Using this structured approach offers several advantages. It provides a holistic view of financial health, enabling informed decision-making. Scenario planning and sensitivity analysis become more accessible, facilitating better risk assessment and strategic planning. Furthermore, it enhances communication with stakeholders by presenting a clear and cohesive financial narrative.

This foundation facilitates deeper exploration of key financial concepts, including integrated forecasting techniques, scenario analysis methodologies, and the practical application of such models in various business contexts.

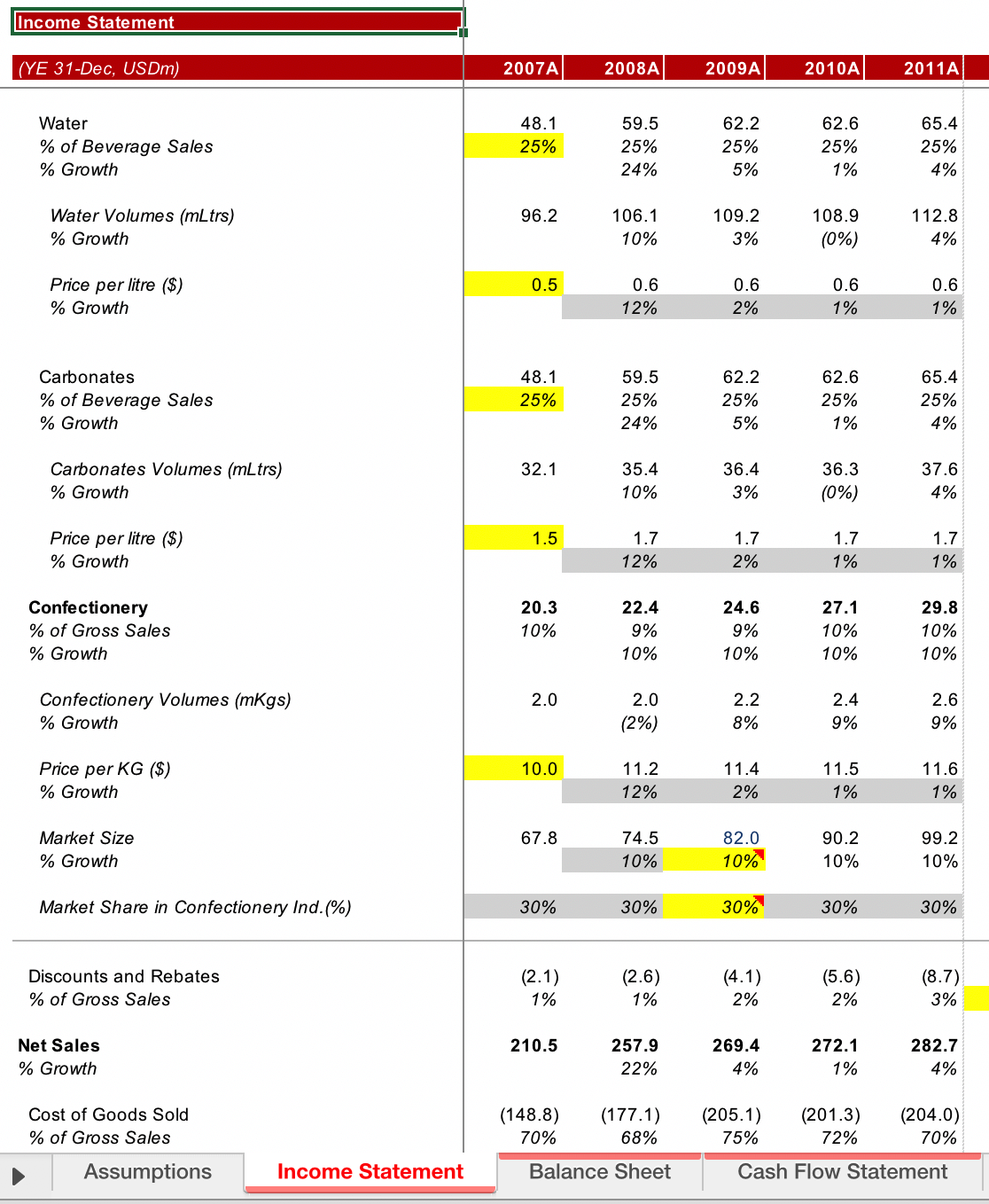

1. Income Statement

The income statement, a crucial component of a three-statement financial model, provides a detailed overview of a company’s financial performance over a specific period. It reveals profitability by outlining revenues, expenses, and resulting net income or loss. Understanding its structure and function is essential for interpreting the interconnectedness within the broader financial model.

