Utilizing a pre-designed structure for financial documents offers several advantages. It provides a standardized format for organizing financial information, simplifying budgeting, expense tracking, and financial analysis. This can be particularly useful for identifying discrepancies or unusual transactions. Furthermore, a standardized format aids in preparing for tax season or other financial reporting requirements.

This foundational understanding of structured financial records allows for a deeper exploration of related topics such as budgeting techniques, financial analysis methods, and best practices for managing personal or business finances.

1. Structure

The structure of a bank statement, including those from Wells Fargo, follows a standardized format designed for clarity and comprehensibility. This structure typically includes sections for account information, transaction details, and summary information. Account information generally lists the account holder’s name, account number, and statement period. The transaction details section provides a chronological listing of deposits, withdrawals, and other activities, including dates, descriptions, and amounts. Finally, the summary section usually presents beginning and ending balances, along with any applicable fees or interest.

A consistent structure allows for efficient analysis of financial activity. For example, the chronological order of transactions facilitates tracking spending habits and identifying potential irregularities. The clear delineation of deposits and withdrawals simplifies the reconciliation process. Furthermore, the standardized format allows for easy comparison of statements across different periods, enabling trend analysis and informed financial planning. For businesses, this consistent structure simplifies accounting procedures and streamlines reporting.

Understanding the structure of a bank statement is fundamental for effective financial management. This structured presentation of data enables individuals and businesses to monitor cash flow, identify potential errors, and make informed financial decisions. While the specific layout may vary slightly between institutions, the underlying principles of organization remain consistent, emphasizing the importance of a standardized structure for clear communication of financial information.

2. Transactions

The “Transactions” section forms the core of a Wells Fargo bank statement template, providing a detailed record of all financial activities within a given period. This section meticulously documents each deposit, withdrawal, payment, and other transactions affecting the account balance. The record typically includes the transaction date, a description of the transaction, and the corresponding debit or credit amount. Understanding this section is crucial for accurate financial analysis and reconciliation.

The detailed record of transactions within the statement allows for precise tracking of financial activity. For example, a business can analyze transaction data to understand cash flow patterns, identify peak spending periods, and optimize budgeting strategies. Similarly, individuals can use transaction details to monitor personal spending habits, identify areas for potential savings, and reconcile their records with the bank’s data. Without a comprehensive record of transactions, accurate financial management becomes significantly more challenging.

Effective financial management relies heavily on the accurate recording and interpretation of transactions. Challenges can arise from unclear transaction descriptions or missing information. However, by carefully reviewing the transaction details within a bank statement and comparing them with personal or business records, discrepancies can be identified and addressed promptly. This diligent approach to transaction analysis is essential for maintaining accurate financial records and preventing potential issues. Understanding the importance of transactions within the broader context of financial management empowers individuals and businesses to make informed decisions and maintain financial health.

3. Balances

Within the structure of a Wells Fargo bank statement template, “Balances” represent a crucial component for understanding financial standing. Balances provide a snapshot of available funds at specific points in time, enabling effective tracking of financial progress and informing financial decisions. Analyzing balance trends over time allows for identification of spending patterns, evaluation of financial goals, and proactive management of available resources.

- Opening BalanceThe opening balance represents the available funds at the beginning of the statement period. This figure serves as the foundation for all subsequent transactions and is essential for accurate reconciliation. For example, an opening balance of $1,000 indicates the starting point for the period’s financial activity. Discrepancies between the expected and actual opening balance should be investigated promptly.

- Closing BalanceThe closing balance reflects the available funds at the end of the statement period after accounting for all transactions. This figure provides a clear picture of current financial standing and serves as the opening balance for the next statement period. A closing balance higher than the opening balance indicates a net gain during the period, while a lower closing balance signifies a net loss.

- Available BalanceThe available balance represents the portion of the closing balance that is immediately accessible for use. This figure may differ from the closing balance due to pending transactions or holds on funds. For instance, a pending debit card transaction may reduce the available balance but not yet affect the closing balance until it posts. Understanding the available balance is crucial for avoiding overdraft fees.

- Balance TrendsAnalyzing balance trends over multiple statement periods offers valuable insights into financial habits. Consistently increasing closing balances suggest positive financial management, while declining balances may indicate a need for budget adjustments. Tracking balance trends allows for proactive financial planning and adjustment of strategies as needed.

