Utilizing a structured framework for financial reporting offers several advantages. It allows for easy comparison of financial data across different periods, enabling trend identification and informed decision-making. A standardized format simplifies the process of financial analysis for stakeholders, including investors, lenders, and management. Furthermore, such a structure can assist in budgeting and forecasting, promoting better financial control and stability.

The following sections will delve into the specific components of these frameworks, exploring best practices for their creation and utilization, and examining how they can be adapted for various contexts, from personal finance to business management.

1. Standardized Format

Standardized formatting is a cornerstone of effective financial reporting, providing a consistent structure for presenting financial data within a statement of income and expenses. This consistency is crucial for comparability, analysis, and informed decision-making.

- Uniformity Across Reporting PeriodsConsistent formatting ensures data comparability across different reporting periods, whether monthly, quarterly, or annually. This allows for trend analysis, performance evaluation, and the identification of potential issues or opportunities. For example, consistent placement of revenue and expense categories facilitates year-over-year comparisons, revealing growth patterns or declines.

- Simplified Interpretation for StakeholdersA standardized format simplifies the interpretation of financial data for all stakeholders, including investors, lenders, and management. By presenting information in a familiar and predictable structure, it reduces the cognitive load required for analysis and promotes clear communication. A standardized template ensures that all parties can quickly locate and understand key financial metrics.

- Reduced Errors and Improved AccuracyStandardized templates often incorporate formulas and automated calculations, reducing the risk of manual errors and improving the accuracy of financial reports. This automation streamlines the reporting process and frees up time for analysis and strategic planning. Pre-built formulas for calculating net income or profit margins minimize the potential for human error.

- Enhanced Efficiency and Streamlined ProcessesUsing a standardized format streamlines the process of data entry and report generation. This increased efficiency saves time and resources, allowing organizations to focus on higher-value activities such as financial analysis and strategic decision-making. Pre-formatted templates eliminate the need to recreate the structure for each reporting period.

These facets of standardized formatting contribute significantly to the overall effectiveness and utility of a statement of income and expenses. By ensuring consistency, clarity, and accuracy, standardized templates empower stakeholders to make informed decisions based on reliable financial data. This ultimately contributes to better financial management and improved outcomes.

2. Categorized Income

Categorizing income is essential for a comprehensive and insightful statement of income and expenses. Clear categorization provides a granular view of revenue streams, enabling accurate tracking, analysis, and informed financial decision-making. This structured approach clarifies the origins of funds, facilitating the identification of profitable activities and areas requiring attention. For instance, a business might categorize income by product line, service offering, or geographic region. This allows for the assessment of each segment’s contribution to overall revenue and informs strategic resource allocation.

The benefits of categorized income extend beyond basic tracking. It provides the foundation for meaningful financial analysis. By understanding the composition of income, organizations can identify trends, evaluate performance against benchmarks, and project future earnings. For example, a non-profit organization might categorize income by donation source, such as individual contributions, grants, or fundraising events. This detailed breakdown facilitates targeted fundraising strategies and demonstrates the impact of various initiatives. Furthermore, categorized income is crucial for accurate tax reporting, ensuring compliance and minimizing potential liabilities. Proper categorization facilitates the identification of applicable deductions and credits, optimizing tax strategies.

In conclusion, categorized income is integral to a robust statement of income and expenses. Its importance lies in providing detailed insights into revenue streams, enabling informed decision-making, supporting accurate financial analysis, and ensuring compliance. Challenges can arise from inconsistent categorization or a lack of clearly defined categories. Addressing these challenges through standardized practices and regular review ensures the ongoing accuracy and utility of financial reporting, contributing to effective financial management and long-term stability.

3. Itemized Expenses

Itemized expenses are a crucial component of a comprehensive statement of income and expenses template. A detailed breakdown of expenditures provides essential insights into the cost structure of an organization or individual, enabling effective financial management, informed decision-making, and accurate reporting. Without itemization, the template loses its analytical power, reducing its utility for evaluating performance, identifying areas for cost optimization, and projecting future financial outcomes.