- Revenue RecognitionRevenue recognition principles dictate how and when revenue is recorded. A software company using a subscription model, for example, might recognize revenue over the subscription period rather than as a lump sum upfront. Accurately reflecting revenue patterns is critical for projecting future performance within the three-statement model. Inaccurate revenue projections can significantly impact the balance sheet and cash flow projections.

- Cost of Goods Sold (COGS)COGS represents the direct costs associated with producing goods or services sold. For a manufacturer, this includes raw materials and direct labor. Understanding COGS is essential for calculating gross profit and assessing operational efficiency. Within the financial model, projected COGS directly influences profitability and subsequent cash flows.

- Operating ExpensesOperating expenses encompass costs not directly tied to production, such as sales and marketing, research and development, and administrative overhead. Analyzing these expenses reveals insights into a company’s cost structure and operating leverage. Within the model, accurately forecasting operating expenses is vital for projecting future earnings and overall financial health.

- Net IncomeNet income, the bottom line of the income statement, represents the profit remaining after deducting all expenses from revenue. This figure serves as a key performance indicator and a crucial input for other parts of the three-statement model. It feeds directly into retained earnings on the balance sheet and acts as the starting point for the cash flow statement’s operating activities section, highlighting the integrated nature of the model.

The income statement’s components are integral to the three-statement model’s interconnectedness. Accurately projecting revenue, COGS, and operating expenses is fundamental for deriving a reliable net income figure, which subsequently impacts the balance sheet and cash flow statement. This interconnectedness allows for a dynamic understanding of how changes in one area ripple through the entire financial picture, enabling more robust forecasting and scenario planning.

2. Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. Within a three-statement model, it plays a critical role by illustrating the interconnectedness between assets, liabilities, and equity. Changes reflected on the income statement and cash flow statement directly impact the balance sheet, creating a dynamic and integrated financial picture. For instance, net income from the income statement flows into retained earnings on the balance sheet, increasing equity. Similarly, financing activities from the cash flow statement, such as debt issuance or repayment, directly affect the balance sheet’s liabilities section. This dynamic interaction underscores the balance sheet’s importance in a comprehensive financial model.

Consider a company investing in new equipment. This purchase, reflected as a cash outflow on the cash flow statement, simultaneously increases assets (the equipment) and decreases assets (cash) on the balance sheet. If the equipment is financed through debt, liabilities also increase. This example demonstrates the intricate link between the statements and the crucial role the balance sheet plays in reflecting these transactions. Analyzing the balance sheet in conjunction with the other statements provides a holistic view of financial health and facilitates informed decision-making.

Understanding the balance sheet’s role within a three-statement model is crucial for accurate financial analysis and forecasting. The balance sheet captures the cumulative effects of operational and financial activities, providing essential insights into a company’s financial stability and long-term sustainability. Effectively interpreting the balance sheet within the context of the broader model allows for a deeper understanding of financial interconnectedness and enhances the ability to project future financial performance and assess potential risks and opportunities.

3. Cash Flow Statement

The cash flow statement, a critical component of a three-statement financial model, details the movement of cash both into and out of a company over a specific period. Unlike the income statement, which operates on an accrual basis, the cash flow statement provides a clear picture of actual cash inflows and outflows, categorized into operating, investing, and financing activities. This distinction is crucial for understanding a company’s liquidity and its ability to meet short-term obligations. Within the context of a three-statement model, the cash flow statement links the income statement and balance sheet, reflecting how profitability and balance sheet changes translate into actual cash movements. For example, an increase in accounts receivable, reported on the balance sheet, represents revenue recognized on the income statement but not yet received in cash. This difference is reflected in the cash flow statement, providing a more accurate representation of a company’s current cash position.

The cash flow statement’s interconnected nature is fundamental to financial modeling. Depreciation, a non-cash expense on the income statement, is added back in the cash flow statement’s operating activities section. This adjustment ensures that the cash flow statement accurately represents the cash generated from operations. Furthermore, capital expenditures, reflected as investing activities, impact the balance sheet’s fixed assets and the cash flow statement’s investing section. Debt issuance or repayment, categorized as financing activities, affects the balance sheet’s liabilities and the cash flow statement’s financing section. These examples illustrate the intricate links within the three-statement model and the crucial role the cash flow statement plays in representing actual cash movements.

