- Prescribed Reporting PeriodsAdhering to standardized reporting periods, whether monthly, quarterly, or annually, allows for meaningful comparisons over time and against competitors. Regular reporting intervals facilitate timely identification of trends and enable proactive adjustments to strategy. For example, consistent quarterly reporting allows stakeholders to monitor seasonal variations in revenue and expenses.

- Defined TerminologyUsing consistent terminology throughout the statement avoids confusion and misinterpretations. Clearly defined terms ensure that all stakeholders understand the information presented. For instance, consistently using the term “operating income” as opposed to “earnings before interest and taxes (EBIT)” promotes clarity and understanding.

These elements of a standardized format contribute significantly to the value of a statement of financial performance template. By ensuring consistency, comparability, and transparency, the standardized format empowers stakeholders to make informed decisions based on reliable financial data. This consistent framework enhances the utility of the statement as a tool for performance evaluation, strategic planning, and investor communication.

2. Clear Data Presentation

Clear data presentation is essential for effective communication of financial performance. A well-designed statement of financial performance template facilitates clear presentation by providing a structured framework for organizing and displaying financial data. This structure ensures that information is presented logically and consistently, enabling stakeholders to quickly grasp key financial metrics and trends. Without a clear presentation, even accurate data can be misinterpreted, leading to poor decision-making. For example, presenting revenue and expenses in a cluttered or disorganized manner can obscure profitability trends and hinder effective performance analysis.

Several factors contribute to clear data presentation within a financial statement template. Logical grouping of related items, such as categorizing expenses by function (e.g., marketing, administrative), improves readability and comprehension. Consistent formatting, including the use of clear labels, appropriate units of measurement, and consistent decimal places, enhances clarity and reduces the risk of misinterpretation. Visual aids, such as charts and graphs, can further enhance understanding, particularly for complex data sets. Consider a company comparing sales performance across different product lines. A clearly formatted table within the statement can present the sales figures for each product line, while a bar chart can visually highlight the relative performance of each product, facilitating rapid identification of top performers and areas needing attention.

Clear data presentation within a statement of financial performance template directly impacts the ability of stakeholders to understand and utilize the information effectively. It facilitates informed decision-making by enabling stakeholders to quickly assess financial health, identify trends, and evaluate performance. Furthermore, clear presentation enhances transparency and builds trust with investors and other stakeholders. Challenges in achieving clear presentation can arise from complex data sets, inconsistent data sources, or inadequate reporting tools. Overcoming these challenges requires careful planning, data validation, and the selection of appropriate reporting formats within the template structure. This ultimately supports the broader goal of providing accurate, accessible, and actionable financial information for strategic decision-making.

3. Comparative Analysis Enabled

Comparative analysis is integral to financial assessment, providing context and insights beyond standalone figures. A statement of financial performance template, through its standardized structure, facilitates this crucial comparative analysis. By providing a consistent framework for presenting financial data across different periods or against industry benchmarks, the template empowers stakeholders to identify trends, evaluate performance, and make informed decisions. Without this structured approach, comparisons become difficult, potentially obscuring critical insights into financial health and progress.

- Trend AnalysisExamining performance over multiple reporting periods reveals trends in key metrics such as revenue growth, expense management, and profitability. A statement of financial performance template enables this analysis by presenting historical data in a consistent format. For instance, comparing quarterly revenue figures over several years reveals seasonal patterns and long-term growth trajectories. Identifying such trends allows for proactive adjustments to business strategies, resource allocation, and operational efficiency.

- BenchmarkingComparing performance against industry averages or competitors provides valuable context for evaluating relative financial standing. A standardized template facilitates this benchmarking by enabling direct comparisons of key metrics. For example, comparing a company’s profit margin to the industry average can highlight areas of strength or weakness, informing strategic decisions to improve competitiveness. This external comparison adds another layer of understanding beyond internal trend analysis.

- Variance AnalysisAnalyzing variances between actual results and budgeted or projected figures helps identify areas of overperformance or underperformance. A statement of financial performance template, particularly when used in conjunction with budgeting tools, facilitates variance analysis by presenting actual and budgeted figures side-by-side. For instance, if actual marketing expenses significantly exceed the budget, this variance highlights the need for further investigation and potential corrective action. Understanding these variances provides valuable insights into operational efficiency and cost control.