The connection between itemized expenses and the template is one of fundamental interdependence. The template provides the structured framework for organizing and presenting financial data, while itemized expenses populate this framework with granular detail. This interplay allows for a nuanced understanding of where funds are being allocated. For instance, a business can analyze itemized expenses to identify trends in operating costs, assess the return on investment for specific projects, or pinpoint areas of potential overspending. A household might use itemized expenses to track spending habits, identify opportunities for budgeting improvements, and make informed decisions about major purchases. Without this level of detail, financial analysis becomes superficial and less actionable.

Accurate and comprehensive itemization is crucial for several reasons. It provides the basis for data-driven decision-making, allowing stakeholders to allocate resources strategically and identify areas for improvement. Furthermore, detailed expense tracking is essential for accurate tax reporting and compliance. Challenges in maintaining accurate records, such as inconsistent categorization or inadequate documentation, can hinder the effectiveness of the entire financial reporting process. Therefore, establishing clear guidelines for expense tracking and ensuring consistent adherence are crucial for maximizing the value of the statement of income and expenses template and achieving sound financial management.

4. Period-Specific Reporting

Period-specific reporting is integral to the utility of a statement of income and expenses template. Defining a specific timeframe, whether a month, quarter, or year, provides the context necessary for meaningful financial analysis. This temporal constraint allows for the accurate tracking of income and expenses within a defined period, enabling comparisons across periods and the identification of trends. Without this specificity, the data becomes aggregated and loses its analytical value for assessing performance, identifying fluctuations, and making informed projections.

The relationship between period-specific reporting and the template is one of essential synergy. The template provides the structural framework for organizing financial data, while the specified reporting period dictates the scope and relevance of that data. For example, a quarterly income statement provides insights into financial performance over three months, allowing businesses to assess short-term trends and make necessary adjustments. An annual statement offers a broader perspective, enabling year-over-year comparisons and long-term strategic planning. A household might use monthly reporting to track budgeting adherence and identify recurring expenses, while annual reporting facilitates tax preparation and long-term financial goal setting. The chosen reporting period directly influences the insights derived from the template.

The practical significance of period-specific reporting lies in its ability to facilitate informed decision-making. By analyzing financial data within defined timeframes, stakeholders can identify areas of strength and weakness, track progress towards goals, and adapt strategies as needed. Challenges can arise from inconsistent reporting periods or a lack of standardized timeframes. Consistent adherence to defined reporting periods ensures data comparability and maximizes the analytical power of the statement of income and expenses template. This rigor contributes to more effective financial management, informed resource allocation, and improved long-term outcomes.

5. Facilitates Analysis

A primary purpose of a statement of income and expenses template is to facilitate analysis. The organized structure and detailed categorization inherent in these templates provide the foundation for meaningful interpretation of financial data. This analysis is crucial for informed decision-making, performance evaluation, and strategic planning across various contexts, from personal finance to complex business operations.

- Performance EvaluationTemplates enable performance evaluation by providing a clear comparison of income and expenses over specific periods. This allows for the identification of trends, such as increasing revenue or rising costs. For example, a business can analyze monthly statements to assess sales growth or identify areas where expenses consistently exceed budget. This analysis informs strategic adjustments to maximize profitability and ensure financial stability. Similarly, individuals can use personal finance templates to track spending habits and evaluate progress towards financial goals.

- Trend IdentificationConsistent use of a template over time allows for the identification of financial trends. By comparing data across multiple reporting periods, stakeholders can discern patterns in income and expenses, providing valuable insights for forecasting and planning. A business might observe seasonal fluctuations in sales, informing inventory management and marketing strategies. Individuals tracking personal expenses might identify recurring monthly costs, enabling more effective budgeting and spending decisions. This ability to identify trends is crucial for proactive financial management.

