Utilizing a standardized structure offers several advantages. It ensures consistency and comparability of financial information across reporting periods, simplifying analysis and trend identification. This clarity promotes transparency and builds trust with stakeholders by offering a straightforward view of ownership structure changes. Moreover, it helps management understand internal factors influencing equity, facilitating strategic decision-making related to dividends, share repurchases, and other capital management activities. This structured approach ultimately contributes to greater financial accountability and informed investment decisions.

This foundational understanding of the structure and advantages of reporting ownership changes paves the way for a deeper exploration of its specific components and their significance. The following sections will delve into the details of each equity account, demonstrate how to interpret the report effectively, and explain how it integrates within the broader financial reporting landscape.

1. Beginning Balances

Beginning balances in a statement of stockholders’ equity represent the equity position at the start of the reporting period. These figures serve as the foundation upon which all subsequent changes in equity are built. Accurate beginning balances are crucial for a reliable and meaningful representation of equity activity. They provide context for understanding the impact of business operations and financing decisions on ownership interests. Without accurate beginning balances, the overall picture of equity changes becomes distorted, hindering effective analysis and informed decision-making. For example, a company misrepresenting its beginning retained earnings balance could misstate its net income impact and create a misleading impression of financial performance. This underscores the importance of beginning balances as a cornerstone of accurate financial reporting.

Consider a scenario where a company reports $50,000 as the beginning balance for retained earnings. During the period, the company generates $10,000 in net income and distributes $5,000 in dividends. The ending retained earnings balance would be $55,000 ($50,000 + $10,000 – $5,000). If the beginning balance were incorrectly reported as $40,000, the ending balance would be misstated as $45,000. This seemingly small discrepancy can have significant implications for financial analysis and investor interpretations. An error in beginning retained earnings could lead to miscalculations of key financial ratios, impacting valuations and investment decisions. This highlights the practical significance of accurate beginning balances in ensuring the integrity of the entire statement of stockholders’ equity.

Accurate beginning balances are essential for understanding the flow of equity throughout the reporting period. They provide the baseline against which changes in equity are measured, enabling stakeholders to assess the company’s financial health and performance. Challenges in determining accurate beginning balances can arise from mergers, acquisitions, or changes in accounting methods. However, ensuring the accuracy of these initial figures is paramount for maintaining the integrity and reliability of the entire statement of stockholders’ equity, which is a critical component of transparent and informed financial reporting.

2. Net Income/Loss

Net income or loss plays a pivotal role in the statement of stockholders’ equity, directly impacting retained earnings. It represents the culmination of a company’s operational performance during a specific accounting period. A positive net income increases retained earnings, reflecting profitable operations, while a net loss decreases retained earnings, indicating an unprofitable period. Understanding this relationship is crucial for analyzing financial performance and predicting future equity changes.

- Impact on Retained EarningsNet income increases retained earnings, strengthening the company’s equity position. For instance, if a company earns $50,000 in net income, retained earnings increase by the same amount, assuming no dividends are distributed. Conversely, a net loss of $20,000 reduces retained earnings, weakening the equity position. This direct link demonstrates how operational profitability translates into changes in ownership value.

- Connection to Business ActivitiesNet income/loss reflects the aggregated effects of all revenue-generating activities and expenses incurred during the reporting period. A manufacturing company selling goods for $1 million and incurring $800,000 in production and operational costs would report a $200,000 net income, increasing retained earnings. This highlights the connection between core business activities and equity changes.

- Influence on Dividend DecisionsRetained earnings, influenced by net income, often serve as the basis for dividend distributions. A company with consistently high net income and growing retained earnings is more likely to declare dividends, returning value to shareholders. Conversely, sustained net losses can restrict dividend payouts, prioritizing financial stability. This demonstrates how profitability shapes dividend policies.