- Ratio AnalysisCalculating and comparing financial ratios, such as profitability ratios, liquidity ratios, and solvency ratios, provides a comprehensive view of financial health and stability. The data organized within a statement of financial performance template serves as the foundation for these calculations. For example, comparing a company’s current ratio to previous periods or industry benchmarks assesses its ability to meet short-term obligations. Ratio analysis, enabled by the structured data within the template, offers deeper insights into financial performance and risk.

The comparative analysis enabled by a well-structured statement of financial performance template is essential for informed decision-making. By facilitating trend analysis, benchmarking, variance analysis, and ratio analysis, the template empowers stakeholders to gain a comprehensive understanding of financial performance, identify areas for improvement, and develop strategies for future growth and stability. It transforms raw financial data into actionable insights, crucial for navigating the complexities of the business environment.

4. Performance Evaluation

Performance evaluation relies heavily on the structured data provided by a statement of financial performance template. The template serves as a foundation for assessing financial health, identifying trends, and measuring progress toward strategic goals. This structured presentation of financial data enables objective analysis and facilitates informed decision-making regarding resource allocation, operational efficiency, and future strategies. Without a standardized template, performance evaluation becomes subjective and prone to inconsistencies, hindering effective strategic planning and resource management. For example, a company aiming to increase revenue by 10% can use the template to track actual revenue growth against this target, enabling timely adjustments to marketing strategies or sales operations if performance deviates from the plan. A consistent structure for reporting revenue figures is essential for accurate performance measurement against this objective.

The statement of financial performance template provides the quantitative basis for evaluating various aspects of performance. Profitability analysis, facilitated by the template’s presentation of revenue and expenses, assesses the effectiveness of pricing strategies, cost control measures, and operational efficiency. For instance, declining profit margins, as revealed by the template, might indicate pricing pressures, rising input costs, or inefficiencies in production processes, prompting management to investigate and implement corrective actions. Similarly, analysis of revenue trends, enabled by the consistent reporting of sales figures within the template, reveals market share gains or losses, customer behavior shifts, or the effectiveness of new product launches. Cash flow analysis, utilizing the templates data on operating cash inflows and outflows, evaluates the efficiency of working capital management and the ability to generate sufficient cash to meet operational needs and investment requirements. For example, consistently negative cash flow from operations, revealed by the template, signals potential liquidity issues and the need for improved cash flow management practices.

Effective performance evaluation, enabled by the statement of financial performance template, is crucial for organizational success. It provides the necessary insights to identify areas of strength, diagnose weaknesses, and implement corrective actions. This process of continuous monitoring and evaluation, facilitated by the template, fosters a culture of accountability and drives continuous improvement. However, challenges such as data integrity, the complexity of financial metrics, and the need for effective analytical tools must be addressed to maximize the value of performance evaluation. Overcoming these challenges through robust data management practices, appropriate metric selection, and effective utilization of analytical tools empowers organizations to leverage the full potential of the statement of financial performance template for informed decision-making and sustainable growth. By providing a consistent framework for capturing, analyzing, and interpreting financial data, the template becomes a cornerstone of effective performance management, driving strategic alignment and enhancing organizational performance.

5. Informed Decision-Making

Informed decision-making represents the culmination of financial analysis and interpretation, relying heavily on the structured insights provided by a statement of financial performance template. The template’s organized presentation of financial data empowers stakeholders to move beyond raw numbers and discern underlying trends, evaluate performance against benchmarks, and ultimately, make sound judgments regarding resource allocation, strategic direction, and operational adjustments. Without this structured framework, decision-making risks becoming reactive and based on incomplete or misinterpreted information, potentially leading to suboptimal outcomes. Consider a scenario where a company is contemplating a new product launch. A statement of financial performance template, presenting historical revenue and expense data for existing product lines, provides critical insights into potential profitability, market demand, and resource requirements for the new venture. This informed perspective enables data-driven decisions regarding pricing, marketing strategies, and production capacity, maximizing the chances of a successful launch. Conversely, relying solely on intuition or incomplete data could lead to misaligned resource allocation and ultimately, product failure.

