1. Beginning Retained Earnings

Beginning retained earnings represent the accumulated profits a company has held onto from previous periods. Within the structure of a statement of retained earnings, this figure serves as the foundation upon which current period activity is built, providing crucial context for understanding changes in a company’s financial position. A thorough grasp of this initial value is essential for accurate financial analysis.

- Cumulative NatureBeginning retained earnings reflect the cumulative impact of all past income, losses, and dividend distributions. This cumulative perspective underscores the importance of consistently applying accounting principles across reporting periods to ensure accuracy. For example, a company consistently profitable over several years will likely exhibit a growing beginning retained earnings balance.

- Impact on Current Period ReportingThe beginning retained earnings balance directly impacts the ending retained earnings calculation. Current period net income or loss is added to, and dividends are subtracted from, this beginning balance. Therefore, an accurate starting point is crucial for a reliable representation of a company’s financial performance during the reporting period. A significant prior period loss could, for example, offset a strong current period profit.

- Link to Prior Period StatementsThe beginning retained earnings figure for a given period should match the ending retained earnings figure from the preceding period. This linkage reinforces the continuous nature of financial reporting and provides an audit trail for verifying accuracy. Discrepancies would signal potential errors requiring investigation.

- Analysis and InterpretationAnalyzing trends in beginning retained earnings provides insights into a company’s long-term profitability and dividend policies. Consistent growth suggests sustained profitability and potential for future investment. Conversely, declining balances may indicate financial difficulties or a shift in dividend policy. Comparing these trends against industry benchmarks offers further context.

Understanding beginning retained earnings is essential for interpreting the full statement of retained earnings and gaining a comprehensive understanding of a company’s financial health and performance. By considering its cumulative nature, impact on current period reporting, link to prior periods, and implications for analysis, stakeholders can gain valuable insights into a company’s financial trajectory.

2. Net Income/Loss

Net income/loss plays a pivotal role in the statement of retained earnings, representing the profit or loss generated during a specific accounting period. This figure directly impacts the change in retained earnings, reflecting the company’s core operating performance and its ability to generate earnings. A thorough understanding of net income/loss is crucial for interpreting a company’s financial health and its potential for future growth.