Accurate interpretation of balances within the context of a Wells Fargo bank statement template provides valuable information for effective financial management. By understanding the relationship between opening and closing balances, considering the available balance for immediate spending decisions, and analyzing balance trends over time, individuals and businesses can gain a comprehensive understanding of their financial health and make informed decisions to achieve financial goals.

4. Dates

Within the structure of a Wells Fargo bank statement template, “Dates” provide the chronological framework for all recorded transactions and balance changes. Accurate and consistent date recording is critical for reconstructing financial activity, analyzing trends, and ensuring accurate reconciliation. Understanding the role of dates within a bank statement enables effective tracking of financial progress and informed decision-making.

- Statement PeriodThe statement period defines the timeframe covered by the bank statement, typically spanning one month. This period establishes the boundaries for all included transactions and balance calculations. For instance, a statement period of January 1st to January 31st encompasses all financial activity within that month. The statement period provides the context for interpreting all other date-related information within the statement.

- Transaction DatesEach transaction recorded within the statement includes a corresponding transaction date, indicating when the activity occurred. This precise dating allows for chronological tracking of deposits, withdrawals, and other balance-affecting activities. For example, a transaction date of January 15th signifies that the specific transaction occurred on that day. Accurate transaction dates are essential for reconstructing the sequence of financial events and identifying any discrepancies.

- Posting DatesIn addition to transaction dates, some statements include posting dates, indicating when a transaction was officially applied to the account balance. This distinction is important for understanding the timing of balance changes and can affect the available balance. For instance, a transaction may occur on one date but not post until a later date due to processing times. The posting date determines when the transaction impacts the account balance.

- Check Clearing DatesFor check transactions, the clearing date signifies when the funds were deducted from the account. This date may differ from the transaction date, particularly for checks deposited remotely. Understanding check clearing dates helps reconcile checkbook balances with bank statement data and ensures accurate accounting. Delays in check clearing can affect available funds calculations and should be considered during reconciliation.

The precise recording and interpretation of dates within a Wells Fargo bank statement template are essential for accurate financial management. Understanding the relationships between statement periods, transaction dates, posting dates, and check clearing dates enables individuals and businesses to reconstruct financial activity, analyze trends, and ensure accurate reconciliation. The chronological framework provided by dates empowers informed decision-making and facilitates effective financial planning.

5. Account Details

Account details within a Wells Fargo bank statement template provide crucial identifying information, linking the statement to a specific account and account holder. These details typically include the full account name, account number, and often the customer service contact information associated with the account. This information serves as a critical identifier, ensuring that the financial information is correctly attributed and facilitating accurate record-keeping. For instance, the account number allows both the bank and the account holder to unequivocally identify the specific account to which the statement pertains, preventing confusion or misattribution of financial activity. Furthermore, the inclusion of contact information allows for efficient communication regarding any discrepancies or inquiries related to the statement.

The accuracy and completeness of account details are paramount for several reasons. Incorrect account details can lead to misdirected statements, potentially compromising sensitive financial information. Furthermore, accurate account details are essential for internal bank processes, such as transaction processing and customer service inquiries. From the account holder’s perspective, accurate account details simplify reconciliation efforts and contribute to organized financial records. For example, when managing multiple accounts, clearly identified account details on each statement prevent errors during reconciliation and financial analysis. This clear identification also aids in tax preparation and other financial reporting requirements.

Understanding the role and importance of accurate account details within a Wells Fargo bank statement template is fundamental for responsible financial management. Account details not only connect the statement to the correct individual or entity but also play a vital role in ensuring the security and integrity of financial information. Maintaining accurate account information and promptly reporting any discrepancies to the bank are essential steps in protecting financial interests and ensuring the smooth functioning of financial processes. This attention to detail strengthens the reliability of financial records and supports sound financial decision-making.