Understanding the cash flow statement’s role within a three-statement model is essential for comprehensive financial analysis. It provides insights into a company’s ability to generate cash, manage working capital, and fund investments. This understanding is crucial for evaluating financial health, forecasting future performance, and making informed decisions regarding capital allocation and strategic planning. The statement’s focus on actual cash flow offers a practical perspective on financial sustainability, going beyond the accrual-based accounting of the income statement and offering a clear view of a company’s liquidity and ability to generate cash flow to meet obligations and support future growth. Accurately projecting cash flows is paramount for assessing the feasibility of various business strategies and ensuring long-term financial viability.

4. Interconnected Formulas

The integrity of a three-statement financial model hinges on the precise and dynamic relationship between its components. This relationship is established and maintained through interconnected formulas, which ensure consistency and accuracy throughout the model. These formulas create a network of dependencies, where changes in one financial statement automatically flow through to the others, reflecting the real-world interconnectedness of financial activities. Understanding these connections is fundamental for building a robust and reliable financial model.

- Income Statement to Balance SheetNet income from the income statement flows directly into retained earnings on the balance sheet. This link ensures that profits earned increase the company’s equity. For example, if a company reports $1 million in net income, its retained earnings on the balance sheet will increase by the same amount, reflecting the impact of profitability on the company’s overall financial position. This connection is crucial for accurately representing the cumulative effect of earnings on equity.

- Balance Sheet to Cash Flow StatementChanges in balance sheet accounts, such as accounts receivable or accounts payable, directly impact the cash flow statement. Increases in accounts receivable, for instance, represent revenue recognized but cash not yet received. This difference is reflected as a deduction in the operating activities section of the cash flow statement. Conversely, an increase in accounts payable represents expenses incurred but not yet paid, appearing as an addition in the operating activities section. These connections ensure the cash flow statement accurately captures the actual cash impact of changes in the company’s assets and liabilities.

- Cash Flow Statement to Balance SheetThe ending cash balance on the cash flow statement becomes the beginning cash balance on the balance sheet for the next period. This link ensures consistency in cash reporting and reflects the cumulative impact of cash flows on the company’s cash position. For example, if the cash flow statement shows an ending cash balance of $500,000, this amount becomes the starting cash balance on the balance sheet for the subsequent period. This direct link maintains accuracy and consistency across the model.

- Debt Schedules and Interest ExpenseDebt schedules, which detail debt principal and interest payments, are often integrated into three-statement models. These schedules link to both the balance sheet, impacting the liabilities section (outstanding debt), and the income statement, where interest expense is calculated and deducted. This integration allows for accurate forecasting of debt servicing costs and their impact on profitability and financial ratios. For example, changes in interest rates or debt levels will automatically flow through the model, impacting both the balance sheet and income statement.

These interconnected formulas form the backbone of a robust three-statement model, ensuring consistency and accuracy. They enable dynamic forecasting, allowing users to assess the impact of various assumptions on a company’s financial position and performance. By understanding these connections, analysts can build more reliable models that provide valuable insights for decision-making.

5. Forecasting Capabilities

Forecasting capabilities are integral to a three-statement financial model, transforming it from a static representation of historical data into a dynamic tool for projecting future performance. This forward-looking perspective is crucial for strategic planning, resource allocation, and investment decisions. A robust model enables businesses to anticipate potential challenges and opportunities, facilitating proactive adjustments to strategies and operational plans. The core functionality lies in projecting future financial statements based on historical trends, current conditions, and informed assumptions about future performance drivers. For example, a retail company might project future sales based on historical growth rates, anticipated market trends, and planned marketing campaigns. These sales projections then flow through the interconnected model, impacting projected profitability, asset requirements, and financing needs. This interconnected forecasting across all three statements income statement, balance sheet, and cash flow statement provides a comprehensive and consistent view of the company’s potential future financial position.

The depth and accuracy of forecasting capabilities significantly influence the model’s effectiveness. Sophisticated models incorporate sensitivity analysis and scenario planning. Sensitivity analysis examines the impact of changes in key assumptions, such as sales growth or interest rates, on projected outcomes. Scenario planning explores the potential financial implications of different strategic decisions or macroeconomic conditions. For example, a manufacturer might model the financial impact of expanding into a new market, considering different scenarios for market penetration rates and competitive responses. These capabilities enhance the model’s value as a decision-making tool, enabling businesses to assess the potential risks and rewards associated with various strategic options and adapt to evolving market dynamics. The integration of advanced forecasting capabilities with the rigorous structure of a three-statement financial model creates a powerful tool for effective strategic planning and financial management.