The connection between informed decision-making and the statement of financial performance template manifests in several practical applications. Investment decisions benefit significantly from the templates clear presentation of profitability, cash flow, and financial stability, allowing investors to assess risk and potential returns more accurately. Operational adjustments become more targeted and effective when based on the templates insights into cost structures, revenue streams, and operational efficiency. Strategic planning gains precision and foresight by leveraging the template’s historical data and trend analysis for forecasting future performance and identifying growth opportunities. For example, a company experiencing declining profitability in a specific product segment can utilize the template’s detailed breakdown of revenue and expenses to identify the root causes. This informed analysis might reveal increasing raw material costs, declining sales volume, or ineffective marketing campaigns, enabling targeted interventions such as price adjustments, cost reduction initiatives, or revised marketing strategies.

Understanding the crucial link between informed decision-making and the statement of financial performance template is essential for maximizing organizational effectiveness. While the template provides the crucial framework, challenges such as data quality, interpretation biases, and the need for robust analytical skills must be addressed. Organizations must prioritize data integrity, foster analytical expertise, and cultivate a culture of data-driven decision-making to fully leverage the power of the template. By integrating these elements, the statement of financial performance template becomes a powerful tool for navigating the complexities of the business environment, enabling informed decisions that drive sustainable growth and long-term success. This understanding transforms the template from a mere reporting mechanism into a strategic asset, empowering organizations to proactively shape their future based on a clear and comprehensive understanding of their financial performance.

Key Components of a Statement of Financial Performance Template

A robust template requires several key components for accurate and comprehensive financial reporting. These elements ensure clarity, consistency, and comparability, facilitating informed decision-making.

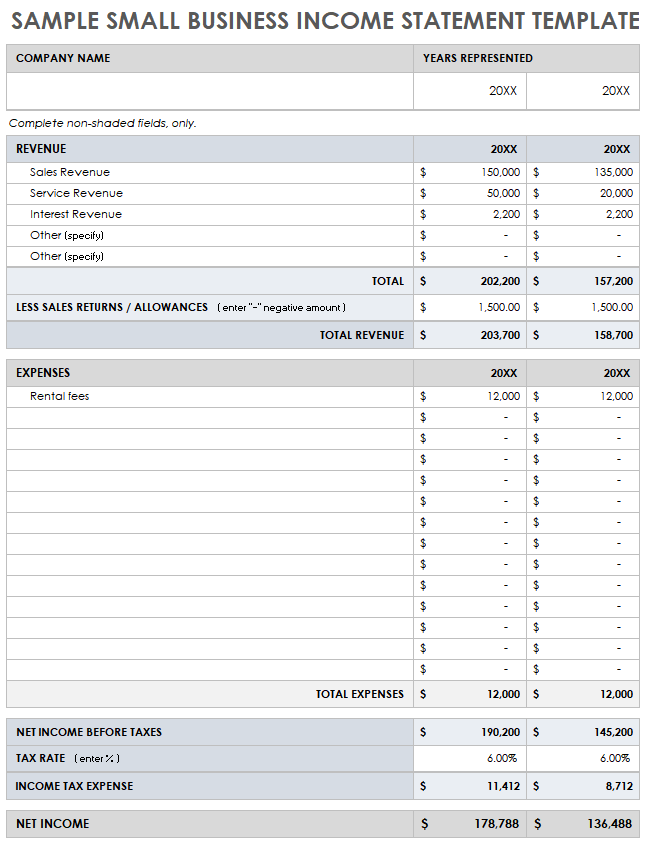

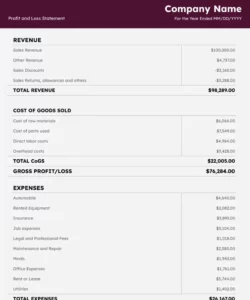

1. Revenue: This section details all income generated from primary business activities. It typically includes sales of goods or services, and may be further categorized by product line, geographic region, or customer segment. Accurate revenue recognition is crucial for assessing financial performance.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods sold. This includes raw materials, direct labor, and manufacturing overhead. Accurate COGS calculation is essential for determining gross profit.

3. Gross Profit: Calculated as Revenue minus COGS, gross profit represents the profitability of core business operations before considering operating expenses. This metric provides insights into pricing strategies and production efficiency.

4. Operating Expenses: This section encompasses all expenses incurred in running the business, excluding COGS. These expenses are often categorized by function, such as selling, general, and administrative expenses (SG&A), research and development (R&D), and marketing. Careful tracking and analysis of operating expenses are crucial for cost control and efficiency.