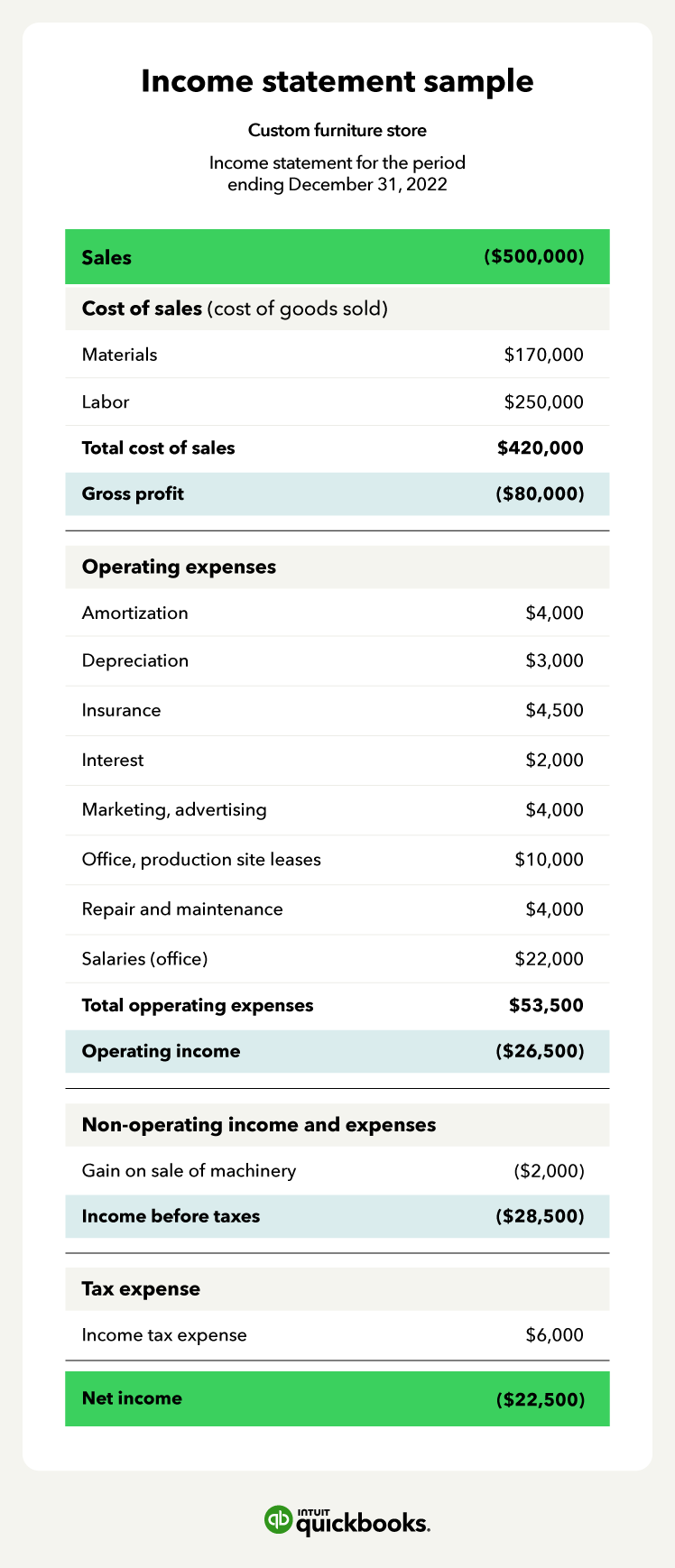

- Calculation and DerivationNet income/loss is derived by subtracting total expenses from total revenues. This figure summarizes the overall profitability of a company’s operations after all costs have been considered. A positive net income increases retained earnings, while a net loss decreases them. For example, a company with $200,000 in revenue and $150,000 in expenses reports a net income of $50,000, which increases retained earnings.

- Impact on Retained EarningsThe net income/loss figure directly adjusts the beginning retained earnings balance. A profitable period increases retained earnings, enhancing the company’s ability to reinvest profits, pay dividends, or weather future financial challenges. Conversely, a net loss reduces retained earnings, potentially limiting these options. Continued losses can deplete retained earnings, raising concerns about financial stability.

- Relationship to Other Financial StatementsNet income/loss flows from the income statement to the statement of retained earnings, demonstrating the interconnectedness of financial reporting. This flow highlights how operational performance, reflected in the income statement, directly impacts a company’s accumulated profits. The ending retained earnings balance then carries over to the balance sheet, further illustrating the integrated nature of financial statements.

- Analysis and InterpretationAnalyzing trends in net income/loss provides valuable insights into a company’s operational efficiency and profitability over time. Consistent profitability indicates sound financial management and growth potential. Conversely, declining or fluctuating net income may signal operational challenges or market volatility requiring further investigation. Comparing net income/loss figures to industry averages offers valuable context for assessing performance.

The net income/loss figure provides a crucial link between a company’s operational performance and its overall financial position as reflected in the statement of retained earnings. By understanding how net income/loss is calculated, its impact on retained earnings, its relationship to other financial statements, and its implications for analysis, stakeholders can gain a deeper understanding of a company’s financial health and prospects.

3. Dividends

Dividends represent a distribution of a company’s earnings to its shareholders. Within the context of the statement of retained earnings, dividends signify a reduction of accumulated profits. Understanding the implications of dividend payments is crucial for interpreting a company’s financial decisions and their impact on retained earnings.

- Types of DividendsDividends can take various forms, including cash, stock, or property. Cash dividends are the most common, representing direct cash payments to shareholders. Stock dividends involve distributing additional shares to existing shareholders, while property dividends involve distributing company assets. Each type impacts retained earnings differently, with cash dividends directly reducing the balance while stock dividends primarily affect the share structure.

- Impact on Retained EarningsDividend payments, specifically cash and property dividends, directly reduce retained earnings. This reduction represents a return of capital to investors, decreasing the company’s available resources for reinvestment or future growth. For example, a $20,000 cash dividend declared and paid reduces retained earnings by the same amount.

- Dividend PolicyA company’s dividend policy dictates how it distributes profits to shareholders. Some companies maintain a consistent dividend payout ratio, distributing a fixed percentage of earnings. Others prioritize reinvesting profits for growth, paying lower or no dividends. Understanding a company’s dividend policy provides insights into its financial priorities and long-term strategy. Consistent dividend payments can attract income-seeking investors, while a focus on reinvestment signals growth potential.