- Implications for Financial AnalysisNet income/loss trends within the statement of stockholders’ equity provide valuable insights into a company’s financial health and sustainability. Consistent profitability suggests strong operational efficiency and growth potential, while recurring losses raise concerns about long-term viability. Analyzing these trends helps investors and creditors assess financial risks and opportunities.

The direct relationship between net income/loss and retained earnings underscores the importance of operational performance in building or diminishing shareholder value. Analyzing net income trends within the context of the statement of stockholders’ equity provides a comprehensive view of a company’s financial trajectory and its ability to generate sustainable returns for investors.

3. Stock Issuances

Stock issuances represent the creation and sale of new shares of stock by a company. Within the statement of stockholders’ equity, stock issuances increase both the common stock and additional paid-in capital accounts. The common stock account reflects the par value of the issued shares, while additional paid-in capital represents the amount received above the par value. This dual impact reflects the influx of new capital into the company, strengthening its equity position and providing resources for growth and operations. For example, issuing 1,000 shares with a par value of $1 and a selling price of $5 increases the common stock account by $1,000 and the additional paid-in capital account by $4,000. This demonstrates how stock issuances directly contribute to the expansion of a company’s equity base.

The inclusion of stock issuances in the statement of stockholders’ equity provides critical information about a company’s financing activities and ownership structure. Frequent or large-scale stock issuances can indicate a company’s reliance on equity financing to fund operations or expansion plans. However, excessive issuance can dilute existing shareholders’ ownership, reducing their proportional claim on company assets and earnings. Conversely, a lack of stock issuances might suggest a conservative financial strategy or reliance on debt financing. Analyzing stock issuance activity within the broader context of the statement of stockholders’ equity helps stakeholders understand a company’s capital structure and growth trajectory.

Understanding the relationship between stock issuances and the statement of stockholders’ equity is essential for assessing a company’s financial health and future prospects. It provides insights into financing strategies, ownership dilution potential, and the overall growth trajectory. Challenges in interpreting stock issuance information can arise from complex equity transactions, such as stock options or warrants. However, recognizing the impact of stock issuances on the equity accounts allows for a more informed analysis of a company’s financial position and its implications for long-term value creation.

4. Dividend Payments

Dividend payments represent distributions of a company’s earnings to its shareholders. Within the statement of stockholders’ equity, dividend payments directly reduce retained earnings. This reduction reflects the return of capital to investors, decreasing the company’s overall equity. The magnitude of the decrease corresponds to the declared dividend amount. For instance, a $0.50 per share dividend on 10,000 outstanding shares would decrease retained earnings by $5,000. This direct impact underscores the importance of dividend payments in understanding changes in a company’s equity position over time.

The inclusion of dividend payments in the statement of stockholders’ equity provides insights into a company’s profitability, financial health, and shareholder return policies. Consistent and increasing dividend payments often signal strong financial performance and a commitment to rewarding investors. However, excessively high dividend payments can deplete retained earnings, limiting a company’s ability to reinvest profits for future growth or weather economic downturns. Conversely, a company’s decision to suspend or reduce dividend payments may indicate financial difficulties or a strategic shift towards reinvesting earnings for expansion or debt reduction. Analyzing dividend payment trends within the statement of stockholders’ equity helps stakeholders assess a company’s financial stability and long-term sustainability.

Consider a company with $100,000 in retained earnings that distributes $20,000 in dividends. This distribution reduces retained earnings to $80,000, directly impacting the company’s equity. While dividend payments return value to shareholders, they also reduce the company’s internal funds available for reinvestment. This trade-off highlights the importance of balancing shareholder returns with the need to retain earnings for future growth and stability. Furthermore, analyzing dividend payments in conjunction with other elements of the statement of stockholders’ equity, such as net income and stock issuances, provides a comprehensive understanding of a company’s overall financial strategy and its implications for long-term value creation.