- Benchmarking and ComparisonTemplates facilitate benchmarking and comparison by providing a standardized format for presenting financial data. This allows for comparison against industry averages, competitor performance, or internal targets. Businesses can use industry benchmarks to assess their financial health and identify areas for improvement. Individuals can compare their spending patterns to national averages to assess their financial standing. This comparative analysis provides valuable context for evaluating performance and identifying areas for optimization.

- Informed Decision-MakingUltimately, the analysis facilitated by a statement of income and expenses template supports informed decision-making. By providing a clear understanding of financial performance, these templates empower stakeholders to make strategic choices regarding resource allocation, cost management, and future investments. A business might use financial analysis to justify expansion plans or identify areas for cost reduction. Individuals might use personal finance analysis to make informed decisions about major purchases, investments, or retirement planning. The insights derived from the template directly contribute to improved financial outcomes.

These interconnected facets of analysis demonstrate the crucial role of a well-structured statement of income and expenses template in facilitating informed financial management. The template’s ability to support performance evaluation, trend identification, benchmarking, and ultimately, informed decision-making, underscores its value across a wide range of financial contexts. By providing a framework for organizing and interpreting financial data, these templates empower individuals and organizations to achieve their financial objectives.

6. Supports Decision-Making

A well-maintained statement of income and expenses template provides crucial data that directly supports informed financial decision-making. The template’s structured presentation of income and expenses allows stakeholders to gain a clear understanding of financial performance, identify trends, and evaluate the impact of various financial strategies. This informed perspective empowers effective resource allocation, risk management, and the pursuit of financial objectives.

- Strategic PlanningFinancial data derived from the template informs strategic planning processes. Analysis of income streams, expense trends, and profitability metrics provides insights essential for developing realistic budgets, setting achievable targets, and making informed decisions regarding investments, expansion, or diversification. For example, a business might use historical data from the template to project future revenue and allocate resources accordingly. Non-profit organizations might analyze program expenses to determine the most effective allocation of funds for maximum impact.

- Risk ManagementThe template supports risk management by providing a clear view of financial vulnerabilities and opportunities. By analyzing expense trends and identifying potential cost overruns, organizations can mitigate financial risks and develop contingency plans. For instance, a business might observe increasing material costs and explore alternative suppliers or adjust pricing strategies to maintain profitability. Individuals can use personal finance templates to identify areas of excessive spending and adjust budgeting practices to mitigate the risk of debt accumulation.

- Performance OptimizationRegular review of the statement of income and expenses allows for performance optimization. By analyzing income streams and identifying high-performing areas, organizations can allocate resources strategically to maximize revenue generation. Similarly, analysis of expenses can reveal opportunities for cost reduction and efficiency improvements. A business might identify underperforming product lines and adjust marketing strategies or discontinue production. Individuals can use personal finance templates to identify areas where spending can be reduced to achieve savings goals.

- Adaptive StrategiesThe dynamic nature of financial environments requires adaptive strategies. A statement of income and expenses template provides the data necessary for ongoing monitoring and adjustment of financial plans. By tracking actual performance against projected figures, stakeholders can identify deviations and implement corrective actions. A business experiencing unexpected market fluctuations can use the template data to adjust pricing, marketing, or production strategies to maintain profitability. Individuals facing unforeseen expenses can revise budgeting plans to accommodate changing circumstances.

The ability to support informed decision-making across these diverse areas underscores the critical role of a statement of income and expenses template in effective financial management. By providing a clear, organized, and readily analyzable overview of financial performance, the template empowers stakeholders to make strategic choices, mitigate risks, optimize performance, and adapt to evolving financial landscapes, ultimately contributing to financial stability and success.

Key Components of a Statement of Income and Expenses Template

Essential components comprise a robust and informative statement of income and expenses template. These components work together to provide a comprehensive financial overview, facilitating analysis, decision-making, and ultimately, sound financial management.

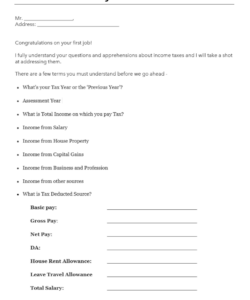

1. Reporting Period: A clearly defined reporting period establishes the timeframe for the financial data presented. This period, whether a month, quarter, or year, provides the necessary context for meaningful analysis and comparison.