- Legal and Financial ConsiderationsDividend declarations require careful consideration of legal and financial constraints. Companies must have sufficient retained earnings and available cash to legally distribute dividends. Furthermore, the decision to distribute dividends impacts a company’s ability to reinvest profits for growth and expansion. A high dividend payout ratio can limit a company’s ability to fund internal projects or acquisitions, potentially hindering future growth.

Dividend payments represent a key component of the statement of retained earnings, reflecting a company’s decisions regarding the distribution of accumulated profits. By understanding the various types of dividends, their impact on retained earnings, the influence of dividend policy, and the associated legal and financial considerations, stakeholders can gain valuable insights into a company’s financial health and its strategic priorities.

4. Ending Retained Earnings

Ending retained earnings represents the cumulative profits a company has accumulated after accounting for net income or loss and dividend distributions during a specific period. Within the statement of retained earnings template, this figure serves as the culminating point, reflecting the net impact of all activities affecting retained earnings during the reporting period. The ending retained earnings balance is a crucial component for understanding a company’s financial position and its capacity for future investment and growth.

The calculation of ending retained earnings follows a structured process within the template. Beginning retained earnings are adjusted by the net income or loss for the period, and then dividend distributions are subtracted. This sequential process ensures a clear and transparent presentation of how the ending balance is derived. For example, if a company begins the year with $150,000 in retained earnings, earns a net income of $75,000, and distributes $25,000 in dividends, the ending retained earnings would be $200,000. This ending balance then becomes the beginning retained earnings for the subsequent period, creating a continuous chain of information across financial statements. The ending retained earnings figure is not merely a calculation; it signifies the residual profits available to the company after fulfilling shareholder distributions, reflecting its capacity for reinvestment in operations, debt reduction, or future expansion. This understanding provides stakeholders with insights into the company’s financial strength and potential for future growth.

A robust understanding of ending retained earnings is fundamental for financial analysis. Trends in ending retained earnings over time can reveal insights into a company’s profitability, dividend policy, and overall financial health. Consistent growth in retained earnings suggests sound financial management and the potential for sustained growth. Conversely, declining retained earnings may indicate operational challenges, excessive dividend payouts, or other financial difficulties. Analyzing ending retained earnings in conjunction with other financial metrics provides a comprehensive view of a company’s performance and its future prospects. Challenges in interpreting ending retained earnings can arise due to accounting complexities, changes in accounting standards, or unique industry circumstances. Therefore, careful consideration of these factors is essential for accurate and meaningful analysis. Understanding ending retained earnings within the context of the statement of retained earnings template provides essential insights into a company’s financial performance, its ability to reinvest profits, and its overall financial stability, contributing to a broader understanding of its long-term prospects.

5. Reporting Period

The reporting period defines the timeframe covered by a statement of retained earnings. This specified duration, whether a quarter, a year, or another designated length, provides the temporal context for analyzing changes in retained earnings. A clear understanding of the reporting period is fundamental for interpreting the information presented within the statement and drawing accurate conclusions about a company’s financial performance.

- Duration and FrequencyReporting periods can vary based on regulatory requirements, company policy, or analytical needs. Publicly traded companies typically report quarterly and annually, while privately held companies may have more flexible reporting schedules. The chosen duration influences the magnitude of changes observed in retained earnings. Shorter periods, such as quarters, provide more granular insights into recent performance, while annual reports offer a broader perspective on yearly trends.

- Comparability and ConsistencyConsistent reporting periods facilitate meaningful comparisons of financial performance over time. Using consistent durations allows for the identification of trends and the assessment of a company’s progress in managing retained earnings. Changing the reporting period can distort comparisons and hinder the accurate assessment of financial health. For example, comparing a quarterly statement to an annual statement can lead to misleading conclusions due to the difference in timeframes.

- Impact on Financial AnalysisThe reporting period directly impacts the interpretation of key financial metrics derived from the statement of retained earnings. Metrics such as earnings per share and return on equity are calculated based on the reporting period’s net income and ending retained earnings. Therefore, understanding the reporting period’s length is essential for accurately interpreting these metrics and comparing them across different companies or timeframes. Analyzing short-term fluctuations versus long-term trends requires consideration of the chosen reporting period.