5. Ending Balances

Ending balances in a statement of stockholders’ equity represent the cumulative result of all equity transactions during a given accounting period. These balances, derived from the beginning balances and adjusted for net income/loss, stock issuances, and dividend payments, provide a snapshot of a company’s ownership structure at the period’s end. The ending balance of each equity accountretained earnings, common stock, additional paid-in capital, and treasury stockreflects the final position after considering all contributing factors. For instance, if a company begins with $50,000 in retained earnings, earns $25,000 in net income, and distributes $10,000 in dividends, the ending retained earnings balance would be $65,000. This calculation demonstrates how ending balances encapsulate the net effect of various financial activities on a company’s equity.

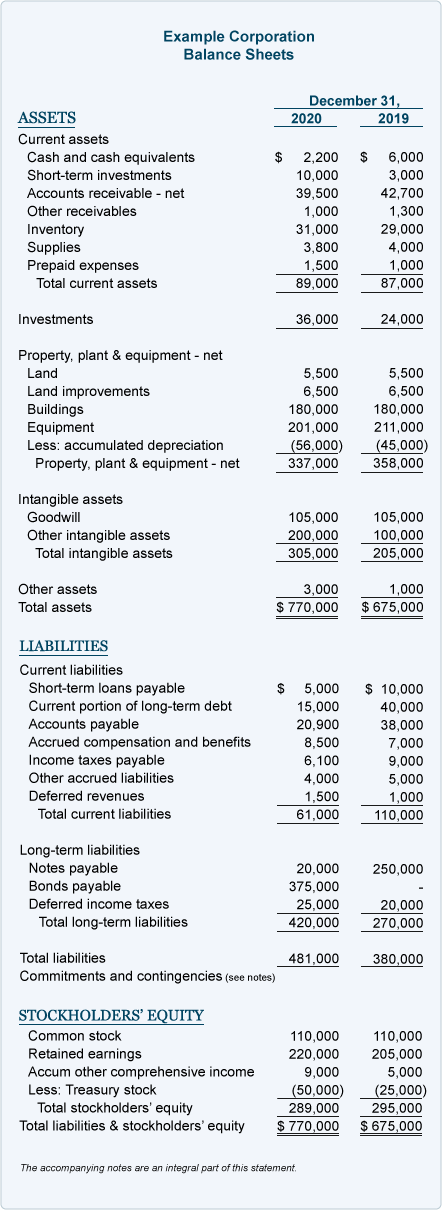

The significance of ending balances lies in their ability to reflect a company’s financial health and stability. These figures serve as crucial inputs for financial ratio calculations, such as return on equity and debt-to-equity ratio, enabling analysts and investors to assess profitability, solvency, and overall financial performance. Furthermore, ending balances provide a basis for comparison across different reporting periods, facilitating trend analysis and identification of potential issues or opportunities. A consistent growth in retained earnings, for example, suggests sound financial management and profitable operations. Conversely, declining retained earnings may signal financial distress or unsustainable business practices. This analytical power highlights the practical importance of understanding ending balances within the broader context of financial reporting.

Accurate determination of ending balances is crucial for reliable financial reporting and informed decision-making. Challenges may arise from complex accounting treatments for stock-based compensation, mergers and acquisitions, or changes in accounting standards. However, ensuring the accuracy of these figures is paramount for maintaining the integrity of the statement of stockholders’ equity. A clear understanding of how beginning balances, net income/loss, stock issuances, and dividend payments interact to produce ending balances provides valuable insights into a company’s financial performance, capital structure, and overall equity position. This understanding is fundamental for investors, creditors, and other stakeholders seeking to evaluate a company’s financial health and prospects.

Key Components of a Statement of Stockholders’ Equity

A comprehensive understanding of a statement of stockholders’ equity requires familiarity with its core components. These elements provide a structured view of the changes in a company’s ownership interests over a specific accounting period.

1. Beginning Balances: These represent the equity position at the start of the reporting period. They serve as the foundation for calculating subsequent changes and provide context for understanding the impact of business activities.