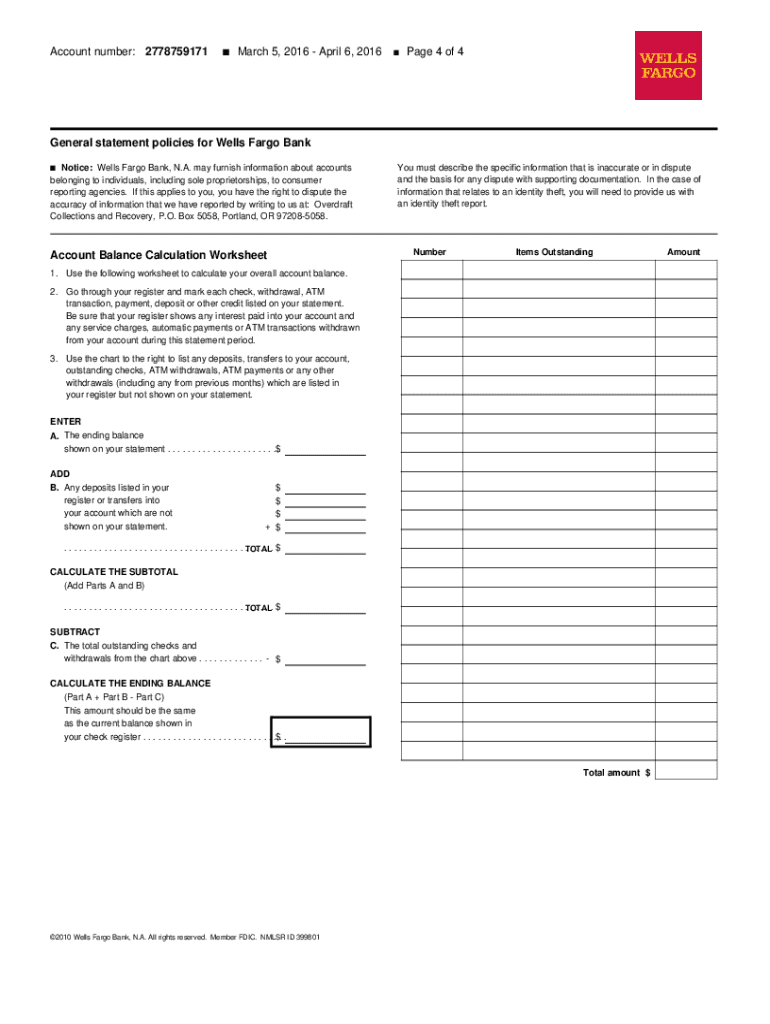

6. Reconciliation

Reconciliation, the process of comparing internal financial records against a Wells Fargo bank statement template, forms a critical component of sound financial management. This process verifies the accuracy of both sets of records, identifies discrepancies, and ensures a comprehensive understanding of financial activity. Reconciliation hinges on meticulous comparison of transactions, balances, and dates present within personal or business records against the corresponding information provided within the bank statement. For example, matching checkbook entries with cleared checks listed on the statement confirms that all recorded transactions have been processed and accounted for correctly.

The importance of regular reconciliation extends beyond simple error detection. It provides a vital safeguard against fraud and unauthorized transactions. Discrepancies revealed during reconciliation may point to errors in personal record-keeping, bank errors, or even unauthorized activity. Furthermore, reconciliation facilitates accurate financial reporting, ensuring that financial statements reflect true financial standing. For businesses, this accurate reporting is crucial for tax compliance and informed decision-making. For individuals, reconciliation provides a clear picture of spending patterns, aiding in budgeting and financial planning. A practical example includes identifying a recurring subscription payment that was overlooked during manual budgeting.

Reconciliation, while a critical process, can present challenges. Missing transactions, unclear transaction descriptions, or timing differences between transaction dates and posting dates can complicate the process. However, leveraging the structured format of a Wells Fargo bank statement template, combined with diligent record-keeping practices, simplifies reconciliation. Understanding the components of the statementtransactions, balances, dates, and account detailsempowers effective reconciliation. By regularly reconciling internal records with bank statements, individuals and businesses establish a strong foundation for financial accuracy, minimize the risk of errors and fraud, and gain valuable insights into their financial activity.

Key Components of a Wells Fargo Bank Statement Template

Understanding the key components of a Wells Fargo bank statement template is crucial for effective financial management. These components provide a structured overview of account activity, enabling informed decision-making and accurate financial analysis.