Effective forecasting within a three-statement model requires a thorough understanding of the business, its industry, and the broader economic environment. Developing realistic assumptions is crucial for generating credible projections. Historical data provides a valuable starting point but should be adjusted to reflect anticipated future trends and specific company initiatives. While inherent uncertainties exist in any forecasting exercise, a well-constructed three-statement model, combined with rigorous analysis and informed assumptions, equips businesses with the foresight necessary to navigate a complex and dynamic business landscape. Challenges related to data availability, model complexity, and the inherent uncertainty of future predictions must be addressed to ensure the model remains a relevant and reliable tool for strategic decision-making.

6. Scenario Analysis

Scenario analysis is an indispensable component of a robust three-statement financial model, providing a framework for evaluating the potential impact of various uncertain future events on a company’s financial performance. By exploring multiple plausible scenarios, businesses can assess their resilience to unforeseen circumstances and make more informed strategic decisions. This proactive approach moves beyond deterministic forecasts, acknowledging the inherent uncertainties in business and providing a range of potential outcomes.

- Base Case ScenarioThe base case scenario represents the most likely outcome based on current conditions and reasonable assumptions. It serves as a benchmark against which alternative scenarios are compared. This scenario typically reflects management’s expectations for future performance and provides a starting point for exploring the potential impact of deviations from the expected path. For example, a base case for a retail company might assume moderate sales growth, stable margins, and consistent consumer spending.

- Best Case ScenarioThe best-case scenario explores the potential upside if key assumptions outperform expectations. This scenario often involves optimistic, yet plausible, assumptions about market conditions, competitive landscape, and internal performance. For a technology company, a best-case scenario might involve rapid market adoption of a new product, exceeding initial sales projections and driving significant revenue growth. This analysis helps businesses understand the potential rewards of successful strategic initiatives.

- Worst Case ScenarioThe worst-case scenario assesses the potential downside if key assumptions underperform or negative events occur. This analysis helps identify vulnerabilities and develop contingency plans. A worst-case scenario for a manufacturing company might involve a significant increase in raw material prices, impacting profitability and potentially requiring price adjustments or cost-cutting measures. Understanding the potential downside allows businesses to proactively mitigate risks and prepare for unfavorable market conditions.

- Sensitivity Analysis within ScenariosScenario analysis often incorporates sensitivity analysis to explore the impact of changes in key assumptions within each scenario. This layered approach provides a more granular understanding of the factors driving financial outcomes. For example, within a base case scenario, sensitivity analysis might examine the impact of variations in sales volume, pricing strategies, or cost structures on profitability and cash flow. This additional layer of analysis strengthens the model’s predictive power and enhances decision-making by providing a more comprehensive view of potential outcomes.

Integrating scenario analysis into a three-statement model enhances strategic decision-making by providing a range of potential outcomes based on different assumptions and external factors. This forward-looking perspective enables businesses to assess risks, capitalize on opportunities, and develop contingency plans, ultimately contributing to greater financial resilience and long-term sustainability. By exploring multiple plausible futures, businesses can make more informed choices, better allocate resources, and navigate uncertainty with greater confidence. The insights gained from scenario analysis are essential for proactive financial management and strategic planning.

Key Components of a Three Statement Financial Model

A robust three-statement model hinges on several key components working in concert. Understanding these elements is crucial for developing, interpreting, and utilizing the model effectively.

1. Income Statement: The income statement projects revenue, expenses, and resulting net income or loss. Key considerations include revenue recognition principles, accurate cost of goods sold (COGS) estimations, and detailed operating expense forecasts. Its bottom line, net income, directly impacts the balance sheet and cash flow statement.

2. Balance Sheet: The balance sheet provides a snapshot of assets, liabilities, and equity at a specific point in time. It reflects the cumulative impact of the income statement and cash flow statement. Key elements include working capital management (accounts receivable, inventory, accounts payable), long-term asset investments, and financing strategies (debt and equity).

3. Cash Flow Statement: The cash flow statement tracks the movement of cash, categorized into operating, investing, and financing activities. It reconciles net income with actual cash generated and spent. Analyzing cash flow is crucial for assessing liquidity and short-term solvency. Key areas include cash flow from operations, capital expenditures, and financing activities (debt issuance, repayment, dividends).

4. Interconnected Formulas: Formulas link the three statements, ensuring consistency and accuracy. Net income flows from the income statement to the balance sheet (retained earnings). Changes in balance sheet accounts affect the cash flow statement. The ending cash balance on the cash flow statement becomes the beginning cash balance on the next period’s balance sheet.