5. Operating Income: Calculated as Gross Profit minus Operating Expenses, operating income reflects the profitability of the business after accounting for all operating costs. This metric provides a clear picture of core business performance.

6. Other Income/Expenses: This section captures income or expenses not directly related to core business operations. Examples include interest income, investment gains or losses, and gains or losses from the sale of assets. These items provide a comprehensive view of financial performance beyond core operations.

7. Income Before Taxes: This represents the company’s earnings before accounting for income tax expense. It provides a measure of profitability before considering the impact of tax obligations.

8. Income Tax Expense: This reflects the expense associated with income taxes. Accurate calculation of income tax expense is essential for determining net income.

9. Net Income: This bottom-line figure represents the company’s profit after all expenses, including taxes, have been deducted. Net income is a key indicator of overall financial performance and profitability.

These components, when presented within a structured template, provide a comprehensive overview of financial performance. This structured approach facilitates analysis, comparison, and ultimately, informed decision-making.

How to Create a Statement of Financial Performance Template

Creating a robust template involves several key steps. A well-structured template ensures data consistency, facilitates analysis, and enhances the transparency of financial reporting. The following steps outline the process of developing an effective statement of financial performance template.

1. Define the Reporting Period: Establish the timeframe for the statement, whether monthly, quarterly, or annually. Consistent reporting periods facilitate trend analysis and comparisons.

2. Determine Key Performance Indicators (KPIs): Identify the most relevant financial metrics to track, including revenue, cost of goods sold, operating expenses, and net income. Selecting appropriate KPIs ensures the statement provides meaningful insights into performance.

3. Establish a Standardized Format: Create a consistent structure for presenting data. This includes defining line items, calculation methods, and terminology. Standardization promotes clarity and comparability.

4. Choose a Suitable Software or Tool: Select a spreadsheet program, accounting software, or dedicated financial reporting tool to create the template. The chosen tool should support the required calculations and formatting options.

5. Input Formulas and Automated Calculations: Utilize formulas and functions within the chosen software to automate calculations of key metrics, such as gross profit, operating income, and net income. Automation reduces the risk of errors and improves efficiency.

6. Design for Clarity and Readability: Format the template for clear data presentation. Use clear labels, consistent formatting, and appropriate units of measurement. Consider incorporating visual aids, such as charts and graphs, to enhance understanding.

7. Implement Data Validation and Control Measures: Establish data validation rules and control procedures to ensure data accuracy and integrity. Data validation minimizes errors and enhances the reliability of the statement.

8. Regularly Review and Update: Periodically review the template to ensure it remains aligned with reporting requirements and evolving business needs. Regular updates maintain the templates relevance and effectiveness.

A well-designed template streamlines financial reporting, enabling stakeholders to analyze performance, identify trends, and make data-driven decisions. Regular review and updates ensure ongoing relevance and accuracy. Implementing these steps contributes to the creation of a robust and valuable tool for financial management and communication.

A statement of financial performance template provides a crucial framework for organizing, presenting, and interpreting financial data. Its standardized structure enables consistent reporting, facilitates comparative analysis across periods and against benchmarks, and empowers stakeholders to evaluate performance objectively. From revenue recognition and expense categorization to the calculation of key profitability metrics, the template ensures clarity, accuracy, and comparability, fostering informed decision-making across all organizational levels. Its components, from revenue and cost of goods sold to net income, offer a comprehensive view of financial health, enabling effective monitoring of progress towards strategic goals. Furthermore, the process of creating and implementing such a template, from defining reporting periods and key performance indicators to establishing data validation measures, reinforces a commitment to data integrity and robust financial management. Ultimately, mastering this structured approach to financial reporting equips organizations with the insights necessary for sustainable growth and long-term success.

Effective utilization of a statement of financial performance template represents a commitment to financial transparency and accountability. It empowers organizations to move beyond reactive decision-making based on gut feelings and embrace data-driven strategies grounded in objective analysis. By providing a clear and consistent view of financial performance, this structured approach facilitates proactive identification of opportunities and challenges, enabling timely adjustments to optimize resource allocation, enhance operational efficiency, and navigate the complexities of the business environment. In an increasingly data-centric world, embracing this structured approach to financial reporting is not merely a best practiceit is a necessity for organizations seeking to thrive and achieve long-term sustainability.