2. Revenue Streams: Categorized revenue streams offer detailed insights into the various sources of income. Clear categorization enables tracking of performance across different revenue channels and informs strategic resource allocation.

3. Cost of Goods Sold (COGS): For businesses selling products, COGS represents the direct costs associated with producing those goods. Accurate COGS calculation is crucial for determining gross profit margins.

4. Operating Expenses: Detailed categorization of operating expenses, such as rent, utilities, salaries, and marketing, provides insights into the cost structure of an organization or individual. This detailed breakdown enables identification of areas for potential cost optimization.

5. Non-Operating Income and Expenses: These entries capture income and expenses unrelated to core business operations, such as interest income, investment gains or losses, and one-time expenses. Their inclusion provides a more comprehensive view of overall financial performance.

6. Net Income/Loss: Calculated as the difference between total revenues and total expenses, net income or loss represents the overall profitability or deficit for the reporting period. This key metric serves as a crucial indicator of financial health.

7. Depreciation and Amortization: These non-cash expenses account for the decrease in value of assets over time. Their inclusion provides a more accurate representation of long-term profitability.

These components, when accurately recorded and presented within a structured template, facilitate clear financial analysis, enabling stakeholders to make data-driven decisions, optimize resource allocation, and achieve financial objectives. Careful attention to each component ensures the templates effectiveness as a tool for sound financial management.

How to Create a Statement of Income and Expenses Template

Creating a robust template requires careful consideration of key elements and adherence to established accounting principles. A well-structured template facilitates accurate financial reporting, analysis, and informed decision-making.

1. Define the Reporting Period: Specify the timeframe covered by the template, such as a month, quarter, or year. Consistent reporting periods are crucial for accurate trend analysis and comparisons.

2. Structure Income Categories: Establish clear categories for different revenue streams. Categorization should align with the specific nature of the business or individual’s financial activities. Examples include sales revenue, investment income, or donations.

3. Detail Expense Categories: Create a comprehensive list of expense categories relevant to the organization or individual. Common categories include operating expenses (rent, utilities, salaries), cost of goods sold (COGS), and non-operating expenses (interest, taxes).

4. Incorporate Calculations: Include formulas and automated calculations within the template to ensure accuracy and efficiency. Calculations such as gross profit (revenue – COGS), net income (total revenue – total expenses), and profit margins should be integrated.

5. Design for Clarity and Readability: Use a clear and consistent format for presenting information. Proper labeling, clear headings, and visually distinct sections enhance readability and comprehension. Consider using a spreadsheet program for easy data entry and manipulation.

6. Ensure Accuracy and Consistency: Implement data validation procedures to minimize errors and ensure data integrity. Regularly review and reconcile the template against supporting financial documentation.

7. Adapt to Specific Needs: Tailor the template to the specific requirements of the user. A business template might include detailed COGS calculations, while a personal finance template might focus on budgeting categories and savings goals. Consider consulting with a financial professional for guidance.

A well-designed template provides a structured framework for capturing and analyzing financial data, enabling informed financial management and supporting strategic decision-making. Regular review and refinement of the template ensure its ongoing relevance and effectiveness.

Accurate financial reporting is fundamental to sound financial management. A structured approach, facilitated by a statement of income and expenses template, provides the necessary framework for organizing, analyzing, and interpreting financial data. From detailed categorization of income and expenses to period-specific reporting and automated calculations, these templates empower stakeholders to gain a comprehensive understanding of financial performance, identify trends, and make informed decisions. Standardized formatting ensures consistency and comparability, while built-in formulas enhance accuracy and efficiency.

Effective utilization of these templates requires diligent maintenance, accurate data entry, and regular review. The insights derived from a well-maintained template inform strategic planning, risk management, and performance optimization. Ultimately, the consistent application of a robust template contributes to financial stability, informed decision-making, and the achievement of financial objectives, regardless of the scale or complexity of the financial context.