1. Account Information: This section identifies the specific account and account holder. It typically includes the full account name, account number, statement period, and customer service contact information. Accurate account information is essential for proper record-keeping and communication.

2. Transaction Details: This section provides a chronological record of all transactions impacting the account balance. Each transaction entry includes the date, a description, and the corresponding debit or credit amount. Detailed transaction records enable precise tracking of financial activity and facilitate accurate reconciliation.

3. Balances: Balances represent snapshots of available funds at specific points in time. Key balances include the opening balance (starting balance), closing balance (ending balance), and available balance (funds readily accessible). Analyzing balance trends over time offers valuable insights into financial health.

4. Dates: Dates provide the chronological framework for the statement. Key dates include the statement period (the timeframe covered), transaction dates, posting dates (when transactions are applied to the balance), and check clearing dates. Accurate date recording is crucial for reconstructing financial activity and ensuring accurate reconciliation.

5. Fees and Interest: This section details any applicable fees or interest accrued during the statement period. Examples include monthly maintenance fees, overdraft fees, and interest earned on certain account types. Understanding these charges is crucial for accurate financial planning.

6. Summary Information: This section provides a consolidated overview of account activity during the statement period. It may include total deposits, total withdrawals, and net change in balance. Summary information facilitates quick assessment of overall financial performance.

Careful analysis of these interconnected components provides a comprehensive understanding of account activity, empowering informed financial decisions and facilitating proactive financial management. Regular review and reconciliation of bank statements against personal or business records are crucial for maintaining financial accuracy and security.

How to Create a Wells Fargo Bank Statement Template

Creating a template that mirrors the structure of a Wells Fargo bank statement can be valuable for various purposes, such as budgeting, financial forecasting, and educational exercises. While recreating an exact replica of a secure document is neither advisable nor feasible, a functional template can be constructed using common software tools.

1. Software Selection: Spreadsheet software, such as Microsoft Excel or Google Sheets, offers the necessary functionality for creating a structured template. These programs allow for the creation of columns, rows, and formulas, mirroring the organized format of a bank statement.

2. Header Creation: The template header should include essential account details. Fields for “Account Name,” “Account Number,” and “Statement Period” should be included. These details, while fictional for a template, reinforce the structure of an authentic statement.

3. Transaction Area: The main body of the template should be dedicated to transaction details. Columns for “Date,” “Description,” “Debit,” and “Credit” are essential. This structure allows for chronological entry of fictional transactions, mimicking real-world statement activity.

4. Balance Calculation: Spreadsheet formulas can be employed to automatically calculate running balances. A dedicated “Balance” column, updated with each transaction entry, replicates the dynamic balance updates seen in actual bank statements.

5. Summary Section: A summary section at the bottom of the template can include calculations for “Beginning Balance,” “Total Deposits,” “Total Withdrawals,” and “Ending Balance.” These aggregated figures mirror the summary information typically found on bank statements.

6. Formatting and Customization: Adjusting column widths, font sizes, and cell borders can enhance the template’s visual clarity and readability. Adding a bank logo or other stylistic elements, while optional, can further enhance the template’s resemblance to an authentic statement.

7. Data Population (Optional): For practical application, hypothetical transactions can be entered into the template. This allows for practice with budgeting, forecasting, and reconciliation exercises using a familiar, statement-like format.

By meticulously structuring the template and incorporating these key elements, a functional representation of a Wells Fargo bank statement can be created. This template, while not a replacement for official documents, can serve as a valuable tool for financial education and planning exercises. This structured approach allows users to familiarize themselves with the organization and interpretation of financial data, promoting better financial management practices.

Careful examination of the Wells Fargo bank statement template reveals its structured approach to presenting key financial information. Understanding the components, such as account details, transactions, balances, dates, and summary information, is essential for accurate interpretation and effective financial management. Creating a personal template based on this structure, though not a substitute for official documents, can provide a practical tool for budgeting and financial forecasting exercises.

Proactive engagement with bank statements and their underlying structure empowers informed financial decision-making. Regular review and reconciliation of these documents remain crucial for maintaining financial accuracy, identifying potential discrepancies, and fostering responsible financial practices. This diligent approach to financial management contributes to greater financial stability and informed goal setting.