2. Net Income/Loss: This element reflects the company’s profitability during the period. Net income increases retained earnings, while a net loss decreases them. This direct relationship highlights the link between operational performance and shareholder value.

3. Stock Issuances: Issuing new shares of stock increases both common stock and additional paid-in capital. This activity reflects new investments in the company, expanding its equity base and providing funds for operations or growth initiatives.

4. Dividend Payments: Dividends represent distributions of earnings to shareholders. These payments reduce retained earnings, reflecting a return of capital to investors. Dividend policies offer insights into a company’s financial health and shareholder return priorities.

5. Treasury Stock: This represents shares of a company’s own stock that it has repurchased. Treasury stock transactions can impact the statement of stockholders’ equity by decreasing the outstanding shares and potentially affecting the overall equity balance depending on the accounting method.

6. Other Comprehensive Income (OCI): OCI encompasses certain unrealized gains and losses that are not included in net income, such as foreign currency translation adjustments and unrealized gains/losses on available-for-sale securities. These items are reported separately in the statement of stockholders’ equity and can affect accumulated other comprehensive income.

7. Ending Balances: These figures represent the final equity position after considering all transactions and adjustments during the period. Ending balances are essential for financial analysis, trend identification, and assessing a company’s overall financial health.

Analyzing these interconnected components provides a complete picture of how a company’s ownership structure evolves over time due to operational performance, financing decisions, and distributions to shareholders. This understanding is fundamental for assessing a company’s financial health and making informed investment decisions.

How to Create a Statement of Stockholders’ Equity

Creating a statement of stockholders’ equity involves a structured approach to present changes in ownership interests over a specific accounting period. The following steps outline the process:

1. Establish Reporting Period: Define the specific start and end dates for the statement. This period typically aligns with the company’s fiscal year or quarter.

2. Gather Beginning Balances: Obtain the equity account balances from the end of the preceding period. These figures serve as the starting point for calculating changes.

3. Calculate Net Income/Loss: Determine the net income or loss for the reporting period from the income statement. This figure directly impacts retained earnings.

4. Account for Stock Transactions: Document any stock issuances or repurchases (treasury stock) during the period. Calculate the impact on common stock, additional paid-in capital, and treasury stock accounts.

5. Determine Dividend Payments: Calculate the total dividends declared and paid during the period. This amount reduces retained earnings.

6. Incorporate Other Comprehensive Income (OCI): Include any unrealized gains or losses recognized in OCI during the period, such as foreign currency translation adjustments.

7. Calculate Ending Balances: Add net income and stock issuances to, and subtract dividend payments and treasury stock purchases from, the beginning balances to arrive at the ending balances for each equity account.

8. Prepare the Statement: Organize the information into a clear and concise format, presenting beginning balances, changes, and ending balances for each equity account. Ensure proper labeling and adherence to accounting principles.

A well-prepared statement presents a transparent record of changes in a company’s equity, enabling stakeholders to understand the factors influencing ownership interests. Accuracy and adherence to established accounting standards are critical for reliable reporting and informed financial analysis.

Careful examination reveals the structured framework for reporting changes in ownership interests offers a comprehensive view of a company’s financial health. Beginning balances provide the foundation, while net income/loss, stock issuances, dividend payments, and other comprehensive income contribute to the dynamic changes within the equity accounts. Ending balances reflect the cumulative impact of these factors, providing a snapshot of the company’s equity position at the period’s end. This structured approach facilitates transparency and comparability, enabling informed analysis of a company’s financial performance and capital structure.

Understanding and interpreting this framework is crucial for investors, creditors, and other stakeholders seeking to evaluate a company’s financial stability, growth potential, and long-term prospects. Accurate and consistent reporting within this structure contributes to informed decision-making, efficient capital allocation, and the overall health and stability of financial markets. Further exploration of industry-specific nuances and evolving reporting standards will enhance the practical application and analytical power of this essential financial statement.