- Relationship to Other Financial StatementsThe reporting period aligns across all financial statements the income statement, balance sheet, and statement of cash flows ensuring consistency and allowing for a comprehensive view of a company’s financial position during the specified timeframe. The ending retained earnings balance from the statement of retained earnings for a specific period flows directly to the balance sheet for the same period, demonstrating the interconnectedness of financial reporting. This linkage enables a holistic analysis of a company’s financial performance.

Understanding the reporting period is critical for effectively utilizing the statement of retained earnings as an analytical tool. By considering the duration, frequency, its role in comparability, impact on financial analysis, and relationship to other financial statements, stakeholders can gain a deeper understanding of a company’s performance and its financial trajectory.

Key Components of a Statement of Retained Earnings Template

A comprehensive understanding of a statement of retained earnings requires familiarity with its core components. These elements provide a structured framework for analyzing a company’s accumulated profits and their changes over a specific period.

1. Beginning Retained Earnings: This figure represents the accumulated profits from all prior periods up to the start of the current reporting period. It serves as the foundation upon which current period activities are reflected.

2. Net Income/Loss: Derived from the income statement, this component represents the profit or loss generated during the current reporting period. Net income increases retained earnings, while a net loss decreases them.

3. Dividends: Represent distributions of a company’s earnings to shareholders. Dividends, typically cash distributions, reduce retained earnings, reflecting a return of capital to investors.

4. Ending Retained Earnings: This figure represents the cumulative profits after considering beginning retained earnings, net income/loss, and dividend distributions during the reporting period. It reflects the company’s retained profit available for reinvestment or future distribution.

5. Reporting Period: The specific timeframe covered by the statement, such as a quarter or a year. This duration provides the context for interpreting the changes in retained earnings and ensures comparability across different periods.

These interconnected components provide a clear and concise representation of how a company’s retained earnings have changed over a specific timeframe, offering valuable insights into its financial performance, dividend policy, and potential for future growth.

How to Create a Statement of Retained Earnings

Creating a statement of retained earnings involves a structured process, ensuring accurate representation of a company’s accumulated profits over a specific period. The following steps outline this process.

1: Determine the Reporting Period: Clearly define the specific timeframe covered by the statement. This period, whether a quarter or a year, provides crucial context for the data presented.

2: Obtain the Beginning Retained Earnings Balance: This figure, representing the accumulated profits at the start of the reporting period, is obtained from the ending retained earnings balance of the preceding period.

3: Determine Net Income or Loss: Refer to the company’s income statement for the reporting period to ascertain the net income or loss. This figure represents the profit or loss generated during the period.

4: Identify Dividend Distributions: Gather information regarding any dividend payments made to shareholders during the reporting period. This includes cash dividends, stock dividends, or other forms of distribution.

5: Calculate Ending Retained Earnings: Apply the following formula: Beginning Retained Earnings + Net Income/Loss – Dividends = Ending Retained Earnings.

6: Present the Information Clearly: Structure the statement with clear labels for each component: Beginning Retained Earnings, Net Income/Loss, Dividends, and Ending Retained Earnings. Clearly state the reporting period.

7: Review for Accuracy: Before finalizing, thoroughly review all figures for accuracy and ensure consistency with other financial statements. Verify that the beginning retained earnings balance matches the ending balance from the previous period.

By following these steps, stakeholders can construct a reliable statement of retained earnings that accurately reflects a company’s profit accumulation and distribution activities over a specified period. This structured approach ensures transparency and facilitates informed financial analysis.

Careful examination of a standardized format for reporting accumulated profits reveals its importance in understanding a company’s financial health. This structured approach provides insights into how profits are generated, reinvested, or distributed to shareholders over a specific period. Key components, including beginning retained earnings, net income or loss, dividends, and the resulting ending retained earnings, offer a comprehensive view of a company’s financial activities. The reporting period provides crucial context, enabling meaningful comparisons and trend analysis.

Effective utilization of this reporting structure empowers stakeholders to make informed decisions based on a clear understanding of a company’s profit management. This transparency fosters trust and accountability, promoting financial stability and informed investment strategies for continued growth and success.