5. Forecasting Assumptions: Forecasting requires well-defined assumptions about key drivers such as sales growth, cost trends, and macroeconomic factors. These assumptions are fundamental to projecting future financial performance and should be based on historical data, industry trends, and management expectations.

6. Scenario Analysis: Exploring different scenarios, such as base case, best case, and worst case, allows for assessing the impact of various assumptions and external factors on financial outcomes. This analysis is crucial for understanding potential risks and opportunities and informing strategic decision-making.

7. Sensitivity Analysis: Testing the model’s sensitivity to changes in key assumptions helps identify the most critical drivers of financial performance and quantifies the potential impact of uncertainty. This process enhances understanding of the model’s limitations and strengthens its predictive power.

8. Debt Schedules (if applicable): For companies utilizing debt financing, integrating debt schedules into the model is crucial for accurately projecting interest expense, principal repayments, and the overall impact of debt on financial performance. This integration ensures a comprehensive and accurate representation of financial obligations and their impact on the company’s overall financial position.

These integrated components allow for a comprehensive analysis of historical performance and provide a framework for projecting future financial outcomes. Effective utilization requires a thorough understanding of the business, its industry, and the broader economic environment. The models value lies in its ability to provide insights for strategic planning, resource allocation, and informed decision-making.

How to Create a Three Statement Financial Model

Building a three-statement model requires a structured approach. The following steps outline the process, from initial setup to integration and validation.

1. Historical Data Collection: Begin by gathering historical financial data for at least three to five years. This data forms the foundation of the model and should include income statements, balance sheets, and cash flow statements. Ensure data consistency and accuracy.

2. Income Statement Construction: Project future revenue based on historical trends, market analysis, and company-specific drivers. Forecast cost of goods sold (COGS) and operating expenses, considering factors such as inflation, pricing strategies, and operational efficiency initiatives. Calculate net income by subtracting total expenses from revenue.

3. Balance Sheet Construction: Project balance sheet items based on income statement projections and assumptions about working capital management, capital expenditures, and financing activities. Link key balance sheet items to the income statement and cash flow statement through formulas. For example, retained earnings on the balance sheet should link to net income from the income statement.

4. Cash Flow Statement Construction: Project cash flows from operating activities, investing activities, and financing activities. Operating activities should link to net income and changes in working capital. Investing activities reflect capital expenditures. Financing activities capture debt issuance, repayments, and equity transactions. Ensure the ending cash balance each period flows to the beginning cash balance on the next period’s balance sheet.

5. Formula Linking and Model Integration: Establish formulas to connect the three statements, reflecting the dynamic relationships between them. Net income from the income statement should flow to retained earnings on the balance sheet. Changes in balance sheet accounts should impact the cash flow statement. Ensure consistency and accuracy across the model.

6. Assumptions and Driver Identification: Clearly define and document key assumptions driving the model’s projections, such as sales growth rates, cost inflation, and capital expenditure plans. Sensitivity analysis can be used to assess the impact of changes in these key drivers on financial outcomes.

7. Scenario Planning: Develop multiple scenarios (base case, best case, worst case) to evaluate the potential impact of different assumptions and external factors on financial performance. This provides a range of potential outcomes and enhances strategic decision-making.

8. Model Validation and Testing: Thoroughly test and validate the model to ensure accuracy and reliability. Compare projected results to historical trends and industry benchmarks. Stress test the model by inputting extreme values to assess its stability and identify potential errors.

Building a robust three-statement model involves a structured process of historical data analysis, forecasting, and integration. Key assumptions must be carefully considered, and the model should be thoroughly tested and validated. This process creates a dynamic tool for projecting future financial performance, informing strategic decision-making, and enhancing financial understanding.

Building and utilizing a robust, interconnected framework for financial projections offers a powerful tool for strategic decision-making. Understanding the interplay between the income statement, balance sheet, and cash flow statement, coupled with rigorous forecasting and scenario analysis, provides valuable insights into a company’s financial health, potential risks, and future opportunities. Mastering the interconnected formulas and key assumptions driving these models enables informed assessments of various strategic options and enhances the ability to navigate complex business environments.

Effective financial planning requires a dynamic and integrated approach. Developing proficiency in constructing and interpreting these integrated financial statements allows organizations to proactively manage resources, assess the potential impact of various business strategies, and enhance long-term financial sustainability. The ability to accurately project financial performance and understand the interconnectedness of key financial drivers is crucial for achieving strategic goals and navigating a dynamic and competitive business landscape.